Interpreting Lens V2 Will ERC-6551 Bring the iPhone Moment for Web3?

Will ERC-6551 Bring the iPhone Moment for Web3?The social protocol Lens Protocol was officially launched in May last year. After more than a year of growth, Lens has established its own ecosystem, with over one hundred projects built on the Lens platform. The number of users holding Lens Profiles has exceeded 110,000, making it a leading social project.

At the recent Ethereum ETHCC event in Paris, Lens founder Stani announced Lens Protocol V2, an important step for Lens to achieve an open and decentralized social network layer.

In this article, we will first introduce several key changes in Lens V2 upgrades, and then delve into the real protagonist – the changes brought to Lens by ERC-6551.

Lens V2 Upgrades

- Q2 2023 Web3 Developer Report Surge in Developer Activity, Rapid Adoption of Account Abstraction…

- Exploring the Hidden Corner of USDT Drug Trafficking, Online Gambling, Money Laundering

- Do the sender and receiver need to be online at the same time? Low capital efficiency? Dispelling six misunderstandings about the Lightning Network.

Several key changes in Lens V2 are as follows:

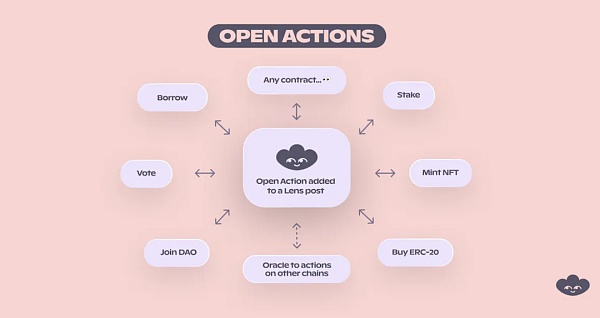

Open Actions

Integrating smart contracts into Lens posts to enhance interactivity. In simple terms, Lens is no longer just an information flow platform. It can directly integrate various Dapps, allowing users to interact with external smart contracts within published posts.

For example, you can directly click “Mint” on a Lens post to create an NFT on Lens through the OpenSea contract;

Or when you find that the borrowing interest rate of the GHO stablecoin is very friendly, you can insert the interface for borrowing GHO in AAVE into your published post, allowing other users to borrow with one click through the interface.

This integration is similar to seeing product recommendations on Xiaohongshu and directly purchasing them through built-in plugins in Taobao, eliminating the need to copy links to shopping platforms.

This integration can even support cross-chain operations and will be expanded to Ethereum and other Layer 2 networks with the help of oracles in the future.

(Source: Lens Blog)

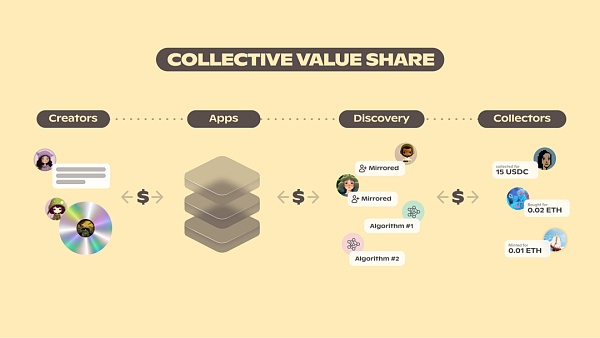

Collective Value Share

In the creator economic chain of Lens, creators publish their content on various Lens applications as the source.

These contents are recommended to target audiences, which can be end users or suitable curators, through algorithms. The content can also be disseminated to a wider audience through curators’ reposts, gaining more attention.

Ultimately, end users can pay for valuable creative content through collection.

Each link in the entire creator economic value transmission chain plays an important role. A healthy creator economic system should balance the interests of each role.

Creators can share revenue to reward those who contribute to the entire value chain, thereby enhancing the value chain and strengthening the business model of ecosystem partners.

Let’s use an example to illustrate this process: a creator publishes an article on Orb, a user posts a comment, and then another user sees the article on another application (such as Buttrfly) because of the comment and finds it meaningful, so they pay to collect the article.

Along this journey, algorithms and curators now have the opportunity to share revenue, incentivizing more interaction.

(Source: Lens Blog)

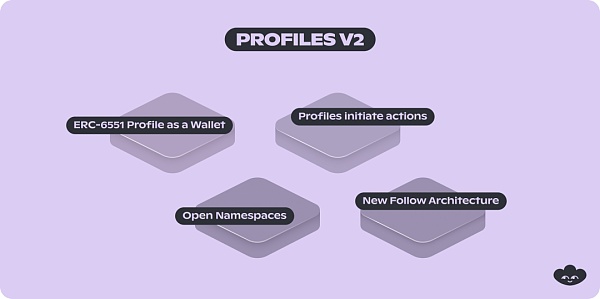

New Generation Account (Profiles V2)

Introducing ERC-6551 allows each Lens Profile to create a smart contract wallet account, thereby obtaining all the functions of an Ethereum account, such as holding NFT and token assets, and interacting with Dapps.

