Getting Started with Blockchain | How to calculate Bitcoin transaction fees?

Author | Huohua

Production | Vernacular Blockchain (ID: hellobtc)

When it comes to the advantages of bitcoin, many people will add the "low bitcoin transfer fee" clause. For example, on January 3 this year, a large bitcoin transfer valued at about 10.51 million US dollars (1500 BTC), the transaction fee when transferring from a "big whale" wallet to a trading platform was much lower than $ 1 (0.00002653 BTC) ).

- The "National Team Alliance Chain" blockchain service network will be officially commercialized in April, with hundreds of city nodes

- Telegram official reminder: Gram won't help you get rich

- Is crypto taxation complicated? TaxBit receives $ 5 million in seed funding to provide accurate tax calculation tools

Moreover, due to the bleak market conditions, the transaction fees for bitcoin transfers have also fallen to a trough in recent times . According to data from the Tokenview website, the amount of bitcoin on-chain transfers on the first day of the new year of 2020 plummeted, and transaction fees were at their lowest point in nearly 360 days. However, in the big bull market of 2017, the transaction fee for bitcoin transfers was once as high as more than $ 50.

Why is there such a big gap? How to calculate the transaction fee of Bitcoin transfer? Today, let's find out.

01Bitcoin fee is not mandatory

"There is no free lunch in the world," so many people take it for granted that Bitcoin transfers must require a fee. Actually, this is a misunderstanding.

In Bitcoin's underlying system, there is no provision for fees. In other words, the handling fee is not mandatory. In the early days, due to the low price of Bitcoin and the small number of transfers on the chain, many miners did not care whether the user paid a fee (also called miner fee), so many Bitcoin transactions that did not pay the fee were also confirmed by the miner. For example, the block below has a height of 100,000, and there is no commission for this Bitcoin transfer.

However, with the rapid rise in the price of Bitcoin, the number of transfers on the chain is increasing. In order to maximize their own benefits, miners have begun to prioritize transactions with fees. Now, if the transfer fee is not paid, it will basically not be confirmed by the miner.

02Factors Affecting Bitcoin Fees

If it is a bank transfer, the handling fee will be charged according to the amount of the transfer. The larger the amount, the higher the handling fee (now the bank also sets a handling fee ceiling). For Bitcoin transfers, the amount of fees is not related to the amount. For 1BTC and 1000 BTC, the fees can be the same.

So, what are the factors that affect Bitcoin transfer fees?

With the development of Bitcoin, transactions without fees will not be packaged and confirmed by miners, so many Bitcoin clients and wallets have customized fees. This leads to different Bitcoin clients, the transfer fees may be inconsistent. At present, the mainstream fee standard is charged by byte: a fee of 0.0001 BTC per kilobyte (for transactions less than one kilobyte, one kilobyte is counted).

