Research Report Arbitrum

Arbitrum Research Report1 Basic Overview

Official Website: https://arbitrum.io/

Foundation: https://arbitrum.foundation/

Twitter: https://twitter.com/arbitrum

Data: https://dune.com/gm365/L2

- Who is behind Binance A Borderless Company in 4000 Resumes

- Coinbase has been approved to provide cryptocurrency futures services to retail traders in the United States.

- Coinbase CEO Canadians Are Moving Away from Cryptocurrency Speculation Trading

Data: https://dune.com/msilb7/l2-benchmarks

1. Arbitrum is Ethereum’s rollup layer2. Currently, the TVL (Total Value Locked) is as high as $5.93 billion, ranking first. There are 427 ecological projects, also ranking first. It has excellent ecological projects like GMX, Radiant, TreasureDAO, and Camelot. However, Optimism, leveraging the advantages of the Op stack, has recently shown rapid growth in on-chain transactions and active addresses, showing a trend of surpassing Arbitrum.

2. The main products of Arbitrum are Arbitrum One, Nova, and Orbit. One is the rollup mainnet we commonly use now. Nova adopts a trust assumption, and the data is managed off-chain and not bundled into the mainnet. This greatly reduces transaction costs and speeds. Orbit is a chain used for other people to deploy Layer3.

3. The current circulating market value of ARB is $1.45 billion, with a FDV (Fully Diluted Valuation) of $11.3 billion, and there will be no new unlocks in the next 6 months. However, from the analysis of chain data, Arb is not very satisfactory. 1) It has mixed the chips of the locked-up institutions and teams to prevent on-chain tracing. 2) It has sold 50 million arb from the DAO treasury to market makers, and 2,000 arb have been mixed. These actions violate the spirit of openness and transparency.

4. For the project report and in-depth research on ARB on-chain, please refer to other reports.

2 Project Introduction

Arbitrum is a suite of technologies aimed at scaling Ethereum. Users can use the Arbitrum chain to do everything they do on Ethereum—using Web3 applications, deploying smart contracts, etc.—but with cheaper and faster transactions. The flagship product, Arbitrum Rollup, is an optimistic rollup protocol that inherits Ethereum-level security.

The Arbitrum system has two main networks: Arbitrum One, Arbitrum Nova, and Arbitrum Orbit for Layer3 deployment, as well as a test network called Arbitrum Goerli Testnet.

Arbitrum One: It is the core main network of Arbitrum Rollup, which is a true L2 and packages transaction data onto the Ethereum mainnet. Most of the DApps we see now are on the One network.

Arbitrum Nova: It is an AnyTrust chain. Unlike One, the data on AnyTrust does not necessarily need to be packaged into the mainnet. It introduces a trust assumption, and data availability is managed by a Data Availability Committee (DAC). As long as no more than a threshold number, such as 2 members, behave maliciously, the data is managed off-chain. It does not have the same decentralized/trustless/permissionless security guarantees as the Rollup chain, but the benefit is a significant reduction in fees. It is more suitable for high-frequency trading or large-scale applications. The ecosystem on Nova includes Reddit, Sushiswap, and some games.

Arbitrum Orbit: Users can use Arbitrum Orbit to build their own Layer3, and they can choose flexible options for Rollup and AnyTrust technologies. For example, there is an Orbit Rollup chain with Ethereum-level security (such as Arbitrum One), or they can choose the Orbit AnyTrust chain (such as Arbitrum Nova) with minimal trust assumptions, while achieving ultra-low transaction costs for high-capacity applications. Users can customize the privacy, permissions, fee tokens, governance, etc. of the Arbitrum Orbit chain to unlock more potential use cases.

Arbitrum Goerli Testnet

is a Layer2 based on the Ethereum Goerli testnet, used for deployment testing of smart contracts.

