X’s encryption business first obtains permission, Musk may bring new variables to the cryptocurrency world.

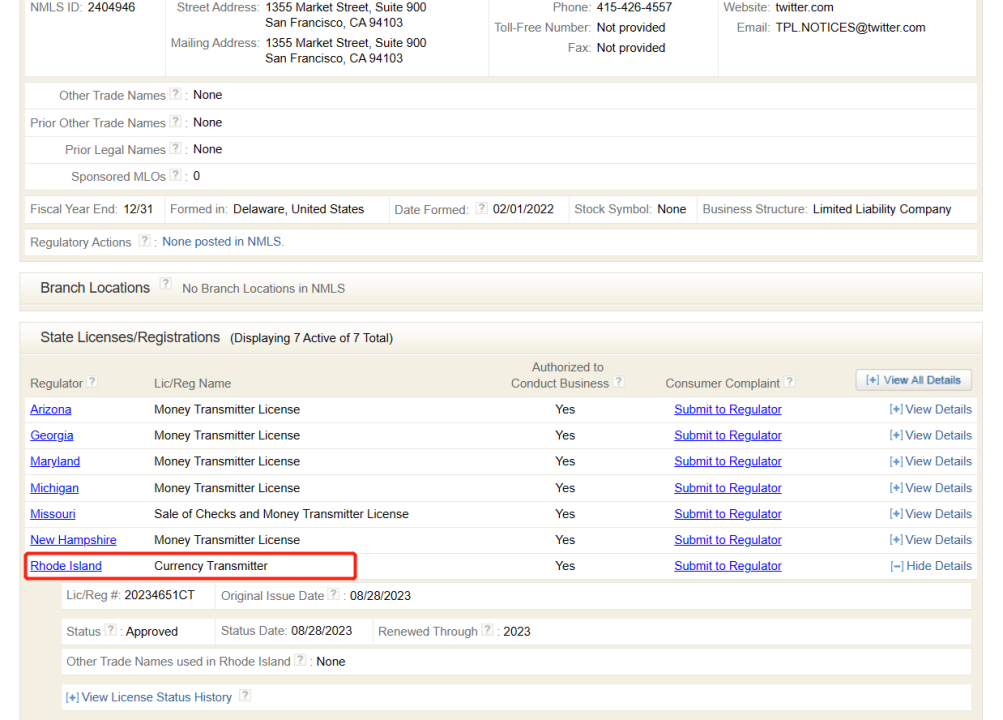

X's encryption business gets permission; Musk may bring new changes to the crypto world.According to data from the National Mortgage Licensing System (NMLS) website, X (formerly Twitter) subsidiary Twitter LianGuaiyments LLC obtained a Currency Transmitter license in Rhode Island, USA on August 28. This marks a crucial step towards Elon Musk’s goal of turning X into a multi-functional “Everything App”. In this article, veDAO will analyze the significance of this news and the impact it may have on X and the cryptocurrency industry.

