Emerging Consumer Behavior in Web3 Worth Paying Attention to

Web3 Consumer Behavior Worth NotingAuthor: Esther Kim; Source: Medium; Translation: MetaCat

The opening of the Web3 social era has evolved from the traditional digital social paradigm.

Recently, many tweets on Twitter have been about Zuckerberg’s “Threads”. Surprisingly, Threads has a touch of Web3, attracting 5 million users in just a few hours. You can write and read posts, connect with your Instagram contacts, and interact with other open and interoperable social applications (such as Mastodon). This reminds me of the current Web3 social dApp.

- What information does the lawsuit reveal about the two co-founders of Gala Games?

- Aiming for the opportunity of the next bull market Ordinals ecosystem

- LianGuaiWeb3.0 Daily | CZ Binance Leads the Way in Regulatory Compliance

Web3 often attracts users under the banner of privacy and self-sovereignty. However, given the huge monopoly position of Web2 social media and the established user habits of social products, I believe there is only one way forward, and that is to shape new consumer behaviors for Web3 native social dApps to succeed.

Consumer sales depend on the habits and behaviors of consumers, and those who manipulate consumer markets cannot but address behavior and attitude.

– Benjamin R. Barber from Consumed

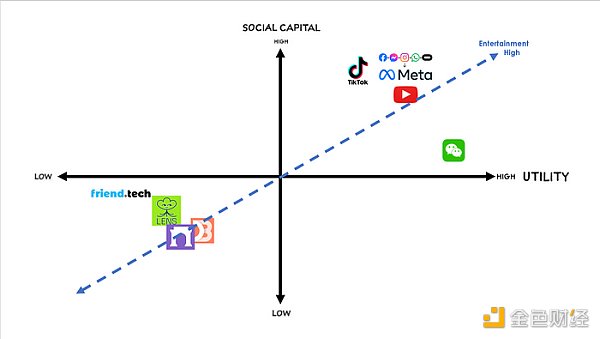

Most of the Web3 social projects we see today are copies of existing successful social networking products with added encryption. Of course, there are good reasons for this. However, the sheer number of projects claiming to be “Web3 [some famous Web2 companies]” is surprising. Web3 social must understand why users need social applications (social capital, entertainment, utility), and play different games by inspiring new emerging user behaviors. Web3 social should encourage new consumer behaviors and differentiate them from the user interface and user experience of existing social networking products.

Let’s explore

-

What users want in social applications (Status as a Service)

-

What famous Web3 social products are doing

-

Metaphorization and emerging consumer behaviors in Web3

Status as a Service

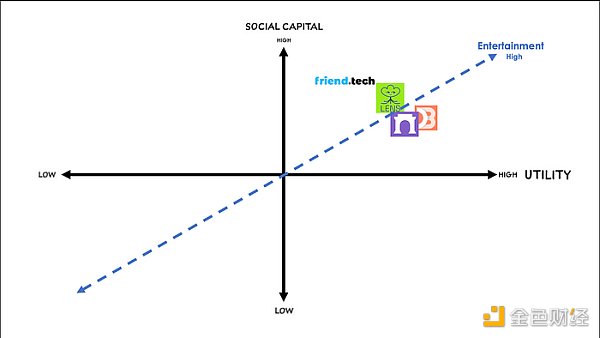

First of all, only when we understand the social network in the form of applications from the perspective of “first principles”, can the user experience and creator tokenization make sense. According to “Status as a Service”, social networks provide value in three dimensions: entertainment, utility, and social capital (capital from interpersonal networks). When users and creators expect to obtain social capital (status) while enjoying entertainment and utility, they will be guided.

Humans are monkeys seeking status, seeking the most effective way to maximize social capital – summarized as “Status as a Service.”

Let’s pause for a moment and see how fascinating Web3 social projects based on these elements are.

Web3 Social Landmarks

Four milestone Web3 social products have gained significant attention and are good models for this thought experiment: Lens, Farcaster, Friendtech, and Debank.

Lens and Farcaster are decentralized, protocol-rich, pluggable thin applications with a familiar user experience (most applications can rival Twitter, Youtube, and Facebook with encryption capabilities).

Meanwhile, Friendtech and Debank lean more towards Web3 native in terms of experience, which users are less familiar with and rely on non-fungible token (NFT), wallet-to-wallet interactions, and DeFi models for consumer interactions. From the perspectives of social capital, practicality, and entertainment, these applications meet the basic requirements of social applications.

In my opinion, these Web3 social applications are the best representatives of Web3 social. It comes from the quadrant of state as a service.

The following will give a quick introduction to the four Web3 social Dapps mentioned above. Skip if you already know.

