Tony Tao: Blockchain for ten years, from cryptography community to big country game

The following is a speech finishing, enjoy:

In 2009, the first block of Bitcoin was dug up and the history of the blockchain officially opened.

- Wuzhen·NEO founder Da Hongfei: The next generation of the Internet uses a hierarchical structure

- Wuzhen Hu Jie: Libra vs DCEP, one is a new bottle of new wine, and the other is a new bottle of old wine.

- Bella Fang: The exchange is at the top of the food chain. How can small and medium-sized projects seize this channel?

In 2019, the world's influential governments, such as the United States, China, and Germany, vigorously promoted the blockchain.

2009-2013

Awkward teenager

Wuling young gold city east, silver saddle white horse spring breeze

Protagonist: Bitcoin

Participant: Minority Geek

Keywords: encrypted digital currency

Application area: financial innovation

The root of the blockchain: Bitcoin

Even so, the participants are still niche geeks, and the discussion of Bitcoin is still spreading on a small scale. At this time, people have not separated the blockchain technology from Bitcoin. The keywords discussed in the community are mostly CryptoCurrency.

We can find that during this period, the community's application of blockchain technology and Bitcoin are highly overlapping, that is, currency. The crypto-digital currency community at the time was full of experimentation, romance, grassroots, geeks and even idealistic colors. In order to innovate the financial system at the time, the global blockchain of the Internet (where the blockchain is more suitable for Crypto) is brought together.

- In 2009, the Bitcoin Creation Zone was dug up by Nakamoto.

- Silk Road accepts Bitcoin as payment method in 2010

- MtGox, the first bitcoin exchange in 2010, started operations

- The emergence of LTC in 2011 using bitcoin open source code evolution

- The first ICO in 2013: Mastercoin appeared on bitcointalk

When we talk about blockchain technology and the future, we should not forget these root causes. We should thank the open source community, thank the pioneers, not the one-size-fits-all saying that "coins are bad, blockchain technology is good."

2014-2017

Fenghua Zhengmao

Jiangshan is so beautiful, attracting countless heroes

Leading role: Ethereum

Participant: Capital / Entrepreneur

Keywords: blockchain technology

Application area: general technology

Leading the protagonist of the great era: Ethereum

The reason why the protagonist of this period changed from Bitcoin to Ethereum was simple: Ethereum Turing's complete smart contract directly extracted the "blockchain" attribute from bitcoin.

As a result, not only is the encrypted digital currency community using Ethereum to achieve the infinite possibilities of blockchains, but more importantly, everyone has found that the cost and threshold for researching and utilizing blockchains has plummeted. Financial institutions, research institutions and even governments have begun to join the blockchain research and pilot teams.

