DeFi data observation in 2019: the efficiency of the lending market has improved, and DEX has developed differently

Source: TokenGazer

On January 6, 2020, the official website of TokenGazer released the DeFi annual report.

Overview

If the Ethereum ecosystem in 2019 needs to be described with a keyword, I believe that DeFi should not have much suspense as this keyword. According to loanscan.io, the total amount of DeFi-related mortgage lending business funds on the Ethereum platform increased by 253% in 2019 compared to 2018. Some people think that DeFi is the best prospect and future of the digital economy, and some people think that DeFi is still full of risks and cannot be accepted by regulators in the foreseeable future. We use data analysis to try to analyze what happened in the DeFi world in 2019, what behavior models and business logic users have on the DeFi platform, and within the existing technology architecture, regulatory framework and legal system, DeFi is predictable What will happen in the future?

What is DeFi

- Babbitt weekly election 丨 The flags of 2020 have already been established. Where do you stand?

- Baidu launches open network platform, blockchain moves towards "scale replication" into consensus among big companies

- What are the expectations for 2020 blockchain games? I interviewed 5 senior practitioners

DeFi itself does not have a strict definition.In 2018, it was gradually proposed as a series of decentralized financial collection concepts and began to attract attention. Under this concept, all "decentralized" transaction lending platforms and so on belong to the category of DeFi . At the core of the DeFi concept is the use of transparent and verifiable features of a decentralized platform to implement various traditional financial infrastructures. In the past one or two years of development, some DeFi projects have been widely recognized:

- MakerDao-MakerDao is a stablecoin and derivative financial system based on Ethereum's smart contract infrastructure and issued with on-chain digital assets as collateral;

- Compound-an open source lending market. Compound uses algorithms to determine the lending rate, and users lend through digital assets on the mortgage chain.

- dYdX-a decentralized trading platform, which is also based on the open source protocol of Ethereum, which can conduct leveraged transactions;

- Uniswap-a decentralized market with resource pools to support liquidity, all transactions are completed on the Ethereum chain;

- Kyber / 0x / IDEX-both are based on the decentralized trading market on Ethereum, and each has certain differences in the technical structure of order set management, matching and transaction;

- Synthetix-a crypto asset-backed synthetic asset platform that opens the way to using cryptocurrencies to buy financial derivatives such as fiat currencies, commodities, stocks, and indices.

Mortgage loan

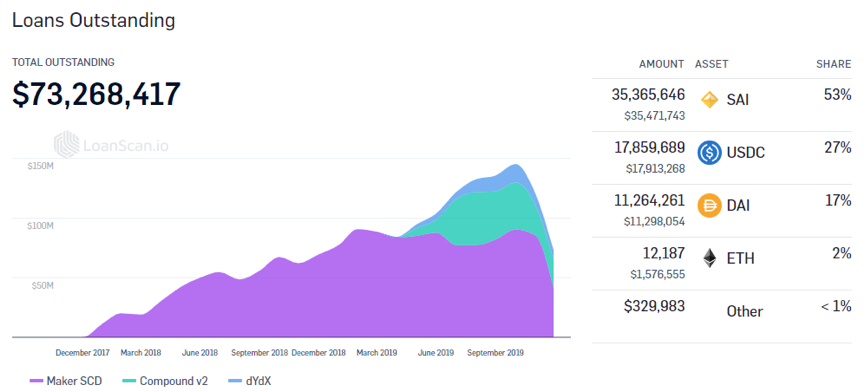

According to loanscan.io, as of December 29, 2019, the outstanding loans in the Maker SCD, Compound v2, and dYdX platforms totaled $ 73.27 million. In addition, there are a large number of tokens in the fund pool of the decentralized lending platform, and the market cannot be ignored. Interest rates may vary between platforms due to different supply and demand and mortgage rates. The following examples illustrate some practical applications due to different interest rates.

Data source: loanscan.io

DeFi and CeFi carry trades

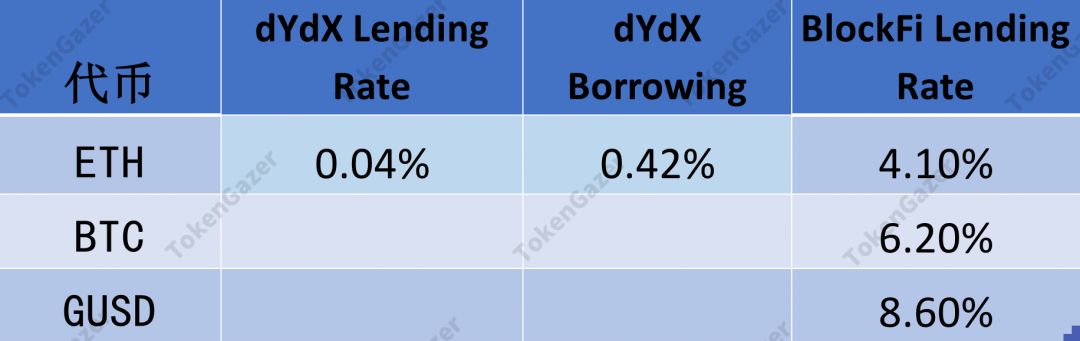

As mentioned earlier, lending rates for centralized platforms are usually higher than for decentralized platforms. One feasible approach is to borrow some kind of token from the decentralized platform and lend it on the centralized platform. When users want to lend tokens on a centralized platform, the first consideration is security, and the second is the return rate. BlockFi is a U.S. licensed institution. Users lend coins to BlockFi, and BlockFi lends tokens to trusted institutions and their partners. This process also requires over-collateralization. Binance Research has also reported interest rate differences between BlockFi and decentralized platforms. As shown in the figure below, Ethereum's borrowing interest rate on the decentralized platform is very low, but it can earn 4.1% annualized income by depositing in BlockFi. Therefore, the method of borrowing Ethereum to blockFi at dYdX is feasible and can earn a 3.68% spread.

Spread trading between DeFi

For the same token, the borrowing interest between different decentralized platforms may not be the same, as shown in the figure below. Currently, it is possible to borrow DAI from dYdX at an interest rate of 2.39%, and to lend at an interest rate of 3.97% on Compound, earning an annualized interest rate spread of 1.58%. But the rates of lending and borrowing change in real time, and the rate of lending DAI on dYdX is already lower than the stable rate of generating DAI and SAI on MakerDAO. This situation may not be sustainable. The short-term interest margin earned may not cover the transaction fee of the transfer process. These processes include: transferring a certain token into dYdX to lend DAI, transferring DAI to Compound to lend, and then redeeming DAI to dYdX for redemption Tokens, transfer tokens back to the original account.

Different tokens have different lending rates, and you can choose to mortgage assets with low interest rates. For example, for ETH holders, if ETH is lent out on dYdX and Compound at an annualized interest rate of 0.42% or 0.12%, there is almost no gain except fees. At this time, using the above method, borrowing a stablecoin in dYdX, and then lending the stablecoin or switching to another currency with a higher interest rate can increase the income, but the interest rate of each token may occur at any time during this period Variety.

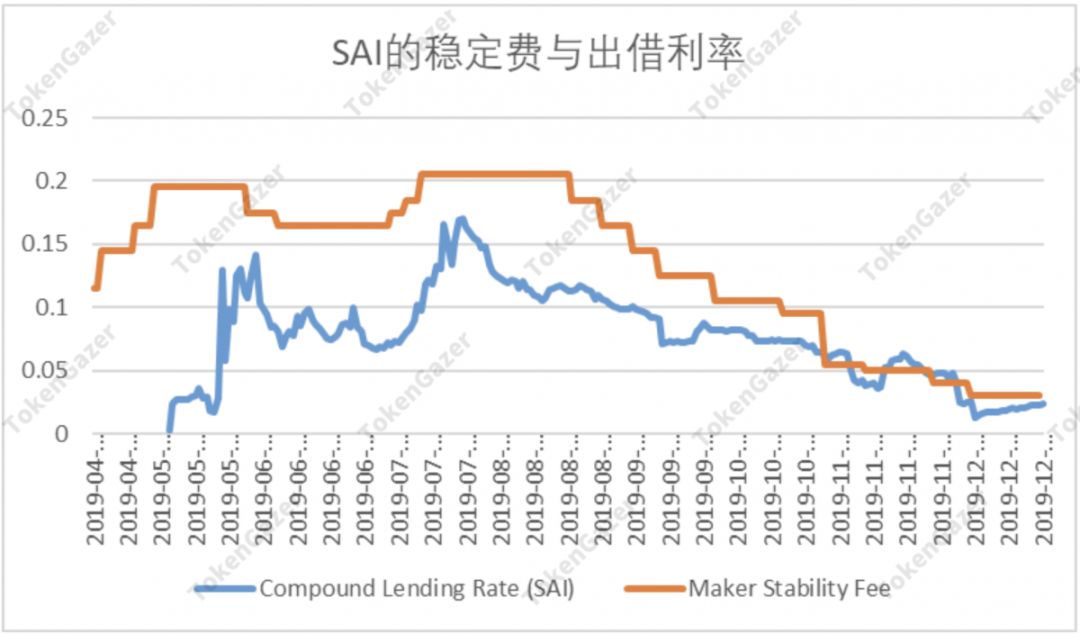

For Ethereum holders, a larger and more commonly used method is to mortgage ETH in Maker to generate stable currency SAI, and then lend the SAI directly or exchange it for other stable currency with higher interest rates. From December 17 to August 26, 18 and December 17, 18 to February 8, 19, the annualized rate of the stabilization fee in Maker was only 0.5%. However, the current stable fee rate for generating DAI / SAI in Maker has exceeded the interest of borrowing DAI directly from dYdX.

In September this year, Binance Research published an article analyzing the DeFi carry trade strategy in the Ethereum ecosystem. The spread trading strategy between DeFi is summarized as follows:

