Interpreting Arweave Atomic Assets and Its Ecosystem A New NFT Paradigm Paving the Way for Creators’ Migration

Understanding Arweave Atomic Assets and Its Ecosystem A New NFT Paradigm for Creators' Migration

Author: Kyle @ Contributor of PermaDAO

Reviewed by: MiddleX @ Contributor of PermaDAO

Introduction

On August 18, 2023, Sam (founder of Arweave) changed his Twitter profile picture, and many other core builders in the ecosystem followed suit. This series of actions has attracted widespread attention.

- Dark version of Friend.tech? A quick look at nofriend.tech, a social platform that converts friendship into rewards.

- What are the legal risks of NFT digital collectibles playing lottery?

- The Wonderful Use of Tokens in the Web3 Gaming Sector Incentivizing Community Engagement and Enhancing Network Effects

So what happened? Let me explain slowly.

The profile picture that everyone changed to is called Permaweb mfers, which is an atomic asset on Arweave. It was sold out within a few hours after being listed on the BazAR exchange.

Image description: Permaweb mfers Image source: https://bazar.arweave.dev/

From any perspective, Permaweb mfers has special significance in the Arweave ecosystem. It is not only the creator of the atomic asset listed on BazAR, but also an explorer of a series of innovative protocols.

Atomic assets can be seen as the native NFT standard in Arweave. By integrating the UCM and UDL protocols, atomic assets can fully unleash their potential, which is also a significant opportunity for Web3 creators.

For the new terms or concepts mentioned above, they may be unfamiliar to many people. Let’s be patient. Before deeply understanding these new concepts, the best way is to first get to know the “predecessor” in this field – ERC-721. By exploring the past and present of ERC-721, we can better understand atomic assets and discuss the opportunities for Web3 creators.

ERC-721 Pioneers the NFT Era

Undoubtedly, the most mainstream and widely used NFT standard at present is the pioneering ERC-721. ERC-721 was first introduced by the CryptoKitties project as an Ethereum improvement proposal in 2017, breaking the standardization era of ERC-20. Unlike ERC-20, ERC-721 tokens are non-fungible, each with unique attributes and value, bringing new possibilities to the fields of digital art, virtual real estate, and more. Subsequently, non-fungible tokens (NFTs) quickly emerged.

However, ERC-721 is not perfect and cannot meet the ever-changing needs. As the first NFT protocol standard, ERC-721 has relatively long transaction times and each transaction can only support 1 NFT. In this context, many new NFT standards have emerged, aiming to make up for the shortcomings of ERC-721 and explore and adapt to more application scenarios – whether it is the more flexible and low-cost ERC-1155 protocol or the EIP2615 protocol focused on leasing.

Ownership for Creators

For creators, the ERC-721 standard brings new opportunities and possibilities. By tokenizing their works into non-fungible tokens (NFTs), creators can have ownership over their digital assets while also ensuring their rights as creators.

In addition, the ERC-721 standard provides creators with new ways to monetize their content. Creators can directly generate income by selling their works on NFT markets. Furthermore, with the introduction of smart contracts, creators can earn a certain percentage of royalties when their works are resold. This automated royalty payment mechanism allows creators to continuously generate income from their works without relying on cumbersome traditional royalty processes.

However, although smart contracts bring transparency and fairness to royalty payments, there are still some issues within the NFT trading market. NFT trading platforms often adopt mandatory and inconsistent royalty distribution methods or have unfriendly policies, which restrict the potential and rights of creators. Fortunately, the Ethereum community and the community of creators have not stood idly by and have introduced some improved NFT protocol standards for royalties.

Royalty Protocols under ERC-721

“Under the current ERC-721 standard, royalties are actually just a business agreement and not enforceable on-chain.” – TechFlow Research

Below, we will focus on two representative standards – EIP-2981 and ERC-721C, both of which are improvements on the ERC-721 standard.