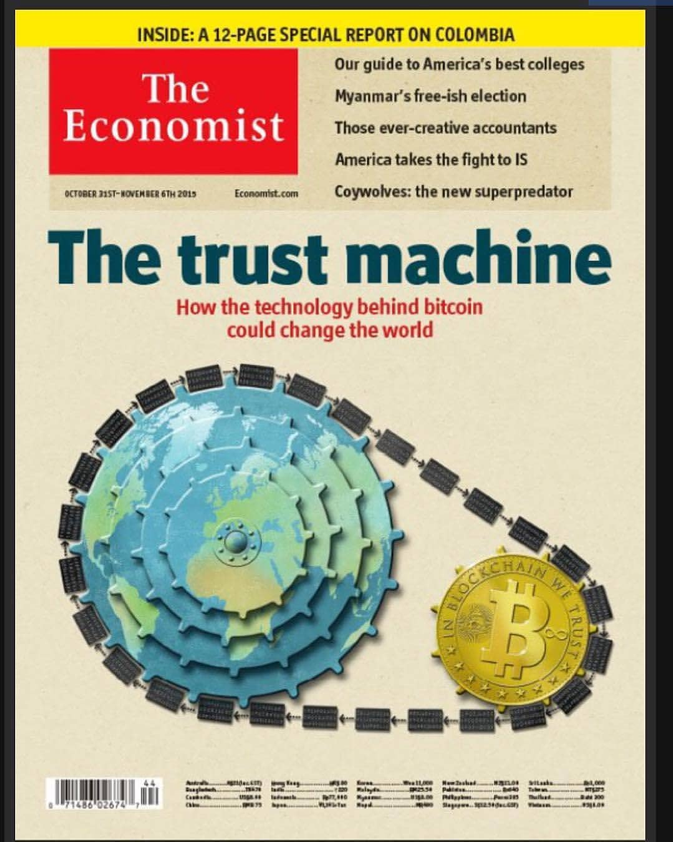

October 31, 2015 Economist cover article "The Machine of Trust"

The concept of blockchain has rapidly expanded from the financial sector to more. The global blockchain carnival has followed.

Now let's review this period, we can find that this is the typical Hype Curve peak stage: the irrational fanaticism caused by the over-pursuit of a new technology.

