Asset management giant Fidelity report Where does the value of ETH come from? How to conduct valuation?

Fidelity reports on the value and valuation of ETH.

Author: Fidelity Digital Assets

Translation: WEEX Exchange

While users gain technical utility from the Ethereum network by accessing various applications within its ecosystem, one might ask, “How is utility converted into the value of ETH tokens?” In other words, why should investors purchase and hold ETH instead of merely using it to interact with the Ethereum network? This article will delve into this question, including some technical aspects related to various investment themes.

- X’s encryption business first obtains permission, Musk may bring new variables to the cryptocurrency world.

- LianGuai Daily | Arbitrum plans to allocate 75 million ARB tokens as rewards to the ecosystem protocols; DYDX tokens will migrate to dYdX Chain as its L1 token.

- OG Protocol Betrays Ethereum? MakerDAO Builds New Chain, Good or Bad?

This article mainly discusses:

- The best way to understand Ethereum is as a technological platform that uses ETH as a means of payment.

- The perceived value of Ethereum is related to network use cases and supply-demand dynamics, which have changed since The Merge.

- The overall platform usage of Ethereum may transfer value to token holders, resulting in the appreciation of ETH tokens.

- One investment theme for holding ETH is to consider it as an emerging form of currency, similar to Bitcoin.

- However, it seems unlikely that any other digital asset will surpass Bitcoin as a monetary good, as Bitcoin has its own characteristics and network effects.

- That being said, value is subjective and does not imply that other competing forms of currency, such as ETH, cannot exist, especially in specific markets, use cases, and communities.

- We examine the capabilities of ETH as a medium of exchange for two main functions: a store of value and a means of payment.

- Ethereum is still not perfect and is expected to undergo upgrades every year, which brings recurring technical risks and unknown factors that dampen its prospects as a store of value asset.

- While ETH is used for various payment purposes, unstable fees remain a barrier to widespread adoption.

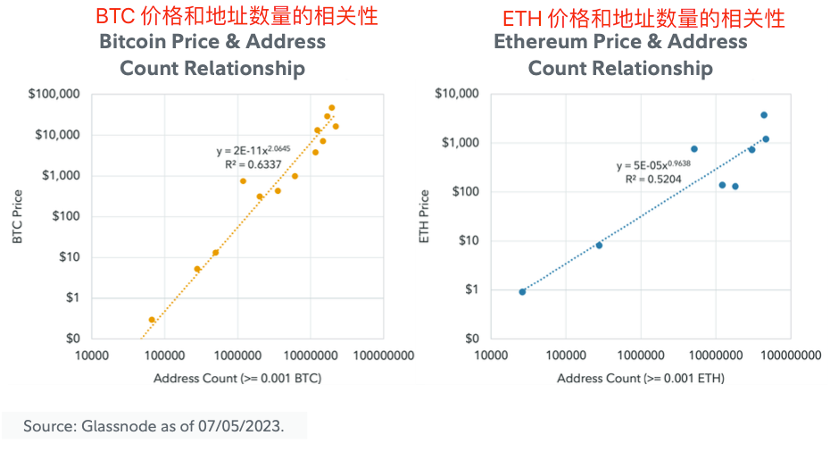

- We examined the demand-side model of ETH and found that the correlation between ETH address growth and price is not significant compared to BTC.

- Ethereum is now transitioning to PoS, allowing token holders to earn rewards, some of which come from increasing network use cases; we studied where these rewards come from and what various driving factors and risks are.

- As an income-generating asset, the value of ETH can be tested using a discounted cash flow model; we constructed a simple model to illustrate the assumptions driving this model.

Ethereum vs. Ether

There is a certain relationship between a digital asset network and its native token, but the “success” of the two is not always completely correlated. In some cases, a network can provide utility to users, settling a significant number of complex transactions daily, but may not bring much value to its native token holders. Other networks may have a stronger connection between network usage and token value.

One commonly used term for describing the relationship between network design and token value is Tokenomics. Tokenomics is short for Token Economics, which explains how the design of a network or application creates economic value for token holders.

