Analyzing the Current State of the Solana Ecosystem from On-chain Data

Analyzing Solana Ecosystem with On-chain DataAuthor: LD Capital Research

With the progress of the FTX incident and XRP being recognized as a non-security, Solana, as a public chain deeply connected to FTX, and its governance token SOL being recognized as a security by the SEC in lawsuits against Coinbase and Binance, has once again attracted market attention under the dual narrative. This article will analyze the current situation of Solana from the perspectives of on-chain data and ecosystem projects.

With the progress of the FTX incident and XRP being recognized as a non-security, Solana, as a public chain deeply connected to FTX, and its governance token SOL being recognized as a security by the SEC in lawsuits against Coinbase and Binance, has once again attracted market attention under the dual narrative. This article will analyze the current situation of Solana from the perspectives of on-chain data and ecosystem projects.

- Exploring Sidechains and Rollups Differences and Similarities in Architecture, Security Guarantees, and Scalability Performance

- Fed raises interest rates to the highest level in 22 years, Powell warns that there will be no rate cuts this year.

- LianGuai Morning News | Insider The United States may reach a comprehensive framework agreement on stablecoins.

Abstract

According to on-chain data, Solana’s TVL has increased by approximately 47% since January, ranking second only to Arbitrum, Optimism, and Mixin among public chains and layer-two solutions in terms of TVL growth. In terms of transaction volume, there were two peaks after the FTX incident, which were closely related to BTC NFT, SMB NFT, and the overall market. The average daily transaction volume on Solana in July was around 20 million transactions, which was relatively stable overall. The development activity is greatly influenced by non-full-time developers, and the overall development activity is low.

Currently, the liquidity staking sector dominates the ecosystem, with the leading protocol Marinade occupying 46% of Solana’s market share. The recent growth in TVL of other liquidity staking protocols is mainly driven by the rise in SOL token price. The utilization rates of the two major on-chain lending protocols are approximately 16% and 21%, much lower than Ethereum. On-chain native DEX operations are relatively conservative with no significant highlights. The overall trading volume of the NFT sector has shown a shrinking trend, with recent trading volume concentrated in SMB. Overall, although there are some actions from established protocols in the Solana ecosystem, there is no significant splash, and there are no signs of a reversal in ecosystem activity.

On-Chain Data

1. TVL

As of July 23rd, Solana’s TVL is 359.9M, ranking 10th among all public chains and layer-two solutions in terms of TVL. Compared to its peak period, TVL has fallen by over 95%. Prior to the FTX incident, TVL had dropped by over 70%. Its historical low point of TVL was around 244M in January 2023. Currently, it has increased by approximately 47%, ranking second only to Arbitrum, Optimism, and Mixin among the top 10 public chains and layer-two solutions in terms of TVL growth.

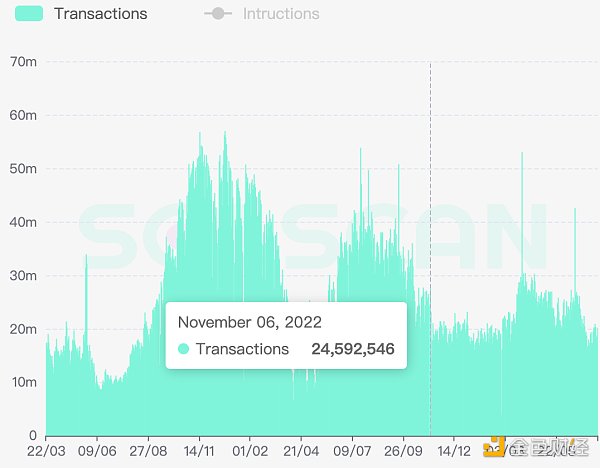

2. Transaction Volume

Since the FTX incident, the transaction volume has been relatively quiet for nearly two months. However, there have been two phased peaks in transaction volume from March 21st to May 15th and around June 19th, with daily transaction volume exceeding 25 million transactions. Currently, the daily transaction volume fluctuates around 20 million transactions. The trading volume from March to May was greatly influenced by BTC NFT trading, while June 19th may have been affected by the overall market.

