Interpreting decentralized reserve stablecoins Faced with the impossible trinity dilemma, what tricks have various protocols used?

Decentralized reserve stablecoins faced the impossible trinity dilemma. What tricks did various protocols use?Author: Lawrence Lee, Mint Ventures

In late July, Liquity, the leading decentralized stablecoin, announced that its V2 version will launch risk-neutral stablecoins called “Delta Neutral Stablcoins”. Ethena Finance, a newly funded project, also aims to hedge its reserve assets through risk hedging to achieve decentralized high capital efficiency. In this article, we will delve into these stablecoin protocols that attempt to achieve the impossible triangle.

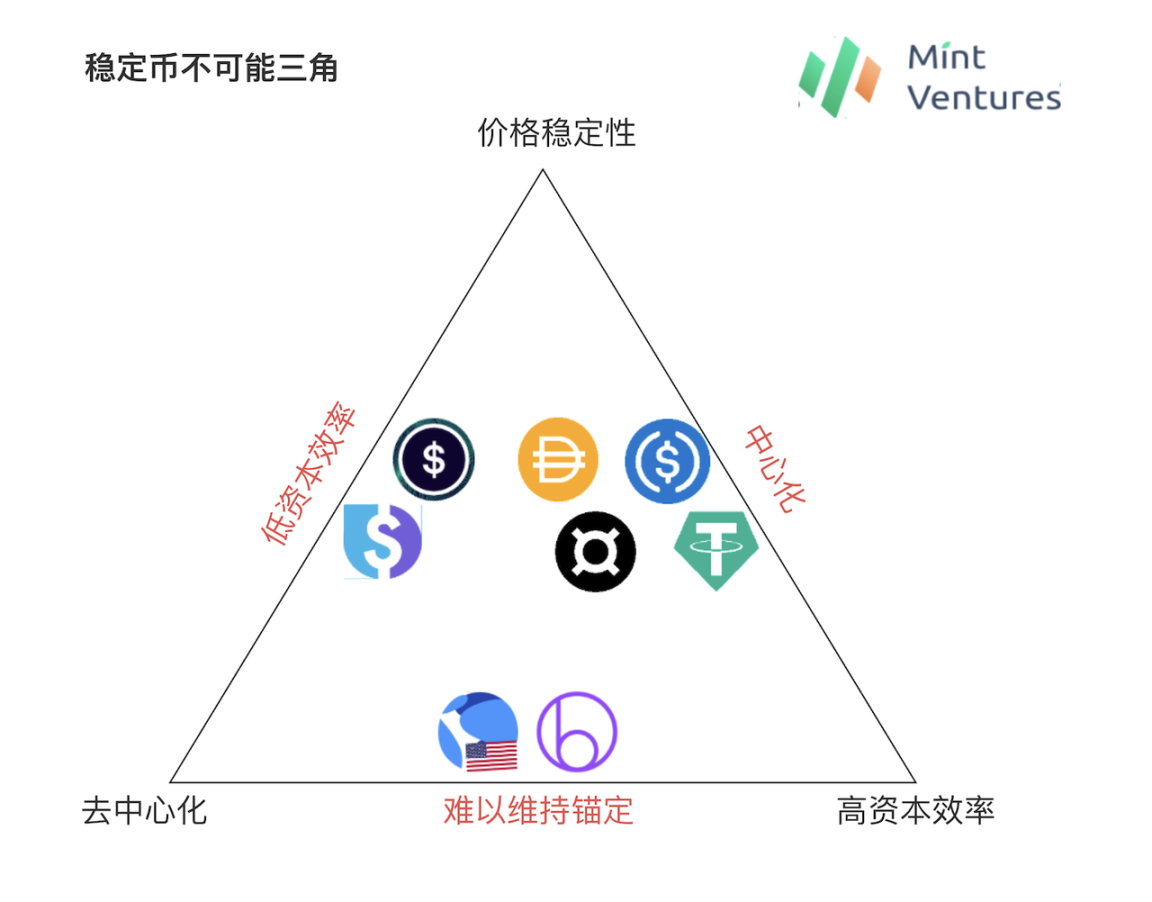

The Impossible Triangle

Graphic: Mint Ventures

- Pendle PT YT Mechanism Analysis Why Choose to Buy YT-GLP?

- The popularity of FriendTech is due to its cleverly avoiding these social product traps.

- LianGuaiWeb3.0 Daily | friend.tech trading volume exceeds 30,000 ETH

There has always been an impossible triangle in the field of stablecoins, where price stability, decentralization, and capital efficiency cannot coexist.

Centralized stablecoins like USDT and USDC have the best price stability and up to 100% capital efficiency on-chain. The only problem is the risks associated with centralization. The BUSD being affected by regulations and the SVB incident in March this year clearly demonstrated this.

The algorithmic stablecoin craze that started in the second half of 2020 attempted to achieve under-collateralization on a decentralized basis. Projects like Empty Set Dollar and Basis Cash quickly collapsed. Luna, which followed, used the credit of the entire blockchain as implicit collateral and did not require over-collateralization in the process of minting UST for users. It achieved a combination of decentralization, capital efficiency, and price stability for a considerable period of time (from 2020 to May 2022). However, it eventually suffered credit collapse and spiraled into death. Subsequently, projects like Beanstalk, which used under-collateralized tokens, appeared but did not attract much attention from the market. The difficulty of stable anchoring is the death knell for the development of such tokens.

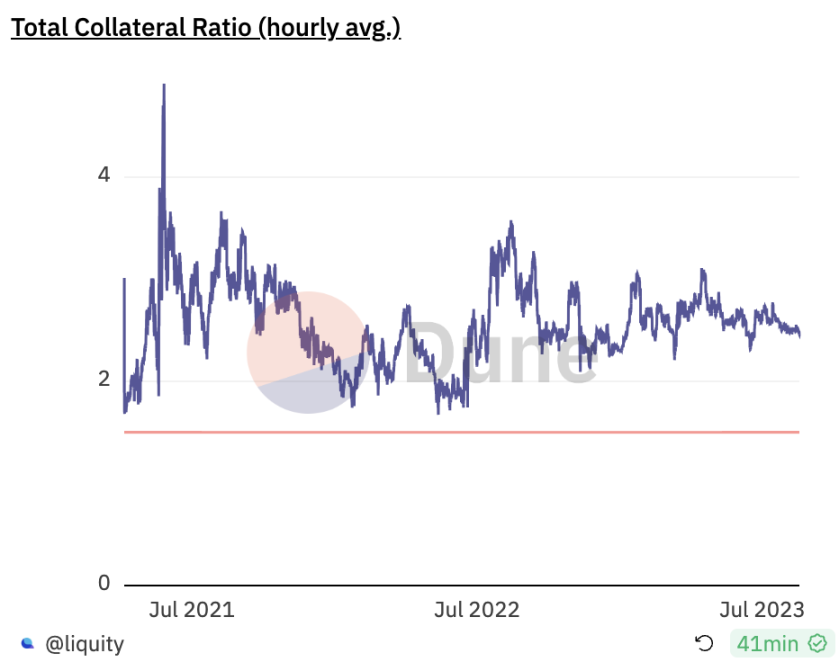

Another approach started with MakerDAO, aiming to achieve price stability by over-collateralizing underlying decentralized assets while sacrificing some capital efficiency. Currently, Liquity’s LUSD is the largest stablecoin supported entirely by decentralized assets. However, to ensure price stability for LUSD, Liquity sacrifices capital efficiency. The collateralization ratio of the entire system is consistently above 250%, which means that every circulating LUSD requires over 2.5U worth of ETH as collateral. Synthetix’s sUSD is even more extreme. Due to the higher volatility of the collateral SNX, Synthetix usually requires a minimum collateralization ratio of over 500%. Low capital efficiency means a low ceiling for scale and low attractiveness to users. The main problem that Liquity plans to address in its V2 version is the low capital efficiency of V1. Synthetix also plans to introduce other assets as collateral in its planned V3 version to reduce the requirement for minimum collateralization ratio.

