Stablecoins: Not a Replacement for Banks, but a New Disruptor

Stablecoins: Not a Bank Replacement, but a New DisruptorAuthor: STEVEN KELLY

Translator: Block unicorn

USD Coin (USDC), the second largest stablecoin by market capitalization, received government assistance in March, proving that it has the ability to compete with banks.

- Flashbots: Restraining all parties, committed to thoroughly decentralizing MEV

- MEME Coin: From Internet Meme to a Market Cap of Over One Billion, What’s Behind the Power?

- When AI meets blockchain: ushering in a new era of human-machine integration

Stablecoins may also face banking crises

USD Coin (USDC) issued by Circle has long been a “good guy” among stablecoins, second only to Tether, which often gets into trouble, in terms of market capitalization. Circle’s model is based on investments in cash and short-term government bonds, and provides transparent disclosure. This is also the basic model adopted by Congress when trying to legislate stablecoins, but it is not wise.

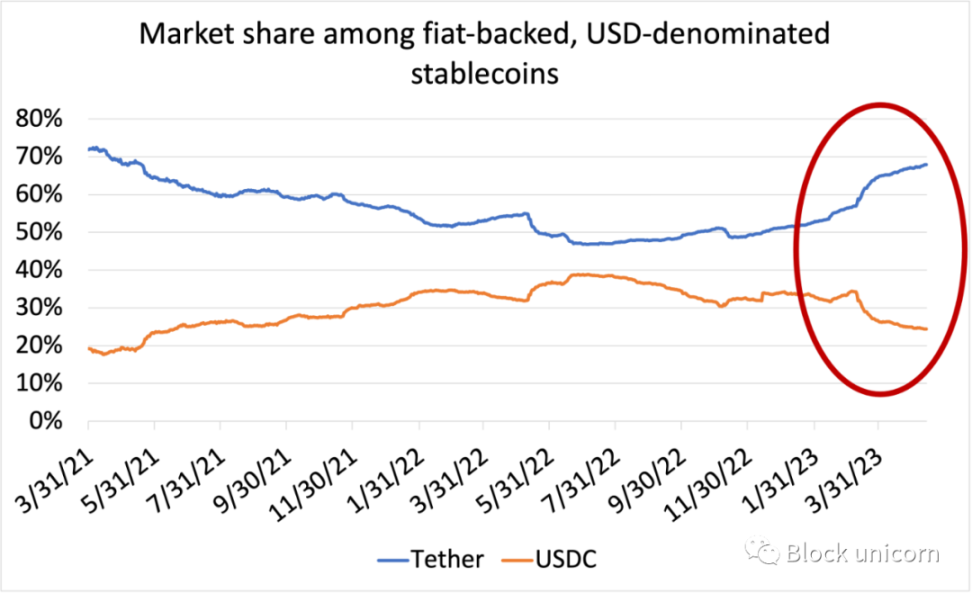

This structure was very effective for Circle for a period of time. Despite Tether’s first-mover advantage and other advantages, Circle was almost catching up in market capitalization. When the Terra/Luna collapse occurred in May 2022, Tether’s market share of USD-based stablecoins fell to less than half, while Circle’s market share almost reached 40%.

As Circle wrote in its “Trust and Transparency” blog series in July last year (all emphasis is mine):

“Comparing Circle to trusts or banks that use partial reserve models is like comparing apples and oranges (two fundamentally different things that cannot be compared). We don’t lend out the reserves of USDC to anyone. The USDC issued by Circle is a fully reserved digital currency in dollars. Unlike banks, exchanges, or unregulated entities, Circle cannot lend out the reserves of USDC… “

This is a point that Circle has repeatedly emphasized in the public opinion field and in Washington, D.C.

As Circle CEO Jeremy Allaire testified before Congress: “A fully reserved digital currency model, such as USDC, where 100% of assets are fully reserved in the form of high-quality liquid assets such as cash and short-term U.S. government bonds, is different from bank deposits. Bank deposits are the process by which banks receive deposits and then re-pledge and lend them out.”

For stablecoin holders, this sounds great! Customers’ money is fully stored in a safe place, their money is labeled with their name and can be easily withdrawn and used, and the risk investment of short-term government bonds does not expose customers to the risk of capital loss.

