Viewing the Governance and Game Theory under the Chain from the Merchant Law in the Middle Ages

Source | Medium

Translation | First Class (First.vip) Gisele

This paper outlines the relevance of game theory systems to under-chain governance.

(Source: brewminate.com)

- The Swiss Stock Exchange is based on the XTZ-based ETP, and investors can get XTZ staking income.

- Morgan Creek CEO: Every asset in the world will be tokenized, selling Amazon stock to buy bitcoin

- Getting started with blockchain | 10 common misconceptions about blockchain and cryptocurrency

The Role of Institutions in the Renaissance of Trade: The Merchant Law, Private Judges and Champagne Fair, by Paul Milgrom, Douglas North and Barry Weingast, published in 1990, outlines Lex Mercatoria (Law Merchant Customary Law) and Law Merchant (Businessman Law) The laws of the two medieval ruling merchants for commercial transactions. Their findings suggest that the cost-benefit relationship of the reputation system can be used to motivate a merchant's integrity behavior. Milgrom and his colleagues explained the role of merchant law in distributed networks using the prisoner's dilemma and other game theory systems. The article suggests that traders need to know what their trading partners have done in the past. A well-informed businessman can resist a partner who has deceived. As long as the cost of obtaining and communicating information is lower than the cost of participation, the merchant law can thrive.

This article will outline the relevance of its game theory system to under-chain governance. In the field of decentralization, the public often ignores the importance of chain governance. How to judge the offender? Those who lie or lie? Or someone who steals information from honest players?

What is the merchant law?

The nation-state as a central entity has existed for a long time. As early as the 11th century Europe, most of the areas were in feudal society ruled by local governments, but local governments were only responsible for their jurisdiction. With the development of regional trade specialization, merchants find that when they conduct transactions outside their own towns, there is no governance system that can mutually encourage honesty. The merchant law evolved from a need to reduce new types of fraud to a new, cross-regional trading system. Although the feudal government can enforce agreements between two members within its jurisdiction, it has no power to regulate merchants in other towns. Therefore, the development of the system is to prevent the dishonesty of businessmen. The merchant law is a means of reducing uncertainty, which is related to transactions outside the typical jurisdiction.

The reputation system of merchant law is maintained by private judges. Private judges act as the authority to determine who has deceptive behavior, advocate private problem solving, and pass on enough information to the community to maintain a balance of reputational systems. The services provided by the judge are beneficial to both the community and the merchants seeking arbitration. Merchants seeking a ruling from a former partner will benefit themselves by accepting the verdict and identifying the dishonest in the network will benefit the community.

"The law is a piece of paper, there is no court to clarify and define its true meaning and role." – Hamilton

Merchant law seeks to solve multiple incentive problems in commercial trade. The main focuses include:

· Encourage community members to be honest;

· The community will resist people who are dishonest;

· Community members must always tell who is dishonest;

· Community members must provide evidence to prove that the other party is dishonest;

· The results of arbitration by private judges have a legal effect.

The following is a summary and reaffirmation of the merchant law and game theory by Milgrom et al.

Prisoner's dilemma

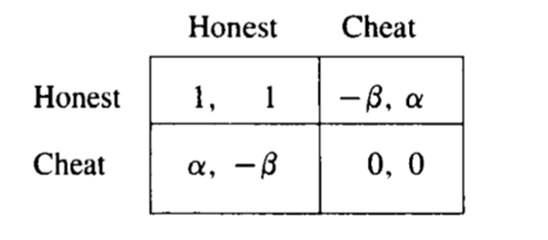

Prisoners Dilemma (PD) is a representative example of game theory and non-zero sum game, which describes the incentive mechanism for the interaction between two participants. In the merchant law, the results of the participation of the two parties are divided into: honesty and deception. Let α > 1 and α – β,

Source: Milgrom et al.

When both parties demonstrate honesty, the interests of both parties are maximized (1). However, if a trader chooses to cheat when his partner is honest, his personal income will be higher (α> 1). Suppose the traders only trade once for each other. If his partner is honest, then the action that can best benefit him is deception. However, the opposite of both parties is honest, the result of both parties choosing to deceive is the behavior with the least benefit to both parties (0).

Now, if this relationship is assumed to exist, the trader can make a choice based on the past behavior of his trading partner. If the other party trades frequently, a Teething (TFT) strategy can be used, in which the trader will repeat the last round of action of his partner.

