The Blockchain 50 Index rose by more than 5%. Can you understand what the sample companies are doing?

Source: Caijing.com

Author: Chen

According to the data on January 6, since the Shenzhen Stock Exchange Blockchain 50 Index (399286) went online on December 24, 8 out of 9 trading days have shown an upward trend, reaching a maximum of 3333.67 yuan at one time, which is higher than the opening price on the launch date. 3120.58 yuan increased by about 6.86%, and is now reported at 3,296.56 yuan, which is about 5.64% higher than the opening price on the launch day.

According to the Shenzhen Stock Exchange, the above indexes include pure price indexes and full-return indexes. Pure price indexes release real-time market data through the Shenzhen Stock Exchange market system, and full-return indexes release closing market data through the China Securities Index Network.

- Third World War Phantom strikes, digital gold BTC may usher in a super bull market

- Global blockchain ebb in 2019, China's "dominance" strengthens

- Industry still wait-and-see on SEC's proposal to expand "qualified investor" scope

The Shenzhen Stock Exchange Blockchain 50 Index is based on the companies listed in the Shenzhen Stock Exchange, whose business areas involve the upstream and downstream of the blockchain industry as a sample space. They are ranked according to the daily average market value in the past six months from high to low, and the top 50 are selected. The stocks constitute sample stocks.

