VC such a hot blockchain | Interpretation of the first half of the financing report

In the first half of 2019, the entire industry experienced a round of "bear-cow" conversion. First, IEO, DeFi, Staking and other hot concept one by one become the industry's enthusiasm. Then Facebook released the Libra white paper to inject a shot in the industry. At the same time, Bitcoin also attacked the highest station on the road for 12,000 US dollars, the mainstream currency rose.

So, does the superficial prosperity mean that the entire industry is really active? This article will focus on the financing amount, amount, and investment institutions of the blockchain project in the first half of 2019, with a view to understanding the true status of current project financing.

The data sources for this article include Crunchbase, Zero2IPO, LinkedIn, and other publicly available materials.

PAData Inghts:

4. Round B is the round with the highest financing amount for a single project. On average, each B round project can obtain financing of 13.15 million US dollars.

- Institutional running into the blockchain: Who are, what, what is the impact?

- Who is competing for C? Read the encrypted payment contest

- How to design a self-adjusting consensus agreement?

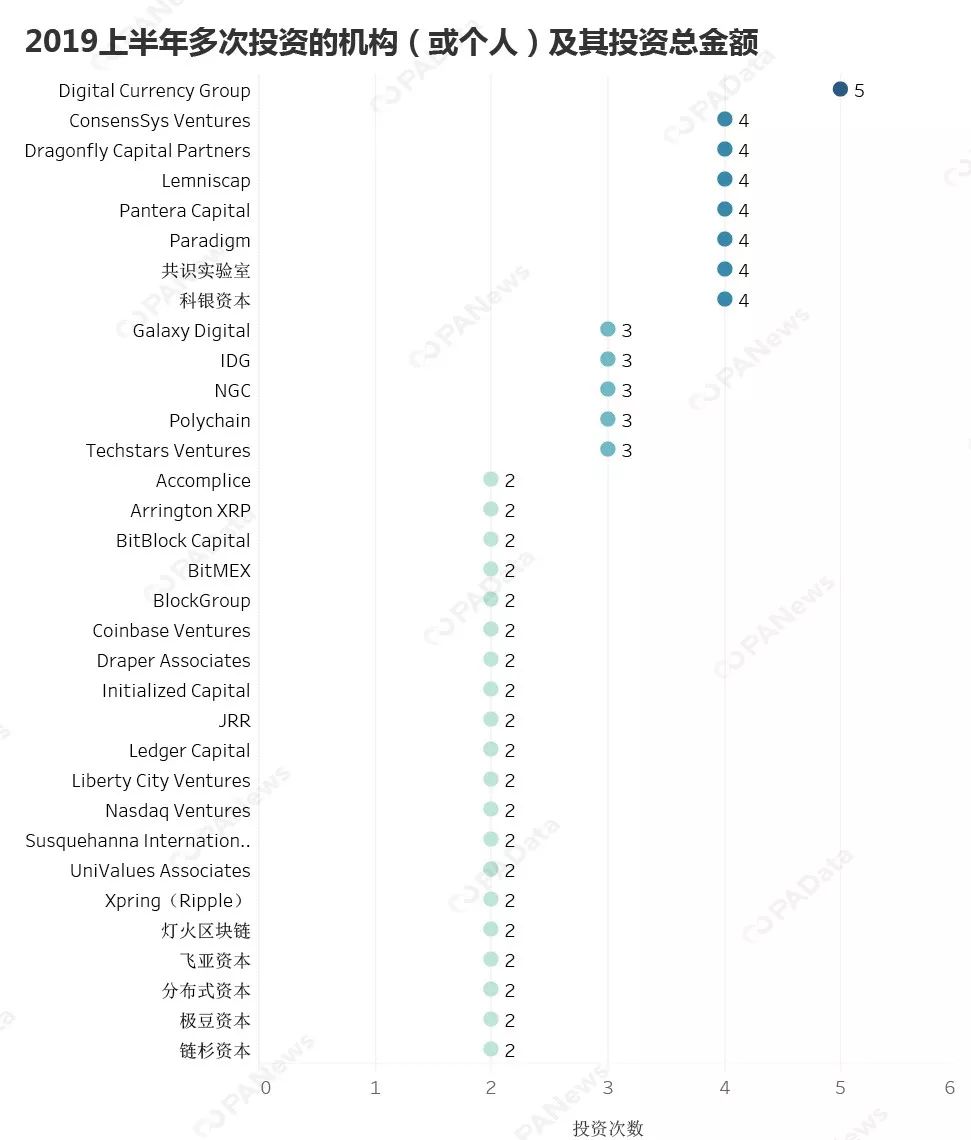

5. Of the 283 investment institutions, a total of 33 institutions invested in more than two projects in the first half of the year.

