Stable currency analysis: Most stable coins will not be used for large transactions except USDT

Stabilizing coins is a very important part of cryptocurrency, providing a powerful liquidity for the encryption world and an integral part of the encryption world. Encrypted world stable currency is not a small number, legal currency, mortgage, algorithmic, unregulated, regulated, diverse, and compete for the market.

The USDT with the largest market capitalization has been subject to regulatory threats for a long time. There is uncertainty. Although most people do not want to stabilize the currency, the currency has a strong network effect, and the strong liquidity supported by large users, the strength of liquidity. It often determines the user's choice, so although the USDT often has a black swan, it still cannot be replaced.

This paper analyzes the data of the main stable currency on the network and finds some interesting conclusions. For example, the network of the French currency-supported stable currency has not increased in the past three months. Most of the stable currency except USDT will not be used for large transactions. Most of the counter currency stabilized coins are used more outside of Asia, as well as the good development of the mortgage-type stable currency DAI.

- Exchange Real Volume Report (on) | TokenInsight

- Gartner reports: Blockchain business is facing a test, the industry is still dark

- Bakkt also can't impact traditional cryptocurrency futures trading? – Coin, OKex, Matcha, and the same station

Stabilizing coins are usually divided into three main categories:

1. Stabilized currency supported by legal currency: This stable currency usually anchors legal currency or other physical assets. Tether or TrueUSD (TUSD) is a stable currency supported by French currency, while Digix Global token represents a stable currency supported by commodities.

2. Stabilized currency collateralized with cryptocurrency: This stable currency is supported by a pool of cryptocurrency assets. Often, in order to address market volatility, stable currencies that use cryptocurrency collateral often require overcollateralization. A more famous example of this is Maker.

3. Unsecured Stabilizing Coins: This stable currency is not supported by any physical assets or cryptocurrency assets. Instead, its value is maintained by people's expectations of it. The most common unsecured method is coinage, which uses smart contracts to automatically increase and decrease the supply of stable coins through algorithms to maintain its value. Carbon (CUSD) is such a representative.

In the current market, stable currency based on legal currency dominates, and stable currency like Maker using cryptocurrency for mortgage has received considerable attention. The unsecured stable currency is still in the experimental stage. Some of these projects have been sought after, but we don’t know much about what’s behind them. The following data may surprise you.