This logic applies to businessmen who do not trade frequently but often trade with the community. If the information of the deceiver is widely spread in the community, even if he changes a partner, he will be deceived by the next partner, even if the partner is an honest businessman. Milgrom calls it a reputation for being transferable. Why is an honest businessman who has not been deceived deceiving others? According to the rules of the prisoner's dilemma, deceiving others will be more profitable, and this is also a punishment for dishonest businessmen.

Incidentally, this logic holds that in a typical cooperative environment, as long as the merchant assumes that other merchants will be honest in the future, no one can benefit from the deviation rules. The boycott mechanism is still valid when all the merchants in the community know the reputation of others.

Honest reputation system

Without a centralized body, participants will not have access to information about traders in the community. There is no honest motive if there is limited information about the past behavior of current partners and there is no enforcement system.

If the centralized authority informs other traders in the community about the historical behavior of a trader, it may solve the incentive problem in the system, but it requires high cost and inefficiency. In this regard, the merchant law solution is to provide enough information, which means that the trader does not need to know all past behaviors, nor the information of the previous trading partner. If the trader is aware of the behavior of his partner in the previous period, even if he is not a deceived trader, he has the ability to impose penalties on his partner. This merchant law can ensure that previously deceived members cannot easily trade with new partners to avoid being punished for the last cheating.

judge

The existence of “judges” alleviates the problem of high system cost, inefficiency and inaccessibility of information. This role, also known as the "legal merchant" (LM), is at the heart of adjudicating disputes and mastering information.

Before the final trade agreement is reached, the parties can ask the judge about the historical behavior of their partner. In the case of querying LM, the model assumes that the trader has no information about the past of his partner. If a party is cheated, they can appeal to LM. If the defendant is found to be deceptive, he has the right to award damages, but since there is no police enforcement, the amount of compensation is voluntarily paid. If the trader has not asked LM before finally reaching a deal agreement, he may not file a lawsuit.

If the cost of investigating a complaint is too high, this system is not feasible. If the cost exceeds the revenue, the trader will waive the appeal. When the cost is low and the threat is credible, the system will actively play a deterrent role. The benefits of deceptive behavior are negligible compared to the value of honesty.

As a result, the merchant law solves the biggest information cost problem. The “Judge” is a central information center, and each trader only needs to refer to the local judges, which reduces the cost of the trader collecting historical behavior of the partner.

Applicability of Merchant Law to Blockchain

Like medieval merchants, the participants in the blockchain network are global and cannot be governed by local governments. Even barbaric multinational groups like terrorist groups have their own rules of management. The main reasons for this are: 1) the state does not recognize multinational groups, so its laws do not exceed the group; 2) multinational groups do not recognize the state's jurisdiction over its network and therefore do not recognize national laws.

The blockchain is somewhere in between, and it is also a new technology, so that local governments have not yet determined how to regulate it. And the decentralized network of blockchains stems from the mistrust of honest executives to the centralized government. The merchant law originated from a centralized state that lacks enforcement action. Therefore, the commonality between the two is that the existing governance system cannot meet the needs of the system. Merchant law is highly applicable to blockchain governance.

For transactions that are entirely on the chain, thanks to the automatic execution of smart contracts, it does not require a ruling because it is almost impossible to deceive. But not all transactions are carried out on the chain, and as the blockchain expands, more and more transactions are completed under the chain.

Take the lightning network as an example. How is its security?

The security of transactions in Lightning Networks is defined as follows:

“A bitcoin transaction that uses smart contracts and is signed has not yet been incorporated into the Bitcoin blockchain. Smart contracts allow us to link unconfirmed transactions together in a secure manner. Allowing smart contracts in lightning networks Participants can repeatedly update unconfirmed trading chains and only the latest deals are valid."

Although under-chain transactions may be affected by elements on the chain, the behavior under the chain of custody is not the most effective or optimal solution.

Suppose Lily wants to buy socks from the socks manufacturer John. They signed a contract in which Lily paid a token for a pair of socks. Several results may be:

· Lily receives the socks and pays the token to John.

Lily received the socks but told John that she had never received it.

Lily has no socks and tells John that she has never received a sock.

John didn't send the socks, but told Lily that he had sent the socks.

· The quality of the socks sent by John is much worse than the quality promised.

