Depth | The bottom of the question, is PoS really better than PoW?

The author of this article is stakingrewards.com, compiled by Cobo

This article has a total of 7268 words and is expected to read 18 minutes.

In order to understand Staking and PoS (Proof of Equity) in depth, we will compare it with the current mainstream consensus mechanism, PoW (Proof of Work).

At present, most public chains use PoW, but with the increasing attention of PoS, it is expected that the proportion of PoS will exceed PoW in the near future.

- Depth | Read the seven big blockchain project foundation operation mode

- Continued to update Zhong Chang Zhao Changpeng live "review" theft, announced that no block reorganization, but was smashed

- PoW and PoS debate: Who has real openness? Who can stay away from the end of thermodynamics?

Almost all new public chains are now based on PoS, and even the second largest public chain, Ethereum, will move to PoS in the next major upgrade. Why is this? Is PoS really better than PoW?

PoS is indeed better than PoW in some respects. In the following we will compare and analyze the two from several dimensions.

First, the definition of PoS

First, let us explain the basic concepts.

PoW and PoS are two different algorithms that determine consensus in distributed networks and how to reward consensus maintainers.

In other words, PoW and PoS explain how to issue new coins to provide incentives for the network to reward those consensus maintainers who provide resources. The value of these coins is backed by resources (mine machines, ASIC chips or a certain amount of coins, etc.), and the premise of getting rewards is that you must act honestly. This is true whether it is BTC, ETH, or XTZ.

You might say: Providing or locking certain resources on the network while taking on certain risks, it sounds a lot like Staking. That's right, it is true!

PoW can actually be understood by the logic of PoS. Spending money on mining equipment and electricity is equivalent to a form of Staking. We can further conclude that Staking is a traditional form of economy – investing capital to get a return.

Although this understanding is not wrong in some cases, we return to the definition of the two and their core differences.

The security of the PoW network comes from the hash computing power. In theory, the greater the computing power, the higher the profit. For details, refer to the bitcoin miners and mining pools.

The security of PoS comes from the value of the mortgage economy. In theory, the higher the number of Staking, the higher the return. (The reason for saying "theoretically" is because the choice of the Validator is random, so you can avoid over-centering.)

Although each consensus agreement is different, there are still some basic principles that we can compare.

Next, we will compare PoW and PoS through trends, scalability, cybersecurity, decentralization, cost, governance, community involvement, cold start, and environmental protection.

Second, the development trend

Although PoS has a shorter history than PoW and a small share in the overall market, it is growing rapidly.

In fact, 13 out of the top 30 cryptocurrencies by market capitalization have used PoS or PoS-like, including EOS, Stellar, Tron, Dash, Neo, Binance Chain, Ontology, Tezos, NEM, VeChain, Waves, Qtum, Decred, Lisk, and three others (ETH, Cardano, and OmiseGO) are turning to PoS.

This also means that more than half of the top 30 currencies in the market use PoS. In addition, almost all Layer 2 solutions use the Staking mechanism. Even the bitcoin lightning network can be considered a form of PoS: some relay nodes take bitcoin to help users trade through the channel and earn some fees.

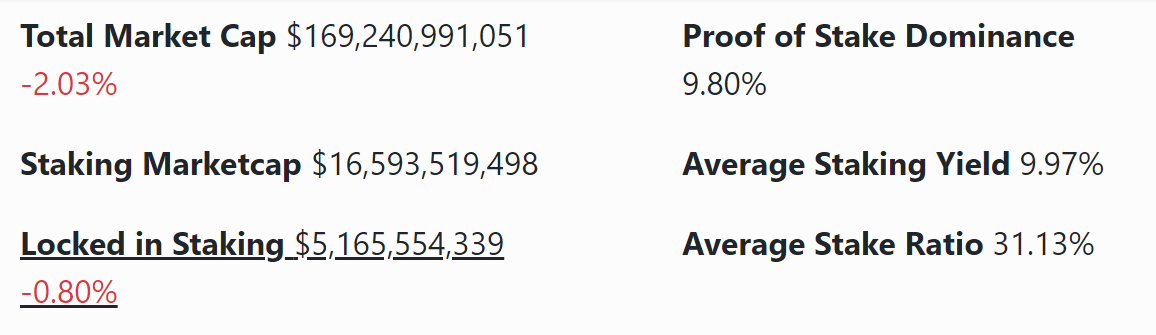

- Total Staking market value: > $16 billion

- The total value of locks in Staking: > $5 billion.

