What are the threats to Bitcoin?

Bitcoin is the most powerful cryptocurrency in the past decade. It overcomes every major obstacle since its birth, including the CVE-2010 vulnerability, the Mentougou incident, the BCH hard fork, and the rise of the altcoin. But that doesn't mean we've solved all possible attacks, and it doesn't mean that Bitcoin has been a winner in the global value store of a sustainable millennium.

Add a disclaimer here: Yes, most of the issues mentioned in the article have solutions; also hope that all of these issues will not happen; and not everyone will agree with the following.

I think the biggest problem Bitcoin can face:

1. Centralization of mining: each part of the mining infrastructure is concentrated

- How can NuCypher bring privacy to Dapp by investing more than 10 million USD in more than 10 companies such as YC and Bitland?

- United Nations agencies set up cryptocurrency funds, Ethereum official donated 10,000 ETH for its support

- Telegram announces the Grams Wallet Terms of Service, and the encrypted wallet will be integrated into the messaging app.

- Concentration of mining machine production, if there is a back door, it will lead to block production pause

- 8 large mining pools control 85% of the hashing power

- It is possible to gather most of the computing power (70%+) in a room. In fact, once happened, the hard fork of the miners’ leadership was imminent in 2016, and the core developers and miners gathered in a room in Hong Kong. Decide on the fate of bitcoin

- Most hashing power is concentrated in one country

In short, the entire mining stack is quite concentrated. Attacks that can be performed by most computing powers include: chain reorganization, 51% attack, death spiral, eclipse attack, and PoW algorithm reset can lead to other difficult problems. (Blue Fox notes: In actual operation, first, the cost of attack is very high. According to game theory, miners will not do things that are not good for themselves; second, it is difficult to coordinate.)

2. Short-selling and alternative chains make the game theory proposed by Nakamoto Chong invalid

A key part of game theory considerations is that miners have long-term motivation to become good actors because of the close relationship between miners and Bitcoin. But now the situation is different. Miners may attack the bitcoin chain while shorting bitcoin to get instant profits and then dig other chains.

3. Unverified security model, charging market: Calculated by BTC, its security budget is halved every 4 years.

The main arguments against this argument are as follows:

- Before the 2140 block reward is zero, we don't have to worry.

However, in fact, in just 9 years, Bitcoin's security budget will drop by 88%, and each block reward will drop from the current 12.5BTC to 1.5BTC, which will drop to 0.39BTC in 17 years, compared with our current situation. , a 97% reduction in rewards. (Blue Fox Note: Since this is BTC pricing, it may be another matter to calculate the price in French currency. Of course, there is nothing 100% in the future. It is only a matter of probability. So pay attention to your risk tolerance and risk appetite. )

- The price will increase by more than 2 times in the next halving. The problem with this idea is that the bonus for the intervention also increases with the price. In addition, according to this logic, it also means that the value of bitcoin is higher than the global GDP after nine halvings.

The only three methods I can see that can get rid of this situation.

- PoS. This will not happen.

- Violation of the 21 million ceiling rule, and stop halving, continue to give the same mining awards. This will not happen.

- Take some of Nakamoto's tokens and use it to fund inflation. This can happen. (Blue Fox notes: The question is where the Nakamoto is, or the private key is still not there)

- Let the cost market develop. This is the most likely path. The problem is that if we want each block to charge a transaction fee of 12.5 BTC (Blue Fox notes: that is, assuming no block rewards, transaction costs can reach the current block reward level), then the cost of each transaction To reach 0.0034 BTC or $340 (if the bitcoin value is $100,000). However, this is not the most terrible part, and the most terrible thing is that it will develop an unknown behavior.

What we understand is that we cannot have two methods at the same time, and miners must be paid, whether it is a fee or a subsidy. Therefore, we will end with a high cost, or the hashing power of other tokens will surpass Bitcoin… This will produce the attack possibilities mentioned above.

At the same time, this will have to pay a fee, which will cause the lightning network to be too expensive for most people in the world, and most people will not use a few days of salary to lock and unlock their bitcoin.

Possible attacks: Other higher inflation tokens have higher hash rates and can carry out the attacks mentioned in the first point above. At the same time, higher costs make the network unsuitable for the public, and can only maintain the niche market. .

3. Bitcoin is slowly getting old due to lack of innovation: this has its advantages and disadvantages.

Bitcoin won't change, it doesn't matter.

