Q2 2023 Investment and Financing Report Total investment amount decreases quarter-on-quarter, with the United States taking the lead.

Q2 2023 Investment and Financing Report US leads with a decrease in total investment amount compared to the previous quarter.Original Text: “Crypto & Blockchain Venture Capital – Q2 2023” by Alex Thorn, Head of Firmwide Research & Gabe LianGuairker, Research Analyst

Translation: Kate, Marsbit

This report uses data from Pitchbook. Reports on venture capital transaction data are often delayed, so Galaxy Research may revise the data for the second quarter of 2023 in future reports.

Key Points

- Venture capital in the crypto space has not yet hit bottom. Although the number of transactions in the second quarter has slightly increased, the total investment amount by venture capitalists in cryptocurrency and blockchain startups continues to decline.

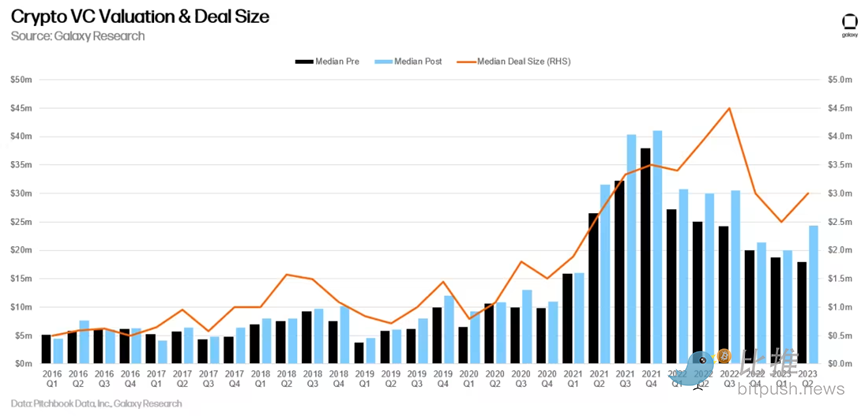

- Valuations continue to decline. The median pre-money valuation for crypto venture capital transactions in the second quarter of 2023 was $17.93 million, the lowest level since the first quarter of 2021, while the median transaction size has slightly increased.

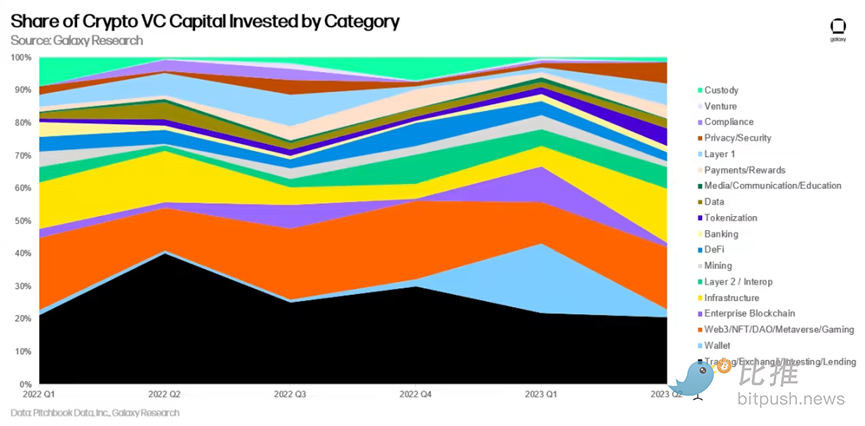

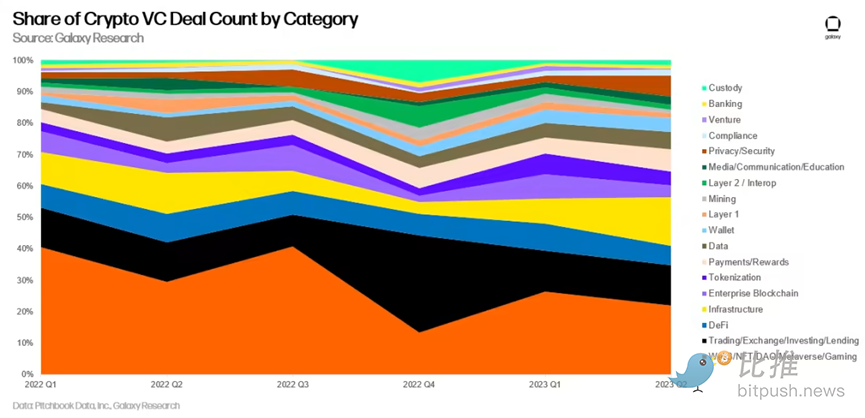

- Companies in the broad Web3 category dominate in terms of transaction volume, while companies in the transaction category raise the most capital. The second quarter performance continues the trend from the previous quarter.

