Let’s listen to Jiang Zhuoer and Lu Haiyi’s understanding of the relationship between bitcoin price and computing power, as well as the price trend of this round.

Vernacular blockchain

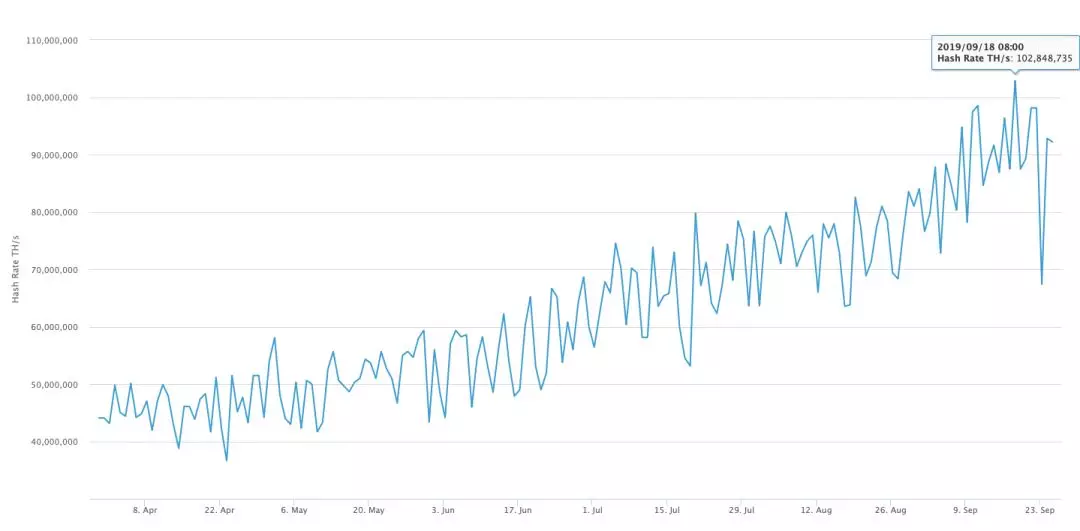

Since June of this year, the total network computing power of Bitcoin has risen by more than 70%, and it rose to an all-time high of 102.8EH/s on September 18. Then it fell sharply in a few days and fell to 67.4 on the 23rd. EH/s.

- Is there a loophole in the Ethereum FAIRWIN smart contract? Detailed technical analysis is here

- Decentralized "short" agreement dYdX's hope and hope

- Ant Block Chain Yunqi Conference: 2020 to use the blockchain to serve 100 million Chinese

Just after the bitcoin collapsed, the price of bitcoin plunged from $9,500 to a minimum of $7,800 on September 25.

Is there a relationship between the fluctuation of Bitcoin computing power and the rise and fall of prices? Will the calculation period continue to rise when the dry season is approaching? In the next round of bull market, what is the highest price of Bitcoin?

With these questions, the vernacular blockchain text interviewed Lu Zheer, founder of the Leipzig Mine Pool (BTC.TOP) , and Lu Haiyi , founder and CEO of Bit Deer.

The following is the content of the interview:

01 Reasons for the skyrocketing power

Vernacular blockchain: Bitcoin's full-line computing power has soared more than 70% in the last three months (60EH/s on June 14 and 102.8EH/s on September 18). What are the reasons for the skyrocketing power? What is the relationship between bitcoin computing power and price?

Jiang Zhuoer : There are many reasons for the increase in computing power. One of them is that all major mining machines are shipping. New machines, such as Ant's 17 series, as well as Shenma mining machine, M20M21 series, and heart-moving T2T3 series, are all shipping recently.

The computing power of these new machines is probably five or six times that of the previous ones. For example, the computing power of the previous one may be 13.5T. Now a computing power is generally between 60 and 70T, so the computing power will definitely rise faster. .

Bitcoin computing power is basically determined by the price of the currency, which means that the currency price directly determines the amount of computing power, because the miners will always calculate power until there is no profit. Then the increase in computing power will increase the market's confidence in the price of the currency to a certain extent. Since the production cost of the currency is high, everyone will have certain psychological support.