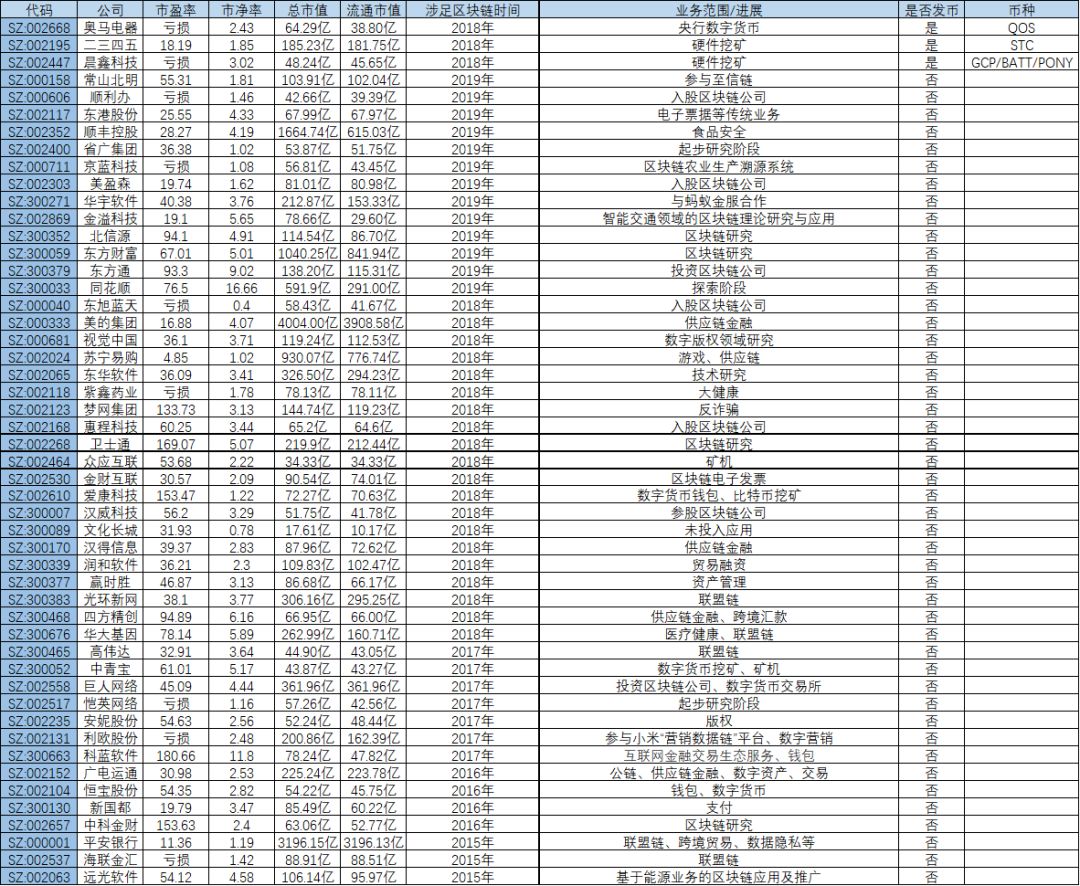

According to Caijing.com, the 50 index samples of the SZSE Blockchain 50 Index are Jinyi Technology, Kelan Software, Ping An Bank, Dongxu Lantian, Changshan Beiming, Midea Group, Smooth Office, Visual China, Jinglan Technology , Suning Tesco, Yuanguang Software, Donghua Software, Hengbao Shares, Donggang Shares, Zixin Pharmaceutical, Monternet Group, Leo Shares, Radio and Television Express, Huicheng Technology, 2345, Annie Shares, Weiston , Meiyingsen, SF Holdings, Provincial Broadcasting Group, Chenxin Technology, Zhongying Internet, Kaiying Network, Jincai Internet, Hailian Jinhui, Giant Network, Aikang Technology, Zhongke Jincai, Aoma Electric, Hanwei Technology, Flush, Zhongqingbao, Oriental Fortune, Great Wall of Culture, New Country Capital, Hande Information, Huayu Software, Runhe Software, Beixinyuan, Wintime Win, Dongfangtong, Halo New Network, Gao Weida, Sifang Jingchuang, China Big genes.

According to the analysis by Caijing.com, among the 50 sample stocks, some companies are indeed in the field of blockchain, and some applications have begun to land, but there are also some companies that are only linked to hot spots without any landing, even more Some companies entered the game early, but relied on illegal acts such as issuing coins to plunder money.

Alliance chain, combined with traditional business as a number of priorities

According to the analysis of Caijing.com, the above 50 sample companies did not have much innovation in direction selection, but were consistent with the overall environment and rooted in their traditional business to extend. The role of blockchain technology for these companies is more In improving the efficiency of the existing business, rather than exploring new areas. Alliance chains, supply chain finance, and cross-border payments are the three "hot spots."

Among them, the alliance chain is the field with the most explorers. Of the above 50 sample companies, more than 16% of the companies involved in the alliance chain-related business.

Multi-party information shows that when traditional companies enter the blockchain field, the alliance chain is an important racetrack. At present, the development focus of traditional Internet giants such as Tencent, Baidu, Ali, and Jingdong in the blockchain field is also the alliance chain. In foreign countries, Internet giants such as IBM, Microsoft, Google, and Amazon have also entered the market and launched corresponding alliance chain products. .

The alliance chain has the characteristics of partial decentralization, strong controllability, data will not be open by default, and fast transaction speed. Therefore, the alliance chain is more feasible than the public chain in the actual landing level.

Shao Bing, head of the Tencent Cloud blockchain, believes that the alliance chain is the future trend of blockchain applications. For the blockchain, letting value circulate is its real mission, and the alliance chain is currently the most suitable form for combining technology and business, and has the feasibility of commercial landing. At present, Tencent Cloud's blockchain business is mainly based on the alliance chain.

In addition to the alliance chain, the application of blockchain technology in supply chain finance and cross-border trade is also a key research object. Enterprises such as Suning Tesco, Midea Group, Sifang Jingchuang, Handel Information, and Broadcasting and Television Express have all been involved in related fields.

According to the 2019 Tencent Blockchain White Paper, in the field of supply chain finance, blockchain can be combined with a variety of business scenarios, such as: achieving multi-level circulation of accounts receivable, implementing electronic systems in bank drafts, and real estate Increased liquidity in collateral and more. Shao Bing also believes that supply chain finance will become a key application area.

In the banking industry, blockchain + cross-border payment has become an indispensable place.

In 2019, Wells Fargo, MasterCard, PNC, VISA, and JP Morgan Chase all launched corresponding blockchain + cross-border payment products. Many traditional companies such as Ant Financial, Goldman Sachs, and China Merchants Bank are also actively developing the commercial landing technology of blockchain + cross-border payment.

General entry does not generate actual income late

According to the statistics of Caijing.com, among the above 50 sample companies, the layout of the blockchain business is generally late. 72% of them started the blockchain business after 2018, and 26% of them started in 2019. In public, he said he would start to get involved in the blockchain field.

