Summarizing the three major innovations of Uniswap V4

Summarizing Uniswap V4's three major innovations.On June 13th, Uniswap released the Uniswap V4 code draft. The vision for Uniswap V4 is to allow anyone to make these tradeoffs by introducing “hooks.” Hooks are contracts that run at various points in the pool operation lifecycle, and the pool can make the same tradeoffs as in v3, or add entirely new functionality.

Two years ago, Uniswap V3 introduced concentrated liquidity to increase capital efficiency. Today, Uniswap V4 is bringing customization and optimization to the AMM space. If you care about DeFi and its future, you should read this article to dive deeper into Uniswap V4.

Since the birth of DeFi, Uniswap has always been at the forefront of AMM innovation. In its 5-year history, Uniswap has gone through three changes in total.

- Who is bullish on Azuki? Analysis of the movements of the top eight whales

- Why did Azuki’s Elementals release collide with another release?

- Chainlink Proof of Reserve (PoR): Putting Transparency at the Forefront

1. V1 = Innovative ERC20 to ETH liquidity pool and AMM;

2. V2 = Enable ERC20/ERC20 liquidity pool and flash swap;

3. V3 = Concentrated liquidity.

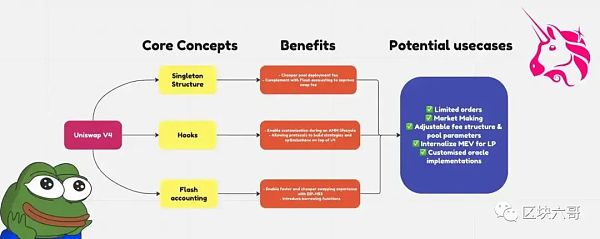

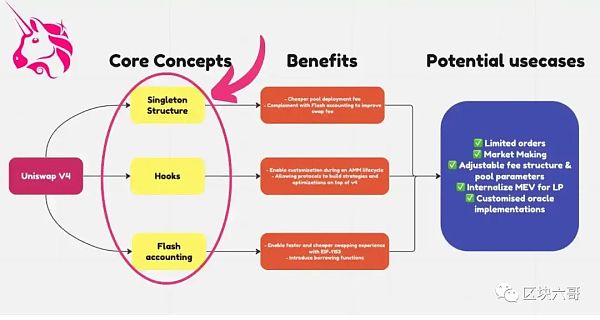

With the release of Uniswap V4, Uniswap is set to completely change the DeFi space with three new concepts, including:

1. “Hooks”

2. “The Singleton”

3. “Flash Accounting”

First, we need to understand the necessity of Uniswap V4. The lack of customizability has always been a problem in the V2/V3 versions. Due to technical complexity, third-party developers have been unable to implement volatility oracles and limit orders in V2/V3.

What are Hooks?

In V4, Uniswap is attempting to solve this problem by introducing a new feature called Hooks. Hooks are an external smart contract that can execute logic at different “key points” in the pool. Key points refer to operations before/after the swap, or when LP deposits/withdrawals are made, etc.

Through Hooks, liquidity pool creators can adjust pool parameters and introduce new features to the AMM. Moreover, the implementation of Hooks can change the curve and allow for various strategies to be built on top of Uniswap, ultimately benefiting LPs/swappers more.

Examples include:

・Creating limit orders with the smallest possible price change, known as minimum price increments.

・Breaking down the order itself into smaller parts through time-weighted average market maker (TWAMM) market-making.

・Implementing dynamic fees during high volatility periods to encourage a balanced liquidity pool.

Hooks can even allow for customized oracles and distribution of internal MEV to LP holders.

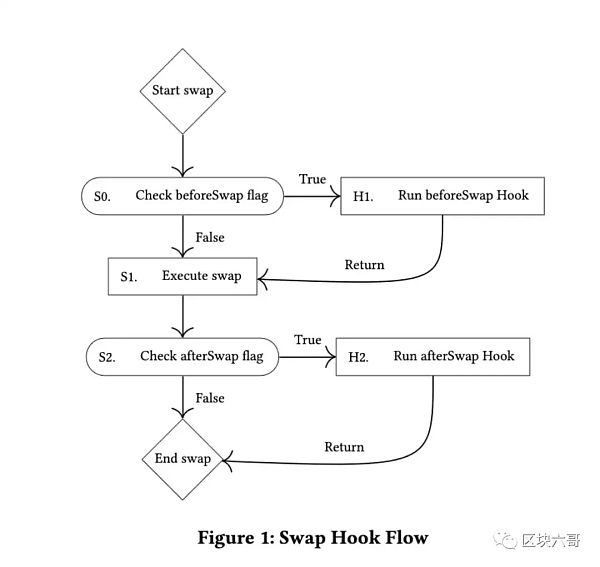

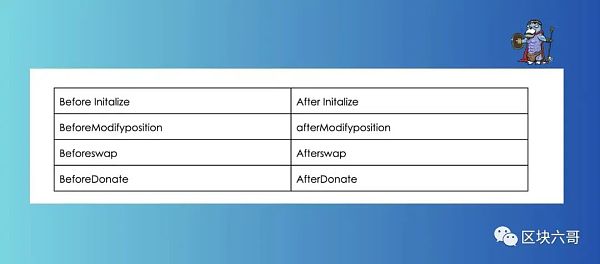

Additionally, V4 also has another feature called Action Hooks, which can call logic during execution. Action Hooks are contracts that only trigger and run when the “Flag” condition is met and becomes “True”.

