Thunder and heavy rain: Small Bakkt "Seeing the light dead"?

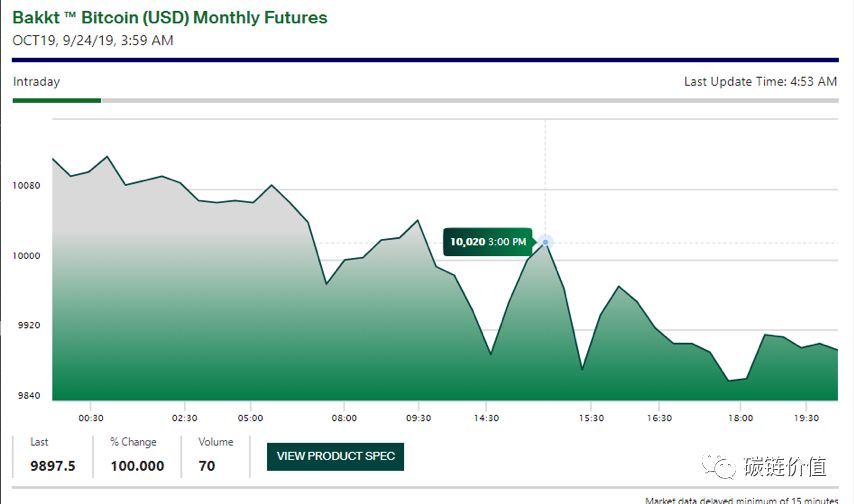

As of 5 am Beijing time on September 24, trading data on Bakkt | Source: Bakkt

01 less than expected market performance

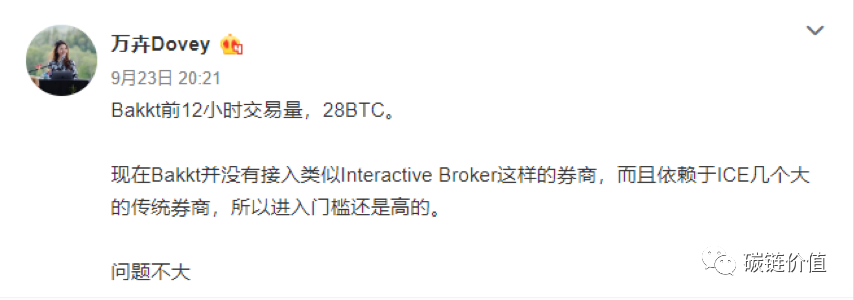

In this situation, some industry insiders have given an analysis, in which the issue of access is a common inspiration for everyone. Dovey Wan, founding partner of Primitive Ventures, publicly stated that Bakkt is temporarily more dependent on traditional large brokers such as ICE, and the entry barrier is still high;

- Bitcoin plunged 21% last night, or related to the US House of Representatives impeaching Trump

- Vitalik: Understanding the new universal zero-knowledge proof scheme PLONK

- The encryption market was battered, and Bitcoin plunged $1,000 an hour.

Qitao Capital is one of the first users to experience the use of Bakkt. The value of Kanglu's carbon chain from Qitao Capital indicates that the regulation of futures trading in the United States is relatively strict. On the one hand, both individual and institutional clients are required to face detailed KYC and AML processes; on the other hand, it is difficult for users to find mutual trust and reliable. FCM (futures agent):

Zhu Xiaochen, another person at Qitao Capital, explained that because large exchanges in the United States are not directly in contact with users, but are handled by specialized FCMs, FCM is licensed as a license to obtain institutions costing tens of millions of dollars. There is a distance from the average user, which makes the user have to go further and look for the Broker to link to the FCM and get to the big exchange.

This layered process naturally makes users face a lot of account opening resistance. Although it is already a senior user of CME Bitcoin futures, and successfully seized the trading qualification in Bakkt, Qitao Capital also took a long time to harvest. The above qualifications.

Another factor that has dominated the performance of Bakkt but has received little market attention is the incompleteness of liquidation. It is reported that as an important part of the futures market, the clearing institution is responsible for the hedging, settlement and settlement of futures contracts. It is the agent of both parties to the transaction and is obliged to guarantee the performance of each contract. From the current situation of the market, there are few large-scale clearing institutions that are willing to provide services for Bakkt.

The Wall Street Journal (hereinafter referred to as WSJ) reported recently that one of the potential problems facing Bakkt is that in the initial stage, only a small number of clearing institutions are willing to deal with their contracts. According to WSJ sources, Goldman Sachs, one of the largest clearing institutions in the futures market, has no plans to provide clearing services for Bakkt's contracts.

Since the clearing house is a necessary link for users to reach such futures products, such a large absence from Goldman Sachs means that users have to choose some smaller clearing institutions to complete the transaction.