1. The investor lost the money

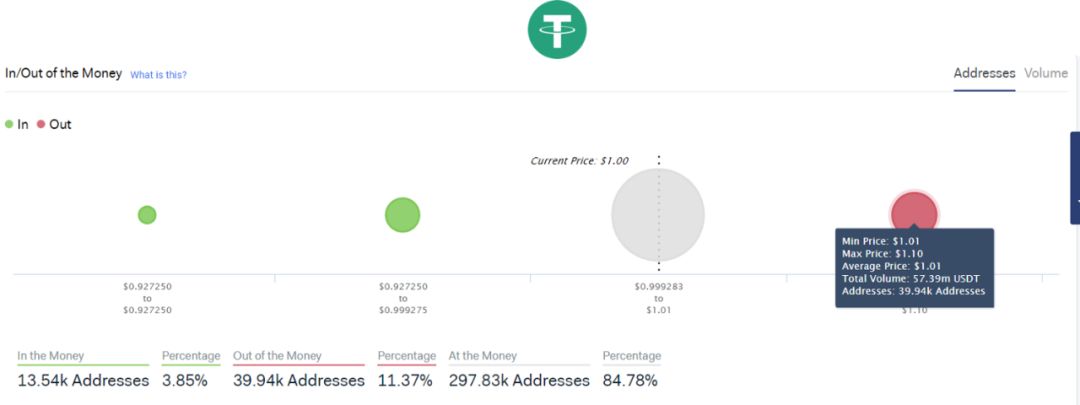

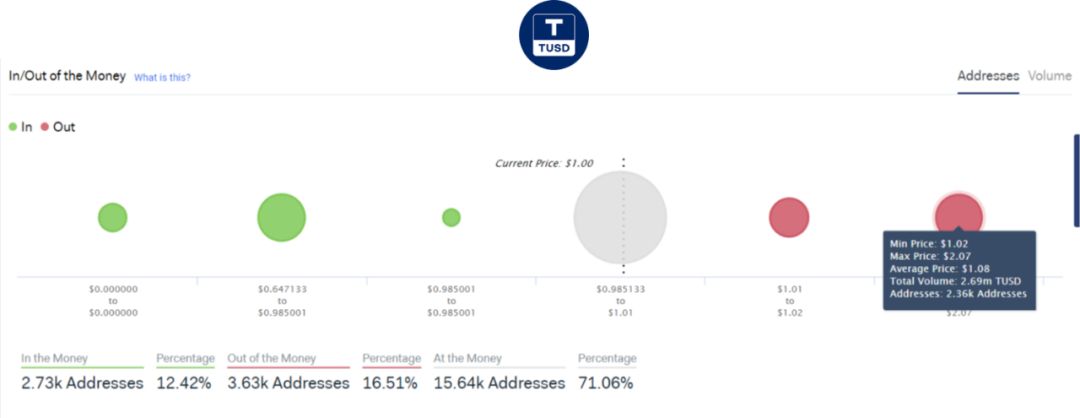

IntoTheBlock's buy-and-sell analysis shows that some investors bought stable coins supported by French currency at prices well above their benchmark price. Let's take a look at the data analysis results of Tether (USDT) and TrueUSD.