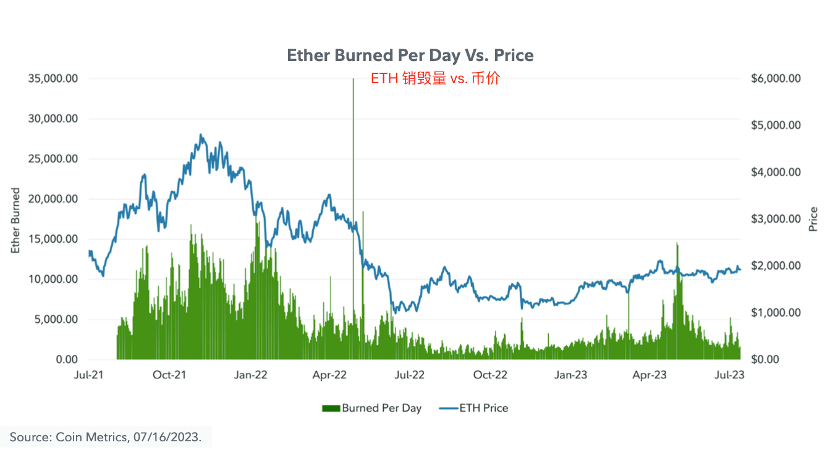

The Ethereum network has undergone significant changes in the past few years, impacting its tokenomics. The introduction of burning a portion of transaction fees (base fees) was implemented in August 2021 through Ethereum Improvement Proposal 1559 (EIP 1559). Burning ETH is equivalent to destroying it, so executing transactions on Ethereum will cause some ETH to be taken out of circulation.

In addition, the transition from Proof of Work (PoW) to Proof of Stake (PoS) in September 2022 reduced the issuance rate of ETH tokens and introduced staking, which allows entities to earn rewards in the form of tips, issuance, and Maximum Extractable Value (MEV). The previous upgrades to Ethereum fundamentally changed the tokenomics of ETH and altered people’s perception of the relationship between the Ethereum network and ETH tokens.

Tokenomics: How ETH Accumulates Value

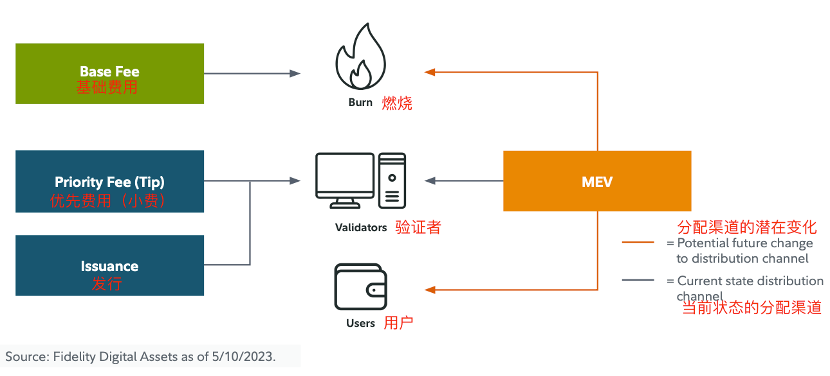

ETH’s tokenomics consists of three functions, where use cases translate into value. When transacting on Ethereum, all users pay base fees, priority fees, and may generate additional value for other participants through MEV. MEV refers to the maximum value validators can extract from user transactions by adding/excluding transactions or changing the transaction order in blocks during the block creation process.

The base fees paid in ETH are destroyed when adding a block (transaction packaging), thereby reducing the supply of ETH. Priority fees are paid to validators, individuals or entities responsible for updating the public ledger and maintaining consensus. When creating a new block, validators have an incentive to include transactions with the highest priority as it may be their primary way of earning income. Lastly, potential MEV opportunities (usually arbitrage) are provided by different users and most of the value is transferred to validators through the competitive MEV market in the current state.

The mechanisms for value accumulation can be viewed as different uses of network “revenue.” Firstly, the destroyed base fees contribute to the overall supply tightening, benefiting existing token holders. Secondly, priority fees and MEV come from users and are allocated to validators who provide the service. Although the relationship between them is non-linear, increasing platform use cases is equivalent to increasing burning and increasing validators’ revenue.