6, Digital Currency Group shot 5 times, is the most investment institutions.

7. Many traditional large institutions and large enterprises have invested in blockchain projects, including IDG, Fidelity International, Japan Softbank, Sequoia Capital India, Ant Financial, PayPal, and Shun Capital.

8. Most large enterprise investment blockchain projects are closely related to their own business.

151 financing events, starting from 6.3

According to PAData's incomplete statistics, in the first half of 2019, a total of 145 blockchain projects received investment from investment institutions/individuals, including four first-time token financing projects and one private-venture token financing project. In addition, six projects announced financing progress twice in the first half of the year.

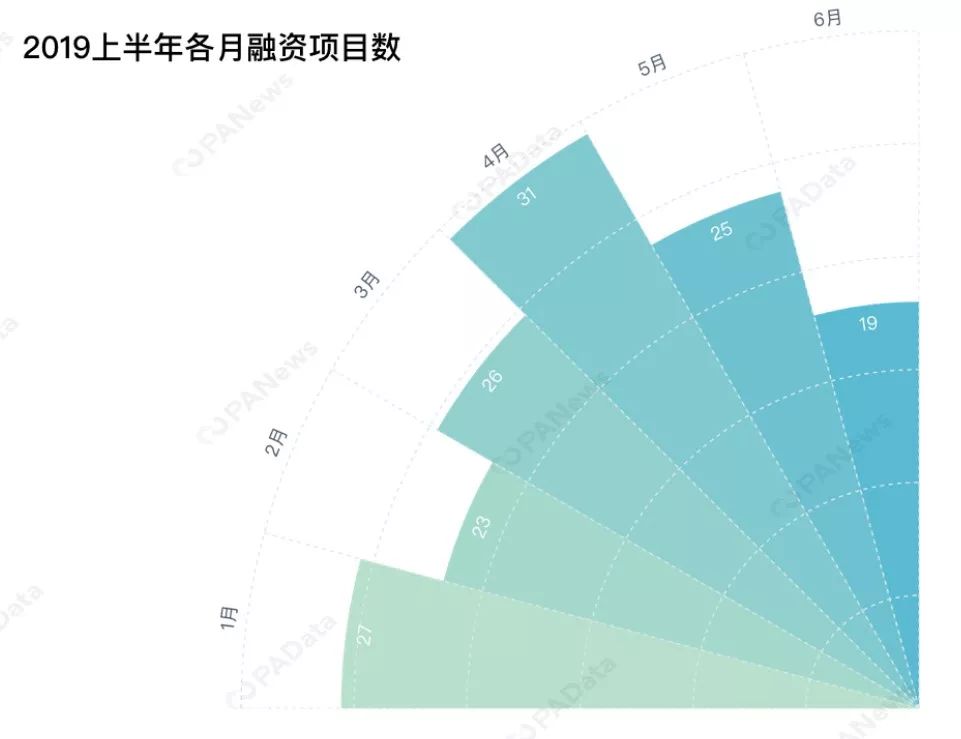

Due to the need for follow-up statistics, and in order to maintain consistent statistical standards, the two announcements of financing are considered as two financing events. In the first half of this year, there were 151 financing incidents. Among them, April was the month with the most financing incidents, a total of 31, followed by January, a total of 27 cases. In June, due to statistics only on the 23rd, according to the average level of 6.3 financing events per week in the first half of the year, the estimated financing event in June was about 25 cases. Overall, the financing incidents occurred in the first half of the year were relatively uniform, and there was no reduction in financing events due to the fact that the market was not warm at the beginning of the year (January, February).

The total amount of financing disclosed is about 712 million US dollars . Mature projects after the B round are more favored by capital.