EIP-2981 is an innovative standard proposed in September 2020, aiming to address the issue of incompatible cross-platform royalty payments in the NFT field. In the past and present, different NFT markets often have unique royalty requirements, and creators and users must comply with the royalty settings of each market. The birth of EIP-2981 is to standardize the market by introducing a standardized royalty information retrieval mechanism, allowing every creator or holder of an NFT to receive royalties that meet their expectations in any market transaction. In addition, EIP-2981 supports various types of royalty arrangements, including fixed royalties, decaying royalties, and dynamic royalties.

ERC-721C was introduced by the game development studio Limit Break in May 2023, aiming to give NFT creators more control and customization capabilities over royalties. Based on the ERC-721C standard, creators can choose diverse royalty handling methods. They can choose royalty sharing, where only the minter receives royalties, conditional royalty payments, and royalty transfers. This diversity not only allows creators to better adapt to market changes but also brings more possibilities for creativity to the NFT ecosystem.

The introduction of EIP-2981 and ERC-721C brings royalty innovations and creator control to the NFT field. EIP-2981 standardizes the royalties in the NFT market, while ERC-721C empowers creators with more flexibility in handling royalties.

Mainstream Bottlenecks Represented by ERC-721

We cannot deny the powerful dominance and market coverage of ERC-721, but we cannot overlook its biggest existing problem: storage. In simple terms, ERC-721 only solves the problem of ownership and has never addressed the issue of storage.

The reasons for the bottleneck are also easy to understand. Ethereum has always been jokingly referred to as the “aristocratic chain,” characterized by high transaction fees and slow transaction speeds. For on-chain NFTs, in order to save costs, their asset data (such as images) is usually stored on third-party servers off the chain or temporarily stored on the chain. Therefore, NFT assets under the ERC-721 standard are at risk of asset data loss. In other words, digital assets under the ERC-721 standard do not fully belong to creators or holders.

However, Arweave provides a solution to the missing link in the ERC-721 standard.