Arbitrum Nitro

Nitro is the Arbitrum technology stack, both One and Nova networks are supported by Nitro. It is a major technical upgrade made by the Arbitrum team in 2022. In Nitro, WebAssembly (Wasm) is used to execute low-level instructions. Therefore, ArbOS programs can be implemented in Go and include Geth itself as a submodule. Its advantages include:

-

Throughput increased by 7 to 10 times

-

Advanced Calldata compression, further reducing the transaction cost of Arbitrum by reducing the amount of data published to L1

-

Ethereum L1 gas compatibility, making the pricing and accounting of EVM operations consistent with Ethereum

-

Additional L1 interoperability, including closer synchronization with L1 block numbers and comprehensive support for all Ethereum L1 precompiles

-

Geth tracking, providing wider debugging support

3 Project Status

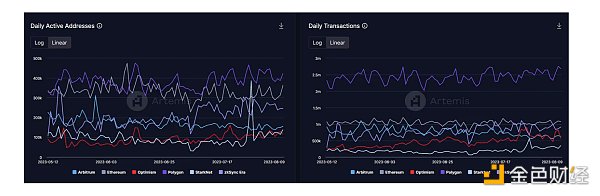

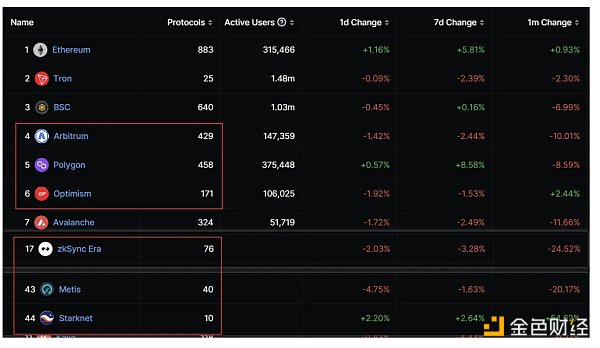

In terms of the number of daily active addresses, Aribitrum is roughly around 150,000, compared to Ethereum at around 300,000, Optimism at around 110,000, StarkNet at around 130,000, and zkSync at around 250,000.

Looking at the number of daily transfers, Aribitrum is roughly around 620,000, compared to Ethereum at around 1.08 million, Optimism at around 560,000, StarkNet at around 350,000, and zkSync at around 910,000.

Although there may be fluctuations in the number of daily active addresses and transfers between different chains, and the rankings may change, the overall trend has not changed much. We can see that Ethereum ranks first in both data, followed by zkSync, Aribitrum, Optimism, and StarkNet. Considering that zkSync and StarkNet have a large number of testnet transactions, the data is not accurate. So the remaining rankings are basically ETH, Aribitrum, Optimism.

Interestingly, the goal of creating Layer2 was due to the high transaction fees and TPS issues on the ETH mainnet. But now, the main activities and transactions are still happening on the Ethereum mainnet, possibly because Ethereum still has a large number of native projects.

According to Defillama data, there are 429 ecological projects included in Aribitrum (580 projects listed on the Aribitrum official website, possibly due to different statistical methods). The number of ecosystems is not much different from Polygon, ranking fourth after Ethereum and BSC. However, Polygon and BSC have experienced a boom in the 2021 bull market and have been supported by a $1 billion ecological fund. This indicates that the ecological development of Aribitrum has been relatively rapid in the past year. In comparison, Optimism has only 171 ecological projects and zkSync has only 76. From the perspective of ecological development, Aribitrum’s progress is very promising.

In terms of ecology, the native ecology of on-chain projects is relatively important. We often see a public chain promoting its ecological projects, and they can list many of them, but apart from those large projects with multiple chain deployments, there is no impressive one. This public chain has not attracted truly outstanding developers.

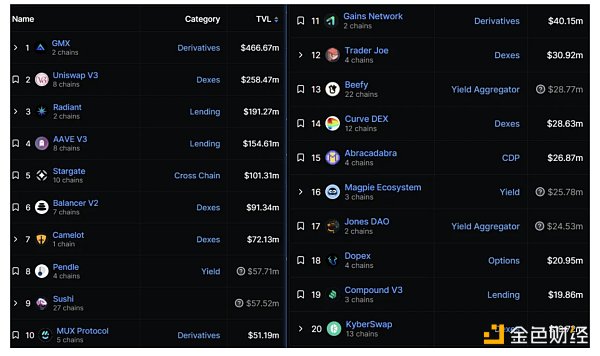

On Aribitrum, however, we can see excellent projects such as GMX, Radiant, TreasureDAO, Camelot, and Gains.

Meanwhile, the TVL of Uniswap and Balancer is only on the Ethereum chain.

Please refer to the separate research report for specific ecological projects.