In the first half of the year, a total of 75 financing incidents were disclosed, and the total financing amount reached US$711.8 million. In addition, there were 57 financing events that did not disclose the specific amount, and 19 financing events disclosed the approximate size.

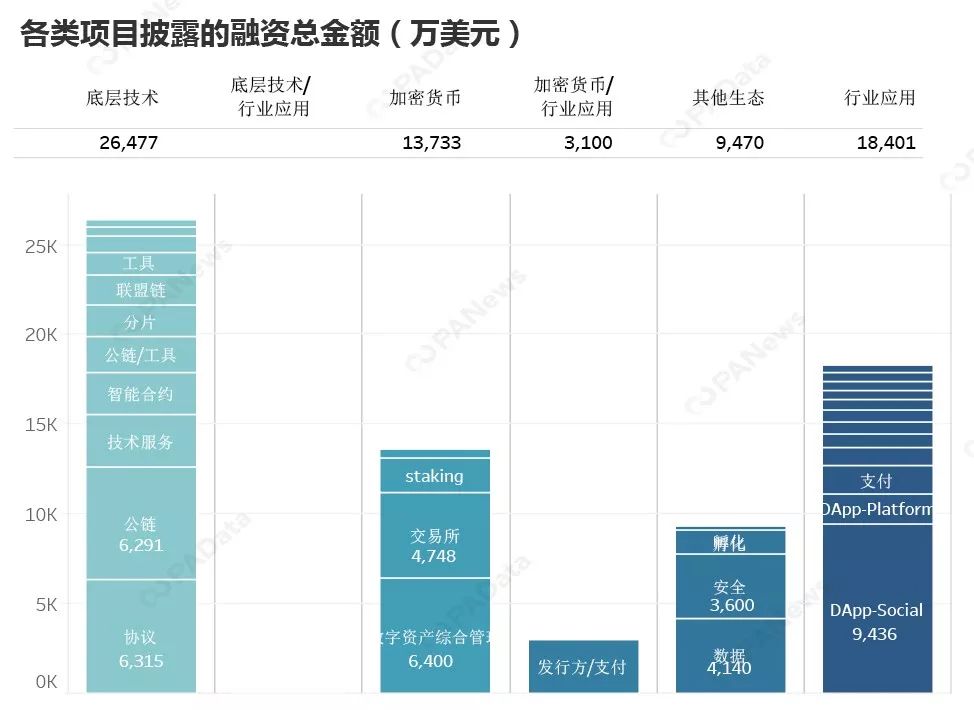

From the perspective of each category, the underlying technology is the one with the highest total amount of financing, totaling approximately $265 million. Among them, the total financing of the agreement and public chain projects reached 63.15 million US dollars and 62.91 million US dollars respectively. The total financing for industry applications is approximately $184 million, of which DApp-Social accounts for 51.28%. However, it is important to note that 90 million of DApp-Social's $94.60 million in financing is from Private X (Kakao)'s private placement token subscription, and the disclosed subscriber is Crescendo Equity Partners.

The total amount of financing disclosed in the cryptocurrency project is approximately $137 million, which is only about 50% of the total underlying technology financing. The exchanges with the most financing events only disclosed a total of $47.48 million in financing, while the integrated management of digital assets with only eight financing events disclosed a total of 64 million in financing. If the special case of Ground X (Kakao) is not considered, then the digital assets are integrated. Management is a breakdown of the largest amount of financing disclosed in the first half of the year.