Arweave has created the correct NFT

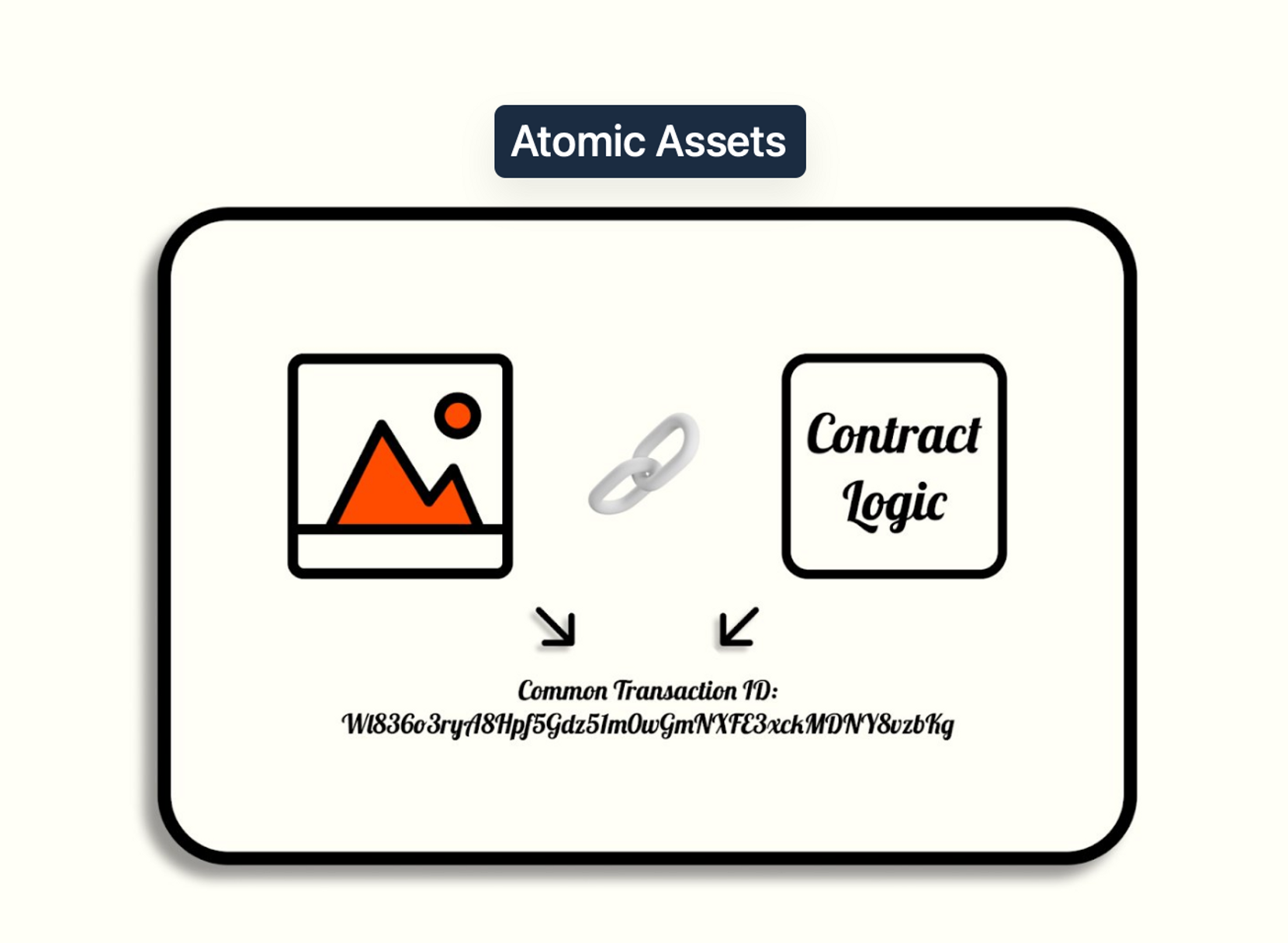

Quoting Sam, the founder of Arweave: “The atomic assets on Arweave are the correct NFTs, which not only represent the right to sell, but also true ownership of permanent digital content.”

Image description: Atomic assets image source: https://twitter.com/CommunityLabs/status/1678857765165363201?s=20

Atomic Assets

Atomic assets are a new on-chain data and NFT paradigm based on Arweave. It regards everything uploaded to Arweave as atomic assets, including images, videos, web pages, and applications. What makes atomic assets unique is that they achieve full on-chain data, making them common and easily identifiable digital assets within the Arweave ecosystem under the same Arweave transaction ID.

Differences between Atomic Assets and ERC-721

Atomic assets and ERC-721 have significant differences in essence. To better understand these differences, let us first recognize that NFTs usually consist of three parts: asset data, metadata, and smart contracts.

For the most popular ERC-721 standard, including EIP-2981 and ERC-721C mentioned earlier, they may have slight differences in functionality and implementation, but they are essentially the same—meaning their asset data, metadata, and smart contracts are separated. Smart contracts and metadata are stored on the blockchain, while asset data is stored off-chain, specifically on centralized third-party servers (usually AWS). This creates a problem where if the third-party server encounters issues, the asset data of the NFT, such as images, faces the risk of loss. Of course, there are also many NFT asset data stored on decentralized IPFS, but we need to recognize a problem: although IPFS is decentralized, it is still only a temporary storage solution from a storage perspective and still has the possibility of data loss.

The main differences between atomic assets and ERC-721 are reflected in three aspects:

- All data is stored on the chain. The unique feature of atomic assets is that their asset data, metadata, and contracts are all permanently stored on the Arweave network, bundled together in a single Arweave ID. Therefore, for atomic assets, the address of the smart contract is the address of the NFT data.

- Permanent storage. All data of atomic assets is permanently stored on the Arweave network, so there is no risk of losing NFT asset data and it can be accessed at any time.

- No storage capacity limit. Arweave has no limit on the amount of data that can be stored for atomic assets. This means that atomic assets can not only be common images, audios, and videos, but also applications or other larger data. This unlimited storage capacity opens up new possibilities for the tokenization of digital content.