Early (before 2020), DAI also had the problem of low capital efficiency. Due to the small market value of the entire crypto market at that time, the collateral asset of DAI, ETH, had large fluctuations, resulting in large fluctuations in the price of DAI. In order to solve this problem, MakerDAO introduced PSM (Price Stability Module) in 2020, which allows the use of centralized stablecoins such as USDC to generate DAI. DAI partially sacrifices decentralization in the trade-off between decentralization, capital efficiency, and price stability, bringing more stable price anchoring and higher capital efficiency to DAI, thereby better supporting the rapid growth of DAI with the overall development of DeFi. FRAX, which went live at the end of 2020, also has centralized stablecoins as its main collateral. Currently, DAI and FRAX are the top two circulating decentralized stablecoins, which proves their successful strategies in providing stablecoins that better meet the needs of users, but also indirectly indicates that “maintaining decentralization” restricts the scale of stablecoins.

However, there are still a series of stablecoins that attempt to achieve high capital efficiency and strong price stability while maintaining decentralization. They all attempt to provide users with such a stablecoin:

-

Generated by decentralized assets (such as ETH) to avoid audit risks;

-

1 unit of stablecoin can be generated with 1 unit of assets, without over-collateralization, which is more conducive to scalability;

-

The value of the stablecoin remains stable.

In fact, this is also the most intuitive and theoretically optimal decentralized stablecoin. We use the term “Decentralized Reserve Protocol” to name this type of stablecoin, based on Liquity V2. It should be noted that unlike stablecoins generated by traditional over-collateralization, for users, once their assets are exchanged for this type of stablecoin, the assets used to generate the stablecoin belong to the protocol and are no longer associated with the users. In other words, users are more like performing an ETH -> stablecoin swap operation. This type of stablecoin is more similar to centralized stablecoins like USDT, where 1 unit of assets can be exchanged for 1 unit of stablecoin, and vice versa. The only difference is that decentralized reserve protocols accept crypto assets as collateral.

(Some people may think that since the collateral does not belong to the user, such stablecoins do not have leverage function and will lose a major use case of stablecoins. However, the author believes that stablecoins in our real life do not have leverage function either. Centralized stablecoins such as USDT and USDC also do not have leverage function. The core functions of currency are settlement tool, unit of account, and store of value. Leverage is only a special function of stablecoins of the CDP (Collateralized Debt Position) type, not a general use case of stablecoins.)

However, the reason why previous stablecoin protocols have not been able to consistently provide such stablecoins is because there is a simple but difficult problem to solve for these stablecoins: decentralized asset prices are highly volatile, so how can they guarantee the redemption of the stablecoins they issue with a 100% collateral ratio?

From the balance sheet of a stablecoin protocol, the collateral deposited by users is considered an asset, while the stablecoins issued by the protocol are considered liabilities. How can they ensure that the assets always exceed or equal the liabilities?

Or a more intuitive example is when ETH = 2000U, and a user sends 1 ETH to the protocol to mint 2000 stablecoins. Then, when ETH falls to 1000U, how can the protocol ensure that these 2000 stablecoins can still be exchanged for assets worth 2000U?

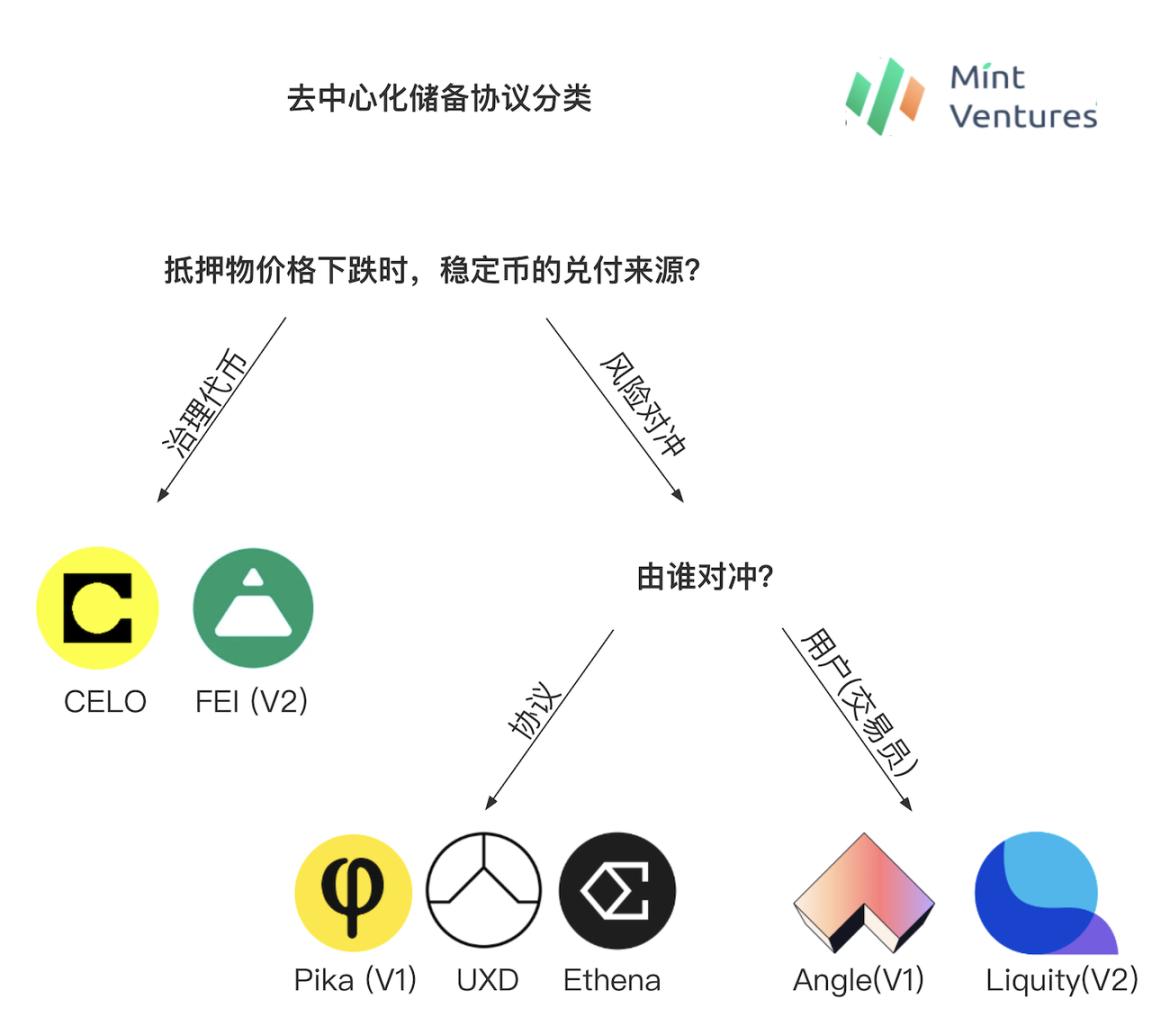

In the development history of decentralized reserve protocols, there are mainly two approaches to solving this problem: using governance tokens as reserves and hedging reserve asset risks. Based on the method of hedging reserve asset risks, there are decentralized reserve protocols that hedge protocol risks and decentralized reserve protocols that hedge user risks. Let’s learn about them one by one.