Among the 13 companies that began to lay out in 2019, some companies did not publicly indicate that they have blockchain-related businesses until after "10.24 Speech". Take Jinglan Technology as an example. Prior to the "10.24 Speech", Jinglan Technology rarely saw any news related to the blockchain. On the evening of October 27, Jinglan Technology issued an announcement saying that its affiliate company, Good Nongyi E-Commerce, The “Blockchain Agricultural Production Traceability System” independently researched and developed by the company with independent intellectual property rights has been put on record by the National Internet Information Office. Some media interpreted it as "Beijing Blue Technology joined the blockchain concept stocks at a rapid speed under the blockchain air."

In addition to Beijing Blue Technology, Meiyingsen has also been questioned for its popularity. At the end of October, Meiyingsen frequently issued public relations drafts stating that its participating companies are involved in the blockchain field. In response to this, on the evening of October 28, the Shenzhen Stock Exchange issued a letter of concern asking Meiyingsen whether it is necessary to involve the blockchain industry. Is there any use of blockchain and other concepts to hype the stock price to reduce shareholder holdings.

And some companies that seem to have application landings are not short of hot spots. Changshan Beiming's main achievement in the field of blockchain is participation in the development of Xinxin Chain, but it was not until October 26 that Changshan Beiming began to add the concept of blockchain.

In addition to the general late deployment, there is still a slow development of related businesses. It is understood by Caijing.com that up to now, more than 36% of enterprises have remained at the research stage and no actual business has landed. Taking China Science and Technology Jincai as an example, China Science and Technology Jincai is one of the 50 companies that entered the company earlier. Public information shows that China Science and Technology Caicai has been focusing on the blockchain field since 2016, but its progress has remained at this point. At the research stage, there was no public information showing the specific application landing. Kaiying Network, which entered in 2017, is currently in the "starting research stage".

In terms of revenue in the blockchain field, except for a few companies that rely on the issuance of coins to make a huge profit, almost none of the 50 sample companies rely on the blockchain business to generate income.

In April of this year, Jin Yi Technology stated that the current blockchain of Jin Yi Technology is still in the research stage and has not generated related business and revenue. This state continues to this day.

In November 2019, Jinglan Technology responded to the Shenzhen Stock Exchange's letter of concern. The announcement said that the company it owns, Hoi Nong, has indeed applied the blockchain technology, but it is still a loss-making company.

It is difficult for the original business to issue coins for some enterprises

It is worth noting that 8 of the 50 sample companies are in a loss state, which are Hailian Jinhui, Leo Stocks, Zixin Pharmaceutical, Dongxu Lantian, Jinglan Technology, Shunli Office, Chenxin Technology and Omar Electric.

At the end of November, Hailian Jinhui issued an announcement saying that due to the combined effects of the company's increased investment in fintech, financial value-added services for innovative business, and fierce market competition, the company is expected to lose money in 2019 . The loss is the first net profit loss eight years after the listing of Hailian Jinhui.

Leo shares were once caught in the storm of delisting. Leo's original business was pump production. After 2014, it began to transform its digital marketing business. In less than two years, it has continuously acquired 6 digital marketing companies. In 2018, it also acquired WeChat for 2.34 billion yuan. The issue of the 75% equity interest in Suzhou Mengjia, a public account company, caused inquiries from the Shenzhen Stock Exchange.

Accompanying the crazy mergers and acquisitions is the growing business risk of Leo shares. According to the China Securities Journal, the performance of Leo's merger and acquisition target is not optimistic. Some target companies are unable to achieve the promised performance, and some target companies have experienced a steep decline in performance after the commitment period expires. Huge amounts of goodwill face impairment risks. Significantly increased, asset conditions are worrying. This year, Leo shares again face major asset restructuring.

And Zixin Pharmaceutical, Dongxu Lantian, Jinglan Technology, and Shunli Office have also fallen into the predicament of a precipitous decline in performance and a bleak main business operation.

In contrast, Chenxin Technology and Aoma Electric have fallen into a deeper quagmire. In the case of bleak revenue, due to the issuance of coins on the line, in an attempt to "cut" the life-saving funds in the currency market, Chenxin Technology and Aoma Electric Co., Ltd. have cast a layer of policy risk.

At the end of 2017, Chenxin Technology, which is seeking for development, quickly caught up with the blockchain's enthusiasm and launched the competition cloud. Its concept comes from Thunder's "player cloud". Drawing on the DPOS algorithm, that is, the super node mode, through the competition of cloud hardware equipment, the idle bandwidth, storage and computing resources in the user's home are collected and recycled, and converted into cloud computing services for transmission to Internet companies.

