The young man who didn’t buy Bitcoin for $3,000 bought it when he was 10,000.

Bitcoin's compound yield in recent years is 83.75%. But how many people can you hold?

The bitcoin bull market is back.

"Bitcoin has to be revolutionized again." Starting in April this year, Bitcoin (BTC) began to rise all the way.

Last weekend, on June 22, Bitcoin broke through the $10,000 mark, and since then it has been like a dislocated wild horse, and prices have skyrocketed. After 4 days, BTC's gains continued unabated, breaking through 11,000 US dollars and 12,000 US dollars. Since the beginning of this year, BTC has increased by 220%.

- Analysis: Bakkt is expected to be approved in just 10 days

- Zhu Jiaming: The Super Experiment of Currency Internet——Libra Analysis

- Cross-border payment, three countries

Although there is still a certain distance compared to the 2017 bull market high price of 19,875 US dollars, the single-day trading volume of BTC and the total daily trading volume of the entire cryptocurrency market have surpassed the previous high and set a new high again.

(BTC trading volume)

(BTC trading volume)

“I earned 180,000 a month.”

Some newcomers have invested a month's salary to the current rate of return of more than 150%; more people do not get on the car in time to regret, and are afraid of stepping into the air is more afraid of chasing high, only to ask Bitcoin to "turn around" to get on the train.

Research firm OK Research believes that the bitcoin market has entered a full recovery period, and it is expected to see explosive growth during the 4-6 months of volatility growth, and to integrate the current round market based on the long-term trend of bitcoin prices. Demand amplification signal, this round of price peak is expected to hit a record high.

For a time, those who did not believe in Bitcoin believed it again; those who were short-sellers came back to “recharge their faith”; the disappearing shackles came back again and shouted; the bitcoin mining machine was in short supply.

Lei Jun once said that the cost of trial and error is not high, and the cost of missing is very high. It is precisely because of this truth that countless leeks enter the market when the price of the currency peaks.

As the saying goes: "The bitcoin of 3000 is a scam. When you are 10,000, you are rushing to get on the train yourself…" As the price of the currency rises, people begin to fall into the deep FOMO (fear of missing) emotions. .

As the bitcoin bull market becomes more concentrated, the investors who are in it are not tested how deep the digital currency or blockchain is, but human.

Amaranth: hundreds of thousands of months, not afraid of stepping on the air and afraid of chasing high

Amaranth: hundreds of thousands of months, not afraid of stepping on the air and afraid of chasing high

The cryptocurrency market is picking up, and retail investors are hoping to take this train to the road to freedom of wealth.

“I earned 180,000 last month.”

Investor Chen Yin told the Odaily Planet Daily that by investing in cryptocurrencies, it has accumulated a revenue of 300,000 in the past two months, and it is difficult to hide the excitement in the words.

There are many examples like Chen Yin. Among them, there are many new investors. The official name is “New Amaranth Admission”, and investor Zhang Ning is one of them. After knowing the bitcoin skyrocketing in Weibo in April this year, Zhang Ning invested a month's salary, and the current rate of return is over 150%.

"I don't know anything. I just voted for it. I earned it when I took it." Zhang Ning said with a smile. "In this bull market, fools can make money. I am the fool."

When I got on the car, I hoped that the car would not turn around.

"Before I went to eight or nine thousand (US dollars), I felt too high. I didn't expect it to rise to more than 10,000 now. I hope that it will quickly call back and let me get on the bus." One pays attention to bitcoin prices. The retail investors who have been hesitant to buy have said.

"I voted a little bit before, and now I watched it rise so much, I feel so sad." This year, I studied bitcoin, thinking that it will rise, the white-collar seedlings, started to vote a few months ago, and now I am so sad that I bought too Less, only hate no stud (put most of the assets into the house).

Some people are happy to get on the train in time, and some people regret to get off early.

