The roller coaster trend behind Cyber explosive long liquidation, short selling, and a carefully planned hunting game by market makers.

The roller coaster trend includes cyber explosive long liquidation, short selling, and a hunting game orchestrated by market makers.Author: 0x26, Luccy, BlockBeats

Editor: Jaleel, BlockBeats

This weekend, some retail investors and market makers just experienced a “war”. On the Korean exchange upbit, the price of Cyber was pushed up to $37, with a premium rate of 167%. On the Binance platform, the price of CYBER was temporarily reported as $13.8. CyberConnect released an emergency proposal [CP-1] to unlock 10.88 million CYBER, equivalent to $300 million, which is astonishingly high. Under the panic of the community, the official claimed that there was a data editing error, and the actual unlock quantity was 1.08 million.

- Revisiting EIP-1559 Is Ethereum safer two years after the proposal has been implemented?

- Asset management giant Fidelity report Where does the value of ETH come from? How to conduct valuation?

- X’s encryption business first obtains permission, Musk may bring new variables to the cryptocurrency world.

Last night, a well-known figure in the crypto circle shared his painful experience on his social media, which caused a lot of resonance. Due to the astonishing rise of Cyber, he shorted and longed multiple times, resulting in a loss of millions. What exactly happened in this farce, BlockBeats has compiled the whole story of the event, as well as the market maker logic reflected and represented by DWF behind CYBER.

The Whole Story of the CYBER Farce

As the only token issued by CyberConnect, CYBER was sold to the public through CoinList on May 18th this year. Just three months later, the opening price tripled. On August 21st, Binance launched CYBER 1-20x U perpetual contract, followed by the launch of CYBER on the Korean cryptocurrency trading platform Upbit on August 22nd.

On the day when CYBER was launched on Upbit, according to Lookonchain’s monitoring, DWF Labs increased its holdings of 170,000 CYBER at an average price of $4.5 from Binance, equivalent to $770,000. It is estimated that the value of this increased CYBER rose to $1.26 million on August 30th.

CYBER with Continuous Premium

The “war” between retail investors and market makers officially began on August 31st.

At that time, the wallet address of Upbit exchange already held about 3.6 million CYBER, surpassing Binance to become the largest holder of CYBER, accounting for 33% of the token’s circulating supply. At 3 o’clock in the afternoon, Binance suspended the withdrawal service of CYBER tokens due to insufficient ETH network balance. Then, on-chain data showed that DWF Labs transferred 40,000 CYBER to the Korean cryptocurrency exchange Bithumb, worth about $360,000.

On September 1st, the farce escalated. The price of CYBER on Upbit was more than 30% higher than that on the Binance platform at the same period. Within 24 hours, DWF transferred a total of 170,000 CYBER to Bithumb, worth about $1.46 million.

On September 2nd, this farce reached its climax. The Upbit wallet address held 3.947 million CYBER, reaching the highest quantity. The price of CYBER on mainstream CEXs continued to rise, and the CYBER on Upbit continued to have a premium, rising from 30% to 167% and reaching $37.1.

