Exploring the Path of MEV Redistribution

MEV Redistribution ExplorationAuthor: Tudd Cai

When it comes to MEV (Maximal Extractable Value), most users despise it. When we trade MeMe coins on Uniswap, we set a high slippage to ensure buying and selling during intense fluctuations, but this gives MEV bots the opportunity to front-run the trades. For example, when we were trading the popular MeMe coin PePe some time ago, we used ETH to buy PePe. When a searcher noticed this transaction, they would use a higher gas fee to front-run the purchase of PePe, causing the price of PePe to rise and allowing us to buy fewer PePe than expected. The searcher would then sell for profit, and this process is known as a sandwich attack. As a regular user, we can set a lower slippage to mitigate sandwich attacks, such as 0.1%, which would leave less room for profitable front-running. However, setting the slippage too low can result in failed large transactions and still require paying transaction fees. Users can also choose to increase the gas fee, which would increase the cost for bots to attack. The downside is that it also increases the user’s own transaction costs.

It is evident that users are easily vulnerable to MEV bots. However, for MEV bots, it doesn’t mean easy profits or indiscriminate harvesting of users. By default, all transactions are in the Ethereum public mempool and are monitored. Searchers in MEV check if there are opportunities to exploit these transactions. When multiple searchers compete for the same transaction, builders in MEV use priority fees to preempt the next block space, causing normal transactions to be blocked and increasing the cost of on-chain transactions. All transactions will be confirmed on the chain, but only one searcher can succeed, resulting in unnecessary losses for other unsuccessful searchers. To protect users, projects dedicated to optimizing MEV issues provide users with private RPC and promise that transactions broadcasted through these RPCs will not be front-run. Examples include the Flashbots Protect RPC and OpenMEV RPC (MEV-resistant service provider for Sushiswap). Taking the former as an example, Flashbots Protect is an RPC tool used to resist bots attempting to front-run user transactions. Compared to other node providers, it primarily sends transactions to private mempools to avoid being seen by searchers before being confirmed on the chain, effectively reducing the occurrences of sandwich attacks.

- Will the performance improvement of Arbitrum make it a paradise for Web3 games?

- Reviewing the NFT Cold Winter of the past half year Who is ‘surrendering’ and who is growing against the trend?

- Is the golden age of scamming over? Connext’s witch-hunting program goes awry, community poisoning becomes the norm.

When competition among searchers intensifies and users are protected, searchers start to make cooperative requests to users. Why would users agree to cooperate with searchers? Because MEV in the public mempool can be avoided by searchers, but MEV in the private transaction pool is still susceptible to capture. Even if users use Flashbots Protect RPC, it can only prevent potential MEV from being captured by searchers in the public mempool. Searchers in Flashbots Auction still have the opportunity to extract MEV from their transactions. Flashbots Auction provides a private transaction pool and a sealed block space auction mechanism, allowing block validators to outsource the task of finding the best block construction to searchers. In this private transaction pool, searchers can communicate privately. Through Flashbots Auction, searchers no longer need to engage in gas wars to ensure their transactions are prioritized, nor do they need to pay for failed transactions.