If the transaction is protected on the chain, it is likely to appear as a special smart contract that is not yet included in the blockchain. Therefore, smart contracts must control every possible outcome, which is a bit difficult. Also, when Lily says she has never received a sock, how can she be judged to be honest? In this regard, the third party (courier) needs to confirm whether the socks are received by Lily.

If the transaction was made in the above method, the LM is queried to take precautions before signing the smart contract. Lily knows if John has cheated on her and vice versa. If one party has been cheating, the other party can terminate the cooperation or choose to deceive the partner. In addition, the risk of fraud in the chain management is higher than that in the chain. Because in the chain of governance, the deceiving party needs to risk losing all returns, and the deception in the chain is just a token that is locked in the smart contract.

Due to the lack of information, players are more likely to cheat in chain trading. Traders do not have easy access to their partners' previous trading history information, so honestly transferable reputation is not enough to prevent players from continuing to cheat. As long as the people involved in the community activities are encouraged to keep an understanding of who is cheating, the reputation system is likely to play a role.

Reputation system in blockchain

In collaboration with CasperLabs, I proposed a reputation system that establishes a self-enforcement mechanism between participants without the government providing a formal execution model. This stems from the fact that after the judge decides that the player is guilty, he rejects the dishonest person through the community collective boycott, so as to prevent the dishonest behavior of the community members. It is an ideal situation, assuming that the community legalizes the judge's ruling and is willing to give up the proceeds of trading with the cheater, thereby benefiting the entire community.

This idea is similar to Milgrom's argument that players must maintain sufficient right to know to communicate TFT strategies with other players. If there is no information about the past behavior of the partner, there is no incentive to act honestly. This requires the introduction of information about the past behavior of each trader in the game, or through the chain of smart contract tools to solve this problem.

Judge role in blockchain governance

Incentives between judges and participants promote honesty among members and punish those who do not value the judge to protect their transactions.

But who is the judge in the blockchain? Verifier? Election committee? The validator provides most information about the behavior of the transaction, but is primarily used for chain trading. The members of the Election Committee are inconsistent with the incentives for themselves and their voters. Based on this, the individual believes that the judge should be a completely independent institution, separate from the other governance departments in the blockchain.

A judge is the central authority only if he recognizes his legitimacy among members and reports fraudulent acts to him. Judges only record these examples and expand their understanding of past behaviors, thus creating a transferable reputation system for enough people in most cases. This means that first, a judge needs to conduct a certain number of chain transactions in order to establish a sufficient reputation for the user.

In addition, how to ensure that there is no corruption in the judicial system on the blockchain? Because of the shortcomings of institutional imbalances in the current chain governance system, I propose to establish a permanent judiciary, and judges must publish all financial statements on a regular basis to ensure that all decisions are handled fairly and fairly. In this system, there is no ransom, because the judge will charge a fee to conduct the investigation, the cost is C. If the judge extorts the member, the participant will stop filing the lawsuit against the judge, and the judge will not be able to earn the investigation fee C, which means that the judge will have no income.

in conclusion

The Internet age has changed the cost and accessibility of access to information. The reputation system has been developed through technologies such as Uber, Fiver, UpWork and Airbnb. Perhaps the blockchain was born in the best period of governance history. Today, the accessibility of information is high, and reputation as one of the forms of governance is everywhere.

Medieval merchants and blockchains share a common lineage. As Benson (1989) puts it: “The idea of the merchant law is to coordinate the self-interested behavior of the merchant, but perhaps by treating it as a person who coordinates knowledge and has limited trust, it can also gain the same valuable perspective.”

At the same time, this also means that governance has been fully developed. History is the foundation of today's technological development. For decades, the merchant law has proven to be practical, and what we need to think about is what kind of system can be built based on this model.

Please reprint the copyright information.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Do not blow black, a quick overview of the 2019 cryptocurrency 10 development trend

- Last year’s battle, this year’s cold and clear, BCH upgraded this year?

- QKL123 Quote Analysis | Libra will replace Ethereum? Unable to help themselves! (1114)

- Speed | Cryptographic Currency Derivatives Exchange: Clearing Mechanism; Bitcoin and "Great Wealth Transfer"

- Ten facts that Bitcoin does not know most people

- Babbitt column | Cold thinking of the central bank's digital currency

- Switzerland promotes cryptocurrency payments, 65,000 merchants will accept bitcoin