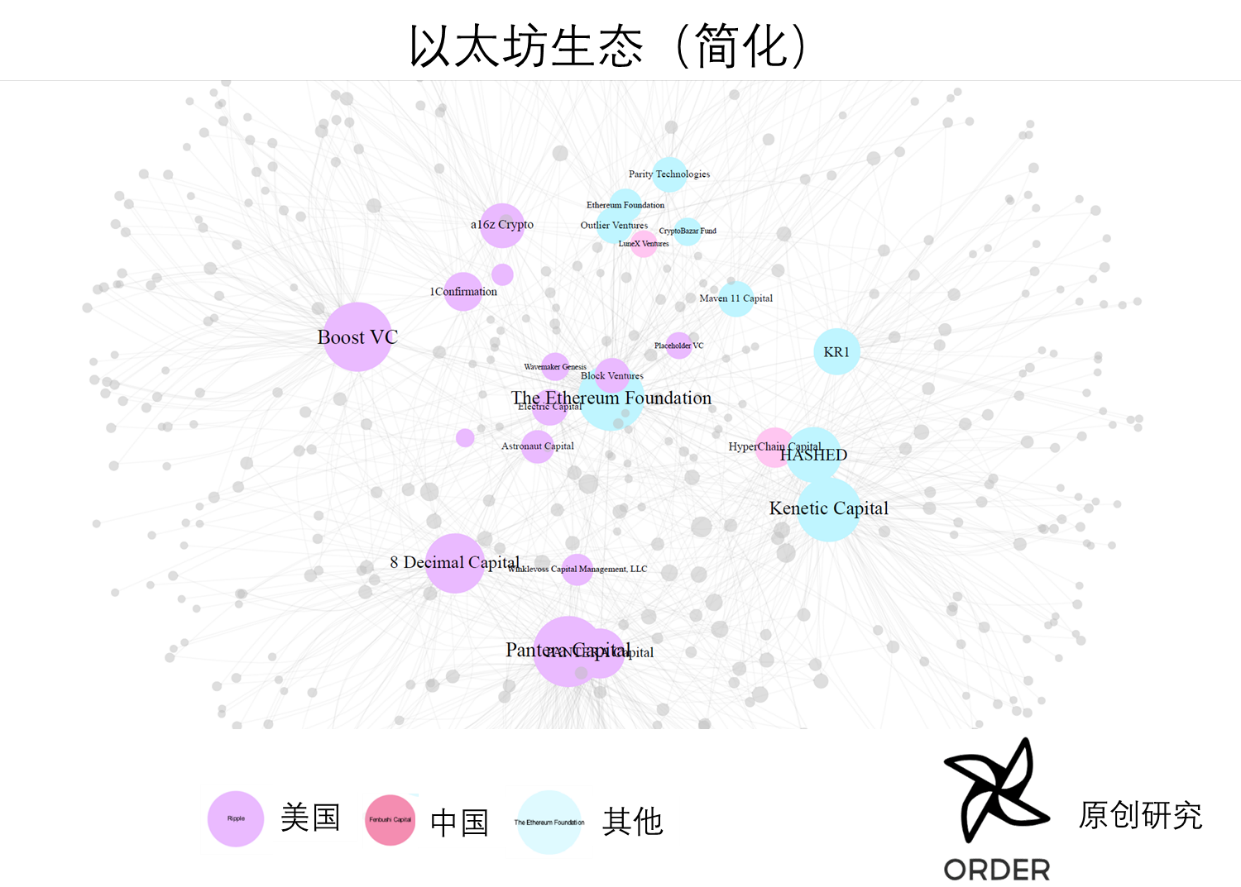

A network of knowledge maps dotted with Ethereum

- 2014 Ethereum ICO

- 2015 USDT appeared

- 2015 Ethereum online

- IBM launched HyperLedger in 2016

- In 2016, Vitalik proposed alliance chain and public chain

- The 2016 DAO project on the Ethereum was smashed after being highly launched.

- 2016 NEO (small ant) online

But there is one exception – USDT.

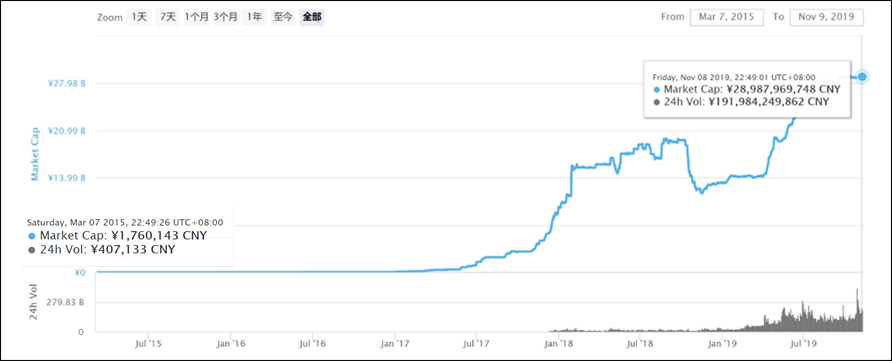

In fact, until now, the importance and impact of USDT on the blockchain world is still underestimated. According to CMC data, USDT has increased its market value by 16500 times since March 2015. As a comparison, Ethereum's market value growth is “only” less than 500 times. It can be said that since 14 years ago, the most acceptable way to reflect the acceptance of the blockchain financial market is the stable coin originator: USDT.

Even in the opaque operation, people are often criticized, and the social experiment of stabilizing the coin is successful, and this directly affects the later Libra.

2018 Capital is gone, supervision is coming Flowing water, spring, spring, heaven and earth

Protagonist: SEC

Rule maker: SEC 2019 new player When the wind and the waves break, there will be time when the clouds sail to the sea.

Leading role: Libra

Participant: Government / Large Enterprise

Keywords: stable currency

Application area: Back to finance

Libra that makes it difficult for everyone

From the mentality point of view, 18 years is the end of the past fanaticism, and in 19 years it blew the horn of the new era. Almost every practitioner has experienced the baptism of falling from heaven to the world in 18 years. Most speculators suddenly find that technology is good in the future. If there is no landing support, it is useless.

The tides receded, and the banknotes that blindfolded people suddenly fell, and the value of the project was good. It was true and false, and it was clear at a glance.

- STO is getting more and more attention in 2018

- Staking direction in the community in 2019

- DeFi developed rapidly in Ethereum in 2019

- In 2019, the mainstream exchanges’ compliance/licensing process was obvious

- BTC prices dominated by Coinbase in 2019

- 2019 Facebook launches digital currency project Libra

- The first SEC Reg A+ STO project was launched in 2019

- In 2019, China, the United States, and Germany promoted the development of blockchain from the national level.

This is because: SEC is coming.

Since 2018, equity financing has become more and more common, and people are waiting for the official supervision of the SEC. Finally in 2019, the first pass that met the SEC Reg A+ financing specification appeared: BlockStack. This represents the formalization of blockchain securities from the grassroots community to regulatory norms.

