Last year’s battle, this year’s cold and clear, BCH upgraded this year?

Text | Wang Ye

Produced | Odaily Planet Daily (ID: o-daily)

On November 15th, Bitcoin Cash (BCH) is about to usher in a hard-for-half upgrade for half a year.

BCH's currency price was boosted by this upgrade, from 200 USDT on October 24 to the highest point of 308 USDT on November 6th, up 54% before and after. Of course, this rise is not lacking. Bit Continental is a good push.

- QKL123 Quote Analysis | Libra will replace Ethereum? Unable to help themselves! (1114)

- Speed | Cryptographic Currency Derivatives Exchange: Clearing Mechanism; Bitcoin and "Great Wealth Transfer"

- Ten facts that Bitcoin does not know most people

However, the BCH upgrade market failed to stabilize. On the day before the upgrade, on the morning of November 14, according to the data of the Firecoin Global, BCH fell for a short time and has now fallen below the 280 USDT mark, down to 275.35 USDT, a 24-hour drop. 2.92%.

This hard fork upgrade is not as big as the power battle in November last year, and there are not many people in the market. Liu Chang, the founder of Zhimi University, said to the Odaily Planet Daily that "this time it was only a regular upgrade, and there was no need for hot speculation. Last year, the CSW team took the opportunity of upgrading to engage in a rebellion that was planned for half a year."

Shortly after the birth of BCH in 2017, developers developed a plan to upgrade every six months.

On May 15th and November 15th of each year, a fixed upgrade time point is adopted, and a hard fork upgrade is adopted. Within 2 months of each upgrade, the developer will discuss the next upgrade and release the new version about 3 months before the next upgrade.

The upgrade has been upgraded: two new features added

The upgrade has been upgraded: two new features added

According to the official WeChat public account of BitcoinCash, BCH has added two new features during the upgrade.

The first function is to eliminate the ductility vector on the BCH network through Minimaldata rules. The upgrade announcement on November 15 explained:

“This eliminates the final BIP 62 ductility vector, meaning that most transactions on the Bitcoin cash network (including all P2PKH transactions) will not be postponable in the future. ”

This effectively protects the security of the transaction, and the executed Minimaldata rules can also enhance the client that simplifies payment verification (SPV).

The second feature added by BCH is support for OP_Checkmultisig and OP_Checkmultisigverify to complement the last added Schnorr signature feature. The upgrade announcement states:

"This upgrade adds support for OP_Checkmultisig. After the upgrade, all signature checks will support Schnorr signatures."

Schnorr aggregate signatures (using OP_Checksig) are a way to do multiple signatures. With Schnorr signatures, the BCH network will allow for more complex mechanisms for multi-signature transactions.

Liu Chang summed up the BCH hard fork upgrade. "This hard fork upgrade solves the scalability problem, which makes the transaction more secure and improves the security of the currency. Multi-signature is mainly to improve the network in reducing the amount of data. Processing performance, in terms of providing more signatures, can provide a richer application scenario for currency payments."

Normal users do not need to do anything until the BCH network upgrade feature changes take effect. For infrastructure such as exchanges and wallets, the impact is not too great.

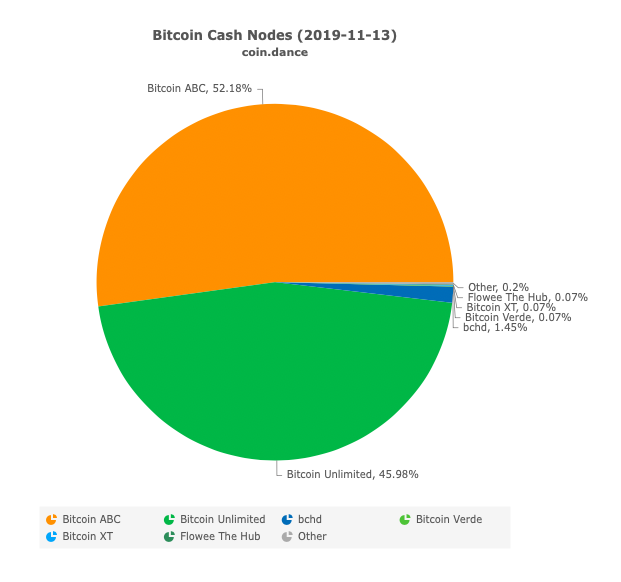

Miners and node operators need to download and run the BCH client that supports the latest version on November 15. According to the latest data from the block browser CashCoinDance, there are currently 1510* nodes in the BCH network, and 71% of the nodes are compatible with the upgrade content.

Three hard fork upgrades in BCH history

Three hard fork upgrades in BCH history

Bitcoin Cash (BCH) was first introduced as a competitive currency for Bitcoin on August 1, 2017. BCH still follows Bitcoin's protocol, but increases the block ceiling and does not use SegWit to isolate witness upgrades.

The birth of BCH was quite resounding in the world of cryptocurrency at that time. In the subsequent bull market, it once occupied the second place in the market value, which triggered a series of bifurcation incidents that followed. Since then, the BCH has been upgraded three times with a hard fork:

The first upgrade took place in November 2017, mainly due to the unstable Emergency Difficulty Adjustment Mechanism (EDA).