Before the launch of the Battle Cloud, the stock price of Chenxin Technology hovered around 5 yuan. During the "first-generation competition cloud" pre-sale, the stock price of Chenxin Technology reached a maximum of 8.68 yuan.

With the "first generation of competition cloud" bonus exhausted, Chenxin Technology quickly changed its strategy. After the launch of Battle Cloud 2.0, the BATT (Bure Chain Token) exchange channel was introduced, allowing users to use GCP points to exchange BATT at a certain ratio. BATT was launched on the AllCoin and BCEX exchanges in June 2018. It is understood that BATT is now renamed to PONY. PONY can act as a currency function by purchasing goods. GCP can also pay directly with the RMB through second-hand websites such as Xianyu.

The upgraded version of Battle Cloud not only helps Chenxin Technology to sell hardware to make money, but also replaces fiat currencies with "currency", attracting a group of speculators from the currency circle. On August 31, 2018, Chenxin Technology released the semi-annual report for 2018, and the data showed that the company realized operating income of 208,408,900 yuan, a year-on-year increase of 42.77%.

Different from the general route “route mining” of listed companies' currency issuance, the way for Omar Electric to issue coins is “currency reform”.

Public information shows that on August 4, 2018, the QOS project was launched as the first currency in FCoin's "Coin Reform Pilot Zone"-Mainboard C Zone. On the first day of trading, the daily limit was opened, but after that, the daily limit fell for two consecutive days. By the fourth day, the QOS currency price had plummeted by 85%.

There is an inextricable relationship between Aoma Electric and QOS. According to the Daily Economic News report, most of the QOS project team has the background of listed company Aoma Electric. For example, Zhang Zhe, co-founder of QOS, was the deputy general manager of Aoma Electrical Appliances, and co-founder Wang Yining once worked at Wallet Financial (Beijing) Technology Co., Ltd. (hereinafter referred to as Wallet Financial), a wholly-owned subsidiary of the company. At present, Zhang Zhe, Wang Yining and Zhou Haijing are serving in Digital Wallet (Beijing) Technology Co., Ltd. (hereinafter referred to as Digital Wallet), a joint stock subsidiary of Aoma Electric. In addition, the QOS project has two consultants, one is Zhang Jian, the founder of FCoin, and the other is Zhao Guodong.

According to the QOS white paper, Kaoma, a digital wallet, a wallet wallet, and Changzhi Bank are all “QOS” partners.

Later, Omar Electric issued an announcement saying that after verification, the above personnel's participation in the QOS project was their personal behavior, and the company's controlling and participating companies did not participate in the QOS project. Zhao Guodong's personal behavior as the consultant of QOS project is not related to the company. But this statement has not been endorsed by QOS investors.

Neither Chenxin Technology nor Aoma Electric has reversed the loss of the parent company after the issuance of the coin. Compared with this, relying on "hardware mining" to indirectly issue a coin to turn a profit into a profit is very "lucky".

In March 2018, Octopus Planet was launched on 2343.The first batch of products was sold out within 12 seconds under the order of 1.8 million people. On April 11, the second batch of products was even faster at 4 seconds. Sold out. Planet Octopus is a "private cloud disk based on blockchain technology". Through "mining", octopus planet users can get a kind of points called STC,

Although 2345 has publicly denied disguised ICOs and stated that no ICO operations will be performed. However, STC finally launched two digital currency exchanges, Coineal and Biclub.

On February 25, the latest performance report released by 2345 showed that due to the steady growth of the business, the company's unaudited net profit attributable to shareholders of listed companies in 2018 was 1.365 billion yuan, a year-on-year increase of 44.07%.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain Weekly | The nation's first blockchain unsecured loan issuance, and the application landing continues to accelerate

- Getting Started with Blockchain | How to calculate Bitcoin transaction fees?

- The "National Team Alliance Chain" blockchain service network will be officially commercialized in April, with hundreds of city nodes

- Telegram official reminder: Gram won't help you get rich

- Is crypto taxation complicated? TaxBit receives $ 5 million in seed funding to provide accurate tax calculation tools

- Views | Information theory of money: Is Bitcoin our ultimate choice?

- Digital Securities Research Report 2019: What is preventing it from becoming mainstream? What to expect in 2020?