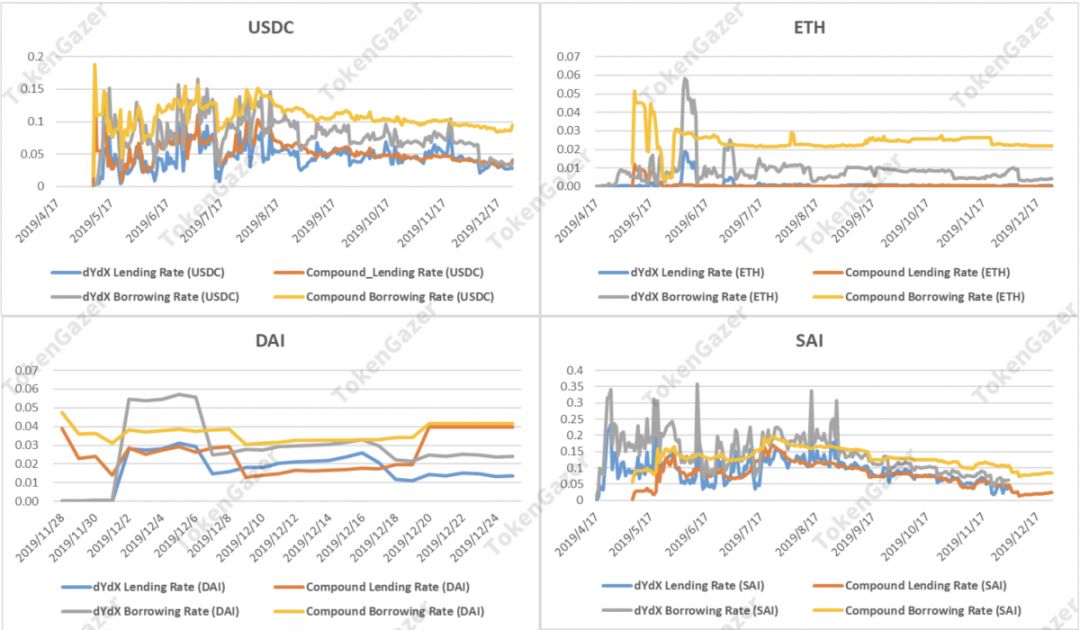

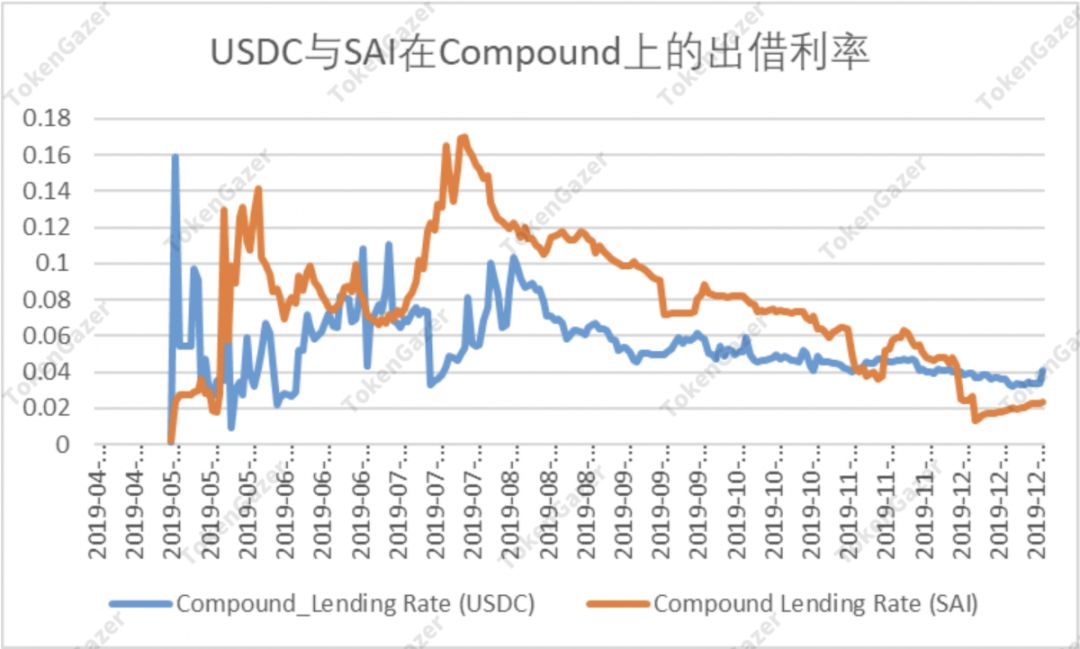

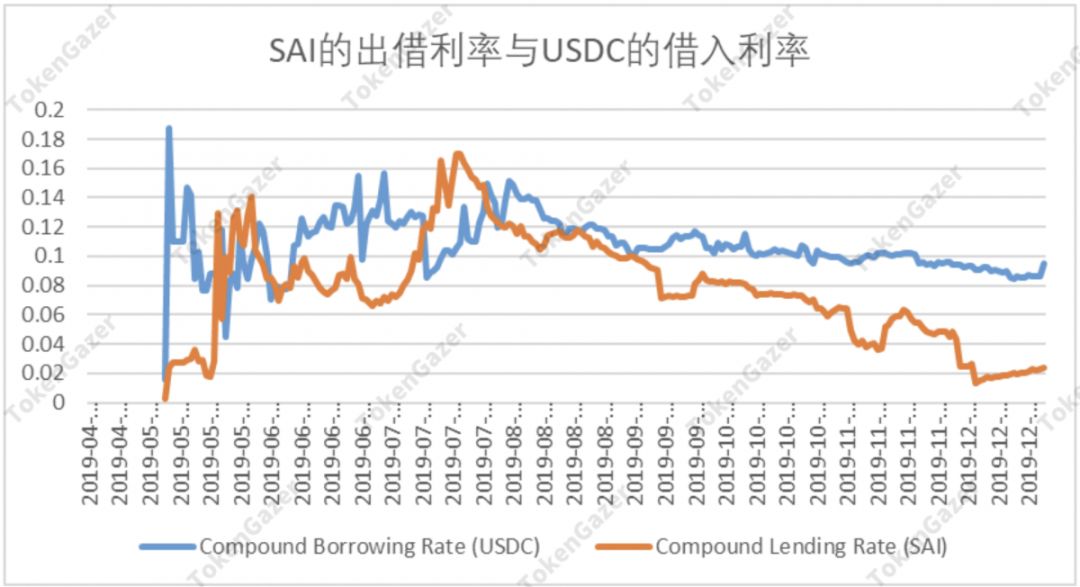

- The loan interest rate of SAI on Compound is higher than USDC. You can exchange USDC for SAI and then lend. The loan interest rate of SAI on Compound is higher than USDC. However, the loan interest rate of USDC in Compound is now higher than SAI, and this situation may change again, as shown in the figure below.

- The interest rate for lending ETH directly is very low, and the interest rate for borrowing USDC on Compound is lower than the interest rate for lending SAI. The interest rates of the two are shown below. ETH holders can borrow USDC and exchange it for SAI. However, the interest rate for borrowing USDC on Compound is currently much higher than the interest rate for borrowing SAI. Therefore, this strategy is no longer applicable.

- The SAI is mortgaged on Maker to generate SAI, and the interest on borrowing SAI on Compound is higher than the stabilization fee. With the rise in stabilization fees, this one has long since lapsed.

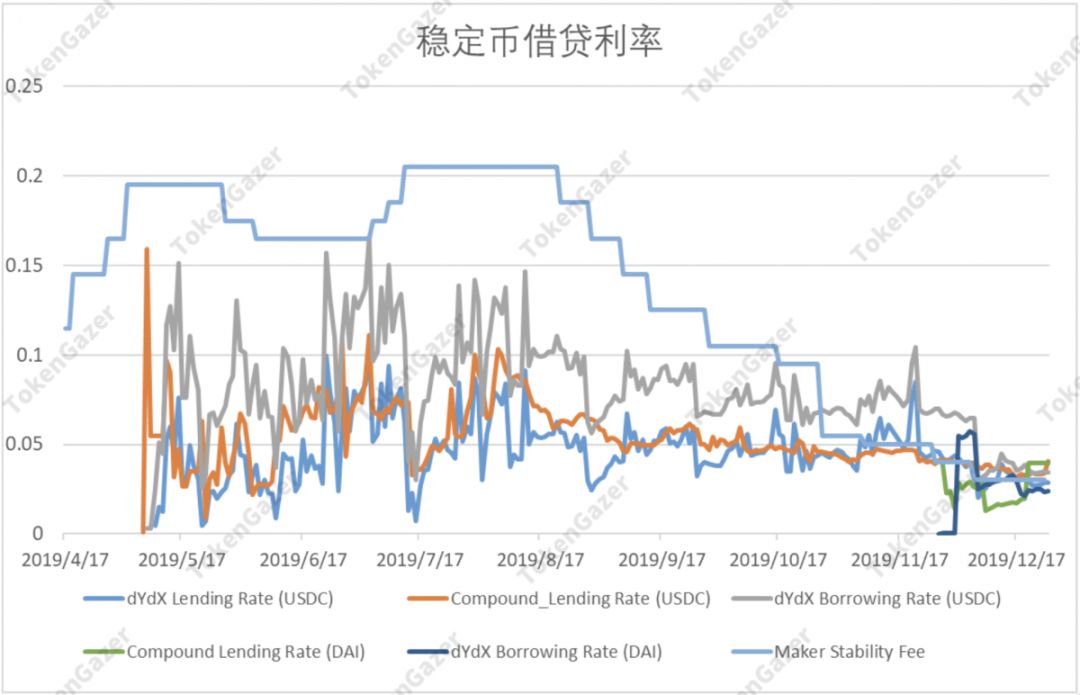

The central idea of carry trade is to borrow a stable currency from a platform with a low interest rate, and lend it at a higher interest rate. We put all the stablecoin borrowing and lending rates together, removing the highest borrowing rate and the lowest lending rate without arbitrage, and the resulting chart is as follows. It can be seen that the lowest borrowing interest rate is DAI on dYdX with an annualized interest rate of 2.39%; the highest lending interest rate is USDC on Compound with an interest rate of 4.07%. Borrow DAI from dYdX, change to USDC, and then transfer to Compound to lend, you can earn a maximum 1.72% spread. It can also be seen from the figure below that the stablecoin's lending interest rate has shown a downward trend this year, which is in line with the adjustment of the legal interest rates of major global central banks. The interest rate of stablecoins has gradually converged, and opportunities for stable inter-currency spread transactions in decentralized platforms have decreased, or even disappeared, and the market has become more efficient.

The above analysis did not discuss all the opportunity costs of holding the original tokens, such as lending the original tokens directly to obtain a portion of the revenue. If you take this into account, there will be fewer opportunities for carry trades. Future opportunities may be more concentrated on Ethereum, because the interest rate for lending Ethereum directly on decentralized platforms is basically negligible. In addition, the lending rate of a centralized institution is higher than that of a decentralized institution, but this also sacrifices some security.