But we cannot deny that innovation has dried up. Since I bought Bitcoin in 2013, I haven't seen any substantial new applications or use cases from the user's perspective. Yes, node synchronization is faster; yes, the signature is smaller… but the big innovation we promised has not been realized, and even some features are still dead.

- ChangeTip closes and is acquired by Airbnb.

- The dyed coins are cool, but they are like Dodos, giving us the rise of ETH and altcoin through ERC20. It is over.

- Counterparty promised a smart contract, but the Core side unilaterally decided to change the OP_RETURN size from 80 bytes to 40 bytes.

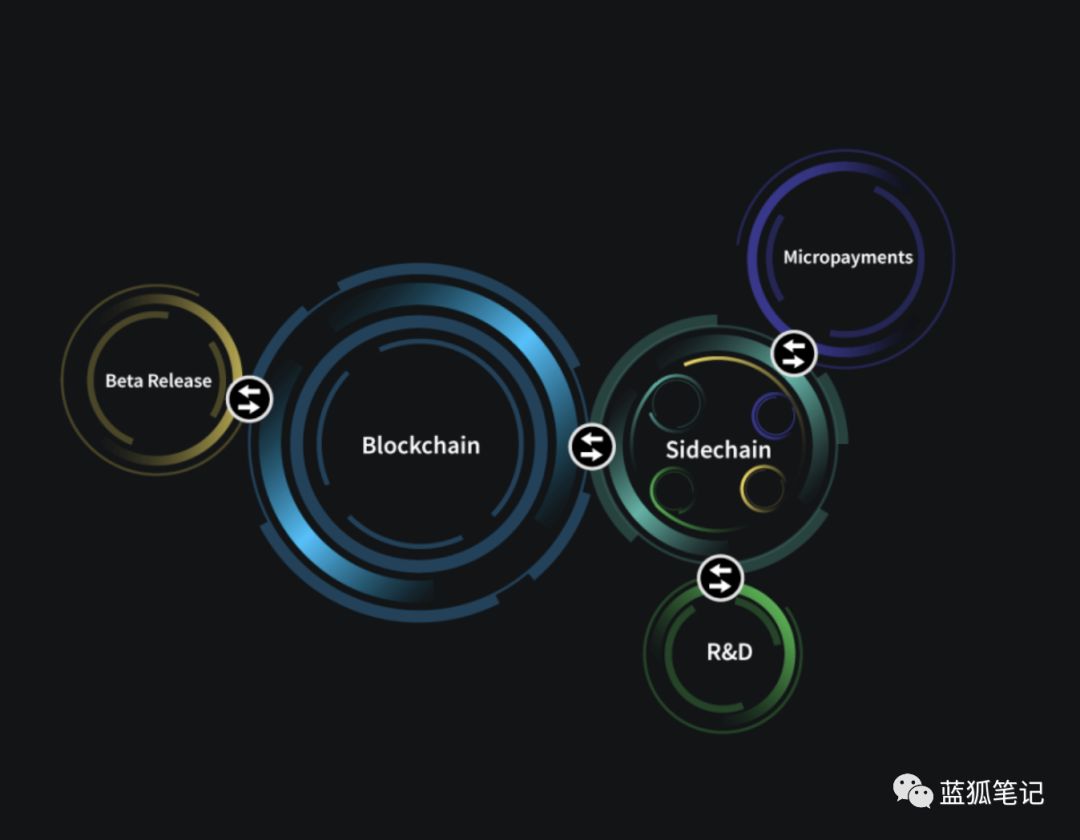

- Blockstream promises a bitcoin-based sidechain, all experiments will be handled in the sidechain, it will be trusted, very good. Now they have basically given up and are making a licensed alliance sidechain where all the nodes need to be pre-approved by Blockstream and run on proprietary hardware.

- Rootstock, a joint sidechain, trusts a select set of verifiers.

It’s only the lightning network that stands still, and it’s interesting to see how it works with the expense market.

The biggest risk here is that Bitcoin can never go to the mainstream and grow old.