Chart: Mint Ventures

Decentralized Reserve Protocols Using Governance Tokens as Reserves

The first type of protocol uses the protocol’s governance token as the “new collateral” to act as reserves. When the price of collateral assets drops dramatically, the protocol will mint more governance tokens to redeem stablecoins for stablecoin holders. We can call this type of protocol a decentralized reserve protocol using governance tokens as reserves. In the example above, when ETH drops from 2000U to 1000U, the decentralized reserve protocol using governance tokens as reserves will use 1000U worth of ETH + 1000U worth of protocol governance tokens to redeem the 2000 stablecoins held by users.

Protocols that adopt this approach include Celo and Fei Protocol.

Celo

Celo is a stablecoin project launched in 2020. It previously existed as an independent L1, but in July of this year, the core team proposed to transition Celo to the Ethereum ecosystem through the OP stack. The stablecoin mechanism of Celo is as follows:

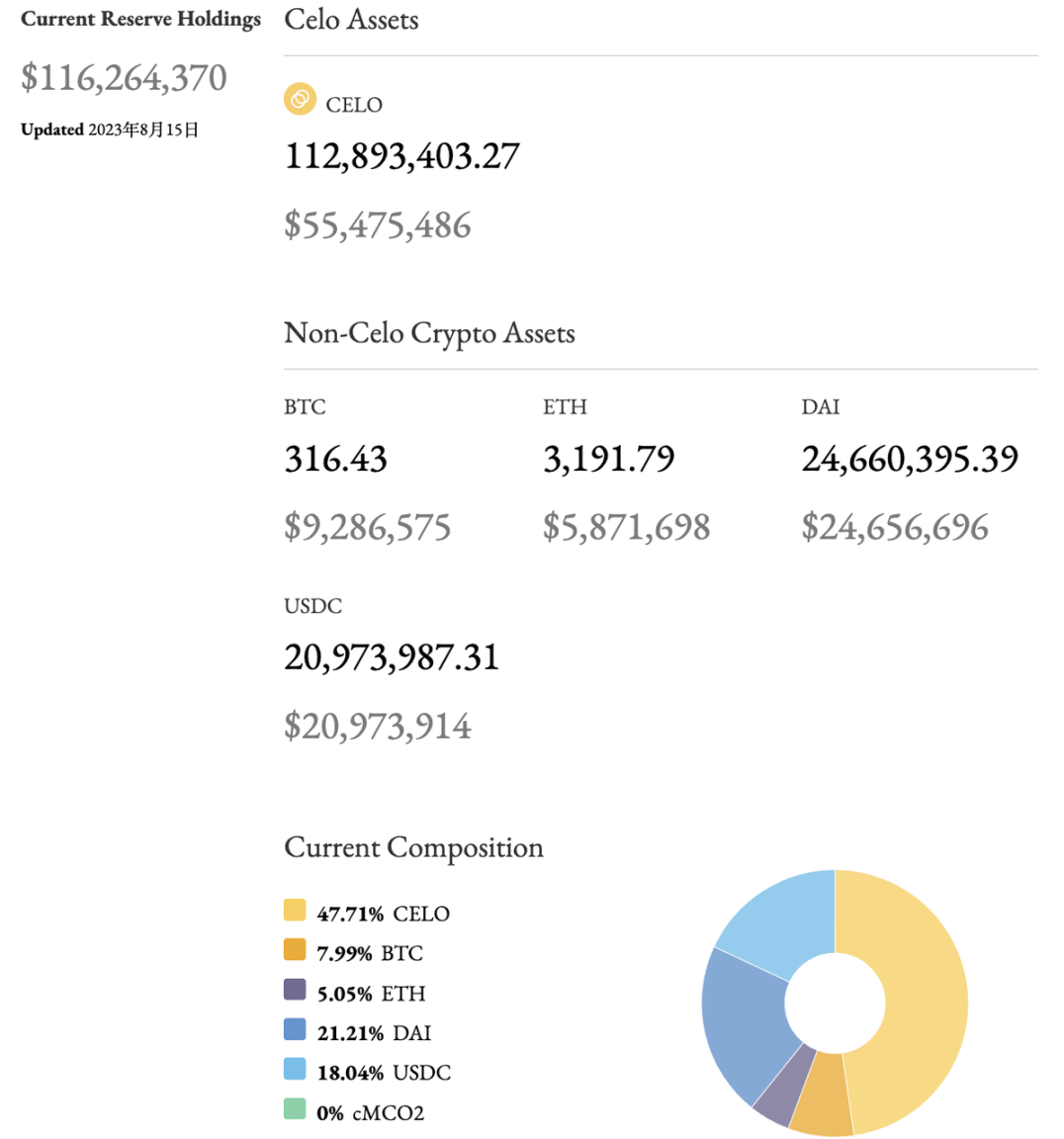

Celo’s stablecoin is backed by a reserve pool consisting of a comprehensive asset composition. The reserve ratio (the value of reserve assets divided by the value of circulating stablecoins) is much higher than 1, providing the core underlying value for its stablecoin. Celo’s stablecoin is not minted through overcollateralization, but by sending Celo tokens to the official stable module Mento. Users can send 1 USD worth of Celo to receive 1 USD worth of cUSD or vice versa. In this mechanism, when the market price of cUSD is lower than 1 USD, someone will buy cUSD at a lower price in exchange for 1 USD worth of Celo. Similarly, when cUSD is higher than 1 USD, someone will mint cUSD with Celo to sell it. The presence of arbitrageurs ensures that cUSD does not deviate too far from its pegged price. Three mechanisms will be used to ensure the adequacy of the reserve pool funds: 1. When the reserve ratio is lower than the threshold, newly minted Celo will be added to the reserve pool to replenish capital; 2. A certain transfer fee can be charged to supplement capital (currently not in use); 3. A stable fee will be charged in Mento’s trading module to supplement reserve capital. To enhance the security of the reserve, the asset composition is more diverse, currently including Celo, BTC, ETH, Dai, and carbon credit token cMCO2. This is safer than using only project tokens as collateral (Terra has a similar solution, with Luna being the invisible margin for its native stablecoin). Source: Mint Ventures Celo Research Report

It can be seen that Celo is similar to Luna, both of which are L1s centered around stablecoins. They are also very similar in terms of minting and redemption mechanisms, with the main difference being that when the entire system enters a potential under-collateralized state, Celo will first use the $CELO generated by blocks as collateral for the protocol to ensure the redemption of its stablecoin cUSD.

