The value of money is out of nothing and there is no middle and no life.

Money can be born out of nothing, and there will be no middle school.

This sentence is understood in two levels:

The first is the creation and destruction of new currencies.

The free-money theory of the Austrian economist Hayek advocates the non-stateization of money. He believes that private money can be issued. As long as the stability of the monetary value can be guaranteed, it is a good currency. The currencies should compete freely.

Hayek’s ideas were realized in the blockchain. From Bitcoin, to the coin, to the ICO of Ethereum, a large amount of money was born out of nothing.

- Babbitt Column | Using Blockchain Technology to Promote Legal System Construction in Digital Society

- In the next 20 years, what new business models will be brought about by Web 3.0 based on blockchain technology?

- The Trusted Blockchain Promotion Plan Organization officially released the "White Paper on Public Chains" (with PPT Interpretation)

Part of the currency realized the storage of value and became a wealth warehouse, and survived. Market competition is cruel, most of the competition coins die, and the ultimate survival rate is never the same. Most of the currencies, which failed in the competition, were eliminated.

The imitation currency will basically be eliminated, imitating bitcoin, and will eventually be eliminated by bitcoin. Only one who claims to be a bitcoin brother from beginning to end can live very well.

In reality, few people can surpass the star case by imitating the star. The reason is basically the same, you have to learn to innovate, have your own characteristics, have your own style, only imitate, and never go long. Of course, I am not talking about a certain field.

In the currency sector, Bitcoin currently has no competitors. The new currency must open up new battlefields instead of blindly competing with Bitcoin. For example, the privacy currency is still in the Spring and Autumn Period and the Warring States Period, and the smart contract battlefield is also playing well.

Most currencies are reduced to air because they cannot store value, and they can only go with the wind. Of course, there are still some mercenaries and speculators who have never wanted to survive this war, take a shot and take some loot, they are cutting the leek experts, and the currency like Bit God is invented by them.

In the bear market, they ran away; in the bull market, Hu Hansan, came back. This kind of person, you have to discuss without cutting, especially be careful.

The second refers to the issuance and destruction of currency.

Let's talk about the currency. The currency in the legal currency usually refers to the credit currency. You borrow money from the bank through credit. These currencies were originally not available in the market. This is out of nothing. M2 is mainly a credit currency. It is a large number in China. Real estate credit, money has flowed into the house, how can it be that housing prices are not rising?

When the credit currency is paid off by you, this part of the currency is equivalent to disappearing.

Let's take a look at the blockchain world. The issuance of currency is equivalent to nothing. For example, the coins that are fixed by pow every day, such as the coins obtained by pos mortgage, and the keys that are smashed every day. The destruction of money is usually to put a part of the currency into an address that no one can retrieve. This part of the currency is equivalent to withdrawing from the circulation market and disappearing. This is the middle of nothing.

This kind of destruction currency is also divided into occasional ones, which are regularly made. For example, EOS destroys 34 million EOS. This kind of occasional behavior, if sustained for a long time, actually reduces the rate of increase, from 5% to 1%.

For example, the currency security regularly destroys BNB. This long-term destruction behavior is a means to enhance the intrinsic value of BNB. So there is a new term called Burn Token. There are many exchanges that have been imitated. However, an exchange was converted from dividends to destruction. As a result, the amount of destruction was too small, and it was smashed by netizens. It was a good thing, and as a result, I was stingy, and I couldn’t bear it. If I couldn’t make a tiger, I would like to laugh.

There are also two interesting monetary phenomena in terms of monetary value, such as “out of nothing” and “having nothing”.

The value of money is nothing but a two-stage, a monetization stage, a mature currency stage, or a stable monetary stage.

In the monetization stage, how the value of money is born out of nothing, this content I also said in the previous article, a brief summary:

The value of money is not born out of nothing, it is supported.

The part of the real value of money that is greater than the value of the currency itself is called the currency premium. It is generally considered that the currency premium is out of nothing.

To give a simple example, you lend a friend 100,000 yuan, and a friend gives you a loan. This loan has a premium of 100,000. Is this premium out of nothing? I don't think so. Behind the premium is the credit of your friend and your trust in your friends, and friendship.