4 Tokenomics

https://docs.arbitrum.foundation/airdrop-eligibility-distribution

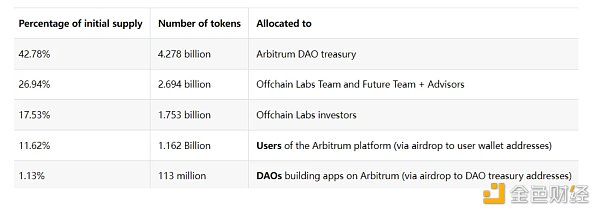

Total supply of ARB is 10 billion, and the initial distribution is set for March 16, 2023.

42.78% is allocated to the DAO Treasury, which will be unlocked based on DAO voting.

26.94% is allocated to the team, with a 1-year lock-up period, followed by linear unlocking over 36 months.

17.53% is allocated to investors, with a 1-year lock-up period, followed by linear unlocking over 36 months.

11.62% is airdropped to users.

1.13% is airdropped to the DAO of ecological projects.

-

ARB tokens can be used to vote on Arbitrum DAO governance proposals, allowing $ARB holders to collectively shape the future of Arbitrum.

-

Token holders will be able to delegate their voting power to delegates.

5 On-chain Data Analysis 0812

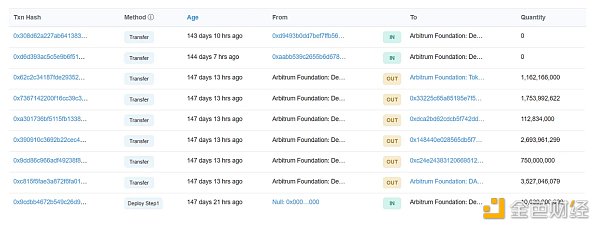

Looking at the genesis distribution, ARB was transferred to a total of 6 addresses, two of which are DAO Treasuries, corresponding to the allocation shares in the whitepaper. We have conducted preliminary research on them:

0x67a24ce4321ab3af51c2d0a4801c3e111d88c9d9

Airdrop address, with a total airdrop of 1.162 billion, and there are still 76 million remaining in the address. Due to the long time, the daily claim amount is now in the tens of thousands.

0xd29029369d07f6fcdc2ffcb72aa1f1cc38d42794

Airdropped to ecological projects, with a total airdrop of 113 million, fully distributed according to the allocation plans of each project.

Investors and Team Holdings

Investors hold 17.53% and the team holds 26.94%, totaling 44.47% of the tokens. According to official information, these tokens are locked for one year. However, the official has employed multiple addresses and paths for mixing, and some of the ARB in these addresses are from other sources. The largest mixed address, marked as coinbase, has been fully traced by the author. So far, the author has traced 206 individual addresses totaling 3.36 billion and 5 mixed addresses.

Although it is said that we are now in the era of privacy, as project parties, they should also be open and transparent and be subjected to community supervision. Therefore, the author considers this behavior of the project party to be questionable.

The largest mixed address is: 0x1E7016f7C23859d097668C27B72C170eD7129A10

DAO Treasury

The DAO Treasury has two addresses:

The outgoing addresses are:

0xf3fc178157fb3c87548baa86f9d24ba38e649b58

0x15533b77981cda0f85c4f9a485237df4285d6844

1) 800,000 transferred to a new address, no action taken

2) 50 million transferred to market maker Wintermute before going live, transferred to exchanges such as Binance and OK

3) 47 million transferred to a new address, and this address transferred 20 million to a mixed address for investors and team chips

Market maker Wintermute’s two addresses:

0xcce300c0a6a2757c66f6e8b83515834689ef06c0

0xba019c30f79eb93a0058c6d3333160091db22cef

From the analysis of on-chain data, Arb is not very satisfactory:

1) It mixed the chips of locked institutions and teams to prevent on-chain tracing, which violates the spirit of openness and transparency

2) It sold 50 million ARB from the DAO Treasury to the market maker, and also mixed 2,000 ARB.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- In-depth study of the efficient cross-chain exchange protocol Chainflip

- CFTC Chairman 70% of cryptocurrency products should be classified as commodities

- Vitalik Buterin Social media experiment Community Notes embodies the spirit of encryption.

- Who is creating Binance A Borderless Company in 4,000 Resumes

- LianGuai Morning Post | Federal Reserve Meeting Minutes Core Inflation Will Significantly Decrease in the Second Half of the Year

- Is the ‘big boss’ of the cryptocurrency world, Binance, starting to decline?

- Vitalik Buterin What are my thoughts on Community Notes?