Third World War Phantom strikes, digital gold BTC may usher in a super bull market

Major General Casim Suleimani, Iran's No. 2 real figure, was killed in the attack. Iran claimed that it would "toughly retaliate", and the war seemed to be imminent.

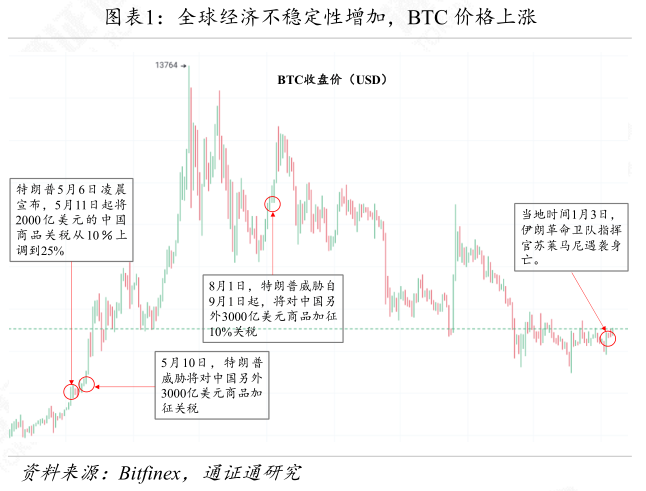

Special Topic: BTC rose sharply as Iran ’s No. 2 real figure was killed in the attack. The vicious events in hot spots have reduced the risk appetite of investors, and the need for hedging has pushed up the price of BTC. After the air strike, BTC surged 5.46% within a day, and the local BTC price in Iran reached up to 23,000 US dollars. In the context of war or local conflict, the stability of credit currency has fluctuated, and the price of safe-haven assets has tended to rise. As the international situation changes and the situation in the Middle East becomes more severe, the phantom of World War III flashes, and the demand for safe-haven assets increases. If the local Middle East war or World War III breaks out, the digital gold BTC price will reach another peak.

- Global blockchain ebb in 2019, China's "dominance" strengthens

- Industry still wait-and-see on SEC's proposal to expand "qualified investor" scope

- Blockchain Weekly | The nation's first blockchain unsecured loan issuance, and the application landing continues to accelerate

