The “economic” logic behind the rise of Bitcoin

The economic reasoning for Bitcoin's growth.Author: Xu Yuan, Finance Professor, National Development Research Institute, Peking University

This article is excerpted from “The Monument of Currency: The Economic Logic of Digital Currency”, published by CITIC Publishing Group in March 2023.

Looking back on the more than 14 years of development of Bitcoin, we can see that Bitcoin has gone through a rough development path from scratch, from obscurity to well-known, and from skepticism to gradual recognition. The fluctuation of Bitcoin’s price is the embodiment of this path.

By now, Bitcoin has been accepted and recognized by more people and institutions, and the technology and concepts it contains have also been more widely accepted and recognized. In this sense, Bitcoin has changed the world we live in and has an impact on the future world. From this perspective, the price of Bitcoin is not high at all.

- Full Text of Bloomberg’s Interview with He Yi: “I’m the One Who Introduced CZ to Crypto Trading”

- Future Web3 New Chapter: Triple Impact of VSAP on Exchanges, Financial Markets, and TradFi

- Future of Web3: Triple Impact of VSAP on Exchanges, Financial Markets, and TradFi

On June 28, according to Reference News, the data of the US “Bitcoin Counter” website shows that as the world’s highest market value cryptocurrency, Bitcoin’s price has risen to the highest level since June 2022 this week.

On June 23, the unit price of Bitcoin rose to $31,411, and then fell slightly.

Data shows that at around 7:30 a.m. Greenwich Mean Time on June 25, the trading price of Bitcoin was $30,814, an increase of about 0.4% from 24 hours ago. In the past week, the price of Bitcoin has risen by about 20%, and since the beginning of the year, it has risen by about 87%. However, the current price is still more than half lower than the historical high point, which was close to $69,000 touched in November 2021.

Some analysts believe that this round of gains is related to the recent surge of interest in cryptocurrencies by financial giants. Last week, BlackRock, the world’s number one asset management company headquartered in the United States, applied to register a Bitcoin spot trading exchange-traded fund (ETF). In this way, investors can hold Bitcoin assets without buying Bitcoin. The other two financial services giants, American Jingshun Investment Company and Zhihuitree Investment Company, have also submitted applications to launch similar products recently.

Just before the above-mentioned companies submitted their applications, the cryptocurrency industry had just been hit by US regulators. Earlier this month, the US Securities and Exchange Commission sued two major cryptocurrency trading platforms, “Bitcoin Base” and Binance, for alleged violations of securities regulations.

Some industry experts believe that the launch of a Bitcoin ETF can be seen as a positive step in the process of seeking recognition from regulatory agencies in the cryptocurrency industry.

Strategist and Director of Data and Analysis at FRNT Financial, Strahinja Savic, wrote: “If bitcoin price continues to break through $31,000, it would mean that we have entered a new phase, in which market participants begin to reassess the previous regulatory anxiety. Although it feels like some regulatory agencies have voiced opposition, the application involving bitcoin spot ETFs further convinces people that institutions are still interested in cryptocurrencies.”

So, are digital currencies just speculation? Why are some valuable and some not? What is the economic logic and essence behind them? What is the relationship between these digital currencies and the central bank’s digital currency that is being promoted? How will the popular encryption technology and digital currency being promoted change our future?

In a recent book, “The Monument of Currency,” author Xu Yuan systematically combs through the development of digital currencies represented by bitcoin, thinks about important issues, and uses the most basic logic of economics such as demand, price, and value to comb through the development, price changes, and development trends of digital currencies to help readers understand the economic logic and future behind them.

01 Demystification: From anonymity to fireworks

For those who are not familiar with it, bitcoin is a digital monster: a few simple lines of code generate an encrypted string that is worth more than $60,000? The price of this string is like bungee jumping, up and down.

Is bitcoin’s sky-high price a scam set up by computer geeks?

Really not. Geeks designed bitcoin, but it was ignored for a long time until it was discovered by the secular world. The involvement of speculators further promoted the price increase.

So let’s sort out the history of bitcoin from anonymity to fireworks. Hegel said: existence is reasonable. After many years of existence, attracting widespread attention, and carrying the joys and sorrows of many people, there may be a reasonable explanation behind it. After sorting it out, in the seemingly chaotic and even crazy price increase, you may see a reasonable trajectory.

After such combing, we found that, after nearly 15 years of development, Bitcoin has tended to mature, manifested in six aspects.

