LianGuaiWeb3.0 Daily | Binance Labs announces strategic investment in AltLayer

Binance Labs invests in AltLayerDeFi Data

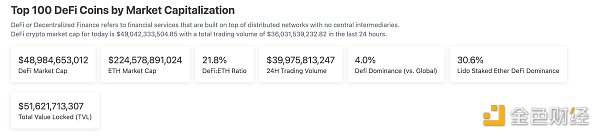

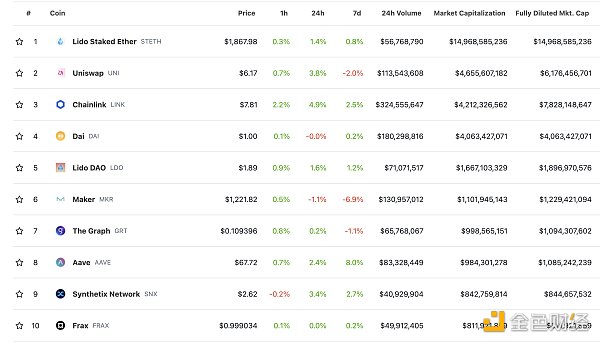

1. Total market value of DeFi tokens: $48.984 billion

- Interpreting Lens V2 Will ERC-6551 Bring the iPhone Moment for Web3?

- Q2 2023 Web3 Developer Report Surge in Developer Activity, Rapid Adoption of Account Abstraction…

- Exploring the Hidden Corner of USDT Drug Trafficking, Online Gambling, Money Laundering

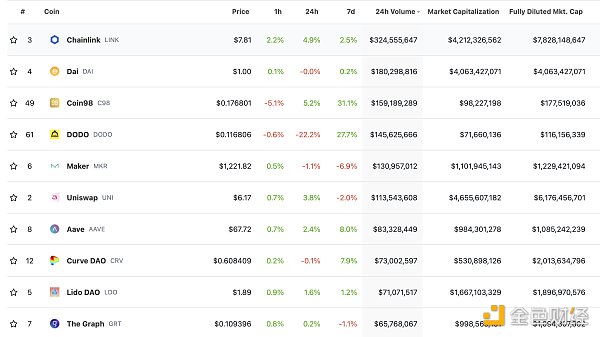

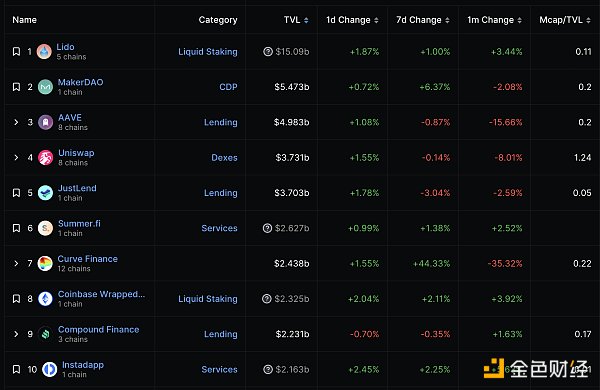

DeFi total market value and top ten tokens data source: coingecko

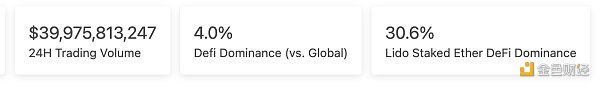

2. Trading volume of decentralized exchanges in the past 24 hours: $3.997 billion

Trading volume of decentralized exchanges in the past 24 hours data source: coingecko

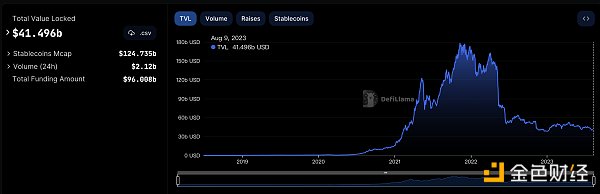

3. Locked assets in DeFi: $41.496 billion

Data source: defillama

NFT Data

1. Total market value of NFTs: $16.835 billion

Total market value of NFTs and top ten projects by market value data source: Coinmarketcap

