Exploring the truth behind PulseChain’s 13.7 billion fundraising: ultimate innovation or Ponzi scheme, risk or opportunity?

Examining if PulseChain's 13.7 billion fundraising is a groundbreaking innovation or a fraudulent scheme - opportunity or risk?Written by: @Yinan_cycle

Introduction:

PulseChain is a hard fork chain of Ethereum with full state, the first hard fork that includes the complete state of the Ethereum blockchain, which means it maintains a record of every transaction, user account, and smart contract interaction on Ethereum.

The platform aims to reduce the computational burden on the Ethereum blockchain and create a cost-effective alternative for smart contract developers.

PulseChain aims to increase the value of the Ethereum network by sharing some of the network load and reducing gas fees. The Ethereum block time is 15 seconds, but PulseChain has a block time of 12 seconds, which is faster and more scalable, according to the official website.

- Interpreting Injective (INJ): A comprehensive evaluation of DeFi project based on SWOT

- zkML: zk+Machine Learning Emerging Project and Infrastructure

- Overview of EDCON Super Demo Winning Projects at Ethereum Conference 2023

PulseChain uses the Proof-of-Stake (PoS) consensus mechanism Blockingrlia, a branch of the Binance Smart Chain (BSC). However, the project has shifted to a new Proof-of-Stake Authority (PoSA) consensus model, which introduces native validator staking, rotation, and reward reduction contracts.

As of writing, PulseChain has 15,893 validator nodes in the entire network. Anyone can become a validator by staking 32,000,000 native PLS tokens. Validators earn a portion of the transaction fees from the entire network.

Pulsechain completed the tests for V3 and V4 earlier this year and launched the official version on May 14.

Team:

PulseChain was founded by Richard Heart, who is also the founder of HEX.

Richard Heart is an American cryptocurrency entrepreneur. As early as 2015, when Ethereum raised funds through crowdfunding, Richard Heart was one of the first major investors.

He has hundreds of thousands of followers on Twitter and YouTube, and people have mixed opinions about him. While he has a large number of fans, many people think that his projects are completely Ponzi schemes and look down on him.

HEX token allows holders to earn up to nearly 40% annualized returns by staking the tokens. The project raised $60 million on its first day of issuance, setting a record for blockchain token fundraising at the time. From 2019 to 2021, HEX’s highest increase was a thousandfold, making Richard Heart even more famous.

Richard Heart is a very marketing-savvy person. He previously bought a 555.55-gram black diamond with 55 facets, symbolizing HEX’s maximum staking period of 5,555 days, and named it “The HEX.COM Diamond.” He also sponsored a NASCAR race featuring JJ Yeley, one of the three-time champions.

HEX:

HEX claims to be the world’s first high-interest blockchain certificate of deposit, offering substantial ROI promises to early adopters. Richard Heart distributed HEX to Bitcoin holders as a snapshot of a Bitcoin UTXO set that appeared on block 606227 on December 2, 2019.

Initially, the distribution of HEX to Bitcoin holders was 10,000 HEX for every 1 BTC. Bitcoin holders could only claim HEX within the first year of issuance. During this period, they could also interact with the HEX smart contract to donate ETH in exchange for HEX.

At the end of the first year of issuance, all unclaimed HEX coins by Bitcoin holders were distributed to other active HEX users. After the first year, HEX’s maximum annual inflation rate was designed to be 3.69%.

HEX holders can stake their tokens for a period of time (1-5555 days) and receive their principal and interest upon reaching the specified deadline. Holders who stake HEX will encounter inflation, and if they terminate the stake before the set lock-up period, half of their profits will be deducted as a penalty.

For example, at a 3.69% inflation rate and a 10% staking rate, the staker’s staking annualized return rate is 36.9%. 90% of the total number of tokens is held by an OA address for HEX, which the community claims has never sold a token in three years, and HEX has never been hacked.

Additionally, the project has designed a promotional reward mechanism, whereby users who are referred to the project will receive a 10% reward, and the referrer will receive a 20% reward. JACK later launched XEN, which was also inspired by HEX.

Airdrop:

The PulseChain airdrop will begin when the PulseChain blockchain is launched. Anyone who has an Ethereum token balance in a non-custodial wallet will receive a 1:1 balance of PLS tokens, without any action required, enabling users to access all Ethereum tokens on PulseChain. Any ETH held in non-custodial wallets will be replaced by PLS balance. However, all ERC-20 tokens will retain their original names.

