How does Layer2 make a profit?

Layer2 profit model?Author: 0xTodd, Wuwei Capital Source: Twitter, @0x_Todd

Many people ask how Layer2 makes a profit?

-

The GAS fees paid by everyone to L2 = revenue

-

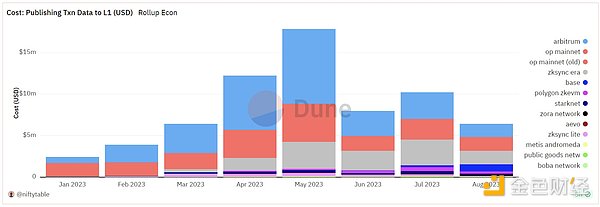

The GAS fees paid by L2 to Ethereum = expenses

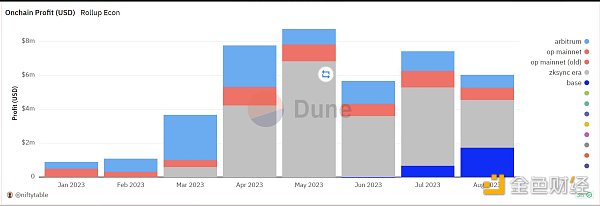

Essentially, L2 is a business of skimming fees. Arb and OP can extract about $1 million a month from this business; while the more popular Base and ZK can extract $2-3 million a month.

Why is the London hard fork upgrade of Ethereum so important for L2?

The most important upgrade of London hard fork, EIP-4844, allows L2 to not send data to Ethereum, but to the Blob area of Ethereum (to use an analogy, it’s like developing a new area in land planning)

L2’s expenses are greatly reduced. Anyone in business knows that when expenses are reduced, profits go up. If the London hard fork upgrade is completed, assuming L2 does not reduce fees, theoretically profits could easily double.

Of course, L2 could also reduce fees in theory.

Currently, L2 is a fully homogeneous competition. For example, OP launched Stack, and Arb and ZK are rushing to follow suit. After all, if your competitor has done it and you haven’t, that puts you at a disadvantage in the competition.

Back to the point

What about during a bull market? With more geese and stronger geese, there will be more feathers to pluck.

This also leads to another question: why doesn’t L2 use its own token for GAS fees?

Most L2s do not use their own tokens for GAS fees, and the reason is simple. First of all, ETH is more popular among users, and using ETH as GAS is more mainstream.

Second, it’s practical — you can earn ETH. You have to know that the project party is the least lacking in their own tokens. If you earn a bunch of your own tokens as GAS fees, it always feels less profitable than earning ETH directly.

After all, the unit being plucked is ETH, and pricing it in USD is just for everyone’s convenience in understanding. I fully believe that L2 can extract $10 million a month during a bull market.

So the future trend of L2 becomes clear:

1. Increase revenue (activity). For example, constantly luring you with airdrops, or secretly encouraging dog coins, free mint NFTs, and so on.

2. Increase revenue (average transaction value). Use strategies in the MEV field.

3. Reduce expenses (self). Embrace the London hard fork upgrade; use cheaper Layer 2 solutions.

4. Reduce expenses (cooperation). “Carpool” with other L2 solutions, share L2 gateways, share sequencers, and reduce GAS fees.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Survival Skills in the Cryptocurrency Dark Forest Wallet Security Strategies and Risk Level Management

- FastLane Atlas Protocol Use Case Analysis What is the potential for development?

- Why has friend.tech become popular?

- The Past and Present of OPNX – From Bankruptcy Alliance to Hundredfold Increase

- Exploring the Future of Web3 Social (Part 1) From 0 to 1 – Achieving Cold Start of Applications with Social Graphs.

- Enterprise Blueprint BC Technology Group (0863) approved to provide digital currency trading services to retail investors.

- Interpreting the Current Situation of Velodrome V2 Upgrade Record High Revenue, but Token Value Doesn’t Match the Increase in Issuance