Investment Theme 1: Aspiring Currency

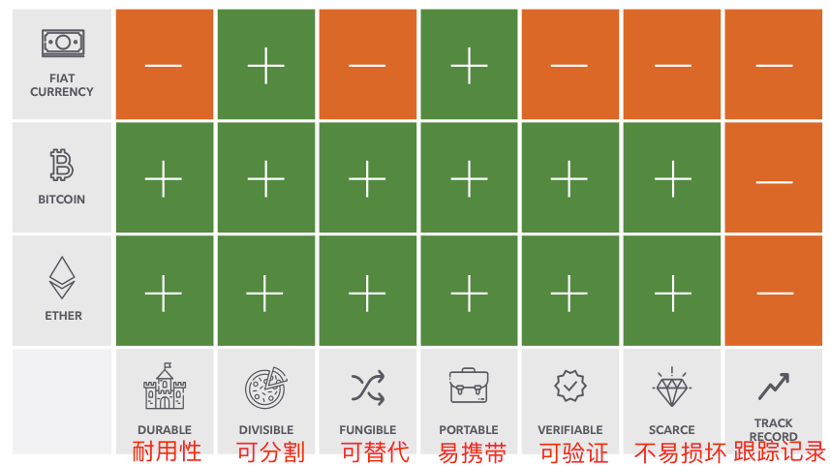

A common narrative theory suggests that the best way to understand Bitcoin is as an emerging monetary commodity, which sparked discussions on whether ETH tokens can also be considered as currency. The short answer is yes, some people may think so; however, ETH, as a currency, may face more resistance to widespread acceptance compared to BTC.

ETH has many currency attributes similar to Bitcoin and other tokens; however, its difference from Bitcoin lies in scarcity and historical records. ETH has an infinite supply parameter technically, which is maintained within a certain range based on validators and burn quantity. Although these parameters are strictly enforced by the network, they do not equate to a fixed supply plan and may fluctuate in unexpected directions.

Due to Ethereum’s network upgrades that occur approximately every year, new code takes time to update and review, and more importantly, it requires developers’ attention to rebuild its performance history.

Any other digital asset seems unlikely to surpass Bitcoin as a monetary commodity, as Bitcoin is considered by some as the safest, most decentralized, and soundest cryptocurrency to date, and any “surpassing” would require careful consideration. Although network effects are crucial in the blockchain ecosystem, Bitcoin holds the optimal position as a monetary commodity in this regard. However, this does not mean that other forms of competing currencies cannot exist, especially targeting different markets, use cases, and communities.

More specifically, Ethereum has alternative use cases that Bitcoin lacks, such as facilitating more complex transactions, which leads people to contemplate whether ETH has a unique purpose similar to Bitcoin. While ETH, like Bitcoin, is typically transferred between addresses to transmit value, its additional role as a currency for executing smart contract logic is its true differentiation.

Transactions of everyday goods have not yet significantly taken place on Ethereum, but the physical and digital worlds seem to be merging. As we see from leading tech companies, applications that provide unique services to users drive network effects and demand. By default, mainstream applications used on Ethereum will result in demand for ETH, which is one of the most notable reasons for this long-term trend that ETH may be an aspiring alternative currency.

In fact, Ethereum has already seen some notable integration in the physical world and traditional financial sectors:

- MakerDAO purchased $500 million in government bonds.

- The first real estate sale on Ethereum was completed in the form of an NFT.

- A European investment bank issued bonds on the blockchain.

- Franklin Templeton’s money market fund uses Ethereum and the Polygon network to process transactions and record ownership.

The fusion of the Ethereum ecosystem and real-world assets has already begun. However, it may still require several years of improvements, clear regulations, education, and a test of time before the general public starts transacting on Ethereum or competitive platforms. Until then, ETH may still be a niche form of currency.

Among the many challenges, regulation is the most controversial topic when it comes to shaping the future of Ethereum. Although Ethereum is a global permissionless blockchain, many of the largest centralized exchanges that hold and stake Ethereum funds are based in the United States. This means that any guidelines issued by the United States targeting validators or investors could have a significant impact on the valuation and network health of Ethereum. With recent regulatory enforcement actions in the United States and the shutdown of cryptocurrency-related banking services and Kraken’s staking service, regulatory risk has become one of the biggest obstacles Ethereum may face in the near future.