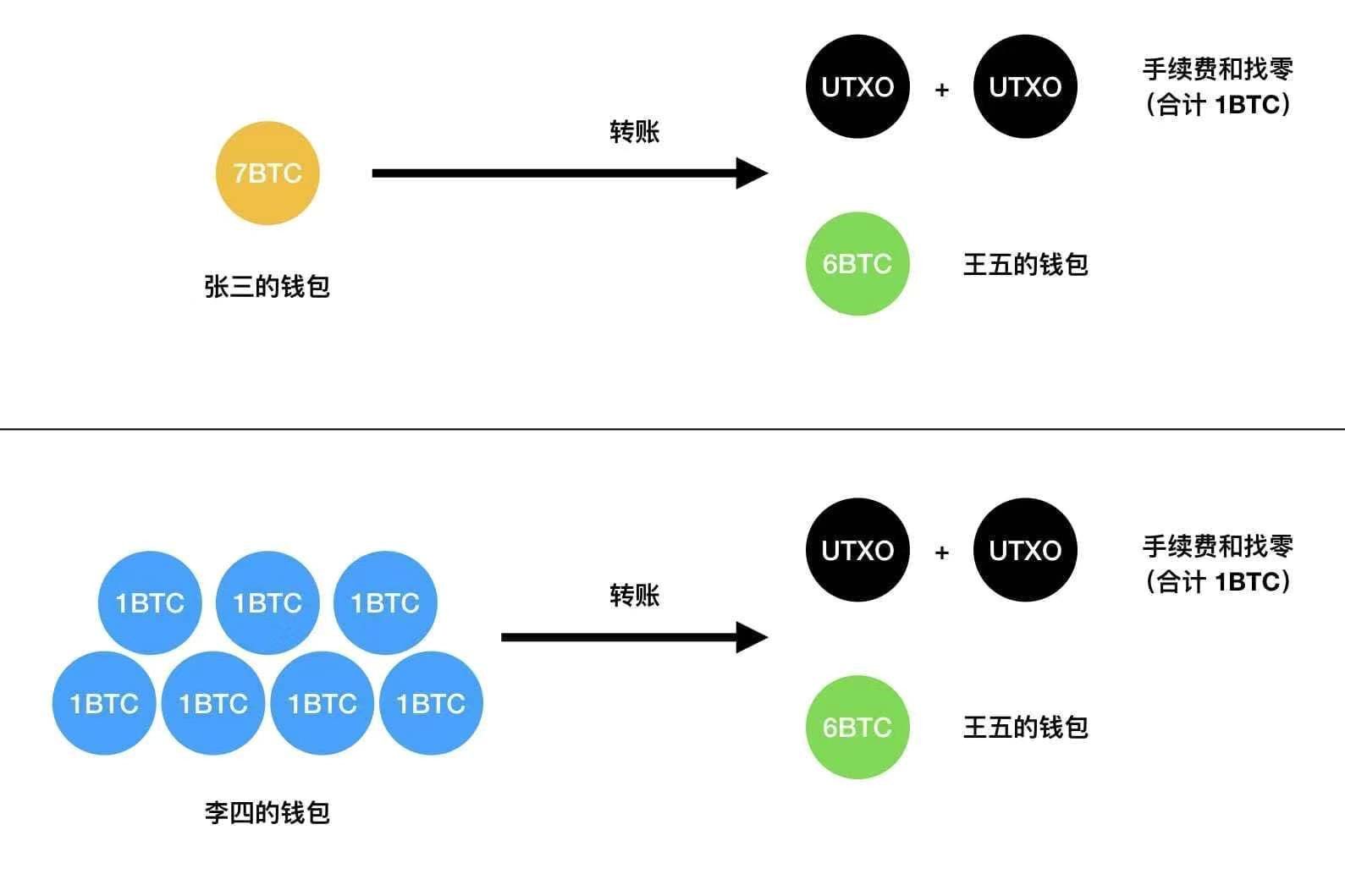

The byte size of a Bitcoin transfer has nothing to do with the amount of the transfer, and the amount of UTXO. For example, Zhang San and Li Si each gave Wang Wu a transfer of 6 BTC. If Zhang San used a UTXO with a denomination of 7 BTC, and Li Si used seven UTXO with a denomination of 1 BTC, then it is clear that Li Si ’s The transfer byte is much larger. For UTXO's knowledge, please check out the vernacular tweet "Bitcoin may not run so stably for 10 years without UXTO".

In addition to the size of the bytes, the congestion of the Bitcoin network will also affect the fees. If there are many people using the Bitcoin chain to transfer money, causing congestion in the Bitcoin network, and you want to confirm your transfer as soon as possible, you will need to pay a higher processing fee for "plugging in" to increase the priority of package confirmation. Of course, if you are not in a hurry, there is no need to increase the transaction fee due to the congestion of the Bitcoin network.

The byte size and the congestion of the Bitcoin network are the main factors affecting the fees. In addition to these two factors, factors such as currency age (also known as currency sky) will affect the priority of the transaction being packaged and confirmed, so it will also affect the processing fee, but I will not explain it here.

03How ordinary people set reasonable fees

For ordinary users, it is unrealistic to accurately calculate how many UTXOs will be used for each Bitcoin transfer, how many bytes there are, and how the Bitcoin network is congested. So, what should we do?

The easiest way is to use the fees recommended by the wallet. Many bitcoin wallets are very smart now, and they will recommend a suitable fee based on the network congestion and the size of your transaction bytes. Of course, you can also manually adjust it based on your recommended fee based on the wallet recommendation fee.

04 Summary

The transaction fee for Bitcoin transfer is not mandatory. In the early days, there were no transaction fees for many on-chain transactions, but now if the transaction fee is not paid, it will basically not be confirmed by the miners. The main factors affecting the transaction fee are the byte size of the transaction and the congestion of the network. If you want your transaction to be packaged and confirmed by the miner as soon as possible, you need to pay a higher transaction fee for “cutting in”.

For ordinary users, it is most convenient to use the recommended fee setting recommended by the wallet.

How do you usually set fees when making a Bitcoin transfer? Welcome to share your views in the message area.

——End——

"Disclaimer : This series of content is only for the introduction of blockchain science popularization, and does not constitute any investment opinions or suggestions. If there are any mistakes, please leave a message to point out. Article copyright and final interpretation rights belong to the vernacular blockchain. A

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Views | Information theory of money: Is Bitcoin our ultimate choice?

- Digital Securities Research Report 2019: What is preventing it from becoming mainstream? What to expect in 2020?

- Looking ahead to DApp 2020: from smart contracts to application chains

- Technical Articles | What are the bottlenecks and thresholds for developing Dapps on Ethereum?

- Coinbase CEO: the next decade of cryptocurrencies

- From Web2.0 to Web3.0: Is Web3.0 a wake-up call or an alarmist?

- Compared with the original chain of the original chain in 2020, MOV, more than the original, Bystack, more than the original