Source: https://reserve.mento.org/

Currently, the total collateral of the Celo system is $116 million, and the total issuance of stablecoins is $46 million, with an overall over-collateralization ratio of 254%. Although the entire system is over-collateralized, for users who want to use its stablecoin cUSD, they can exchange 1U worth of CELO for 1 cUSD at any time, with excellent capital utilization. Of course, in terms of the composition of collateral, half of Celo’s collateral comes from centralized USDC and semi-centralized DAI, so Celo cannot be considered a fully decentralized stablecoin.

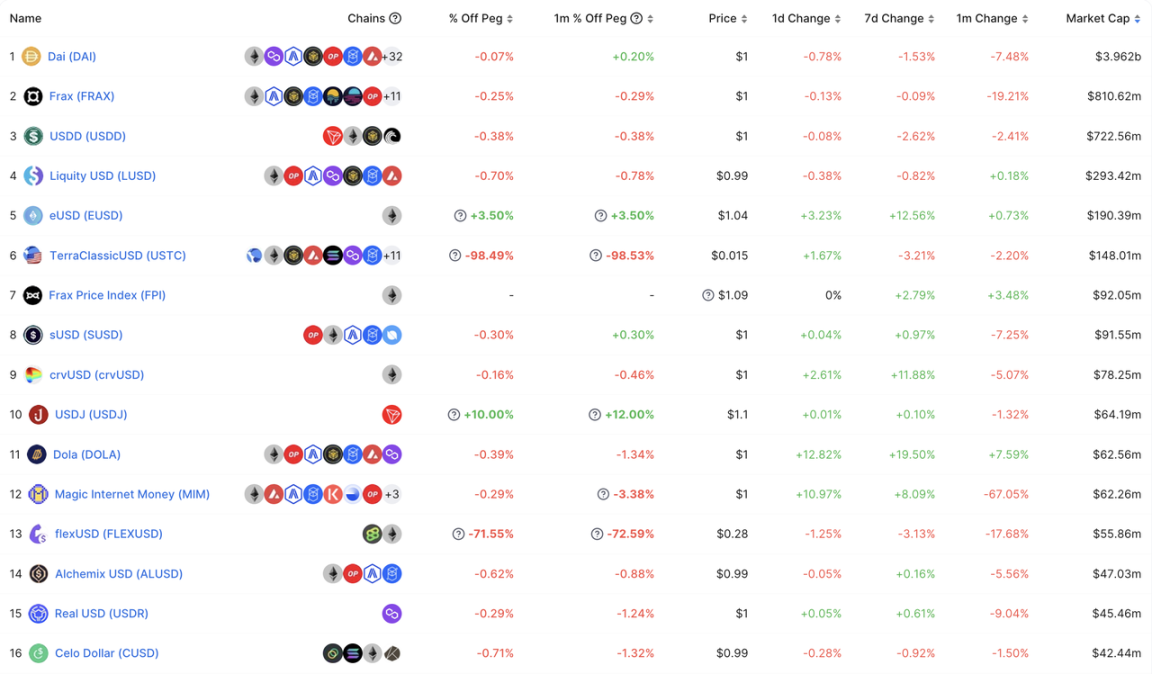

Currently, Celo’s stablecoin size ranks 16th among decentralized stablecoins (excluding UST and flexUSD, which can no longer be pegged, it ranks 14th).

Source: https://defillama.com/stablecoins?backing=CRYPTOSTABLES&backing=ALGOSTABLES

Fei

In early 2021, the Fei Protocol, which raised $19 million in funding from institutions such as A16Z and Coinbase, attracted widespread attention in the market due to its concept of algorithmic stablecoins, which was the hottest at the time. In the initial stage of their project launch (late March), they attracted 639,000 ETH to mint the stablecoin FEI, generating a total of 1.3 billion FEI, making FEI the second-largest decentralized stablecoin after DAI (with a circulating market value of $3 billion at the time).

Subsequently, due to the excessive oversupply of FEI in the early stage, as all the demand for FEI was mainly for obtaining the governance token TRIBE of Fei Protocol, FEI remained below $1 for a long time. Soon after, in May, market volatility caused panic selling, and users redeemed FEI, causing the protocol to struggle since its launch.

In the V2 version launched at the end of 2021, Fei Protocol proposed a series of measures to try to bring the protocol development back on track, including modifying its price stabilization mechanism. In V2, FEI can be directly generated by collateral such as ETH, DAI, and LUSD at a collateralization ratio of 100%. After generating stablecoins, the user’s collateral is included in the Protocol Controlled Value (PCV). When the protocol’s collateralization ratio (= PCV / circulating FEI) is above 100%, it means that the protocol’s assets appreciate well and there is no pressure to redeem FEI, so the protocol will issue additional FEI to purchase TRIBE, thereby reducing the collateralization ratio of the protocol; similarly, when the protocol’s collateralization ratio is below 100%, it means that the protocol may not be able to fully redeem all FEI, and the protocol will issue additional TRIBE to purchase FEI, thereby increasing the collateralization ratio of the protocol.

Under this mechanism, the governance token TRIBE becomes a reserve fund for the entire FEI system in times of potential risk, and can also generate additional income during system growth (this mechanism is similar to the Float Protocol launched with Fei V1). Unfortunately, Fei V2 was launched at the peak of the bull market, and since then the price of ETH has been falling. Fei also suffered a hacker attack in April 2022, losing 80 million FEI tokens, and ultimately decided to terminate protocol development in August 2022.

A decentralized reserve protocol with governance tokens as reserves essentially dilutes the rights of all governance token holders to ensure the redemption of stablecoins. During a bull market cycle, as the scale of stablecoins rises, governance tokens also increase, forming a positive feedback loop. However, during a bear market cycle, as the reserve assets of the protocol decline, the total market value of the governance tokens themselves will also decline with the market. If more governance tokens need to be issued at this time, the governance tokens are likely to further decline, forming a death spiral for the governance token price. If the market value of the governance tokens falls below a certain proportion of the stablecoin, the credibility of the protocol’s commitment to redeeming stablecoins will also be lost in the eyes of stablecoin holders, ultimately accelerating the flight and leading to the death spiral of the entire system. Whether they can survive the bear market is the key to the survival of stablecoins of this kind. In fact, the reason why Celo is able to survive in the current bear market is closely related to the overall “over-collateralization” status of the protocol. The reason why the protocol is in an over-collateralized state is also because when the market was at its peak, Celo allocated a relatively large proportion of its reserve funds to USDC/DAI and BTC/ETH, allowing the protocol to remain secure even as the CELO price dropped from 10 to 0.5.