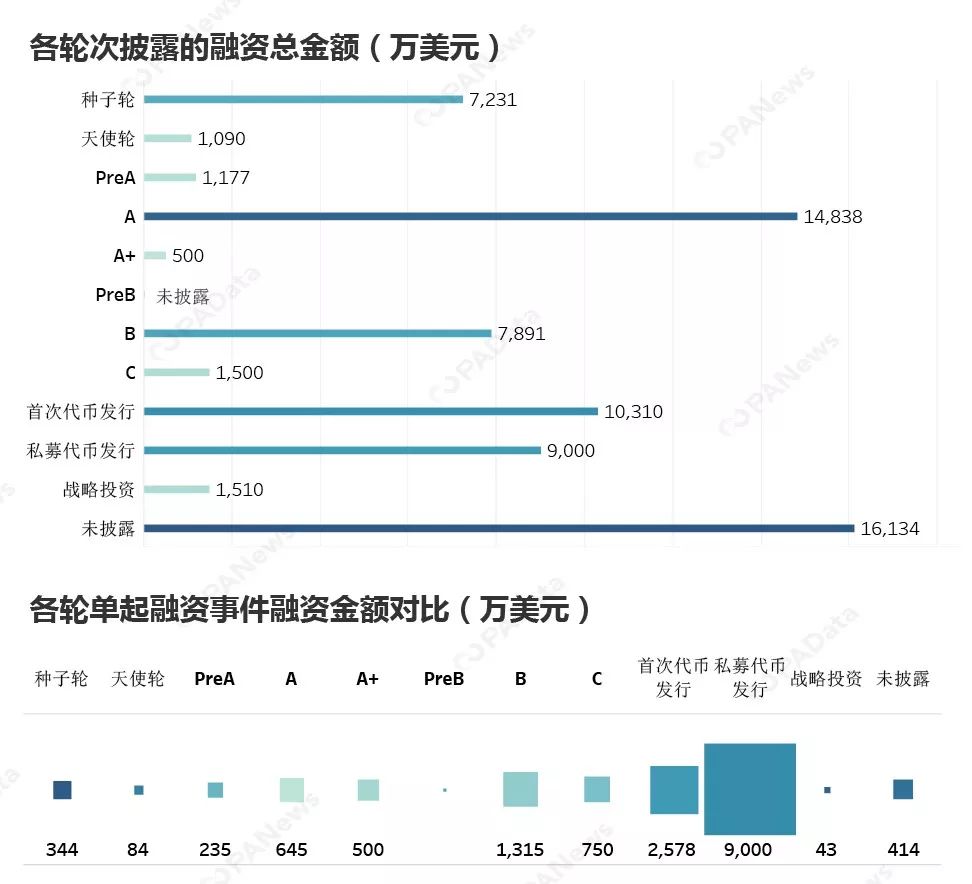

In the case of not considering the first-time token issuance and private-equity token issuance, the B round is the highest round of financing for a single project, and an average of $13.15 million in financing for each B-round project. Followed by the C-round project, an average of $7.5 million in financing for each C-round project. In addition, the A round, the A+ round and the seed round also reached an average single project financing amount of more than 3 million US dollars.

It should be said that projects that are more mature after entering the B round are more likely to be favored by capital and obtain a higher financing amount. In contrast, the amount of financing that can be obtained for the first-time token financing and private-equity token issuance financing with higher regulatory risk is much higher than any other financing round.

Large companies and traditional institutions have appeared in 33 institutions for more than 2 times

Among the 283 investment institutions, a total of 33 institutions invested in more than two projects in the first half of the year , accounting for 26.4%. Among them, the Digital Currency Group has been launched five times and is the largest investment institution among all investment institutions. In addition, ConsensSys Ventures, Dragonfly Capital Partners, Lemniscap, Pantera Capital, Paradigm, Consensus Laboratories, and Kevin Capital invested in four projects.

In the first half of the year, many traditional large institutions and large enterprises invested in blockchain projects, including IDG, Fidelity International, Japan Softbank, Sequoia Capital India, Ant Financial, PayPal, and Shun Capital . Most of the large enterprise investment blockchain projects are closely related to their own business and are pragmatic. For example, Ant Financial and PayPal, which are related to payment, have invested in privacy technology and digital identity. Large investment institutions have a wide range of investments, including industry application platforms, protocol layer tools, data or security service providers.

Source | PANews.io

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Market Analysis: Bitcoin starts to oscillate, funds back to the altcoin

- "Moving brick arbitrage" scam reappears, a user is deceived 885 ETH

- Analysis of the Internal Relationship between Facebook Libra Project and Sino-US Trade Friction and Coping Strategies

- On June 23, the market analysis continued to touch the bitcoin, and the heavy pressure zone on the top was difficult!

- Looking back at the four bull markets that Bitcoin has experienced, the major lessons that are worth learning

- Staking: The new wave of mining in the PoS era, value investment or the correct way to open

- Market Analysis: BTC is blocked at $11,200, and the risk of short-term retracement increases