- PoS market capitalization ratio: 9.80%

- In addition to BTC and ETH, PoS market capitalization ratio: 26.6%

(Source: Stakingrewards.com 29.04.2019)

These numbers continue to grow, and many expect the total value of the PoS chain to reach $50 billion by the end of the year. As Binance Chain, Cosmos, and Polkadot move various projects to the PoS blockchain protocol, and the introduction of ETH 2.0, the total value of the PoS chain may exceed this scale.

Proof of Rights (PoS) seems to be slowly occupying the entire market.

Third, scalability

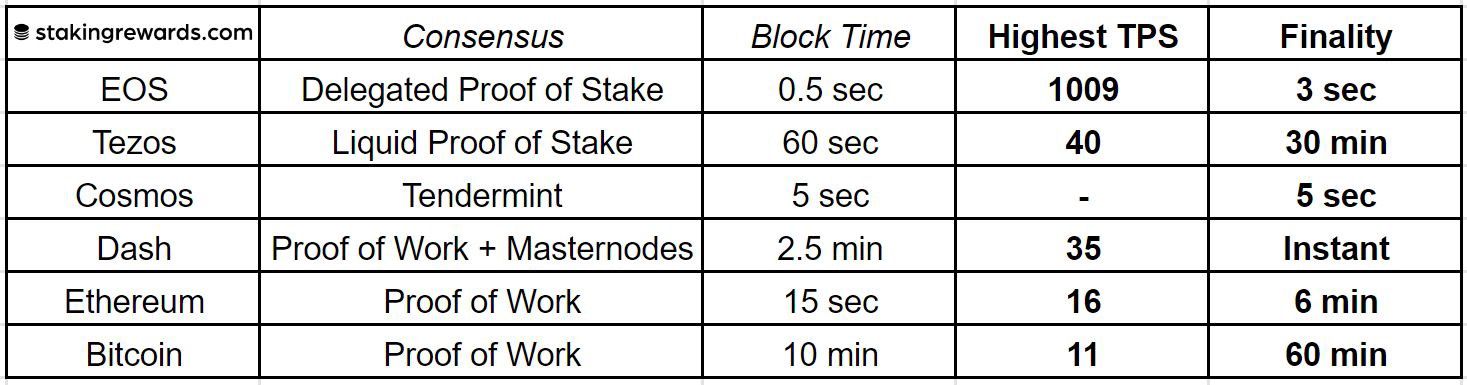

When it comes to scalability, you must consider transaction throughput and transaction confirmation time.

Transaction throughput : The block time and block size limit the transaction throughput of the network. Bitcoin using PoW mechanism is about ten minutes, other currencies are shorter, Ethereum can be reduced to fifteen seconds, and transaction throughput will increase slightly as the time of the block is reduced.

With the joint efforts of PoS consensus maintainers (such as Validator, block producers), transaction throughput is on average much higher than PoW due to a much shorter block time.

For example, Tezos has been able to achieve 40 transactions per second (40 TPS). EOS, TRON in DPoS (Certificate of Entitlement) can even handle transactions over 1000 TPS.

(Source: https://blocktivity.info/ )

Transaction Confirmation Time: Transaction confirmation time is also an important measure of blockchain scalability, especially in a business environment. In the PoS consensus mechanism, transactions are faster and can be confirmed almost instantly in some scenarios.

Fourth, network security

As we all know, bitcoin was launched as a pioneer of PoW in 2009 and has been running stably for more than a decade. Later, many other digital currencies also adopted the PoW consensus mechanism. Over the past decade, PoW has become a public-chain design template, with many attacks, reliability and security have been tested.

In the short term, PoW may be threatened by mining monopoly, boosting computing power by purchasing external equipment and launching a 51% attack. But for Bitcoin, it is almost impossible to buy hash computing to achieve such attacks, but for some small-scale PoW chains, like Verge, ETC is feasible.

If we want to estimate the cost of implementing a 51% attack on Bitcoin, we must first consider the hardware and power costs.