However, this airdrop has almost no value, it is more of a gimmick, as at this time the price of PLS is three zeros after the decimal point, and the 1:1 exchange can be almost ignored.

Mechanism:

Almost all projects on the Pulse network are launched through a mechanism called the Sacrifice activity , which is a donation mechanism, with no upper limit on donations, and token distribution determined by the amount of the donation.

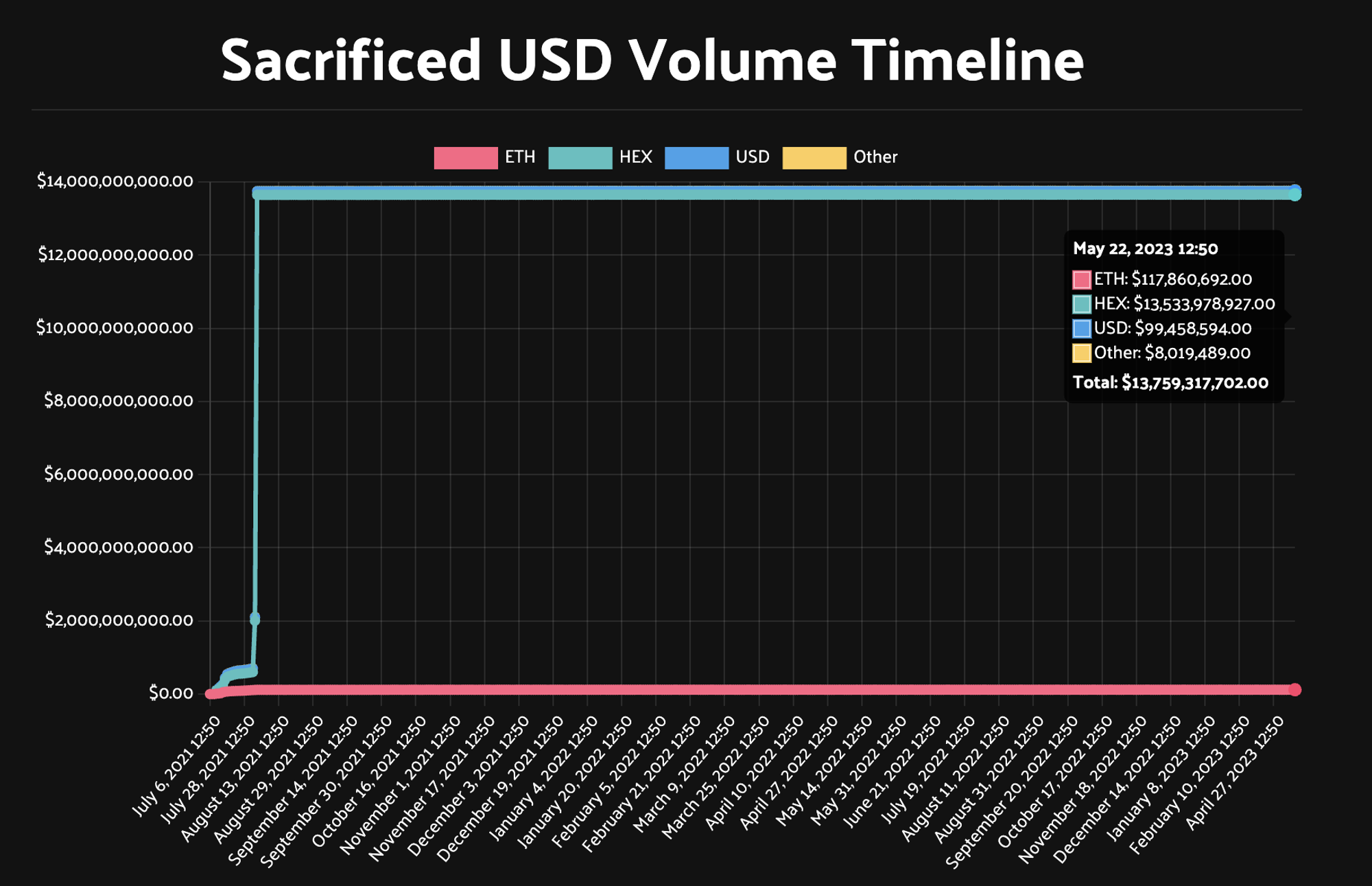

Initially, during the donation period, the $PLS community donated $670 million, and the $PLSX community donated $1 billion. Near the end of the donation period, the OA wallet (HEX’s genesis wallet, widely regarded in the HEX community as RH’s wallet) donated approximately $13 billion and $54 billion to the two projects, respectively.

