Why is Buffett always reluctant to invest in Bitcoin?

On May 4th , Beijing time, Berkshire Hathaway's 2019 shareholders meeting was held in Ohama, Nebraska as scheduled. As an annual investor conference, it attracted the attention of global investors. More than 50,000 followers gathered in this small city of Omaha.

Buffett and Charlie Munger’s press conference were even reported by tens of thousands of media around the world. One of them was about bitcoin sharing, which caused extensive discussion.

Buffett said that bitcoin speculation has rekindled his feeling of seeing people gambling in Las Vegas. This is a gambling thing. There is a lot of fraud related to it. Bitcoin does not produce any value. It is like a shell. Class things are not investments for me.

Of course, this is not the first time Buffett has publicly criticized Bitcoin. At the Berkshire Shareholders' Meeting in 2018 , Buffett commented, "The final result of the cryptocurrency will be very bad because they did not produce any Asset-related value, the value of such assets depends on more people entering the market, and then the holder sells to the pick-up at a higher price than the purchase price.

- Dust seal 20 years of cryptography problems, solved by unknown programmers for 3 years

- WSM Destruction: How is the world's second largest dark market market collapsed?

- What is the valuation and rising logic of Ethereum?

So today, I have seen many blockchain practitioners contempt for Buffett, thinking that their investment philosophy is outdated or criticizing his investment style, but we really have to seriously think why Buffett is not willing to invest in Bitcoin?

Compound interest? Profiteering?

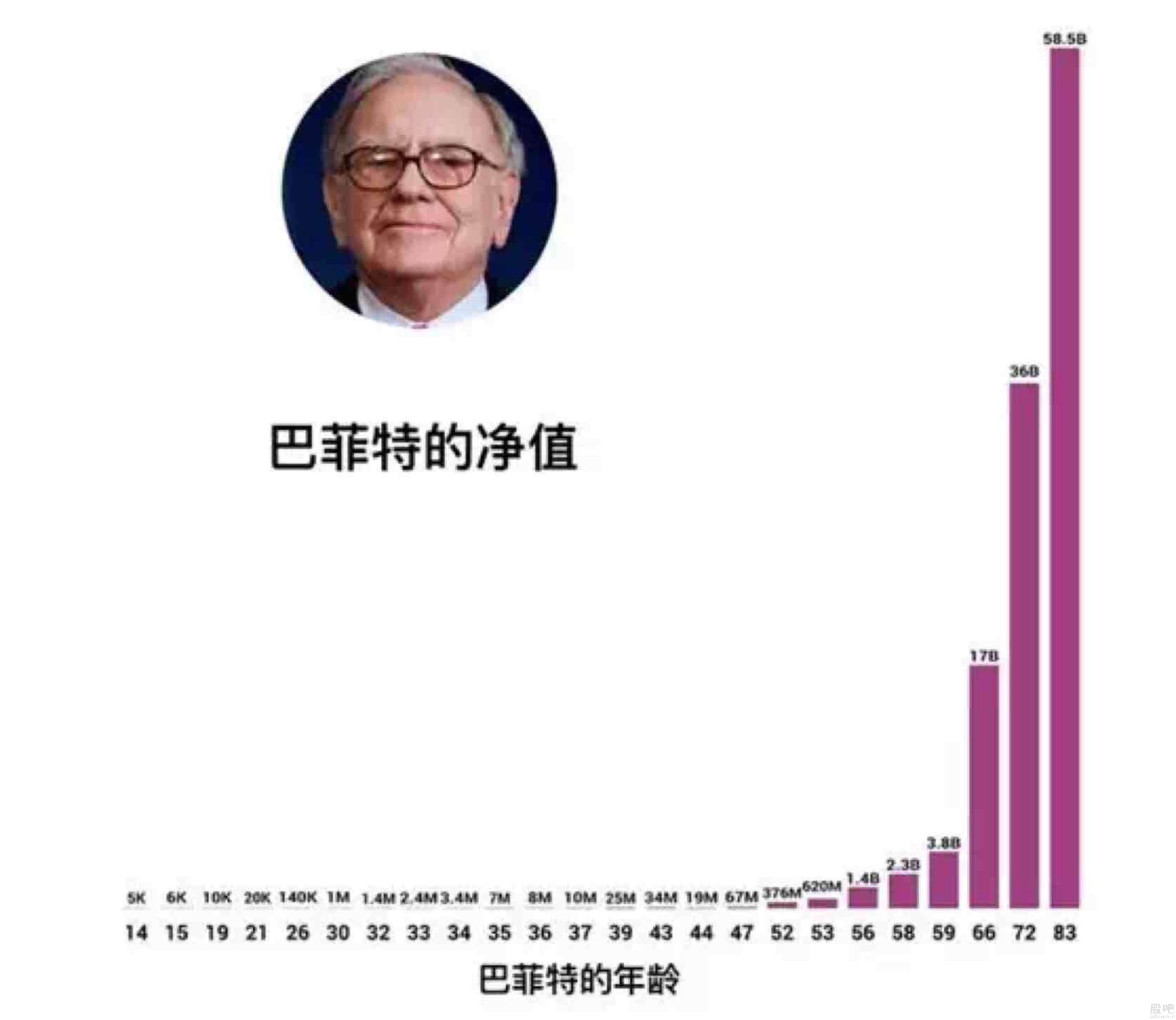

First, let's take a look back at Buffett's investment process and return (from E )