Decentralized Reserve Protocol for Risk Hedging of Reserve Assets (Risk-Neutral Stablecoin Protocol)

The idea of the second type of protocol is to hedge the risk of the protocol’s reserve assets, so that when the price of collateral assets plummets, the hedge can generate income to ensure that the assets of the stablecoin protocol can always repay its debt. We call this type of protocol a decentralized reserve protocol for risk hedging of reserve assets, or a risk-neutral stablecoin protocol. In the example mentioned above, when receiving 1 ETH worth 2000U, the decentralized reserve protocol for risk hedging of reserve assets will hedge this 1 ETH (for example, by opening a short position on an exchange). When ETH drops from 2000U to 1000U, the decentralized reserve protocol for risk hedging of reserve assets will use 1 ETH worth 1000U + the hedging income worth 1000U to redeem the 2000 stablecoins held by users.

Specifically, depending on the specific hedging party, it can be divided into decentralized reserve protocols for hedging protocol risks, and decentralized reserve protocols for user hedging risks.

Decentralized reserve protocol for hedging protocol risks

Stablecoin protocols that adopt this approach include Pika Protocol V1, UXD Protocol, and Ethena, which recently announced financing.

Pika V1

Pika Protocol is currently a derivative protocol deployed on the Optimism network. However, in its initial V1 version, Pika planned to launch a stablecoin, and its hedging was achieved through Bitmex’s inverse perpetual contract. The inverse perpetual contract (or coin-based perpetual contract) is also one of Bitmex’s inventions. Compared with the currently more popular “linear perpetual contract” that tracks the price of the coin with a U-based unit, the characteristic of the inverse perpetual contract is to track the price in U units based on the coin. The profit of the inverse perpetual contract is as follows:

A trader goes long 50,000 contracts of XBTUSD at a price of 10,000. A few days later the price of the contract increases to 11,000.

The trader’s profit will be: 50,000 * 1 * (1/10,000 – 1/11,000) = 0.4545 XBT

If the price had in fact dropped to 9,000, the trader’s loss would have been: 50,000 * 1 * (1/10,000 – 1/9,000) = -0.5556 XBT. The loss is greater because of the inverse and non-linear nature of the contract. Conversely, if the trader was short then the trader’s profit would be greater if the price moved down than the loss if it moved up. Source: https://www.bitmex.com/app/inversePerpetualsGuide

A little analysis reveals that the inverse perpetual contract is a perfect match for decentralized reserve protocols that hedge reserve asset risks. Using the example above, suppose that when ETH = 2000U, after receiving 1 ETH from the user, Pika Protocol uses 1 ETH as collateral to short 2000 contracts of the inverse perpetual contract on Bitmex. When the ETH price falls to 1000U, the profit of Pika Protocol = 2000 * 1 * (1/1000-1/2000) = 1 ETH = 1000U. In other words, when the ETH price drops from 2000U to 1000U, the reserve of Pika Protocol at this time changes from 1 ETH to 2 ETH, and it can still effectively redeem the user’s 2000 stablecoins (without considering transaction fees and funding rate costs). The product design of Pika Protocol V1 is exactly the same as the product design of NUSD mentioned by Arthur Hayes, the founder of Bitmex, in his blog post. It can always perfectly hedge the long position based on the coin.

Unfortunately, the inverse perpetual contract has non-linear characteristics in terms of inverse and profit (the relationship between the base currency’s price fluctuations and the contract’s price fluctuations is not linear), which makes it not very easy for most USDT-based cryptocurrency investors to understand. In the subsequent development process, the development of inverse perpetual contracts (coin-based perpetual contracts) lags far behind the currently popular linear perpetual contracts (U-based perpetual contracts). In mainstream exchanges, the trading volume of inverse perpetual contracts is only about 20-25% of linear perpetual contracts. BitMex, which is affected by regulations, has gradually declined from a first-tier contract exchange to a state with a market share of less than 0.5%. Pikka believes that linear perpetual contracts cannot meet their hedging needs, while the market space for inverse perpetual contracts is relatively small. In its V2 version, it has abandoned stablecoin business and officially turned to derivative exchanges.

UXD

UXD Protocol is a stablecoin protocol running on the Solana network, launched in January 2022. UXD completed a $3 million financing led by Multicoin in 2021 and raised $57 million in IDO. In January of this year, UXD decided to cross-chain into the Ethereum ecosystem and has already launched Arbirturm in April, with plans to launch Optimism in the future.

When it was first launched, UXD Protocol supported users to deposit SOL, BTC, and ETH to mint its stablecoin UXD at a 1:1 ratio to USD value. The collateral deposited by users will be hedged through Solana’s lending and perpetual contract exchange Mango Markets’ short positions, in order to realize the redemption of stablecoins through hedging. The funding fees collected from short positions will be used as protocol income, and the funding fees paid will be covered by funds raised by the protocol. For a considerable period of time after it went live, the UXD protocol operated well, and the protocol even needed to limit the issuance of UXD, because the overall open position of Mango Markets was below the level of hundreds of million dollars. If the short position of UXD reaches tens of millions of dollars, there is a potential risk of being unable to redeem it. In addition, too many short positions will make the funding rate more likely to become negative, thereby increasing hedging costs.

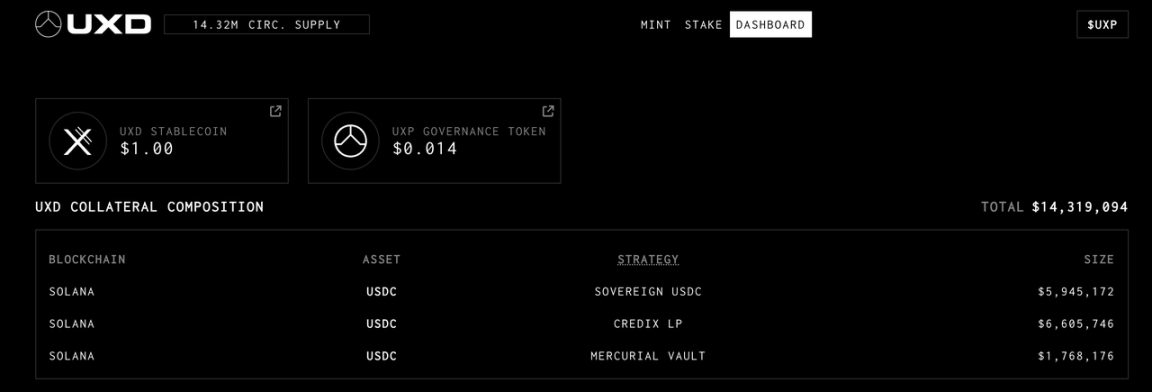

Unfortunately, Mango Markets suffered a governance attack in October 2022, and UXD lost nearly $20 million in this incident. At that time, the insurance fund balance of UXD was still over $55 million, so UXD could be redeemed normally. Although Mango Markets subsequently returned the funds to the UXD protocol, Mango Markets has since been in a decline, and the FTX scandal caused funds to rapidly flow out of Solana. UXD could not find a suitable exchange to hedge their long positions. Subsequently, the only collateral supported by the UXD protocol is USDC, and USDC does not require hedging risks, so they have invested users’ collateral USDC in various on-chain USDC vaults and RWAs. It was also after this that UXD decided to cross-chain into the Ethereum ecosystem and has already launched Arbirturm in April, with plans to launch Optimism in the future. They are also actively looking for suitable on-chain hedging venues.