Token Economics:

PLS is the native token of PulseChain, serving as the token for paying GAS on the network. It uses the PRC-20 token standard, a variant of the Ethereum ERC-20 standard.

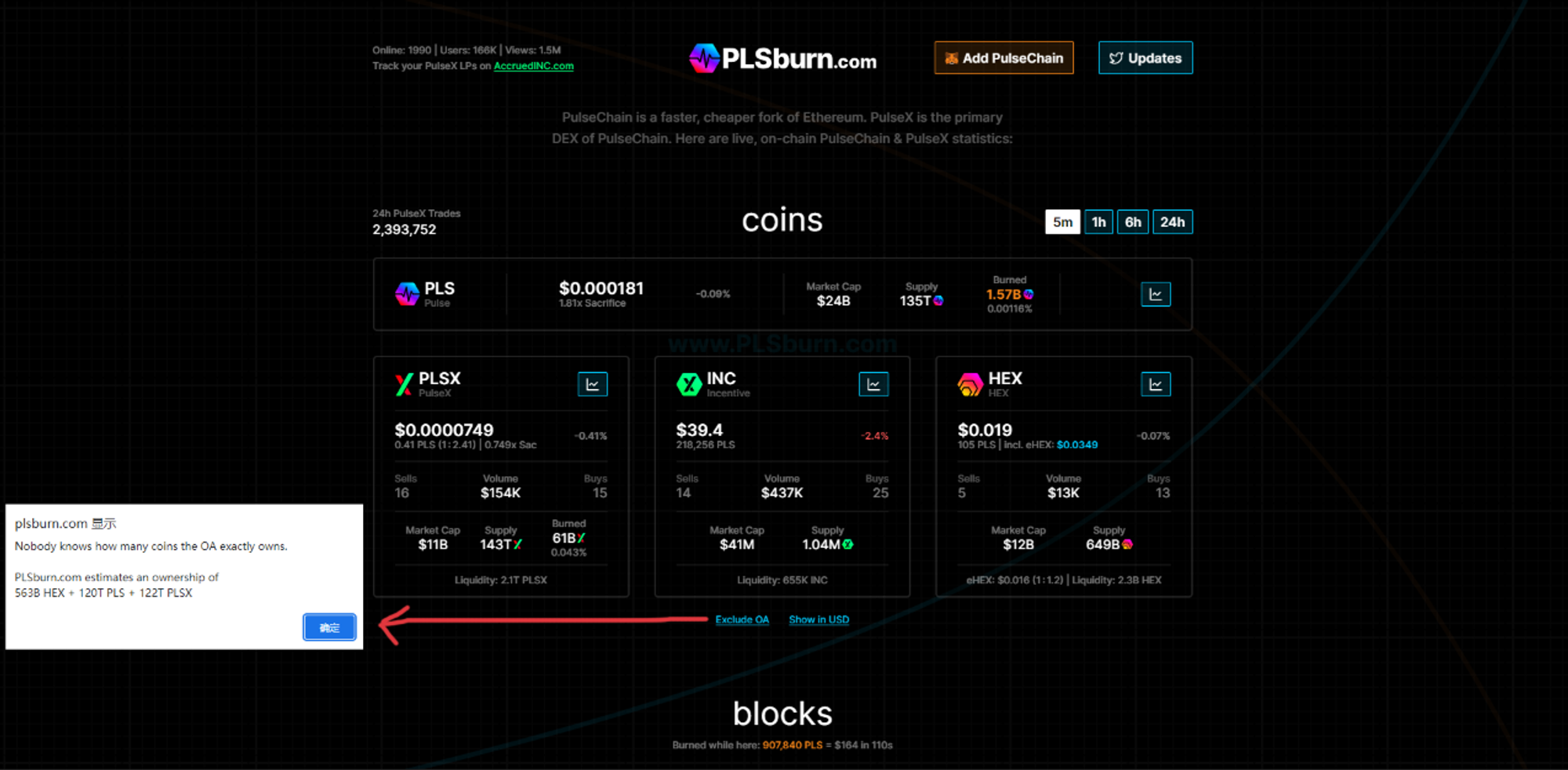

Total token supply: 135T. The OA address, which holds more than 90% of the tokens (the largest HEX address), theoretically does not participate in market circulation. The community is quite confident about this, while outsiders think it could be a double-edged sword.