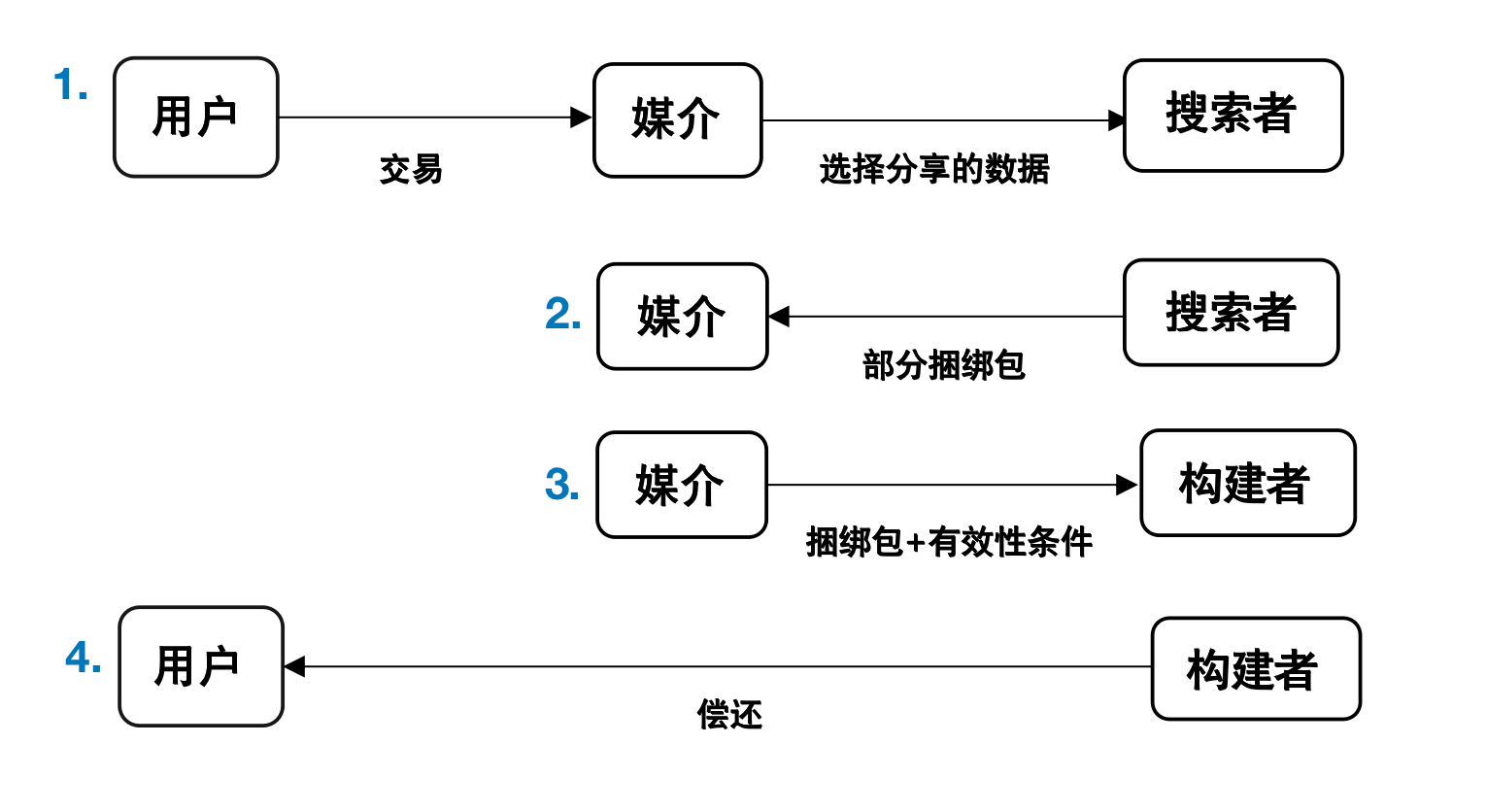

Users wonder since they cannot completely avoid being extractedMEV, it is better to get some rebates from the searchers themselves. So, a win-win solution emerged, called MEV-Share. MEV-Share is a protocol proposed by Flashbots in February 2023, which achieves programmable privacy for users: users selectively share data about their transactions with searchers. This allows users to decide how their transactions are executed, when, and by whom. By default, users only share the hash of the transaction and the supported liquidity pool address. Searchers bid in the programmable private order flow (private order flow refers to non-publicly visible transaction activities and order information submitted to the Flashbots auction system) and participate in the auction of the order flow to obtain the right to execute users’ private orders. This selective disclosure of transaction data by users helps searchers bid better, optimizes competition among searchers, and users also receive fees refunded by builders. So, who mediates the data exchange between users and searchers? MEV-Share introduces a new participant called the Matchmaker to facilitate this exchange.