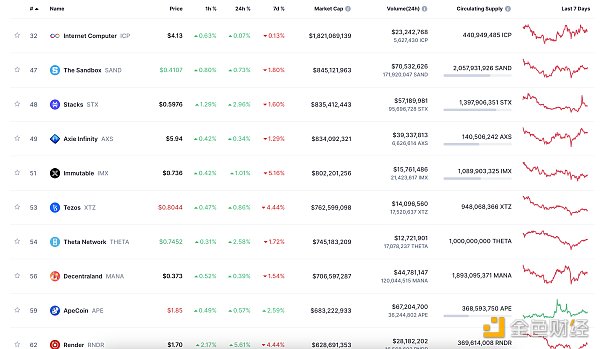

2. 24-hour NFT trading volume: $1.114 billion

24-hour NFT trading volume and top ten projects by trading volume data source: Coinmarketcap

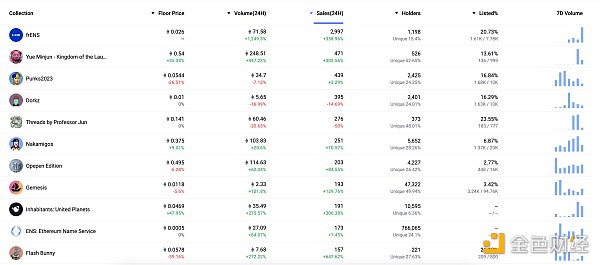

3. Top 10 NFT sales in the past 24 hours

Top ten NFT sales in the past 24 hours data source: NFTGO

Headlines

Binance Labs announces strategic investment in AltLayer

LianGuai reports that Binance’s venture capital and incubation department, Binance Labs, has announced a strategic investment in AltLayer, a leading Web3 application decentralized Rollups as a Service (RaaS) provider.

NFT/Digital Collectibles Highlights

1. Crypto-friendly check account application Juno acquires NFT music platform Swaraj Labs

On August 9th, crypto-friendly check account application Juno announced that it has successfully acquired Indian music NFT platform Swaraj Labs (formerly Humit), and the specific acquisition amount has not been disclosed. Swaraj Labs primarily helps artists create and distribute art using Web3 technology. Sources say that Swaraj Labs will lead Juno’s global expansion plans.

2. NFT minting platform Manifold adds support for Base network

LianGuai reports that NFT minting platform Manifold tweeted that Manifold has added support for Base, a Layer 2 blockchain by Coinbase, and has now launched NFT minting, claiming, burning, airdropping, and other functions.

3. Bicycle Card, the company that holds BAYC #1227, plans to launch a limited edition BAYC playing cards

On August 9th, Bicycle Card, the American playing card company that holds BAYC #1227, announced the launch of a limited edition Bored Ape Yacht Club (BAYC) playing cards. The estimated delivery time will be between December 23, 2023, and February 24, 2024.

In addition, Bicycle Card will release an exclusive Golden Banana Collection card for the Bored Ape community (only for BAYC, MAYC, and BACK holders). Bicycle Card is a 135-year-old playing card brand in the United States and has collaborated with well-known companies such as Harry Potter, Coca-Cola, Pepsi, Disney, and Ford to launch co-branded playing cards.

4. NFT lending platform NFTfi launches “Loan Streak” continuous lending incentive program

LianGuai reports that NFT lending platform NFTfi has officially announced the launch of the “Loan Streak” continuous lending incentive program during Earn Season 1. Users (whether lenders or borrowers) who maintain an active lending status continuously for three months or longer from May 15, 2020, to August 6, 2023, will be eligible for reward points. However, NFTfi reminds users that they are temporarily unable to monitor loan records in the Dapp, so they need to add their email address to their NFTfi account to receive regular updates on their loan streak status via email.

DeFi Highlights

1. Microsoft partners with Aptos to explore digital payments and tokenization

On August 9th, Aptos Labs announced a new partnership with the technology giant Microsoft. In addition to exploring “innovative solutions” related to asset tokenization, digital payments, and central bank digital currencies, both parties will leverage Microsoft’s Azure OpenAI services.