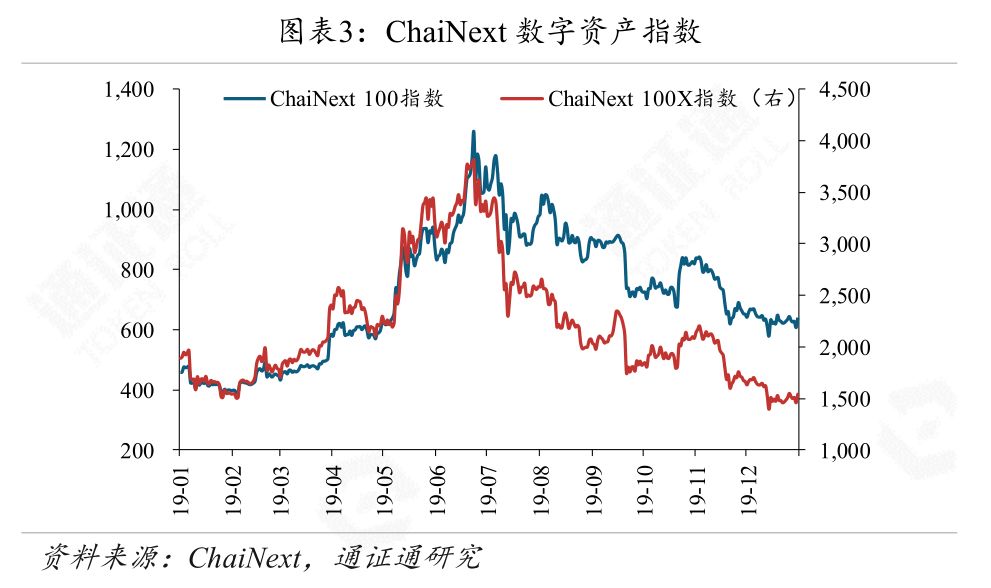

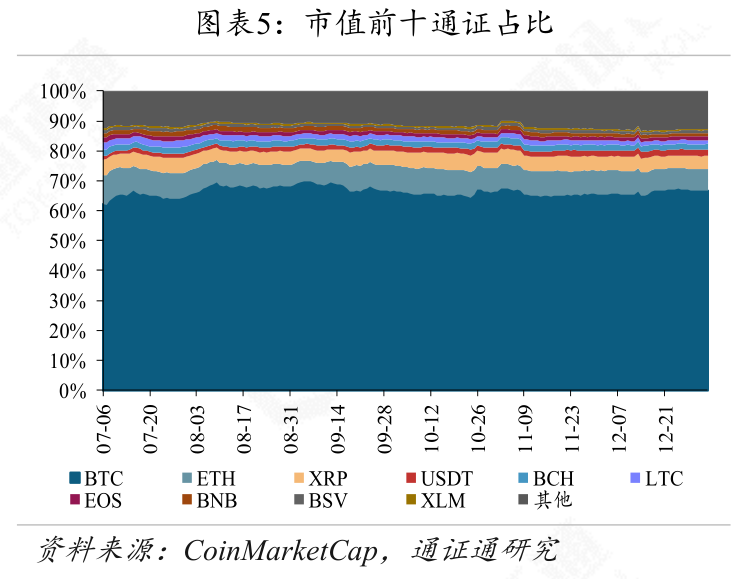

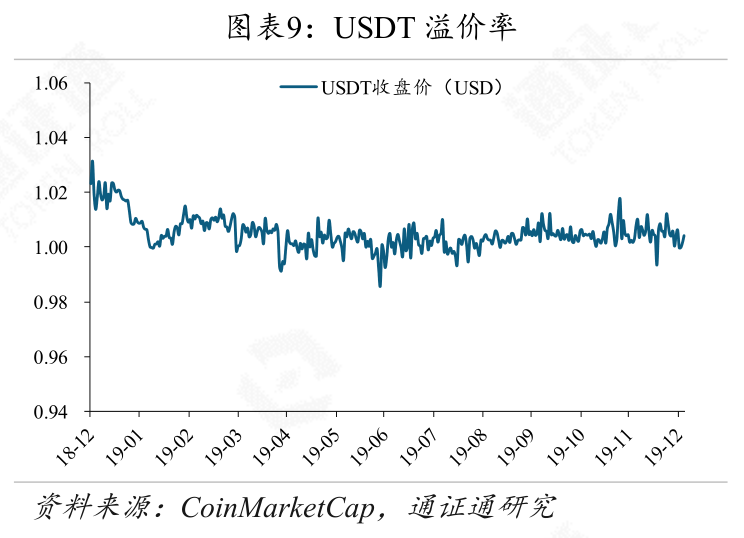

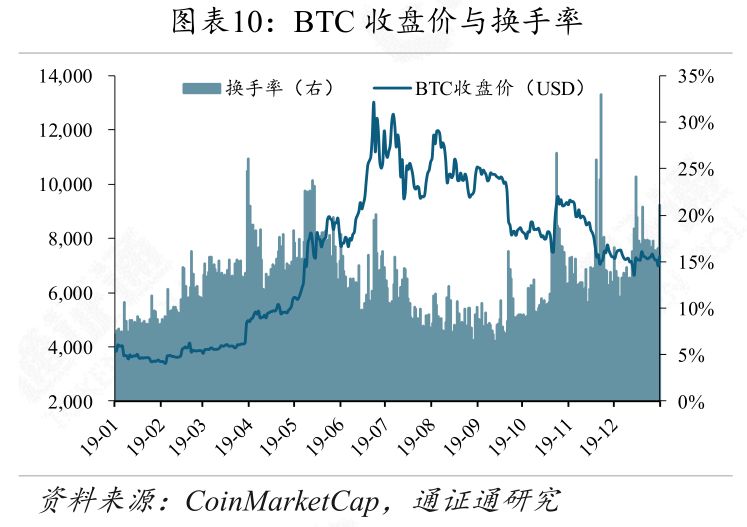

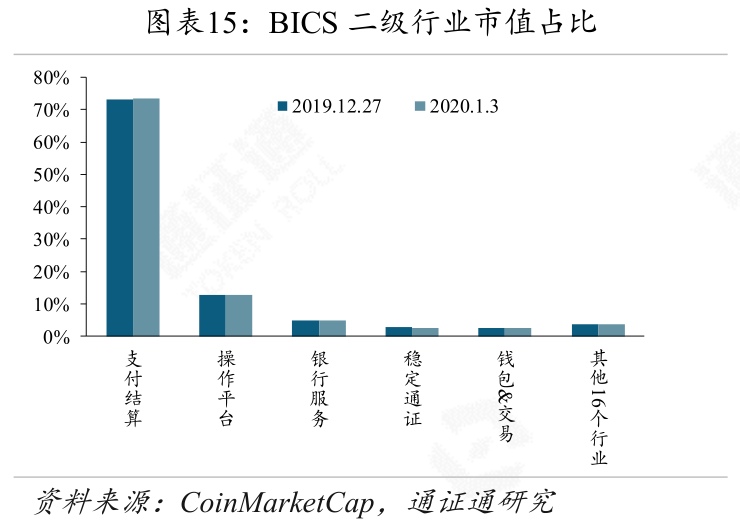

Quotes: The weak sideways oscillated and the bottom gradually formed. The ChaiNext Digital Asset 100 Index closed at 640.04 points this week, up 1.96%. The ChaiNext Digital Asset 100X Index closed at 1540.97 points, up 3.88%. The total market value of digital tokens this week was 1997.11 billion US dollars, an increase of about 1.6%; the average daily transaction volume was 73.61 billion US dollars, a decrease of 1.1%. BTC is currently trading at US $ 7,345, with a weekly increase of 0.8% and an average daily volume of US $ 22.2 billion. The current price of ETH is US $ 134.2, a weekly increase of 5.5%, and the average daily trading volume is US $ 8.99 billion. The BTC balance of the exchange this week was 803,600, an increase of 2495 from last week. The exchange ETH balance was 9.867 million, an increase of 220 thousand from last week. In the BICS secondary industry, the proportion of the market value of payment and settlement increased slightly.

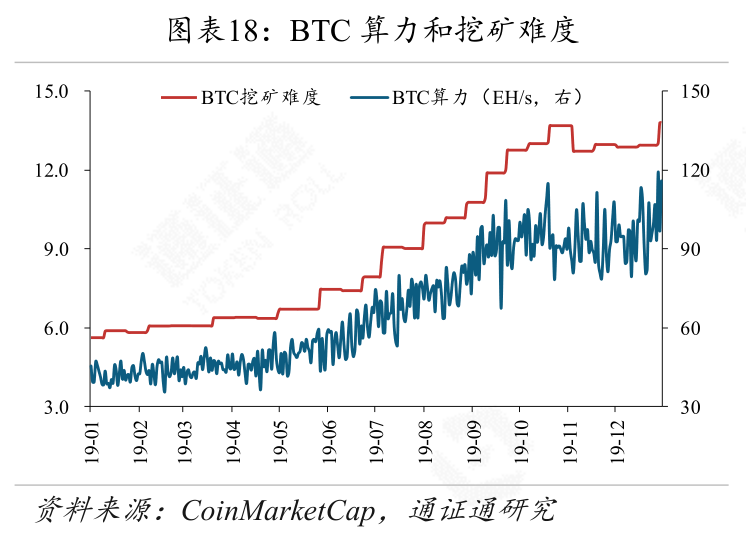

Output and heat: Mining currency computing power doubled. BTC's mining difficulty this week was 13.80T, an increase of 0.85T from last week; the average daily computing power this week was 103.98EH / s, an increase of 7.15EH / s from last week; ETH's mining difficulty this week was 1983, which was a decrease of 509 from last week, The average daily computing power is 153.6TH / S, which is 0.6TH / S higher than last week.