The Matchmaker can regulate three stages in the MEV-Share supply chain process. It can receive users’ transactions and selectively share the data of these transactions with searchers. It can also insert users’ private transactions into the bundles that searchers have not yet completed, thus creating complete bundles. Bundles are roles introduced in the Flashbots Auction, consisting of multiple transactions to be executed. They can be sent by searchers to builders, and builders select the most profitable ones from the received bundles, pack them into complete blocks, and send them to relays, which are then sent to validators. In MEV-Share, the Matchmaker can send the complete bundles along with the validity terms that builders must comply with (e.g., refunding fees to users) to the builders. Builders must comply with the validity terms to participate in the MEV-Share supply chain. We know that MEV-Share is a cooperation between users and searchers, why do builders also participate? Here, we need to introduce the division of roles in the MEV process.

In the current transition of Ethereum to proof of stake, validators can independently sort and package transactions in the memory pool, or they can choose to package already sorted blocks with higher MEV income pushed by MEV-Boost. Through MEV-Boost, validators’ income will increase significantly, so the majority of validators will choose to adopt MEV-Boost instead of sorting themselves. In fact, according to mevboost.pics, the current percentage of validators adopting MEV-Boost has reached 90.7%.

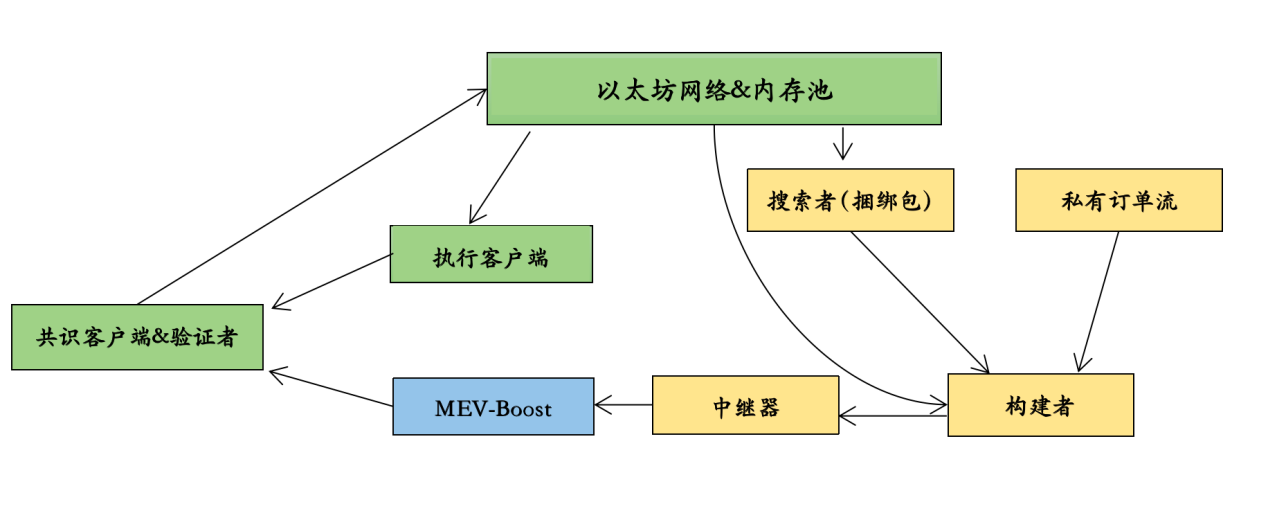

In the MEV-Boost supply chain, there are five roles with different divisions of labor: users, searchers, builders, relays, and validators; their relationships can be referred to in the diagram below. Users are the initiators of the order flow. When a user submits a transaction on the blockchain, the transaction generally enters the transaction pool in the memory pool first. Searchers (arbitrage and liquidation robots, DeFi traders, Ethereum Dapps) start retrieving the memory pool to find extractable value and then bundle the transactions together to provide them to builders. Builders (usually professional institutions) are responsible for packaging transactions from searchers, as well as transactions from the public mempool and the private transaction order flow, into blocks. Relays connect builders and validators, verify the validity and bidding of the blocks submitted by builders, and submit the highest valid bid to validators. Validators are the miners after Ethereum transitions to proof of stake, also known as proposers, responsible for proposing blocks to the network and adding them to the chain. Currently, the competition among validators is stable, and Lido holds the largest market share. Validators can receive both consensus rewards (block rewards) and execution rewards (MEV+Tips).

As can be seen, the builder is an important component in the MEV supply chain. Although MEV-Share regulates the relationship between users and searchers, if the builder behaves improperly and has a negative impact on order flow, users have almost no possibility of recourse. Therefore, it is necessary to build a method to share order flow with trusted builders. Flashbots is building such a method, and in order to receive order flow from the Matchmaker, builders must adhere to the principle of fair market. In this principle, builders need to ensure that they act in a market-neutral manner and do not use their privileged position to manipulate auctions, thereby harming the interests of users. Therefore, MEV-Share also plays a role in reducing the centralization of order flow.

