Taking Bitcoin and Ethereum as examples, let’s talk about making up the pitching method.

“Investing without research, like playing poker never looking at cards, must fail.”

Article introduction:

1. Investors who missed the timing

2. Annual line half-year buy-in method

- Australia ICO new guidelines introduction

- The IPFS mining machine entered a strange outbreak, and the miners’ wool party was cleaned.

- Lightning network capacity plummeted by 13%. When will this most anticipated expansion solution be able to get rid of the simple "belief support"?

3. Take Bitcoin Ethereum as an example

1. Investors who missed the timing

Since the Spring Festival this year, I have been recommending everyone to vote. If the friends who have followed our decision from the beginning have now achieved stable returns. Bitcoin has risen from about $3,600 at the beginning to nearly $8,000 at the time of writing, and Ethereum has risen from about $136 to about $250.

Of course, there are still many friends who have missed the opportunity of fixed investment in the past six months for various reasons.

2. Annual line half-year buy-in method

Yesterday, I saw an article by Laobai, "If there is no fixed investment in the past six months, how to make up for the missed opportunity," I introduced an investment method. For those friends who have completely missed this round of the past six months, how to continue to seize opportunities in the follow-up is a very worthwhile way to learn.

I share and refer to the methods described in the article in conjunction with my ideas:

This method is very simple: when the currency price is retreated to the half-year line or the annual line, the funds are bought once.

The semi-annual line here is the moving average of the currency price over the past 180 days, and the annual line is the moving average of the currency price over the past 360 days.

When the currency price is retreated to the half-year line, the funds are bought once, which is similar to the fact that we have participated in the fixed investment in the past six months. When the currency price is retreated to the annual line, it will be invested in one time, which is similar to the fact that we have participated in the fixed investment in the past year.

But what everyone must pay attention to is that this is only an approximation effect and not a 100% equivalent to a half-year or one-year fixed vote. In addition, this method I think is only applicable during the non-bullish period, and must be used with caution when using it in other markets.

Using this method, we must rely on powerful technical tools. The tool software I use is "tradingview". Its official website is https://cn.tradingview.com/ .

When you enter the website, select the currency you want to view, set the moving average of 180 days and 360 days, you can see the price trend and the moving average.

3. Take Bitcoin Ethereum as an example

Below I will take Bitcoin and Ethereum as examples to explain to you.