"I also got off at 9700 and 9800. It felt like I was left in the parking lot, and then I watched the car drive away." Wang Qi had to catch up when he was going to call back. However, Bitcoin has triumphed all the way, not like it. As expected, Wang Qi did not unexpectedly "walk the air".

Not only afraid of stepping on the air, but also afraid of chasing high, even more afraid of missing. The FOMO mentality makes the heart of the new amaranth uneasy.

According to the data on the chain, the new address of Bitcoin increased by 30.98% in the past seven days, and the active address of Bitcoin increased by 6.86% in the past seven days. This indicates that BTC investors' participation and activity are increasing.

Chris Kline, CEO of Bitcoin IRA, the largest bitcoin personal retirement account (IRA) platform in the United States, said that because Bitcoin broke $11,000, investor interest and investment activity over the past six weeks exceeded the previous year, and the volume of its IRA platform It is at the highest level in history and is expected to continue to grow.

According to The Tie Twitter, on June 22, the number of Bitcoin tweets exceeded 50,000, reaching the highest level since February 20, 2018. The Baidu search index shows that the current search volume of Bitcoin is more than three times the total search volume of the previous six months, or that the Chinese encryption market is hotter than the Western market.

Big shouting: Yuhong at three o'clock is back.

Big shouting: Yuhong at three o'clock is back.

After the BTC broke through $10,000, the former "retreat" currency circle drove through the trains that hang the banner of "Freedom of Fortune" and greeted investors to get on the train. Among them, the promoter of the three o'clock group, Yuhong, is the most prominent.

On June 20th, the cryptocurrency XMX initiated by Yuhong re-entered the vision of the coin circle. On the same day, XMX drew a big Yang Xian line, which was over 70%.

In the next few days, XMX founder Yu Hong began to scream in the community, sending news daily, and promised that XMX would open a position after five times.

As for why it was 5 times when the position was opened, Yuhong explained: "My personal fund size is determined. The plate is too small for me to play."

However, in the opinion of investor Duan Hong, Yuhong’s approach is to draw a big cake for the leek. "He has a lot of money, and he can gradually build a position. There is no need to rebuild the warehouse five times. The reason for this is actually to draw a pie, which is equivalent to a promise to disguise himself."

Yuhong's shouting is undoubtedly effective. XMX gained a high level of attention in the next 5 days with a 6-fold increase, and Duan Hong also entered it. However, due to the lack of trust in Yuhong, Duan Hong has already got off the bus when he earned a profit of 1 times.

“XMX will never do market value management. Community mutual cutting is the only strategy for XMX market value management! You are also welcome to cut me.” Looking back at the information distributed by Yuhong, it seems that the word “cut” is not avoided because he once Was put on the title of "cut amaranth".

For Yuhong in 2018, it is the ice and fire of heaven and hell. In the first half of the year, from the Internet circle to the blockchain, through the organization of the "three o'clock community" to push Yuhong to the altar, for a time, all kinds of reputations come to the fore – "Evangelists", "the first person in the blockchain community" Wait. In the second half of the year, the project XMX launched by Yuhong was broken after it was on the exchange, and it was also called “cutting leeks” and “swindlers”.

The mining machine is in short supply again.

The mining machine is in short supply again.

The leeks that buy the coins are in turmoil, and the retail investors who dig mines are also excavated.

Mine owner Kennen clearly remembers that since Bitcoin began to stand at $5,000 on April 2nd, his WeChat has been rumored to be friends with mines and mines.

"WeChat has been blown up, and all of them are asking about mining. They can’t come back. These investors are not afraid to hold hundreds of millions of traditional business executives and can buy mining machines for tens of thousands of units." Kennen told Odaily Planet Daily.

Stimulated by huge demand, the price of second-hand mining machines has risen since April. The ant mining machine Z11 has risen by 8,000 pieces (47% increase), and the old model mining machines such as Shenma Mining Machine M3 and Ant Mining Machine T9+ have been sold out, and the new generation of major mining machine manufacturers such as Jianan Zhizhi and Shenma Mining Machinery The mining machine order has been placed in October.