Below, we will explore ETH from the perspective of its two main functions as a currency:

ETH as a Store of Value

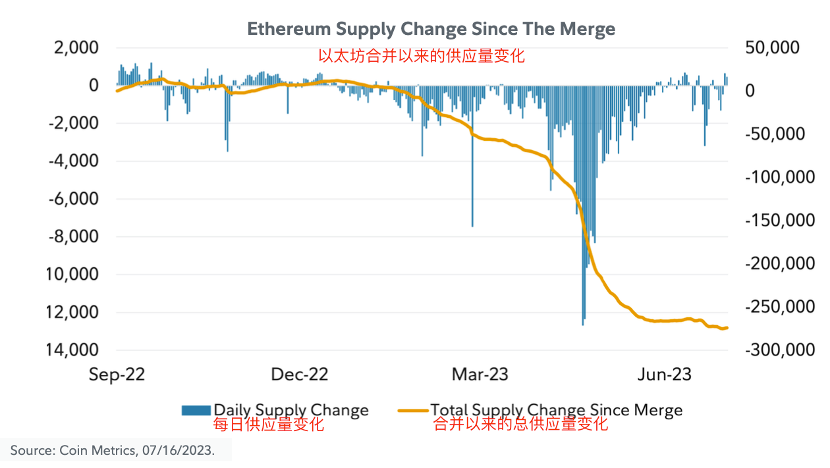

For something to be a good store of value, it must be scarce or have a high stock-to-flow ratio. As of July 2023, Ethereum’s stock-to-flow ratio is higher than Bitcoin’s. This dynamic has attracted attention since the merger, significantly reducing the issuance of ETH, as shown below.

One of Bitcoin’s core value propositions is its maximum fixed supply of 21 million coins, and the supply schedule is unlikely to change. Bitcoin’s supply schedule is programmed into the code and enforced through social consensus and incentivization of network participants. But what supports the scarcity and supply schedule of ETH? From the chart above, it can be seen that ETH issuance is not like a strict schedule but more like a balancing process between a set of predefined parameters. In fact, there are two variables that determine the total supply of ETH, which makes it difficult to evaluate future supply:

First is issuance: Issuance is determined by the number of active validators and their performance. One important trend of this model is that as the total amount of ETH staked increases, the total issuance of ETH will also increase, but the issuance rate will decrease. Since ETH issuance is related to the number of staked ETH, part of the formula is not easily subject to drastic fluctuations. The Ethereum protocol sets limits on the number of validators that can enter and exit staking, aiming to support the security of the protocol and maintain a stable issuance rate over time.

Second is burning: Burning is determined by the demand for block space, as computational resources for block space are limited, with a new block being produced every 12 seconds. Burning has high volatility, making it difficult to predict the exact future supply of ETH.

Destroying is like an incentive pendulum, with few similarities between blocks. The protocol specifies the target gas fee that each block should include. If the gas fee of a block is higher or lower than the target, it will cause the base fee of the next block to be adjusted accordingly. This adjustment is non-linear and can result in a sharp increase in transaction fees when the network is highly active. It also serves as a security mechanism, making it uneconomical for malicious actors to periodically send spam to the network.

Ultimately, the supply of ETH is not based on a fixed schedule. The two components of ETH’s monetary policy may continue to change. The current mechanism ensures that the total supply of ETH inflates by a maximum of approximately 1.5% per year. This assumes that 100% of the current supply is staked and not destroyed, meaning that no transactions occur on Ethereum. As shown in the graph, maintaining the issuance of ETH or keeping inflation low does not require increasing destruction. In fact, increasing destruction typically leads to net deflation or a decrease in total supply.

It has been pointed out that the future supply of ETH is related to the number of active validators (issuance) and transaction execution demand (destruction), with the latter being relatively unpredictable in the long term. Upgrades to Ethereum could directly impact the destruction or issuance at the base layer, adding to the uncertainty of supply dynamics. For example, the Shanghai/Capella upgrade reduces staking risk and may increase total issuance due to higher staking participation. On the other hand, improvements in data availability (increased transaction throughput) and the maturity of layer 2 platforms could change the supply-demand dynamics of destruction in unpredictable ways and further disrupt the future supply of ETH.

In addition, competitive L1 networks are independent blockchains with their own native tokens responsible for completing transactions but do not have the same iteration and development time as Ethereum. As dApps develop and integrate with other blockchains, investors should be aware that this could drive user growth. For certain use cases, such as NFTs or gaming, users may not require the decentralization and security provided by the Ethereum base layer.

If users are willing to sacrifice decentralization or security, the trilemma of blockchain, in order to prioritize scalability at the L1 layer, some user value may be generated outside of Ethereum. Since the economy of smart contract platforms can be multi-chain in any case, investors should consider which use cases Ethereum will retain in the long term and where other use cases will occur.

