Staking is essentially an inflation, why does it create the illusion of wealth?

Yesterday in the text, we mentioned Adam Smith’s point of view that money itself is not wealth. There is also a saying that the value of money is born out of nothing.

Money itself does not have much value, and the true value of money is its corresponding purchasing power.

Before discussing today's problems, it is simple to distinguish between two concepts: the book value of money, or nominal value, usually refers to the value shown by the book value; the actual value of money refers to the corresponding actual purchasing power.

First, the currency illusion

The term "currency illusion" was coined by American economist Irving Fisher in 1928 and is the inflationary effect of monetary policy. It refers to a psychological illusion that people only respond to the nominal value of money while ignoring the changes in their actual purchasing power.

- Guosheng Blockchain | Consensus Conference, Hangzhou Forum Double Star shines, China and the United States lead the world blockchain trend

- In order to promote the commercialization of a larger scale, the blockchain giants of Ali, Thunder, Baidu and Jingdong changed in spring and summer.

- Depth | The bottom of the question, is PoS really better than PoW?

For a simple example:

Your original monetary income was 1,000 yuan, and now the income doubles to 2,000 yuan; but the price doubles year-on-year, the actual purchasing power of income has not changed.

Although the actual purchasing power of the currency has not changed, the overall wealth has not increased. But you feel that your disposable income has doubled, and the book value of the currency has doubled, so it has created a sense of wealth.

This illusion of wealth is called the currency illusion, also known as the currency illusion.

The root cause of the illusion of money is that people mistakenly regard the book value of money as the actual purchasing power of money.

This kind of illusion of wealth will make people feel happy and affect people's behavior habits.

Western economists believe that the role of money illusion is very powerful: because people's work behavior and willingness to work are largely based on his monetary wage level, not his actual wage level. Therefore, when a person’s money wages fall, even if the price level falls and his real wages remain the same, he will refuse to work and protest. On the other hand, when his money wages are constant and the price rises to lower his actual wages, he does not feel lost and will not stop working.

At the same time, the currency illusion will have an impact on household consumption. When wages and prices rise year-on-year and real wages remain unchanged, shopping will still be expanded, and actual consumption levels will increase. In other words, people will increase their consumption when they have more money, but they will ignore the price increase, which will lower their savings. The illusion of money is super powerful, it will affect people's mood and mentality, and thus affect people's behaviors and habits.

NB's economic designers often use the illusion of money to motivate people to work hard, expand consumption, and promote economic growth. Master Keynes believes that moderate inflation is good for employment, advocates the issuance of money, increase employment, and expand consumption to stimulate economic growth.

Of course, the most used of this illusion is CX. Now CX will set up a virtual exchange, let you buy btc through the regular exchange, enter his account, and then show you a number in his virtual exchange, promise you a high rate of return. Then, every month you can see your virtual number credited and your account number increased. Let you create the illusion of increasing wealth and making money. In fact, the account number will never be returned, that is, it cannot be honored.

Looking at the many token economic models of the currency circle, it also implies the shadow of the "currency illusion", a currency that is born out of nothing, using the value of nothing, to motivate a group of fanatic miners, to create the illusion of wealth explosion, think special Interesting, people are boiling.

Second, Staking is essentially an inflation

Extend some of the above points and use them in the digital currency field:

The token of the project itself is not of value. The value of a project is not the quantity of its currency, but whether the project itself has achieved the accumulation of value. The value of the token depends on whether the value of the store can be realized in the development of the project.

So the currency itself does not create value, regardless of whether the Staking income is 100% or 10 times.

If the project itself does not create more value, the token does not capture more value. Then the level of Staking's rate of return has no practical significance. There is no difference between 1% and 100%. It is just an inflation.