Decentralized exchange DEX

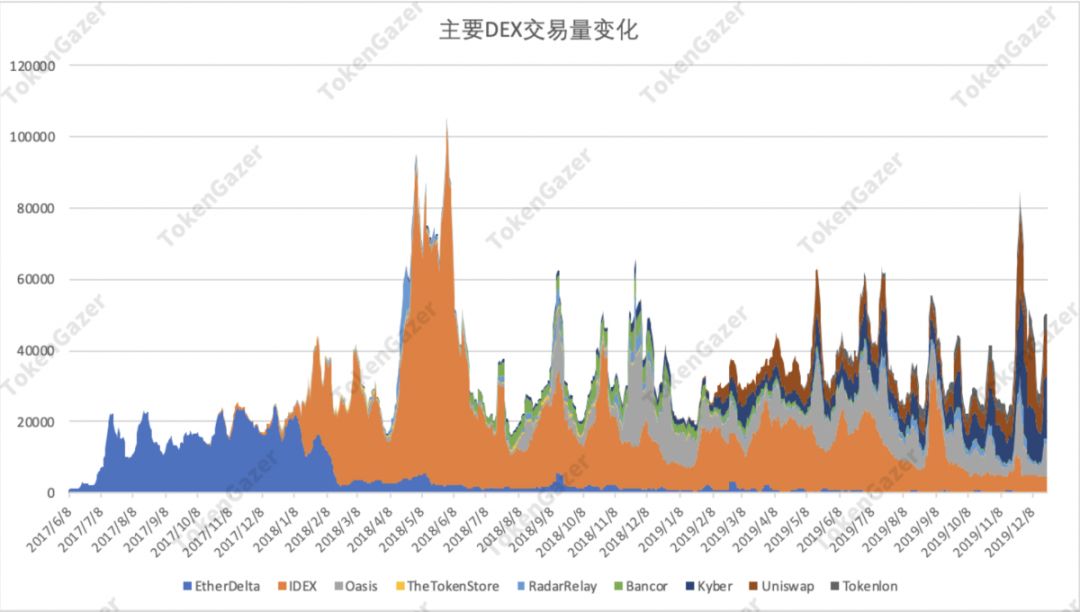

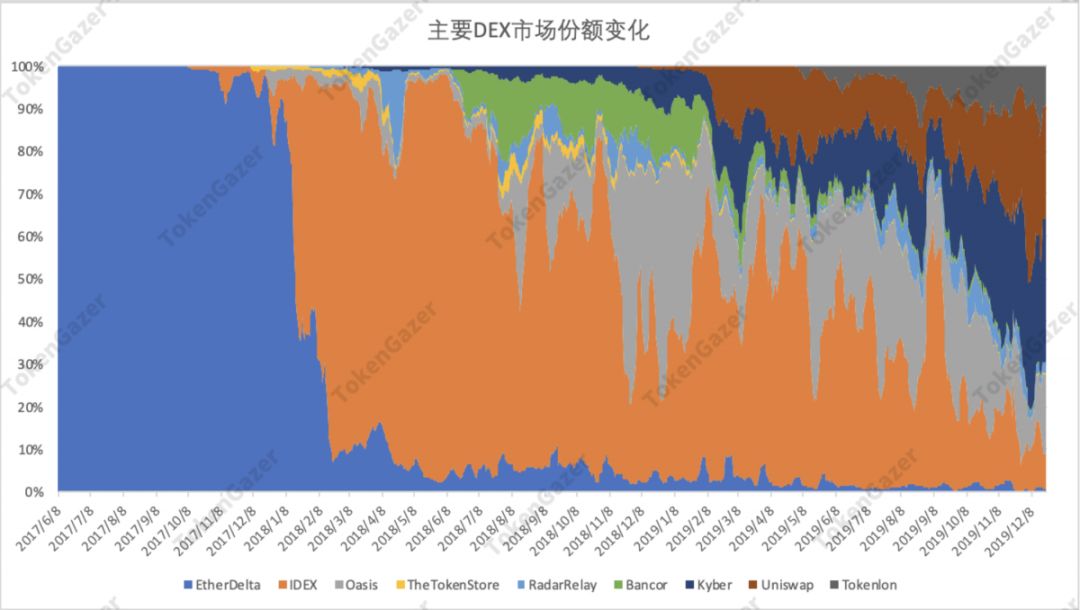

We have selected 9 major DEXes for observation. The above figure shows the changes in the transaction volume (in ETH) since the release of each DEX. We see that EtherDelta dominated initially due to the release ahead of other DEXs, but then IDEX took more market share. We can see that EtherDelta's market share has fallen sharply and the current transaction volume is very low.

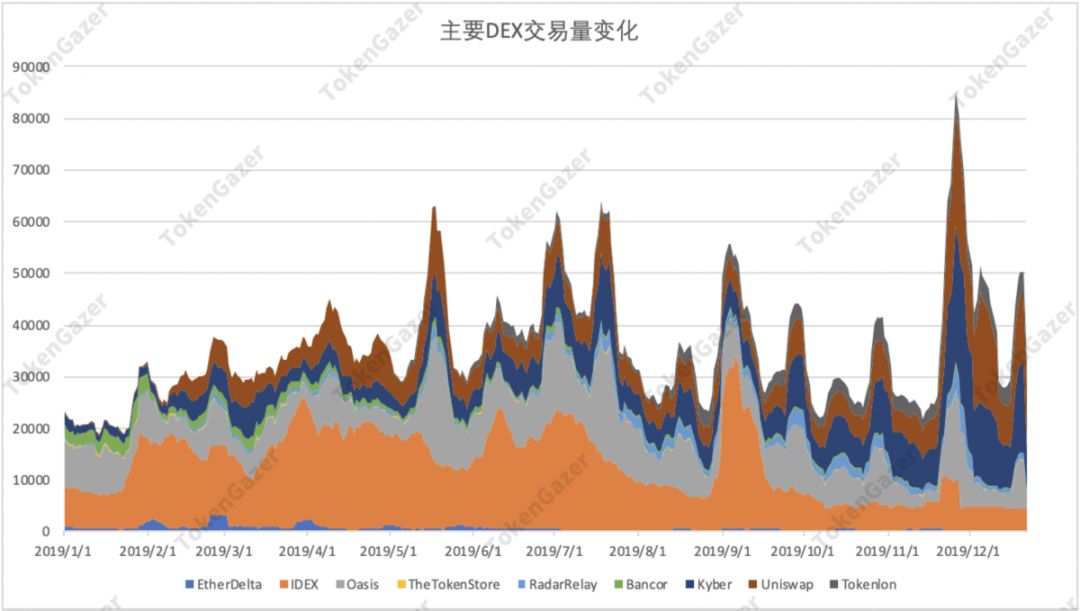

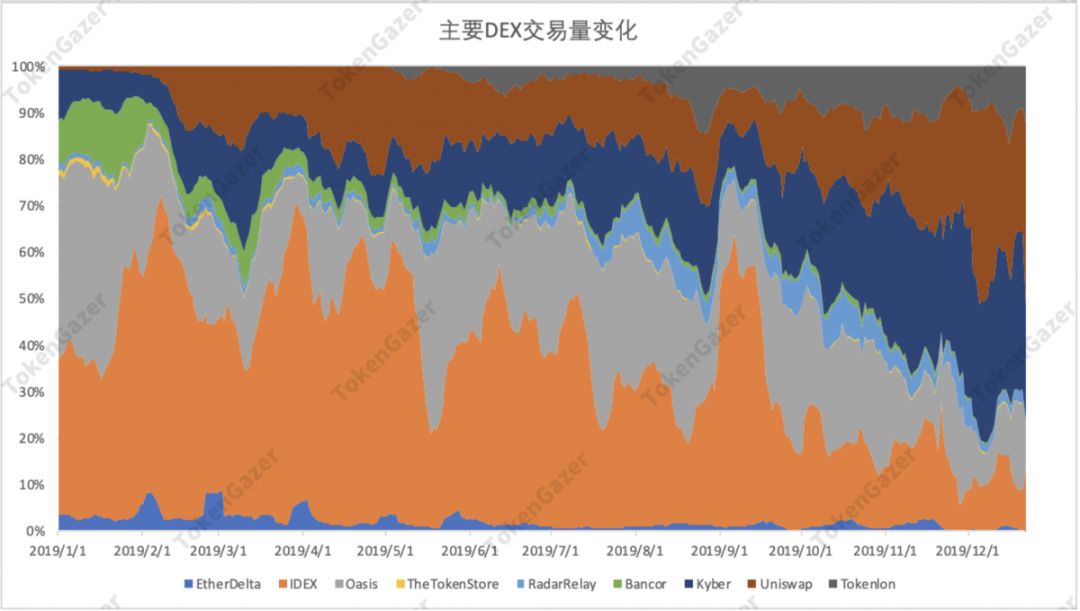

The transaction volume of DEX in 2019 is shown in the figure below. The IDEX transaction volume and market share have declined, and replaced by Uniswap, Kyber and Tokenlon. In addition, Oasis and RadarRelay have the largest market share.

Next, we mainly analyze Uniswap, Kyber, IDEX, Oasis, Tokenlon and RadarRelay, which dominate the DEX, to explore the development status and future development trends of DEX in 2019.

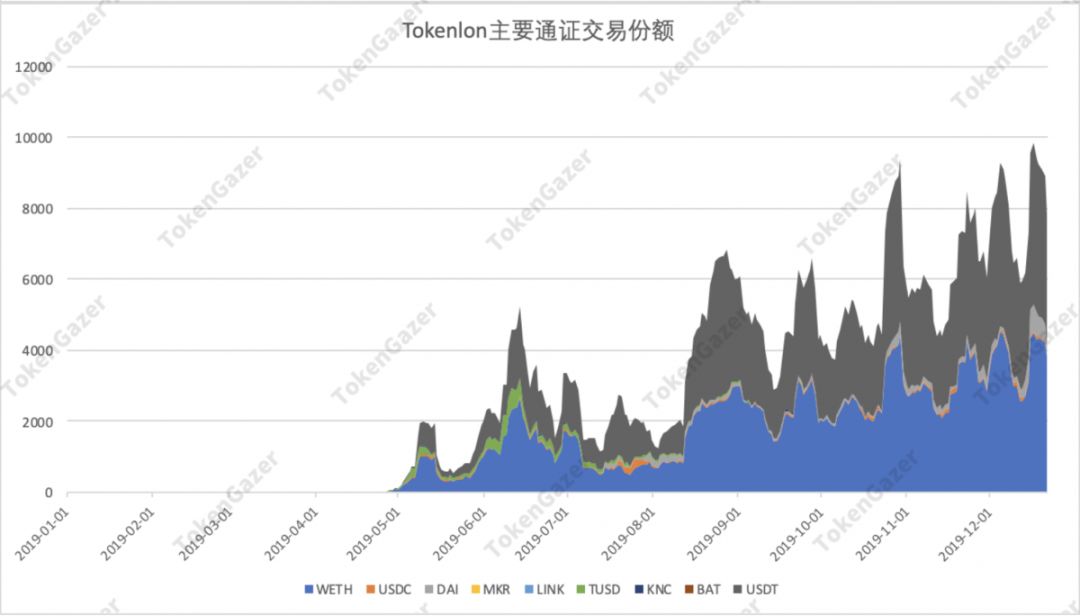

The above figure shows the trading status of Uniswap, Kyber, IDEX, Oasis and RadarRelay in 2019. From the perspective of the total transaction volume throughout the year, the overall transaction volume of Uniswap and Kyber is at the forefront, followed by IDEX, Oasis, and the transaction volume of Tokenlon and RadarRelay is relatively small. However, Tokenlon has only been operating since April, so the transaction volume is only 8 months of data. From the time dimension, we can see that the transaction volume of all exchanges increased from April to July, and then fell to some extent, which is consistent with the market trend of the crypto market.