First, Bitcoin’s own security has withstood the test of time.

Second, the general public, including businesses and investors, has gradually become familiar with and accepted Bitcoin.

Third, the infrastructure of Bitcoin in some countries has become complete, including exchanges, ATMs, and other facilities.

Fourth, some countries’ financial institutions have provided a large number of Bitcoin-related services.

Fifth, Bitcoin has become an important part of many investors’ (including institutional investors) asset portfolios.

Sixth, Bitcoin has been incorporated into regulations in many countries, which is conducive to the standardization and long-term development of Bitcoin.

Looking to the future, Bitcoin risks still exist, mainly in two aspects: One is the instability of Bitcoin itself, which may be manifested as time goes by; Second, although regulators have begun to accept Bitcoin, regulation may be strengthened, which may also induce Bitcoin instability. 02 Bitcoin has changed the world

Looking back on Bitcoin’s development for more than 14 years, we found that Bitcoin has gone through a bumpy development path from scratch, from obscurity to well-known, and from full of suspicion to gradually recognized. The fluctuation and rise of Bitcoin prices are the concretization of this road. Up to now, Bitcoin has been accepted and recognized by more people and institutions, and the technology and ideas it contains have also been more widely accepted and recognized. In this sense, Bitcoin has changed the world we live in and has an impact on the future world. From this perspective, the price of Bitcoin is not high at all.

Moreover, carefully combing through Bitcoin’s development process, we will find that stripping away the high-tech coat, Bitcoin’s development is in line with general economic laws and general market laws. Therefore, we do not need to completely regard Bitcoin as a monster. In many countries, Bitcoin has entered commercial life and financial portfolios. Regarding the future of Bitcoin, we do not need to mythologize it, and we can analyze it with basic economic laws.

As a new species, it is normal for Bitcoin to be suspected, but in reality, Bitcoin has been accepted quickly. There are factors of technological progress and interest in the game.

The big picture behind Bitcoin’s rapid acceptance is the “money-printing race” since the 21st century, let’s take the United States as an example. In mainstream financial discussions, the Fed’s massive easing began with the 2008 financial crisis. In fact, this is the Fed’s second big easing since the turn of the century. In 2000, after the Nasdaq bubble burst, especially after the 9/11 terrorist attacks, the Fed lowered interest rates from 6.5% to 1.0% in an emergency and kept low rates until 2004, when inflation was already evident.

In hindsight, the recession in the United States in 2000 was mild and did not cause such a large reduction in interest rates, let alone a long period of low interest rates. It was precisely this long period of low interest rates that stimulated the US real estate bubble, brewed the subprime crisis in 2007, and triggered the financial crisis of 2008-2009. Then, the Fed launched quantitative easing, and the balance sheet began to expand rapidly. With the 2001 and 2008 preparations, when the new crown pneumonia epidemic broke out in the United States in 2020, the Fed’s money printing became more resolute and the scale was larger.

Printing money is not the behavior of the Fed alone. Among the major central banks, the Bank of Japan was the first to start quantitative easing in 2001. After the financial crisis, the European Central Bank also greatly relaxed, and even implemented a negative interest rate policy. Therefore, the three major central banks in the world, the Federal Reserve, the European Central Bank, and the Bank of Japan, are actually engaged in a money-printing race. Relatively speaking, the loose monetary policy of the People’s Bank of China is very restrained.

Bitcoin’s development took place against this background. Printing money inevitably leads to the redistribution of wealth. People who are far away from the printing press will have to pay a “coinage tax”. Since 2000, a large amount of banknotes have been printed, and the scale of wealth redistribution is huge. The technology behind Bitcoin provides a tool and a way of thinking to protect wealth. This tool is not perfect and is being tested by time. Under the inspiration of Bitcoin, more and more encryption tools have emerged, and the pattern of the financial market is changing.

Bitcoin has contributed in at least three aspects.

First, Bitcoin has promoted the development and maturity of blockchain technology. Although the popularity of blockchain technology still requires time, its technical principles have been understood and well-known by the market. The potential importance of blockchain technology remains to be explored by the market.

Second, Bitcoin has promoted the development of the financial market. After Bitcoin, many other cryptocurrencies emerged, each with its own characteristics, such as Ether and stablecoins. As of the end of 2021, the cryptocurrency market has become quite large, with a total size of 2.33 trillion US dollars, with a peak of 3.07 trillion US dollars on November 9, 2021. The value of cryptocurrencies lies not in these tens of trillions of dollars, but in the fact that these tens of trillions of dollars, which are created out of thin air and grow wildly, promote the development of new technologies and will trigger more chain reactions.