Currently, the circulating supply of UXD is $14.3 million, and the protocol insurance fund balance is $53.2 million.

Source: https://dashboard.uxd.fi/

In addition, Ethena Finance, a stablecoin protocol that recently announced financing, will also use risk hedging to hedge its reserve assets. Ethena Finance has received a $6 million financing led by Dragonfly, with participation from centralized exchanges such as Bybit, OKX, Deribit, Gemeni, and Huobi. Ethena’s financing institutions include many secondary derivative exchanges, which will be beneficial for hedging its collateral. In addition, Ethena also plans to cooperate with decentralized derivative protocol Synthetix, open short positions as a liquidity provider in Synthetix, and bring more use cases to its stablecoin USDe (allowing USDe as collateral for certain pools).

For decentralized reserve protocols that hedge against risk, the advantages are obvious. By hedging the collateral’s crypto assets, the protocol as a whole can obtain risk-neutral positions, ensuring the redemption of stablecoins and ultimately achieving 100% capital efficiency on a decentralized basis (mainly depending on the hedging venue). If the protocol can complete the position hedging in a highly capital-efficient manner, the reserve assets held by the protocol can also generate interest in various forms. In addition, the funding rate can be used as protocol income, providing more room for maneuvering for the protocol: these profits can be distributed to stablecoin holders to create interest-bearing stablecoins and give stablecoins more use cases; they can also be distributed to governance token holders.

In fact, the governance token of any stablecoin protocol has an implicit use case as the “lender of last resort” for its stablecoin. Stablecoin protocols that hedge against reserve asset risks can also use their governance tokens as a source of redemption for extreme cases of stablecoin redemption. For stablecoin holders, holding this type of stablecoin provides an extra layer of security compared to stablecoins that are solely backed by governance tokens. And from a mechanism perspective, the logic of hedging reserve asset risks is more self-consistent and theoretically not affected by market cycles, without the need to test the resilience of governance tokens themselves in a bear market.

However, there are also limitations to the development:

Centralization risks of hedging venues. Currently, centralized exchanges still account for the majority of liquidity in perpetual contracts, and the designs of most decentralized derivative exchanges are not suitable for hedging stablecoin protocols, so it is inevitable for protocols to face centralization risks. The centralization risks here can be divided into two categories: 1) the inherent risks of centralized exchanges themselves; 2) due to the small total volume of hedging venues, a single hedging venue will inevitably occupy a larger proportion of the protocol’s hedging positions. If a hedging venue encounters problems, it will also have a significant impact on the protocol. An extreme example of this centralization risk is when the UXD Protocol suffered losses and stopped operating due to the attack on Mango Markets.

There are certain limitations in the selection of hedging tools. Currently, the mainstream linear perpetual contract method does not allow perfect hedging of their long positions. Taking ETH as an example, stablecoin protocols require hedging of short positions based on ETH collateral. However, the largest linear perpetual contracts currently require USDT as collateral, and their short profit curve is based on a USD standard, which cannot perfectly hedge the ETH position. Even if stablecoin protocols use ETH to obtain USDT through some form of borrowing, this will increase operational costs and the difficulty of risk management, while also reducing capital efficiency. From the example of Pika Protocol mentioned above, we know that reverse perpetual contracts are the perfect choice for decentralized reserve protocols attempting to hedge reserve asset risks, but unfortunately, the market share of reverse perpetual contracts is not large enough.

Growth in scale has certain self-limitations. The growth of stablecoin protocols implies the need for persistent and sufficient short positions in perpetual contracts for hedging. In addition to the complexity of acquiring sufficient short positions, the more short positions the protocol holds, the higher the liquidity requirement for counterparties during liquidation, and the funding rate is more likely to be negative. This all means potential higher hedging costs and operational difficulties. For stablecoins with a scale of tens of millions of dollars, this may not be a major problem. However, if they want to further scale up to billions or even tens of billions, this issue will clearly limit their ceiling.

Operational risks. Regardless of the form of hedging, it involves high-frequency opening, rebalancing, and collateral management operations, which inevitably require human intervention and can generate significant operational risks and even moral risks.

Decentralized Reserve Protocols for User Hedging Risks

Protocols that adopt this approach include Angle Protocol V1 and Liquity V2.

Angle V1

Angle Protocol was launched on the Ethereum network in November 2021 and had previously raised $5 million in funding led by a16z.

For more information about the protocol design of Angle Protocol V1, readers can refer to Mint Ventures’ previous research report. Here, we will provide a brief overview:

Like other decentralized reserve protocols, in the ideal state, Angle also supports users to generate 1 agUSD stablecoin using 1U worth of ETH (of course, the first stablecoin launched by Angle is anchored to the euro, called agEUR, but the logic is the same. For the sake of consistency in the context, we still use the example of a stablecoin pegged to the US dollar). The difference is that Angle’s target users include not only traditional stablecoin users but also perpetual contract traders, which Angle refers to as Hedging Agencies (HA).

Using the example mentioned earlier, when ETH = 2000U, a user sends 1 ETH to Angle to mint 2000 US dollar stablecoins. At this time, Angle will open a leverage position worth 1 ETH for traders. Let’s assume that an HA collateralizes 0.2 ETH (worth 400U) and opens a 5x leverage position. At this time, the protocol has a total collateral of 1.2 ETH, worth 2400U, and a total liability of 2000U in stablecoins.

When ETH rises to 2200U, the protocol only needs to hold ETH that can be redeemed for 2000U stablecoin, which is 0.909 ETH, and the remaining 0.291 ETH (worth 640U) can be withdrawn by HA.

When ETH falls to 1800U, the protocol still needs to hold ETH that can be redeemed for 2000U stablecoin, which is 1.111 ETH, at this time, HA’s collateral position will become 0.089 ETH (worth 160U).

It can be seen that traders are essentially bullish on ETH. When the price of ETH rises, they not only benefit from the increase in the value of ETH itself, but also from the “surplus” ETH of the protocol (in the above example, the price of ETH rises by 10%, and the trader’s profit is 60%); when the price of ETH falls, they not only need to bear the decrease in the value of ETH itself, but also the decrease in the value of the protocol’s collateral ETH (in the above example, the price of ETH falls by 10%, and the trader’s loss is 60%). From the perspective of Angle Protocol, traders hedge the risk of collateral price decline for the protocol, which is also the origin of its name “hedge agent”. The leverage ratio of traders depends on the ratio between the open hedging position provided by the protocol (0.2 ETH in the above example) and the stablecoin position of the protocol (1 ETH in the above example).

For perpetual contract traders, there are certain advantages in conducting long trades in perpetual contracts through Angle: 1. They do not need to pay funding fees (centralized exchanges usually require long positions to pay funding fees to short positions), 2. The transaction price is directly matched according to the oracle price without slippage. Angle hopes to achieve a win-win situation for stablecoin holders and perpetual contract traders: stablecoin holders can obtain high capital efficiency and decentralization; contract traders can also have a better trading experience. Of course, this is only an ideal situation. In practice, there may be situations where there are no traders opening long positions. Angle introduces Standard Liquidity Providers (SLPs) to provide additional collateral (stablecoins) to continue to ensure the safety of the protocol, while automatically earning interest, transaction fees, and governance tokens $ANGLE rewards.