- The United States continues to dominate in the crypto startup space. US-based crypto startups account for over 43% of all completed transactions and raise over 45% of the funds invested by venture capital firms.

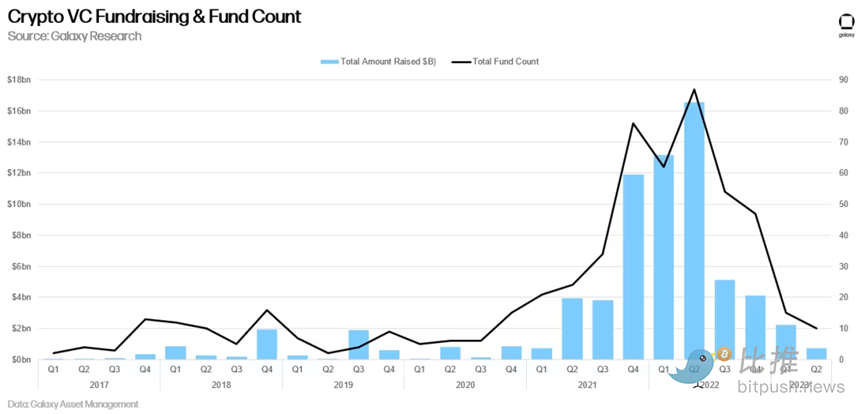

- The venture funding environment remains challenging. In the second quarter of 2023, only 10 new crypto venture capital funds raised $720 million, the lowest level since the start of the COVID-19 pandemic in the third quarter of 2020.

- DigiFT Research Report: Two Paths for MakerDAO to Implement RWA – Offline Trust and On-Chain RWA

- Q2 2023 Polkadot Research Report: Revenue Decline by 32% Quarter-on-Quarter

- Binance Research Report: 88% of institutional-grade users are optimistic about the long-term development of cryptocurrency assets.