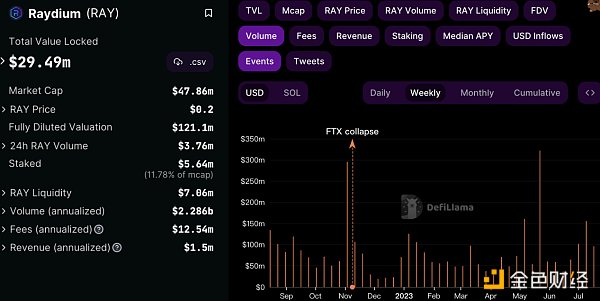

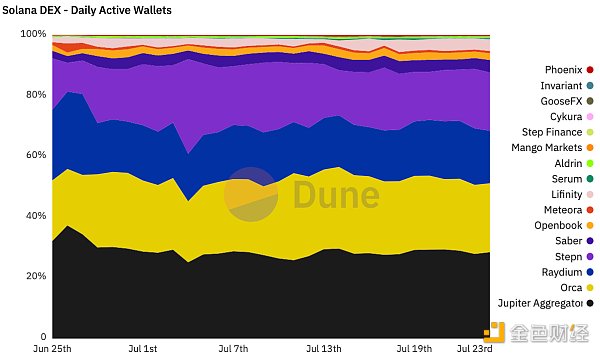

The top DEX on Solana in terms of TVL are Orca and Raydium. From the transaction data, it can be seen that the DEX trading volume increased significantly in the week when the FTX incident occurred, and then declined in the following month. The trading volume started to rebound at the beginning of 2023 and is currently maintaining a relatively stable state.

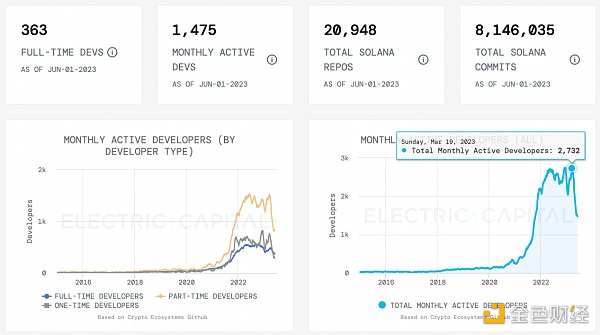

3. Development Activity

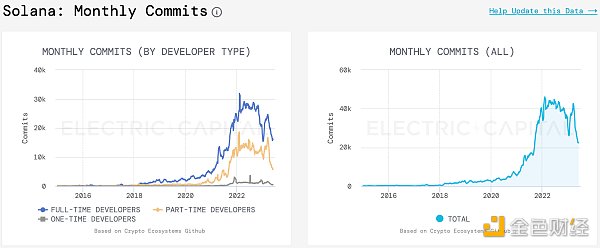

After the FTX incident, the development activity on Solana increased in March, with a monthly active developers reaching 2,732. As of June 1st, the number of active developers decreased to 1,475, a decrease of nearly 50%. The number of code submissions also showed a similar trend. The code submissions reached a peak in March this year and then rapidly decreased. The fluctuation in development activity in 2023 is mainly due to significant changes in non-full-time developers, while the decrease in the number of full-time developers is relatively small. Overall, the development activity has decreased since March.