Significance of Currency Transmitter License

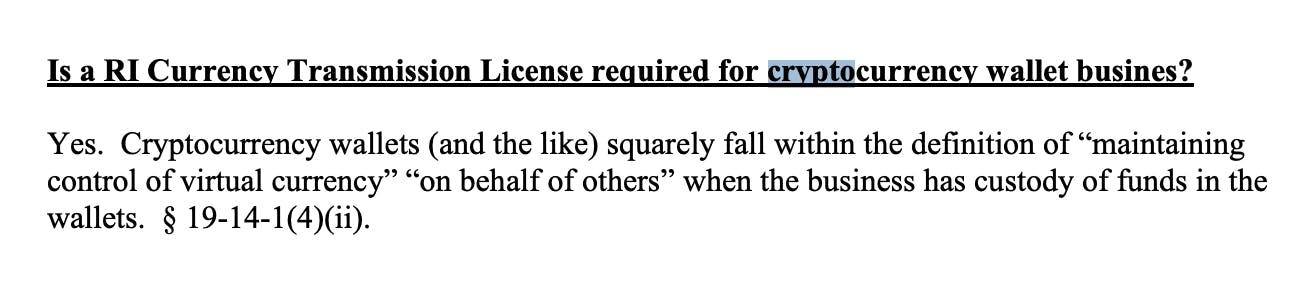

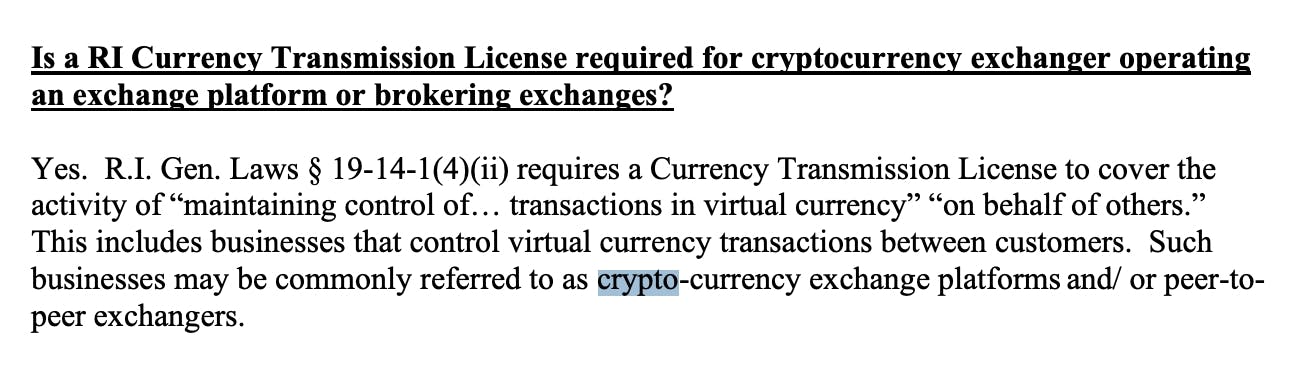

The “Currency Transmitter” license granted to X by the regulatory authorities in Rhode Island involves the transfer and receipt of financial funds, applicable to both fiat currency (such as the US dollar and the euro) and cryptocurrencies (such as Bitcoin and Ethereum).

- LianGuai Daily | Arbitrum plans to allocate 75 million ARB tokens as rewards to the ecosystem protocols; DYDX tokens will migrate to dYdX Chain as its L1 token.

- OG Protocol Betrays Ethereum? MakerDAO Builds New Chain, Good or Bad?

- Financing Weekly Report | 13 Public Financing Events; NFT Startup FirstMate Completes $3.75 Million Financing, Led by Dragonfly Capital

One of the steps to become a payment hub or cryptocurrency payment service provider in the United States is to obtain the necessary licenses for legal operations. X has been gradually doing so in different states, including Arizona, Missouri, Georgia, Maryland, Michigan, New Hampshire, and now Rhode Island, but mainly focusing on fiat payments under the “Money Transmitter License”. However, the “Currency Transmitter” license will now allow X to become a cryptocurrency-related service provider, such as a cryptocurrency exchange, wallet, and payment processor. Specifically, this license will enable X to store, custody, and exchange digital currencies on behalf of its millions of users.

The acquisition of the Currency Transmitter license by X is of significant importance for both itself and the entire cryptocurrency industry. It signifies the move towards compliant operations for X’s cryptocurrency business, which helps enhance the trust of users and regulatory authorities. Of course, X still needs to establish robust anti-money laundering and risk control mechanisms to protect the security of users’ digital assets. At the same time, X’s involvement is expected to increase the awareness and acceptance of cryptocurrencies among the Web2 community, thereby promoting the wider adoption and attention to the crypto world. This news also confirms X’s deeper involvement in the cryptocurrency field, potentially collaborating with more Web3 projects to co-build the crypto ecosystem and create more application scenarios, which will further drive the development of the cryptocurrency industry.