- Total hashing power: 50,000,000 TH/s

- Ant Mining Machine S9 Current price: $300

- Ant mining machine S9 Hash computing power: 13 TH/s

- Hardware cost of 51% attack: $1,153,846,153 USD (about 1.11% of network value)

PoS and Staking are still new, although the coins like PeerCoin and Ardor have been around for a long time, but the first mainstream PoS chain, Tezos, was not launched until the summer of 2018.

PoS coins have not been subjected to rigorous stress testing, so we don't know what problems we might face.

Here are some of the attacks that PoS may face:

A long-range attack is when an attacker creates a long blockchain branch starting from a creation block and attempts to replace the current legal backbone. There may be transactions and blocks on the branch that are different from the main chain, so this type of attack is also known as a replacement historical attack or a historical overwrite attack.

No harm

Nothing at Stake Attack

There is also no harm in the PoS network. Unlike PoW, the cost of running multiple chains in a PoS is low, and the Validator can vote on multiple chains without any loss, which is a violation of the consensus agreement.

51% attack

51% Attack

You might think that a 51% attack would require 51% of the total currency, but in some PoS networks, only a minimum of 33% of the Stake funds would be needed to launch such an attack.

And if they can absorb others' votes, the attackers don't even need to use their own currency to launch an attack. They can even get a vote by buying or bribing.

Another point is that 33% of what I said is not 33% of the total supply of the PoS, but 33% of the Staking pool. In this case, the amount of currency required to launch a 51% attack will be less.

Low Staking participation rate

Low Staking Participation

As mentioned above, in some PoS networks, only a 33% currency that is active in the pool can be pledge to initiate a 51% attack. For example, the take rate is 25%, 33%* 25%=1/12, which means that only one 1/12 of the total supply of the PoS is required to initiate an attack.

Private key attack

Private Key Attack

Once the private key is accessed, the attacker gains ownership of the Staking funds and the right to sign the transaction. Even if the private key does not directly control all Staking funds, the private key gets the power of Validation and Staking to facilitate the attack.

Therefore, a large security risk in the PoS network exists in the process of transferring the network value to the Validator, which may lead to highly centralized and cyber attacks. As long as you have a lot of resources, you can launch an attack by buying a ballot or a monopoly organization of Validator.

LISK is in a similar situation, and Validator has set up several organizations to manipulate the incentive share. EOS's Validator also has an EOS constitution that stipulates that voters cannot receive any rewards.

Please pay attention to the above mentioned attacks. Some PoSs may be designed to prevent these attacks at the beginning of the design, but PoS still has not experienced actual stress tests.

Mixed consensus mechanisms such as DCR and DASH have also begun to emerge. For security reasons, it uses bitcoin as a parent chain in mining, and has a DPoS consensus algorithm similar to EOS. Such a hybrid consensus mechanism is also worth exploring.

Five, decentralized

PoW

PoW mining relies on machine equipment, which has a high threshold and technology is monopolized by a few companies.

Mining is also a daunting project because buying ASIC chips is a long-term investment and not as liquid as PoS funds.

And now the profit of mining is very low, only those large companies with hardware technology and cheap power can be profitable.

PoS

Unlike PoW, the core of the PoS consensus mechanism is the currency in the network. These coins can be purchased in large quantities on the exchange or even in the OTC market. They do not need to be mined, so there is almost no threshold for participation in Staking. In the PoS consensus mechanism, super nodes can be rewarded by running and maintaining the network, so the motivation for running nodes is high.

While not everyone is willing or able to run nodes, the Staking mechanism is important for decentralization because PoS allows all holders to vote and participate in consensus without running a node.