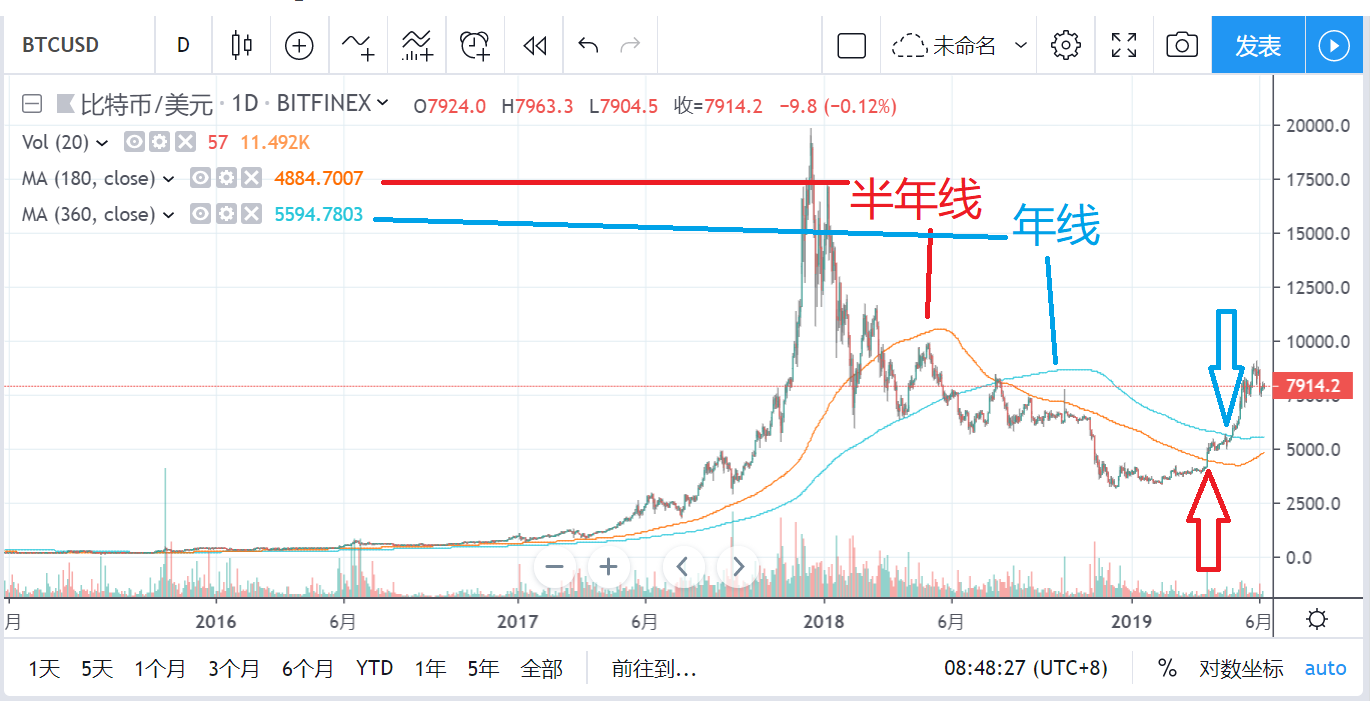

Bitcoin price chart

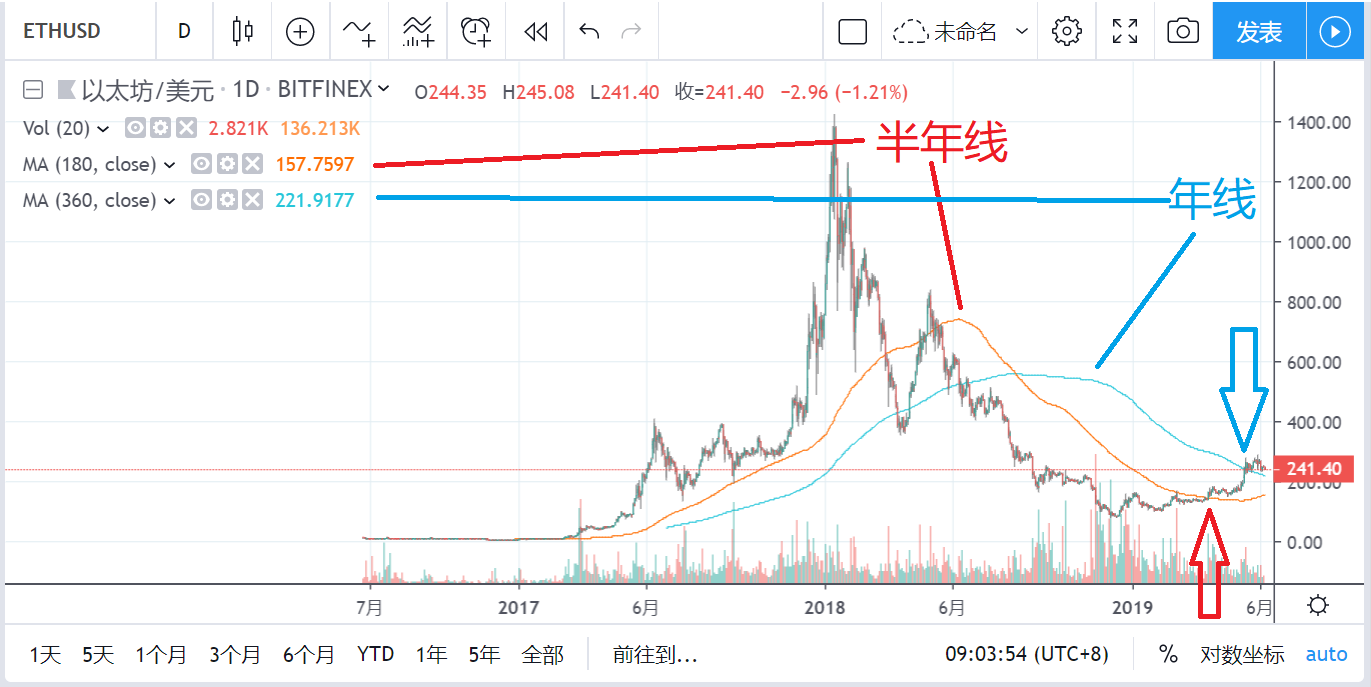

Ethereum price chart

The above chart is the price chart of Bitcoin and Ethereum.

In the picture I marked the half-year line in red. The red curve is the moving average of half a year. "MA(180, close)" is the setting for the half-year line. The intersection of the half-year line and the price chart indicated by the red arrow is the point at which the investor can buy when the price goes to the half-year line.

In the picture I marked the annual line in blue. The blue curve is the one-year moving average. "MA(360, close)" is the setting of the annual line. The intersection of the annual line and the price chart indicated by the blue arrow is the point at which the investor can buy when the price goes to the annual line.

From the chart of Bitcoin, we can see that the price of Bitcoin is now above the half-year line and the annual line. From the chart of Ethereum, we can see that the price of Ethereum is now near the annual line, and higher than the half-year line.

Therefore, the price of Ethereum is now a point that can be bought, and Bitcoin is not yet.

With the development of the market, the annual and semi-annual lines will continue to change. Therefore, according to this method, everyone should pay attention to the market trend, once the price and the half-year line are very close, you can buy as appropriate.

What everyone should pay attention to is that according to this method, it does not mean that the price to buy must be cheap. For example, for Bitcoin, the current price has not yet reached the price that can be bought. In the future, when the price intersects with the annual or semi-annual line, the price at that time may be higher than now, so this method is for your reference only. .

Regardless of the method used, you must establish a risk awareness in your mind, and think carefully about whether you can afford the risks of investment.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- In the second half of 2019, where is the wind vent?

- G20 began to implement a unified encryption asset standard

- Gu Yanxi: Fnality, a milestone in the evolution of financial market infrastructure

- Thailand's blockchain regulation policy and practice (Part 2)

- Yang Dong: Urgent need to strengthen supervision and governance of blockchain technology

- Russia considers setting up an encryption trading center on the Sino-Russian border

- How does Tongzheng work?