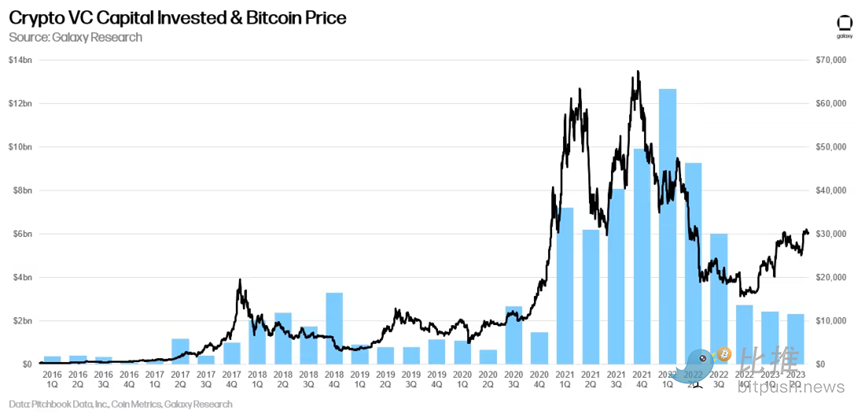

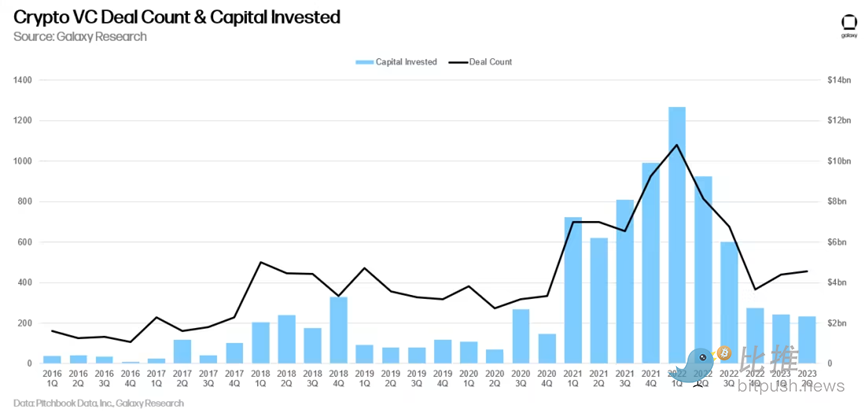

Crypto Venture Capital Transaction Volume and Capital Investment

The total investment amount in the crypto and blockchain industry in the second quarter of 2023 was $2.32 billion, setting a new cyclical low and the lowest level since the fourth quarter of 2020, continuing the downward trend that started after the peak of $13 billion in the first quarter of 2022. The total funding raised by crypto and blockchain startups in the past three quarters is lower than the second quarter of last year.

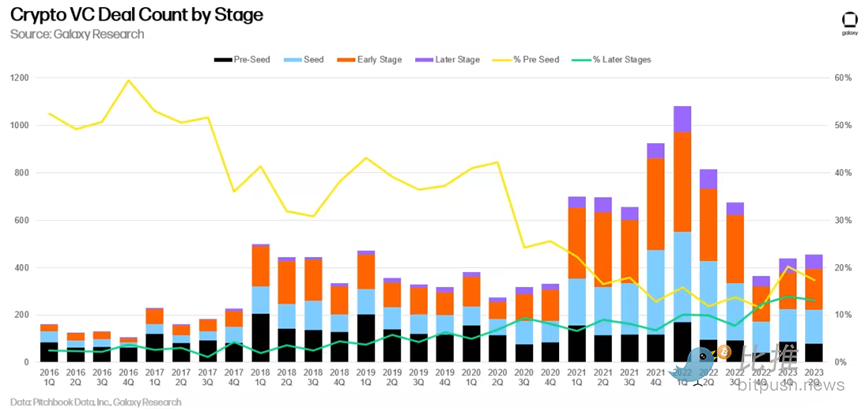

Although capital investment has not yet bottomed out, transaction activity in the second quarter has slightly increased, with 456 completed transactions compared to 439 in the first quarter of 2023. This small increase is due to an increase in Series A transactions from 154 in the first quarter to 174.

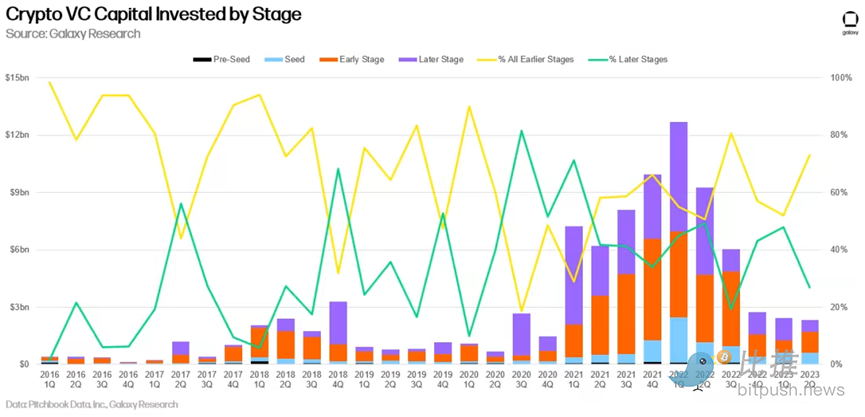

In terms of capital investment, early-stage transactions (Pre-Seed, Seed, and Series A) account for the majority (73%) of investments, while later-stage transactions account for 27%.