Lu Haiyi : The change in computing power is the most intuitive data reflecting the bitcoin mining industry. There are several reasons for the surge in computing power:

1. First, because bitcoin prices have continued to rise since March, meaning that mining profits have gradually increased. Of course, no one will miss the opportunity to earn income.

2. The soaring power of computing also illustrates the enthusiasm of the “miners” for Bitcoin mining, and also reflects the industry's optimistic attitude towards the future trend of Bitcoin currency prices.

3. According to the understanding of mining machinery enterprises and some industry research reports, it can be found that the latest generation of high-calculation mining machines of several major mining machine manufacturers have been put into the mines, including our own platforms, such as ants. The calculation package for the S17 mining machine.

The relationship between computing power and price: computing power will not affect the currency price, but the currency price will affect the computing power. The main reason for affecting the price of the currency is the relationship between supply and demand. For the calculation of power, when the price of the coin rises, the profit of the miner will increase, and more mining machines will be purchased. The new mining machine has high computing power and the quantity is increased, resulting in the overall bitcoin. The computing power is rising.

02 The correlation between the plunge of computing power and the price collapse

Vernacular blockchain: At around 4 am on September 25, bitcoin prices fell from around 9,500 to $7,800. Two days before the 21st to the 23rd, bitcoin's total network computing power also dropped from the highest point to 67EH. /S (down by 34%). Where is the drop in so much power? Is the price plunging related to this?

Jiang Zhuoer : No, the mining industry is normal, the whole network computing power is based on the number of blocks, and the short-term (one or two days) the number of blocks is random (like throwing coins, the positive number fluctuates around 50%), so short-term The calculation of power statistics (presumed) is meaningless, and it takes at least 7 days of calculation power to make sense.

In the previous article, "The panic index hit a record low, what happened to this market?" In the bull market to have what factors , I mentioned that the last round of bull market started in October 2015. This round started to rise 6 months to 4 months earlier, and was halved for too long, so the middle probability is not high. The residence will drop a wave. This is also the last chance to get on the bus before the bull market.

Lu Haiyi : The sudden drop in computing power has caused a lot of discussion in recent days. In fact, the computing power of the whole network will not drop so much, there are several reasons:

1. The computing power of the whole network cannot be monitored in real time. Where do the data of these computing powers come from? Basically, each data website is estimated by the bitcoin mining difficulty and the time of the block. The block time is inherently uncertain, and the calculated data is also calculated by periodic sampling, so the calculation results will have errors.

2. This data is derived from the single-day estimate of the total network power. The probability of error in this short-term calculation of power is greater. We should look at the average estimate on the 7th.

3. Different data platforms have different estimation methods, and the minimum calculation results are also different. In the past two days, the computing power has returned to normal levels, and it is necessary to observe the fluctuations of the whole network computing power in the near future to get the results.

A wave of price plunging on September 25 was shocking to everyone. After the plunging, many people will find the reason and link it with the calculation, but it is not.

In fact, I analyzed the recent trend of bitcoin price on my own Weibo. The price was gradually compressed in the triangle interval. Because the price of the currency is still dependent on the supply and demand of the market, the upward pressure is too large, and the long and short differences are large. And when there is no new capital, the market will naturally give an answer.

03 mining income balance

Vernacular blockchain: Some people predict that due to the continuous increase in computing power, Bitcoin will be halved in time . Do you think that mining power will continue to grow, or is there a balance of profit and mining revenue?

Jiang Zhuoer : If the price of the currency does not rise, the mining power will certainly not rise indefinitely. The industry generally uses the " static mining back to the cycle " to measure, that is, the price of a mining machine today, divided by the net production it can dig today (equivalent to mining output minus electricity). For example, if a mining machine assumes 10,000 pieces, you can dig up a net profit of 50 yuan on that day, and its static return period is 200 days.

In general, this static return cycle is more than 300 days later, unless it is during the bull market, the mining machine is more difficult to sell. These 300 days did not take into account the situation of rising difficulty and currency changes.