So how can a non-bank institution achieve this level of safety? The answer is “cash” (i.e. bank deposits) and short-term Treasuries. These short-term Treasuries include money market fund shares, as well as repo agreements backed by Treasuries with banks and other institutions that may hold long-term Treasuries. In addition, transparency in disclosing these assets is necessary so that the market can trust them. (Transparency, disclosure, and third-party verification are key to preventing the instability of stablecoins, right?)

Alright, let’s take a look at Circle’s disclosure in February 2023:

As of the date of the report, Circle has cash deposited with the following US-regulated financial institutions: The Bank of New York, Mellon Trust Company, NA, Customers Bank, The Bank of New York Commercial Bank, Flagstar Bank, FSB, a branch of Signature Bank, Silicon Valley Bank, and Silvergate Bank.

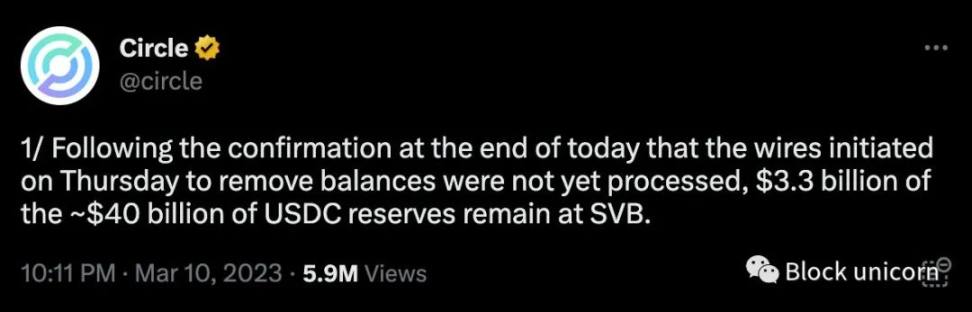

As a result, in the span of just three days in March, the support for “fully reserved” USDC became a portfolio of enviable distressed credit investments. As a result, USDC itself did too. Under the pressure of the aforementioned disclosure (transparency!), USDC began to fall, and its value fell more severely when Circle disclosed that $3.3 billion was actually stuck in SVB, despite attempts to withdraw it:

That weekend, the trading price of USDC dropped below $0.90 – until the government announced it would back uninsured deposits at failed banks:

“We don’t lend out reserve funds” has always been a ridiculous claim, and now USDC has undergone a 48-hour drill that further clarifies this. To truly achieve “full reserve,” all reserves must be held in central banks.

Otherwise, claiming that something less than full reserve is “full reserve” is extremely misleading. Uninsured dollars in banks (of which USDC likely needs at least some, and there is a lot of them regardless) are loans to those banks, as they are the digital currency that connects the blockchain system to traditional currencies, and are an important bridge connecting the traditional financial system and the digital currency system. Circle is issuing demand liabilities and making risk loans, so it is a bank:

In March, transparency around its asset book led to outflows of liabilities (as bank user deposits or USDC volumes grow, liabilities increase as these funds need to be redeemed to customers), and although no losses were ultimately suffered, this indicated it is a bank. Tether, which is riskier but has cleverly lowered transparency, regained a lot of market share in March, so it’s a bank too:

So the new consensus on how to make “stablecoin payments” stable is still unstable. However, from a financial stability standpoint, the drop in value of USDC is not the most important part of this story. The important part of this story is that when Circle learned the bad news about the bank, it tried to pull $3.3 billion out of the bank.

Stablecoins, Unstable Deposits

While in this case $3.3 billion in funds could not have changed SVB’s fate, it’s easy to imagine a scenario where stablecoins representing their holders run on the system and put pressure on important counterparties. If Circle had successfully pulled out the funds, that would have been great for stablecoin holders, but could have come at the expense of system stability.

Between March 6 and March 31, Circle withdrew about $8 billion from the banking system to support USDC deposits. From a macro perspective, $8 billion is not much. But for certain specific banks, this could mean everything; when a bank is in survival mode, someone has to play the role of marginal counterparty.