Speaking of the protagonist of 2019, non-Libra is none other than. Libra makes everyone feel overwhelmed: communities, governments, businesses and even Facebook itself, because:

- For the country and the government, Libra’s initial basket of currencies and node alliance strategies seem to challenge the authority of sovereign currencies;

- For big companies, Facebook does it, do it or not, how to do it;

- For the community, Libra threatens the original rules of the game and faces the danger of being marginalized;

- For Facebook itself, the use of blockchain technology for financialization attempts is not as simple as imagined. Libra-level finance is essentially a political choice rather than a commercial choice.

As a result, the blockchain discussion around the world has once again returned to finance itself – not that other areas of application are not important, simply because the national financial strategy is too important.

Libra has made countries aware that the blockchain does have the key to future global national-level financial competition.

Ten years summary

1. Open communities are the foundation for the development of blockchains.

During the development of this decade, the protagonists of the first eight years, "Bitcoin" and "Ethernet", came from the community. It can be said that if there is no open community, there is no blockchain today.

2. Finance is the most important application of the blockchain in the past decade.

The key word between Bitcoin, Ethereum, SEC and Libra is finance. The internationally recognized mainstream blockchain application direction is also finance. Although other application directions are also worth looking forward to, the most important blockchain application area is only one, that is, finance.

Beginning in 3.2018, the United States became the protagonist of blockchain and open finance.

The protagonists of Bitcoin and Ethereum in 2009-2017 will give way to SEC and Libra after entering 2018. The SEC has developed US securities regulations, and Libra is increasingly inclined to become the channel and tentacles of the US dollar in the future to open the financial world.

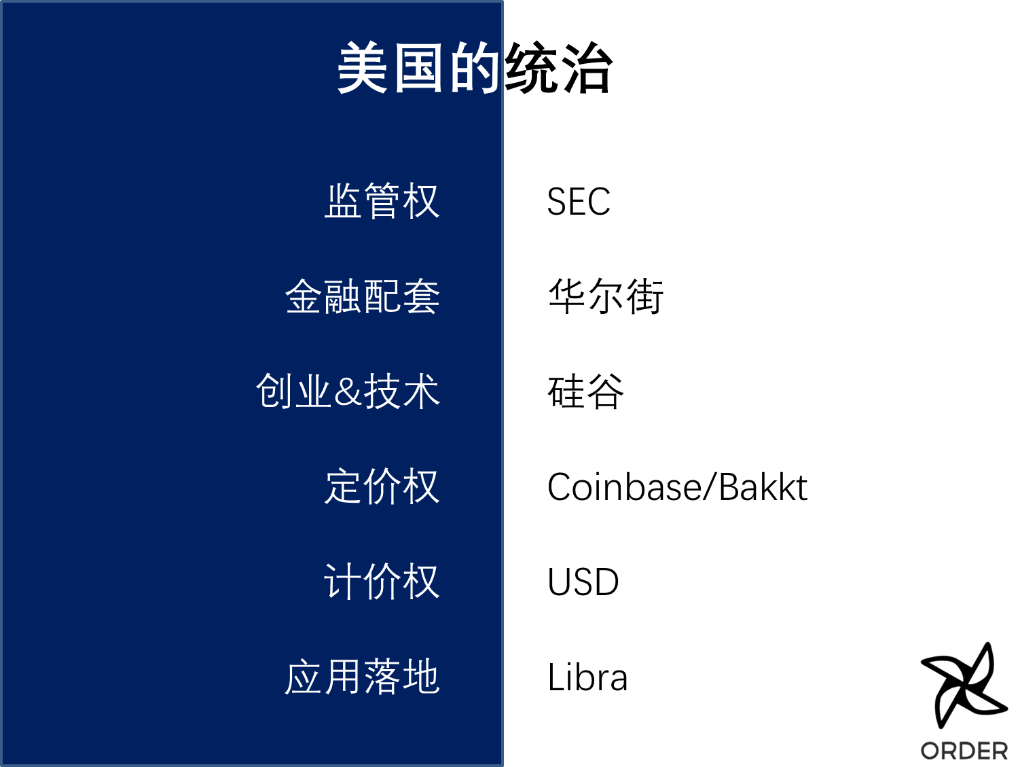

American rule

There is also the fact that the price of most blockchain passes, including Bitcoin and Ethereum, is denominated in US dollars – even within Huobi, the largest exchange in the country. This means that the hegemony of the dollar has spread to the domestic blockchain financial system through pricing power.

