Reviewing the NFT Cold Winter of the past half year Who is ‘surrendering’ and who is growing against the trend?

Reviewing the NFT Cold Winter Who is 'surrendering' and who is growing?Author: NFTGo

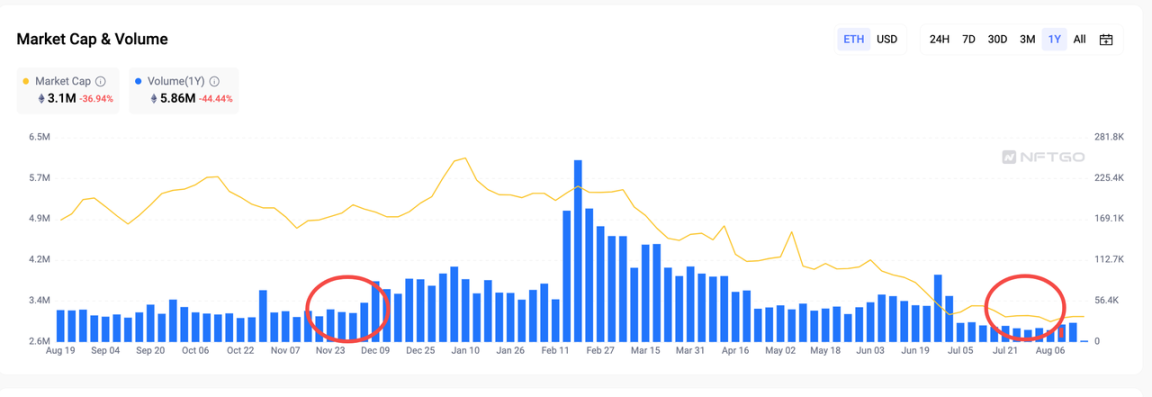

Just like the crypto market, NFTs also have their own cycles. In November 2022, the trading volume in the NFT market experienced a downturn, with a daily trading volume of about 5kETH. In these two bear market cycles, how did the top NFTs perform after going through significant changes for over half a year? Which NFTs experienced a decline and which ones saw a reversal and went up?

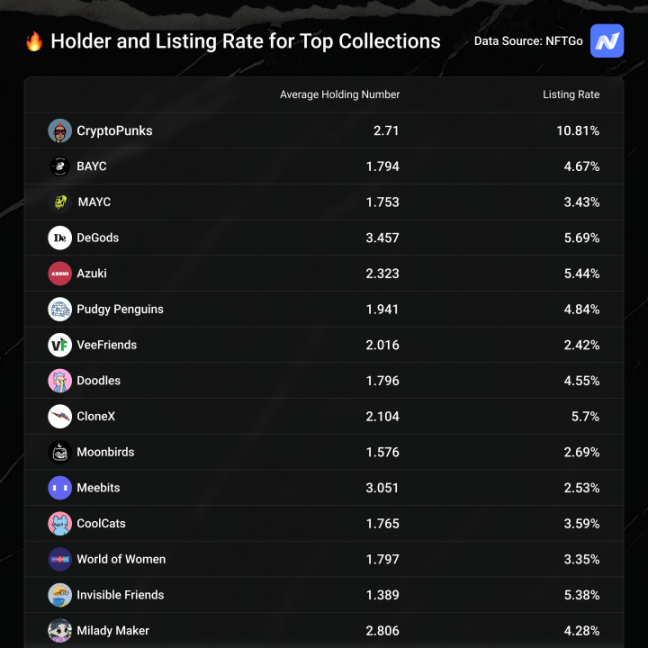

By comparing the average holding rate and listing rate of top NFTs, it can be seen that Degods has the highest average holding quantity, about 3.45, followed by Meebits with around 3. CryptoPunks has the highest listing rate at approximately 10.81%, followed by CloneX, and Veefriends and Meebits have the lowest listing rates.