So, how do users, searchers, and builders use MEV-Share? The MEV-Share protocol is included in Flashbots Protect. Users can connect to Flashbots Matchmaker through Flashbots Protect. Users can also configure their RPC requests to choose whether to share their order flow with registered block builders. Searchers can subscribe to Flashbots Matchmaker to search for programmable private order flow, and builders can receive order flow through MEV-Share.

If we were to describe the role of MEV-Share in one sentence, how would we describe it? My understanding is that it achieves collaboration and optimization of the MEV supply chain through programmable transaction data sharing. We know that MEV-Boost is dedicated to optimizing the cooperation between builders and validators, and MEV-Share does the same for users and searchers. In the near future, there may also be collaboration solutions between searchers and builders.

Let’s further consider why we need members of the MEV supply chain to share and collaborate. Why is Flashbots committed to proposing these small but significant solutions? I believe that fundamentally, this is a decentralized value proposition. It is well known that the MEV market is a highly specialized and competitive dark forest, and Flashbots prefers to encourage community cooperation. Their ideal is to create a permissionless, transparent, and fair MEV ecosystem.

1) For the blockchain, they want to achieve maximum decentralization of ordering. For validators, they want to achieve maximum revenue from block space.

2) For searchers and builders, they want to achieve open access to user and searcher transactions, expression of complex preferences, and cross-chain coordination.

3) For users, they want to achieve the best execution path for order flow and the lowest fees. Keywords such as “preference,” “privacy,” and “coordination” are specific expressions of decentralization.

If MEV-Share is dedicated to research at the starting end of the MEV supply chain, another proposal called MEV-Burn is dedicated to research at the ending end of the MEV supply chain. In the current MEV-Boost system, MEV is captured by searchers and flows to block builders, validators, and the Ethereum network in the form of gas fees. Part of the gas fee paid by searchers is burned according to the EIP-1559 protocol, and the other part flows to block builders in the form of tips. Builders pay fees to validators to propose blocks to the network. For builders, the profit from MEV is reflected as “transaction fees (Gas) + fees paid by searchers – burned gas fees – fees paid by builders to validators.” For validators, the profit from MEV is reflected as fees paid by builders, and for the Ethereum network, the profit from MEV is reflected as ETH burned according to EIP-1559.

EIP-1559 is designed to address the problem of low efficiency caused by Ethereum transaction congestion. It can dynamically adjust the upper limit of Gas fees to cope with short-term transaction peaks, avoiding network congestion caused by excessive transaction volume and ensuring the utilization of blocks. In the process of MEV, there is also a similar congestion problem in the block network, known as the competition cost. Arbitrageurs are willing to pay a large amount of gas fees for faster execution of transactions. The resulting competition cost is the goal of MEV-Burn.