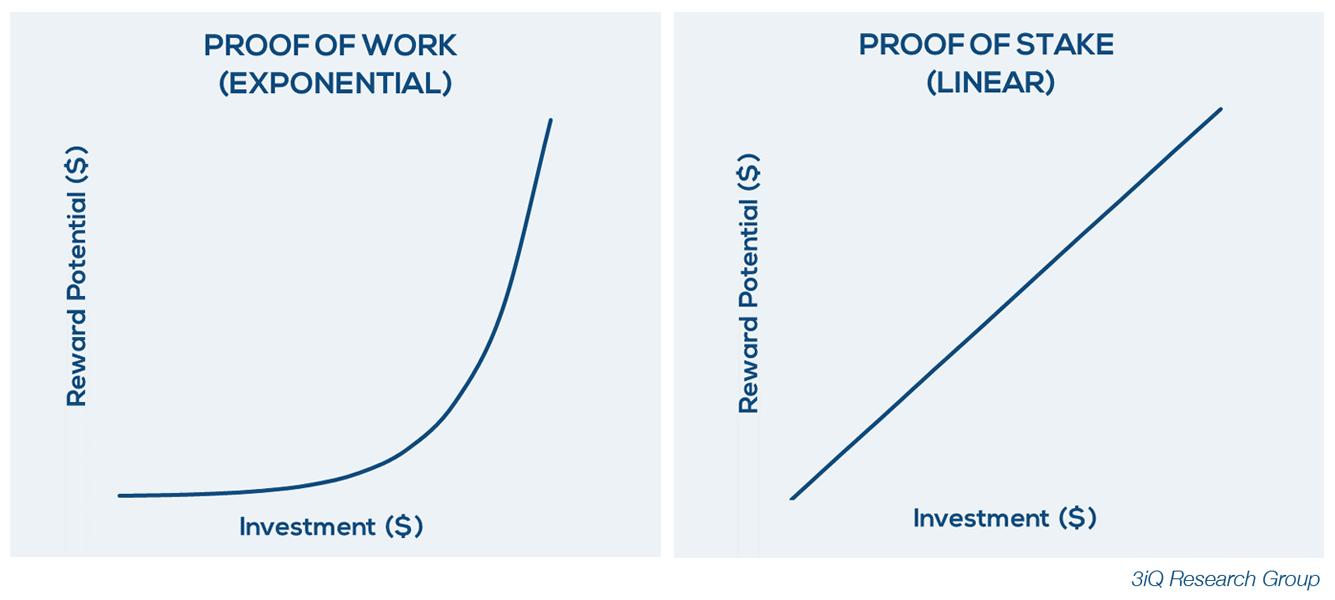

But would you think that the rich are rich under the PoS consensus mechanism? Compared with PoW, it is not. In the PoW consensus mechanism, the rule of the “rich and rich” is more obvious. Rich miners can buy a lot of ASIC mining machines, they have the advantage of resources and enjoy high returns. PoW's big miners enjoy returns in economies of scale; but for PoS Staker, there is only linear benefit.

(Source: 3IQ Study Group)

Sixth, the cost

To discuss costs, we have to consider three aspects:

- Chain transaction cost

- The cost of capital needed to maintain the blockchain

- Compensation for the inflation costs required by the Validator or miner

In the PoW consensus, the cost of bitcoin transactions is about $1.91 per transaction, and the transaction cost of Ethereum is about $0.1 per transaction. The transaction cost will change with the price of the currency. At some point in the bull market highs, Bitcoin and Ethereum transaction costs can be as high as $54.9 and $5.5, respectively.

In the PoS consensus, transaction costs are much lower. Take Tezos for example, the cost per transaction is only about $0.01, and other PoS coins like Cosmos are similar.

Now let's take a look at the cost of maintaining the blockchain.

The cost of maintaining a blockchain

PoW requires high hardware and power costs, and in PoS, becoming a Validator requires only one safe & good running device, and a small amount of electricity costs.

In the Bitcoin network, the annual hardware maintenance cost is about $2 billion (the life of these hardware is about 18 months), and the cost of electricity is about $4 billion (electricity is calculated at $0.08 per kilowatt).

That is to say, in order for the normal operation of the PoW network, it is necessary to invest 6.5% of the total value of the network. In a PoS network, maintenance costs account for only 0.1% of the total network value.

Inflation cost

In the PoS network, the inflation rate is about 6%, while in the PoW network, this ratio is about 4% (just an estimate).

The incentive design of the blockchain will reduce inflation over time. PoW is longer than PoS, so we can say that the inflation level is similar, and the inflation rate of PoS will become more and more in the future. low.

In the PoW network, investors who are not miners do not have a good way to resist inflation. In the PoS network, the holders can get a certain amount of money through the coin.