- Is the golden age of scamming over? Connext’s witch-hunting program goes awry, community poisoning becomes the norm.

- LianGuai Observation | Connext Witch Hunt Program Provokes Public Anger, Poisoning may be the only solution?

- Reviewing the Development History of Web2 Game Engines and Exploring the Future Development Path of Full-Chain Games

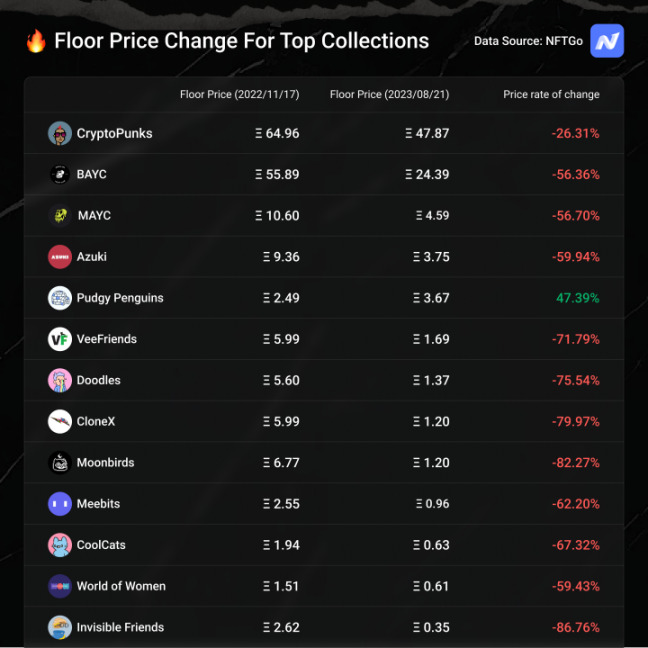

Next, let’s take a look at the blue-chip collections with similar floor prices around November 2022 and compare their performance over the past half year. From this, it can be observed that CryptoPunks still has a floor price above 30 ETH. Bored Ape Yacht Club (BAYC) has reached over 20 ETH, and the range between 6 to 20 ETH is a blank area. Projects with floor prices around 4+ ETH include MAYC, DeGods, Azuki, Captainz, Memeland, Milady, and Pudgy Penguins.

Among these projects, Pudgy Penguins is the only one that has seen a significant increase in floor price, about 47.39%. On the other hand, “Invisible friends” and “Moonbirds” have experienced the largest decrease in floor price.

CryptoPunks & Board Ape Yacht Club

CryptoPunks and BAYC were both top projects in the 50E+ range last year, but they also experienced declines as the market entered a bear market. Over the past half year, CryptoPunks dropped from 64.96 ETH by 26.31% to 47.87 ETH, while BAYC dropped by 56.36% from 55.89 ETH to 24.39 ETH.

From the floor price, it can be seen that CryptoPunks had a more stable trend compared to BAYC. The floor price of CryptoPunks gradually declined along with the overall market sentiment, while BAYC had larger fluctuations and periodic increases during its decline.

The large fluctuations in BAYC’s price are due to the continuous development and news releases in the BAYC ecosystem, with each new piece of information affecting the market trend. Additionally, some BAYC tokens are being used for lending, which also contributes to the price volatility. These factors have resulted in BAYC’s trading volume being six times higher than CryptoPunks, with whale trading volume being five times higher.

The performance of these two projects undoubtedly represents the overall market trend. Whether it is the stable and gradual decline of CryptoPunks or the volatile decline of BAYC, it will affect the overall market sentiment.

Mutant Ape Yacht Club & Azuki

Mutant Ape Yacht Club (MAYC) and Azuki, as blue-chip NFT projects in the 10 ETH price range half a year ago, have both dropped below 5 ETH. MAYC has fallen 56.70% from 10.60 ETH to 4.59 ETH, while Azuki has dropped 59.94% from 9.36 ETH to 3.75 ETH.