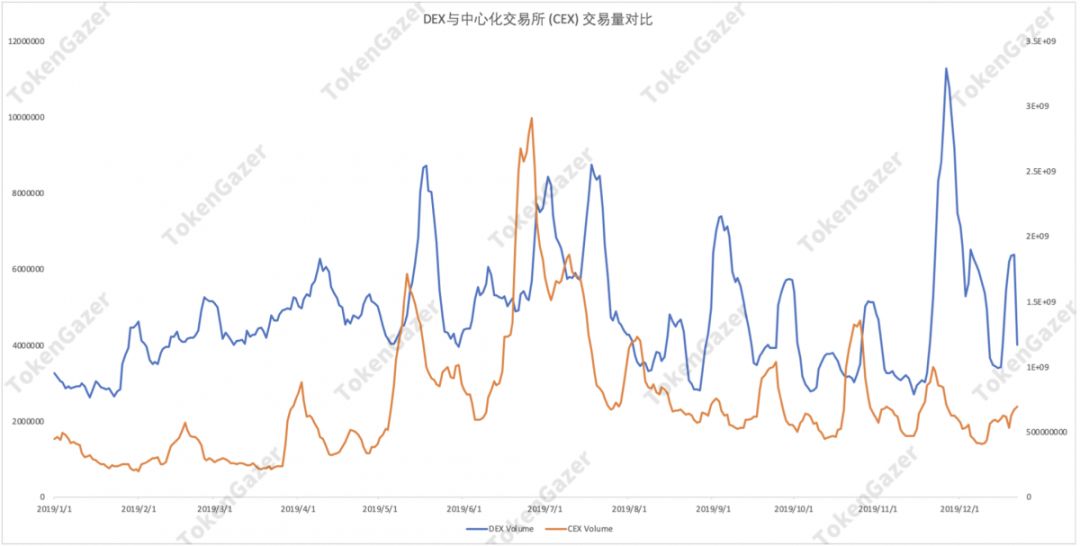

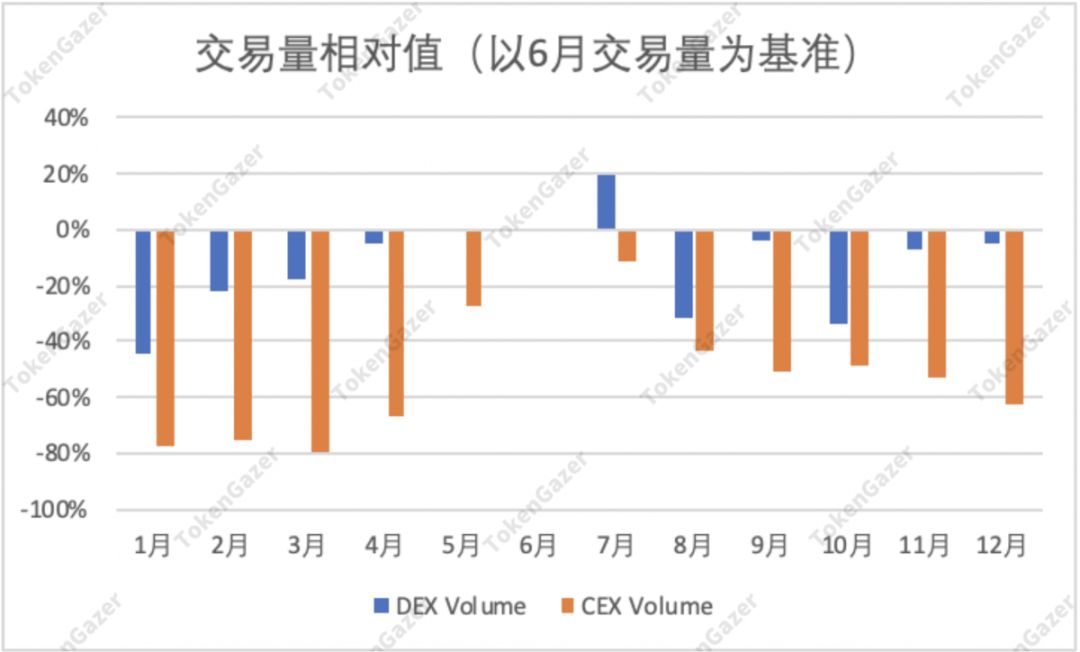

Since the peak of market trading volume in June this year, the trading volume of mainstream centralized exchanges has been declining. However, comparing the transaction volume of the above DEX, we can see that the transaction volume of decentralized exchanges has not decreased as much as that of centralized exchanges. We use the June trading volume of centralized exchanges and decentralized exchanges as a benchmark to examine the relative changes in their trading volumes. It can be seen that the trading volume of mainstream centralized exchanges has fallen by more than 60% since June. Decentralized exchanges have not seen much decline.