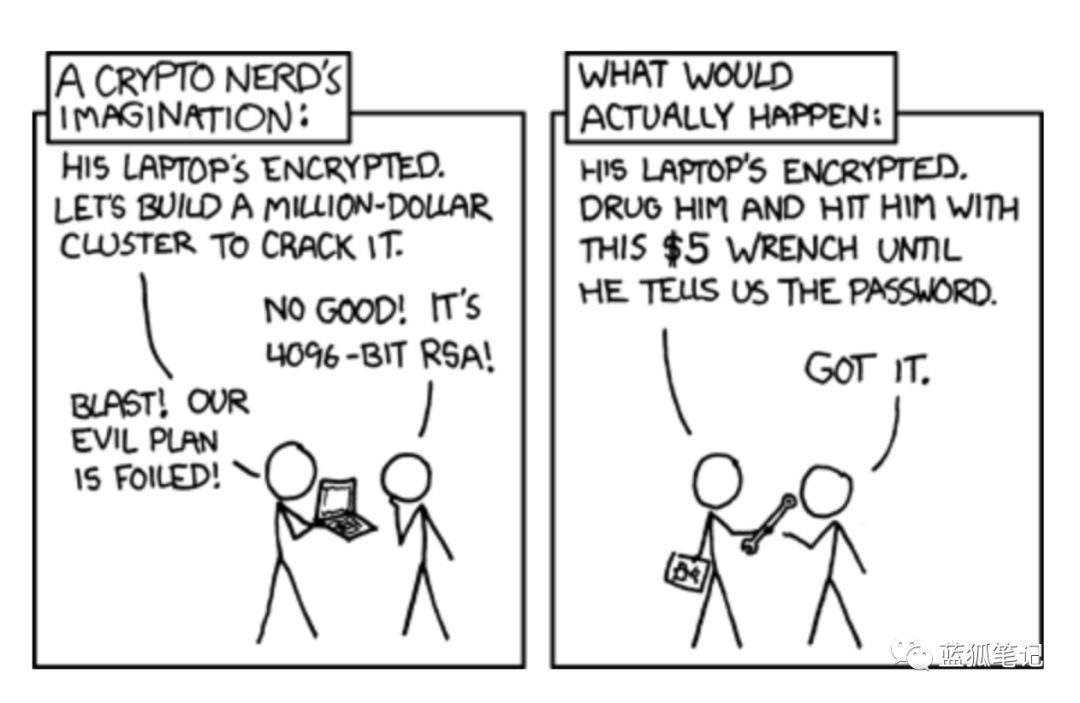

4. Lack of privacy

Bitcoin is at best a pseudonym. If there is a big repression, all satellite nodes and decentralization will not matter, as long as the authorities can easily identify the holders and use the wrench to get them together.

5. Centralized development

In the past year, 70% of submissions were completed by 10 people, and 97% of the nodes used Core software. We can pretend that everyone checks all 300,000+ lines of code and agrees on all the changes. But in fact, we just follow the advice of some star Core developers.

The chances of the Core developer team making some insidious code or erroneous decisions are non-zero. Take a look at CVE-2010-5139+CVE-2013-3220, these are just honest errors, not targeted attacks.

6. Quantum computer

For the moment, "bitcoin is not anti-quantum security," and quantum computing is by no means whimsical. Quantum computers exist, operate, and have low power. However, this does not mean that they will not get better in the next few years.

7. It can't go mainstream

Bitcoin single blocks processed up to 2,763 transactions at the peak. This means that Bitcoin can handle up to 145,223,280 transactions a year, which means that on average, each person can process about 0.02 transactions per year. Therefore, even if we have a cheap fee and the lightning network can work properly, people can only open and close a channel. It takes 96 years to get people from all over the world to get involved.

Even if Bitcoin is only used as SOV, that is, if people just buy BTC and make a single transaction and no longer transfer, it will take 48 years to get people from all over the world.

8. Black swan, unknown unknown.

There is nothing on this list, such as a big planet hitting the earth or a murderous AI. We just don't know it.

As mentioned above, all the possibilities to get rid of BTC are here.

——

Risk Warning: All articles in Blue Fox Notes can not be used as investment suggestions or recommendations. Investment is risky. Investment should consider individual risk tolerance. It is recommended to conduct in-depth inspections of the project and carefully make your own investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Lightning network giant ACINQ received $8 million in financing. Why did the 6-person team get favored by state-owned banks?

- In addition to speculating coins, we still have 10,000 ways to participate in the currency circle.

- Getting Started | What is DAI Stabilizer and why it stays stable

- SWIFT: Instant payment services face challenges from Ripple, Libra, etc.

- September monthly report | Bitcoin 8000 US dollars up and down shock, USDT market value is shortly listed as "fourth"

- Zero-knowledge proof goes into a wide range of application countdowns? 0x officially released OpenZKP

- Bitcoin is a safe haven for Chinese investors? Let’s first understand a strange market trend in early August.