A User, 87% of the Voting Power

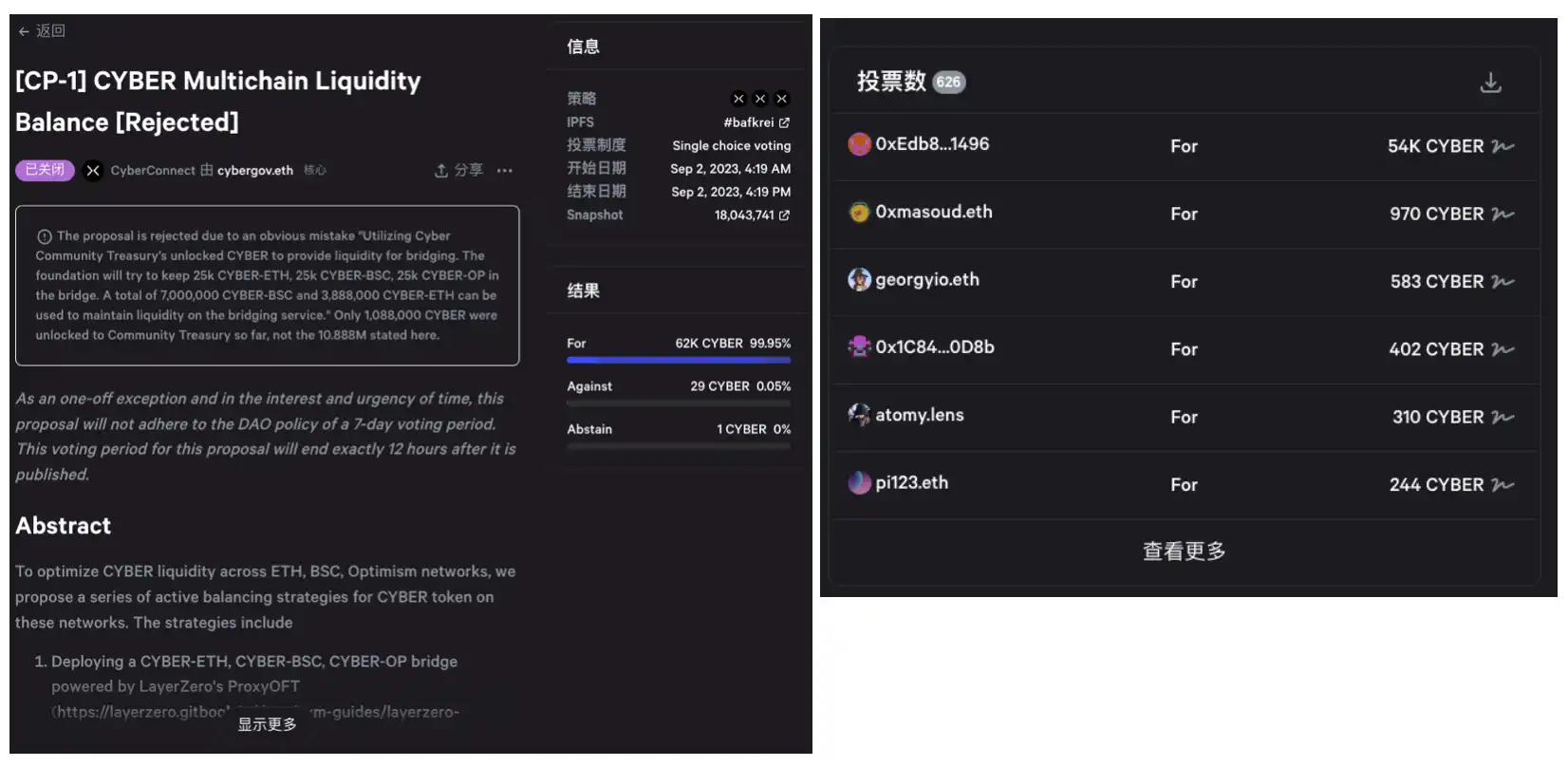

The CyberConnect official couldn’t hold back and issued an emergency proposal [CP-1], hoping to unlock 10.88 million CYBER tokens in advance to ensure liquidity balance between the Ethereum, Optimism, and BNB Chain networks.

Due to the time sensitivity and urgency of this proposal vote, CyberConnect did not comply with the DAO’s 7-day voting period policy and the voting ended at 4 pm on the same day. After the emergency proposal [CP-1] was passed, the price of CYBER on the Upbit platform plummeted below $20. Starting at 8 pm, CYBER tokens from the Upbit wallet address started to be transferred out. Currently, a total of 3.6 million tokens have been transferred, with most of them flowing into Binance.

Although the CyberConnect official issued a statement on September 3, stating that there was an editing error in the emergency proposal [CP-1], and the actual unlock amount was not 10.88 million, but 1.08 million tokens, and quickly revoked the proposal, introducing security measures to prevent similar incidents from happening again.

However, it is apparent that panic, uncertainty, and doubts about CYBER have already spread in the market. At the same time, the community discovered that the number of votes shown in the emergency proposal [CP-1] highlights the issue of centralization in the project. According to the snapshot, a single user cast a decisive vote that accounted for 87% of the total voting power.

Behind this not only reflects the centralization issue of individual projects but also reflects that in today’s encryption community, so-called DAO organizations have hardly considered governance issues. Emergency proposals are urgently passed with a single user casting 87% of the votes, and ultimately closed due to “data editing errors”.