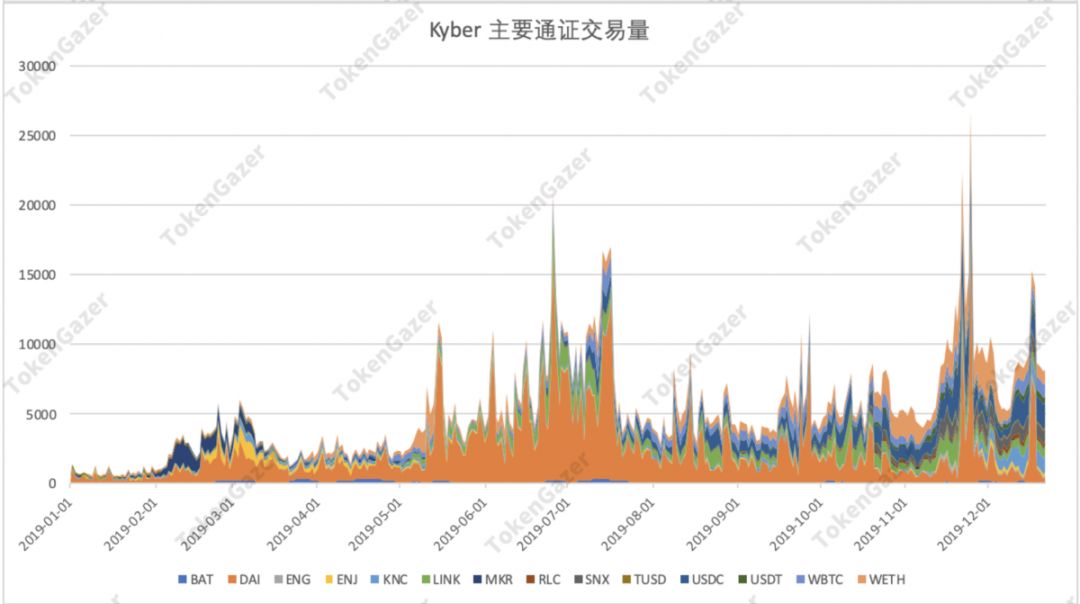

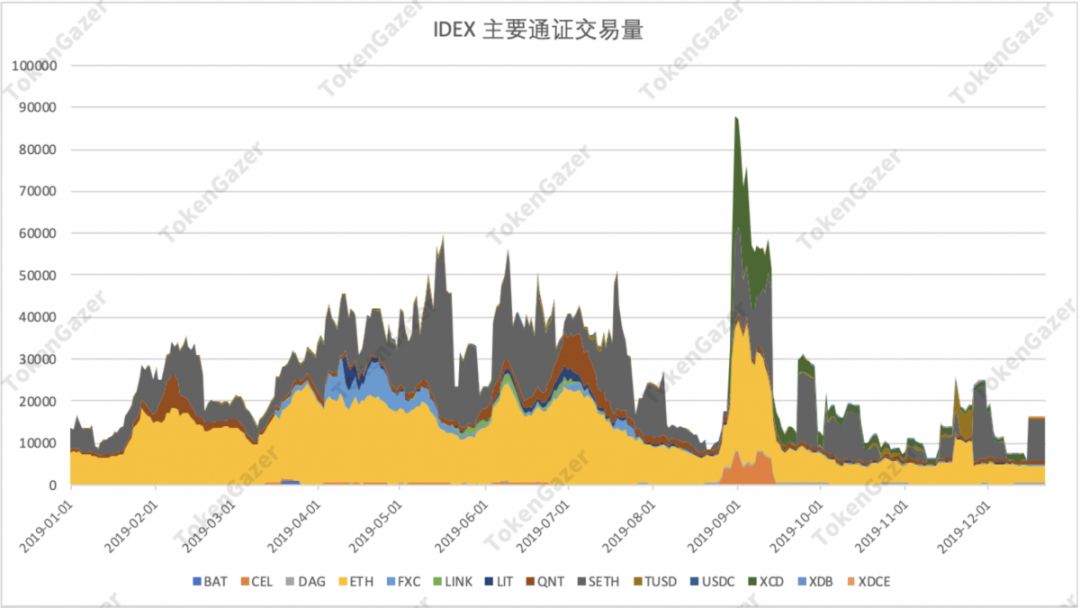

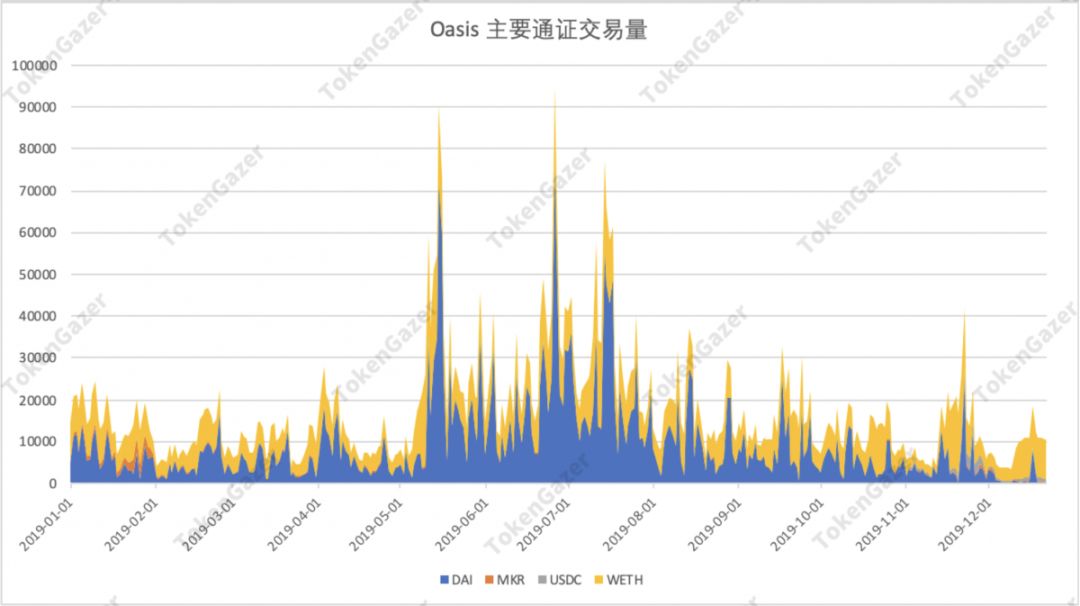

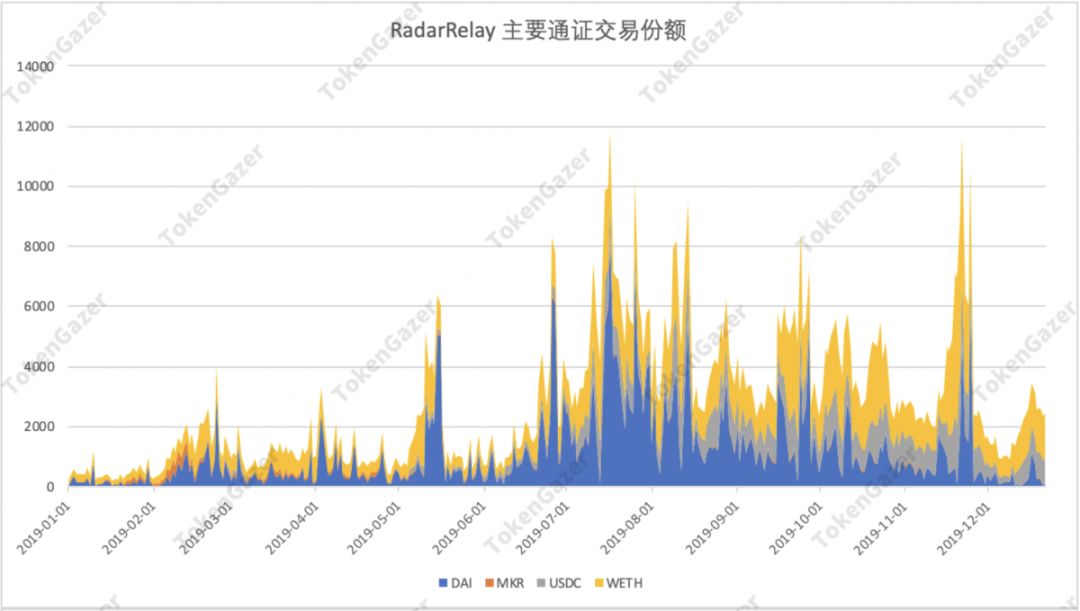

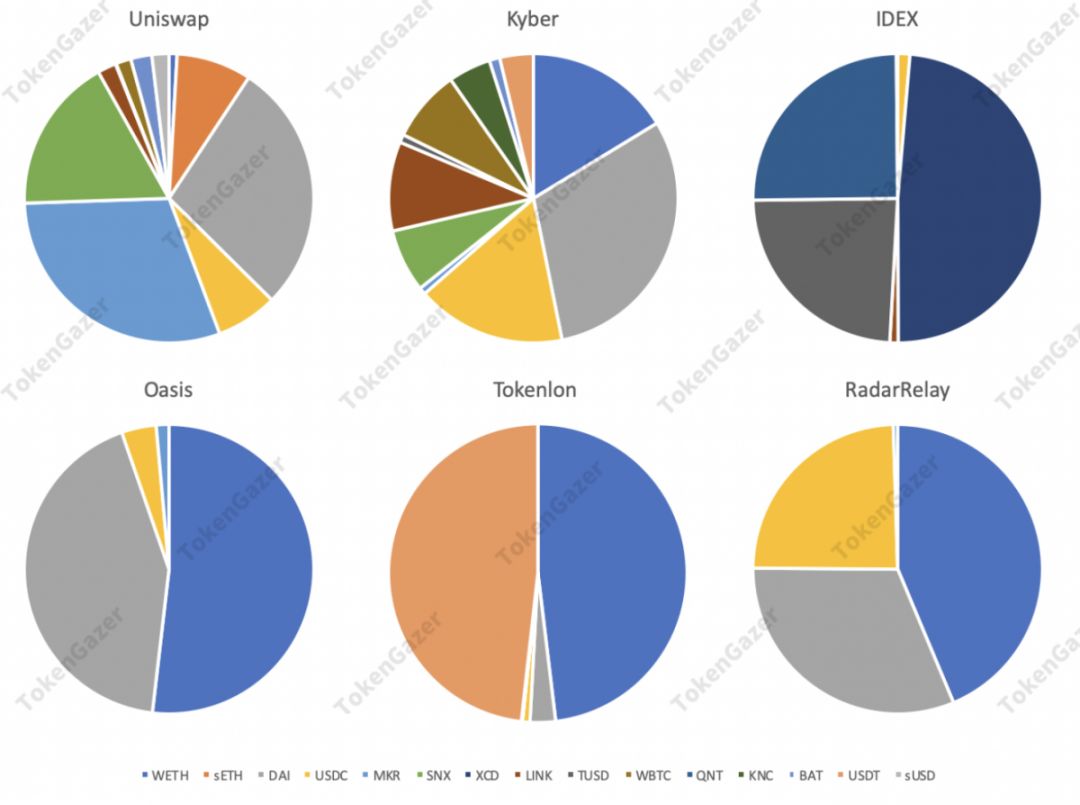

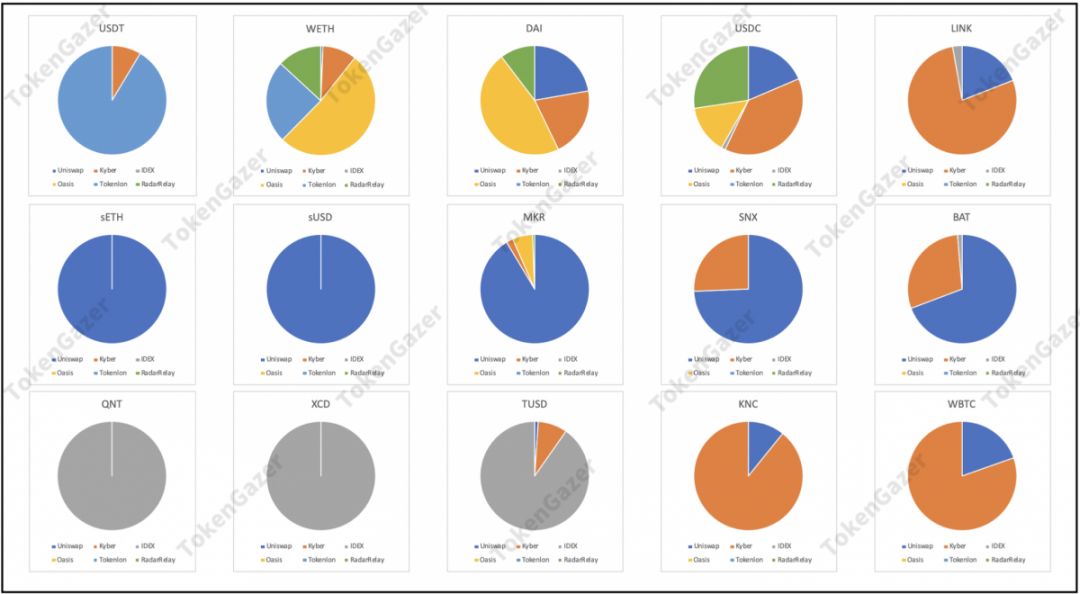

In addition to the changes in the time dimension, we also observed the differences in the main trading tokens on the DEX mentioned above. The picture above shows the share of the main trading tokens in their respective markets in the last three months of each DEX. Oasis supports fewer trading tokens, and IDEX, Tokenlon, and RadarRelay are in other currencies except for the major currency transactions. Each of these types of transactions has a small trading volume and poor liquidity. In contrast, Uniswap and Kyber, as exchanges with large trading volumes, have more tokens with relatively good liquidity in their exchanges. In order to more intuitively analyze the source of liquidity of each token in DEX, and observe the difference of each DEX in the transaction volume of tokens, we have drawn the following figure.

It can be seen that there are four types of tokens with only a single source of liquidity, they are sETH, sUSD, QNT, XCD. The source of liquidity of QNT and XCD is only IDEX, and sETH and sUSD are synthetic assets of synthetic asset project Synthetix. Their liquidity mainly comes from Uniswap. In addition, USDT, as the stablecoin with the largest market value, has good liquidity only in Tokenlon and Kyber. There are reasons for USDT itself, which we will explain in detail in the section on stablecoins. We see that the transaction volume of USDT in Tokenlon is much larger than that of Kyber, and is the stable currency of its main transaction. The stable currency of the main transaction in Kyber is USDC, considering that the main users of Tokenlon are Chinese users, and the main users of Kyber are For overseas users, this data reflects the differences in transactions between Chinese and foreign users.

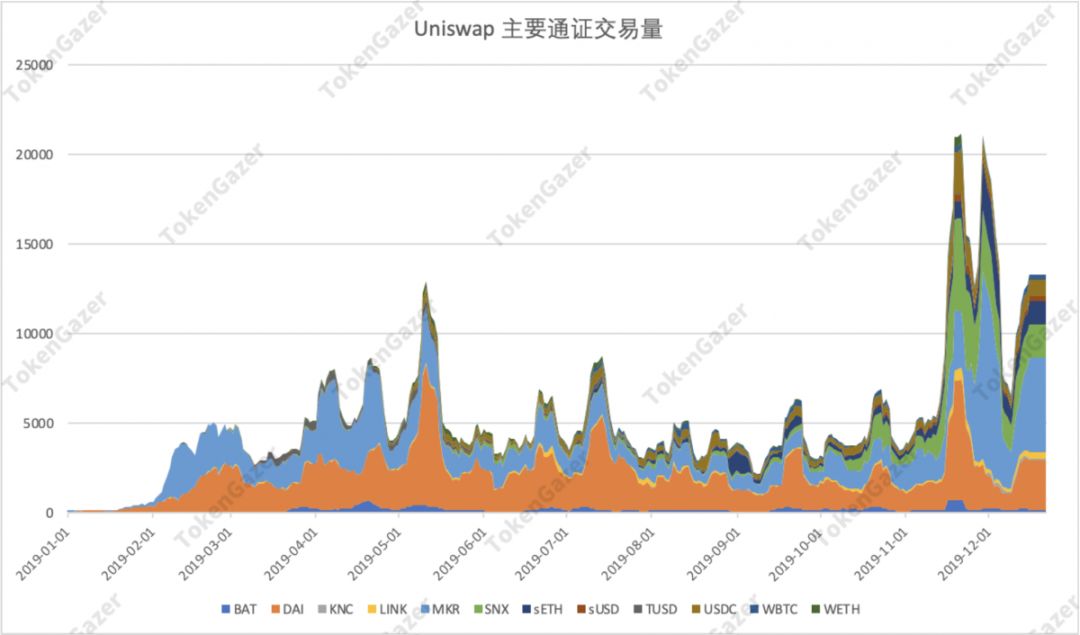

By comparison, we can conclude that Uniswap provides the most liquidity for DeFi in several DEXs, and is the engine of DeFi-related token liquidity; Kyber is mainly BAT, LINK, USDC, etc. Tokens provide liquidity; Tokenlon is the most liquid exchange for USDT. In 2020, with the development of DeFi, Uniswap's market share may further increase, and the continued inflow of USDT to Ethereum may empower Tokenlon.

Synthetic assets

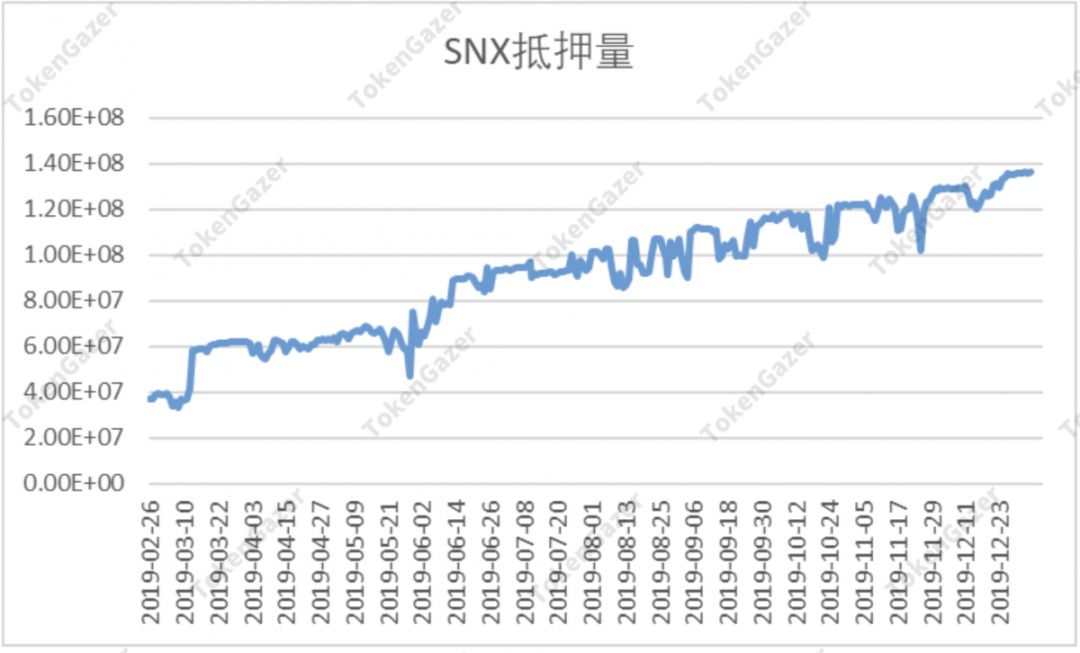

Some people say that cryptocurrencies are the best performing asset class in 2019. Among cryptocurrencies, SNX from the Synthetix project is undoubtedly one of the best performers. According to CoinMarketCap data, as of December 29, SNX has accumulated a cumulative 2872% in 2019. And in the year after the March inflation rule was revised, SNX's inflation rate was 75%.