PulseChain validators receive 75% of all PLS tokens generated by transaction fees. The remaining 25% is burned, reducing the circulating supply. In addition, when the final stage of the project roadmap is completed, PLS tokens will be used for community governance and on-chain voting.

PLSX is the platform token for PulseX Exchange, used for discounting transaction fees and incentivizing traders. Token holders can receive benefits such as PLS airdrops and fee reductions. PLSX tokens also have certain fee-burning properties. 21% of PulseX fees will be used to buy and then burn PLSX tokens.

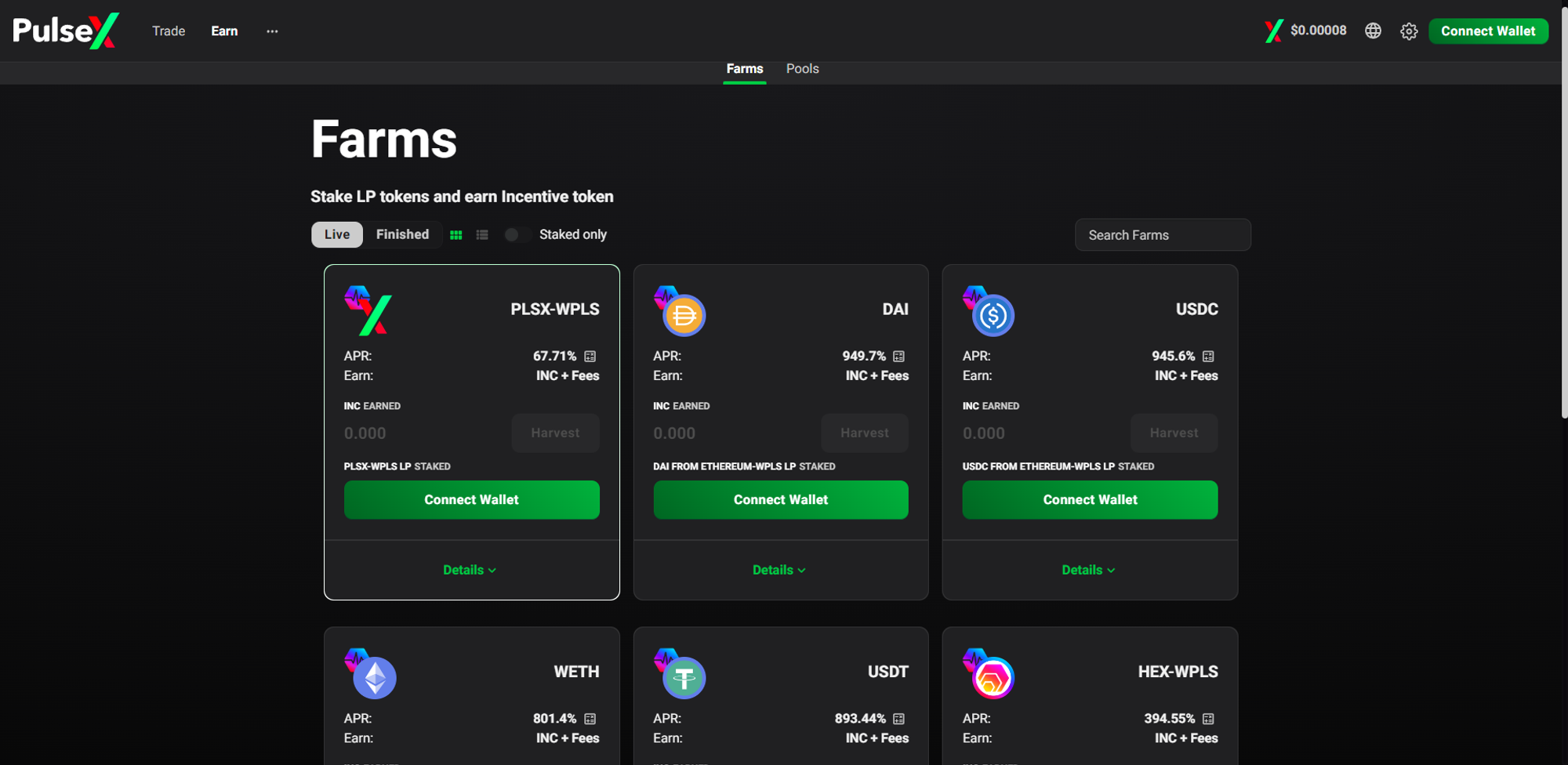

INC is the reward token for staking mining, obtained by staking LP tokens.

Project Ecosystem:

PulseX:

PulseX is the official DeFi token exchange platform of PulseChain. It is a fork of Uniswap. It will provide network participants with access to DeFi features such as AMMs, liquidity pools, and liquidity mining.

Liquid Loans:

is the largest third-party team on PulseChain, dedicated to developing its native over-collateralized stablecoin. Its community has donated nearly $50 million and has thousands of participants. Users can collateralize $PLS and borrow interest-free stablecoin $USDL. In addition, $LOAN tokens will be issued to reward stable pool pledgers. Liquid Loans is a fork of LiquityProtocol on Ethereum.