Industry: Global regulations are tightening, and industry standardization is an inevitable result. U.S. SEC Commissioner: To resolve the regulatory issue of crypto tokens, or the support of Congress is needed; the large-scale adoption of crypto tokens in the Middle East is slow; People's Network issued a document to crack down on digital token exchanges; the EU's fifth anti-money laundering directive will be implemented in the UK.

Risk warning: regulatory policy risks, market fluctuation risks

1Feature : The Third World War Phantom Strikes, BTC Or Usher In Super Bull Market

On January 3, 2020 local time, a U.S. military drone attacked an Iraqi airport, causing the death of many people, including the Supreme Commander of Iran ’s “Holy City Brigade” and Major General Kassim Suleimani of Iran. The Iranian side claimed that it would "toughly retaliate". Tensions in the Middle East were even more tense, and conflicts and wars were imminent.

1.1 Iranian No. 2 attacked, BTC surges

The Iranian No. 2 real figure was attacked and the war seemed to be about to begin. On January 3, local time, U.S. military drones attacked Baghdad International Airport. Major General Kassim Suleimani, commander of the Iranian Revolutionary Guards, was killed on the spot. The US Department of Defense subsequently confirmed responsibility for the attack. Immediately, Iran announced that it would "toughly retaliate." The illusion of World War I reappeared. In 1914, the crown prince of the Austro-Hungarian Empire No. 2 Franz Ferdinand and his wife were assassinated in Sarajevo in the Balkan Peninsula, which became the trigger of World War I.