EDA helps BCH to ensure a stable block under small computing power in the early stage of production, but this mechanism also brings drawbacks. Due to the unstable difficulty, the calculation power fluctuated greatly, making it unstable. To solve this problem, BCH conducted the first hard fork upgrade in November 2017.

The second secondary upgrade was to increase the BCH block ceiling from 8MB to 32MB in May 2018, with the goal of processing more transactions faster.

The adoption of the new OP code and color coin technology will introduce basic smart contracts and representative assets into the BCH network. This change is intended to extend the BCH's more applications. After this upgrade, BCH gave birth to the Token solution, such as wormhole protocol, SLP, and Keoken.

The third upgrade took place in November 2018. The upgrade broke out with Bitcoin Cash ABC supported by Wu Jihan and Bitcoin SV (Bitcoin Satoshi Vision) supported by CSW, which broke out the BSV. CSW insisted on expanding to 128M and made different comments on the upgrade rules.

Two opcodes were added during this upgrade: OP_Checkdatasig and CTOR.

With CTOR, transactions in blocks are ordered in different ways while eliminating the limitations of Topology Transaction Ordering (TTOR). Developers believe that CTOR eliminates the complexity of block template creation time, and when combined with the graphene protocol, a more efficient block broadcast method is also available.

OP_Checkdatasig is used to improve the BCH scripting language. When someone uses OP_Checkdatasig, it calculates the hash value in the transaction and checks the signature based on the data. This is actually an autonomous way to verify the invalid signature. Proponents of OP_Checkdatasig believe that scripting languages can allow for many different contractual concepts, including unlicensed cross-chain atomic exchanges, local warrants, and oracles.

The BCH adds a basic Schnorr signature protocol at block height 582680. This signature algorithm can theoretically increase scalability by reducing bandwidth and storage by 25%. If the agreement is combined with concepts such as transaction blending, the Schnorr solution can also provide benefits such as transaction privacy.

Positioning the world currency, still facing many opponents

Positioning the world currency, still facing many opponents

From the above three bifurcation history and the discussion of the usual BCH community, we can find that BCH's goal is the global “world currency”.

For encrypted digital currencies, factors such as long transaction confirmation time and high transaction fees still limit the use of cryptocurrencies in people's daily lives.

BCH is one of the representatives of large blocks, and it is believed that larger blocks also mean stronger transaction processing capabilities. In addition, BCH has certain advantages over BTC in transaction fees.

Image courtesy of bitinfocharts.com

Image courtesy of bitinfocharts.com According to bitinfocharts.com, the transaction fee for BCH in the past three months is much lower than other mainstream currencies such as Bitcoin, which makes BCH popular with some merchants around the world. At present, the BTC's handling fee basically floats around US$1, while the BCH is around US$0.0091.

According to the BCH online merchant list website acceptbitcoin.cash, there are already 1,128 merchants from all walks of life who are beginning to accept BCH payments; according to Marco Coino, a business map that accepts BCH, there are more than 600 physical stores accepting BCH.

In addition, developers have developed BCH credit cards.

On October 13th, developer Tobias Ruck showed you how to send a transaction to Be.cash and how to sign and secure 10000 satoshi BCH transactions offline through smart contracts.

A month later, developer Tobias Ruck developed a smart card capable of generating a valid BCH signature based on Be.cash. The smart card, like a credit card, completes the transaction in less than a second. The point of sale can receive the BCH payment made by the card by simply installing an application on the mobile phone, and the smart card can generate the BCH signature of the card to the mobile phone.

Although the functionality of the smart card has been implemented, Ruck explains:

“It's still very rough now, and I still need to build the app to send the transaction. However, once it is done, it will become very large. When scaled up, the price of the smart card can actually reach $1 per piece.”

Even with some progress, BCH's payment path is still far away. In addition to its own need to overcome technical obstacles, it is in the cryptocurrency world, against the wealthy rival BSV, the traditional world is facing the counterattack of Libra and DCEP. The upgrade at this time is just a regular armament optimization in these wars.

For the impact of this upgrade and the performance of the currency price, Liu Chang concluded,

“Overall, every hard fork upgrade of BCH is a comprehensive and short-term long-term market development. It is a very pragmatic upgrade after the balance of safety, function and performance. It will contribute to the long-term sustainable growth of the BCH market. The short-term price performance will be affected by various aspects such as capital flow, macro environment and market sentiment, which cannot be predicted."

Reference materials:

"BCH protocol upgrade countdown – more than 68% of BCH nodes support upgrade"

"Developers launch BCH "credit card" to facilitate users to send BCH offline"

"BCH's hard fork upgrade, compile its successful counterattack history in the currency circle"

Original article; unauthorized reprinting is strictly prohibited, and violation of the law will be investigated.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt column | Cold thinking of the central bank's digital currency

- Switzerland promotes cryptocurrency payments, 65,000 merchants will accept bitcoin

- Jianan Road Show PPT Exposure: The release range is 9 to 11 US dollars, and it is planned to be listed in the US next week.

- Half-monthly article: What is the blockchain of the Central Political Bureau collective learning?

- Decentralized Identity (DID) Research Report: An Important Practice for Web 3.0 Development

- Why Libra may be "in the womb": talk about the trend of digital currency, the rise and fall of the monetary system and the evolution of the international monetary system

- Hangzhou Financial Office hosted the blockchain training matchmaking meeting, Babbitt Ma Qianli 45 minutes to explain what is the blockchain