In the current system, validators can monopolize slots (in Ethereum PoS, each slot is 12 seconds) through MEV bribery to achieve profitability. Validators can fully control which transactions occur in which slots. Even if other members of the MEV supply chain do a lot of work, validators always enjoy more profits in comparison. When the more validators control, the more profits they can gain, it will lead to centralization issues, namely, a single validator having a monopoly on proposing blocks. In order to make validators compete and strive for the reward for proposing blocks, the proposal of MEV-Burn has emerged. The core idea of this proposal is to auction the “block generation right” at the consensus layer of the protocol. Once the winners among the validators are selected, the execution blocks they propose will be burned with at least the same amount of competition cost as their bid. This idea will prompt validators to bid closer to the maximum extractable value in the block, thus destroying some MEV.

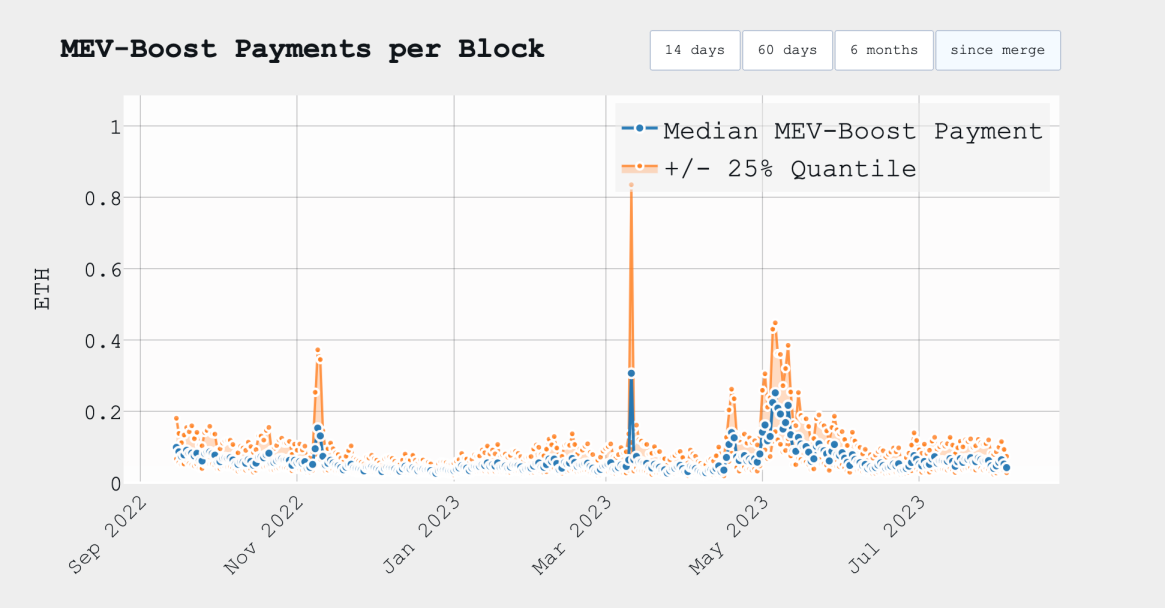

So why burn MEV? What are the benefits of doing so? First of all, burning MEV can reduce the peak effects of MEV. As shown in the figure below, the average MEV payment (the image only describes the blocks created by Flashbots through MEV Boost) is about 0.05 ETH per block. But sometimes, it can soar to an average of 1 ETH per block. During these turbulent market periods, lucky validators have extracted over 100 ETH from a single Ethereum block!

Burning MEV can smooth out the peaks, which can enhance the stability of consensus. Smoothing out the peaks reduces the motivation for individual proposers to steal MEV through short chain reorganizations, P2P attacks, and other methods. Extreme MEV spikes can pose systemic risks to Ethereum, and MEV-Burn can enhance the security of the network.