Another obvious difference and key distinction between ETH and other store of value assets is the possibility of future supply plan upgrades. In the latest version, developers have noted the Endgame EIP 1559 and MEV Burn. These roadmap components clearly indicate that the way destruction affects supply is about to change, but it is not yet certain what the change will be. Whatever the result of these changes, it forms a sharp contrast to Bitcoin’s value proposition, as Bitcoin claims that its fixed supply plan will not change for a long time in the future.

In summary, although Ethereum’s narrative of Ultra-sound Money has gained more attention among community members, there are still many obstacles to prove that the supply of ETH is as stable as other store-of-value assets. The overall use case of ETH can deliver value to token holders. However, value is subjective, and any description of an asset may only be semantic, especially in the early stages of its lifecycle.

ETH as a Means of Payment

ETH is used as a means of payment, but these payments are limited to digital native assets. For most transactions, Ethereum typically completes final confirmation within 13 minutes, making it faster than BTC’s 6 blocks (1 hour) probability settlement. Final confirmation means that the transaction is included in a block, which cannot be changed without a significant amount of ETH being slashed. (WEEX note: Slashing refers to the partial forfeiture of a validator’s stake and the forced removal of the validator from the network when dishonest proposals or blocks are detected.) This mechanism makes Ethereum an attractive payment asset in terms of final settlement time, but there are still many obstacles to overcome for the widespread adoption of payment applications, most of which are related to user experience and high Gas fees.

Since the merge, Gas fees consumed by NFT payments rank second, second only to transactions related to DeFi. NFTs are priced in ETH and inherently experience price fluctuations. For merchants selling NFTs at a price of 1 ETH, the purchasing power represented by this amount can vary greatly due to changes in the market price of ETH. This difference in value reduces the experience (mainly for the seller) and is a common issue in many digital asset claims and payment cases.

Although the Ethereum network has a wide range of transaction options, direct value transfers account for a significant portion of the network’s use cases; since the merge, peer-to-peer transfers have consumed the third-largest amount of ETH.

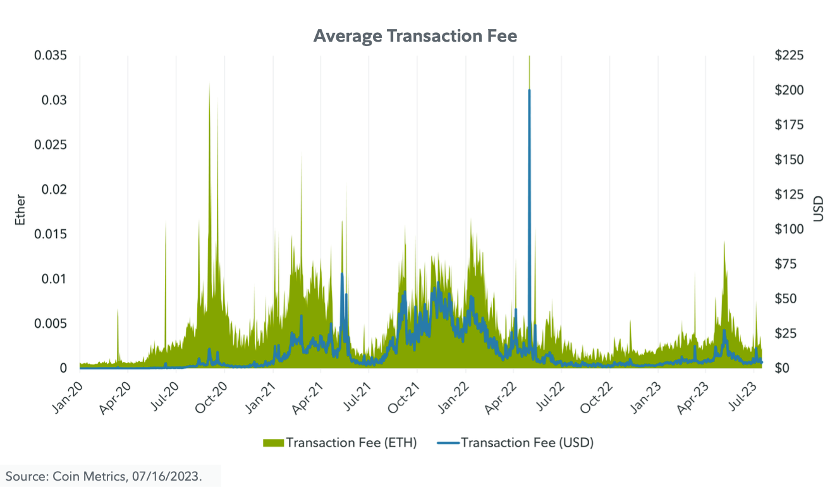

The biggest issue affecting Ethereum’s payment use cases is fee volatility. Ethereum’s dynamic fee model leads to rapid and occasional increases in fees. The variable cost of transactions may limit payment use cases and reduce the user experience of Ethereum as a reliable and inexpensive value transfer network. Users often need to make decisions such as whether to transact now at a high cost or wait until network activity decreases. This variability forces developers to be innovative in maximizing speed and efficiency to meet user preferences.

In addition, if more real-world assets enter the blockchain, the payment of these assets may use ETH, stablecoins, or other tokens. Combining these innovations with the lower fees offered by Layer 2 platforms can create expectations for the payment prospects of the Ethereum network.

According to network data, when used as a payment method, ETH is mainly used for native payments of digital assets. However, due to poor user experience, the potential of Ethereum as a payment network has not yet reached its peak. Whether Ethereum can become a mainstream payment method largely depends on whether the community can overcome various obstacles as soon as possible, such as ease of use, real-world transactions, security, and low-cost transactions.

Evaluation of ETH based on demand

Since applications on the Ethereum network require ETH, an increase in use cases on the Ethereum network may cause the price of ETH to rise, and the value of ETH token holders may increase due to supply and demand mechanisms.