No wonder the community has expressed their feelings of “domestic so-called DAO organizations hardly have any governance and are basically playing house.”

DWF: A Compound Operation Model of “Investment + Liquidity Provision”

In addition to the issues of project centralization and token control, what is even more noticeable behind the CYBER farce is the presence of market makers.

From the initial price of $4.5 on the day of launch to the peak of $37.1 (a premium of 167% over Binance), and then to the fallback price of $12.55 (a premium of 14%), in this strange process of skyrocketing and plummeting, on one hand, there were constantly exceeding expectations gains and premiums, on the other hand, there was a red line that quickly appeared but no one knew when it would come. Perhaps many people can see the traces of market makers behind it, but more people are still attracted by its crazy price increase and have become liquidity providers in the Pump and Dump game.

As introduced by BlockBeats previously, DWF is a global cryptocurrency high-frequency trading company that has been engaged in spot and derivative trading on more than 40 top-tier trading platforms since 2018, ranking among the top 5 in global cryptocurrency trading volume.

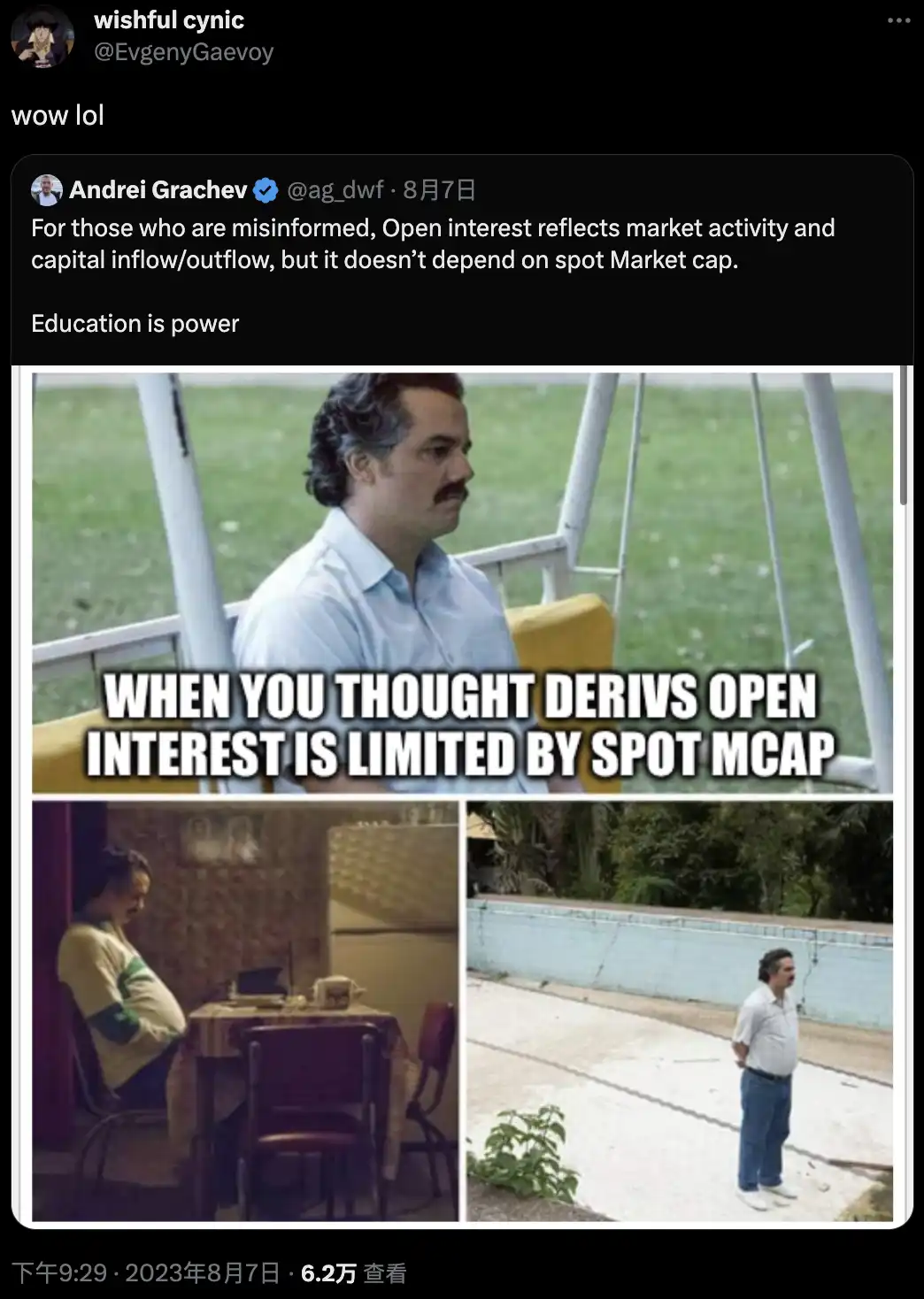

The official website of DWF Labs previously stated, “Regardless of market conditions, DWF Labs invests in an average of 5 projects every month.” Since March, DWF Labs has indeed been investing in the secondary market at a rate of 5 projects per month, which has sparked lively discussions in the community. Some believe that DWF is not really investing and that holding coins is just for market making. DWF Labs partner Andrei Grachev also responded, “In addition to investment, we usually provide additional support,” implicitly acknowledging this composite operation mode of “investment + market making.” The official website also directly advertises the provision of such services.

DWF Labs explicitly positions itself as a global digital asset market maker and a multi-stage web3 investment company engaged in high-frequency cryptocurrency trading. It is currently conducting spot and derivative market trading on more than 40 top-tier exchanges. DWF Labs also mentions that DWF can provide cutting-edge market making execution capabilities, create trading volume for projects-as-a-service, and provide healthy liquidity. Currently, they have integrated with the top 40 ranked trading platforms and traded over 800 currency pairs, including spot and derivatives.

Through market making, DWF states that it allows other market participants to trade project tokens with less price impact, which can increase market depth and give investors more confidence in the market liquidity of the project.