“The current situation seems to have returned to the second half of 2017, when the market demand for mining machines was three times the supply.” Steven Mosher is the head of global sales and marketing for Jianan Zhizhi told the media.

One night, the rush to snap up the futures mining machine is back.

Data from cryptocurrency data service company TonkengInsight shows that the price of coins has risen day after day, resulting in a significant reduction in the average return period of the new generation of mining machines. The average return period for mining equipment was about 120-280 days, but it has dropped to 60-150 days in the second quarter of 2019.

Profitable business, big and small funds do not want to miss. Since May, the mining industry has also entered the ranks of heavyweight players.

Fidelity, a large asset management company with a total of $2.4 trillion, announced that it will deploy bitcoin mining and related energy industries. Fundamental Labs, which invested in unicorns such as Coinbase, Jianan Zhizhi and Binance Coin, also launched a $44.5 million (about RMB 300 million) first-phase fund for computing power. In the future, the fund will also raise funds in batches with a total target size of US$150 million.

If half of Fundamental Labs' first-phase fund is used to purchase the S9 mining machine (at the time, the price is around 1,500 yuan), 100,000 units can be purchased, which is equivalent to nearly 3% of the current total network computing power.

With the arrival of new mining machines and a large amount of low-cost electricity supplied during the wet season, Bitcoin network computing power has broken through the highest level in history. According to data from BTC.com, the 14-day Bitcoin flat network has fallen to 36 million TH/s since the last year's decline in currency prices, compared with 65 million in the most recent day (June 25). TH/s, within a few months, bitcoin computing power rose by 80%, equivalent to the new shelves of about 2 million mining machines.

Blockchain entrepreneurial passion recovery

Blockchain entrepreneurial passion recovery

The leek is gaining momentum, the big shouts are shouting, and the entrepreneurs are doing the game.

“Prepare to put the project online before the bull market.” Zhang Qing told the Odaily Planet Daily.

After the withdrawal of the Internet project in early 2018, Zhang Qing began to slap the “advertising + blockchain project”. After the project white paper is ready, the blockchain industry in 2018 has turned sharply. “The industry has entered a bear market. After two months, it has entered the second half of the bear market.” Capital and token funds are “escaped”. He and the team are in the hope of financing. Turned back to the classical Internet company.

However, in April of this year, the price of the currency has once again revived Zhang Qing’s entrepreneurial passion. He resigned from the Internet company and re-finished opportunities in the currency circle. In the process, he also pulled Apan, a friend who had previously left his job at a token fund.

“I recently felt that the entrepreneurs’ spirits are different, and they have begun to have confidence in the industry.” Mandy, an entrepreneur who has worked hard in the industry since the last round of bull market, said, “I’m starting to believe now’ the market is always Give rewards to people who cross the bulls and bears."

This bull market is different?

This bull market is different?

"There will be no more than $10,000 in bitcoin in the future." This is the most exciting sigh in this round of market.

“I personally think that the price increase of BTC this time is different from that of the bull market at the end of 2017.” A foreign bitcoin believer wrote in his blog, “Now is a good time to buy BTC, we don’t I will see another BTC of 6,000, 8,000 or even less than $10,000."

Such remarks are sensational, but now they are overwhelming. Many people believe that this bull market is not the same as before.

The first is the amount of funds.

The important reason for the last round of bull market was the myth created by ICO, which attracted more people into the field of cryptocurrency, and new incremental (individual) funds were admitted. This time, many commentators believe that the rise in bitcoin is supported by institutions, which means that the rise in bitcoin will be more stable and lasting.

Second is the backing of value support.

At present, only BTC has returned to the bull market, and other cryptocurrencies have not performed well. Behind the BTC's rise, it reflects the degree of interest in different currencies. As an asset or means of payment, BTC is gradually being supported by large financial institutions. Even mainstream foreign media believe that this bitcoin is worthy of support.