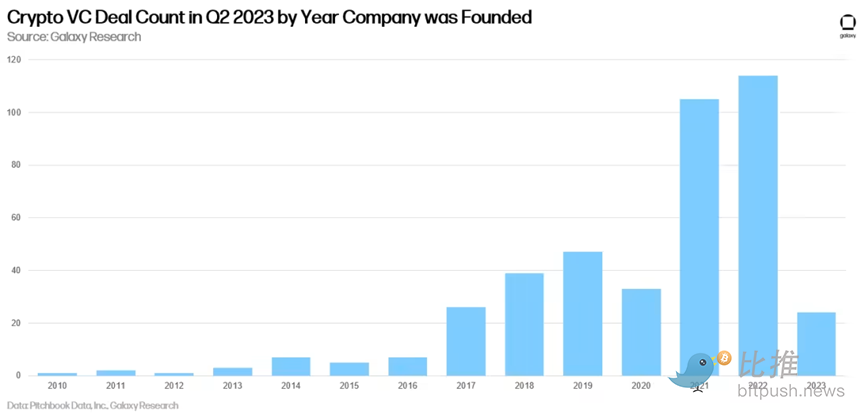

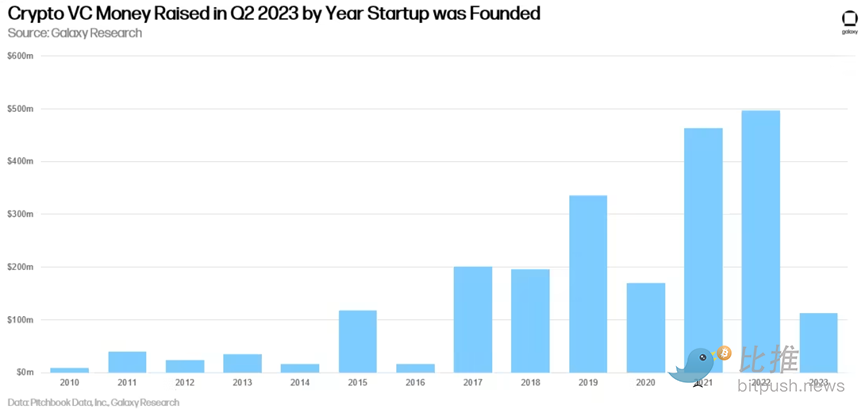

Risk Investment by Company Year

Companies established in 2021 and 2022 completed the most risk investment transactions in the second quarter of 2023.

Unlike the first quarter of this year, companies from 2022 raised the most funds among companies of the same kind in all years, followed closely by companies from 2021.

