UniswapX Creates a New Paradigm for AMM Protocols

UniswapX A New Paradigm for AMM ProtocolsAuthor: Daniel Li, CoinVoice

As a leader and innovator in the decentralized exchange industry, Uniswap has been continuously seeking technological breakthroughs to improve and innovate the entire DEX ecosystem. Last month, Uniswap announced the upcoming release of version 4, which has attracted widespread attention and anticipation in the industry. However, while everyone was still discussing and studying the various disruptive features and technologies of version 4, Uniswap has once again made a move and announced the launch of a transaction protocol based on an unmanaged Dutch auction – UniswapX.

UniswapX has created a new paradigm for AMM protocols. It aggregates on-chain and off-chain liquidity sources to provide traders with the best market prices, effectively prevents MEV attacks, and offers gas-free transactions, and even expands to support cross-chain gas-free transactions, pointing the way for the future development of DEX. Currently, UniswapX has been launched as an optional beta feature on the Ethereum frontend platform of Uniswap Labs and will soon be expanded to other chains and Uniswap wallets.

What changes will UniswapX bring

UniswapX is an unmanaged, permissionless, competitive trading protocol created using Dutch auctions, aiming to provide users with a better trading experience by combining on-chain and off-chain liquidity. According to the white paper recently released by UniswapX, the following changes will be brought to on-chain transactions:

- LianGuai Morning Post | U.S. SEC Significant Errors in the Ruling of the XRP Case Should Not Be Considered

- How to solve the problem of the lack of financial cash flow structure in token economics? Conceptualize the Token Economics Circuit.

- Immersive tourism prevails. How does the metaverse reshape the cultural and tourism industry?

Aggregating on-chain and off-chain liquidity for better prices

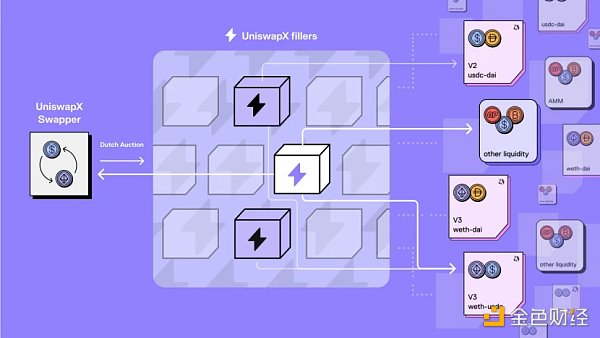

The first advantage of UniswapX is to use third-party fillers to aggregate assets from different on-chain and off-chain liquidity sources to obtain better prices. These fillers are liquidity providers, and anyone can become a third-party filler for UniswapX Swap. Fillers can come from on-chain liquidity sources such as decentralized exchanges like Uniswap, or from off-chain liquidity sources such as market makers.

In the trading process of UniswapX, when a swapper initiates a trade on UniswapX, the system will look for the optimal trading route and try to find the best trading price in different on-chain and off-chain liquidity pools. If the on-chain liquidity is insufficient, UniswapX will automatically turn to off-chain liquidity pools to obtain more liquidity and find the best price for traders. Fillers play an important role in this process by putting their assets into the UniswapX protocol as the initial assets for trading pairs, so that others can trade between these assets. In addition, fillers can use their own algorithms and strategies to help traders find the best price paths and optimal trading pairs. Therefore, traders don’t have to worry about whether they can get the best price. With the help of on-chain and off-chain liquidity pools provided by UniswapX and the competition among fillers, traders can easily obtain the best market prices. At the same time, all transactions will be transparently recorded and settled on-chain, ensuring the fairness of transactions.

No Gas fees and no fees for failed transactions

UniswapX adopts the Permit 2 executable offline signature order structure, providing traders with a transaction experience without paying high Gas fees.

When using the Permit 2 executable offline signature order structure, traders only need to digitally sign the order on their local device and then send the signed order to the pair contract.

Specifically, traders first generate a unique off-chain order through the UniswapX interface, then use their local device to digitally sign the order. Then, traders send the signed order to the Filler, who represents the trader in paying the Gas fees, and the Filler submits the order for execution on the chain. Since traders do not need to pay Gas fees, they do not need to have native network tokens (such as ETH, MATIC) to trade, and they also do not need to bear any fees if the transaction fails.

In actual transactions, the Filler incorporates the paid Gas fees into the swap price and reduces transaction costs by batch processing multiple orders. In addition, in certain cases, traders still need to pay Gas fees, such as for the initial token approval of Permit 2. Furthermore, when selling native network tokens, packaging is required, which also consumes a certain amount of Gas fees.

Multiple measures to prevent MEV

UniswapX has implemented multiple mechanisms to prevent MEV, providing traders with a better trading experience. Firstly, in the off-chain order matching phase, UniswapX introduces some features that regulate the transaction order, making it difficult for MEV to gain arbitrage opportunities and reducing the adverse effects of MEV on traders. These features include partial sorting by price, execution of limit orders, and local book digestion of price differences. This makes transactions in the Mempool difficult to predict, thus squeezing out the arbitrage space for MEV.