This means that Lens Profile has programmability and interoperability. Accounts are wallets that can hold and control assets, and accounts can also log in and initiate interactions. As a result, Lens Profile can build a new attention system.

By introducing these changes, the social asset system has changed from NFT to Wallet to NFT to Profile, greatly increasing the value of the Profile itself. The value of all social graph relationships is directly attached to the Lens Profile.

(Source: Lens Blog)

Account Management (Profile Manager)

The account management function of Lens V2 provides users with more flexible options. Now, Lens Profile can be hosted in a secure cold wallet, while delegating social functions (such as posting, commenting, etc.) to other wallets for operation, further decoupling the association between Profile and wallet addresses, and improving security.

Lens V2 supports more association patterns. Now, a Profile can be bound to multiple wallet addresses, and different operations can be delegated to different wallets for management; or a wallet address can manage multiple Profiles.

Users can also delegate wallet functions to some dApps, allowing dApps to operate uniformly, bringing a decentralized social experience without gas and signatures.

In addition, V2 also supports account abstract addresses as Profile Managers, opening up more application scenarios and use cases for users.

(Source: Lens Blog)

Trust and Security

In Lens V2, the following features are introduced to protect users’ social environment and account security.

First is the on-chain blacklisting function, where users can add other users to the blacklist to prevent any interaction with these users, such as following, commenting, forwarding, etc.

In addition, the Profile Guardian mechanism introduced in LIP-4 is also introduced, which improves the security of Lens Profile and minimizes the risk of phishing and stealing Lens Profile.

Now, users need to wait for a 7-day cooling-off period to transfer Lens Profile, which allows more time to protect assets.

The introduction of these security features makes Lens V2 a more reliable and secure platform.

In the feature updates of Lens V2, it can be foreseen that more open operations will bring a better user experience, allowing users to complete interactions with the external world within Lens; the creator economy has always been a focus of Lens, and sharing social chain revenue is not an aha moment.

Among these upgrades, what really has a profound impact on Lens is the upgrade of the account system, which is the introduction of ERC-6551 into Lens Profile. Only by fully understanding the changes brought by ERC-6551 can one understand the changes in the Lens account system.

The Real Protagonist – ERC-6551

ERC-6551 was first proposed in the Ethereum community in February this year and quickly became one of the hot topics of the year. At the ETHGlobal Waterloo hackathon, 4 out of 11 projects were related to ERC-6551.

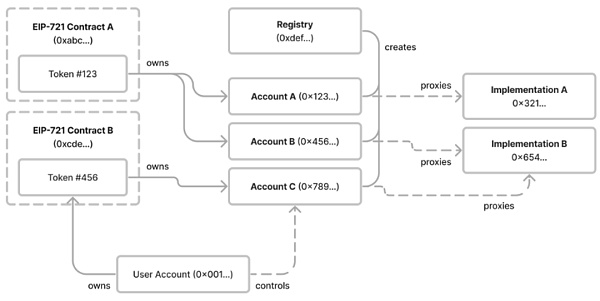

ERC-6551 aims to create a smart contract wallet for each ERC-721 type NFT. This wallet has all the functions of an Ethereum wallet account, can connect and log in to various dApps, can interact with other smart contracts, and can hold various tokens and NFT assets. It is also backward compatible with all ERC-721 NFTs, which means that all existing NFTs in the market will be able to have their own smart contract wallet accounts!

(Source: EIP-6551)

As shown in the above figure, the NFT holder (User Account) holds NFT A and NFT B. Each NFT can generate one or more smart contract wallet accounts (Account A/B/C) through the Registry specified by ERC-6551, or in other words, bind an account.

The owner of the generated NFT-bound account is the NFT itself, not the NFT holder, but the NFT holder actually controls the operational rights of the NFT-bound account.

In other words, the account goes with the NFT. If the NFT holds tokens or NFT assets, they will all be transferred together when the NFT is transferred, and the control of the NFT-bound account will be handed over to the next holder.

Account System under Lens V1: Ethereum Account as the Main Account, Lens Profile as the Auxiliary Account

After understanding ERC-6551, let’s review Lens’s original account system. NFT is one of the most important elements in Lens’s account system:

The personal account Lens Profile itself is an NFT. Actions on Lens, such as following and collecting, are also carried out by minting corresponding NFTs and sending them to the holder’s Ethereum address.