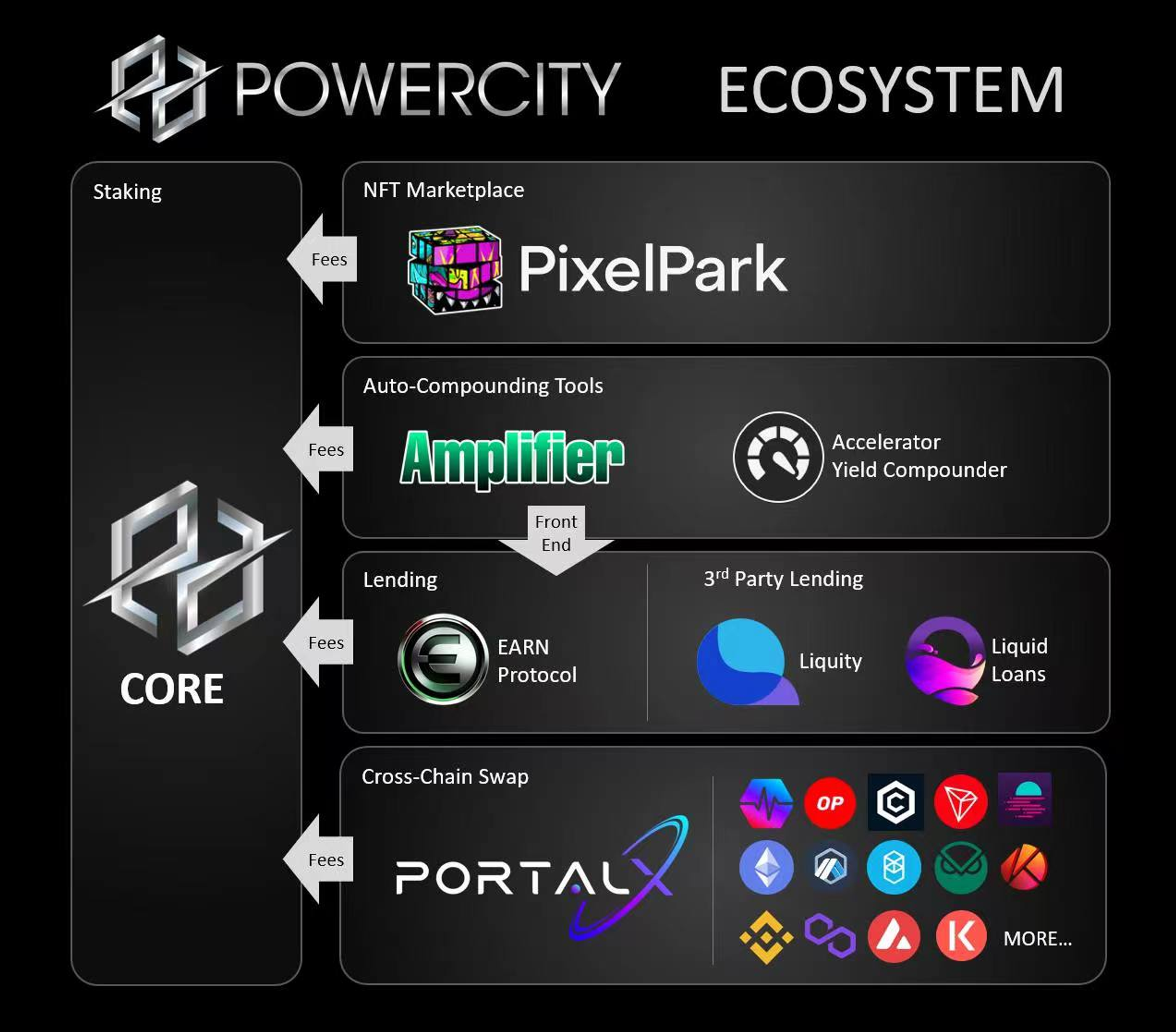

Powercity:

is a team composed of a group of loyal followers of RH. It is a complex small ecological combination, and its sub-projects cover: pledge, cross-chain bridge, borrowing and lending, NFT exchange, etc.

Ph series-Phiat, Phamous, Phux, Phatty:

Phiat is a fork of AAVE V2, an on-chain bank that can collateralize and borrow multiple tokens, aiming to provide leverage, short selling, and hedging tools for RH’s tokens.

Phamous is a fork of GMX on PulseChain, a perpetual contract exchange that can long or short high-liquidity tokens on the Pulse chain.

Phux is a fork of Balancer V2, aiming to build an exchange focusing on stablecoin exchange and multi-currency flow pool index, which can be composed of up to 8 tokens.

Phatty is a wallet aggregator similar to Debank, which can display on-chain assets better, especially on-chain assets on PulseChain. It can not only display the holding amount of spot, but also display the share of pledge.

Summary:

Currently, the entire ecology of PulseChain is dominated by Richard Heart and the HEX community. Most of the ecological projects are forks of Ethereum’s leading projects. The introduction articles and audience on Crypto Twitter are not yet many, and the community promotion is mainly driven by the Pulse community. Currently, there is no VC participation in the entire ecological project, and fundraising is mainly raised within the community. However, one thing to note is that the community members are rich. The $PLSX community alone raised $1 billion, and the total raised was $55.4 billion, of which many were donated in HEX form.