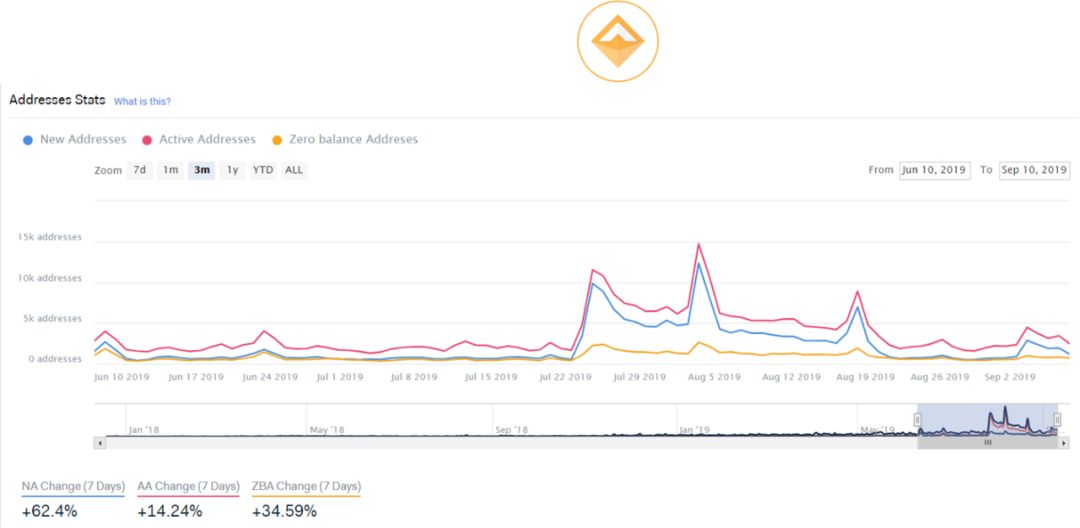

2. The stable currency network has not grown

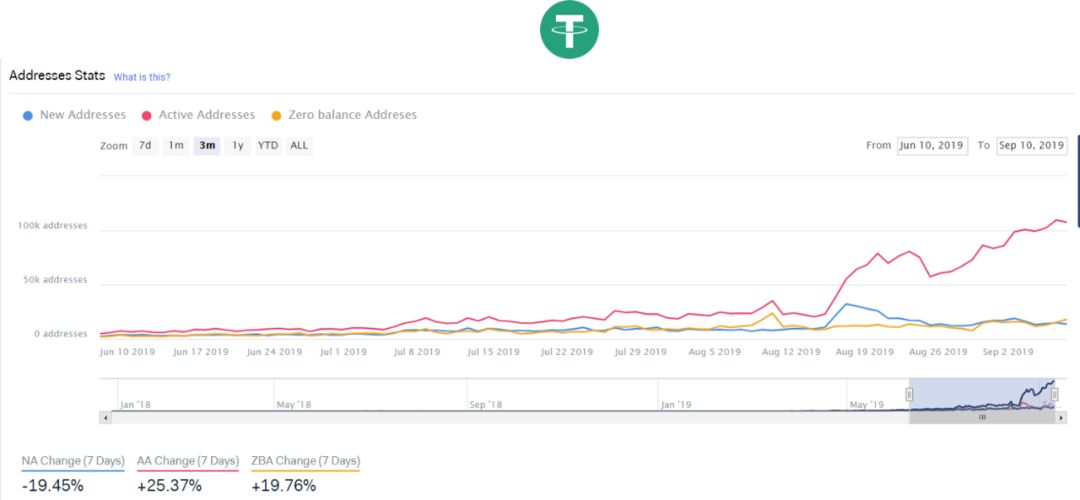

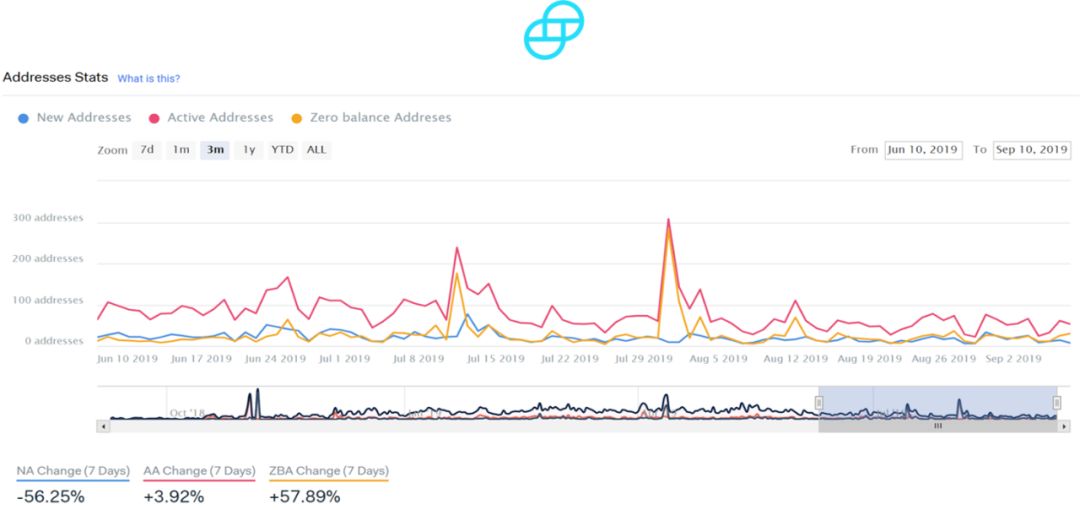

Despite increasing attention, most of the stable currency networks supported by the French currency have not grown, and in some cases, as IntoTheBlock's address analysis shows, they are shrinking. The figure below shows this happening with Tether (USDT) and Gemini Dollar (GUSD).