In a joint statement, the two companies indicated that initially, their collaboration seems to be primarily focused on leveraging Microsoft’s artificial intelligence capabilities to simplify the process of user login to Web3 and help “developers build smart contracts and decentralized applications.”

2. Decentralized stablecoin protocol Angle Protocol releases V2 version

On August 9th, Angle Protocol, a decentralized stablecoin protocol, released its V2 version. This version will enable diversified asset allocation for its Euro stablecoin agEUR reserves, including the tokenized short-term risk-free Euro bond ETF bC3M launched by Backed.

3. DeFi platform Liquid Crypto completes a new round of financing

LianGuai reports that Australian decentralized financial platform Liquid Crypto has announced the completion of a new round of financing, with participation from Baboon VC, a Hong Kong-based cryptocurrency venture capital firm. The specific amount has not been disclosed, but it is reported that the new funding will accelerate the development of its partnership and application Liquid+. Liquid Crypto primarily offers DeFi digital asset purchase, sale, and exchange services. Its cross-chain trading services currently support BSC, Ethereum, Polygon, Arbitrum, etc. Baboon VC, as the investor in this round, also has investments in other Web3 projects, including the cryptocurrency options platform SignalPlus and the decentralized insurance protocol Neptune Mutual.

4. Cosmos Ecosystem DEX Osmosis Integrates Celestia Data Availability Layer

On August 9th, Cosmos ecosystem DEX Osmosis announced the integration of Celestia data availability layer. Osmosis stated that in the future, the Rollup network can access liquidity anywhere and use any token on the Osmosis network for cross-chain payments on Celestia. Osmosis also mentioned that it will soon integrate with the cross-chain application building platform Hyperlane.

5. On-chain Analyst: FDUSD Total Supply on Ethereum Reaches 265 Million

According to data disclosed by Tom Wan, an on-chain analyst from 21co, the parent company of 21Shares, in the past 7 days, the supply of FDUSD has increased by 91%, with a total supply of 265 million on Ethereum. The adoption by Binance has driven the growth of FDUSD, with Binance holding 99.1% of the FDUSD supply on Ethereum. The trading volume in the past 24 hours was 24 million USD, with the trading volume of USDT-FDUSD reaching 13 million USD.

Game Highlights

1. Whale Research Institute Founder Conan: GameFi May Be the Next Breakout Point

In the LianGuai Salon event hosted by LianGuai on August 8th, Whale Research Institute founder Conan stated in the roundtable discussion “Which Web3 Narratives Will Lead the Next Bull Market” that GameFi may be the next breakout point. Companies like 37 Interactive Entertainment and Perfect World have already been laying out in GameFi. Since traditional games have started to lay out, traditional assets such as real estate will also have opportunities. By using blockchain technology, combining virtual assets with real assets can generate more benefits. Investors are advised to remain rational and adjust their strategies according to development trends, policy environment, and the Bitcoin cycle in order to navigate the bear market and embrace the next bull market. He holds an optimistic attitude towards the future prospects of public chains, believing that public chains will continue to develop and create greater value. As a key component of the Web3 ecosystem, public chains will continue to play an important role. The team will continue to innovate based on market demand, creating more value for users and projects.

Disclaimer: LianGuai, as a blockchain information platform, publishes articles for informational purposes only and does not constitute actual investment advice. Please establish a correct investment concept and increase risk awareness.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Do the sender and receiver need to be online at the same time? Low capital efficiency? Dispelling six misunderstandings about the Lightning Network.

- TG BOT Rising Upstarts in Blockchain Marketing and Grassroots Counterattack, Security Issues Await Resolution

- 10 Steps to Enhance Encryption Security

- Looking back at Yuga Labs over the past year, is APE still a good bear market bargain?

- Overview of the development status of NFT lending protocols What are the innovations and unresolved issues?

- DYDX competitor, encrypted derivatives platform MEKE, first round of public testing ends on August 10th.

- Why are there so many Layer2 chains?