The vicious events in hot spots have reduced the risk appetite of investors, and the need for hedging has pushed up the price of BTC. After the outbreak of the Cyprus financial crisis in March 2013, the price of BTC rose from US $ 40 to US $ 92, an increase of 130% (March 5, 2013-March 30). After the Sino-U.S. Trade friction, BTC surged from US $ 8574 to US $ 12407, an increase of 44.70%. From August 1st to 5th, the price of BTC increased by 13.52%, and it will increase by 258.82% in 2019. After the air strike, BTC reversed the trend and rose 5.46% during the day. The local BTC price in Iran overflowed. The maximum BTC on the day was US $ 23,000, which was three times the international market price.

1.2 Increased demand for safe-haven assets during war or local conflict

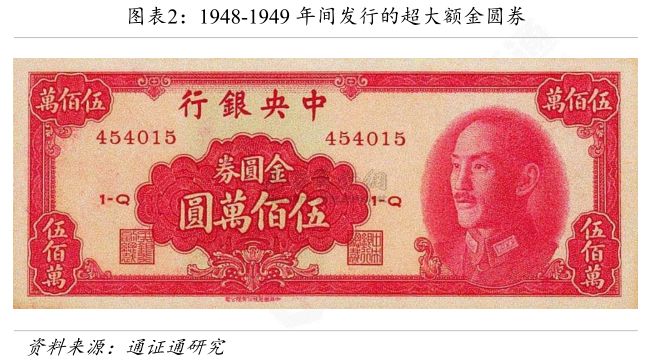

During wars or local conflicts, the risk of depreciation of the fiat currency increases, and the price of safe-haven assets rises. During World War I, Germany announced on August 4, 1914 that the exchange of German marks for gold was suspended. The German marks with gold support became "paper marks" without gold support. It is extremely difficult to issue German marks without gold support. In 1914, the number of paper marks was 5.9 billion, but in 1918 the number of paper marks reached 32.9 billion. From August 1914 to November 1918, the purchasing power of the paper mark has been reduced by more than half, and the exchange rate of the paper mark against the US dollar has also fallen by 84%. In August 1948, in order to solve the fiat currency that had been hyperinflated at that time, the National Government planned currency reforms and replaced the fiat currency with gold round coupons. However, with the Kuomintang's continuous defeat in the civil war and other reasons, the gold coupons also collapsed at an extremely rapid rate. According to Ta Kung Pao ’s statistics published on August 16, 1948, compared with the life index before the liberation war, food prices rose 3.9 million times in the first half of August, housing prices rose 770,000 times, and clothing prices rose 6.52 million times. At that time, the house price in Chongqing was 200 million yuan per square meter.

When the war or regional conflict broke out, the stability of credit currency fluctuated, and the price of gold tended to rise. In November 1979, relations between the United States and Iran deteriorated, triggering a "hostage crisis". In December, the Soviet Union sent troops to Afghanistan, tensions in the Middle East continued to rise, and gold prices rose sharply. In the London international gold market, the price of gold broke the 500, 600, 700 US dollars / ounce mark, and reached a high of 850 US dollars on January 21, 1980. In 1982, the British-Arama War broke out, and the international gold price ushered in a brief rise. Following the events of 9/11 in 2001, the price of the U.S. dollar skyrocketed from $ 271 to $ 291. In March 2011, the price of gold in the Libyan War rose from 1307.8 US dollars to 1575 US dollars, an increase of 18.79%.

1.3 Phantom of World War III strikes, BTC may usher in a super bull market

The US-Iraq conflict escalated, and the phantoms of the Third World War appeared. After the Islamic Revolution broke out in Iran in 1979, Iran became an anti-American vanguard. In November of that year, the Iranian people occupied the US Consulate in Iran and detained more than 60 U.S. citizens. The "hostage crisis" broke out, and the United States announced that it would break diplomatic relations with Iran and demand The NATO allies imposed economic sanctions on Iran, stopped buying Iranian oil, and frozen Iranian assets in the United States. In 1993, the US government introduced a "double containment" policy to contain Iran and Iraq at the same time. In 1996, the U.S. government signed the Iran-Libya Act on the grounds of combating terrorist forces, increasing sanctions against Iran. A March 2006 US National Security Strategy report identified Iran as "a single country with the greatest threat to the United States." In 2017, Trump announced the U.S. strategy on Iran and "vetoed" a comprehensive agreement on the Iranian nuclear issue. Following May 2018, the United States announced its withdrawal from the Iranian nuclear agreement and will resume severe economic sanctions on Iran. Subsequently, the two sides marched and marched on the edge of a gun and fire at any time. On January 3, 2020, Iran ’s “Sacred City Brigade” Supreme Commander Suleimani was killed by a U.S. drone air strike. Iran ’s reaction was fierce. The fuse of the World War.

