Why has friend.tech become popular?

Why is friend.tech popular?Author: Dragos, Onchain Angels member; translation: LianGuaixiaozou

I want to write an article about friend.tech to explain why I believe it will continue to grow and become the first batch of iterations for Web3 social. I didn’t pay enough attention to the growth of TG Bots, so I promised myself to be more proactive when there is a potential new Meta.

1. Viewpoint of this article:

Friend.tech combines three necessary elements, which allows it to spread rapidly:

- The Past and Present of OPNX – From Bankruptcy Alliance to Hundredfold Increase

- Exploring the Future of Web3 Social (Part 1) From 0 to 1 – Achieving Cold Start of Applications with Social Graphs.

- Enterprise Blueprint BC Technology Group (0863) approved to provide digital currency trading services to retail investors.

Utility – This is very useful for the crypto ecosystem market, as it gives people the opportunity to interact with celebrity accounts that they would otherwise be unable to.

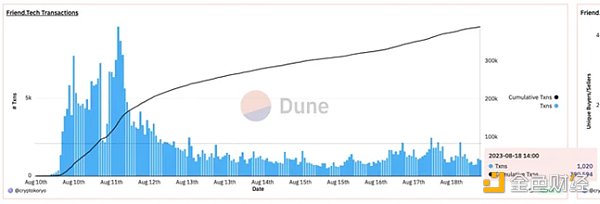

Foundation – The blockchain part works well and runs on the Base chain, with a daily trading volume of around 10,000.

Speculation – This is crucial because it can act as an adoption flywheel; people are betting on the emergence of a creator boom (similar to the NFT frenzy) and actively accumulating airdropped PTS.

This is a smart move because it gives degens what they want most – alpha and the opportunity to get close to celebrities/KOLs. Want to ask Hsaka for advice? Just buy a stock, and you can ask a question on his channel. After the initial excitement, the activities of friend.tech have calmed down, but they still maintain consistent daily activity.

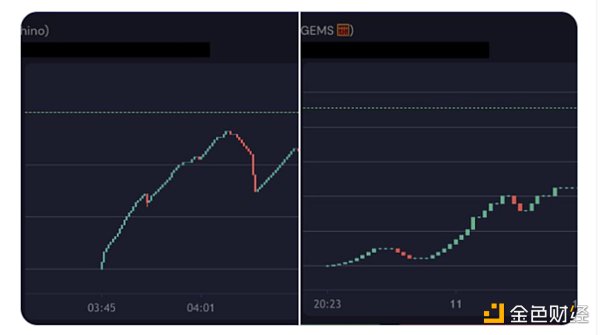

Some people only use friend.tech for the first few days and then abandon it. However, you can see that those accounts that actively publish alpha and interact with shareholders, even after the initial frenzy subsides, the stock price still rises to historical peaks.

This is not a new idea, but I believe it can stand out and create a new Meta. Bitclout is not very honest and lacks interactive elements, while Lens is trying to catch up with the trend (since you can use Twitter/X, why use Lens?).

Ironically, its flaws and (current) lack of functionality make people think it is just a temporary plaything and completely ignore it – this may provide an opportunity for those who bet on the project early on. (Or it can help them get bags for free, we will soon find out.)

2. Advantages:

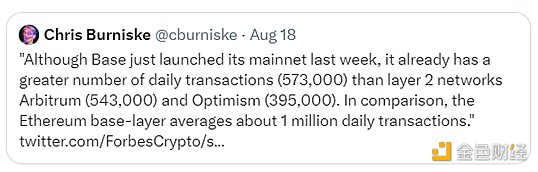

· Runs on Base – Because of Base, it becomes the L2 with the greatest potential for retail inflows; transactions can flow smoothly.

· Easy operation on mobile applications (standard and user-friendly) – No need for hardware wallets, metamask/rabby wallets, etc.

· Creator stocks are rising, and they are incentivized to drive trading volume (they profit from buying and selling stocks).

· Airdrop rewards make everyone on the app very active, as they all want to earn more points.

· The new Meta – it looks more attractive than Bitclout or Lens.

Base’s daily trading volume is larger than Arbitrum or Optimism, and friend.tech is a significant reason for that.

3. Disadvantages

· Interface malfunction – sometimes chat content cannot be successfully loaded.

· Currently only supports SMS, lacks other functions – no photo and other functions (imagine the need to share charts, load links normally, etc.).

· The airdrop rewards for the first points system launched now may make people think that most activities so far have originated from people accumulating points.

· Bear market, low interest rates, not many people using the app.

· The joint curve of stocks may cause some psychological biases and hinder people from buying stocks.

The more holders there are, the more the next person entering will have to pay for 1 share. However, the number of holders can also increase or decrease depending on buying/selling situations. Unlike NFTs, where you can buy NFTs at different levels, but the quantity of NFTs remains the same. Unlike the liquidity of the floor price of NFTs, the joint curve of friend.tech is linear and can be smoothed through dilution of equity (hopefully ongoing).

4. How I Did It

First, buy 1 share of the stocks of all the creators I want to access on the mobile app. If you can’t buy some of them successfully, you can buy them on the Friend Index, which is a cool account created by 0ctoshi.etch, summarizing the popular posts of celebrity accounts on friend.tech.