Since this year, SNX's mortgage volume has been on the rise. On the one hand, SNX has high inflation and its supply continues to rise; on the other hand, the good performance of SNX prices also attracts users to collateralize tokens for additional inflation and transaction fees. At present, 85.18% of the supply of SNX is used for lock-up mortgages.

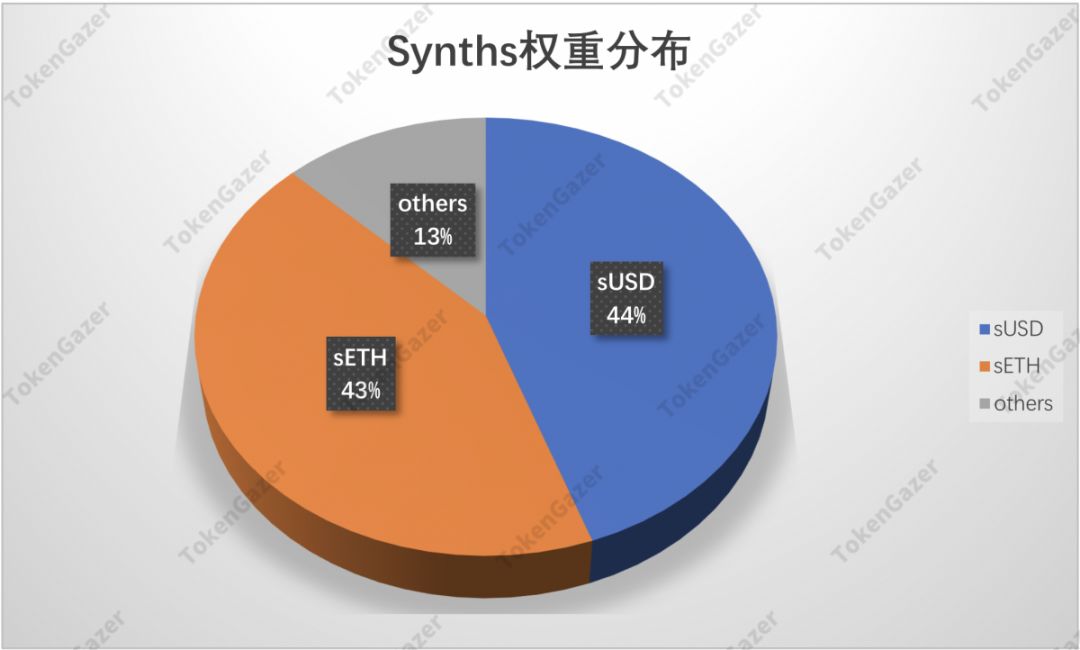

Synthetix's success lies in innovation. It has created a traditional financial derivatives market and indirectly used a common virtual currency to buy traditional financial products. By collateralizing SNX, a variety of synthetic assets can be generated, collectively referred to as Synths. The process of creating Synths also generates "debt". The types of synthetic assets are shown in the following figure, and any two types of Synths can be directly exchanged in synthetix.exchange. Since mortgagers cannot directly trade on the Synthetix exchange, each trader's counterparty is the exchange itself, so the total debt in the exchange will change with the price of each synthetic asset. The price of the synthetic asset is provided by the oracle, and the owners share the debt in the system in proportion to the mortgage. So everyone's debt changes, as long as the synthetic assets they hold perform better than average, they can benefit from it; otherwise, they need to repay more debt. For example, a cryptocurrency holder is optimistic about gold and can collateralize SNX to generate sXAU. If the price of gold during this period is better than the average level of synthetic assets, investors can obtain returns that exceed the average performance.

Since Synthetix requires a 750% mortgage rate (Note: In the traditional financial sector, the collateral ratio = collateral security principal balance ÷ collateral valuation × 100%, so the traditional financial sector mortgage rate should be less than 100%; The mortgage rate given in the project's official information = collateral valuation ÷ collateral guarantee principal balance × 100%, contrary to the traditional financial field, which is subject to the project's official data), resulting in the limited size of synthetic assets Synths. Although Synthetix intends to double the mortgage on ETH on top of SNX in the future, this approach will also introduce other risks. And compared to other projects, the mortgage rate is still too high. The price of Synths is determined by the price of the oracle. It is expected that Synthetix and Chainlink will provide more accurate quotations after cooperation, which can reduce risks and increase SNX's mortgage rate and the size of synthetic assets.

At present, the vast majority of synthetic assets generated by mortgage SNX are sUSD and sETH, the sum of which accounts for 87% of synthetic assets. Synths also includes a variety of other cryptocurrencies and their reverse tokens. Although Synthetix claims that it will also introduce synthetic assets such as Apple stock, it can actually be distinguished from other projects. It represents a very large proportion of synthetic assets in the traditional financial sector. low.

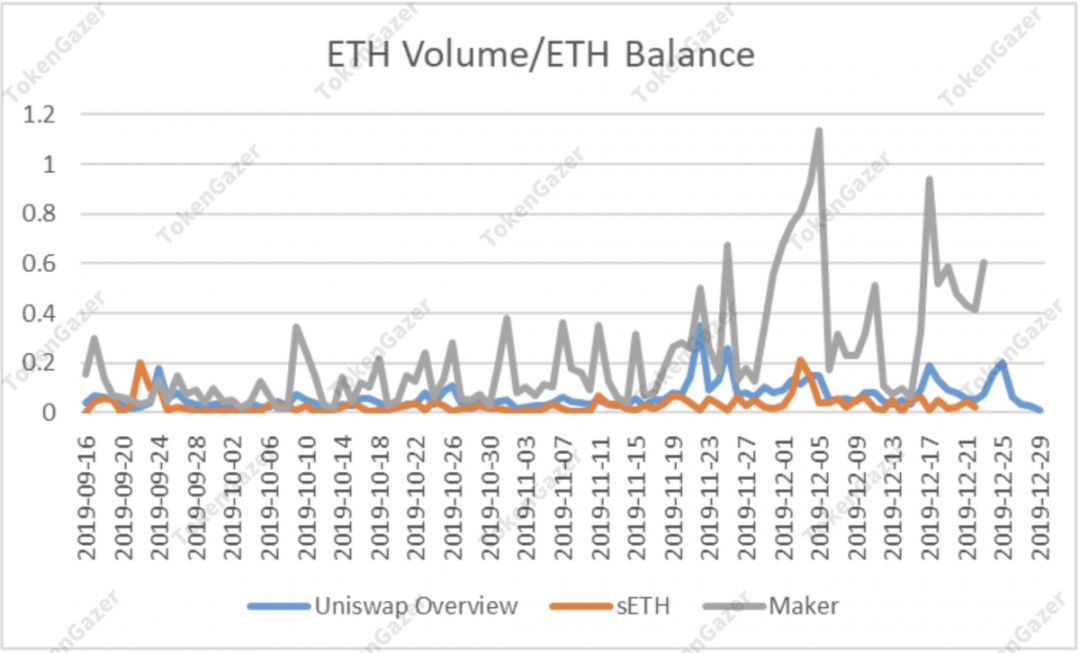

According to Synthetix's official website, the average mortgage rate of the mortgage part is 715.82%, and 43% of the synthetic assets generated by the mortgage are sETH. Based on the market value / price of sETH, a total of 81270 sETH is currently in circulation. sETH / ETH is the most liquid trading pair in Uniswap. The fund pool includes 41197 sETH and 40781 ETH, accounting for 50.2% of the total sETH. A large number of assets are in Uniswap's funding pool, which provides a channel for Synths to circulate with the outside world, but this also reduces the utilization rate of synthetic assets.

Under normal circumstances, ERC20 tokens and ETH are deposited into Uniswap's fund pool in order to earn transaction fees. The commission ratio of each token in Uniswap is the same, so the commission return rate of deposit is proportional to the turnover rate (volume / fund pool balance). Each transaction pair in Uniswap contains an ERC20 token and Ethereum, and the two are equivalent. The commission yield of each token in the fund pool is directly proportional to the transaction volume / Ethereum balance. sETH / ETH is the most liquid trading pair in Uniswap, while MKR / ETH is the trading pair with the most volume. It can be seen from the figure below that the commission income from depositing MKR in Uniswap's fund pool is much higher than the market average, and the income from depositing sETH is lower than the average. Calculate the average of Volume / Balance from December 1st to December 22nd, and deposit the same value of MKR to earn a commission of about 10 times sETH. Therefore, it can be inferred that the large deposits of sETH and ETH in Uniswap are not for the purpose of obtaining handling fees, but only to provide a by-product of the liquidity of Synthetix synthetic assets, and have not been effectively used.

Since sETH and sUSD account for 87% of the total Synths, their respective ratios are also basically the same. With relatively concentrated mortgage assets in the system, hedging collateral debt is easier. When generating synthetic assets, sETH and sUSD each half can basically hedge the risk of rising debt.

For the time being, although Synthetix provides a channel for mortgage cryptocurrencies to purchase traditional financial derivatives, the actual synthetic assets generated are still concentrated in sUSD and sETH, which is not significantly different from other projects. Moreover, the mortgage rate is very high, and the actual utilization rate of the assets is low. The main purpose for investors to mortgage SNX is still to obtain inflationary SNX tokens. Synthetix has had a successful start. For further development, on the one hand, it can reduce the mortgage rate and increase the scale of synthetic assets; on the other hand, it can encourage users to choose more types of synthetic assets, especially their unique financial derivatives, and increase the diversity of synthetic assets. Open the gap with other projects.