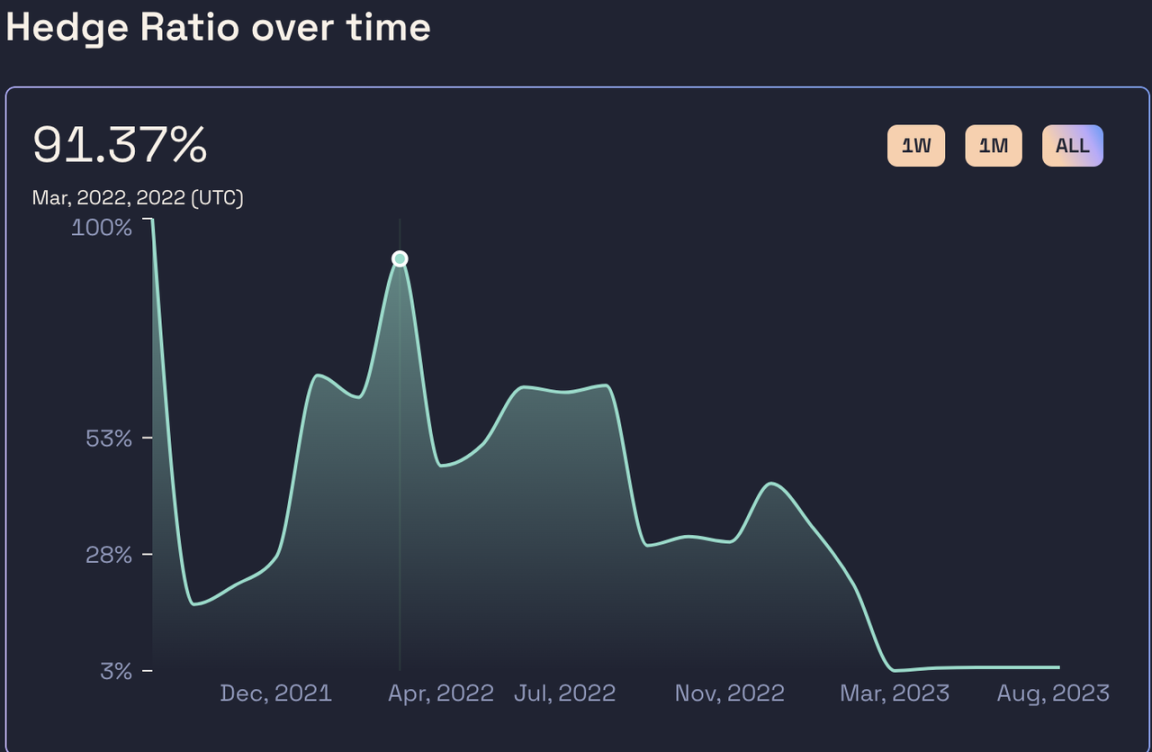

The actual operation of Angle is not ideal. Although traders also have a considerable amount of $ANGLE as a reward, most of the time, the collateral of the protocol is not fully hedged. The core reason for this, in the author’s opinion, is that Angle has not provided a product that is attractive enough to traders. With the decline in the price of $ANGLE tokens, the TVL (Total Value Locked) of the protocol has also dropped from the initial $250 million to about $50 million.

The hedging rate of USDC pool, the main collateral source of Angle stablecoin. Source: https://analytics.angle.money/core/EUR/USDC

Source: https://defillama.com/protocol/angle

In March 2023, Angle’s reserve assets for interest suffered a hacker attack by Euler. Although the hacker eventually returned the corresponding assets, Angle was severely damaged. In May, Angle announced the end of the above logic product, which they called Angle Protocol V1, and launched the plan for V2. Angle Protocol V2 switched to the traditional over-collateralization model and was just launched in early August.

Liquity V2

Since its launch in March 2021, LUSD issued by Liquity has become the third largest decentralized stablecoin in the market (after DAI and FRAX) and the largest fully decentralized stablecoin. We have published research reports on Liquity V1’s mechanism and subsequent product updates and use case expansions in July 2021 and April 2023 respectively. Interested readers can go there to learn more.

The Liquity team believes that LUSD has achieved a relatively good level in decentralization and price stability. However, in terms of capital efficiency, Liquity performs relatively average. Since its launch, Liquity’s system collateralization ratio has been around 250%, which means that each circulating LUSD requires 2.5U worth of ETH as collateral.

Source: https://dune.com/liquity/liquity

Liquity officially introduced the features of its V2 on July 28th. In addition to supporting LSD as collateral, the core content is the claim that it achieves high capital efficiency through delta-neutral hedging across the entire protocol.

Currently, Liquity has not publicly released specific product documentation. The current publicly available information about V2 mainly comes from founder Robert Lauko’s speech at ETHCC, previous introduction articles released by Liquity, and discussions in Discord. The following text is mainly based on the above information.

In terms of product logic, Liquity V2 is similar to Angle V1. It hopes to introduce traders to engage in leverage trading on Liquity, and use the margin of these traders as additional collateral for the protocol to hedge the risks of the entire protocol. At the same time, Liquity provides attractive trading products to these traders.

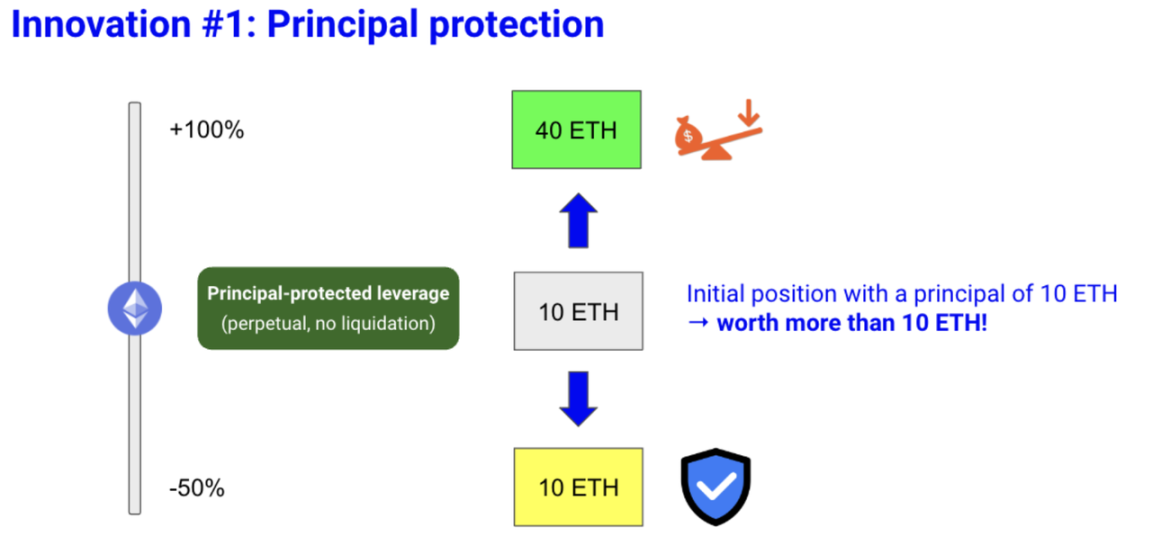

Specifically, Liquity proposes two innovations. The first is the so-called “principal-protected leveraged trading”. Liquity will provide contract traders with a leveraged trading product that protects the principal. After paying a certain premium, users can use this feature. This feature allows them to recover a certain amount of U even if the price of ETH drops significantly. According to the example in the Liquity article, when the ETH price is 1000U, users pay 12ETH (10ETH principal and 2ETH premium) to obtain a 2x leveraged long position + downside protection. In other words, when the ETH price doubles, the 2x leveraged long position takes effect, and the rise allows users to gain a total of 40ETH; when the ETH price falls, the purchased put option takes effect, and users can withdraw their own 10000U (10*1000) at any time.

