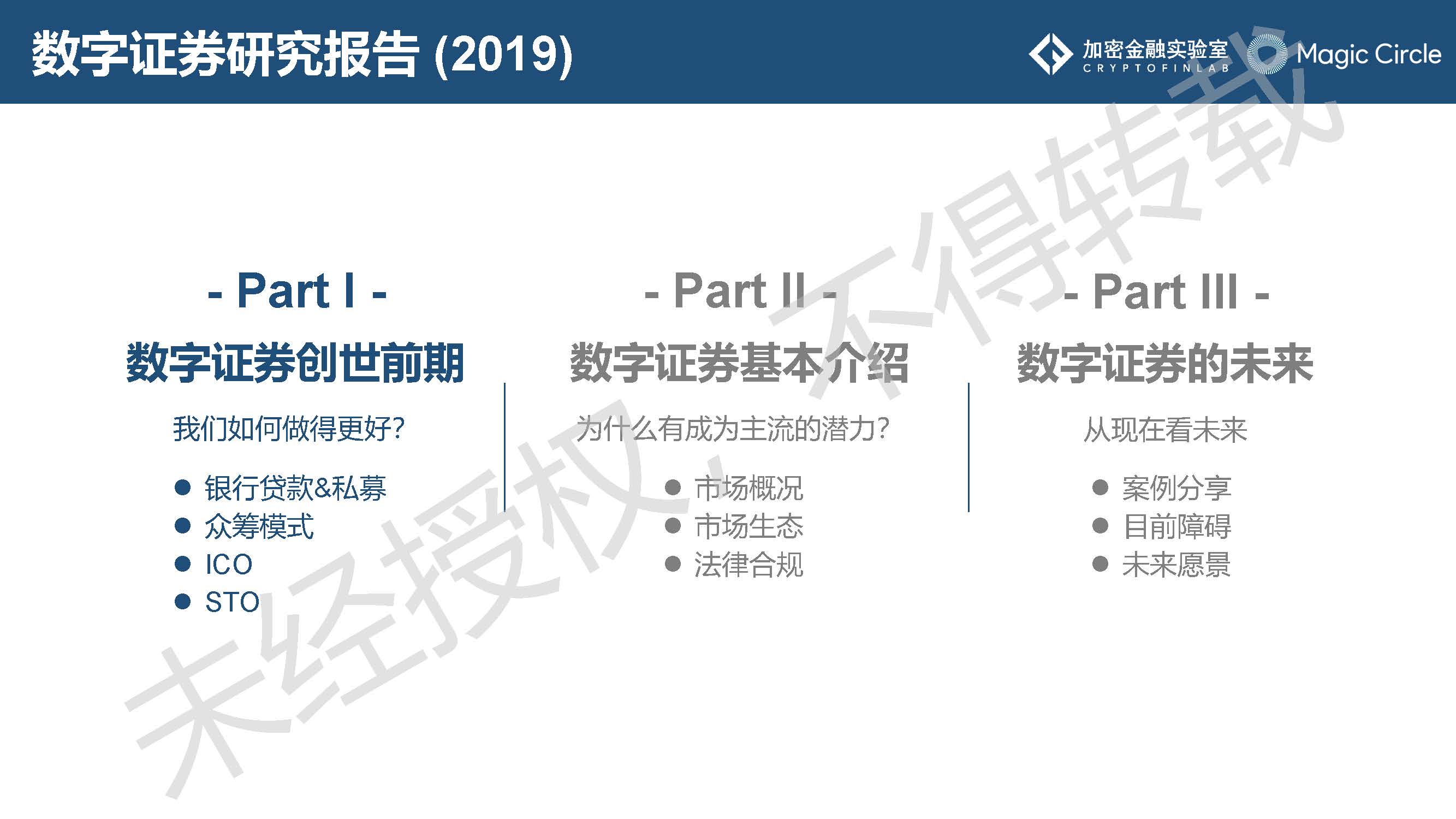

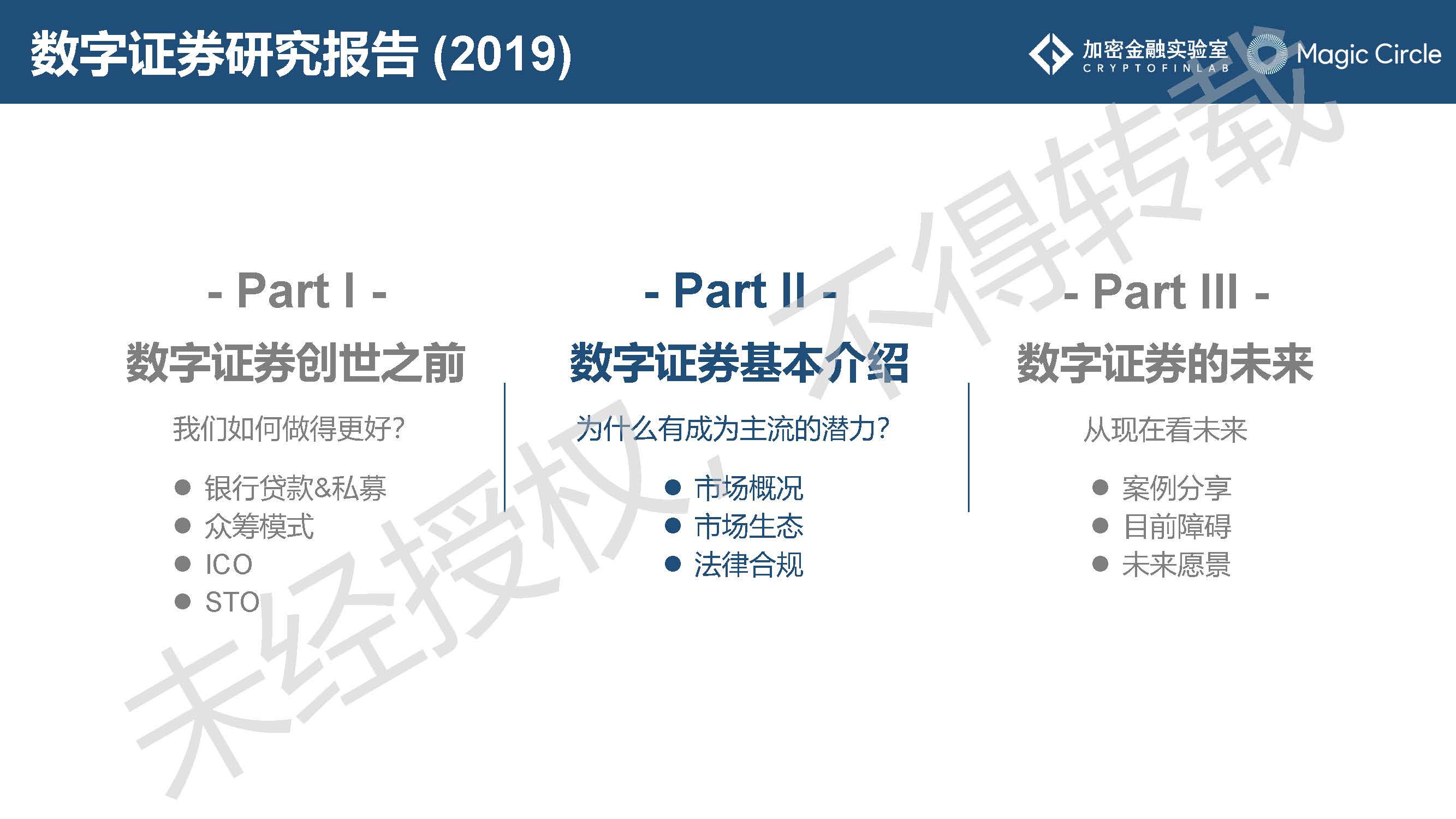

Digital Securities Research Report 2019: What is preventing it from becoming mainstream? What to expect in 2020?