Stablecoin

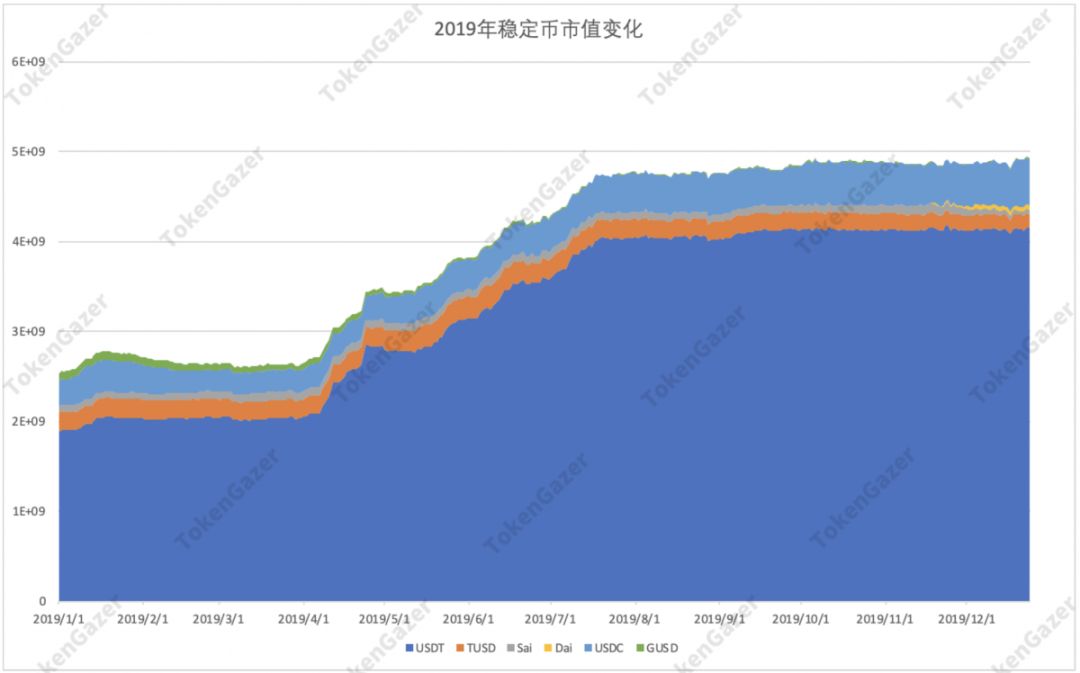

In 2019, stablecoins began to show significant growth in April, continuing until late July, and the market value increased from US $ 2.6 billion to US $ 4.7 billion; in the second half of the year, crypto assets showed a longer period of decline. The growth trend did not continue, but the market value of the stablecoin did not fall, and it slowly increased to US $ 4.9 billion by the end of the year.

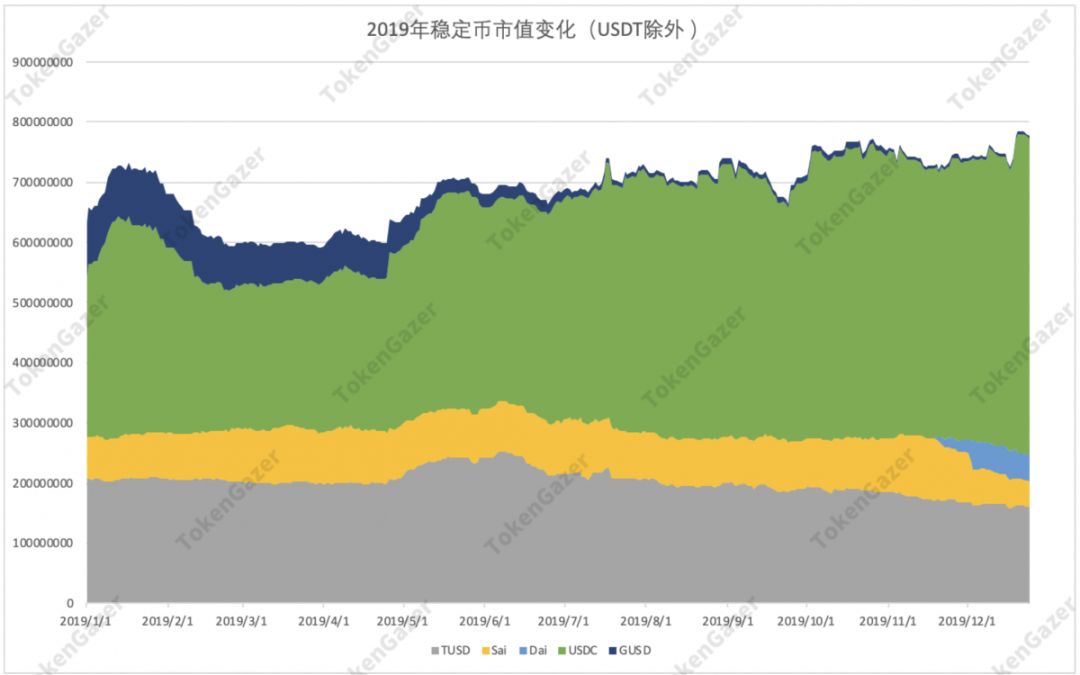

Among stablecoins, USDT occupies a major share, and the rise in the market value of stablecoins is also mainly dominated by it. Excluding USDT, we can better observe the development of other stablecoins:

USDC has been steadily showing relatively stable growth since May, and its market share has also increased; GUSD circulation has continued to decrease, from approximately 90 million at the beginning of the year to approximately 4 million US dollars; the circulation of TUSD and DAI has remained stable overall.

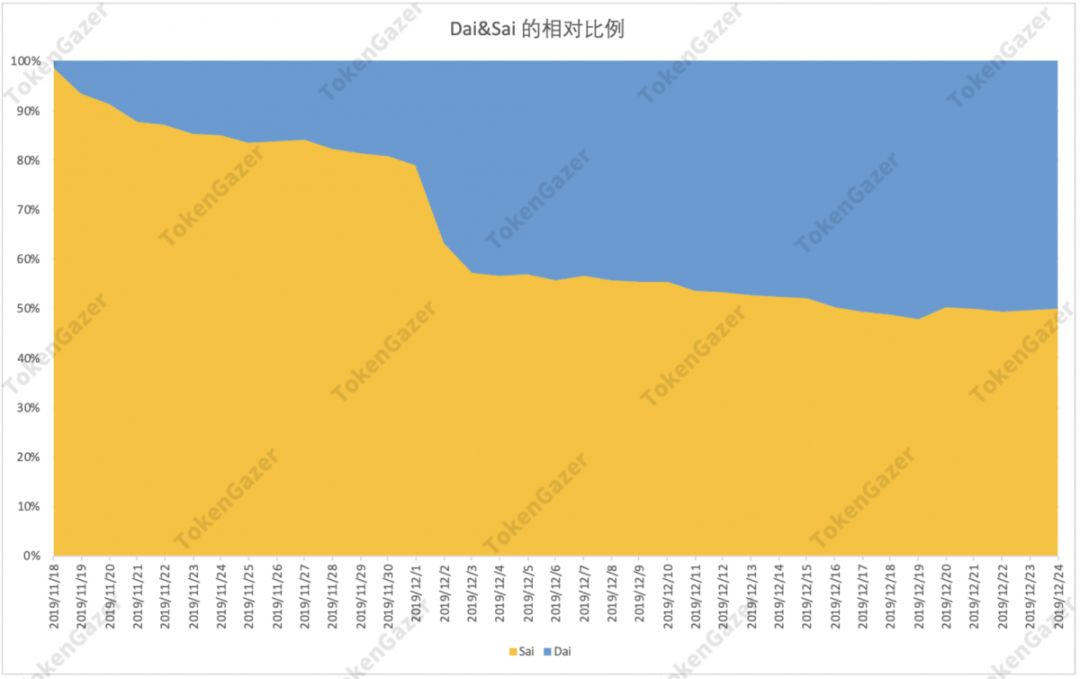

DAI is a stablecoin generated by the user's mortgage of ETH or BAT through the MakerDAO protocol. It was upgraded in November. The upgraded stablecoin name is still DAI. The original stablecoin DAI was renamed SAI. The above picture shows the upgrade of SAI to DAI since the upgrade. You can see that more than half of the SAIs have been upgraded to DAI in the past month or so.

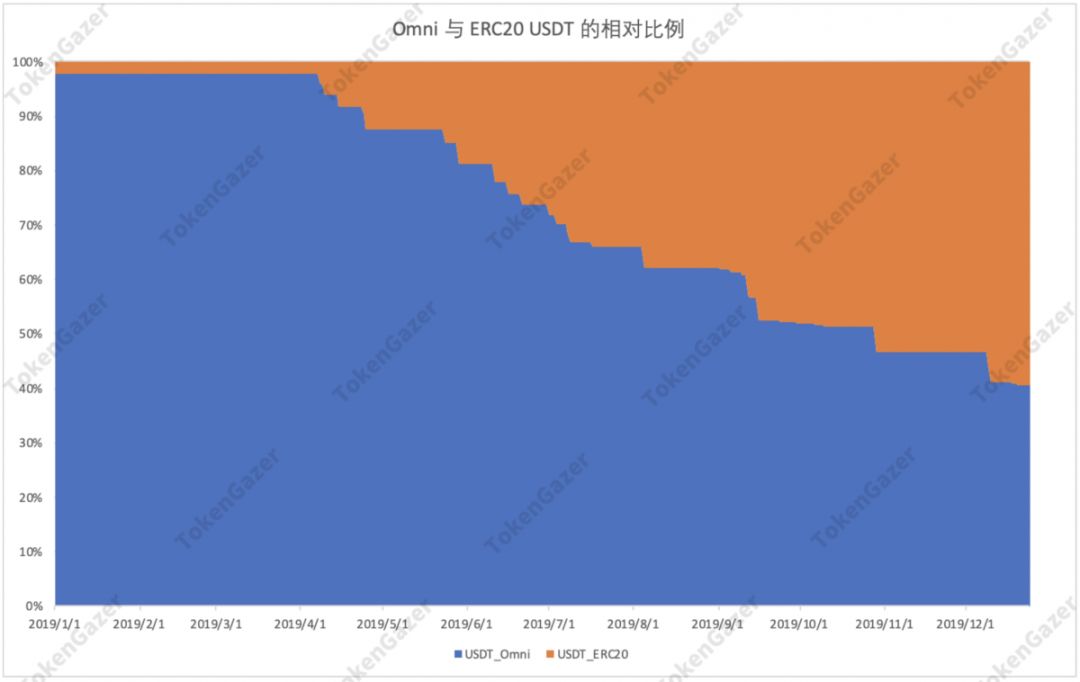

Another important change in stablecoins is that the USDT of the ERC20 version issued on Ethereum has increased significantly, and has exceeded the USDT issued through the Omni protocol on Bitcoin. In addition, the ERC20 version of USDT's daily transfers and on-chain activity have significantly exceeded the USDT issued based on the Omni protocol, and the gap continues to expand. However, the USDT of the ERC20 version does not fully comply with the ERC20 standard. There is no return value in transferFrom in the contract, which causes its transaction results to not be confirmed in real time. Developers need to define an interface template for USDT separately, which is unfriendly to developers and limits its use in Developments in DeFi-As we showed in the DEX section, USDT's trading volume on decentralized exchanges is not much compared to other stablecoins, and only Tokenlon and Kyber support in major decentralized exchanges USDT transactions.

Currently, we are seeing that DAI supplier MakerDAO is stimulating the supply of DAI with lower interest rates. According to past data, MakerDAO's interest rate adjustment mechanism has a more effective regulation of the supply of DAI, so in 2020 we are expected to see an increase in DAI circulation. In addition, as mentioned above, USDC liquidity is also currently on the rise. As the main stable and stable coin in the DeFi ecosystem, the market value increase of DAI and USDC will promote the further development of the DeFi ecosystem.