The situation in the Middle East is becoming increasingly severe, and the price of safe-haven assets is ushered in a rise. If the local war in the Middle East or the outbreak of the Third World War, the price of safe-haven assets such as digital gold BTC will reach another peak. As early as August 2008, the most severe economic sanctions imposed on Iran by the United States began. Iran ’s demand for gold bars and coins tripled in the second quarter from a year earlier. Iran ’s central bank also prepared 60 tons of gold to meet domestic people ’s redemption needs. Iran The price of gold rose against the trend. On January 3, 2020, after the air strike broke out, the international gold price ushered in Sanlianyang, rising from a maximum of 1,517 US dollars to 1,553 US dollars. As digital gold, BTC has taken on the attributes of some hedging assets when the international situation has changed. If the international situation goes extreme in the future, the rise of BTC as digital gold has just begun?

2 Quotes : The weak sideways oscillates, and the bottom gradually forms

2.1 The weak sideways oscillate, the bottom gradually builds

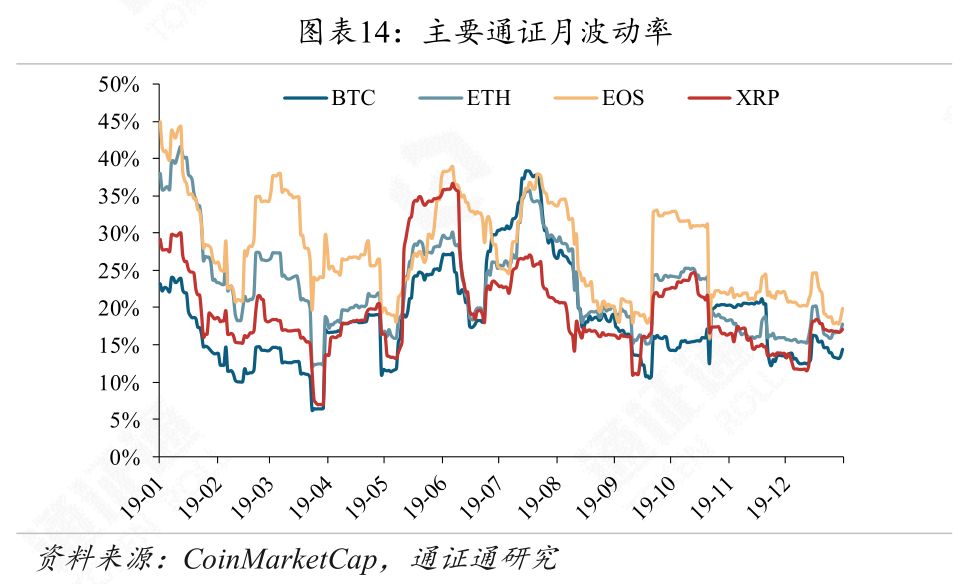

The ChaiNext Digital Asset 100 Index closed at 640.04 points this week, up 1.96%. The ChaiNext Digital Asset 100X (no BTC) index closed at 1540.97 points, up 3.88%. The main circulation certificate is slightly stronger than BTC.

The total market value of digital tokens this week was US $ 1997.1 billion, an increase of US $ 3.11 billion from last week, or an increase of approximately 1.6%.

The daily average volume of digital tokens this week was 73.61 billion US dollars, down 1.1% from last week, and the average daily turnover rate was 37.3%, down 0.3% from last week. This week the market maintained a weak shock consolidation, the market was repeated, the trading volume was severely reduced, and it was in a period of building bottom.

The BTC balance of the exchange this week was 803,600, an increase of 2495 from last week. The exchange ETH balance was 9.867 million, an increase of 220 thousand from last week. BTC and ETH balances on the exchange both increased slightly, and the selling pressure in the market has increased.