According to a survey conducted by Kaspersky Labs in February 2019, about 13% of people use cryptocurrency as a payment method. Coinmap data also shows that since December 2013, the number of companies receiving bitcoin worldwide has increased by 702%.

Matt Greenspan, eToro senior analyst, said, “The market has matured since the last time Bitcoin broke $10,000. Given the current level of adoption, this wave is more reasonable.”

Some analysts believe that the geopolitical turmoil has further strengthened the status of Bitcoin digital gold.

“Financial institutions and individuals have lost confidence in the currency, such as the US dollar, in an attempt to find a safe haven to store their funds. The traditional choice is precious metals such as gold, but in the past two years Bitcoin has slowly entered the public's view. Although it has a larger Volatility, but still seen as a safe and reliable means of value storage," said Bitcoin believer Lucien Lecarme.

Data from coin.dance shows that the weekly bitcoin trading volume in Argentina continues to rise, reaching a record high. This trend is not surprising in countries like Venezuela, which are all in the same hyperinflationary situation. More need to encrypt the currency to achieve value storage. Logically speaking, as the number of these people increases, the mainstream society will gradually adopt cryptocurrency.

The most shocking technology industry is Facebook's currency.

The three things that happened this month directly and strongly brought the digital currency and its rise into the public eye, namely: Facebook issued Libra and "Bitcoin broke" on the hot search. This is all people who don't pay attention to the blockchain. As long as they read and read the newspaper, they will accidentally see the news.

Among them, the most shocking industry is Facebook's Libra. Edward Moya, chief market strategist at Oanda in New York, said the emergence of Libra validated the encryption space and pushed mainstream digital currencies to a higher level.

“The circle of friends and the Internet circle are all in the earthquake.” A BTG employee told the Odaily Planet Daily. "In fact, the biggest pain that day, I came out from the Internet. In the past, I spent two hours and three hours telling him what the blockchain is for? It didn't work. Facebook Libra came out and they all started going. Understanding the technical principles and understanding why this is done is very touching. Although Libra is only EOS+USDT, I think he is more likely to succeed."

“Facebook is the Internet giant, and this event will be another milestone in the blockchain world.” Wang Binsheng, a professor of postgraduate degree at the Chinese Academy of Social Sciences who has participated in many token business models and economic model design, believes.

An industry insider commented on Libra. "Libra's business can be said that the Internet industry or the traditional industry has been able to focus on the blockchain again in a year. And gradually everyone has a clear understanding: blockchain may It can't transform various traditional scenes, but it is absolutely capable of transforming traditional finance. But most of the previous projects were 'cottage army', which is far from mainstream finance. Now Facebook has built this block to achieve global value interconnection through blockchain. Let everyone be even higher. If global money can enter digital assets at a very low threshold, it will definitely be a change."

Finally, this time the market is also inseparable from the inherent design of BTC and its periodicity.

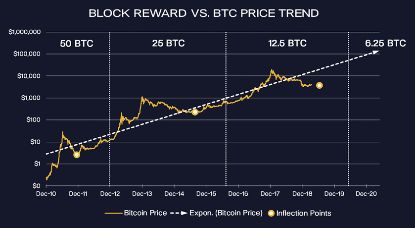

According to the Bitcoin white paper, Bitcoin halved mining revenue every four years, and the next halving is expected to be in mid-May 2020.

According to investment firm PanteraCapital, bitcoin prices have steadily increased in the months leading up to a halving of bitcoin rewards in 2012 and 2016, which is somewhat cyclical with an average period of 348 days. This means that Bitcoin ushered in a new round of market on June 10, 2019.

In the halving of the coming, in order to catch up with this wave of market, some institutions and individuals choose to purchase BTC in advance, which also promotes the rise in the price of the currency.

The dead cat rebound is still a real bull market, more importantly, it can hold

The dead cat rebound is still a real bull market, more importantly, it can hold

Grayscale Investments, the US crypto-investment giant, has made its home. Its published chart shows that grayscale purchased more than 11,000 BTCs in April 2019, accounting for about 21% of BTC's global monthly supply. “Institutional investors are FOMO (fear of missing) bitcoin.”