In Q1, Tether moved about $5 billion of deposits out and instead did repurchase agreement trades, consistent with a broader trend in the bank market. Even if these funds ultimately returned to the exact same borrowers, there was a cost and there may have been some temporary disruptions. More likely, some people lost access to funding.

But isn’t that the fault of bad borrowers (i.e., the banks) rather than the stablecoins fulfilling their fiduciary obligations? After all, holders redeemed about 25% of outstanding USDC stablecoins in March, more than $10 billion! Circle had to have liquidity to fulfill these obligations.

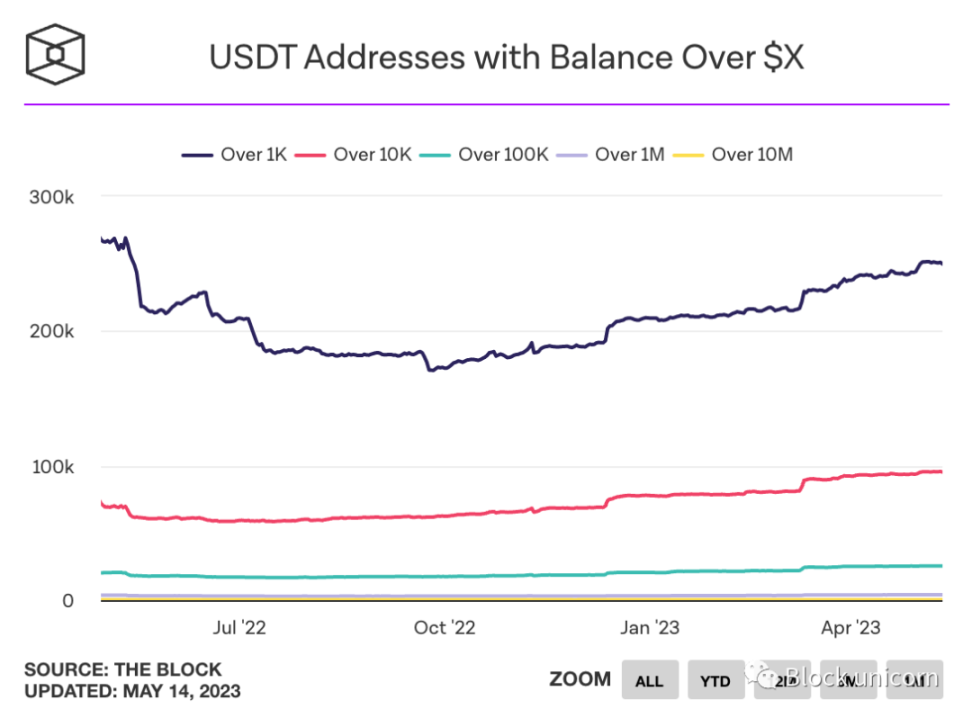

However, the existence of non-bank stablecoins is increasing system fragility by entering the intermediary chain. Blockchain data shows that the amounts held by most Tether (USDT) and USDC holders should typically be within the insurance coverage of the Federal Deposit Insurance Corporation (FDIC):

Therefore, if you exclude non-bank stablecoins from the intermediary chain (or require them to be banks), you are left with sticky, insured depositors in the banking system.

That is to say, in order to provide cryptocurrency services to customers, non-bank stablecoins are actually aggregating insured deposits and transforming them into uninsured deposits and other wholesale financing. And these financings have the risk of fulfilling the fiduciary obligations at the first sign of trouble. If stablecoins are really “payment stablecoins” as Congress said, they should only be a payment technology and exist under the deposit ledger of the banking system. Non-bank stablecoins can achieve security for themselves, but they also bring risks to the entire system.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What are the recent movements of Crypto VCs? 7 tools to help you easily track

- a16z partner jonlai: the most successful application is the packaged game

- How Blockchain Is Impacting Online Poker

- Blockchain in the annual report of listed companies: a comparative analysis of six state-owned banks

- More than 60 organizations in Europe and the United States jointly developed: Rehabilitation Certificate for New Coronavirus Patients Based on Blockchain

- Blockchain war "epidemic" action (1): big data application

- Observation | Is the open source of the blockchain the biggest flaw in the business model or the strongest defense?