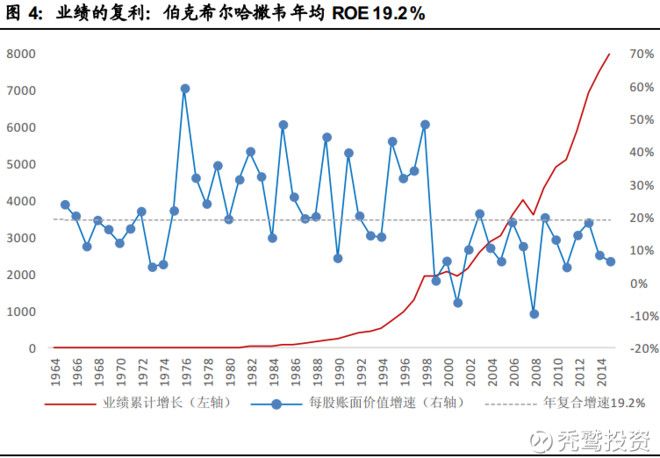

The first stage: from 1957 to 1964 for a total of 8 years, the total rate of return is 608% , the annualized rate of return is 28% , the annual investment income is positive, but there is no one year yield is more than 50% .

The second stage: from 1965 to 1984 for 20 years, the total rate of return is 5594% , the annualized rate of return is 22% , and the annual investment income is still positive. In 1976 , the rate of return exceeded 50% .

The third stage: from 1985 to 2004 , a total of 20 years, the total return rate of 5417% , 40 years total return rate of 287945.27% , an increase of 2879 times, annualized rate of return of about 22% , the third stage only 2001 income is negative There is still no year in which the yield is over 50% .

The fourth stage: a total of 5 years from 2005 to 2009 , the total return is 53% , the total annual yield of 45 years is 440121.43% , an increase of 4401 times, the cumulative annual yield of 45 years is 20.5%. As of 2009 , the 75 -year-old Buffett has more than $ 45 billion in wealth, and 99% of his fortune is earned after the age of 50 .

As everyone knows, Buffett has always used "value investment" as his core concept. He worships "reciprocal thinking" and truly uses time for value. This is why his huge fortune has not come out until the age of 50 .

If you are adhering to this investment philosophy, you let him play bitcoin, more than 20 points of fluctuations a day, it is estimated that the father can live less than 80 .

Small and beautiful? Big but not down?

After 10 years of development, Bitcoin has a return on investment of more than 10 million times, but its overall market value is less than $100 billion, and Buffett’s latest personal wealth has exceeded $ 90 billion, that is, the current volume of bits. The currency Buffett can basically contract.

If Berkshire really invests in Bitcoin, it is actually not responsible for its own shareholders, because the loss of wealth is only overnight, and those who have experienced the 2018 cryptocurrency bear market will probably understand the meaning of this sentence.

Some people may not know such a story. Buffett likes to study the "Stock Market Orientation" magazine in his early 20s, and then uses theory and practical experience to find those stocks that are called " smoke stocks " by Graham (Waffet's mentor). The stock is a stock that is very cheap and can be bought with very little money (that is, the “ junk stock ” we often call). When he determines the stock, he will ask Graham for advice and then buy it as much as he can. Four years later, Buffett’s $10,000 in the stock market turned into $40,000.

So, in fact, Buffett’s first bucket of gold was earned on the “smoke stock”.