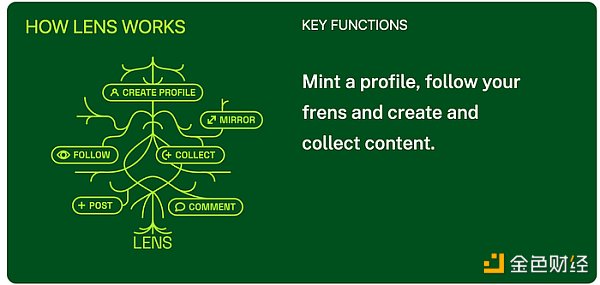

Lens and Farcaster: Social graph and personal profiles run through their dApps (social capital), launching various applications in their ecosystem (entertainment and practicality) that can rival Twitter, Facebook, and WeChat. Both are protocol-oriented and developer-friendly, providing more opportunities for novel application experiments.

Debank: The most popular value-added profile, ranked and streamed (social capital), achieves true financial implementation in the form of interaction similar to NFT bidding and message delivery (entertainment and practicality).

Friendtech: You can create a following, and others can steal (buy) your pictures and draw a social graph, making you the highest bidder (social capital), with the novelty of “stealing” (entertainment), and the transactions involved in stealing (utility).

Although Web3 assumes great appeal and has achieved partial success, this difference is harmful compared to the most popular social applications of our generation.

So, do things that can only be done with Web3 native social. Let’s explore what they are and how they work.

Emerging Consumer Behavior

The general public is unlikely to pay for privacy, autonomy, or sovereign identity, especially at the expense of convenience, at least for now. Therefore, in order to succeed in the near future, Web3 social products should promote emerging consumer behaviors and build products that can provide non-fungible social experiences through the iconic features of cryptocurrencies. Let’s take a look at the projects below.

1. Tokenized Fungibility – Lens Protocol

Lens Protocol allows users to create a profile file that carries their social graph and credentials to all applications built in its ecosystem. The behavior of creating your profile and carrying it between applications is non-fungible, but the applications in its ecosystem replicate many familiar Web2 applications, but with better creator economy, data sovereignty, token integration, and options to “earn while sharing” or “earn while playing”.

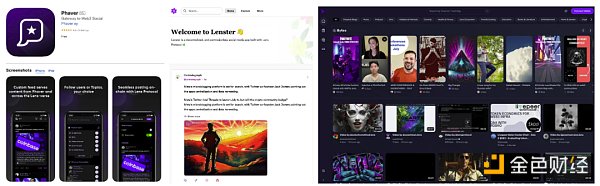

Phaver, Luster, and Lenstube are applications built on Lens Protocol. Their interfaces are similar to Twitter/Facebook/Youtube, but with native encryption features: comments, shares, likes, bookmarks, etc., are all existing user experiences.

Phaver, Luster, and Lenstube are applications built on Lens Protocol. Their interfaces are similar to Twitter/Facebook/Youtube, but with native encryption features: comments, shares, likes, bookmarks, etc., are all existing user experiences.

Ultimately, these projects are just “upgraded” versions of existing user experiences. If users engage in the same actions (analog behavior), then network effects and the scale of the platform will determine the success or failure of the project. It will be difficult to beat competitors like Meta (Threads, Facebook, Instagram).

2. Crypto-enabled Analog Behavior – Farcaster

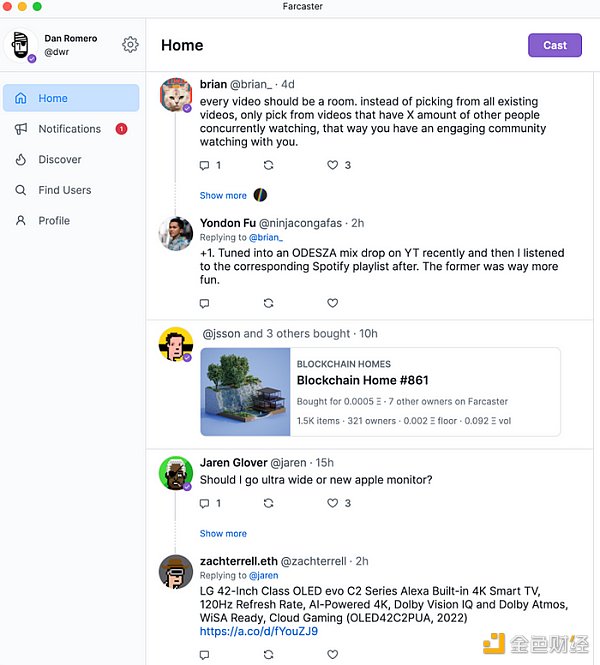

Similarly, Farcaster is known for its “fully decentralized” approach, aiming to return power to users and developers. Farcaster (the application) has a familiar user interface, and the screenshot of the Warpcast update (Farcaster client) below reflects the analog user experience.