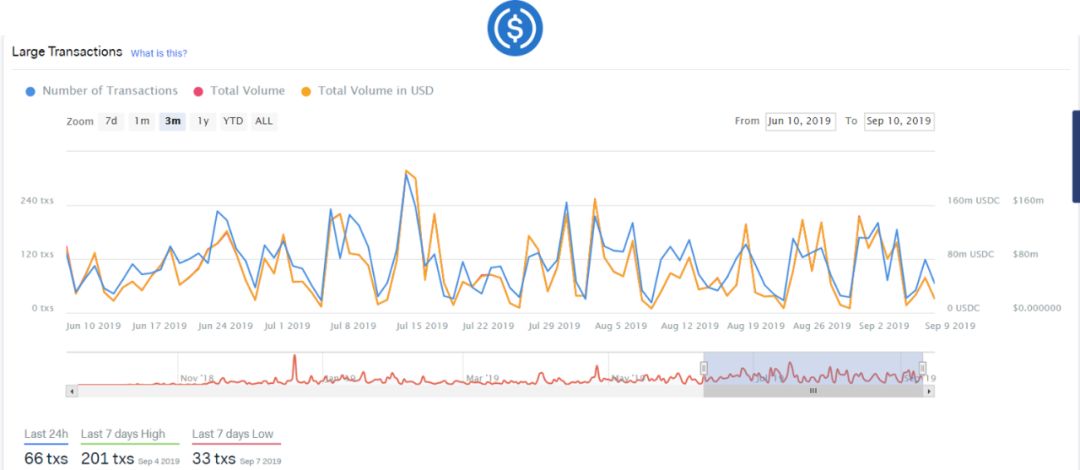

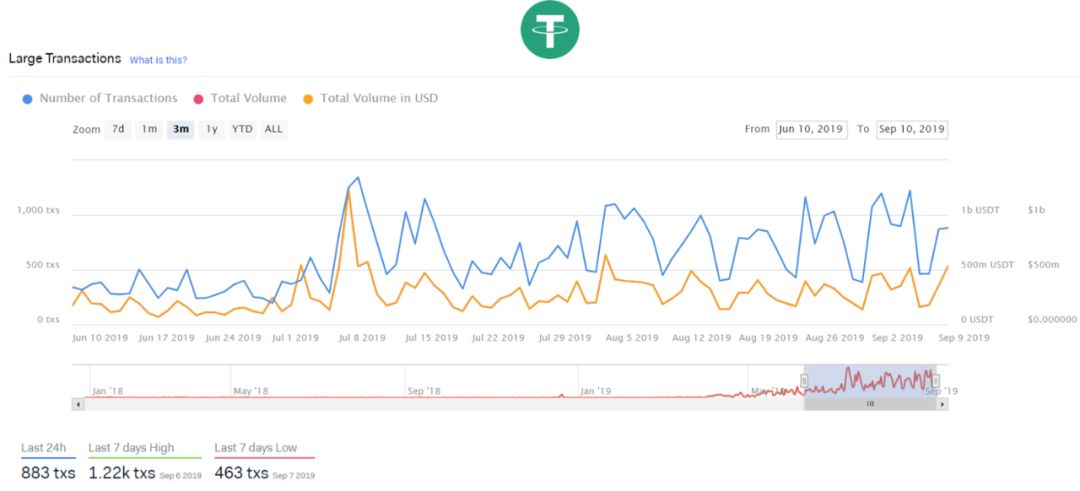

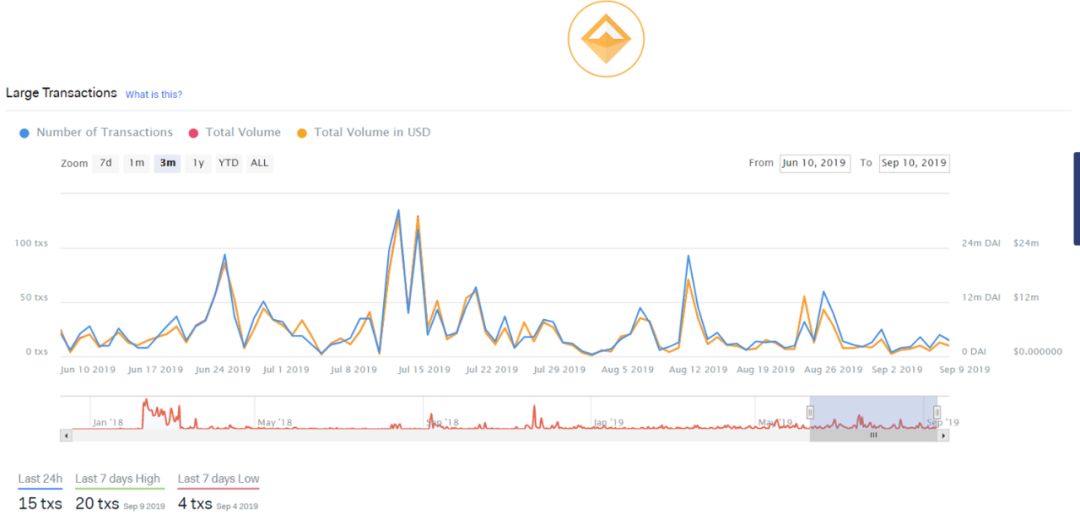

3. Except for Tether, most stable coins are not used for large transactions.

Large transactions have always been a good indicator of the health of cryptocurrency assets. IntoTheBlock's analysis of large transactions shows the following picture. Except for Tether, most of the stable coins supported by French currency do not have many large transactions.