When it comes to the selection of market making tokens, unlike Wintermute, which focuses on fundamentally sound European and American blue-chip projects, DWF Labs primarily targets East Asian projects and various new and old sentimental thematic tokens. Many institutions and investors have started to consider YGG, DODO, C98, and other tokens as the market making targets of DWF Labs and have made their investment layouts accordingly, as well as some currencies that have not yet experienced a rally.

In September 2022, MXC received tens of millions of dollars in investment from DWF, but the price of MXC has been performing poorly this year, falling from around $0.033 at the beginning of the year to $0.019 against the trend.

Bear Market and the Tragic Case of YGG

It is often said that Gamefi is dead, but in early last month, YGG (Yield Guild Games), a guild-based project rooted in Gamefi, performed a “Mario jump” after being listed on major mainstream trading platforms such as Binance, OKX, and Bybit.

It surged nearly 5 times in 6 days and then dropped by 60% within 4 hours, causing over tens of millions of dollars in market liquidation.

Although there is no direct evidence indicating that DWF was involved in this pump and dump activity, multiple on-chain organizations have identified wallets associated with DWF that did receive YGG tokens. Additionally, DWF did lead a $13.8 million financing round for YGG in February 2023, through the sale of tokens. In February 2023, DWF Labs and a16z co-led a funding round for the gaming guild Yield Guild Games (YGG), raising $13.8 million through the sale of tokens.

Starting from August 6th, DWF Labs released consecutive funding decision news about YGG, DODO, and C98, prompting the three currencies to continue to rise in the already rising situation. Among them, YGG had the largest increase in the second phase, approaching 50%. However, after a day of trading, all three quickly fell back, with YGG experiencing the largest drop of about 70%.

The most intuitive feeling comes from DWF’s managing partner Andrei Grachev’s recent tweets about YGG. Andrei, who rarely posts, posted two tweets about YGG, the first of which on August 6th congratulated the listing of YGG on Binance and analyzed the trading depth and order book of YGG tokens.

Shortly after the sharp decline of YGG, Wintermute CEO, who had a gap with DWF before, sarcastically replied to Andrei’s tweet.

Of course, there are certain differences between this CYBER incident and YGG. DWF seems to have not directly manipulated the CYBER incident, but played the role of a brick mover or a rat warehouse, which is different from the nature of the YGG incident.