Farcaster: A Twitter-like interface with analog interactions. Source: https://danromero.org/farcaster/

Farcaster: A Twitter-like interface with analog interactions. Source: https://danromero.org/farcaster/

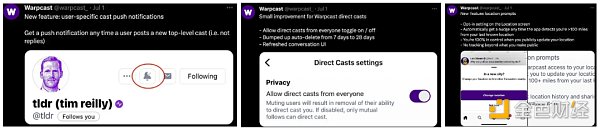

Warpcast: Push notifications, direct messaging, and location prompts are existing features in social applications.

Warpcast: Push notifications, direct messaging, and location prompts are existing features in social applications.

This is not to say that these two projects must compete with Meta or Twitter. In fact, Lens and Farcaster are the fastest-growing and largest-scale Web3 social protocols, with innovative and crypto-native qualities (data management, open social graph, NFT integration, and community-driven growth).

The key here is that these applications themselves are iterations of existing consumer behaviors, which will put them in direct competition with existing traditional social platforms. I bet this is not the best market strategy.

Instead, what if Web3 social drives consumer behavior?

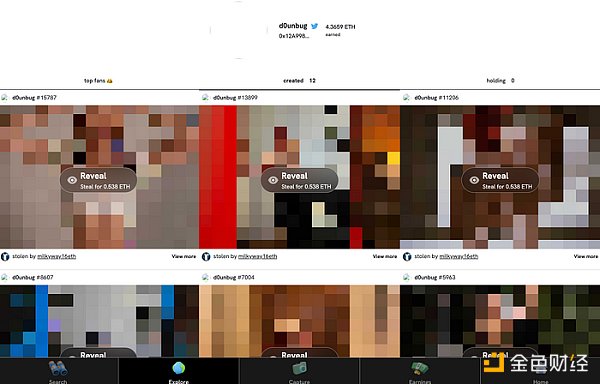

3. Emerging Consumer Behaviors – Friendtech (formerly Stealcam)

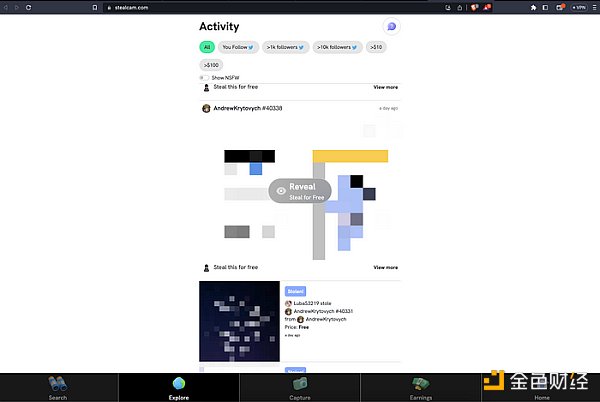

Source: https://www.stealcam.com/

Source: https://www.stealcam.com/

Friendtech positioned itself as the “home of financial and social experiences” from the start, and proved that Web3 Social doesn’t need to be a “supplement” or “alternative” to our beloved Facebook and Twitter, but rather a parallel choice (I personally prefer to believe that Web3 social should play with Web2 in a positive and playful way). Although Friendtech is undergoing transformation through more finance-centered services, let’s quickly dive into their original project “Stealcam” to see how it changes consumer behavior.

Implying the upcoming Friendtech. Source: https://www.friend.tech/

Implying the upcoming Friendtech. Source: https://www.friend.tech/

Stealcam: Anyone can upload a single image. The image is an NFT on Arbitrum and can only be viewed when “stolen”. The first user can “steal” the image for free, but for the second “steal”, a small minimum amount must be paid. After that, each “steal” will increase by 10%. You cannot see the image before “stealing” it, and once someone “steals” (buys) it from you (without permission), the image disappears.

When it was first launched, it was the perfect place for e-girls, artists, and even writers to reap the rewards of the creator economy. For users, it was a fun betting game because if their image was “stolen”, they would receive a certain percentage of the purchase amount.

Pay attention to 0x and ETH. Source: https://www.stealcam.com/profiles/0x12A998aB13a839eDc5F736aEA164F0378f9E8bA5

With its novelty (entertainment value), practicality (for creators), and social capital accumulation, Stealcam is a typical example of how a product drives consumer behavior (paying to view an image without knowing what it is, the image is “stolen” from you).