Seven, governance

In a PoW network, protocol governance can be divided into several parties:

- Miner: Decide whether the transaction information is confirmed and which chain to dig

- User: Decide which protocol to accept and which ecology to use

- Foundation: Deciding how to allocate funds between different development organizations

- Node: Decide which software to run and provide services to users through the API

On the PoW network, it is hard to say who holds the most voting rights because voting rights in PoW are difficult to quantify. However, in order to maintain the network and manage huge resources and networks, there is still a need for a consensus between the parties. The lack of transparency in governance in PoW networks has made the design and upgrade process of the protocol slow.

PoS governance is also distributed among the groups mentioned above, but the governance mechanism is more systematic, and we can follow a simple rule – 1:1 voting.

Moreover, in the PoS network, we can implement chain governance (in fact, PoW networks can also be implemented, but no attempt has been made yet). Governance on the chain allows us to create agreements or propose improvements to the agreement, and we can vote on the chain. Based on the results of the voting on the chain, the protocol can be executed automatically. This chain management mechanism is currently used by Tezos.

Other PoS examples of governance voting are:

- EOS

- Decred

- Dash

- Cosmos

The clear and transparent voting design in PoS governance facilitates the rapid implementation of protocol changes.

Eight, community participation

PoW miners have traditional business thinking and are more willing to invest in a traditional business model that they are familiar with. For them, mining is similar to factory manufacturing. Mining equipment is the production equipment. The higher the technology, the higher the efficiency. Cheap electricity is a necessary resource for mining, and these business models rely on market prices and traditional factories rely on steel prices.

Of course, there are risks: if the price of digital currency falls, mining may become unprofitable. But in most cases, the market price can also make money by selling all the coins.

Most of today's miners are mine equipment and people with certain resources, and they rarely have the motivation to participate in the community. If they really believe in the value of the currency, direct investment can be rewarded. Direct investment in Bitcoin now has more returns than mining, and we believe that this trend will not change in the long run.

In contrast, the Validator in PoS is more like an investor. They need to have a deep understanding of the technology behind their digital currency and contribute to the development of the agreement. Large PoS currencies generally have independent research teams.

In order to get more votes, these Validators generally need to hold a lot of coins. These funds will be locked for a certain period of time through Staking or Staking services. If you want to use some funds, they may not be able to continue to serve all customers.

In this way, Validator becomes a long-term investor, and they are more motivated to drive technology and value. The higher the incentive, the more investment.

This is like venture capital investment in the early stages, and VC supports the companies they invest in. This metaphor graphically summarizes the theory of mining investment and is widely disseminated after the use of Coinfund.

Nine, cold start

What is the best way to issue a public chain? Given the role of tokens in the adoption and financing of public chains, we must consider how the public obtains tokens.

Publishing a PoW chain is very simple. Initially, the circulation of PoW was 0, and everyone gained equal participation through mining. This process seems relatively simple, equal, and transparent.

In order to support ongoing protocol research and development, a development fund can be set up like Zcash, with a small number of block rewards awarded directly to developers.

Bootstrapping of PoS networks is more complicated. From the beginning, many parties need to hold a part of the equity, and the ICO ratio is determined before the release.

The most common method is to issue tokens (ICO, IEO, or other forms), and the original token supply is sold or sent to investors, developer teams, foundations, councils, and more.

Because large investors who participate in the original equity distribution have high barriers to entry and can also get rich returns, such token issuance is generally unfair, and there are more restrictions for ordinary investors in the community.

The grant period for tokens is usually opaque and often changes. This also means that investors' rights may be diluted, but they are still in the dark.

Another way to issue tokens is to drop in, and people can receive a certain amount of tokens without investing directly. This type of token airdrop usually occurs without the recipient's knowledge, and the number is extremely small, which is almost negligible compared to the total amount. This does not seem to be the best method due to the lack of transparency.

In addition, there are other cold start methods, but still in the early stages, it is difficult to draw conclusions. One of them is the concept of "cross-chain airdrops" introduced by Cosmos, which is implemented by hard spoons – by copying the balance of a digital currency account on a PoW or PoS chain onto a new PoS chain, which The new digital currency on the chain is interoperable and can be used for Staking.