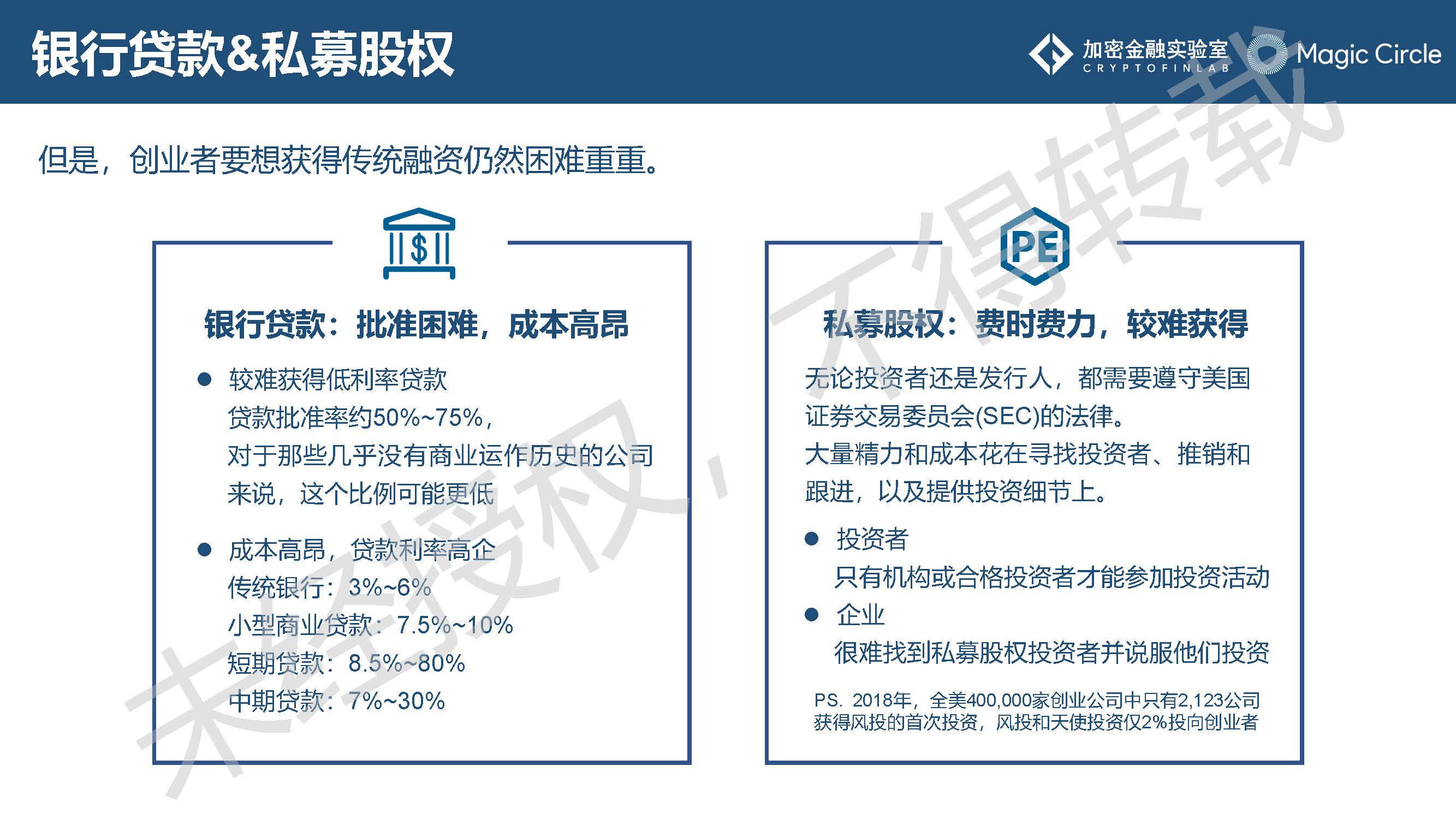

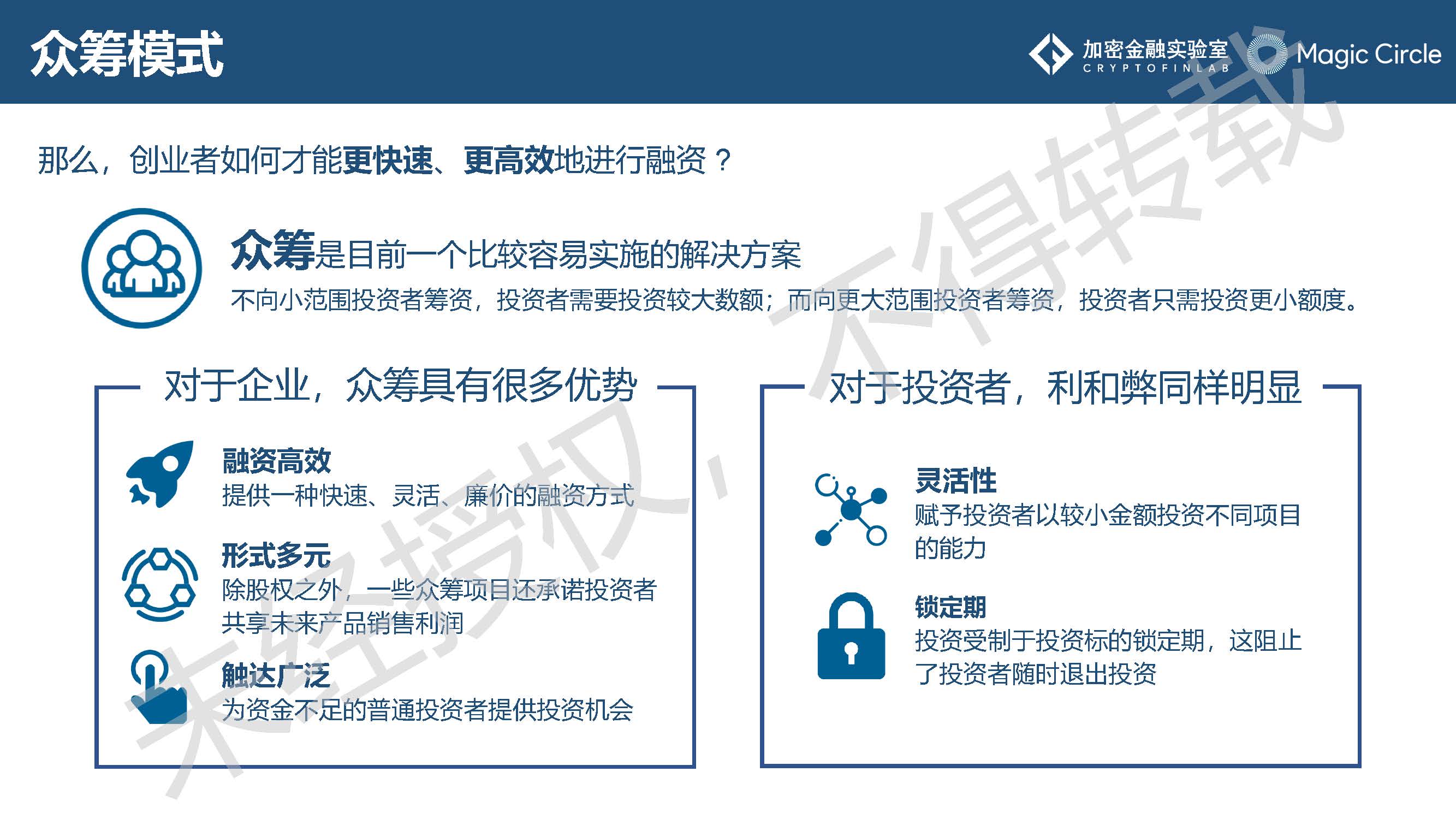

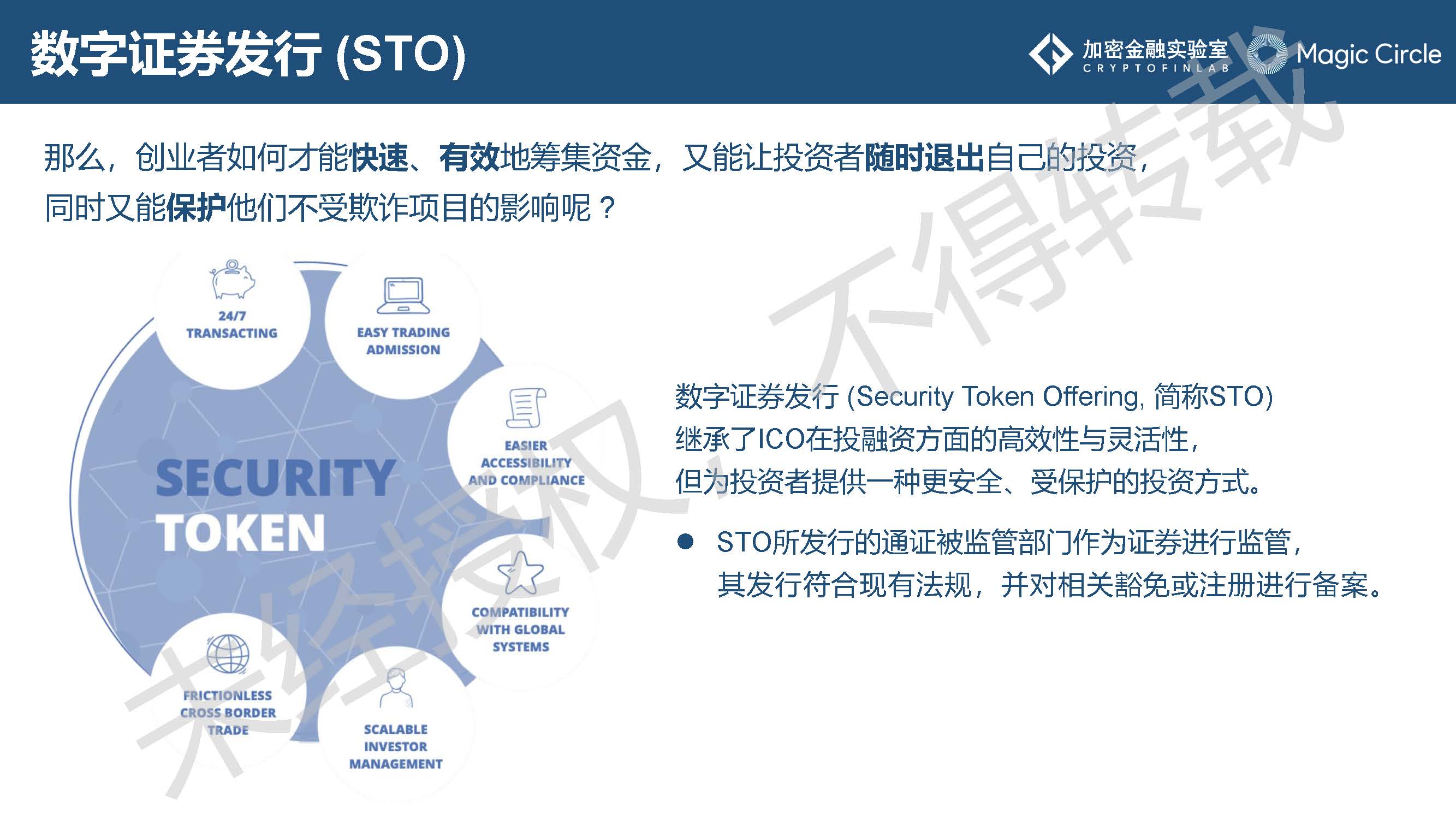

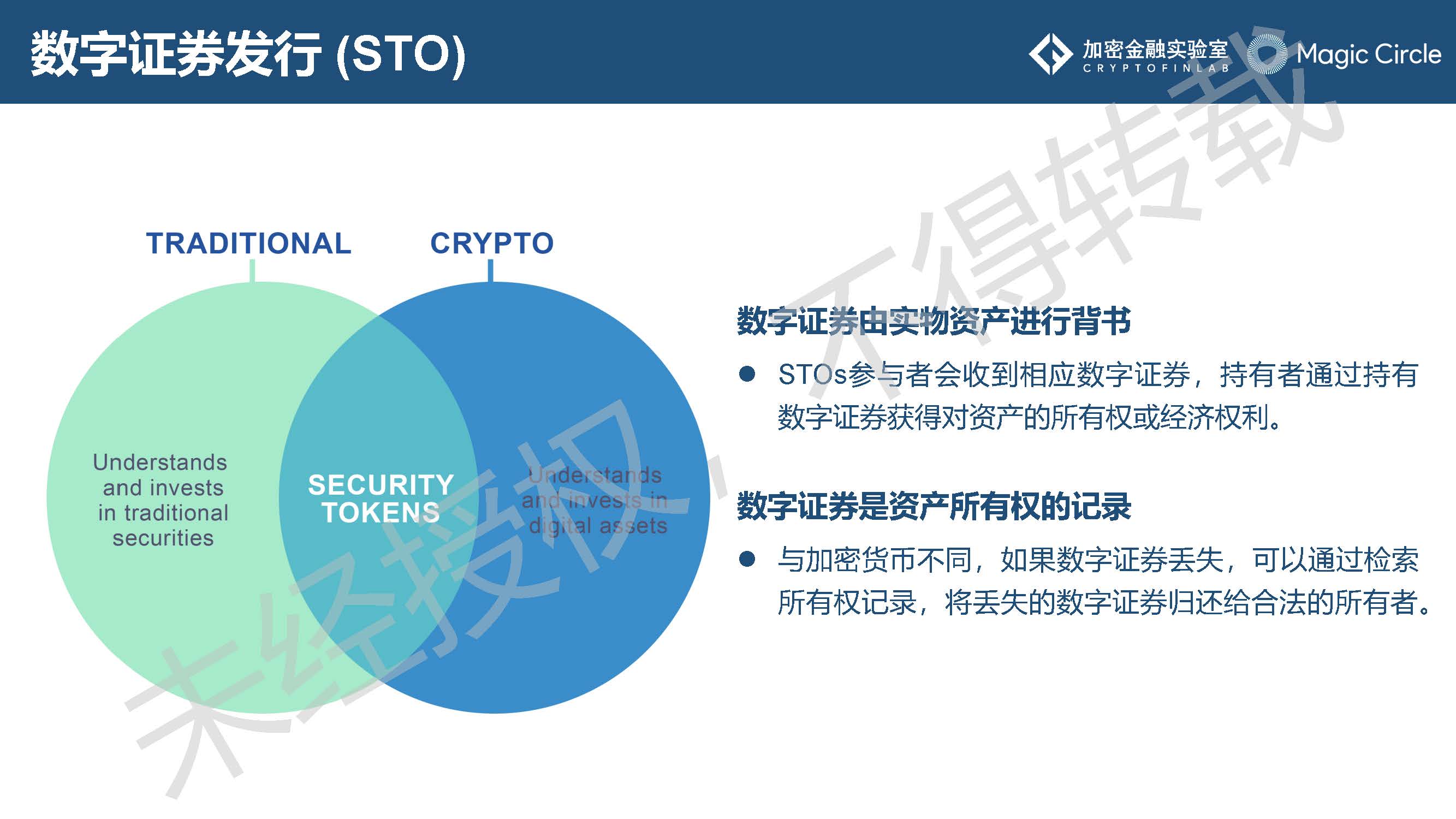

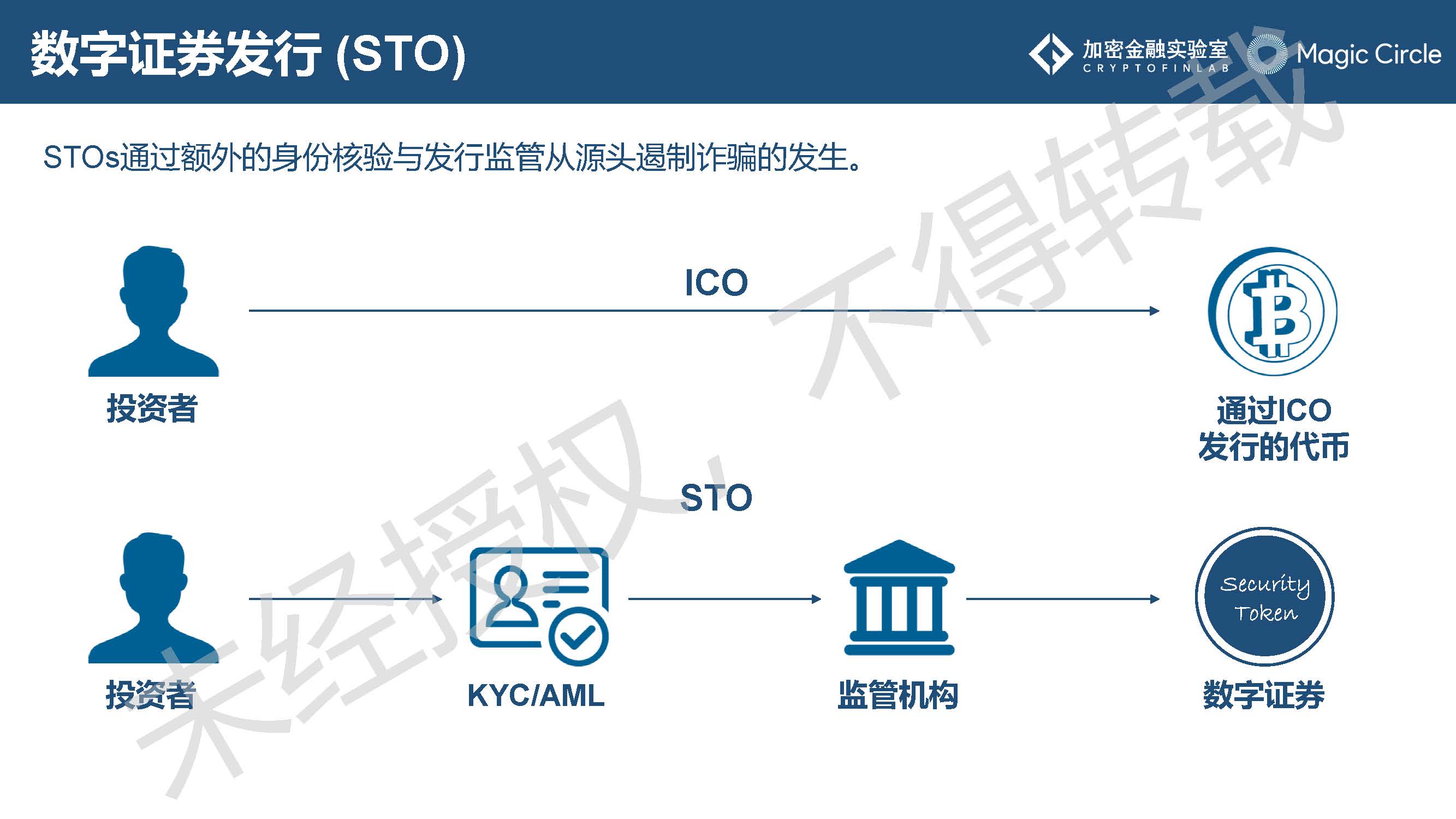