Today, Bitcoin has broken through 10,000, but OK research believes that the price has not stabilized in the “exciting” state, and it is expected to see explosive growth during the 4-6 months of volatility growth and long-term growth based on bitcoin prices. The trend, the comprehensive round of market demand amplification signal, this round of price peak is expected to hit a record high.

Naeem Aslam, chief market analyst at ThinkMarkets, also predicts that bitcoin will reach $60,000 to $100,000 in the next bull market. "The current price point to focus on is $20,000 and $50,000. In addition, Naeem Aslam also pointed out that the Middle East Regional riots and even potential wars are the biggest drivers of diversified asset growth, including bitcoin. He also said that this bull market conservative estimate will push bitcoin prices to the highest point in history.

At the same time, some analysts have reminded to pay attention to risks. Bloomberg quoted Whitney Tilson, founder of Emire Financial Research, as saying that don't be fooled by this year's dead cat, and that the price will be much lower after one year.

OKex senior analyst Charles Cai believes that while holding cryptocurrencies, pay attention to callback risk.

“I once made a statistic on the big bull market that opened in 2015. At that time, the market rose for a period of 22 days to 220 days. The average value was about three months, and it appeared almost every time during the period. 30% of the callback," said Charles Cai.

However, compared to the conversion of the bulls and bears, it can be the king.

"Although HOLD (holding the coin) is the rich password, but there are only a handful of people who insist on making a vote." Wang Qi reflects.

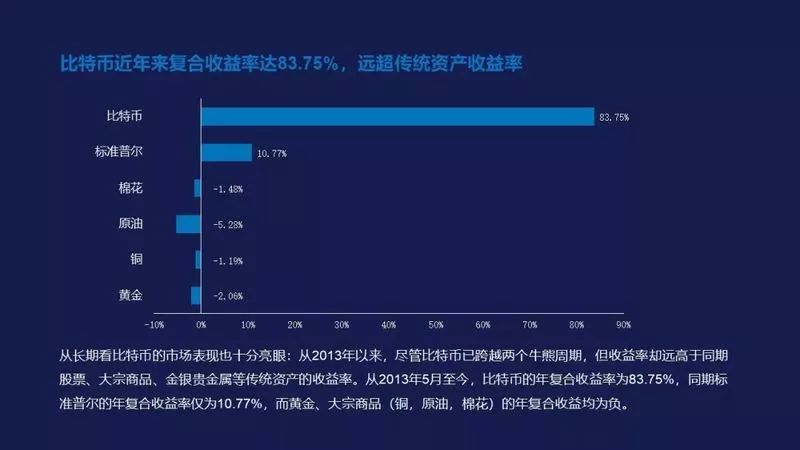

According to the OK Research report, Bitcoin's compound yield in recent years was 83.75%. But as the mining veteran Jiang Zaller said: "Although Bitcoin has risen so many times, how many people can succeed in low-selling and high-selling? It is very difficult to take the coin and successfully escape the top, so if you want to invest in Bitcoin You can build your own business on coins, such as mining, doing over-the-counter trading, etc., and you can't make money."

Text | Qin Xiaofeng Xue Yu

Produced | Odaily Planet Daily (ID: o-daily)

Original article; unauthorized reprinting is strictly prohibited, and violation of the law will be investigated.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Roller coaster market, Algorand really played a "funds disk"?

- Bitcoin hit $12,000, and this crazy situation is reminiscent of 2017…

- Fragile Libra Association: Regulators are eyeing, no one pays for nodes inside

- Anonymous Angrim Grin: Regaining Zhongben Cong Electronic Cash Dream

- Financial Watch | Bitcoin continues to skyrocket and speculative risk rises

- Is it worth looking forward to halving the Litecoin in August? One article says throughlite

- India’s regulation is counterproductive, with a local BTC premium of over $800