In general, the actual return period will be longer than the static return period because the difficulty will continue to rise. If the price of the currency does not match, then the income will become very poor, and there is even the possibility of loss. Therefore, the mining power will certainly not rise all the time, and it will rise to a certain stage. Everyone feels that there is no profit in mining. Then I started to stop.

However, there is often a lag in stopping. That is to say, because the money is put into production machinery, for example, it takes three to four months, it is possible to see the mining market three or four months ago or the market is very good, you go to the mining machine, the mining machine Before you set up your deposit, you will build the machine. After three or four months of machine return, the mining revenue is already very poor.

Therefore, the computing power will not continue to rise. There is a zero-sum game between miners, because the bitcoin produced every day is constant, and if the computing power rises too much, some miners will be squeezed out.

Lu Haiyi : The halving of the Bitcoin block reward involves the mining mechanism . According to the original setting, Bitcoin will dynamically adjust the difficulty of mining to ensure that the block reward will be halved every four years, so the next reduction is calculated. Half is about May 20, 2020.

However, we must be aware that Bitcoin's difficulty adjustment mechanism has a lag, which is a cycle adjustment. With the surge in computing power in recent months, if this momentum continues, then the halving of Bitcoin will definitely be advanced.

As for the question of continuous growth of computing power, it is mainly divided into the following two aspects:

On the one hand is the upgrade of the hardware. Since the 7nm mining machine has been put into the mining army this year, and the 5nm mining machine is already on the road, it means that with the upgrade of the mining machine chip, more and more powerful mining machines will start running, then The computing power will naturally grow.

On the other hand, the impact of currency prices on computing power. At present, the price of bitcoin can support the cost of mining, and then some people will continue to invest in mining. However, if the time scale is extended, the calculation of mining is limited by three aspects: physical (mineral machine), energy (electricity), and cost (currency). The future will be stable in a more reasonable income balance interval. .

04 impact of dry season

Vernacular blockchain: What is the impact and risk of bitcoin mining after the low water price is approaching?

Jiang Zhuoer : The rise in electricity prices during the dry season cannot be said to be risky. First of all, it will definitely cause some machines to dig out the coins and shut down. However, the computing power may not necessarily fall, and there may be a short-term decline. However, in the long run, it is still the case that a new machine squeezes out the old machine, so there is no risk.

This is actually very normal. Everyone knows that there will be a dry season, the price of electricity will rise, and some old machines will shut down. There will be short-term effects, and it may be a small percentage of computing power. Of course, this is not necessarily the case. It is possible that the speed on the new machine is very fast, and the impact of the old machine shutdown on the computing power is very small.

Lu Haiyi : The arrival of the "dry season" is a new test for the miners and our bite deer. The main points are as follows:

1. The energy supply in the northwestern regions such as Xinjiang and Inner Mongolia is more tense than in previous years;

2. Due to the northward movement of the mining machinery in the southwest and the major mining machine manufacturers gradually delivering the mining machine before the end of the year, the northwest vacant mine is gradually being digested;

3. It is difficult for retail investors with small volume and small scale to find the managed mines, and the managed mines have also raised the threshold;

4. Many miners rely mainly on water resources for power generation. Once the dry season comes, the miners need to transfer the mining machine to the thermal power mine. The transfer process is cumbersome and some of the revenue is lost. The users of our Bit Deer's purchase power are seamless and uninterrupted, avoiding the impact.

For the "dry season", we have already prepared accordingly. In addition to Fengshui Power Resources, we have a large number of large-scale professional safety and stability mines in the northwestern region of China and overseas. The computing power is over 3000P, and the power resources are very stable and have good management capabilities.

05 bitcoin market outlook

Vernacular blockchain : Li Qiyuan said bitcoin prices may rise to $200,000 in the short term, while the founder of a mining machine said the final price of bitcoin was $1 million, and the highest point in 2021 was $110,000. What do you think of the recent predictions about Bitcoin? Is it too optimistic, or is it just for the eyes?