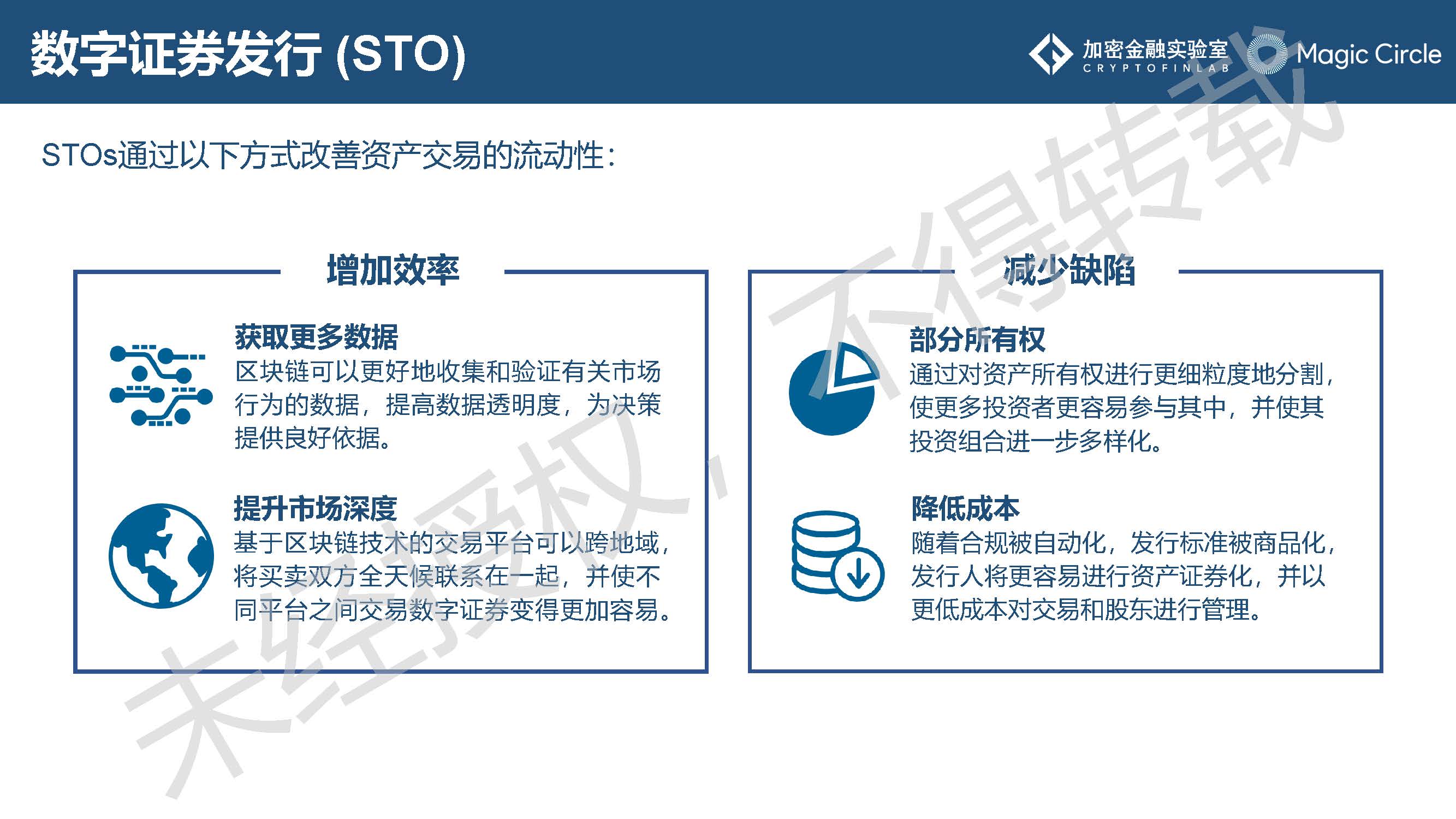

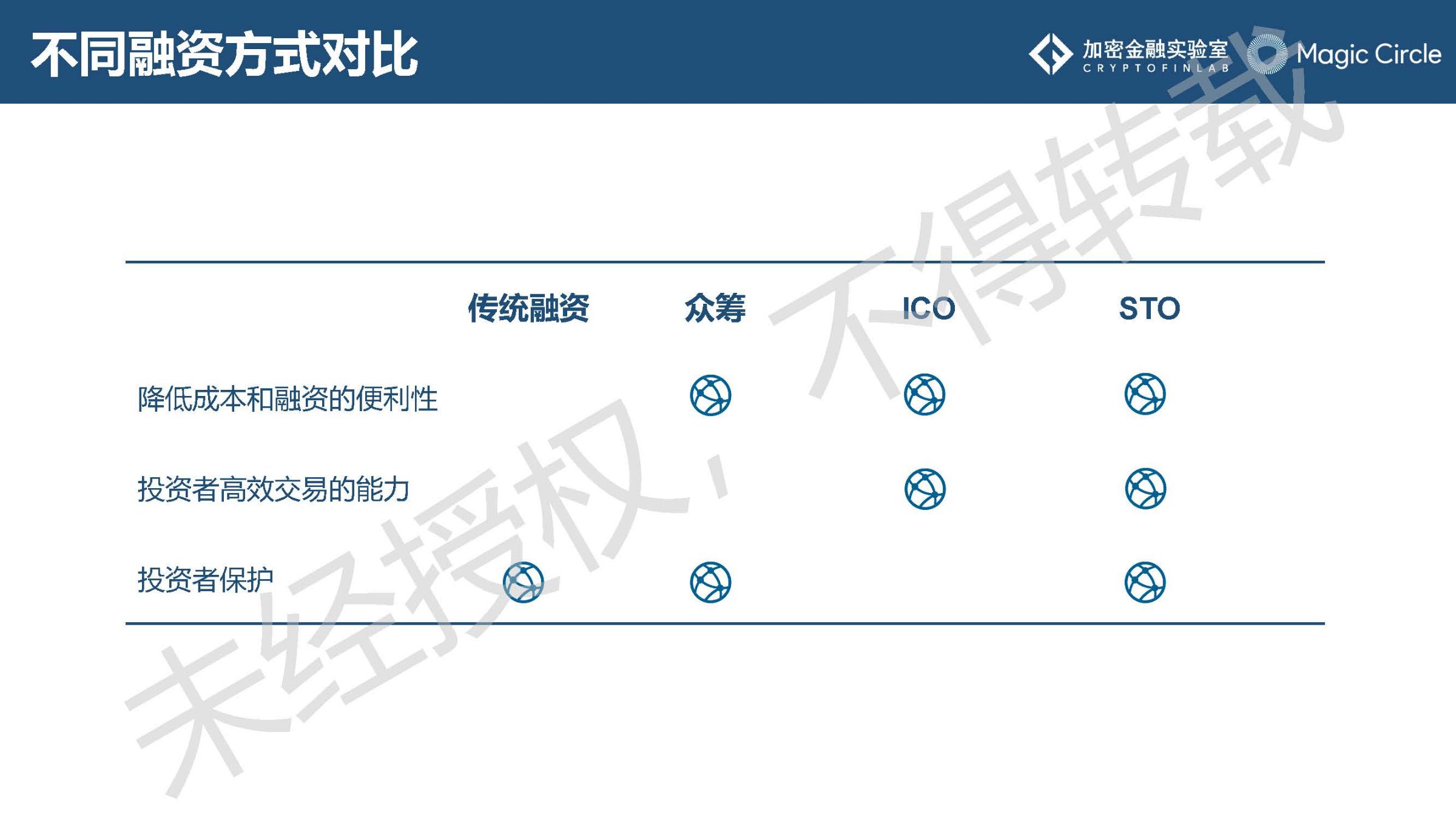

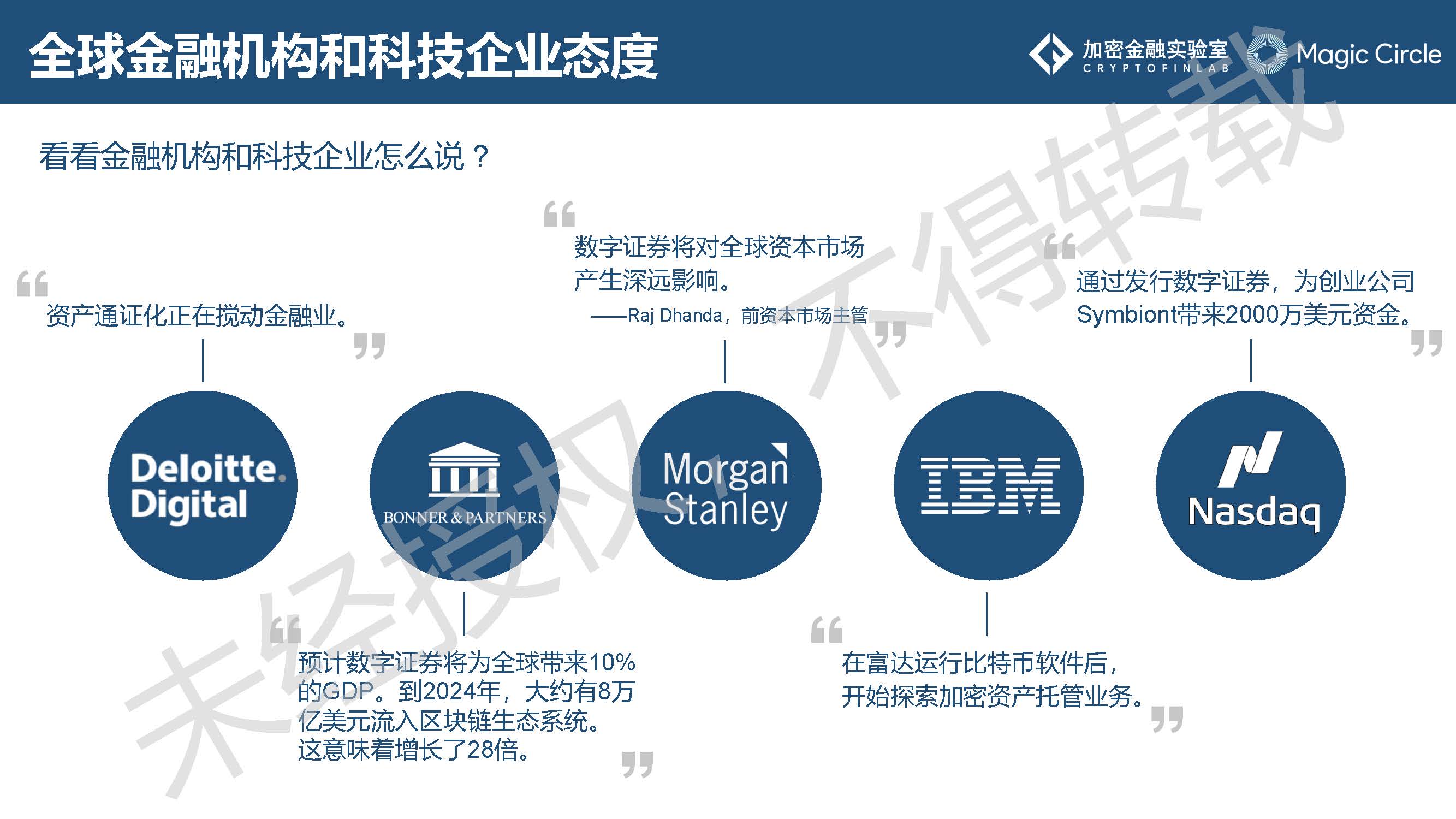

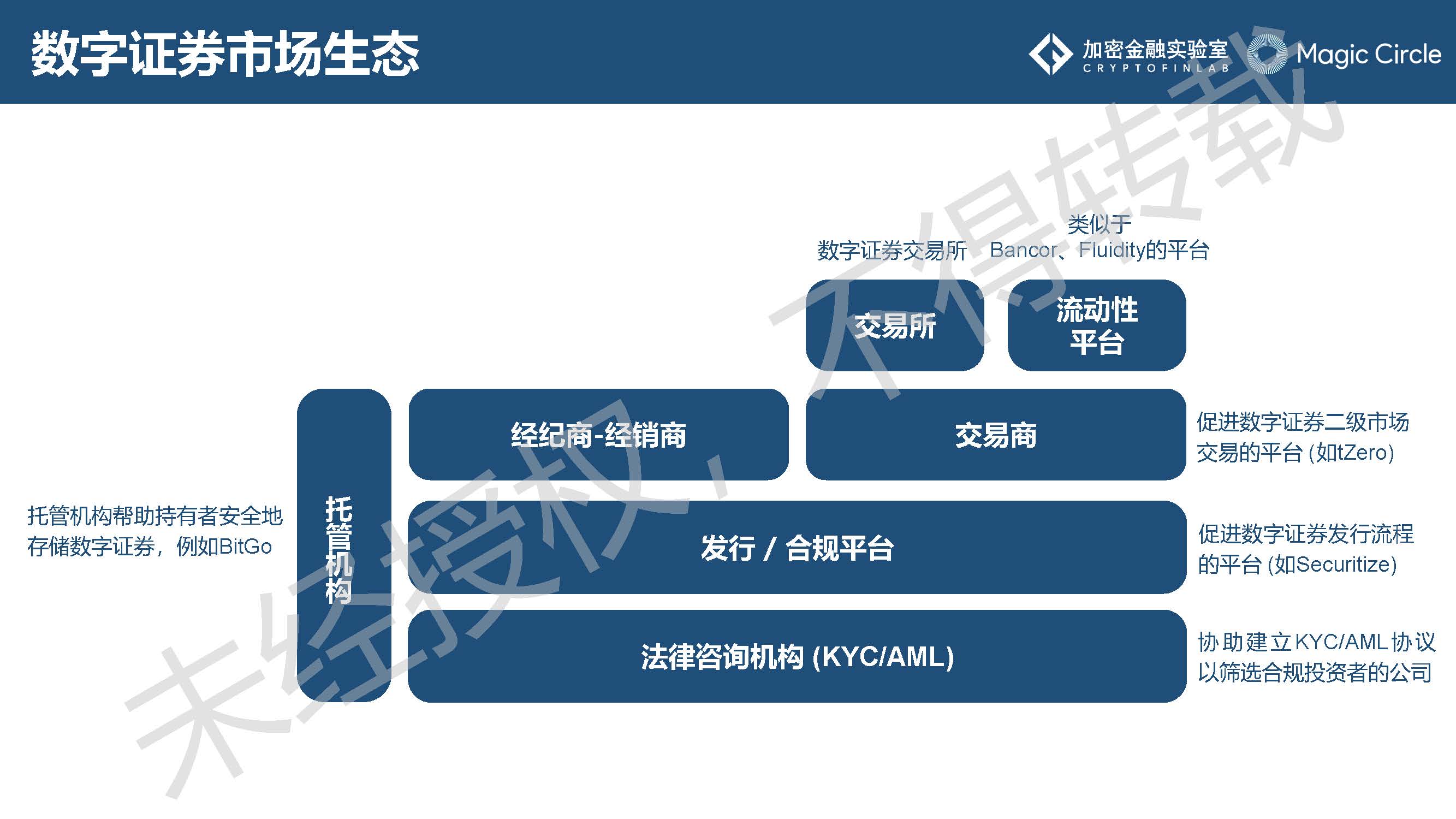