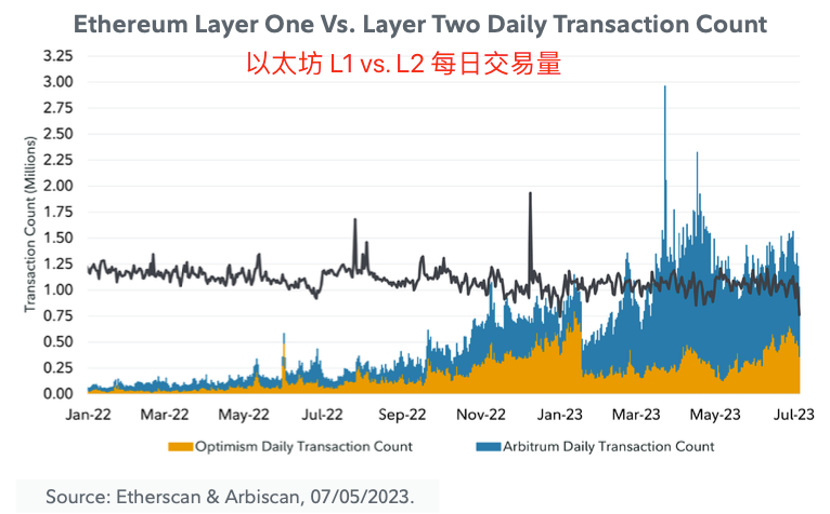

The following chart shows the prospects for the accumulation of value in the base layer (Optimism), ultimately converting network usage into the value of ETH. The L2 network (Arbitrum) is built on top of the base layer, which handles transaction execution and relies on the base layer to provide security and transaction confirmation.

Despite being in a bear market, Ethereum’s Layer 1 transaction volume has remained relatively stable at around 1 million transactions per day, while the price of ETH has fallen by 52% since the beginning of 2022. Additionally, we can see that Layer 2 transaction volume has increased, while Layer 1 transaction volume remains unchanged, which may indicate a certain degree of sticky demand in the base layer, with new demand coming from the Layer 2. This trajectory may indicate that even as Layer 2 becomes more mainstream, the value of the base layer will continue to grow reliably.

It is difficult to measure the demand for ETH as a monetary asset. Metcalfe’s Law is a popular economic principle that indicates the relationship between address growth and the demand and price of Bitcoin. Compared to Bitcoin, we have found less evidence of this demand-price relationship when studying Ethereum.

After all, if Bitcoin is primarily seen as an aspirational monetary commodity, then measuring the relationship between asset demand expectations and price through address count is more reasonable. For ETH, this apparently weaker relationship may imply that its value is derived from other sources, such as network use cases, rather than simply the demand for holding ETH itself.

Risks of the demand-side model:

1. It can be said that the core value of Ethereum comes from the usability layer, and the model that measures use cases through addresses rather than transfer volume, transaction volume, or usage volume cannot effectively capture this.

2. Although the data shows a relationship between address growth and ETH price, there is no guarantee that this relationship will continue in the future.

3. This model is only a demand-side model, as discussed earlier, the supply schedule of Ethereum may change in the future. Therefore, even if demand increases, if supply also increases, the price of ETH may not change or even decrease.

Investment Theme 2: ETH as Income Asset

Why and How Does ETH Generate Income?

Since the merge, ETH has become a completely different asset. Not only has the energy consumption significantly decreased, but it also provides income for those who are willing to lock ETH on the consensus layer. The transition to PoS is a turning point in the Ethereum security model. Compared to PoW, which introduced penalties for validator misconduct, PoS maintains or even enhances network security at a lower cost.

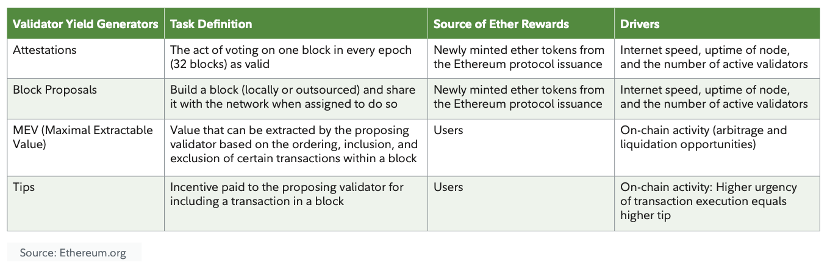

Validators contribute resources to the network and carry out duties to help Ethereum achieve consensus, and they are rewarded economically. The responsibilities and rewards of various validators are briefly explained below:

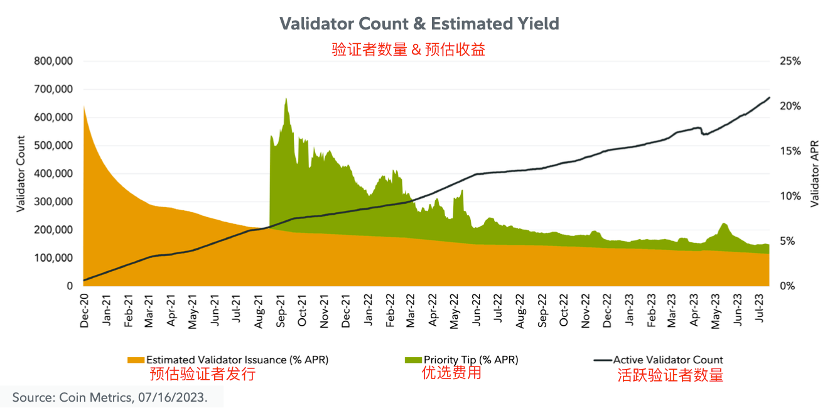

Since the merge on September 15, 2022, until July 2023, 53% of validator income comes from Ethereum (referring to block rewards, WEEX note). Here are some other forms of income that are not paid by the protocol but come from users, providing an interesting connection between network usage and validator income.

MEV:

It is evident that MEV comes directly from user transactions, as increased user activity usually brings more arbitrage opportunities. Due to the various use cases of Ethereum, value can be extracted from user transactions in multiple ways. According to Flashbots, an organization dedicated to mitigating the centralization effects of MEV, the most common forms of MEV typically come from arbitrage and liquidations, which thrive in volatile environments like November 2022.

Tips:

Since the introduction of EIP-1559 in the Ethereum London upgrade in 2021, the fee market of Ethereum has undergone significant changes. Prior to the upgrade, PoW miners received all gas fees from the blocks they mined. After the upgrade, the network has two independent fee types: base fee and priority fee (tips). All fees are still paid by users attempting to execute transactions; after these fees are paid, EIP-1559 affects how they are allocated.

Validators only collect the priority fee and not all fees paid by users. The base fee is burned or taken out of circulation. Tips can incentivize validators to prioritize including transactions in their blocks, otherwise validators may include empty blocks (which is more economically feasible). For users who need to execute transactions urgently, higher tips than other competitive transactions in the memory pool (Mempool, WEEX note) can incentivize validators to consider adding their transactions to a block.

While MEV plays an important role in determining which transactions are included in each block, tips still serve as an incentive mechanism as validators decide which transactions to include in their blocks based on tips. Since the switch to PoS, tips have accounted for 22% of validator income until July 2023.

Valuing ETH based on Discounted Cash Flow Model

After the transition to PoS, the value allocated to ETH becomes easier to model. The demand for block space can be measured by transaction fees. These fees are either burned or rewarded to validators, thereby accumulating value for ETH holders.