“Pump and dump,” DWF’s market-making strategy

Although DWF has touted itself as being able to protect projects from “pump and dump” price attacks and extreme price fluctuations, there have been several unfounded “pump and dump” incidents in DWF’s investment portfolio, not to mention the controversial YGG.

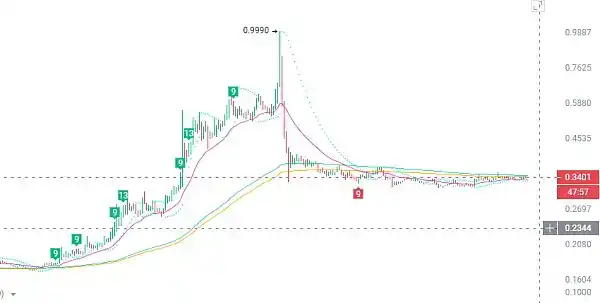

After DWF invested in these projects, within just one month, “pump and dump” events occurred, as seen in the examples of ARLianGuai and Agld.

On April 25th, DWF announced its investment in ARLianGuai Network, and then the ARLianGuai token rose more than doubled within a month, only to drop nearly 40% on the day of the price peak. During this period, the holdings of ARLianGuai tokens on mainstream trading platforms surged, causing a large number of liquidations. The holdings returned to normal after a period of time when the price dropped. The marked area in the figure below indicates the announcement time of the investment.