Third, Bitcoin has promoted the development of central bank digital currencies. Modern society is organized around sovereign states, and the main currency of modern society is the sovereign currency issued by central banks. Faced with the challenge of virtual currencies, central banks around the world are developing central bank digital currencies, and the form of mainstream human currencies may change.

Looking to 2022, the future of Bitcoin is still uncertain. Will regulation of Bitcoin be strengthened? Will the tightening of monetary policy cause the price of Bitcoin to fall and will it be able to rebound? Bitcoin has already mined 90%, and future miners face the problem of insufficient incentives. How will the follow-up consensus mechanism be maintained? If the incentives fail, will the faith in Bitcoin collapse? This is an age of uncertainty, and we must sleep with uncertainty.

But what can be certain is that Bitcoin has already changed our era.

03 Cryptocurrency Jianghu

Things in this world are often not isolated, but a series of events.

The birth and development of Bitcoin has triggered a series of chain reactions, giving rise to a series of cryptocurrencies. Fork coins, stablecoins, and initial tokens have emerged one after another, competing in the exciting cryptocurrency jianghu. Ethereum, which is known as “Blockchain 2.0”, has long occupied the second place in the cryptocurrency jianghu.

These attempts have all gained some market recognition to varying degrees. Although they cannot be said to have been successful, they have inspired people to view the financial market from different perspectives and laid the groundwork for future chapters.

After more than ten years of development, the cryptocurrency world has presented a situation where heroes fight for supremacy.

Forked coins, stablecoins, initial tokens, etc., have all gained market recognition to a certain extent. Ethereum, which claims to be blockchain 2.0, has long held the position of the second in command in the cryptocurrency world. There are more innovations, such as DeFi (decentralized finance), NFT (non-fungible tokens), and metaverse, which are striving for recognition.

After the storm, which ones will be eliminated? Which ones will grow and develop? Based on the development of cryptocurrencies over the past decade, we have some observational experience, and from that, we can try to answer these questions to some extent.

Cryptocurrency Status

Let’s take a bird’s eye view of the entire cryptocurrency market.

According to incomplete statistics, as of January 31, 2022, there are a total of 9,929 cryptocurrencies worldwide, with a total market value of about 1.72 trillion U.S. dollars. However, there are two points to note here.

First, cryptocurrency prices fluctuate greatly , and their market value is only of the order of magnitude, so people do not need to pay too much attention to specific numbers.

For example, at the high point on November 10, 2021, the total market value of cryptocurrencies reached 3 trillion U.S. dollars (see Figure 4-2), with the price of Bitcoin reaching 68,519 U.S. dollars and the price of Ether reaching 4,852 U.S. dollars. However, as the price fell, the total market value of cryptocurrency fell by more than half.

Second, although there are many cryptocurrencies , the vast majority of cryptocurrencies are almost worthless and have no trading volume, with only a few cryptocurrencies being active in trading and having high value.

This head effect on the value of cryptocurrencies is actually not difficult to understand. Anyone who knows a little bit of programming can easily issue cryptocurrencies by modifying the Bitcoin code.

Technically, this is not difficult to achieve. There are now many platforms that offer such services, and uploading code can issue cryptocurrencies, making it easier to issue cryptocurrencies.

The difficulty is not the technology but getting people to recognize and be willing to spend money on the currency you created. The more people recognize it, the more valuable your currency becomes. Think back to when Bitcoin was first created. It was largely ignored for a long time before gaining attention.

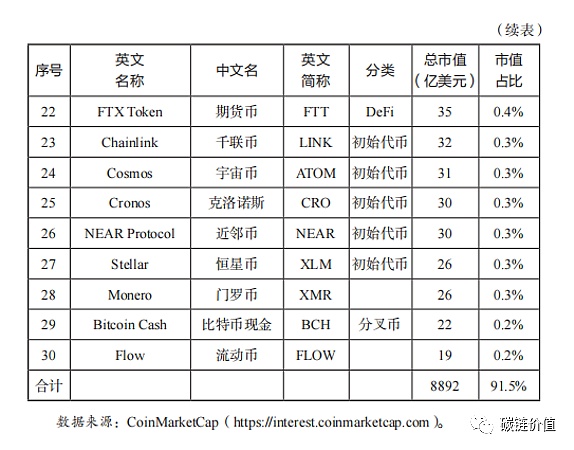

Table 4-2 shows the top 30 cryptocurrencies by market capitalization. Bitcoin has the largest market cap, followed by Ethereum, and the smallest is Flow. The total market cap of these 30 cryptocurrencies is about $1.5 trillion. By examining Table 4-2, you can draw several interesting conclusions.