In contrast, China's past advantages in the blockchain sector include having the world's largest mine community, more than 60% of global blockchain technology patents, and the world's top three Huobi and Binance exchanges. It is a pity that the above three advantages gradually fade in the new era:

- The computing power embodied in the mining industry is in a secondary position in the blockchain, and it is increasingly impossible to determine the direction of industry development;

- A large number of patents require market verification and landing, especially in the blockchain industry, which is rooted in the concept of open source community. Therefore, Europe and the United States, as the source of the blockchain, do not pay attention to patents. On the contrary, the open source community speaks with code.

- As for the exchange, in addition to the above mentioned pricing power and the loss of pricing power, the more direct reason is the lack of domestic supervision.

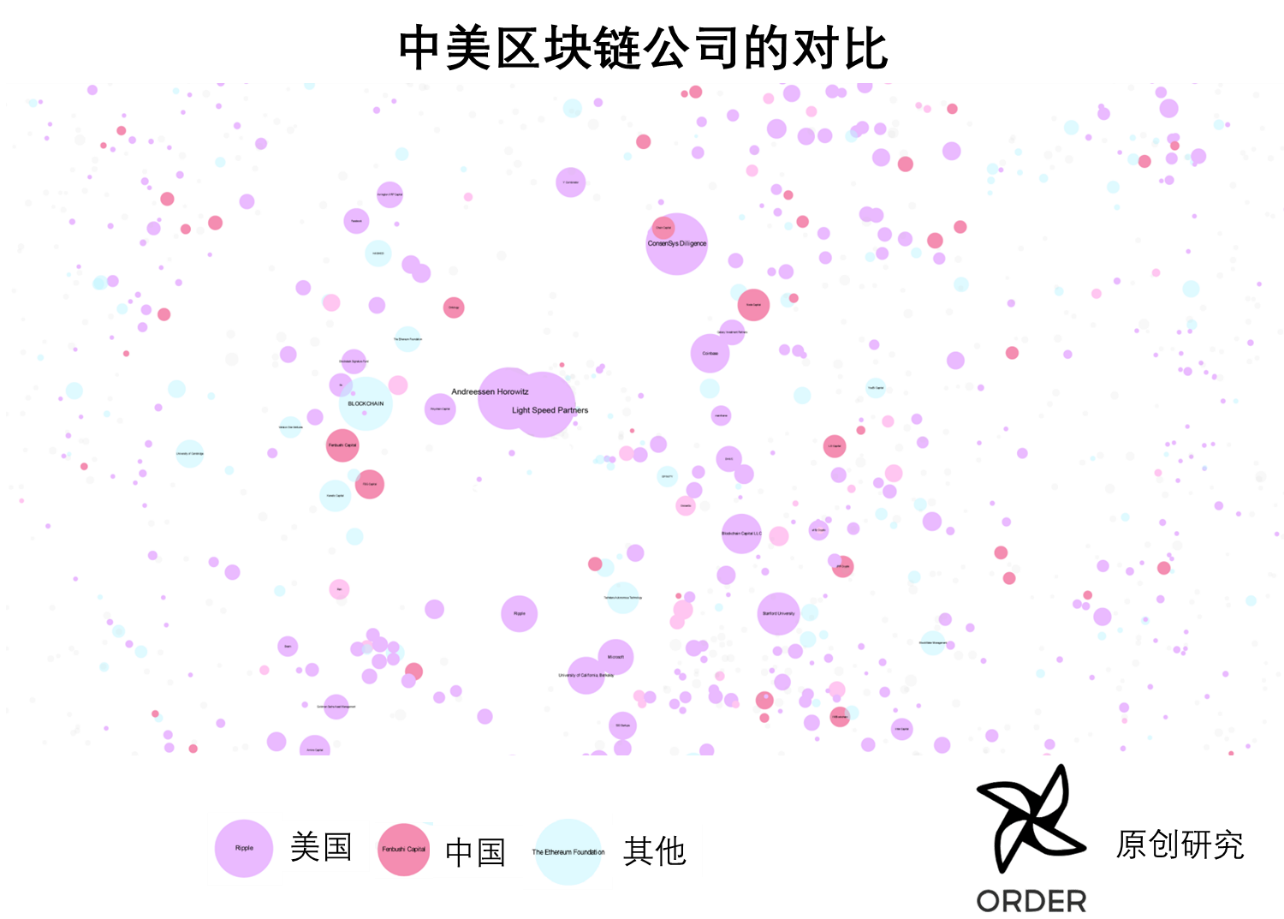

Comparison of blockchains between China and the United States in more fields

Let's take a look at the comparison of other aspects of the Sino-US blockchain. According to Crunchbase data, there are more than 1,300 blockchain companies in the United States and 230 in China. If this number is acceptable, then the next fact: Singapore’s registered blockchain companies surpass China, which will make many people different. .

The reason is very simple. Many domestic blockchain companies are afraid to register in China for policy reasons and can only be forced to go to Singapore. On the one hand, the openness and advancement of the Singapore government is amazing, on the other hand, I feel deeply regretted for the domestic blockchain entrepreneurial environment.

Second, the fund

The following are the top blockchain funds that we have used to score multiple dimensions. The top ten funds only distributed capital and NGC Ventures grabbed 1.5 positions for China. On the one hand, this is related to China's immature financial and capital fields. On the other hand, the previous policy environment has also led to such a result.

Taking BlockStack as a prototype of an open financial system, let's take a look at how this global system works.

Such financial industry operations are spontaneously formed. Ethereum, SEC, exchanges, brokerages, US dollars, bitcoins, and investment institutions all actively or passively participate in the division of labor, as if there is an invisible hand in coordination. It can be imagined that in the near future, with the promotion and recognition of countries around the world, the system of open finance will become more and more mature.