In the previous section, my point is that the currency premium is supported by the value of the social network generated by the currency.

In the process of commodity monetization, the value of the currency network increases as the number of users increases. The value of the currency network is ultimately reflected in the value of the currency, which is the currency premium.

The currency premium is the embodiment of the value of the currency network in terms of monetary value. Money continuously stores the network value of money through the form of “currency premium” to realize the storage of network value.

Therefore, in the value storage stage of currency monetization, the value of money naturally rises and rises.

Bitcoin is currently in the monetized value storage phase, which is a wealth warehouse. At this stage, its value will always be "out of nothing".

After the monetization of the currency, the value of the currency is in a relatively stable state. There is a dynamic balance between the value of money and the goods and services that are traded. The value of money will not rise and fall, this is the mature currency stage.

At this stage, the Fisher formula is the most appropriate: MV = PT or PQ.

It can be known from the formula that M is closely related to the total value of the PQ society in the case where the currency circulation speed V is constant.

As the social productivity increases, it is assumed that the total value of society will also increase steadily, and then M will also increase.

If the amount of money remains constant without additional issuance, the value of money will certainly continue to appreciate as the total value of society increases. This is the out-of-the-box of the monetary value of the stabilization phase.

This is a hypothesis of the Austrian school, allowing the currency to appreciate naturally and let the people share wealth. The premise of imaginary is that the amount of money is constant, or deflated.

But the reality is that the government has to impose a coinage tax. Economists say that an important attribute of money is to be able to guarantee the stability of monetary value. How to ensure the stability of the monetary value, so that the currency will gradually increase with the growth of the economy.

However, the additional currency has not been in the hands of ordinary people and has been taken away by currency issuers. Friedman had a helicopter to say that. Since it is an additional currency, why not distribute it evenly, and spread the money to the people through helicopters. But no government is willing to do this.

At this stage, the value of money is out of nothing, mainly referring to the increase in productivity and the enrichment of social material wealth, which has led to an increase in the purchasing power of money.

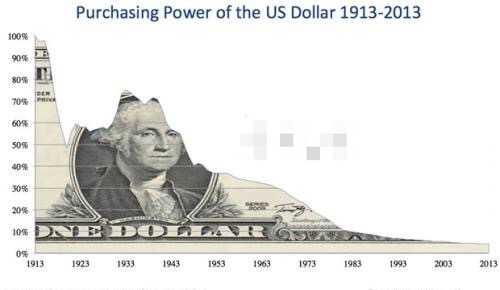

But the reality is often cruel, and the beauty we want is usually in the TV series, in the news LB. The reality is that the money in our hands is depreciating all the time, the value of money is in the middle, and so is China, and so is the United States. Therefore, some people say that the French currency has long been on the way to zero.

The above picture shows the changes in the purchasing power of the US dollar over a hundred years. You can see the trend of long-term depreciation and the result of gradual return to zero. I am in "Why did your income increase and your wealth shrinks?" The article discusses in detail how the currency is devalued.

Because all governments are Keynesians, they are all over the currency, and the currency has been depreciating for a long time. You can't do anything about it.

Bit stupid said, this is the reduced-size wool shears of the French currency, constantly dig your corner and lick your wool.

You have the monetary value of the bank, so you are stolen without a word, and you don't know anything about it.

The value of Bitcoin is "out of nothing", and the value of the French currency is "nothing in the middle."

turn left? Go to the right?

this is a problem.

Author: Allin block chain

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- SNZ Holding, a professional PoS pool service organization, joins the Wanchain Galaxy Consensus Node Program

- Block Chain Female Yang Xia: Provide military-grade security testing for blockchain code 丨 Ant blockchain competition Chengdu registration hot registration

- BSV behind the scenes gold: from the billionaire gambling rich, wanted to the "Ao Ben Cong" creator

- Twitter Featured: Buying 11,000 Bitcoins in a single month, is the institution also suffering from phobia?

- Privacy Computing: Dynamic Encryption Technology – Blockchain Technology

- Forbes: Billionaires love bitcoin and want to buy 4.5 million bitcoins through an encryption broker

- Bitcoin fantasy half a year: the price doubled, and entered after 00