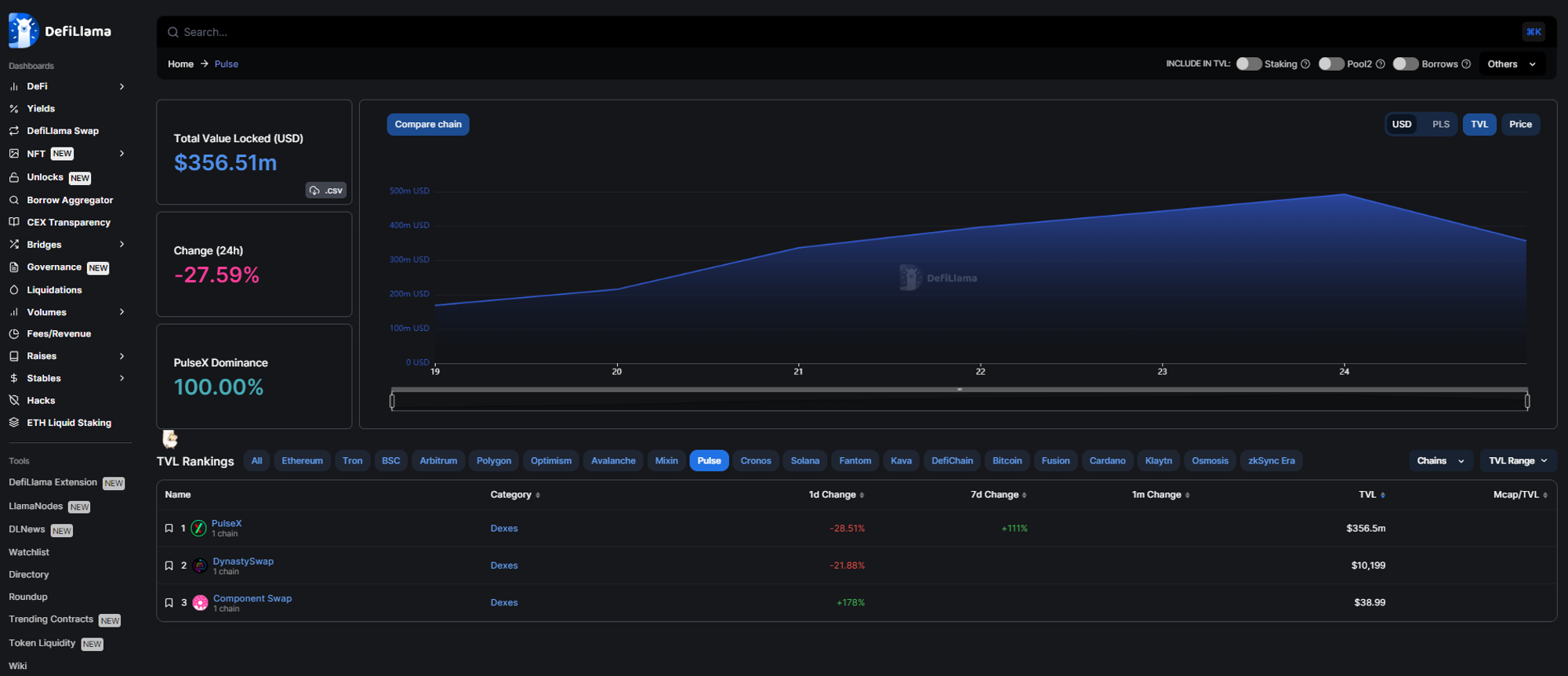

Recently, the focus of attention on the main network has been the almost 500 million US dollars in total TVL of Pulse on Defillama a few days after the launch of the main network, ranking 8th among public chains and surpassing a number of public chains such as Solana and FTM. However, there are only a few projects in the ecosystem, most of which come from PulseX, and the PLSX-WPLS trading pair accounts for more than 40% of the TVL. On May 25th, the TVL began to decline, reflecting that some funds are withdrawing. In terms of the market, on May 23rd, OKX announced the listing of PLS, and the PLS/USDT trading pair was officially launched on May 24th. Prior to this, purchasing PLS required cross-chain transfer of funds to Pulse to make the purchase, and a small amount of PLS was required to be purchased off-site as gas fees. In terms of the community, there is currently only one official Telegram group, and no other documents, blogs, and other channels have been found. The official Twitter is updated infrequently, while the founder RH updates more frequently. (Related reading: “Marketing expert” Richard starts a new business again, why can PulseChain achieve a TVL of 500 million in a week?)