Atomic assets go beyond that

When you delve deeper into atomic assets, you will be amazed.

Atomic assets can not only solve the ownership issues of digital assets for creators like the ERC-721 standard, but also ensure that all data is stored on the chain, permanently and without loss. Furthermore, when it comes to royalties, the applications of atomic assets in the Arweave ecosystem are sufficient to address the challenges faced by EIP-2981 and ERC-721C. By combining with the UDL protocol, atomic assets can also achieve customizable royalties and go beyond royalties. In addition, with the introduction of the UCM protocol, atomic assets can be traded, further unleashing their potential.

Image description: Universal Data License and Universal Content Marketplace Image Source: https://twitter.com/rakis_me/status/1688988561088057344?s=61&t=6eoc1cy89EKUZgbfvU2w_Q

UDL Protocol – The Extension of Rights for Atomic Assets

The Universal Data License (UDL) is one of the groundbreaking protocols in the Arweave ecosystem in 2023, which allows creators to set personalized usage terms for the content they upload to Arweave. Simply put, UDL not only allows creators to monetize their content, but also enables them to customize their content usage rights flexibly.

The operation mechanism of UDL is very ingenious. Through predefined tags, creators can programmatically define license terms and attach these tags to the uploaded content as “licenses”.

These tags cover many aspects, including:

- Whether adaptation and derivative works are allowed (setting revenue shares, attribution, indicating the source content);

- Whether commercial use is allowed (one-time fee, monthly fee);

- Which currency to pay with ($U or $AR, defaulting to $U);

- The duration of the license (any number of years, with different income ratios for different durations);

- Payment methods (random payments, proportional payments);

- Receipt addresses (can specify one or more addresses).

Of course, it is also good news for developers in the Arweave ecosystem. UDL clarifies the rules for data usage, allowing developers to select and use data that may be needed or suitable for their applications without permission.

UCM Protocol – Connecting Atomic Assets with Exchanges

Universal Content Marketplace (UCM) is another groundbreaking protocol after UDL, which is equivalent to Arweave’s on-chain order book contract, allowing atomic assets to be traded on Permaweb without trust. Unlike traditional NFT markets, UCM is not limited to specific types of assets, but can also trade papers, domains, components, and even applications. This is the special feature of Permaweb.

UCM not only creates a decentralized and secure transaction environment for creators and users but also provides developers with broad development space. Anyone with programming knowledge can build a frontend UI based on the UCM protocol, which means that anyone has the opportunity to create their own atomic asset exchange, further promoting the circulation of digital content. BazAR mentioned earlier is the first atomic asset exchange built on the UCM protocol.

UCM also introduces its native token – $PIXL, which is used to incentivize those who purchase atomic assets on the UCM marketplace. According to the token’s incentive mechanism, the daily $PIXL rewards are allocated based on the weight of consecutive purchase days, the more consecutive days of purchase, the more $PIXL can be obtained.

The Atomic Asset Ecosystem around BazAR

BazAR is a decentralized atomic asset exchange built on Permaweb. As the frontend interface of the UCM protocol, BazAR provides an intuitive and user-friendly platform for buying and selling various types of atomic assets, including images, videos, audios, web pages, and applications.

The unique significance of BazAR is that it is the first atomic asset exchange built on the UCM protocol. All atomic assets on BazAR can choose to attach UDL protocol tags, which not only make the management of atomic assets more flexible but also bring more choices and opportunities for creators, developers, users, and other stakeholders.

$U – Liquidity Token

$U token is not the abbreviation for USDT, it is a token based on Smartweave and circulates only within Permaweb, aiming to stimulate the vitality of Permaweb and its ecosystem.

Currently, $U is mainly used to pay for storage fees and more projects in the ecosystem support its usage. However, for users of BazAR, $U is also the only payment method for purchasing atomic assets.