Source: https://www.liquity.org/blog/introducing-liquity-v2

It can be seen that the innovation of Liquity’s product on the basis of Angle is mainly the “Principal Protection” function. Although Liquity did not specify the implementation method, based on the product form and discussions in Discord, this “Principal Protection” function is very similar to a call option.

Liquity believes that this combination product may be more attractive to traders because it can protect their principal. A call option allows traders to profit from leverage when the price rises and protects their principal when the price falls. From a trader’s perspective, it may indeed be more attractive than Angle’s simple leveraged trading product (of course, the specific pricing of the premium by Liquity needs to be considered). From the perspective of the protocol, the premium paid by users can serve as a safety cushion for the protocol: when the ETH price falls, Liquity can use this portion of the premium as additional collateral to redeem stablecoin holders; when the price rises, Liquity can distribute the appreciated portion of its own collateral to contract traders as profit.

Of course, there are obvious problems with this mechanism. When traders want to close their positions and withdraw their ETH, Liquity will face a dilemma: traders have the right to close their positions at any time, but if they do, the hedging ratio of the entire Liquity protocol position will decrease, and the security of the Liquity protocol will become fragile as this portion of “collateral” is withdrawn. In fact, the same problem has occurred in the operation of Angle, where the hedging ratio of Angle’s system has remained at a low level for years, and traders’ hedging of the overall protocol position is not sufficient.

To solve this problem, Liquity proposes a second innovation, an officially subsidized secondary market.

That is to say, in Liquity V2, leveraged trading positions (NFTs) can be traded on the secondary market in addition to being opened and closed like normal leveraged trading positions. In fact, Liquity is concerned that traders will close their positions, as this would lead to a decrease in the protocol’s hedging ratio. When a trader wants to close a position, if there are other traders willing to buy at a price higher than the current intrinsic value of the position on the secondary market, they can earn more cash, which Liquity naturally welcomes. For Liquity, although the “current intrinsic value of the position” is subsidized by the protocol, maintaining the hedging ratio of the entire system through a relatively small subsidy can improve the security of the protocol at a lower cost.

Source: https://www.liquity.org/blog/introducing-liquity-v2

For example, let’s say Alice opened a position of 10 ETH with a collateral of 2 ETH when the price of ETH was 1000U. This position represents the value of being long 10 ETH with capital protection. However, if the price of ETH drops to 800U, the value of the 12,000U worth of ETH that Alice invested can only be converted back to 10 ETH (8,000U). At this point, Alice can either close the position directly and receive 10 ETH (8,000U), or sell her position in the secondary market at a price between 8,000U and 12,000U. For someone like Bob who wants to purchase Alice’s position, buying Alice’s position is similar to buying a call option with a strike price of 1000U at the price of 800U (8,000U + a call option with a strike price of 1000U). This option must have value, which means that Alice’s position can be priced higher than 8,000U. For Liquity, as long as Bob purchases Alice’s position, the protocol’s collateral ratio remains unchanged because the protocol’s premium is still in the protocol’s pool. If Bob does not purchase Alice’s position for a long time, the value of Alice’s position will gradually increase over time in order to maintain the value (specific methods are not specified, but for example, lowering the strike price or increasing the quantity of call options can increase the value of this position), and the subsidy comes from the protocol’s premium pool (note that this situation will slightly reduce Liquity’s overall overcollateralization ratio). Liquity believes that not all positions need to be subsidized by the protocol, and the subsidy does not necessarily need to account for a large proportion of the income from this position. Therefore, subsidizing the secondary market can effectively maintain the protocol’s hedging ratio.

Finally, even with these two innovations, it may still not be possible to completely solve the problem of insufficient liquidity in extreme situations. Liquity will also use a standard liquidity provider mechanism similar to Angle as a final supplement (a possible method is that the protocol will also allow users to deposit a portion of V1 LUSD into the stability pool to support the redemption of V2 LUSD in extreme situations).

Liquity V2 is planned to launch in Q2 2024.

Overall, Liquity V2 has many similarities with Angle V1, but it has also made targeted improvements to the problems encountered by Angle: it has proposed the innovation of “capital protection” to provide more attractive products to traders; it has proposed the “officially subsidized secondary market” to protect the protocol’s overall hedging ratio.

However, Liquity V2 is essentially the same as Angle Protocol, where a stablecoin team attempts to create a derivative product with certain innovation and then feed back to its stablecoin business. The ability of the Liquity team in the stablecoin field has been proven, but it is questionable whether they can also design excellent derivatives, find PMF (Product Market Fit), and successfully promote them.

Conclusion

Being able to achieve decentralization, high capital efficiency, and price stability at the same time in a decentralized reserve protocol is exciting. However, clever and reasonable mechanism design is only the first step for stablecoin protocols. What is more important is the expansion of use cases for stablecoins. Currently, decentralized stablecoins have made slow progress in terms of use case expansion. The majority of decentralized stablecoins only have one real use case, which is “mining tools”, and the incentive for mining is not inexhaustible.

To some extent, the issuance of PYUSD by LianGuaiyLianGuail serves as a warning for all stablecoin projects, because it means that well-known institutions in the web2 field are starting to enter the stablecoin field, and the time window for stablecoins may not be too long. In fact, when we talk about the centralized risks of custodial stablecoins, we are more concerned about the risks brought by unreliable custodians and issuing institutions (Silicon Valley Bank is only the 16th largest bank in the United States, and Tether and Circle are only “crypto-native” financial institutions). If there really are “too big to fail” financial institutions in the traditional financial field (such as JP Morgan) issuing stablecoins, the implied national credit behind them will not only make Tether and Circle instantly lose their foothold, but also greatly weaken the decentralized value advocated by decentralized stablecoins: when centralized services are stable and powerful enough, people may not need decentralization at all.

Before that happens, we hope that decentralized stablecoins can gain enough use cases to reach the Schelling point of stablecoins (referring to people’s natural tendency in the absence of communication), although this is difficult.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Friend.tech becomes explosively popular, how much longer can the bullet fly?

- Can recursive inscriptions trigger the next bull market?

- X-explore In-depth study of the behavior patterns of airdrop experts. What can we learn from it?

- Against the trend, what new patterns will the social application friend.tech bring to NFTs?

- How does Layer2 make a profit?

- Friend.Tech A New Approach to Web3 Social or Just a Flash in the Pan?

- The higher the road, the taller the devil. Has the story of airdrops come to an end?