-

Developers who submit code for more than 10 days per month are considered full-time, and only the original code submissions are counted in the number of developers

4. Users

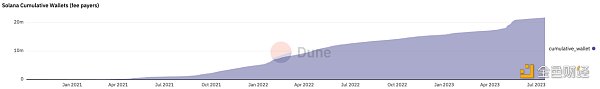

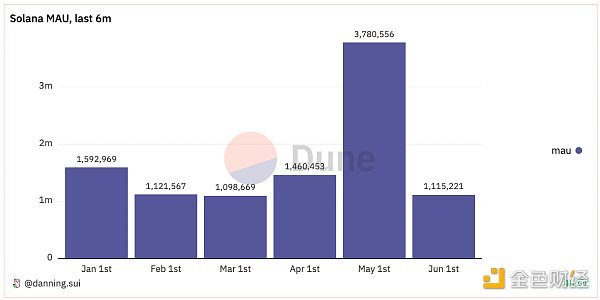

The number of newly created wallet addresses on Solana increased rapidly from the end of April to May, with an increase of 3 million addresses within a month. The number of active addresses increased significantly in May, far exceeding other periods. The main reason is that the Solana NFT market Magie Eden launched a Bitcoin NFT market in March, and during the active period of Ordinals NFT trading, Magic Eden became one of the main trading platforms.

Ecosystem Projects

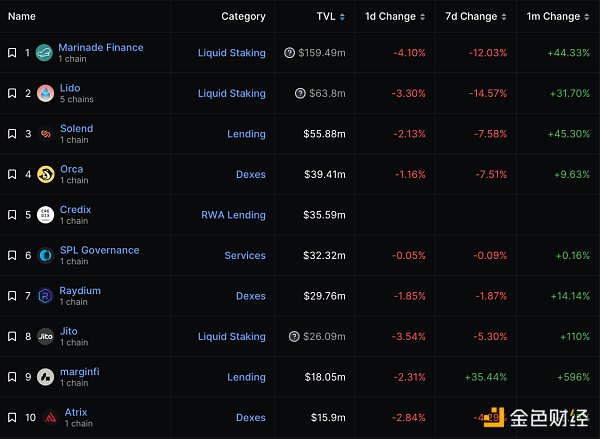

Defillama tracks a total of 98 dapps. Among them, 19 Dapps have a TVL of over 10 million US dollars, mainly distributed in the three sectors of liquidity staking, lending, and decentralized exchanges.

Marinade Finance is the largest liquidity staking protocol on Solana, with a TVL of 159 million, accounting for about 43% of Solana’s market share. The protocol allows users to stake SOL and receive mSOL, and mSOL tokens can participate in Solend and other defi protocols as underlying assets. Currently, mSOL is listed on centralized exchanges such as Coinbase and Kraken, but most of the trading still occurs on decentralized exchanges. In addition to Marinade Finance, the TVL of liquidity staking protocols has also increased, mainly driven by the rise in SOL token price.

Solend is a well-established decentralized lending protocol on Solana, which was launched in 2021. Solend launched the v2 version in April, reopening the liquidity mining of mSOL staking, and on June 2nd, it supported users to convert the collateralized SOL tokens within the protocol into mSOL to earn additional income. Since June, its TVL has increased from 28 million to 44 million US dollars, and the current TVL is 55.28 million. The capital utilization rate on Solend is 16.19%.

Marginfi is a new lending protocol that launched in 2023. Its TVL growth rate in the past month reached nearly 600%, with the current TVL at 17.93M. The protocol raised $3 million in funding in 2022, led by Multicoin and LianGuaintera. The protocol has not yet released its token, but it introduced a points system on July 3rd, where users can accumulate points through deposits, borrowings, and referrals. This may be the main reason for the significant increase in TVL in the past month. The borrowing rate on Marginfi is 21.7%. Aave v3 has a TVL of 2.11B on the Ethereum chain and an almost 35% fund utilization rate, while the transaction volume and leverage ratio on the Solana chain are lower compared to Ethereum.

Currently, most transactions on Solana occur on Raydium, Orca, and Jupiter Aggregator. Raydium is the earliest AMM DEX on Solana, with a TVL that has remained around 28M since the FTX crash, showing mediocre recovery. Orca TVL rebounded from a low of 30M to 38M, making it the largest DEX on Solana. Overall, the operation of DEXs on Solana is relatively conservative and the performance is average.