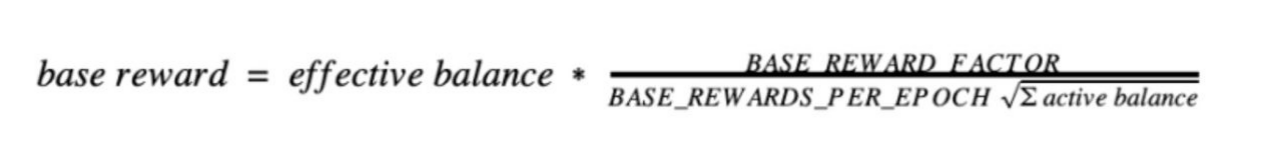

On the other hand, MEV-Burn can generate the same economic benefits as EIP-1559. Under the mechanism of Ethereum’s proof-of-stake, the rewards for validators are mainly reflected in the base reward, which represents the average reward for each validator under the best conditions in each period. This is calculated based on the validator’s effective balance (maximum of 32) and the total number of active validators.

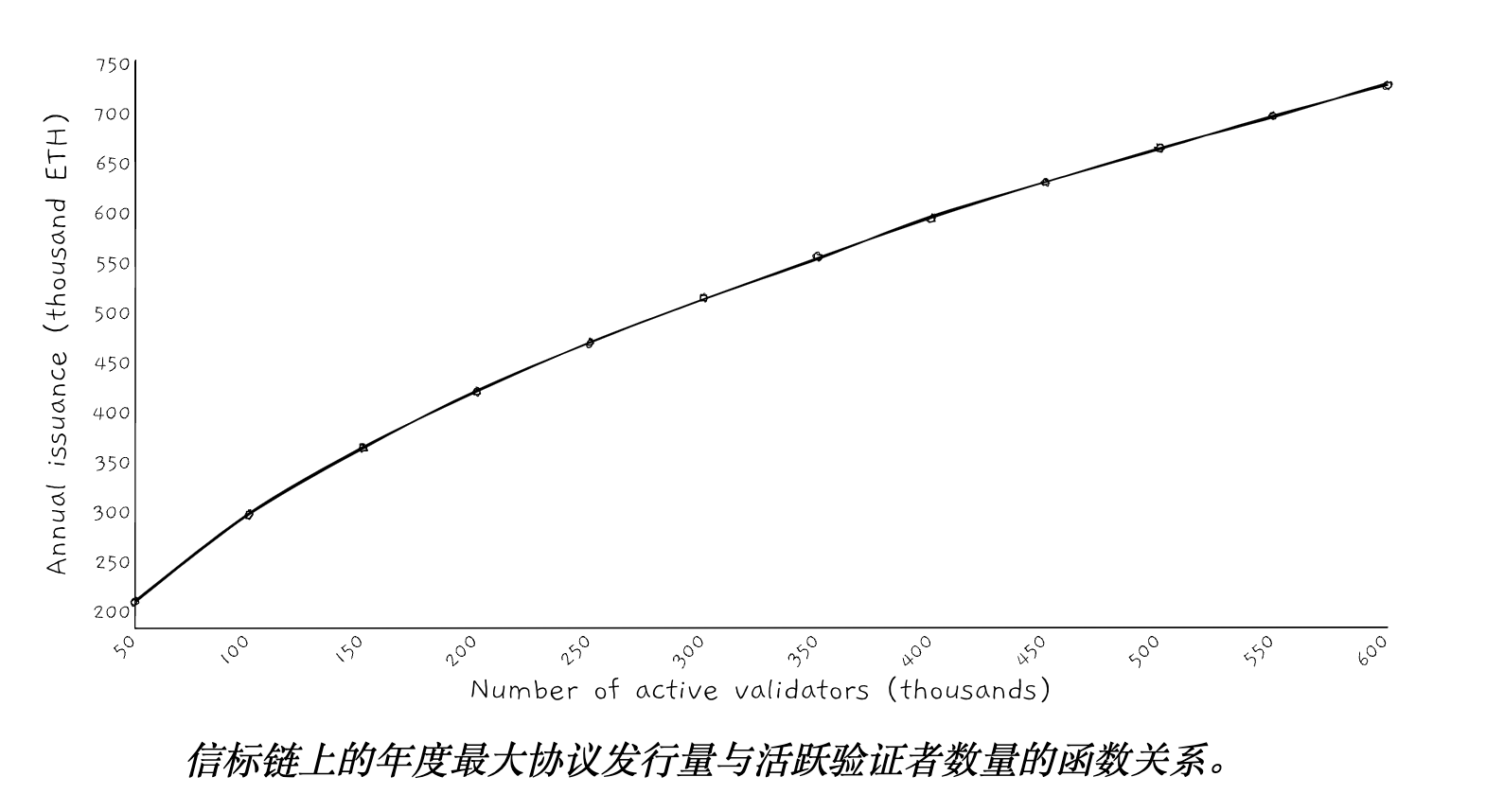

As for the issuance of ETH, the issuance is directly proportional to the square root of the number of validators. MEV burning reduces the income of validators, thereby reducing the total rewards for ETH staking, which in turn leads to a decrease in ETH staking. With the decrease in ETH staking, the total issuance of ETH will also decrease. Since the beacon chain is designed to ensure security solely through issuance, EIP-1559 and MEV burning can reduce excessive investment in economic security and improve economic efficiency, and a decrease in the number of validators can alleviate the pressure on the beacon node. MEV burning can also achieve the effect of increasing scarcity for ETH. If MEV–Burn can be successfully implemented, the rate of decrease in ETH supply will be accelerated by about 2.5 times.

Another interesting point is taxation – in traditional business, when a company wants to distribute profits to shareholders, there are often two options. The first option is to pay dividends to shareholders, and the second option is to buy back shares like Apple. Share buybacks are often subject to Capital Gains Tax, while dividends are subject to Income Tax. The burning of MEV follows a similar pattern to share buybacks. For most jurisdictions, income tax is significantly higher than capital gains tax. In the UK, income tax is 50% while capital gains tax is 20%. EIP-1559 and MEV burning can