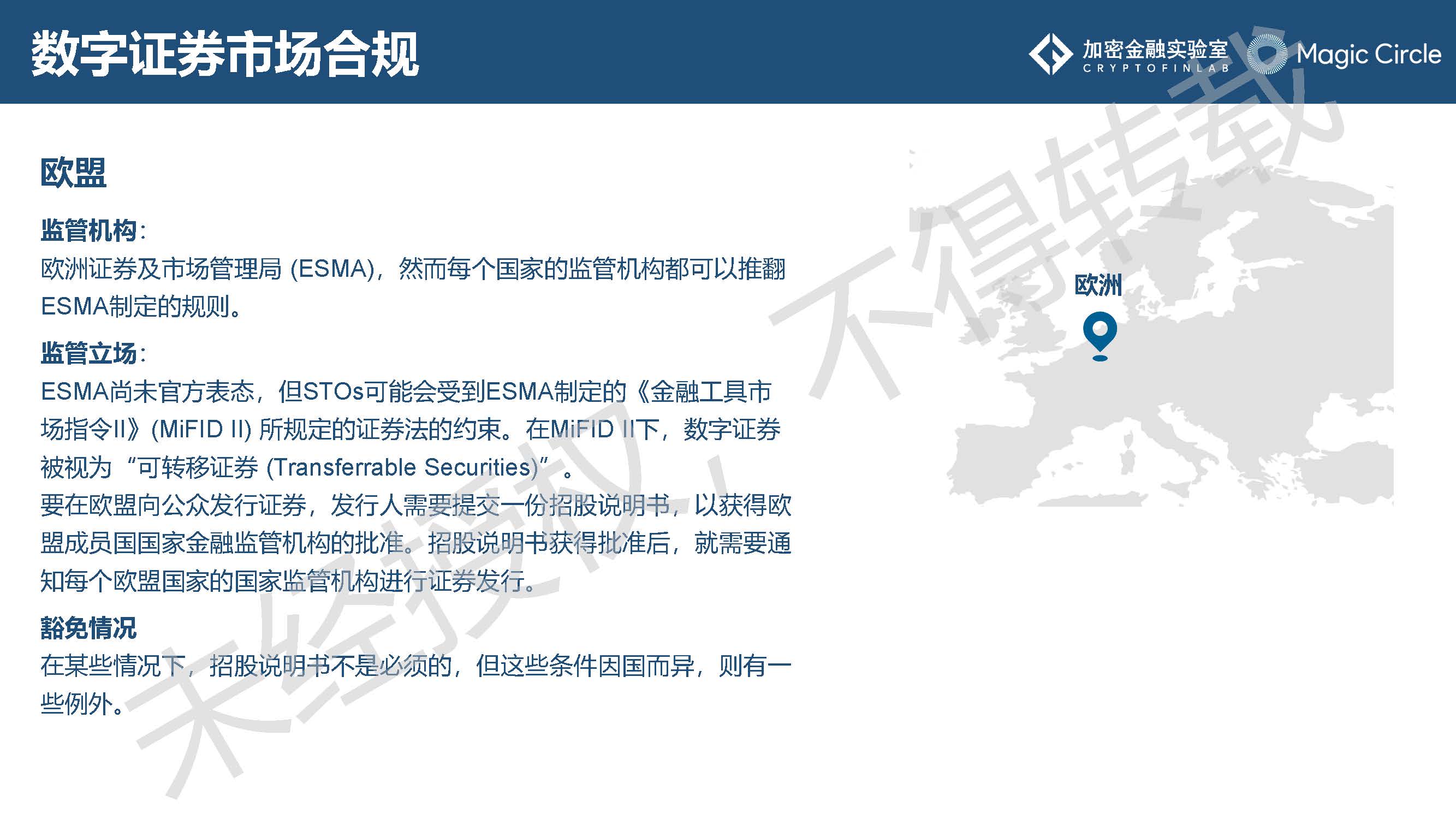

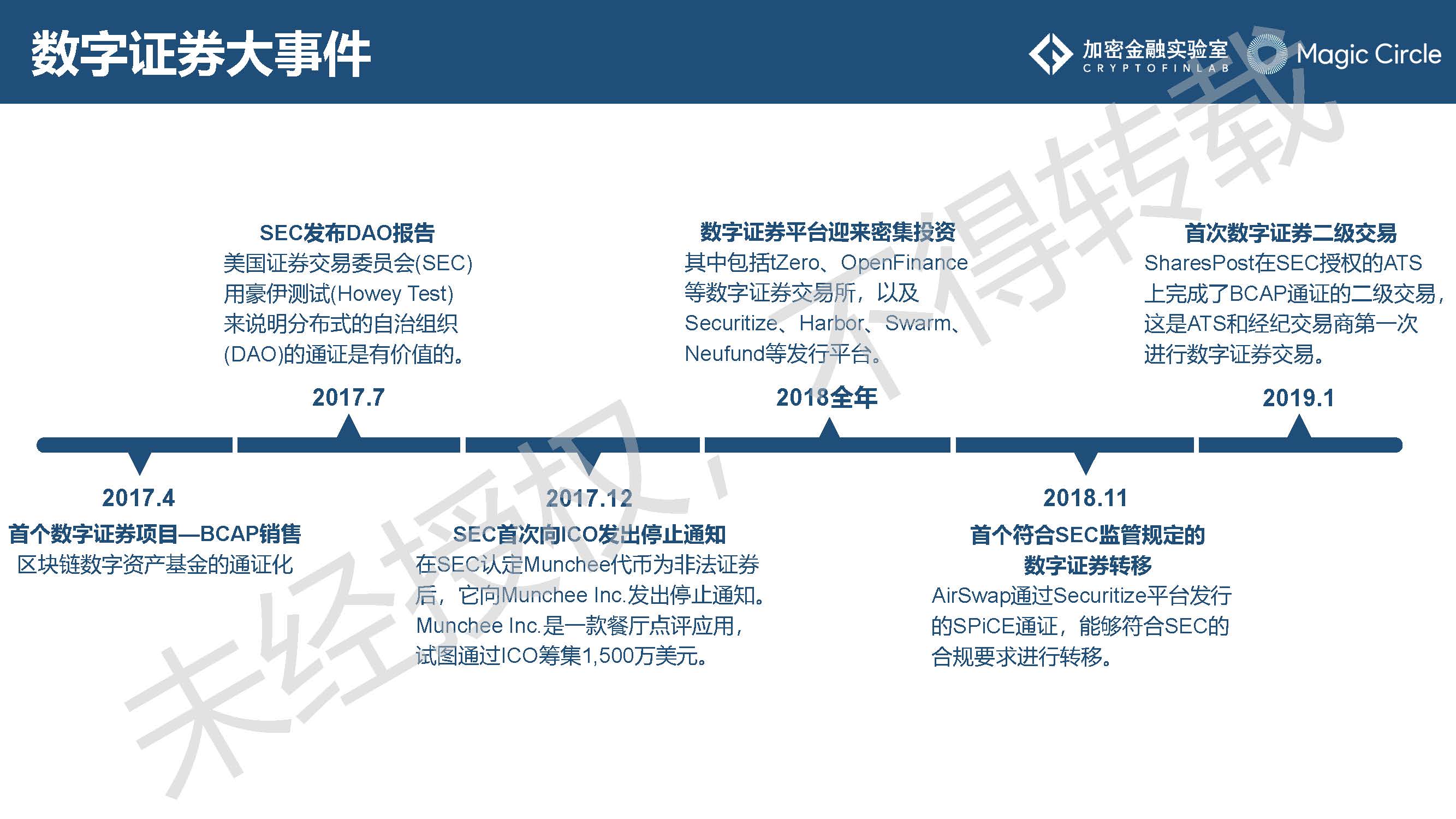

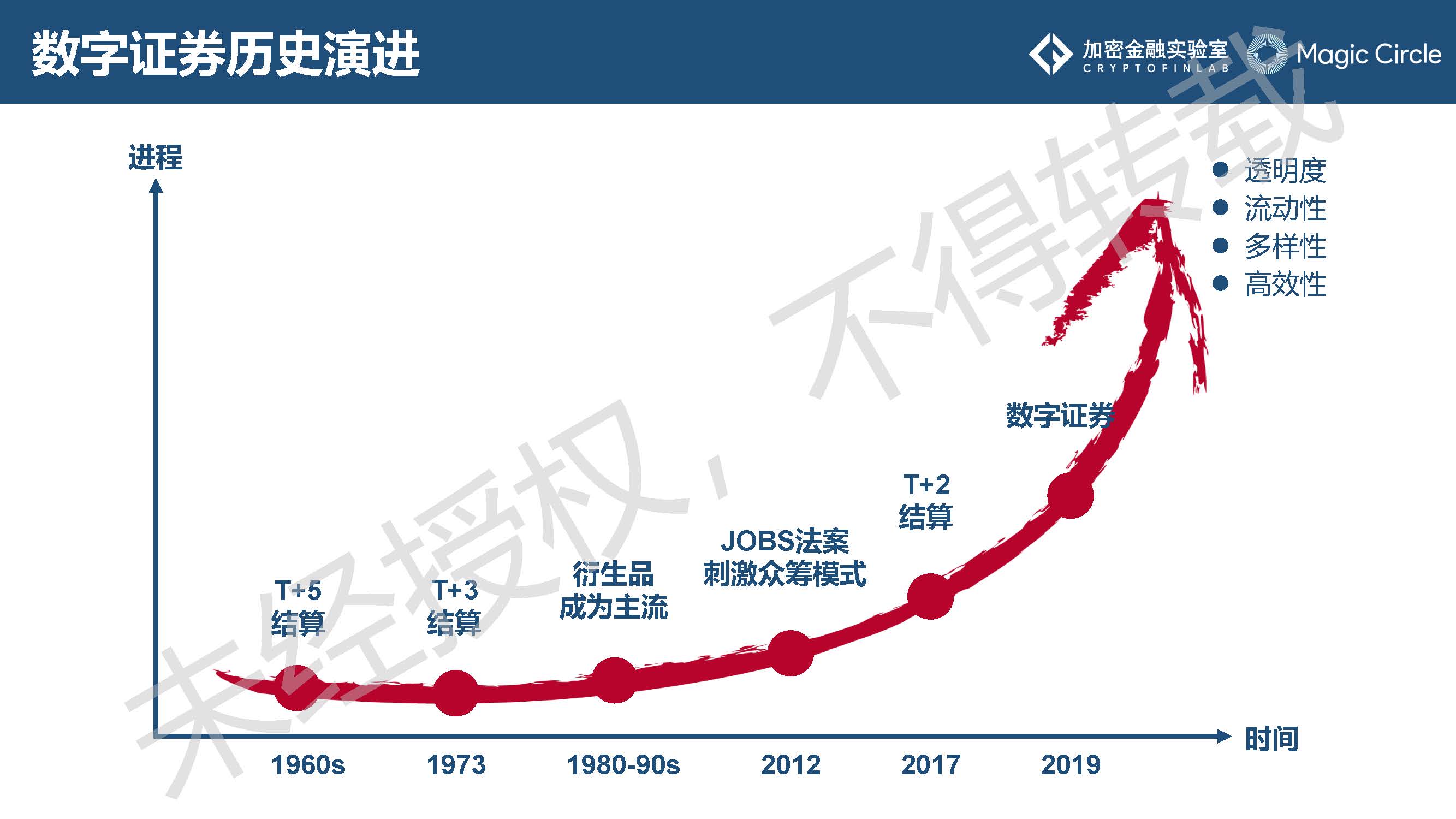

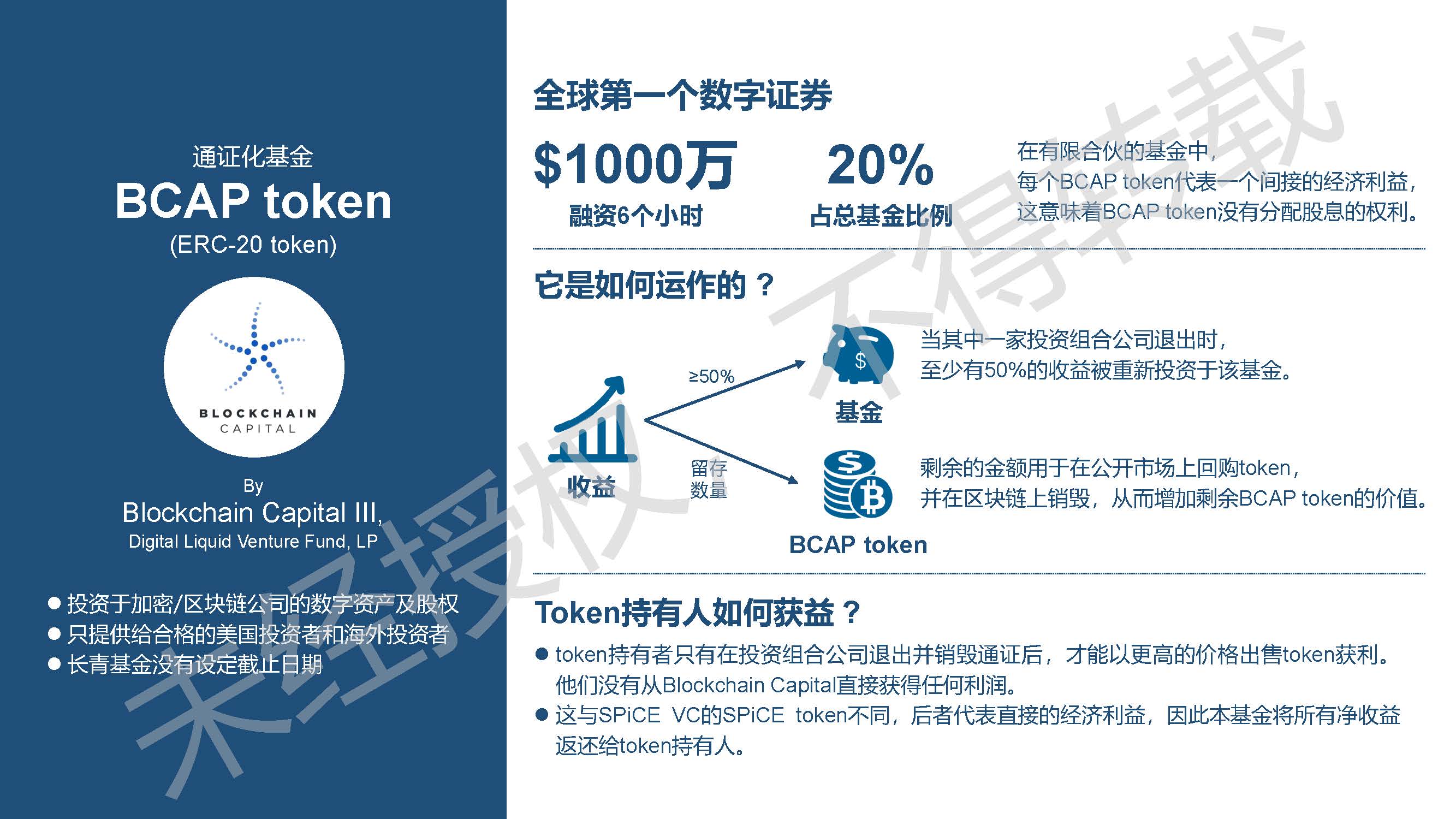

2019 is a year of booming digital securities (STO), which is different from the sloppy ICO model before. Digital securities have been injected with the genes of compliance since the day of their birth. Global governments, financial institutions, and investment funds have been embracing this innovative finance. Most of the models are open-minded, and some blockchain companies take the lead in eating "crabs" and have developed a number of outstanding companies focusing on digital securities technology, issuance and trading, such as Polymath, Harbor, Securitize, tZERO, and OpenFinance. This model quickly secured financing.