There are many ways for users to obtain $U, for example:

- Using AR token to pay for storage fees can earn $U at a 1:1 ratio;

- Users can also obtain $U through trading on the decentralized exchange Permaswap;

- Users can visit https://getu.arweave.dev/#/burn/ and directly obtain $U by burning AR tokens (i.e., sending AR tokens to the Arweave Donation Fund to mint $U).

STAMP – Reputation System

Stamp is a content curation protocol built on Arweave. It allows users to “STAMP” content on the Permaweb, similar to clicking the “Like” button on social media.

BazAR has integrated the Stamp protocol and embedded the STAMP button. Users can “STAMP” their favorite atomic assets in BazAR, and both the user and the creator can receive $STAMP tokens. The token incentive mechanism of the Stamp protocol can motivate user interaction and increase the enthusiasm of creators.

In addition, each STAMP is authentic and valuable because each address needs to verify its human identity through the Vouch Twitter service before “STAMP” is applied. As a result, the Stamp protocol establishes a trustworthy reputation system for BazAR, helping users filter optimized content.

Universal Commenting Protocol – Freedom of Expression

The Universal Commenting Protocol allows anyone to interact with content on Arweave, currently only supporting commenting. The protocol fills the gap for commenting functionality on the Permaweb.

Now BazAR Exchange has integrated the Universal Commenting Protocol, allowing anyone to comment on atomic assets on BazAR. The Universal Commenting Protocol can record the history of each atomic asset, giving it additional cultural and historical value. In addition, the comments left on atomic assets can provide valuable information for collectors and better decision-making for future buyers.

Conclusion: Arweave is Cultivating a Fertile Ground for Creators

Arweave has long been known as the infrastructure for permanent storage, but what many people don’t know is that its application scenarios have already surpassed the conventional impression of simple storage and can host a rich ecosystem like a public chain. On Arweave, not only can applications be built, but NFTs can also be minted and traded.

Arweave’s atomic assets, as a new NFT paradigm, effectively address the shortcomings of the ERC-721 protocol and ensure true ownership for creators. In addition, atomic assets, through the combination with UDL and UCM protocols, have more flexible and diverse functions. Specifically, the atomic asset exchange BazAR provides a trading market for atomic assets and introduces $U payment tokens, the Stamp protocol, and the Universal Commenting Protocol, building a complete atomic asset ecosystem.

Web3 should not only consist of ERC-721 and its improved protocols. We are delighted to see that Arweave’s atomic assets bring innovation and possibilities to the NFT field. At the same time, the atomic asset ecosystem built by Arweave allows creators to obtain more rights from the real world in the virtual world. This time, Arweave is telling a grander narrative, paving the way for the migration of future creators.

References:

- NFT Protocol Overview: Standard Protocol, Liquidity Protocol, and Cross-Chain Protocol

- [Web3 Exploration] Evolution of NFT Standards: ERC-721 and ERC-1155

- Why is the activation of EIP-2981 crucial for NFT creators?

- Analysis of the current three popular Ethereum standards: EIP-6969, ERC-721C, and ERC-6551

- Atomic NFTs with Warp Contracts

- Introducing the Universal DataLicense

- Twitter rakis_me

- Twitter fwdresearch

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- TaxDAO Writes to the U.S. Senate Finance Committee Addressing the 9 Key Issues of Digital Asset Taxation

- Connext has made another mistake? Learn about the Connext airdrop claim incident in one article.

- The roller coaster trend behind Cyber explosive long liquidation, short selling, and a carefully planned hunting game by market makers.

- Revisiting EIP-1559 Is Ethereum safer two years after the proposal has been implemented?

- Asset management giant Fidelity report Where does the value of ETH come from? How to conduct valuation?

- X’s encryption business first obtains permission, Musk may bring new variables to the cryptocurrency world.

- LianGuai Daily | Arbitrum plans to allocate 75 million ARB tokens as rewards to the ecosystem protocols; DYDX tokens will migrate to dYdX Chain as its L1 token.