“Hard Spoon: Forming a new chain based on an existing blockchain network state; this new chain does not compete with the original chain, but provides a wider range of access.” Tendermint founder Jae Kwon Jae Kwon

Ten, environmental protection

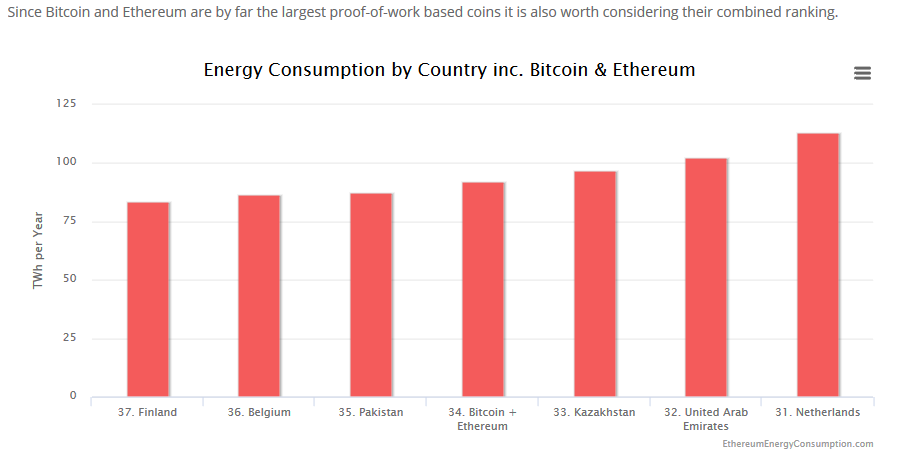

If we look at the cost of protecting a public chain, PoW is much more expensive than PoS, after all, equipment and electricity costs are high. From this perspective, PoW is clearly not friendly to the environment.

Despite this, we believe that the power consumed is negligible compared to the value we get. What we get is a book that is trustworthy, global, non-tamperable, and highly secure. The cost of PoW is not as high as the cost of gold mining and the cost of existing financial systems. If we only look at the impact on the environment, we recognize that PoS is better because it is more environmentally friendly.

in conclusion

In this article, we compare PoW and PoS from several dimensions. The two are not perfect, and there will be no consensus mechanism to unify the world in the future.

We strongly believe that at least one PoW chain will eventually exist, and it is likely to be bitcoin. The PoW chain provides unparalleled security and irrevocability and can serve as a source of global settlement and real data. Around Bitcoin, people have placed a lot of visions and there are also many controversies.

More and more new blockchain protocols are beginning to adopt the PoS security model, and as Ethereum moves from PoW to PoS, the proportion of PoS will increase significantly.

Most of the second-tier solutions also use PoS, and the topic of Staking has become hot in the world of blockchains.

If we look at the interactive and applied PoS chains like Cosmos and Polkadot, we will find that PoS even links to PoW chains like Bitcoin, Monroe, and Big Coin. These PoW chains need to have their own zones, Parachains, and Bridges to communicate with them and indirectly become part of the Staking economy.

To sum up, the reasons for the rise of PoS are:

- Can earn Staking income, not diluted by inflation

- Low threshold for participation in consensus

- More scalable

- No economies of scale, more decentralized

- Maintaining blockchain costs are lower

- 1:1 vote, governance is more transparent

- Higher incentives for consensus maintainers (such as Validator) and the community

- More environmentally friendly

It is worth mentioning that several advantages mentioned above are at a certain cost and cost. PoS does not currently have historical data traceable like PoW. In the future, as the overall market matures, we will see that the development trajectory of PoW and PoS is more and more complete and easier for us to learn. Of course, there will be no situation in the world, just as there is no such thing as an algorithm. A PoS+PoW hybrid system like Decred may become more popular, but this is another topic.

(This article was compiled by Cobo, the article does not represent Cobo's point of view)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- If Buffett doesn't touch Bitcoin and gold, would you dare to vote for Bitfinex's LEO?

- Babbitt column | Coin East, new species?

- Babbitt interviews Zhao Dong | Bitfinex releases LEO to raise 1 billion, RenrenBit has opened an appointment

- The shadow bank hidden behind the currency, Bitfinex and Bitmex

- POS mortgages make money look good, but there may be fatal loopholes?

- Why does the betting DAPP do not need to be issued?

- Analysis of the market: On May 1st, the fixed investment in multiple positions will gradually reduce profits, and the bag will be the king.