Overall, MAYC has been on a downward trend amidst continuous fluctuations. The price fluctuations of MAYC are highly correlated with the price fluctuations of Bored Ape Yacht Club (BAYC). In most cases, when BAYC rises or falls, MAYC also experiences relatively small price ranges of increase or decrease.

Prior to June 23, the floor price of Azuki showed a slow upward trend. From November 17, 2022, to June 23, 2023, Azuki rose from 9.36 ETH to 16.95 ETH, an increase of 81.09%. This can be attributed to the close-knit community culture and the continuous actions and hotspots from the official Azuki team in the past half year. Additionally, Azuki and Beanz have collaborated with numerous brands and announced the “Follow The Azuki Rabbit” event to be held in LA on June 23, introducing new NFTs.

However, the positive momentum came to a halt on the 23rd. The newly launched Elementals were criticized for their lack of originality in design, resulting in some whales and Azuki holders selling off and exiting the project.

VeeFriends & Doodles & CloneX & Moonbirds

VeeFriends, Doodles, CloneX, and Moonbirds, these four blue-chip NFTs in the 5 ETH range half a year ago, have all dropped to around 1 ETH. VeeFriends has fallen 71.79% from 5.99 ETH to 1.69 ETH, Doodles has dropped 75.54% from 5.6 ETH to 1.37 ETH, CloneX has dropped 79.97% from 5.99 ETH to 1.20 ETH, and Moonbirds has dropped 82.27% from 6.77 ETH to 1.20 ETH.

These four NFT projects have also experienced declines in the overall bearish NFT market environment over the past half year. Among them, VeeFriends experienced the smallest decline in percentage, while Moonbirds experienced the largest decline.

Meebits & Pudgy Penguins & CoolCats & World of Women & Invisible Friends

Meebits, Pudgy Penguins, CoolCats, World of Women, and Invisible Friends, these several blue-chip NFTs in the 1-4 ETH range half a year ago, with the exception of Pudgy Penguins, have all dropped below 1 ETH. Meebits has fallen 62.20% from 2.55 ETH to 0.96 ETH, CoolCats has dropped 67.32% from 1.94 ETH to 0.63 ETH, World of Women has dropped 59.43% from 1.51 ETH to 0.61 ETH, and Invisible Friends has fallen 86.76% from 2.62 ETH to 0.35 ETH. However, Pudgy Penguins has bucked the trend and risen by 47%, from 2.49 ETH to 3.67 ETH. Among them, World of Women experienced the smallest decline in percentage, while Invisible Friends experienced the largest decline.

It is worth noting that Pudgy Penguins is the only collection in these projects that has experienced a reverse trend. After some fluctuations in December 2022, it has remained relatively stable, with a small rise and fall in June. After the NFT market entered a bear market at the end of 2022, Pudgy Penguins also went through a period of decline. Internal team issues and operational problems led to the project’s difficulties, and the floor price once dropped to the bottom. The addition of serial entrepreneur Luca Netz has opened a new chapter for Pudgy Penguins, establishing an all-star board of directors and injecting more experience and resources into the project. At the same time, through the “Phygital” series, it combines physical and digital experiences and launches physical toy products.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Intent-driven Best practices for Web3+AI?

- In-depth analysis of Pendle LSDfi integrates RWA DeFi Lego to stack new puzzle blocks

- Exclusive Interview with Connext Adopting a Points Mechanism to Determine the Number of User Airdrops, with Plans to Expand to 20 Chains by the End of the Year

- LianGuai Daily | Grayscale Wins Lawsuit Against the US SEC; Ethereum Foundation Launches Ethereum Execution Layer Specification

- In-depth conversation with Sui, Chief Scientist of Mysten Labs How does Sui solve the problem of network scalability from theory to practice?

- Friend.Tech frenzy subsides daily trading volume drops by 90%, Base network returns to rationality

- Explaining Zeth, the Ethereum Block Validator The First Type 0 zkEVM