Cross-chain assets

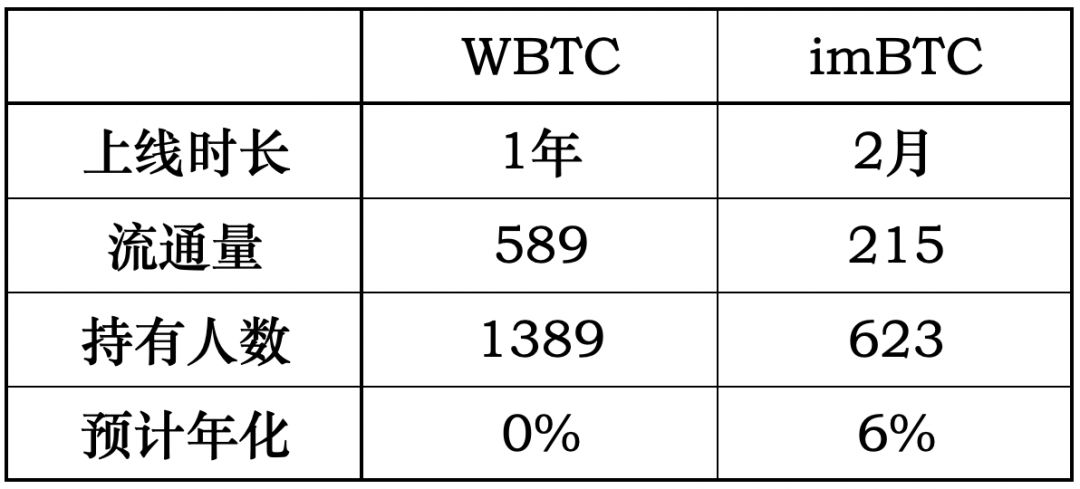

As the largest market capitalized and most liquid asset in cryptocurrency, Bitcoin has some attempts to capture its liquidity, such as WBTC, imBTC on Ethereum, and RBTC on RSK.

The above table counts the current circulation and number of holders of the major BTC cross-chain assets WBTC and imBTC in the DeFi ecosystem. It can be seen from the comparison that although there are a few short ones on the line, the circulation of imBTC has exceeded one-third of WBTC. The user base of imToken, the issuer of imBTC, and the annualized interest rate of imBTC have contributed to its growth. We expect imBTC to continue to grow rapidly in 2020.

WBTC and imBTC enable BTC to circulate in the Ethereum network in the form of ERC20 and participate in the activities of various DApps in the ecosystem. The DeFi ecosystem still mainly uses ETH as the underlying asset. The introduction of cross-chain BTC is expected to greatly increase the scale of DeFi in the future.

Margin trading

Compared with centralized exchanges, decentralized exchanges are more secure, transparent, do not require KYC, have better privacy, and have the characteristics of anti-censorship. Although the business of decentralized exchanges is currently mainly focused on the trading of cryptocurrencies, the volume of transactions is far less than that of centralized exchanges. But the advantages of a decentralized exchange also make it an important part of the Ethereum ecosystem, and this is also one of the main development directions in the future. Decentralized exchanges are also actively absorbing the advantages of centralized exchanges, which have greatly improved their practicability and ease of use.

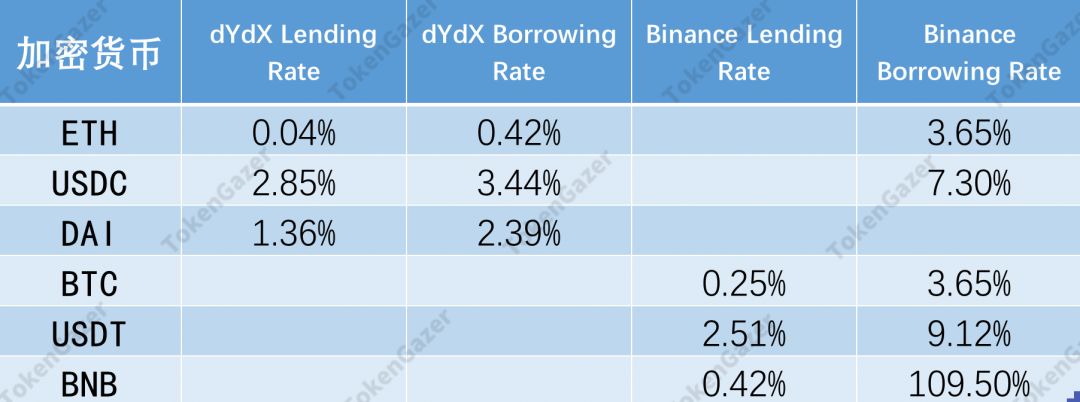

The decentralized exchange dYdX adds margin trading to the trading function. Since there are no centralized intermediaries, borrower costs are reduced. Comparing dYdX and the centralized exchange of Binance's margin trading borrowing interest, borrowing ETH on dYdX only requires an annualized interest of 0.42%, while the annual interest rate on Binance is 3.65%; dYdX borrows USDC at an annual rate of 3.44%. Binance is 7.30%. For the same token, the debit rate of margin trading on decentralized exchanges is significantly lower than that of centralized exchanges.

Decentralized exchanges rely on the underlying public chain where they are located, and the assets they support will be relatively limited. DYdX only supports three tokens: ETH, USDC, and DAI. Binance supports more types of tokens, but lending rates and margin trading rates vary widely. For example, the current interest rate for borrowing BTC on Binance is 0.25%, the borrowing rate is 3.65%, and the borrowing rate is 14.6 times the lending rate. For BNB, the borrowing rate is 260 times the lending rate. Since the decentralized exchange dYdX does not have a centralized intermediary, interest rates are adjusted in real time, and the gap between lending rates and borrowing rates is also smaller.

In terms of ease of use, decentralized exchanges are also actively improving. Generally speaking, to perform margin trading on a decentralized exchange, several steps are required: borrowing tokens on a platform; transferring tokens to the exchange; and placing orders on the exchange. dYdX simplifies all the intermediate steps. With sufficient margin, it can automatically perform the process of borrowing money and transferring to other decentralized exchanges through smart contracts, which can already achieve the same convenience as centralized exchanges.

in conclusion

In the pledged lending and margin trading market, we observed that there were more arbitrage opportunities in the first half of the year, but as the lending rates of various platforms converged and spreads decreased, the opportunities for spread trading on each platform gradually decreased or even disappeared. Decentralized markets are becoming more efficient.

At the same time, we observe that MakerDAO, as the largest decentralized lending application, affects the interest rate of the entire pledged lending market. This is because DAI is still the most important asset in the pledged lending market. Although the second largest asset USDC is currently similar to its function and the borrowing rate is also affected to some extent, it still has a certain degree of independence. This shows that the purpose of the two is not exactly the same, and USDC's borrowing may be used more for leveraged transactions on centralized exchanges.

From the DEX observation, we think it is worth noting that Uniswap is playing an increasingly important role as an important component of DeFi. Among all DEX, Uniswap provides the most liquidity for DeFi, and is the engine of DeFi-related token liquidity. The liquidity of Synthetix synthetic assets is almost entirely provided by Uniswap; and Kyber mainly obtains for BAT, LINK, USDC and other More commonly used tokens provide liquidity; Tokenlon is the most liquid exchange for USDT.

Synthetix, the star project in DeFi in 2019, has seen rapid growth in both market capitalization and business scale, and has received widespread attention. We believe that although there are still a lot of potential risks behind Synthetix's innovation, the high growth and high returns it brings will stimulate more innovators to explore in this field.

Outlook

Growth in the size of the lending market. In the current decentralized lending, there is no credible credit score, and only excess mortgages can be used, and the scale of borrowing is limited. The introduction of an identity / reputation system will make it possible to reduce collateral requirements. In addition, due to the difference in the underlying public chain, the assets supported are also limited. If an efficient and secure method can be found to introduce Bitcoin for collateral, the size of the lending market may grow exponentially.

Innovation is very important to the traditional financial field, and this also applies to decentralized finance. Partial innovation may bring greater opportunities. Synthetix has opened up a channel for purchasing financial derivatives with cryptocurrency through the innovation of financial products. The price of SNX has increased significantly this year. This may stimulate other projects to actively innovate. For example, some decentralized exchanges are actively introducing futures and options trading. While expanding and expanding the market, develop new markets.

Regulatory uncertainty. DeFi is still in a gray area in many cases, does not comply with anti-money laundering and KYC rules, the tax system in the system is not perfect, and contracts based on smart contracts also have systemic risks.

The development of other on-chain DeFi projects will be more difficult. The development of DeFi depends on the integrity of the on-chain ecology. Ethereum does the best in this regard. It can also be seen from the development of the DEX project. DEX is a place for on-chain asset exchange, representing the prosperity of the on-chain economy.

The development of DeFi in 2020 should continue to focus on head projects such as MakerDao. Among the loan projects on the Ethereum platform, SAI accounts for more than half.

Copyright Information and Disclaimer

Unless otherwise stated, all content is original and researched and produced by TokenGazer. No part of this content may be reproduced in any form or mentioned in any other publication without the express consent of TokenGazer.

TokenGazer's logos, graphics, icons, trademarks, service marks and titles are service marks, trademarks (not to mention registered) and / or trade dress of TokenGazer Inc. All other trademarks, company names, logos, service marks, and / or trade dress ("Third Party Trademarks") mentioned, displayed, quoted, or otherwise indicated are the exclusive property of their respective owners . It may not be copied, downloaded, displayed, used as a meta tag, misused, or otherwise used as a mark or a third mark without the prior written permission of the owner of TokenGazer or such third mark. .

This brochure is for reference only, and all information contained in this brochure should not be used as a basis for investment decisions.

This book does not constitute investment advice or assist in judging specific investment targets, financial conditions and other investor needs. If investors are interested in investing in digital assets, they should consult their investment consultants. Investors should not rely on this as their legal, tax or investment advice.

The asset prices and intrinsic values mentioned in this study do not change. The past performance of an asset cannot be used as a basis for future performance of any asset described in this document. The value, price or income of certain investments may be adversely affected by exchange rate fluctuations.

Certain statements referred to in this document may be TokenGazer's assumptions about future expectations and other forward-looking opinions, known and unknown risks and uncertainties that may cause actual results, performance or opinions and statements in events and statements and Assume that there are substantial differences.

In addition to forward-looking statements made as a result of derivation, there are also the words "may, in the future, should, may, can, expect, plan, intend, anticipate, believe, estimate, predict, potentially, predict or continue" and Similar expressions identify forward-looking statements. TokenGazer is under no obligation to update any forward-looking statements contained herein, and purchasers should not place undue ground on such statements, and these statements represent views expressed before the deadline only. Although TokenGazer has taken reasonable care to ensure that the information contained in it is accurate and correct, TokenGazer makes no express or implied representations or warranties (including liability for third parties) regarding its accuracy, reliability or completeness. You should not make any investment decisions based on these inferences and assumptions.

Investment risk tips

Price volatility: In the past time, digital currency assets experienced price fluctuations in single and single periods.

Market acceptance: Digital assets may never be widely adopted by the market. In this case, single or multiple digital assets may lose some of their value.

Government regulations: The regulatory framework for digital assets is still unclear. Supervision and restrictions on existing applications by competent authorities may have a significant impact on the value of digital assets.

Please indicate the source.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- BTC halved | From MA, Z-Score, Reserve Risk, analyze whether it is a good time to enter the market

- EOS drops on the altar: millions of TPS have not been fulfilled, "VOICE" is silent

- Inventory: 2019's biggest winners and losers in the crypto industry

- Fuzhou strives to exceed 430 billion yuan in digital economy in 2020, and accelerates the layout of the blockchain industry

- Ants start rendering blockchains: three major strategic speedup leads?

- Babbitt Column | Blockchain industry to land, these areas still need to be greatly improved

- Ethereum price history: from 2015 to 2020