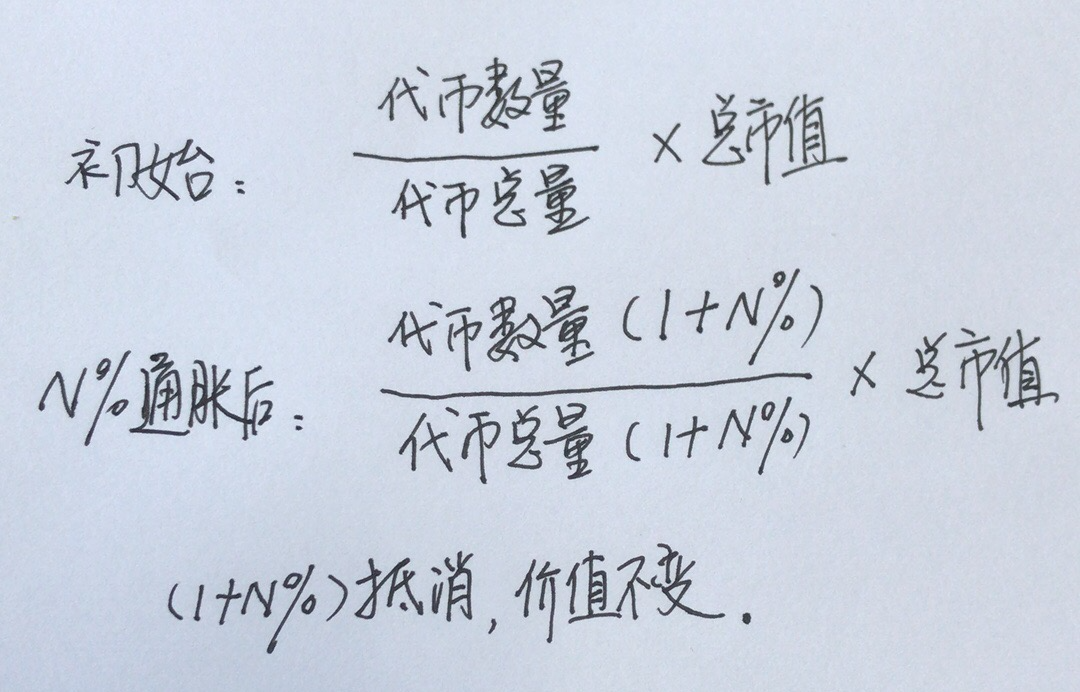

Assuming the value of the project has not changed, your token value depends only on the proportion of your tokens.

The above figure can draw two conclusions:

1. From the perspective of the currency standard, the number of tokens of POS miners has increased, but the value of tokens has not changed, but the illusion that the number of tokens increases, the value increases, and the wealth grows, this is the illusion of money. The illusion of wealth.

2. The inflation rate of money has no essential effect on the value of your token. The real factor affecting the value of your token is the value of the project.

In the same way as the economic inflation policies adopted by governments in the real world, there is “moderate inflation” in all POS consensus mechanisms. This kind of inflation gives miners the illusion of money and is used to continuously encourage miners.

However, this inflation model design has a restraining effect on the price of the token, which is not conducive to the stability and rise of the token price. This is a problem that all POS designs need to consider, and how to ensure that the miners do not sell. Once the miners are smashed, all the illusion bubbles will burst.

Staking economy is essentially an inflationary economy that does not bring real value. The only real value is the project itself.

For projects, tokens should have the ability to store value. Value storage is roughly divided into two aspects: first, whether the project itself creates value, and second, whether the token can capture the value of project growth.

For miners or investors, the increase in the amount of tokens does not represent an increase in value. Everything is inflation, and everything is an illusion. Of course, people are often confused by this illusion, and it is easy to immerse themselves in the illusion of wealth.

This kind of illusion also has a great effect, which can make people feel happy, produce satisfaction and generate happiness. This is also the reason why people know the drug, or someone XD.

This is one reason why I don't like POS. Another reason is the security of POS, which has never proven its security. Nothing at stake, etc. are all issues to consider. If the future largest application market for blockchain is in DEFI, security is the first attribute.

Finally, I suggest that if you support Staking, you must not only focus on the rate of return, you must look at the value of the project itself, whether the project has growth, and the rate of return is only in the mirror, the water in the moon.

Author: Allin block chain

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Depth | Read the seven big blockchain project foundation operation mode

- Continued to update Zhong Chang Zhao Changpeng live "review" theft, announced that no block reorganization, but was smashed

- PoW and PoS debate: Who has real openness? Who can stay away from the end of thermodynamics?

- If Buffett doesn't touch Bitcoin and gold, would you dare to vote for Bitfinex's LEO?

- Babbitt column | Coin East, new species?

- Babbitt interviews Zhao Dong | Bitfinex releases LEO to raise 1 billion, RenrenBit has opened an appointment

- The shadow bank hidden behind the currency, Bitfinex and Bitmex