convert the income tax that users should pay into capital gains tax, significantly improving the tax efficiency of certain jurisdictions for cryptocurrencies. EIP-1559 has already prevented the selling pressure of approximately 1 million ETH, and MEV burning can also prevent the selling pressure of millions of ETH.

A series of solutions regarding MEV are aimed at establishing a fair, transparent, and secure trading environment. In the exploration of the redistribution of MEV, we have seen the collaboration between users and searchers, as well as more intense competition among validators. However, MEV still faces challenges of centralization and inadequate distribution fairness. In the research process, groups such as Flashbots have expressed their commitment to maintaining decentralization and respect for the preferences of each user and each field involved in MEV, and they look forward to more people joining in research and discussion. Looking ahead, we look forward to further research and innovation, and continue to progress towards more decentralization!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuai Observation | Connext Witch Hunt Program Provokes Public Anger, Poisoning may be the only solution?

- Reviewing the Development History of Web2 Game Engines and Exploring the Future Development Path of Full-Chain Games

- Intent-driven Best practices for Web3+AI?

- In-depth analysis of Pendle LSDfi integrates RWA DeFi Lego to stack new puzzle blocks

- Exclusive Interview with Connext Adopting a Points Mechanism to Determine the Number of User Airdrops, with Plans to Expand to 20 Chains by the End of the Year

- LianGuai Daily | Grayscale Wins Lawsuit Against the US SEC; Ethereum Foundation Launches Ethereum Execution Layer Specification

- In-depth conversation with Sui, Chief Scientist of Mysten Labs How does Sui solve the problem of network scalability from theory to practice?