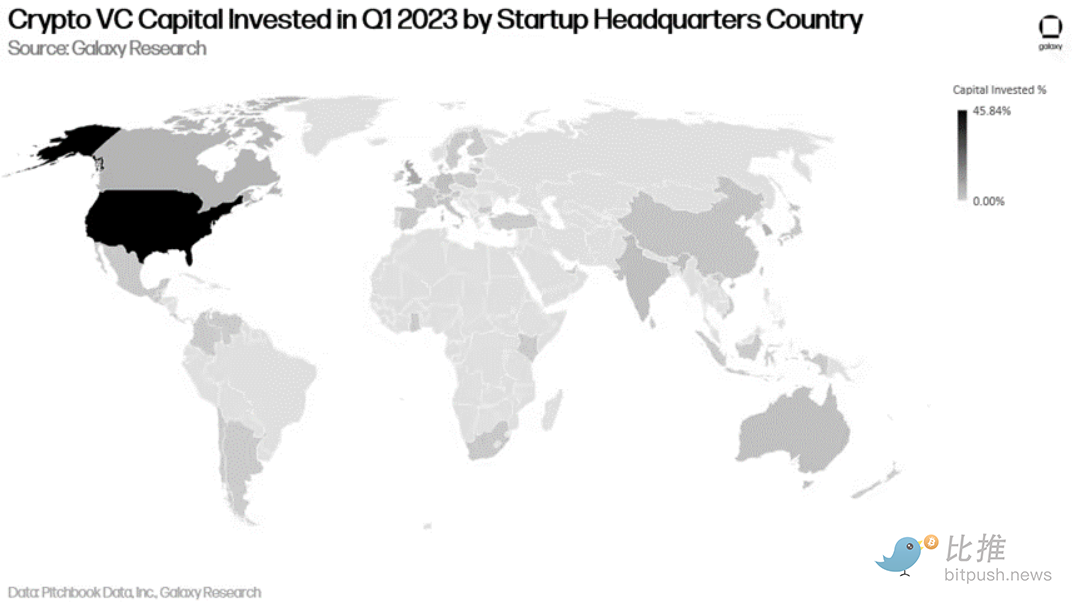

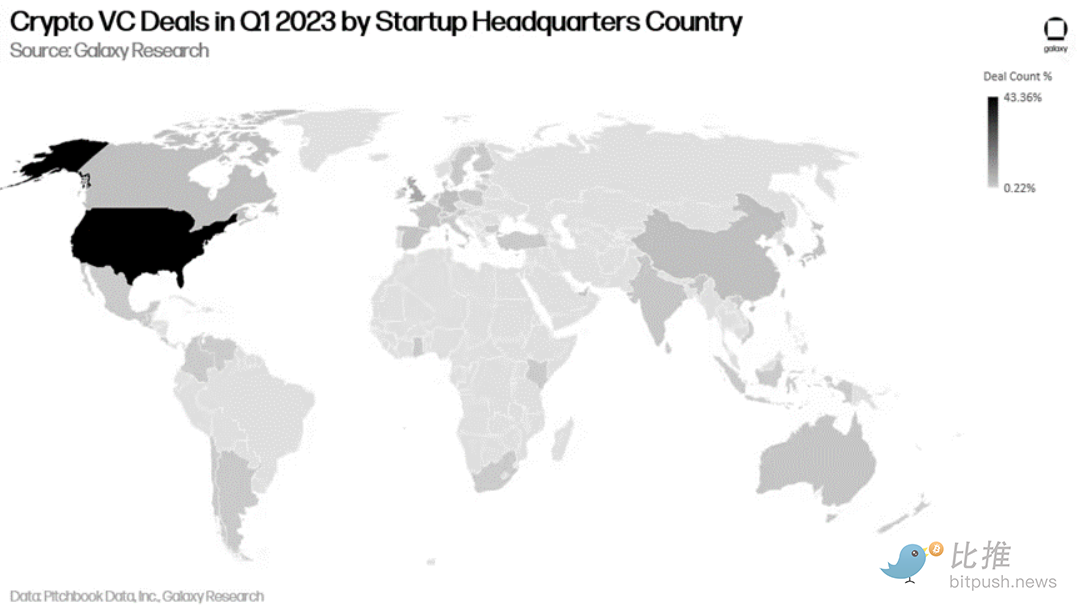

Crypto Risk Investment Company Headquarters

Companies headquartered in the United States dominate both completed transactions and funds raised. In the second quarter of 2023, U.S. companies raised 45% of the crypto risk investment funds, followed by the United Kingdom (7.7%), Singapore (5.7%), and South Korea (5.4%).

A similar situation can be seen from completed transactions. In the second quarter of 2023, U.S. companies completed 43% of all crypto risk investment transactions, followed by Singapore (7.5%), the United Kingdom (7.5%), and South Korea (3.1%).

Crypto Risk Investment Transaction Scale and Valuation

In the second quarter of 2023, the valuation of the entire risk investment sector continued to decline, and cryptocurrencies were no exception. The median pre-investment valuation of cryptocurrency or blockchain risk investment transactions dropped to $17.93 million, the lowest level since the first quarter of 2022. The median of crypto risk investment transactions in the second quarter of 2023 was $3 million, with a pre-investment valuation of $17.93 million.

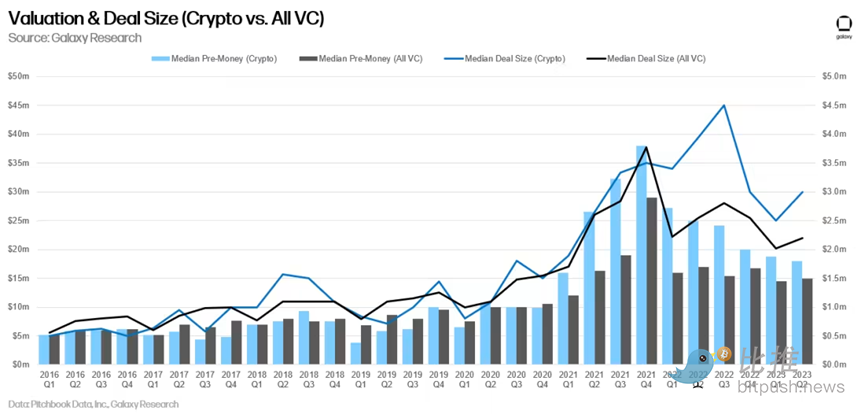

The decline in the scale and valuation of crypto risk investment transactions follows the trend of the entire risk investment industry.