The expression of Kanglu, due to the relatively immature initial stage of Bakkt's launch, coupled with the difficulty of understanding the bitcoin, the relatively complicated operation and the physical delivery, made the large-scale institutions clear the internal compliance costs of the company. Some small or specialized clearing companies are more likely to enter the market. This statement is consistent with WSJ's argument that a small company called Wedbush Securities plans to provide clearing services for Bakkt contracts.

According to Kanglu, the current market is on the whole, and it may take up to a year for Bakkt to form a scale. By then, it will be common for one or two Bakkt contracts and small clearing companies to be born.

Beyond the clearing house, Bakkt currently lacks the support of well-known large liquidity providers. In contrast, the CME Bitcoin futures contract, which has been on the line for nearly two years, has been supported by 13 institutions in this area, including many large companies in the blockchain industry such as Genesis Global Trading, Circle Financial and B2C2. Bakkt is temporarily lacking the support of an equivalent body, which may also be a barrier to the entry of large funds into Bakkt.

Just a large liquidity provider, CME bitcoin futures have won 13 support. If you count brokers and futures agents, this number will be close to 40, which is obviously a significant advantage over Bakkt | Source: CME official website

02 short-term impact is limited, long-term importance

It is always easy to overestimate the short-term effects of a change while ignoring its long-term effects. The performance of Bakkt after its launch is precisely a testimony that the market is too optimistic and overestimates its short-term impact.

After the education of the flat market performance in the early stage of the online game, I believe many people have realized that the short-term impact of Bakkt on the market is very limited. However, as an important infrastructure for the deep development of the encryption market, it is still a significant presence in the long run.

OKEx Principal Investigator William believes that in the long run, Bakkt can help solve the problem of traditional capital entry. Bakkt is currently licensed by the US Commodity Futures Trading Commission (CFTC), and its on-line futures products meet regulatory requirements, and only traditional products can have large-scale inflows of products that meet regulatory requirements.

In my opinion, the most important impact of Bakkt on the encryption market is two parts – miners and pricing standards:

Miners are the underlying components of many cryptocurrency systems led by Bitcoin. They determine the circulation of relevant cryptocurrencies in the market at the source, but at the same time they are also subject to enormous risks: cheap electricity, regulatory conditions that are difficult to obtain. Uncertainty, rapid update iterations of mining equipment, direct fluctuations in currency prices, and other factors have made the miners face potentially expensive costs.

The existence of a compliant bitcoin futures contract such as Bakkt provides miners with an opportunity to hedge the losses caused by the fall in bitcoin prices, just as many oil producers use futures to hedge crude oil prices. Fitzsimmons, CEO of Wedbush Securities, said that as an agent of CME Bitcoin futures, it has attracted more than a dozen customers to start trading, including hedge funds and bitcoin miners.

The value of the company's carbon chain indicates that Bakkt's current user base is mainly small and medium-sized compliance funds, high-net-worth and more professional industry investors, and some people in the professional futures industry who are curious about Bitcoin. If Bakkt can operate smoothly, the miners and large institutions will occupy a large share in the future.

If the miner is a dominant decisive link in this market, then the pricing standard is an invisible decisive link, and in a sense, the pricing standard is a more far-reaching component.

Gu Yanxi once wrote that the settlement price of CME's Bitcoin futures contract is based on the price index provided by the Facility Group, but because the exchanges involved are not in compliance, the credibility of the index is insufficient. In contrast, Bakkt's compliance nature and its product features will allow global financial businesses to rely on their settlement prices.

According to Kanglu, Bitcoin derivatives are of great significance for their spot transactions. Through the active trading mechanism of the derivatives market, the market liquidity will be improved, the enthusiasm of the participants will be promoted, the trading discourse power will be gradually enhanced, and a new trading pricing system will be formed, which will also help to enhance the transparency of over-the-counter trading.

He further pointed out that this can help boost the international market influence of the US dollar and deepen its influence and control over the overall market.

It is worth noting that although many people believe that the benefits of Bakkt physical delivery are to prevent market manipulation, OKEx Principal Investigator William said that in fact physical delivery can only prevent infinity, but still can't stop large-scale shorting.

“On the contrary, speculators have added a means of market manipulation, which is to “crowd out” short positions by means of spot “hoarding” before the delivery, thus raising the price of futures contracts. The real-time delivery of the futures market history often appears, the most famous of which is the 'Hunt Brothers Silver Manipulation Case'."

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- About Staking, which exploded in 2019, you need to understand these eight points.

- Blockchain and the traditional financial industry turtles race, who can win?

- Getting started with blockchain | Can Google's latest quantum computer crack bitcoin? Is the wallet safe?

- People who want to rely on Bakkt scams are really disappointed.

- The first domestic "Digital Currency Dictionary" was launched at the New Moganshan Conference, and the Babit Think Tank was the main editor.

- One-quarter of the nodes are hosted by AWS, is Ethereum really decentralized?

- Fighting against the US SEC? The Kik app will be closed and its cryptocurrency subsidiary will be laid off