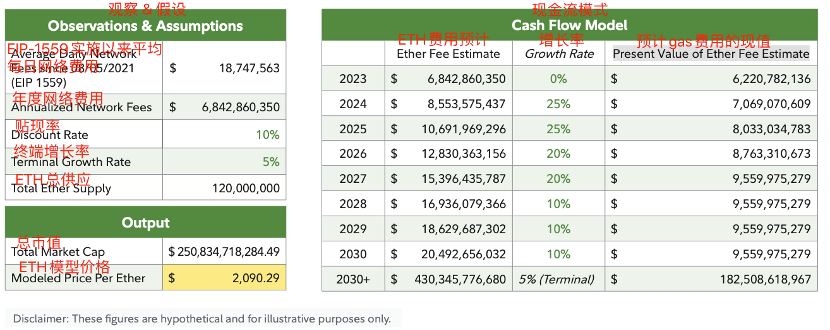

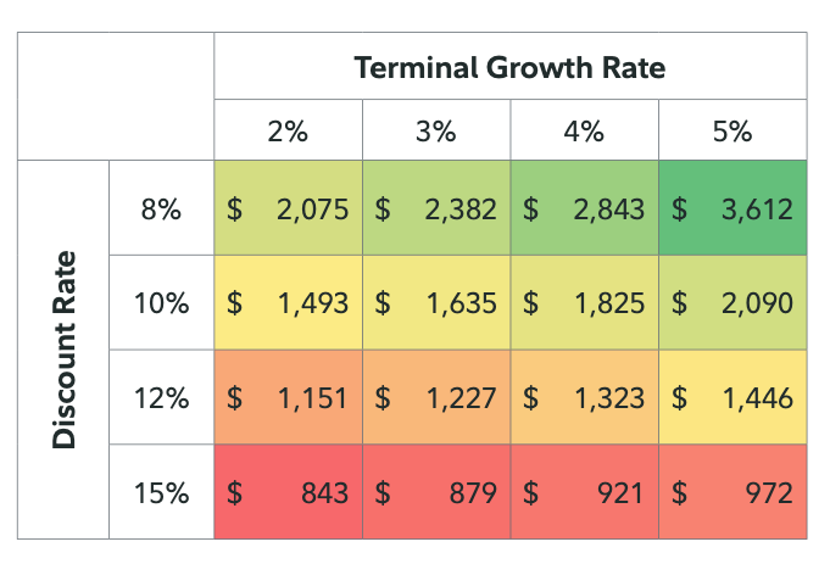

Therefore, in the long run, the growth of fees and the value of ETH should be inherently correlated. The following chart illustrates this relationship using a simple discounted cash flow model. The results of this model differ greatly depending on the growth assumptions and discount rate. The purpose of building such a model is not to provide predictions of the fair value of ETH, but to describe the relationship between network use cases and value accumulation.

As a starting point, the chart below shows the average daily fees paid in USD on Ethereum since the implementation of EIP 1559 in August 2021. The chart is calculated using a two-stage discounted cash flow model, where in the initial stage, fees experience significant growth, followed by a decrease in the growth rate. Therefore, regardless of the utility obtained by Ethereum users, scalability may reduce the upper limit of fee growth.

More than 70% of the token value associated with this model comes from perpetual terminal growth, which assumes a growth rate after 2030 (annual growth of 5%, WEEX note). This result is common when predicting the future of high-growth enterprises and is part of the reason why discounted cash flow models are theoretically effective.

The sensitivity model shown in the chart below further describes the impact of modeling prices on assumed growth rates and discount rates. Understanding the relationship between ETH and users’ willingness to pay is extremely important. However, a model that is highly sensitive to small changes in future growth assumptions may not be as useful.

Risks of the Discounted Cash Flow Model:

1. If scaling technologies reduce gas fee revenue, the relationship between ETH and the value provided by the Ethereum network to users may weaken unless the increase in transaction volume offsets the decrease in revenue due to lower gas fees.

2. Modeling the future of any asset sensitive to growth and applying relevant discount rates is highly subjective, so valuations may only be useful in theory.

3. Current efforts to minimize the negative impact of MEV will improve user experience but may reduce revenue. In this simple model, we have not adjusted or taken into account this issue and many other important details.

Conclusion

There is no doubt that Ethereum is a leading blockchain technology platform that allows developers to build decentralized applications. Due to Ethereum’s outstanding programmability, many applications can accomplish things that are not possible on the Bitcoin network. This has led to some of the largest and most active applications in the digital asset ecosystem being built on Ethereum, and ETH has maintained its position as the second largest market capitalization for many years.

However, the question raised by investors is, “Will the increase in developers and applications translate into value for ETH?” We have indicated that both theoretical and empirical evidence so far suggests that the increase in activity on the Ethereum network drives the demand for block space, which in turn generates cash flow that can bring value to token holders. However, it is equally apparent that these different driving factors are complex, subtle, and subject to change over time, as various protocol upgrades and developments such as L2 emerge and may continue to evolve in the future.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Financing Weekly Report | 13 Public Financing Events; NFT Startup FirstMate Completes $3.75 Million Financing, Led by Dragonfly Capital

- Web3 gypsies walk onto Marques’s land, decentralized souls wander in the magical real world.

- Why is identity proof in Web3 so important?

- Exploring the Path of MEV Redistribution

- Will the performance improvement of Arbitrum make it a paradise for Web3 games?

- Reviewing the NFT Cold Winter of the past half year Who is ‘surrendering’ and who is growing against the trend?

- Is the golden age of scamming over? Connext’s witch-hunting program goes awry, community poisoning becomes the norm.