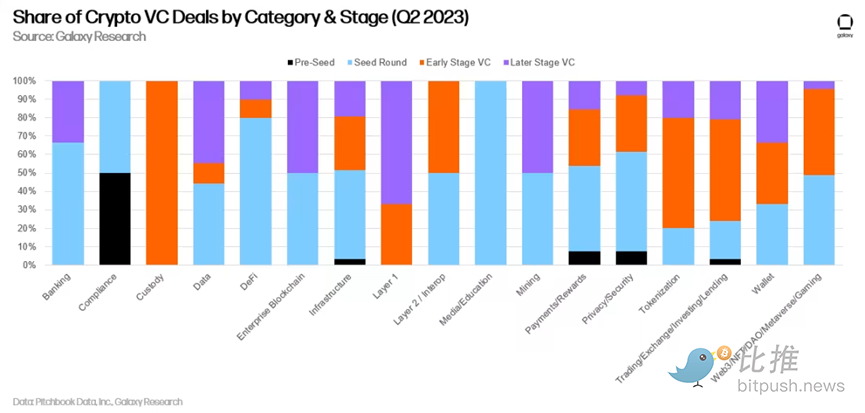

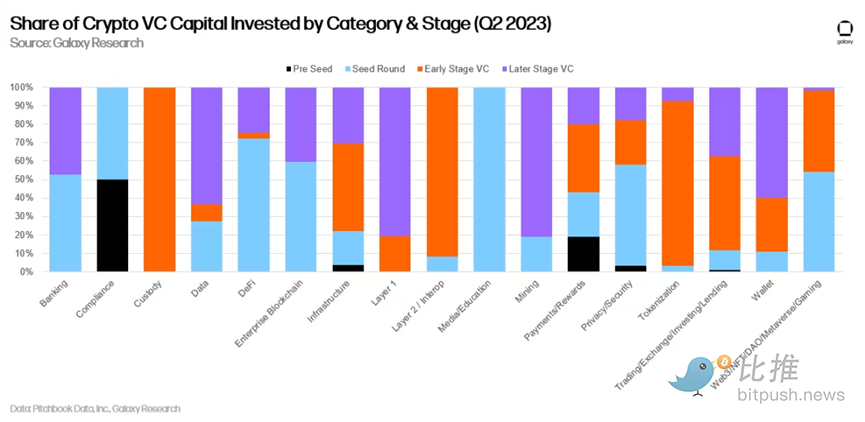

Crypto Risk Investment by Category

Trading, exchange, investment, and lending startups raised the most risk investment funds in the second quarter of 2023 ($473 million, accounting for 20% of capital deployment). Web3, NFT, gaming, DAO, and Metaverse startups raised the second most funds, reaching $442 million, accounting for 19% of all risk capital deployed in the second quarter of 2023. The Layer 2/Interop field witnessed the largest transaction of this quarter-LayerZero, which raised $120 million in Series B financing. Magic Eden had the largest Web3/NFT transaction, amounting to $52 million, Auradine had the largest infrastructure transaction, amounting to $81 million, and River Financial had the largest trading/exchange transaction, amounting to $35 million.

From the perspective of transaction volume, companies developing products in the Web3 gaming, NFT, DAO, and Metaverse sectors are in the first place, followed by transaction, exchange, investment, and lending companies. These trends have remained unchanged compared to the first quarter of 2023. It is worth noting that companies building privacy and security products have seen the highest growth in transaction volume (275%), followed by infrastructure (114%).

In terms of completed transactions in the later stages, the largest share is in the mining and enterprise blockchain categories, while the compliance category (including chain analysis and regulatory tools) has the largest share in transactions completed in the seed stage.

As for financing, mining and Layer 1 transactions are mostly in the later stages, while custody, media/education, compliance, and DeFi have a large portion of funds raised in the early stages.

Crypto Venture Capital Financing

We have collaborated with Galaxy Asset Management to compile information on Q2 2023 venture capital financing, which refers to the funds raised by venture capital firms for new funds or new fund vintage. In Q2 2023, the number of new fund launches was the lowest (10) since Q3 2020, and the allocated capital was also the lowest ($720 million).