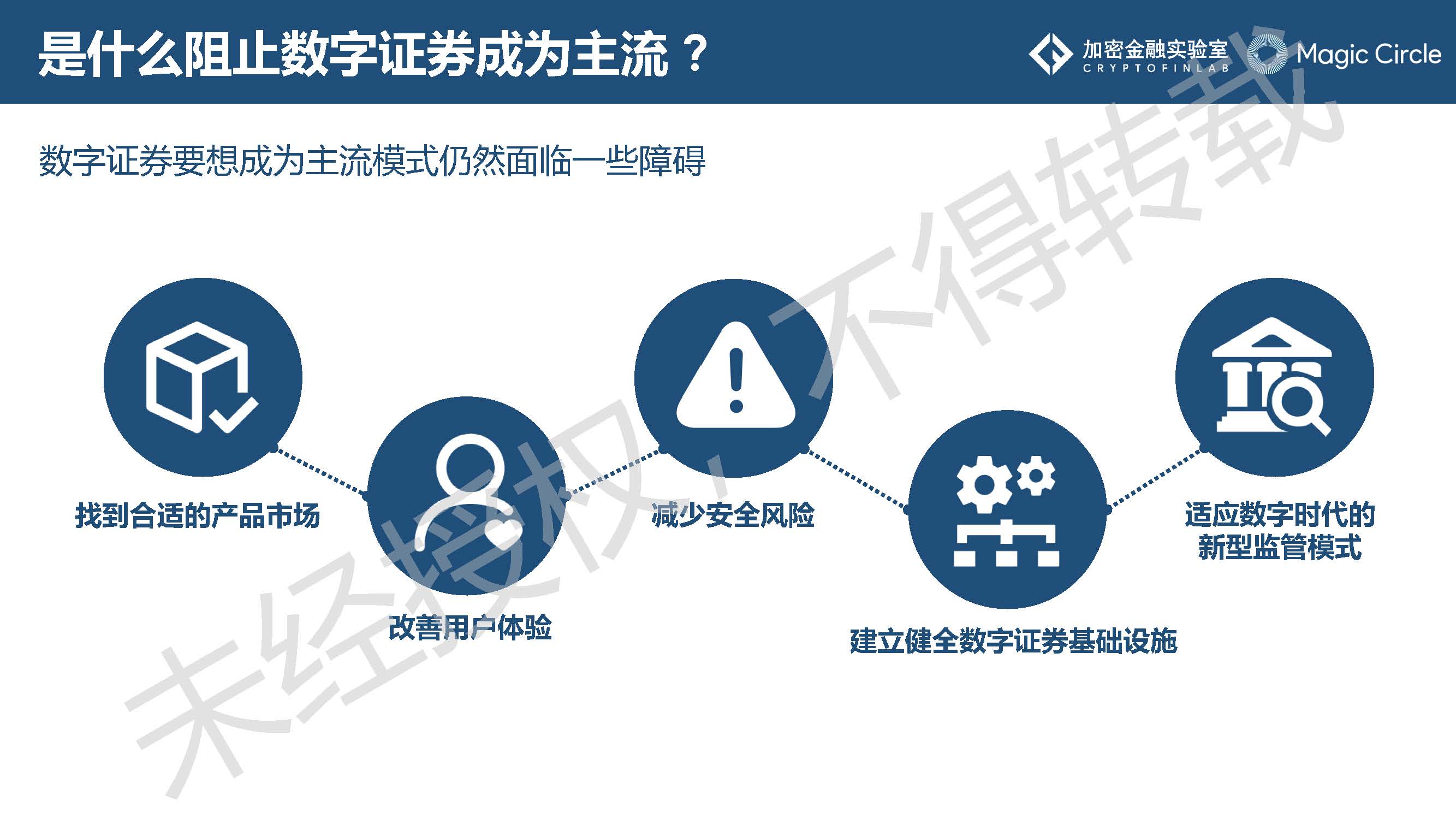

Although under the strong supervision, digital securities have also experienced unrecognized anxiety and faced many challenges, but the pace of financial innovation has never stopped. Digital securities based on blockchain technology are constantly spawning new species, new models and new formats in the financial field. It is foreseeable that a more dynamic and efficient digital securities ecosystem is taking shape.

Looking forward to 2020, the development of the digital securities industry may present the following seven trends:

- Digital securities infrastructure accelerates construction

- The integration of digital securities and traditional finance is further deepened

- Financial giants and venture capital-intensive admissions accelerate ecological construction

- Investors and companies deepen their understanding of digital securities

- More startups choose digital securities offerings

- Government develops compliance framework for digital securities

- Digital securities continue to face strong regulation

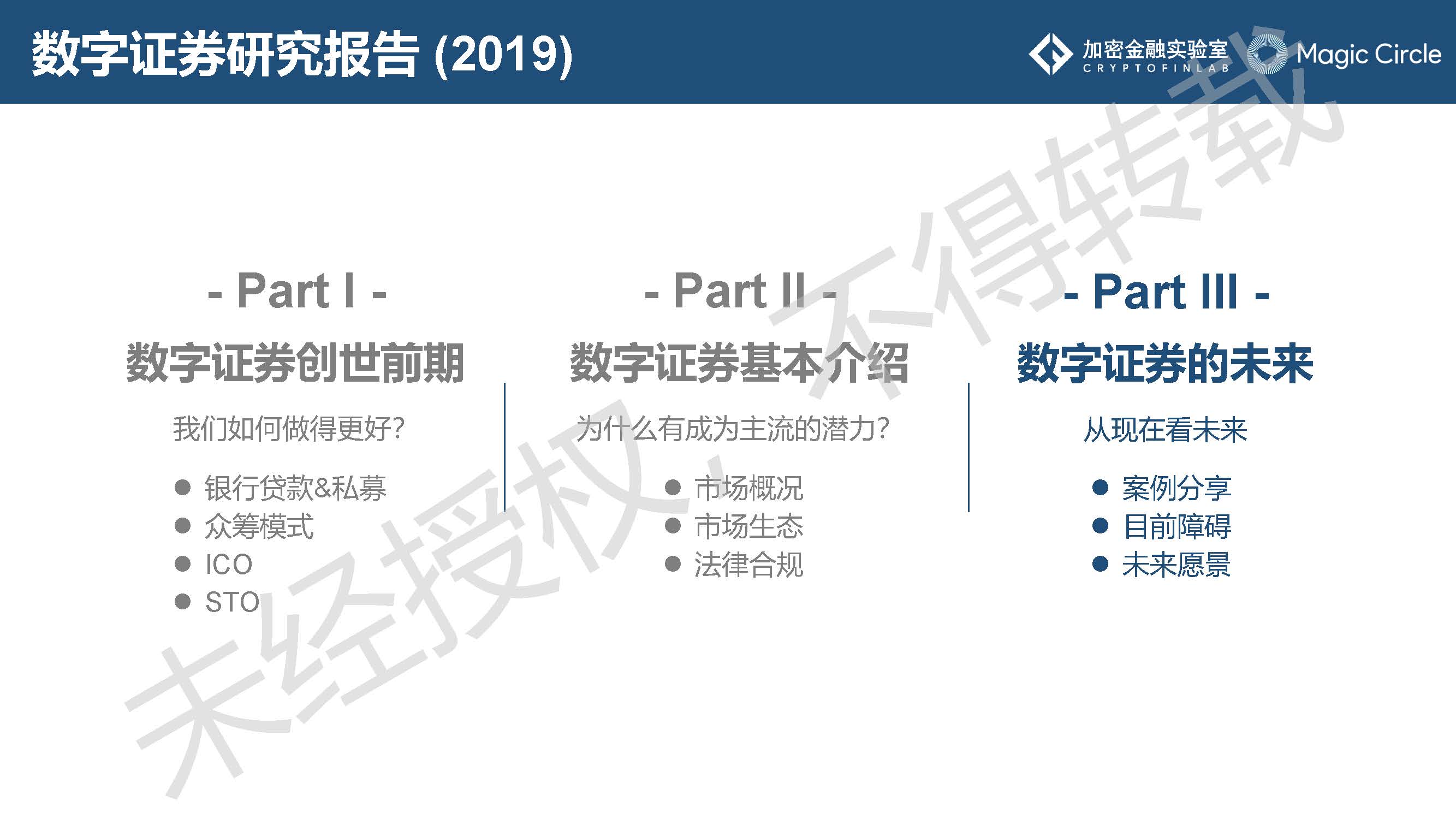

In order to show the development context and ecological evolution of the digital securities industry in a panoramic view in 2019, we today released the annual STO report-"Digital Securities (STO) Research Report-2019", hoping to provide everyone with a deep understanding of the digital securities industry. And materials, and also contribute to building a new world of digital finance in the future.

- Looking ahead to DApp 2020: from smart contracts to application chains

- Technical Articles | What are the bottlenecks and thresholds for developing Dapps on Ethereum?

- Coinbase CEO: the next decade of cryptocurrencies

For a PDF version of the report, please follow the “Crypto Finance Lab” public account, enter “Report” in the input box, and click the link to download.

The following is the full report:

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- From Web2.0 to Web3.0: Is Web3.0 a wake-up call or an alarmist?

- Compared with the original chain of the original chain in 2020, MOV, more than the original, Bystack, more than the original

- Free and easy week review 丨 EHM theory tells you seriously and objectively: BTC halved will not rise in the end

- Industry Blockchain Weekly 丨 Local "two sessions" kicked off, blockchain becomes a hot topic for discussion

- Featured | NFT Game User Overlap Report on Ethereum; How Zero-Knowledge Proof Changes the Blockchain

- DeFi data observation in 2019: the efficiency of the lending market has improved, and DEX has developed differently

- Babbitt weekly election 丨 The flags of 2020 have already been established. Where do you stand?