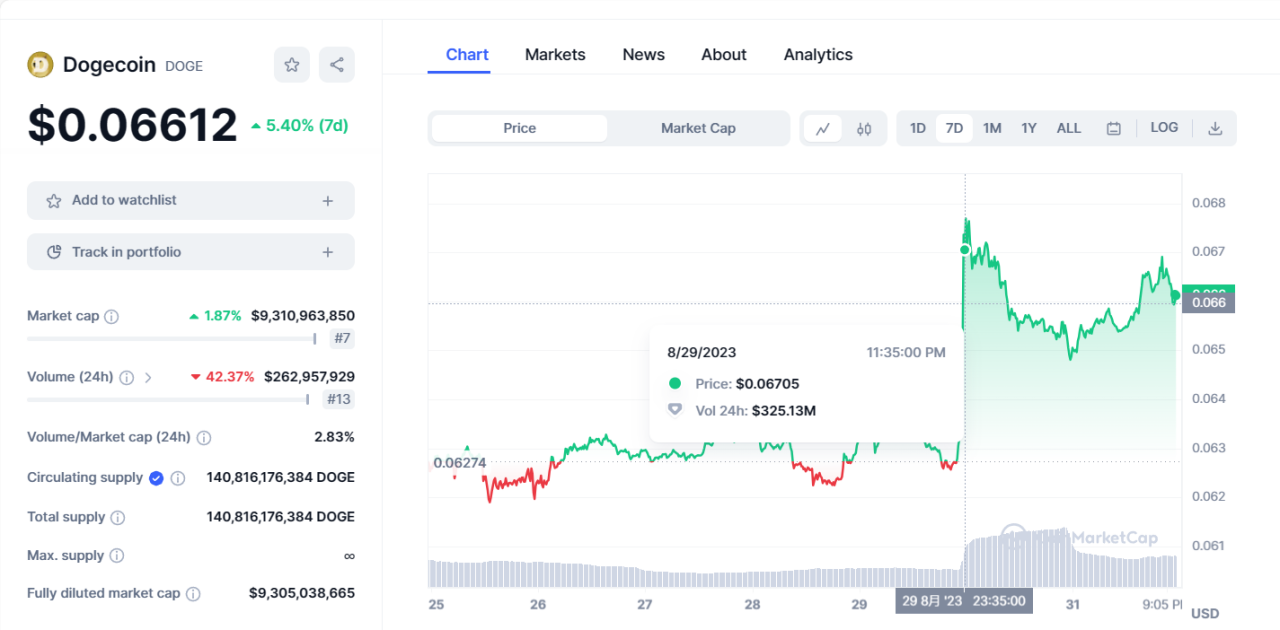

As Elon Musk has been a well-known supporter of the cryptocurrency community, it is possible that he will further drive the development of cryptocurrency technology and the market through the X platform. Elon Musk previously stated that X will be particularly friendly to cryptocurrencies, especially Dogecoin, and may integrate Dogecoin into the X payment system in the future. The former Twitter formed a dedicated team to promote the “Twitter Crypto” project, responsible for cryptocurrency payments and infrastructure development. X has also collaborated with cryptocurrency companies for the development of crypto features, such as partnering with Strike for Bitcoin tipping functionality, and collaborating with eToro to enable users to trade cryptocurrencies, stocks, and other financial assets.

Finally, the news of Twitter LianGuaiyments LLC obtaining these licenses has injected a boost to Meme coin enthusiasts: this news has had a subtle impact on Meme coins with a Shiba Inu theme. According to Coinmarketcap data, Dogecoin rose by 6% in price on the 28th and 29th.

What crypto applications might X launch?

Although X is committed to obtaining compliance qualifications and building crypto business capabilities, Elon Musk has made it clear that X will not issue its own token. However, apart from issuing its own token, what crypto-related applications might X launch?

Support for mainstream cryptocurrencies

X can directly support mainstream cryptocurrencies such as BTC and ETH for platform payment services and creator rewards. This will also become a channel for crypto adoption and potentially an important gateway for Web2 users to enter Web3.

Integration of crypto wallets

In the future, X may consider integrating with third-party crypto wallets, allowing users to manage crypto assets through X and facilitate asset transfers between different wallets.

Decentralized trading

Integration with DEXs to enable users to directly trade crypto assets on X.

Launch unique NFTs

If X were to promote NFTs, there could be three ways: launching NFT features to establish a creator economy, protecting creators and enabling direct purchases of their works; an NFT marketplace; X may also launch its own NFTs on the platform, creating a platform-exclusive digital asset economy while incorporating smart contracts for permission control, etc.

Web3 social applications

Integration of SocialFi functionality to connect decentralized social applications. Users can link external wallets to manage digital identities and virtual assets across platforms. X may also integrate blockchain identity systems to support decentralized social applications, enabling user identity and credentials to be controllable and portable.

Full entry into Web3? Observing X’s subsequent deployments

The currency transmission license obtained by X from Rhode Island is only the first step in building crypto payment capabilities. This has opened a door for X in the crypto field, but the specific applications and scale still need further observation.

X still needs to obtain licenses from more states in order to fully engage in compliant crypto business. At the same time, X has not yet applied for the key BitLicense established by the New York State Department of Financial Services (NYSDFS) and the EMI license in Europe. These will be critical for measuring the scale of X’s crypto business.

Prior to launching practical crypto applications, X needs to conduct comprehensive risk assessments and community testing to ensure a smooth transition of the overall business; and collaborate with authoritative security and compliance institutions in the industry to ensure platform information security and asset security.

Most importantly, regulatory policies and user acceptance will greatly impact the effectiveness of X’s crypto business. Therefore, X is likely to adopt a gradual and cautious strategy instead of fully launching crypto-related functionalities.

Conclusion

In conclusion, this approval has opened the door for X to advance its cryptocurrency business on a legal level. This is not only a new beginning but also the start of a long-term endeavor. Before implementing actual cryptocurrency applications, X still needs to do a lot of preparation work and regulatory coordination. We have reasons to be optimistic and look forward to X becoming an important member of the cryptocurrency ecosystem.

Source: https://www.nmlsconsumeraccess.org/EntityDetails.aspx/COMLianGuaiNY/2404946

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Web3 gypsies walk onto Marques’s land, decentralized souls wander in the magical real world.

- Why is identity proof in Web3 so important?

- Exploring the Path of MEV Redistribution

- Will the performance improvement of Arbitrum make it a paradise for Web3 games?

- Reviewing the NFT Cold Winter of the past half year Who is ‘surrendering’ and who is growing against the trend?

- Is the golden age of scamming over? Connext’s witch-hunting program goes awry, community poisoning becomes the norm.

- LianGuai Observation | Connext Witch Hunt Program Provokes Public Anger, Poisoning may be the only solution?