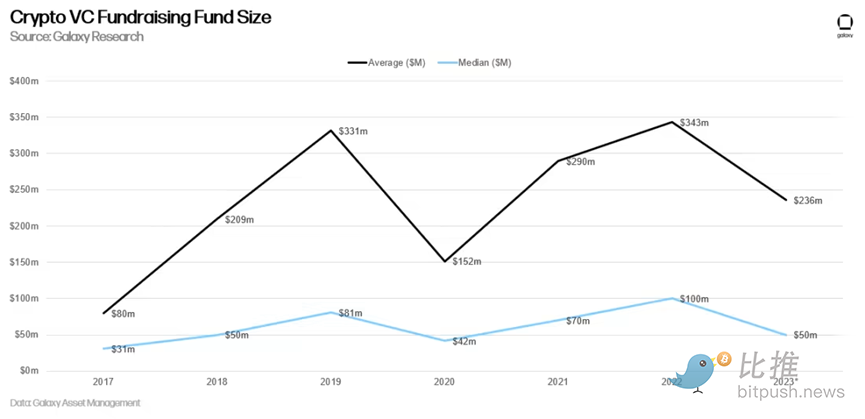

Combining the data from the first half of 2023, the average size of new funds is currently $236 million, with a median of $50 million, both significantly lower than the previous year.

Analysis and Conclusion

The bear market in crypto venture capital continues. Although transaction volume remains strong, the total capital allocated to crypto startups is decreasing compared to the previous quarter. However, the decline in crypto venture capital activity is not unique to the crypto sector as the broader venture capital industry is facing headwinds amidst rising interest rates. Other important conclusions from Q2 2023 crypto venture capital data include:

- Relative to the previous bear market, crypto venture capital activity remains strong. Transaction volume and investment capital are still about twice as high as during the bear market period of 2017-2020, indicating that the startup ecosystem will continue to grow net over a longer period of time.

- Venture capitalists continue to face a challenging financing environment. The rise in interest rates continues to dampen investors’ willingness to bet on long-tail risk assets such as venture funds, compared to the near-zero interest rate policies of the previous decade. In addition to the bear market in crypto assets and the fact that many allocators are reeling from the steep declines of several venture-backed companies in 2022, venture capitalists will continue to find it difficult to raise new funds in 2023. In fact, Q2 2023 was the quarter with the fewest new fund launches and capital allocations since Q3 2020, which was one of the most dismal quarters for venture capital as global investors grappled with the asset collapse of COVID-19.

- The lack of significant new venture capital money will continue to put pressure on founders. Venture-backed startups have faced more difficulty in fundraising this year and will continue to face a challenging financing environment in the foreseeable future. With the bull market frenzy and speculation having faded, many more speculative and ambitious blockchain use cases funded during the bull market are now struggling to find investment. Founders must focus on revenue and sustainable business models and be prepared for smaller-scale fundraising, relinquishing more equity.

- Early-stage pre-seed transactions remain fairly active. Although slightly down from the first quarter, the number of pre-seed transactions remains largely unchanged. If seed and Series A transactions are combined, these early-stage deals account for nearly 75% of all transactions, indicating that entrepreneurs remain active and venture capitalists remain attentive despite overall subdued activity. Savvy investors may find gems among the tenacious individuals starting companies in challenging environments, much like they did during previous bear markets.

- The United States continues to dominate the crypto startup ecosystem. Despite mostly unfriendly regulatory environments, crypto startups based in the United States continue to attract the majority of venture capital activity. U.S. companies hold a dominant position in the crypto ecosystem, and U.S. policymakers seeking to retain top talent, promote technological and financial modernization, and extend U.S. leadership into the future would be wise to formulate progressive policies that foster growth and innovation.

- Web3 continues to lead in transaction volume, while trading still accounts for the largest investment amount. This has been a multi-quarter trend, with traditional moneymakers – companies building exchanges, trading tools, etc. – raising the most funds, but the largest number of individual transactions flowing into emerging Web3, DAO, metaverse, and gaming companies.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Consensys: Global Cryptocurrency and Web3 Survey

- LD Weekly Report: ETH Staking Rate Rises to 19.43%, Layer2 TVL Total Locked Amount Reaches $9.68 Billion USD

- Decoding Chainalysis research report: How retail traders, veterans, and institutions contribute value to exchanges?

- Unrest and Consequences of Centralized Communities: Reddit Protests in Progress

- Game Article: Key Points in Designing Economic Systems

- Huang Licheng sues online detective ZachXBT for defamation

- How to effectively hedge USDT risk on the chain when unexpected events occur?