Finally, whether a place with few people is a risk or an opportunity is subject to different judgments. Currently, the situation of Pulse is as described above. If you want to participate, conduct a more in-depth analysis and investigation on your own.

Related Links:

Official website: https://pulsechain.com/

Twitter: https://twitter.com/pulsechaincom

Telegram: https://t.me/PulseChainCom

DEX: https://app.pulsex.com/swap

Cross-chain bridge: https://bridge.pulsechain.com/#/bridge

Burning data: https://plsburn.com/

Block browser: https://scan.pulsechain.com/

Pulse Ecology New Project and Donation Data Website: https://www.hexpulse.info/projects/

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Ethereum client Prysm releases version v4.0.5, including significant improvements to proof aggregation.

- Arbitrum’s High-Quality Project Inventory: What are the new projects worth looking forward to?

- Inventory of 13 potential zero-cost airdrop projects: Shardeum, Base, Scroll…

- Preview of a New Project | Analyzing the Arbitrum Ecosystem’s Non-Liquidation Lending Protocol – Ghast Protocol

- Preview of New Project | DeFi Operating System Root – Planning to Develop the First Full-Chain ve (3,3) Governance Aggregation Flywheel

- 13 Potential Airdrop Projects You Can’t Miss

- Outlook on Ethereum staking market: Potential opportunities in a dynamic competitive landscape