Jiang Zhuoer : Their predictions are too optimistic. In 2016, at a mining conference in Chengdu, I said that Bitcoin could reach RMB 2 million. The rationale behind this is that I think Bitcoin can be equal to the total market value of gold. The total market value of gold is almost $7 trillion, divided by 21 million coins, which is almost one million yuan.

However, this price is basically impossible to complete in this round of bull market, it is likely to have the next bull market cycle. This round of bull market cycle, I think it can rise 10 times from the bottom, that is, from 3,000 US dollars to 30,000 US dollars, it is already good, and should not rise more than 30 times at most, that is, the highest I I don't think it will rise to more than $100,000, and this is already a very optimistic estimate.

Therefore, the short-term rise to 200,000 US dollars is extremely unlikely. It is also difficult to rise to 100,000 US dollars. I still recognize that it has risen to 30,000 US dollars, that is, it has increased 10 times from the bottom and is about 50% higher than before. I think this should be more likely to be achieved.

Lu Haiyi : Although I continue to be optimistic about the future price of Bitcoin, many people have recently said that the price of the currency will increase tenfold in the short term. The probability of such a surge is actually small. We compare Bitcoin to digital gold, and the total market capitalization has a lot of room for growth compared to the gold trillion dollar gold reserve. However, the current stage of development is still in its infancy, and more people are needed. The value of the currency is subject to consensus and recognition.

The halving of Bitcoin in the next year will play a role in boosting the price of the currency. Because under the PoW mechanism , the halving of the market is accompanied by an increase in cost. The most basic economic principle is the price increase caused by the increase in cost when the demand is constant.

If we take into account the influence of the currency price on the calculation power, the price will not skyrocket, but the spiral will rise. In the short term, the probability of rising to around 20,000 to 30,000 US dollars is relatively large.

06 Google Quantum Computer Threat

Vernacular blockchain: On September 20th, Google's quantum computer was executed in 3 minutes and 20 seconds to complete the calculations that today's supercomputer Summit takes 10,000 years to complete. Will Google’s quantum hegemony threaten the security of Bitcoin and blockchain?

Jiang Zhuoer : The quantum computer is completely unnecessary. It still belongs to a long time and a long time, and quantum computing has a huge obstacle. It can only calculate some very specific types. Therefore, there is no need to worry about the impact of quantum computing on blockchain encryption algorithms and asymmetric encryption algorithms. Some projects or Token take this to talk about it, the big probability is for hype.

Lu Haiyi : First of all, it is certain that quantum computing will threaten the existing blockchain- dependent encryption algorithms.

The successful launch of quantum computing in the future will make the current PW mechanism and the public key and private key in the cryptographic signature of the bitcoin encryption become transparent and can be easily cracked. This kind of threat is even more serious than the cryptosystems such as online banking and mobile payment in the traditional financial system.

But in fact, we don't have to worry too much. First, it takes some time to get out of the lab from quantum computing. Secondly, for the Bitcoin consensus, if you clearly know where the threat is, then you will definitely adopt an upgrade encryption mechanism, a hard fork mapping new chain, and an anti-quantum. Coping strategies such as passwords.

——End——

『Declaration : This article is an independent view of the interviewed guests. It does not represent the vernacular blockchain position and does not constitute any investment advice or suggestion. You are not allowed to reprint this article by any third party without the authorization of the "Baihua Blockchain" sourced from this article. 』

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- We have forgotten that Bitcoin does not yet have a globally recognized story.

- Ling listening to the notice | What is the bottom of the ant Jinfu layout blockchain?

- Will Libra become the “UN coin”? Libra Association: We can help the UN achieve many sustainable development goals

- 13 countries, the United States, China and other 13 countries cryptocurrency supervision pattern

- The market is diving again, but the short-selling power is attenuating

- The life-saving grass of cryptocurrency, the big country dream of Turkey

- Ethereum 2.0 shard development is basically completed, the first shard simulation will be demonstrated at the next developer conference