All or Nothing’ The roller coaster ride of ScienceCoin, discussing the memes in the crypto community

The roller coaster ride of ScienceCoin and the crypto community memes.Author: H+H@InfoFlow

Layout: ZaynR@InfoFlow

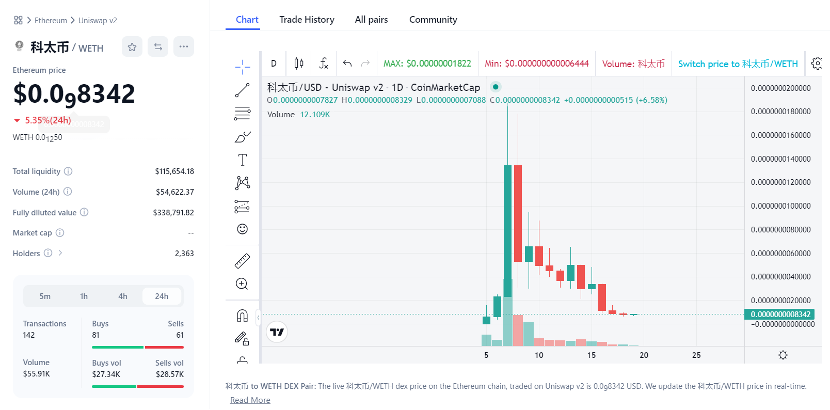

“All In” is a movie that exposes the theme of telecommunications fraud. It contains elements from the Crypto world, such as “Coin” and “Cosmic Coin”. Cosmic Coin was rapidly released in the cryptocurrency market as the movie premiered. Searching for Cosmic Coin on Coinmarketcap website, there are currently trading pairs for the same-named Cosmic Coin on multiple chains, with the majority of these pairs concentrated on ETH, BSC, and the recently popular Base chain. Among them, Uniswap v2 on the ETH chain has the highest liquidity. It can be seen that on August 5th, as the movie had a preview, the price quickly skyrocketed, reaching over 3000 times its original value in just two days. Within 24 hours, on August 8th, the price started to decline, and as of August 19th, the price has almost returned to the price on the day of its release.

- Survival Skills in the Cryptocurrency Dark Forest Wallet Security Strategies and Risk Level Management

- FastLane Atlas Protocol Use Case Analysis What is the potential for development?

- Why has friend.tech become popular?

Cosmic Coin price on Coinmarketcap

There is a broader term for coins like Cosmic Coin: Meme coins.

What is a Meme?

There are various interpretations of Meme. Going back in history, Meme first appeared in Richard Dawkins’ 1976 book “The Selfish Gene”, where he defined Meme as a cultural factor that is similar to genes and can be continuously inherited and spread on the level of human thought. In the official definition, the Oxford English Dictionary explains it as “an element of culture that may be considered to be passed on by non-genetic means, especially imitation.” For most people, Meme takes on a more common form, which is those silly pictures on the internet that satirize or mock serious events happening in the world, such as those memes in the form of reaction images.

These reaction images carry interesting information and are easy to copy and spread, eventually forming a cultural consensus among a wide range of people. Musk is a loyal supporter of Meme culture, but the author prefers to see him as an entrepreneur who is good at using inexpensive tools to spread his own values. Some of his exaggerated statements on Twitter can be seen as memes.

The Combination of Meme and Crypto

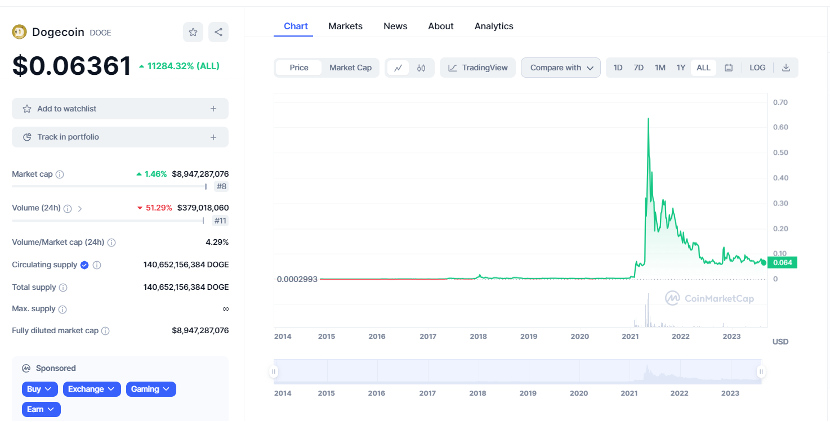

The most famous combination of Meme and Crypto is Doge Coin. In 2013, Jackson Palmer wanted to make fun of the hype around cryptocurrencies at the time, so he put the Doge Meme on a cryptocurrency and tweeted, “Invest in Doge Coin, pretty sure it’s the next big thing.” He also bought the domain name Dogecoin.com and uploaded a picture of Doge on a coin.