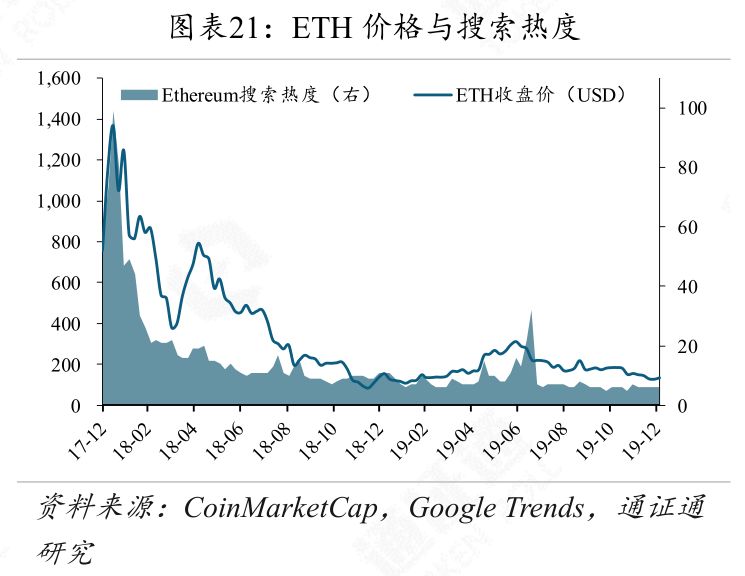

The current price of ETH is USD 134.2, with a weekly increase of 5.5% and a monthly decrease of 8.6%. The average daily volume of ETH this week was USD 8.99 billion, with an average daily turnover rate of 62.8%. ETH is slightly stronger than BTC this week, and the increase is slightly higher than BTC.

The current price of EOS is 2.64 US dollars, with a weekly increase of 2.3% and a monthly decrease of 0.4%. The average daily turnover of EOS this week was $ 1.73 billion, with an average daily turnover rate of 69.8%. EOS this week is slightly stronger than BTC.

The current price of XRP is 0.194 US dollars, with a weekly increase of 1.3% and a monthly decrease of 10.6%. The average daily turnover of XRP this week was $ 1.16 billion, with an average daily turnover rate of 13.8%. XRP is slightly stronger than BTC, but slightly worse than ETH and EOS.

BTC low can gradually increase positions. In the long run, high-quality tokens have a lot of imagination. At the beginning of the bull market, callbacks are rare opportunities to increase positions. Investors can make asset allocation based on their own conditions.

3 Output and Popularity: Double Growth of Mining Coin Power

4Industry Highlights: Strict global regulation, industry standardization is an inevitable result

But she reiterated that the SEC alone cannot provide all the answers to crypto tokens. "I'm glad someone in Congress is interested in this area. Congress has the ability to provide clarity-I think we have the ability to provide clearer information than it does now, but of course Congress has this ability." She said that Congress has the ability to replace the SEC The framework, like the JOBS Act of 2012, which includes a crowdfunding clause, greatly expands the previously ignored Section A of the regulatory exemption. "The agencies really need coordination. In the final analysis, it may be necessary to get some encouragement from Congress."

He Ping, a professor in the Department of Finance at the School of Economics and Management at Tsinghua University and the director of the China Financial Research Center, said that digital tokens may breed a lot of illegal acts, and exchanges may be one of the areas where illegal acts occur. The exchange has the possibility of manipulating the currency stability of digital tokens, but the stability of the currency value is closely related to the risks of the financial system. If currency fluctuations are artificially manipulated, this may lead to unfavorable flow of funds and cause security to the national financial system. influences. He also pointed out that from the perspective of financial stability, increasing supervision of exchanges is conducive to maintaining the stability of financial order. For the practitioners of the chain, due to the large amount of capital flowing into the exchange, under the influence of merchants' profit, it is likely to cause the behavior of the Crowdsale in the currency circle, resulting in the lack of necessary support for the technology development of the chain. In order to regulate the market, relevant departments strengthened Exchange regulation is necessary.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Getting Started with Blockchain | How to calculate Bitcoin transaction fees?

- The "National Team Alliance Chain" blockchain service network will be officially commercialized in April, with hundreds of city nodes

- Telegram official reminder: Gram won't help you get rich

- Is crypto taxation complicated? TaxBit receives $ 5 million in seed funding to provide accurate tax calculation tools

- Views | Information theory of money: Is Bitcoin our ultimate choice?

- Digital Securities Research Report 2019: What is preventing it from becoming mainstream? What to expect in 2020?

- Looking ahead to DApp 2020: from smart contracts to application chains