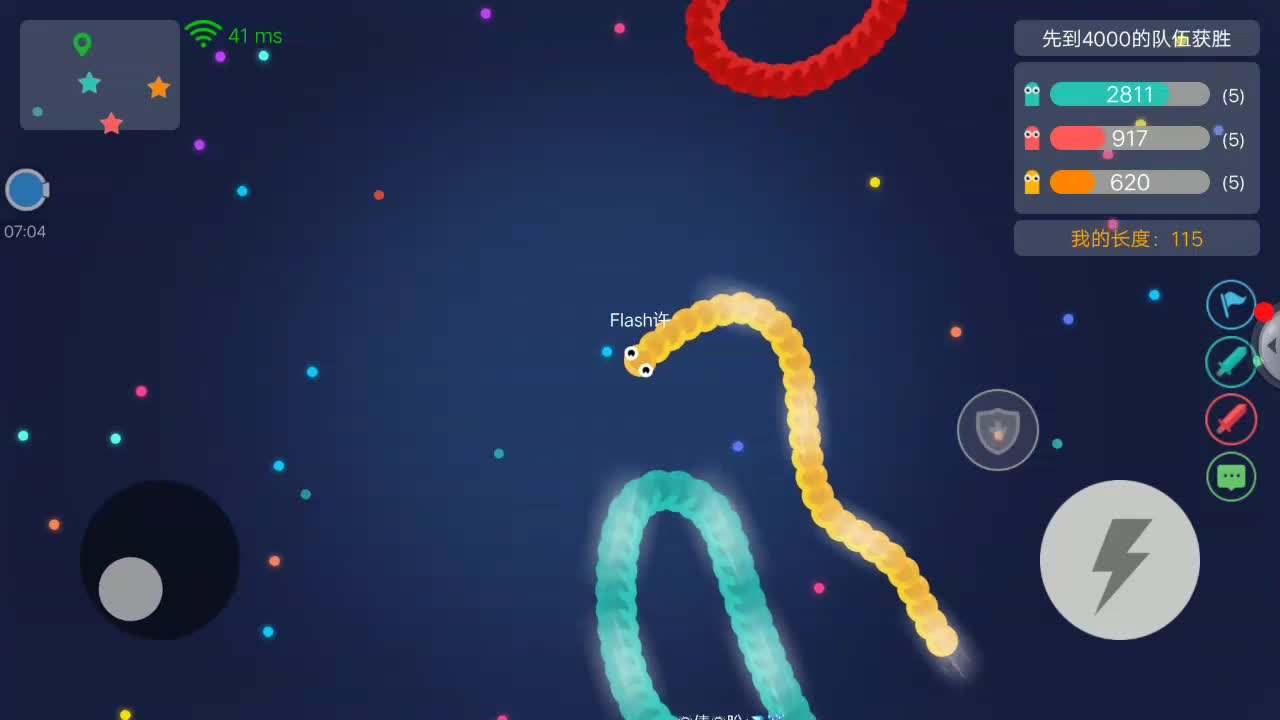

Presumably everyone has played a game of snakes. The secret of winning is that the game needs to be like a fly at the beginning of the game, so the probability of touching the "long snake" will be greatly improved, because the "long snake" will not In the game, they need to be stable, so that they can get the final victory.

When we look back at Buffett’s “History of Family”, the truth is the same. When I have insufficient cash on hand, I can only gain my wealth growth through adventure. If Buffett is now in his 20s and is worth only tens of thousands of dollars, I believe he will also pay out one or two thousand dollars to buy bitcoin.

But now, he manages trillions of assets, and the best way is – "worry development."

Encrypted currency requires a "moat"

At this year's shareholder meeting, another change is that Buffett began to pay attention to Amazon's stock, and said that the purchase of Amazon does not mean that Berkshire's value investment philosophy has changed, this is Buffett's success after IBM and Apple. Test the water technology stock again.

As early as a TV interview in February 2017 , Buffett admitted that it was a pity that he did not buy Amazon earlier. He said, "Obviously, I should have bought it because I have been very optimistic about them long ago. But I I have never realized the power of this model, and its price at that time seems to have been higher than expected."

As for Buffett's recent purchase of Amazon stocks, it seems that he saw that Amazon's "moat" has been set up, which is consistent with the concept that his early expression of Internet technology companies have not established a moat, so he chose not to participate.

So, will Buffett invest in Bitcoin in the future? The author believes that at least three prerequisites are required.

1. Bitcoin (cryptocurrency) produces more applications, while the body mass becomes large enough

2, Buffett saw the "moat" of the cryptocurrency

3. The industry has created a trillion-dollar market capitalization company.

I believe that when these three conditions are met, Buffett (if he is still alive) will definitely invest in companies in the field of cryptocurrency or blockchain.

After all, cryptocurrency (blockchain) is the future.

Of course, it might be more interesting to end the article with another investment. "The history of the world economy is a series based on illusions and lies. To gain wealth, the practice is to recognize its illusion, invest in it, and then be illusioned by the public. Exit the game before you know." (Soros)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Four words explain why bullish bitcoin: from now 50 years, that monetary base will be it

- May 7th Twitter Featured: Switzerland's largest stock exchange launches IDO, Coinbase hosted tokens over 30

- Market analysis on May 7th: The market is prosperous and the USDT exchange rate crisis is highly suspended.

- April cryptocurrency financing monthly report: IEO replaced ICO as the main mode but the total amount still dropped by 70%

- Blockchain privacy development company QEDIT completed $10 million in Series A financing, Ant Financial

- Switzerland's largest stock exchange SIX plans to issue native digital assets and propose a new concept IDO

- The cryptocurrency version of "Game of Thrones", if BTC is a dragon mother, who is the ghost?