Software engineer Billy Marcus contacted Palmer and forked the Bitcoin source code to create 100 billion Dogecoins, then quickly launched it. Marcus said the creation of Dogecoin “didn’t have too much real thought” and he couldn’t even understand large blocks of code in the Bitcoin source code. But unexpectedly, the meme-based Dogecoin quickly rose on Reddit, and tipping bots on Reddit brought Dogecoin its initial use case. In 2015, both founders of Dogecoin left the community because they believed Dogecoin had deviated from its original intention. However, the story of Dogecoin did not end there. In December 2020, Musk started posting information about Dogecoin on Twitter, and ever since, whenever he mentions cryptocurrency, the price of Dogecoin rises. In early May 2021, Dogecoin reached a peak of $0.74. Musk has become the godfather of Dogecoin and is currently the most influential figure in the Dogecoin community.

The price trend of Dogecoin

The Development of Meme Coins

The success of Dogecoin has attracted great attention in the crypto world. From 2013 to 2017, many meme coins based on Dogecoin emerged in the market. They can mostly be seen as derivative narrative products based on certain cultural or media materials. At that time, meme coins would remix materials from internet culture and apply them to cryptocurrencies, promoting and advertising them through social media. For example, using Pepe the Frog as the narrative for Pepe Cash (note: not the same as the Pepe that became popular in recent months).

However, as they developed, meme coins were no longer limited to remixing popular internet culture as narrative blueprints. Instead, they broke free from these constraints and started choosing grand narratives as story foundations. From 2017 to 2020, some meme coins obtained financing through ICOs, such as BAT (Basic Attention Token). The current positioning of BAT on its official website is: to make cryptocurrency and DeFi accessible and usable for everyone, which sounds ambitious indeed. During this stage, many meme coins also explored more use cases and attempted to build active ecosystems.

With the DeFi summer driving a bull market frenzy and the rotation of the crypto ecosystem, Musk promoted Dogecoin on Twitter, and Dogecoin experienced a crazy surge. On May 8, 2021, Shib listed on Huobi, with its logo being a Shiba Inu, which was called “Shit Coin” by Chinese users at the time. After Shib listed on centralized exchanges, it quickly became a hot topic on Weibo, completely going viral. In the early stages of the project, Shib’s founder Ryoshi also conducted a performance art piece by sending half of the initial total supply to Vitalik’s address. With the consecutive surges of Dogecoin and Shib, the meme coin world was dominated by “animal-themed” coins, and at this time, animals became the biggest meme.

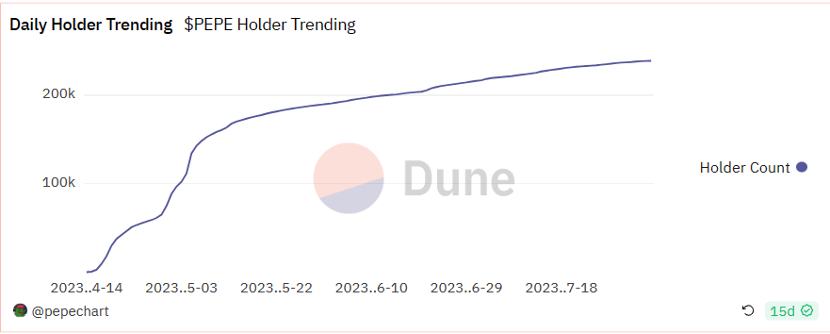

The bull market has turned into a deep bear market, and there are not many highlights in the crypto market. However, the meme coin market has experienced a small wave of enthusiasm. ArbDoge AI (AIDoge) combines AI and Doge under the airdrop of Arbitrum, and adopts the concept of “mining” to incentivize user participation, which has sparked community discussions. Pepe has been particularly successful, becoming the biggest dark horse in this wave of enthusiasm. According to Dune, as of August 20, 2023, the number of Pepe transactions has exceeded 1,500,000, and the number of holders has also exceeded 200k.

Pepe Holder Trend

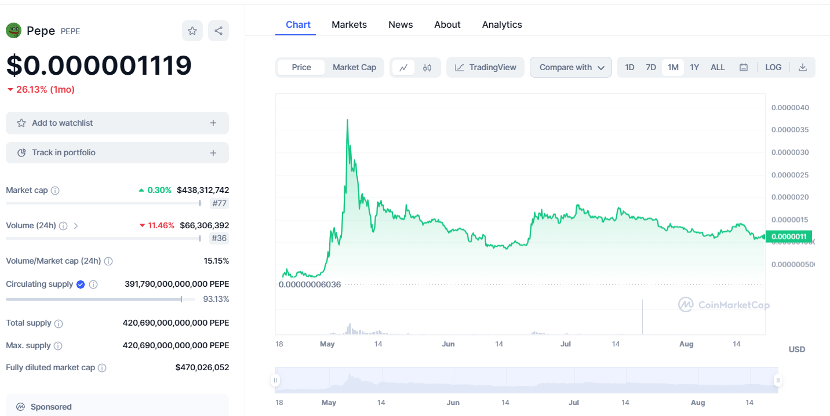

During the fervor of Pepe, the Brc-20 narrative in the Bitcoin ecosystem has also become the focus with the assistance of various institutions, project parties, especially Unisat. Pepe has also appeared in the Brc-20 market. Although the two are not closely related in terms of technical essence, they have both borrowed the momentum and witnessed a continuous rise in price. However, just one week later, the price of Pepe dropped by over 60%. The Brc-20 version of Pepe also quickly fell into depression as the market cooled down.