Obviously, in this account system, the main entity is the Ethereum wallet, and the Profile NFT serves as a membership card, allowing holders to actively participate in the Lens ecosystem and filter out wallets that do not hold Lens Profile NFTs.

Account System under Lens V2: Lens Profile as the Main Account, Ethereum Account as the Auxiliary Account

However, ERC-6551 allows each Lens account to generate a smart contract wallet. The binding wallet generated by Lens Profile already has all the functions of an Ethereum wallet, including logging in and interacting with dApps, and holding assets. The two can almost achieve equal status, thus decoupling the Lens account from the Ethereum wallet.

In this way, naturally, the Lens Profile account is elevated to an independent account status separate from the Ethereum wallet in the Lens ecosystem, leading to changes in the following and collecting systems.

For example, the follow NFT generated after a fan follows or the NFT minted through the collecting function will no longer be assets of the Ethereum wallet, but assets of the Lens account. Even the income generated through creation and monetization will be directly distributed to the Lens account.

Through this change, all interaction records and creation records of Profile become part of the value of the Lens account, making the accounts different and growable. By attaching the value of social graph relations to the Lens Profile, the value of the Profile is greatly increased.

When users want to trade Lens Profile on OpenSea, it is no longer just trading NFTs. They need to consider the implicit value of the account. For example, an artist’s Lens account may continue to receive copyright fees, so buying their account is equivalent to buying their future copyright fees.

In addition to the added value, ERC-6551 also opens up many new scenarios for Lens accounts:

-

Game accounts

The focus of building Lens is on the game direction because games naturally have social attributes. After the V2 upgrade, users can directly log in to the game using the Lens Profile, and the equipment and earnings obtained in the game also belong to the Lens account.

This enables one-click sale of game accounts. The sold account is a complete entity that includes game records and game assets, rather than a scattered pile of NFTs.

-

DAO management

DAOs built on Lens can distribute the contribution records of all DAO members in the form of SBT to their corresponding Lens accounts, instead of the Ethereum addresses of the holders.

The more contributions, the richer the credentials owned by the Lens account, making it easier for DAOs to manage member contributions.

-

Account operations

Currently, project parties need to fully hand over the account passwords to the operators when operating Twitter accounts, which actually carries the risk of being stolen.

However, if account operations are conducted on Lens, the official account’s Profile can be securely hosted in a cold wallet, and operational permissions can be delegated to designated personnel. This can reduce the risk of official Twitter accounts being hacked and phishing false information being published.

-

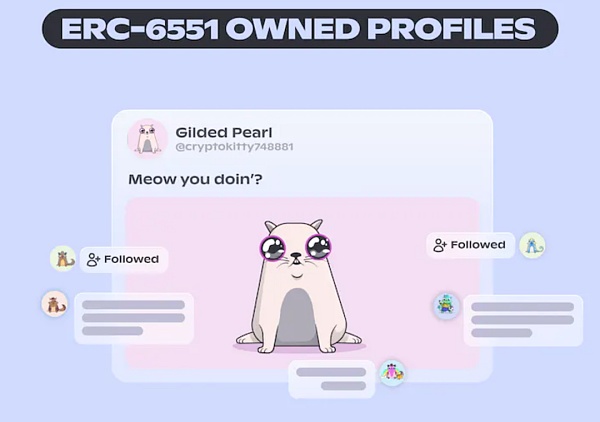

NFT community based on Lens

Lens accounts can own other assets, and other NFTs can also own Lens accounts. This feature provides NFTs with their own social relationships and the power of discourse. Holders of NFTs from the same series can use this to build a follow chain on Lens, form a community, and strengthen consensus.

For example, CryptoKitty can have a Lens Profile, follow other CryptoKitties, and create and publish content, thus building its own value chain.

(Source: Lens Blog)

Summary

The biggest change in Lens V2 is the introduction of ERC-6551, the upgrade of the account system, and the evolution of Profile from an NFT to a smart contract wallet account, greatly enhancing overall composability and operability.

From the interaction centered around Ethereum accounts to the interaction centered around Lens Profile. ERC-6551 can bring more application scenarios to Lens, and the open development environment will also become fertile ground for more small yet refined products.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- TG BOT Rising Upstarts in Blockchain Marketing and Grassroots Counterattack, Security Issues Await Resolution

- 10 Steps to Enhance Encryption Security

- Looking back at Yuga Labs over the past year, is APE still a good bear market bargain?

- Overview of the development status of NFT lending protocols What are the innovations and unresolved issues?

- DYDX competitor, encrypted derivatives platform MEKE, first round of public testing ends on August 10th.

- Why are there so many Layer2 chains?

- LianGuaiWeb3.0 Daily Report | Uniswap has been deployed to the Base network