Data source: Coinglass

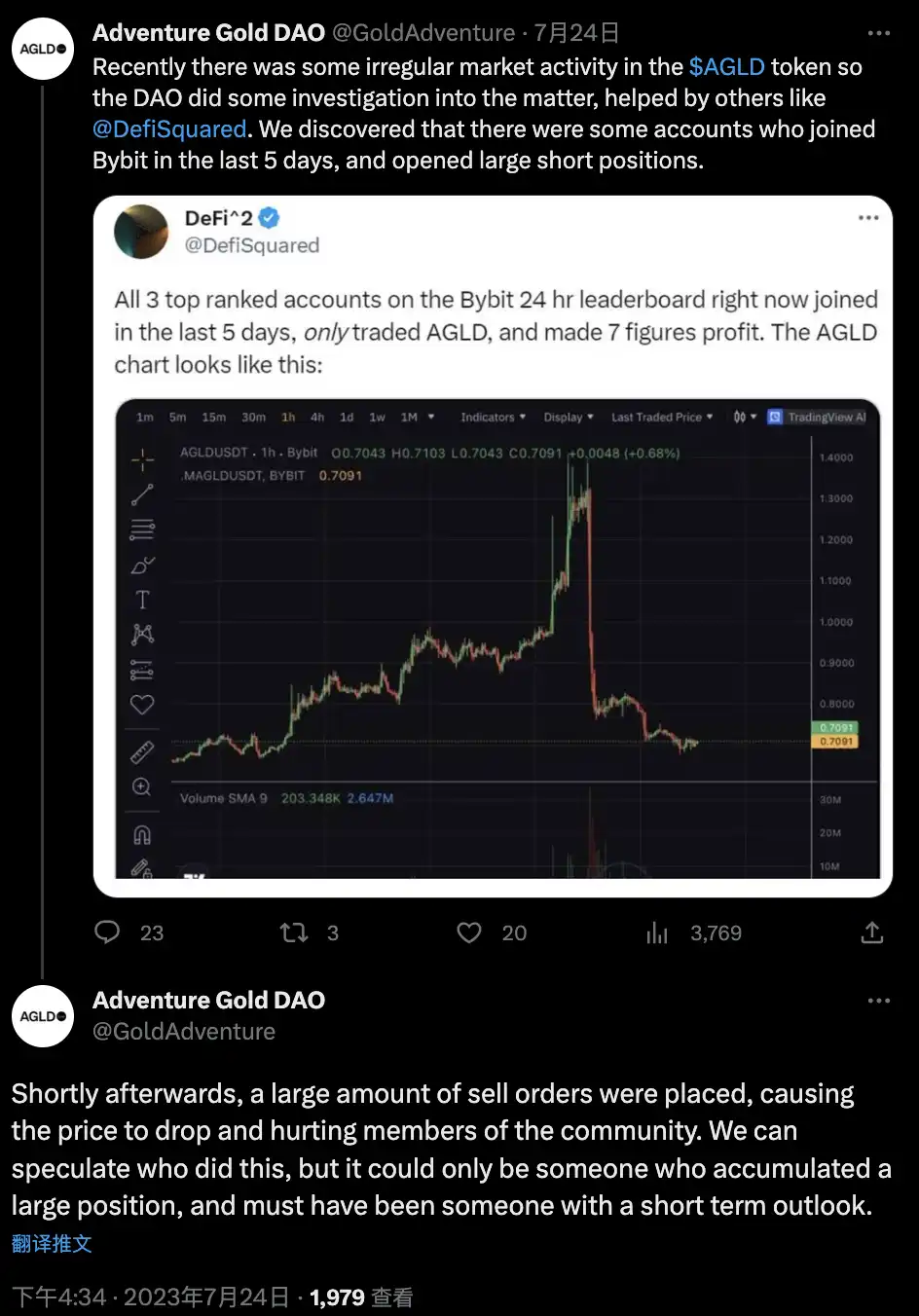

On June 22nd, Adventure Gold DAO announced that it had received investment from DWF, with DWF committing to purchase AGLD tokens worth seven figures. Subsequently, within a month, AGLD tokens rose nearly doubled, only to fall over 40% on the second day of the peak. Similarly, during this period, the holdings of AGLD tokens on mainstream trading platforms surged, causing a large number of liquidations. The holdings returned to normal after a period of time when the price dropped. The marked area in the figure below indicates the announcement time of the investment.

Data Source: Coinglass

It is worth noting that AGLD has commented on this matter, seemingly implying something.

“Around July 22, the top 3 accounts on Bybit’s 24-hour leaderboard joined within the past 5 days, only traded AGLD, and made a seven-figure profit. Based on this, we can speculate who did it…”

On the other hand, the community is confused about the skyrocketing and plunging of YGG, ARLianGuai, and Agld. Take Agld as an example. Despite its roller coaster-like trend and the huge profits created for related interest groups, the number of people in Agld’s Discord community is still less than 200. Many helpless retail investors still don’t know what happened…

Market response: Don’t go against market makers

In order to attract more commercial customers, DWF Labs mentioned in their “Market Making” business that they “will provide efficient and sustainable liquidity for our partners.” Therefore, the trends of YGG, DODO, C98, and even other market-making tokens have just verified the business level and service quality of DWF Labs.

Returning to the CYBER farce at hand, due to the fact that major Korean trading platforms only support CYBER deposits and withdrawals on Ethereum, the demand for CYBER in the Korean market has surged, resulting in price differences. Seizing the opportunity as a skilled market maker, DWF Labs quickly extracted 170,000 CYBER from Binance when CYBER was listed on Upbit.

It can be seen that DWF Labs has already acted as market makers for two of them, YGG and C98. It remains unknown whether the next token to skyrocket and plunge will be among their recent investments.

As retail investors in the crypto community, our attitude towards market makers is very complicated. On the one hand, the crypto industry needs the existence of market makers, and the mechanisms of token market makers themselves are not malicious. The problem is that these mechanisms often do not disclose information to retail investors.

On the other hand, the existence of market makers causes significant losses for retail investors. Going back to what we mentioned at the beginning of the article, in that tweet with over 60,000 views, the retail investor KOL who lost millions wrote at the end of the tweet, “Don’t go against market makers,” which serves as a warning to everyone in the crypto circle.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuai Daily | Arbitrum plans to allocate 75 million ARB tokens as rewards to the ecosystem protocols; DYDX tokens will migrate to dYdX Chain as its L1 token.

- OG Protocol Betrays Ethereum? MakerDAO Builds New Chain, Good or Bad?

- Financing Weekly Report | 13 Public Financing Events; NFT Startup FirstMate Completes $3.75 Million Financing, Led by Dragonfly Capital

- Web3 gypsies walk onto Marques’s land, decentralized souls wander in the magical real world.

- Why is identity proof in Web3 so important?

- Exploring the Path of MEV Redistribution

- Will the performance improvement of Arbitrum make it a paradise for Web3 games?