Pepe Price Trend

In the development of meme coins to the present, the meme behind the current meme coins can no longer represent their original meaning. A meme can be very simple, just a story, and this story can be extravagant and imaginative, after all, the crypto space is never short of stories. Even meme coins can exist without any story. Unlike conventional Web3 projects, the price growth of meme coins purely comes from investors’ FOMO sentiment.

Memes Lacking Motivation for Maintenance

As liquidity is withdrawn from the crypto market, the new generation of popular memes will hardly spend more time exploring and building an active community or creating a future map. Most of them are backed by centralized teams and various interest groups colluding to create market focus. For speculators, they no longer pay attention to whether there are interesting stories and cultural trends behind meme coins. The wealth myth of early participants seems to be more attractive than anything else. In this case, sellers and buyers have reached a certain level of tacit understanding.

Take BALD on the Base chain as an example. On July 30th, its price exceeded $0.05, with a 24-hour increase of over 450%. Subsequently, the deployer of BALD injected 727 million BALD and 6471 ETH into the Base chain’s DEX LeetSwap, attracting market attention with unconventional pool operations. Rumors such as “The BALD deployer is official from Base” and “Because Base cannot issue tokens, the Base official hopes to attract attention through BALD” spread widely. BALD didn’t even create a story itself, investors have already created a story for it. Everyone followed suit, but on the evening of July 31st, the deployer of BALD significantly withdrew liquidity. BALD’s official tweet stated: Since deployment, I have never sold any tokens at any time. I have only added, removed liquidity, and purchased tokens.

BALD Official Twitter Post

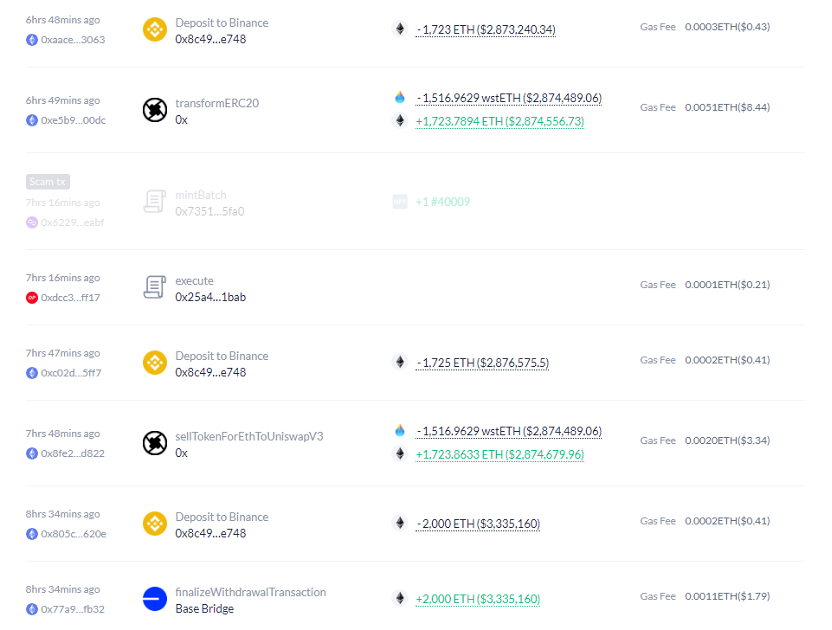

On August 1st, the deployer of the BALD contract has removed all liquidity from the BALD/ETH pool. According to Debank, the BALD deployer transferred 5448 ETH to Binance on August 20th.

Due to the anonymity of the Meme project team, it is easy for them to separate from the project, take the real money and leave without any burden. Therefore, there is no obligation for the project team to maintain the project.

The Future of Meme

Meme coins are moving towards “quick and short” development direction, precisely because the market is not short of stories, and Meme coins are not lacking in development opportunities. If you think about it, even Bitcoin carries meme attributes. Meme coins are destined to be closely tied to the crypto market. However, in the current market where stablecoins are flowing out in large quantities, it seems to be a better strategy to hold onto your bullets (real money) and avoid emotional investments.

The above article represents the author’s phased view at the time of publication and is for discussion purposes only. There may be factual and opinion deviations, and corrections are welcome.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Past and Present of OPNX – From Bankruptcy Alliance to Hundredfold Increase

- Exploring the Future of Web3 Social (Part 1) From 0 to 1 – Achieving Cold Start of Applications with Social Graphs.

- Enterprise Blueprint BC Technology Group (0863) approved to provide digital currency trading services to retail investors.

- Interpreting the Current Situation of Velodrome V2 Upgrade Record High Revenue, but Token Value Doesn’t Match the Increase in Issuance

- Research Report Arbitrum

- Who is behind Binance A Borderless Company in 4000 Resumes

- Coinbase has been approved to provide cryptocurrency futures services to retail traders in the United States.