First, there is a “double super many strong” situation in the cryptocurrency world. Bitcoin and Ethereum are the two main competitors, occupying the top two positions, while other currencies are a bit far from “double super”.

Second, in the “double super many strong” pattern, the head is “double super,” and the many strong are mainly stable coins and initial tokens.

Therefore, it can be subdivided into a pattern of “double super + stable coin + initial token”. In the following subdivision introduction, in addition to Bitcoin and Ethereum, we will focus on stable coins and initial tokens.

Third, the concentration of market capitalization is very high.

Among them, Bitcoin, Ethereum, and Tether, the top three in market capitalization, account for 39.6%, 18.7%, and 6.9% respectively. By carefully examining Table 4-2, you will find that the concentration of cryptocurrencies is very high. The total market capitalization of the top three ranks reaches 65.2%, the top 10 reaches 82.4%, the top 20 reaches 88.5%, and the top 30 reaches 91.5%. To some extent, understanding these 30 cryptocurrencies is to understand the panorama of cryptocurrencies.

Fourth, in the fiercely competitive cryptocurrency world, Bitcoin still firmly occupies the position of the leader.

In Table 4-2, the total market value of Bitcoin is $385.3 billion, accounting for about 40% of the total market value of cryptocurrencies. In contrast, Ethereum, which is known as blockchain 2.0 and an upgraded version of Bitcoin, has a total market value of less than half of Bitcoin. In fact, Ethereum’s second-place position is not stable. In 2017, it was once surpassed by Ripple. By comparison, Bitcoin’s position as the head of the chair has always been stable.

Fifth, the existence of forked coins is very low. Only 4 of the top 30 currencies are forked coins.

The implication here is that although the original intention of forked coins was to improve Bitcoin, it does not seem to have been widely accepted by the market. This inevitably reminds people of what Satoshi Nakamoto once said: “If you don’t believe me or don’t get it, I don’t have time to try to convince you, sorry.” Nakamoto doesn’t have time to persuade people, and the market has already spoken with the price.

Sixth, many of the top-ranked cryptocurrencies are stablecoins and initial tokens.

It seems that these two types of cryptocurrencies have strong vitality. Considering that initial tokens have caused a lot of confusion and once had a bad reputation, their prosperity is particularly interesting. Currently, many countries have accepted stablecoins and initial tokens and incorporated them into their regulations.

Table 4-2 provides an overview of the cryptocurrency world. If you look carefully at this table for a long enough time, you will have a feeling: this world is still dangerous, and it is difficult for us to judge its prospects. But in any case, we can no longer ignore this world.

Because I have studied finance for many years, I am immune to the “speculation theory”. Speculation is a natural part of the financial market and is indispensable. For a market of a certain size, it is not surprising that there are speculations, and it is strange if there are none. To attribute the problem to speculation is actually to cover up the problem rather than to analyze it. The reason behind speculation is the meaningful entry point. As for speculation itself, it is not even an entry point.

The rapid rise in the price of Bitcoin has both speculative hype and fundamental support, and the two are not contradictory. In fact, the price of Bitcoin has indeed been accompanied by speculative hype, but this does not mean that it has no investment value. Overall, the development of Bitcoin is relatively smooth, with wider acceptance and a more tolerant policy environment, providing a foundation for its long-term value.

Undercurrents are surging, and storms are still gathering.

When the storm comes, the world may change.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- BlackRock’s Bitcoin ETF Key Dates and Timeline for Listing

- Can you make money by running a node? How to choose a public chain? We talked to a node operator.

- Victory belongs to the long-termists: June 2023 Secondary Market Trading Strategy

- Will the growth of the NFT market in 2023 come from new capital entering or from old capital circulating?

- Conversation with three senior KOLs: Bitcoin’s four-year halving cycle, the new narrative of the next bull market, and Ethereum’s “dominant” position

- First leveraged Bitcoin ETF in the US quietly opens, with a first-day trading volume of nearly $5.5 million.

- Will Bitcoin’s ecosystem be the focus of the next bull market? 5 major logics support its rapid rise.