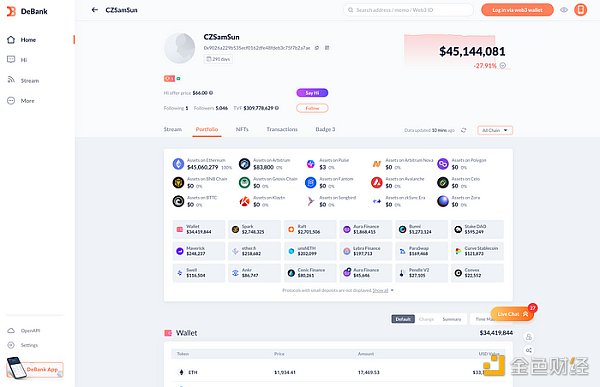

4. Emerging Consumer Behavior – Debank

Another interesting application that creates a new framework for consumer behavior is the Web3 native messaging app Debank.

Debank’s web3 social ranking is the first ranking data. Do you believe this is the interface of a messaging app? Source: https://debank.com/profile/0x9026a229b535ecf0162dfe48fdeb3c75f7b2a7ae

Debank’s web3 social ranking is the first ranking data. Do you believe this is the interface of a messaging app? Source: https://debank.com/profile/0x9026a229b535ecf0162dfe48fdeb3c75f7b2a7ae

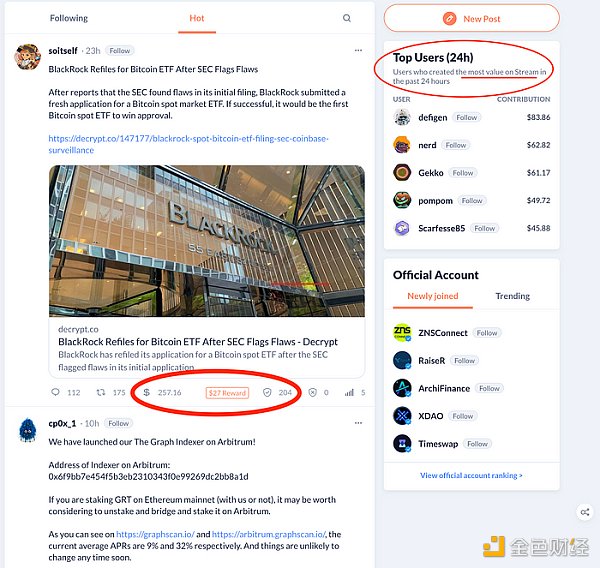

Like Friendtech, Debank focuses on finance x social, but their “information flow” looks like a familiar “feed,” copying existing applications, but their functionality and intent are clearly different.

The highlighted features are very different from our traditional understanding of social applications. Source: https://debank.com/stream?tab=hot

An exemplary example of how a product changes consumer behavior is Debank’s “Attention NFT” or “Saying Hi” concept. According to the white paper, users exchange/trade “attention.” When the receiver mints, attention is a tokenized asset using NFT technology. The novelty lies in the fact that before the recipient opens the app to mint the NFT, buyers can first make bids on the NFT by sending messages. When the recipient logs into the app, they can see the sum of all the bids received for their messages as the final price of the Attention NFT.

It is worth emphasizing again that such projects will usher in a new pattern of consumer behavior. “Attention as NFT” itself is a new understanding of value exchange, but combined with economic incentives, consumers are motivated to build their social capital here. Ultimately, our understanding of the paradigm of “message delivery” and socially interactive economic incentives will also inevitably expand.

Note that tokens themselves are already a new form of consumption, which can be used to design new behaviors (similar to what we see with Zoom unifying virtual meetings and Twitter unifying microblogs). In addition, we learn from the concept of Status-as-a-service that new social networks are similar to crypto projects (especially IC0s), and are therefore in a perfect position to leverage the functionalities of social apps.

Think about it, they all have some form of social capital (usually in the form of tokens) that requires some proof of work to earn, and there is inherent scarcity.

Web3 indeed has the best tools to harness emerging consumer behavior.

Conclusion

Web3 social narratives face complex challenges such as privacy, regulation, decentralized data, token prices, etc. However, the new paradigms of value proposition, trustless exchange, and activity proof are unique to Web3, which existing social networks (even with larger scale) can never replicate. Therefore, it is not just about replicating existing consumer behavior frameworks, but also eagerly trying out more novel social interaction concepts that can redefine social activities.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Who profited from the Federal Reserve’s nearly $100 billion loss due to interest rate hikes?

- Four financing events worth paying attention to last week DeForm, FirstMate, Stroom Network, BuidlerDAO.

- Multichain has fallen, what can save the cross-chain bridge?

- Ethereum SAAS Staking One-Week Data Record

- DeFi Regulatory Woes Uniswap in Heaven, Tornado Cash in Hell

- MEKE public beta countdown ends, focusing on derivative trading in the DeFi sector.

- Hubei Court rules that the virtual currency mining contract is invalid due to the purchase of IPFS storage servers for mining Filecoin.