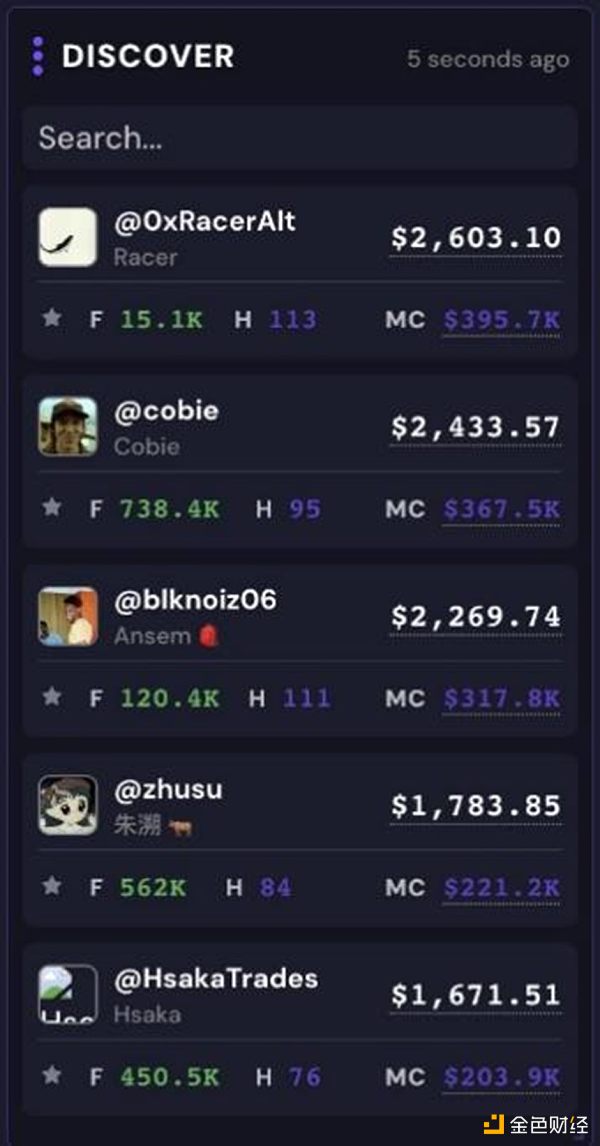

The second step is to bet on the initial “blue-chip stocks” – those big accounts that embrace the platform and are super active. Account @blknoiz06 has been super active and ranks third in market value; account @0xRacerAlt is the founder of friend.tech, so betting on his stocks can act as a proxy for the entire app.

Then, you can bet on the “small” accounts that bring value to shareholders – either start betting on them when they just join the platform, or bet on their future value growth. Here are a few examples: @d_gilz, @Teeznutz11, @AvaxGems, @lBattleRhino are all very active.

There are many other outstanding accounts, so you need to do your own research. The prices of some stocks may seem high, but I think that compared to their potential, their market value is still small if this app becomes popular.

The top five accounts with a market value between $20,000 and $40,000:

5. Useful Tools and Resources

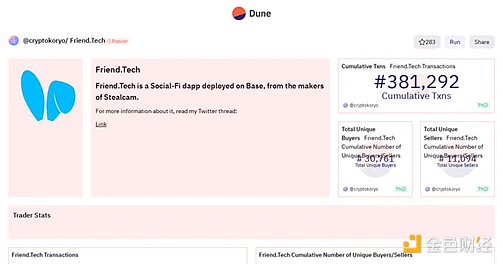

Use the Dune dashboard of Crypto Koryo to monitor all relevant metrics.

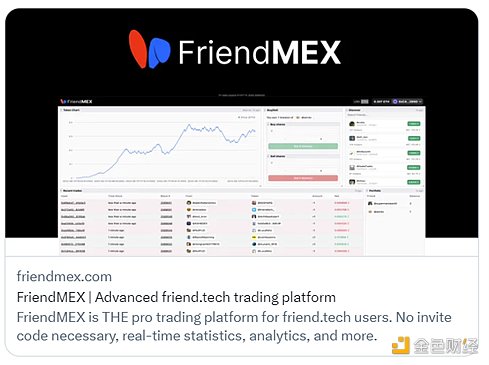

I use two tools, one is realfriend.tech, which may be the best UI for operating friend.tech on desktop, however, you need to hold 1 share of iam4x to use it (0.4 ETH), and there is also a sniper robot FriendMEX, which is free software.

I really think friend.tech has the potential to become a new Meta and create a storm in similar projects; however, if you wait until the metrics, UI/UX, and adoption rates improve, the return on investment will be far less attractive than it is now. Although still an MVP, there may be significant differences in six months from now.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Interpreting the Current Situation of Velodrome V2 Upgrade Record High Revenue, but Token Value Doesn’t Match the Increase in Issuance

- Research Report Arbitrum

- Who is behind Binance A Borderless Company in 4000 Resumes

- Coinbase has been approved to provide cryptocurrency futures services to retail traders in the United States.

- Coinbase CEO Canadians Are Moving Away from Cryptocurrency Speculation Trading

- In-depth study of the efficient cross-chain exchange protocol Chainflip

- CFTC Chairman 70% of cryptocurrency products should be classified as commodities