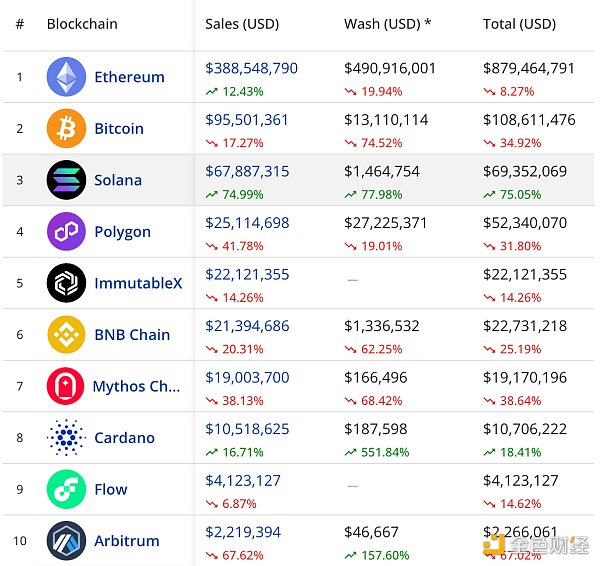

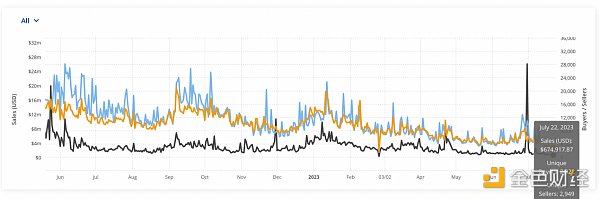

The NFT trading volume on Solana is second only to Bitcoin and Ethereum, with a 75% increase in trading volume in the past 30 days. The main reason is the high popularity of the SMB series released in June. However, the overall daily trading volume is shrinking.

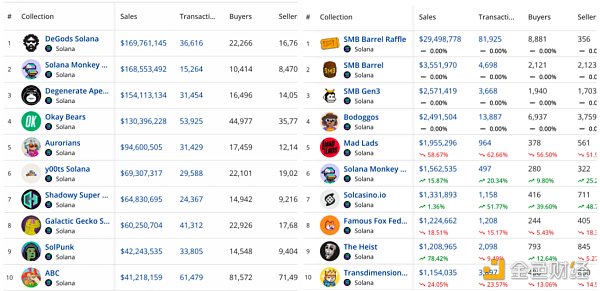

In terms of trading categories, there is a low overlap between the most historically traded NFT series on Solana and the projects with high trading volume in the past 30 days. The recent NFT trading hotspots are mainly focused on Smart Monkey Business (SMB).

SMB is a series of algorithmically generated pixel monkey NFTs, with Gen1 and Gen2 series released in June and August 2021 respectively. The team launched the SMB Barrel Raffle and forged SMB Gen3 at the end of June 2023. In that month, the SMB series accounted for over 90% of the Solana NFT market share in terms of trading volume. Apart from the SMB series, the projects with a trading volume exceeding 2M in the past month include Bodoggos, an NFT series launched by Nifty protocol and @EasyEatsBodega. Both the SMB series and Bodoggos have seen a continuous decline in daily trading volume since their launch. The short-term activity of individual projects has not driven the overall Solana NFT market.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How to handle the confiscated virtual currency worth 400 billion yuan involved in the case?

- Is the hype around AI Agents that Silicon Valley giants are talking about real or just a bubble?

- Be vigilant of the hidden rug pull caused by contract storage leading to a run-off.

- Variant Partner Why is UniswapX said to be a boost for Uniswap?

- Another case of flash loan attack Analysis of the LianGuailmswap security incident

- Why is Musk’s Twitter reform said to have a profound impact on cryptocurrencies?

- Google Play Store announces new rules allowing games and apps to offer NFTs.