China's future advantage

Open finance is a game between the state and the state, and it can only be successful if it is valued at the national level. Among them, adopting a more comprehensive perspective and tools, such as graph network research and open financial world , is one of the effective means to gain advantage in this open financial game between countries.

As the world's first sovereign digital currency, DCEP has already demonstrated China's accumulation and execution in the field of open finance. In addition, as the leading country in the Internet era, the open source and openness of our Internet generation and blockchain communities also reflect their integration advantages.

Finally, I believe that people at the venue can work together to develop China's blockchain and open finance together.

Cycle series Millennium Hazard History | Cycle Observation New cycle? Four possibilities for Bitcoin in the future | Cycle observation Market, economy and cycle (top) | Cycle observation Market, economy and cycle (below) | Cycle observation

Ponzi Research Series

Penetrate Pony's fog and look for the dawn of value | Ponzi Research

I will take you to the development and life cycle of Ponzi schemes | Ponzi Research

Model currency principle analysis and prevention guide | Ponzi research

Written in the back

We create original content and translate the content into English for promotion to foreign communities. If you are interested in open finance, knowledge maps, graph data networks, and are willing to write articles, translate, or communicate with us, please contact our little assistant WeChat.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Wu Zhenqun, CEO of Wuzhen·Zhi block network: Formulate an equality mechanism to improve the high availability of blockchain and make everyone mine at home

- Wuzhen·Yuchain Technology and CEO Luo Wei: Distributed Commercial Infrastructure Based on Blockchain Trusted Data

- Wuzhen·Conflux CTO Wu Ming: Making the “impossible triangle” of the public chain possible

- Interview with Babbitt | Ant Blockchain Li Jieli: 2020 will become a year of concentrated alliance chains

- QKL123 and Babbitt officially released the "2019 Blockchain Value List White Paper"

- Wuzhen·blockchain security has been put on a new height, how to protect the security boundary?

- Wuzhen·“blockchain+game”: Why is the explosion application not going to happen?