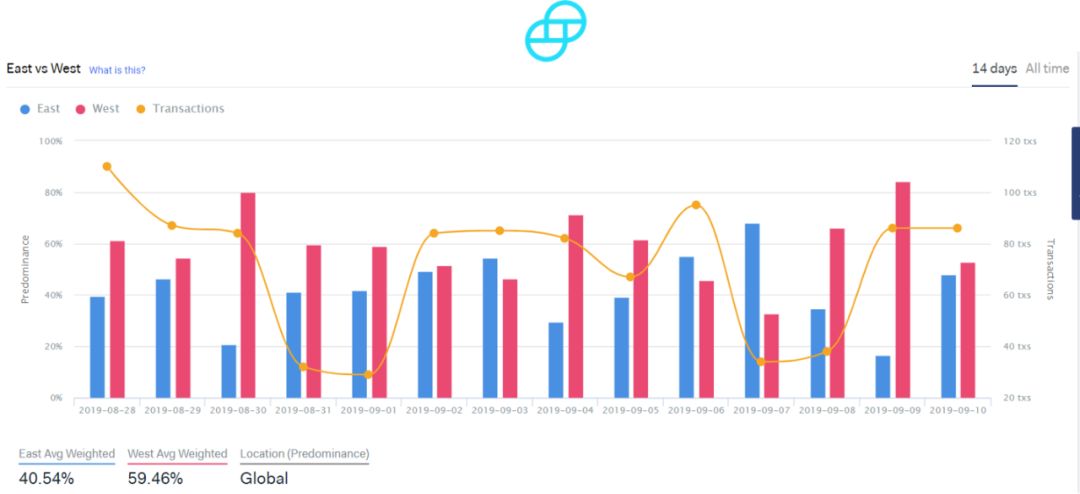

4. Most stable currency based on French currency is more popular outside of Asia

IntoTheBlock's analysis shows that most of the stable currency supported by French currency is more popular in Western countries. A few months ago, Tether was used extensively in Asia, but was later dwarfed by Western countries. The chart below shows the use of Gemini Dollar (GUSD) and Tether (USDT) in Eastern and Western countries.

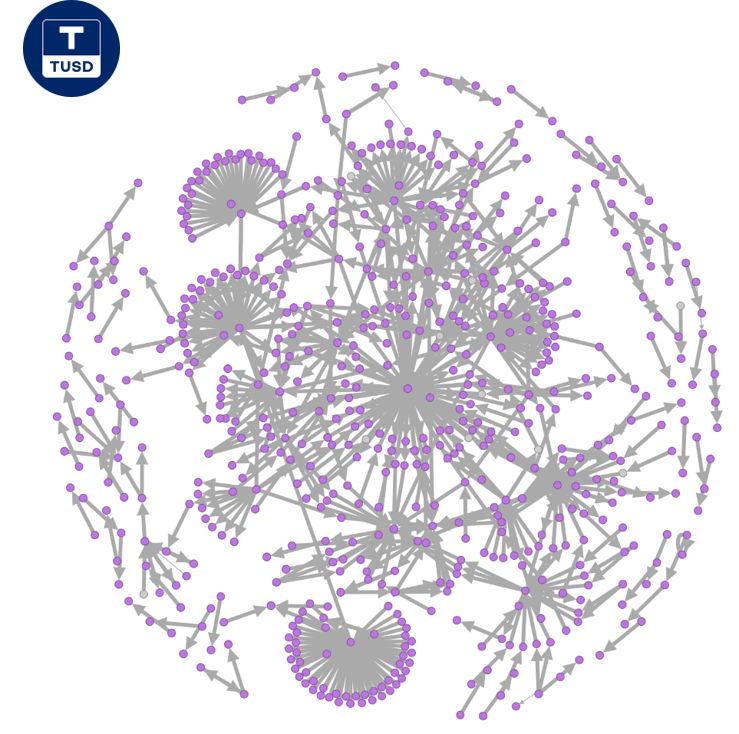

5, stable currency trading outside Tether is still very important

Although Tether has so far dominated the stable currency supported by the French currency, other stable currencies in this category usually have a lot of trading activity. The chart below shows the daily trading chart of TrueUSD generated by IntoTheBlock.

1. Some investors have invested in Dai’s loss of money.

Similar to the stable currency supported by the French currency, IntoTheBlock's analysis of the buy and sell of Dai shows that some investors bought Dai for more than $1.

2, Dai is growing

According to IntTheBlock's address statistics analysis, contrary to the reduction in the amount of stable currency supported by the French currency, Dai's development rate is impressive.

3. Dai's large transaction is not always the same

IntoTheBlock's large transaction analysis shows that Dai's trading situation is good or bad.

4) Dai is used more outside Asia

It is a bit surprising that Dai is used more in Asia than in Asia. The analysis of IntoTheBlock is shown below.

4. Dai’s daily trading is impressive

If you see TrueUSD's daily trading transactions, take a look at what Da's daily trading is like.

-END-

Author: Jesus Rodriguez.

Translator: chuan, the special author of the Blockchain Learning Society.

Disclaimer: This article is the author's independent point of view, does not represent the position of the Blockchain Institute (Public Number), and does not constitute any investment advice or suggestion , the image source network .

Link: https://hackernoon.com/some-shocking-data-analyses-about-stablecoins-e8mh33qo

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Market Analysis: Bitcoin rebounds infinitely, still a short world

- Let’s listen to Jiang Zhuoer and Lu Haiyi’s understanding of the relationship between bitcoin price and computing power, as well as the price trend of this round.

- Is there a loophole in the Ethereum FAIRWIN smart contract? Detailed technical analysis is here

- Decentralized "short" agreement dYdX's hope and hope

- Ant Block Chain Yunqi Conference: 2020 to use the blockchain to serve 100 million Chinese

- We have forgotten that Bitcoin does not yet have a globally recognized story.

- Ling listening to the notice | What is the bottom of the ant Jinfu layout blockchain?