Using the following flowchart as an example:

Before the Swap, the contract checks the Flag to evaluate the volatility of the liquidity pool; if the volatility is high, the Flag becomes “True” and the Action Hook is triggered; if the volatility is not high, the Flag becomes “False,” and the Swap proceeds as usual.

By doing so, Action Hooks provide a more gas-efficient way to determine which hooks to execute. V4 now allows for Action Hooks to be implemented in eight different scenarios:

Singleton Mode

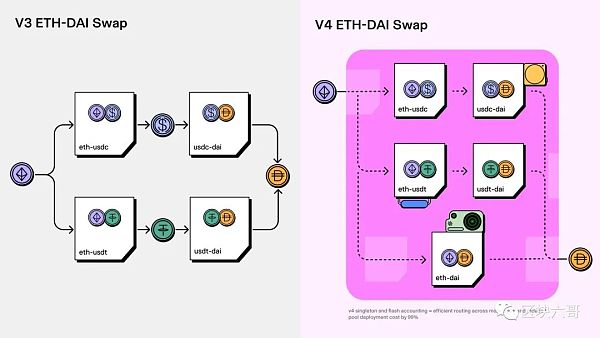

On the other hand, the Singleton structure and Flash accounting will enable cheaper transaction and deployment experiences in V4. How is it achieved?

In V3, every time a liquidity pool is created, a new contract must be deployed, and the cost of deployment is very high. In V4, Singleton mode keeps all pools in one contract, reducing the cost of pool deployment by 99% compared to V3.

In V3, each trade or LP staking ends with a “Token Transfer” action. In short, each of your operations requires a token transfer. This can lead to the exchange consuming a large amount of gas fees during each operation.

Flash Accounting System

Using the Flash accounting system in V4, each operation (exchange/deployment) only results in internal balance updates, where the balance is priced in “delta” units. At the end of the exchange, it only exchanges the net “delta” balance after a series of calculations.

Since liquidity pool managers do not need to hold any tokens at the end of a transfer, the Flash Accounting system ensures the solvency of the liquidity pool. Combined with the Singleton pattern, this architecture can simplify multi-hop transactions and complex pool operations, making V4 more user-friendly.

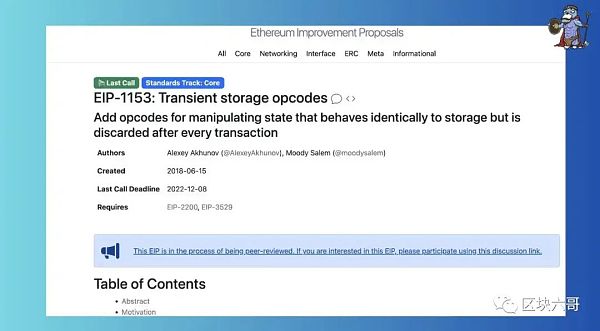

Unfortunately, the Flash Accounting model is still very expensive, as users need to pay gas fees to update internal balances once they exceed the storage refund limit. To reduce gas fees, Uniswap needs a temporary storage upgrade from EIP-1153.

What is temporary storage?

Simply put, temporary storage provides a way to provide a temporary storage area in the transaction execution environment that will disappear after the transaction is completed.

Temporary storage not only helps reduce overall gas costs, but also helps simplify smart contracts and improve their interactions.

Other notable upgrades in V4 include:

Restore native ETH exchange;

Introduce donation functions (tips for liquidity providers, etc.);

Governance updates to control Swap fee caps.

In short, Uniswap V4 provides a more customizable, flexible, and efficient automated market maker than ever before. More DApps are expected to take advantage of V4’s flexibility and design optimization strategies to benefit liquidity providers or increase capital efficiency.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What are the potential chain reactions of Prime Trust facing bankruptcy crisis?

- Bloomberg Interview with He Yi: My relationship with CZ is that of a mentor, friend, and spouse.

- Inventory of Rug Pull events in the crypto world

- Why did Azuki’s Elementals collide in the release?

- Goodbye Fork Swap, Uniswap V4 Enters the Era of “Ten Thousand Hooks”

- LD Capital: MakerDAO Status Update

- Evening Must-Read | Cancun Upgrade is Coming Soon, Reviewing Key Milestones in Ethereum’s History