Secondly, UniswapX eliminates the adverse effects of MEV on traders by increasing the transaction price. In general, arbitrage traders can capture MEV by exploiting price differences, but in UniswapX, these arbitrage opportunities are eliminated. The MEV that could be obtained through arbitrage trades is returned to traders by increasing the price, thus eliminating the adverse effects of MEV on traders. Additionally, UniswapX can help users avoid more explicit forms of MEV extraction. For example, when executing orders using Filler inventory, the Filler is incentivized to use private transaction relays. This prevents orders from being sandwiched in between, avoiding MEV attacks. In summary, UniswapX’s MEV prevention mechanisms can provide traders with a better trading experience, making transactions more fair and transparent.

Support for cross-chain swaps

The UniswapX protocol supports cross-chain swaps, allowing traders to seamlessly trade assets on the target chain of the source chain. This means that traders can exchange assets on different chains without worrying about compatibility and transaction difficulties between different chains. The support for cross-chain swaps allows traders to conveniently trade assets and also improves transaction efficiency and reduces transaction costs.

According to reports, the cross-chain version of UniswapX will be launched later in 2023. At that time, users can achieve cross-chain asset exchange in seconds through UniswapX. Moreover, users can also choose which assets to receive on the target chain, rather than being limited to bridge tokens.

UniswapX: Changing the Rules of the DEX Game

With the launch of UniswapX and the upcoming upgrade of Uniswap to version V4 announced last month, Uniswap is using these innovative technologies and features to depict a DEX application scenario that is not inferior to CEX in terms of user experience. Although most people still hold the view that DEX cannot surpass CEX at present, with a series of innovative initiatives by Uniswap this year, more and more people are beginning to doubt this view. In fact, the DeFi market has always been one of the largest activities in the Web 3 ecosystem. Even during the peak of the bull market in 2021, DeFi’s total value locked (TVL) exceeded $175 billion. Although the market experienced a crisis in 2022, DeFi’s TVL still remains above $39 billion. As an indispensable part of DeFi, the trading volume share of DEX relative to CEX has increased significantly since September 2022, from a low of 8% to a peak of 22%. In a blog post celebrating Binance’s sixth anniversary in July this year, Binance founder Changpeng Zhao directly predicted that the market volume of DeFi would surpass CeFi in the next six years or so. The optimism of leading companies and the future development prospects of DeFi have also brought more attention and investment to DEX. The launch of UniswapX at this time can attract more users and investors to join the DEX industry.

Compared with centralized exchanges, decentralized exchanges still have certain deficiencies in user experience and transaction speed, which is the main challenge facing decentralized exchanges at present. The launch of UniswapX provides a more complete solution. UniswapX opens up a broader design space for DEX. By introducing third-party fillers to aggregate on-chain and off-chain liquidity, UniswapX enables traders to quickly obtain the best trading prices. In addition, the use of the Permit 2 executable offline signature order structure allows traders to achieve gas-free transactions, greatly reducing the transaction costs for users on DEX. Most importantly, UniswapX supports seamless cross-chain exchanges and has designed the right solution for cross-chain exchanges, allowing users to move between different chains cheaply, quickly, and easily. This will be a revolutionary change for DeFi.

In the future, once UniswapX achieves gas-free transactions and seamless cross-chain exchanges, DEX will have overwhelming advantages over CEX in terms of user transaction fees and cross-chain asset transfers. In addition, the new off-chain provider mechanism of UniswapX and the greater space provided by Uniswap V4 for market makers will attract more traditional market makers to enter the DEX industry, further enhancing the competitiveness of DEX against CEX in terms of liquidity. Coupled with the disruptive features brought by the upcoming Uniswap V4 version, it may only be a matter of time before DEX replaces CEX.

The Impact and Controversy of UniswapX in the Industry

While the launch of UniswapX may not be as grand and attention-grabbing as Uniswap V4, its impact should not be ignored. Firstly, the launch of UniswapX further validates the potential of the aggregator market. Although the aggregator market has already become an important track, it is still a relatively unfamiliar field for the general public and ordinary users. However, with the introduction of this innovative feature on Uniswap, the aggregator market is starting to gain more attention from ordinary users. In other words, before the launch of this feature on Uniswap, it may have been seen as a unique selling point for certain projects focusing on specific functionalities, but now it is being considered a legitimate mainstream feature.

The launch of UniswapX will accelerate the competition within the aggregator market. With its large user base and brand power, UniswapX undoubtedly has overwhelming advantages over other aggregator projects, making it the new leader in the aggregator market. This will inevitably have an impact on other aggregator projects and squeeze their market share. Therefore, the appearance of UniswapX is clearly unwelcome for some aggregator projects, especially since UniswapX is to some extent “copying” the 1inch fusion model or Cow Swap, which are off-chain order-matching aggregator platforms. Although UniswapX still has many differentiated innovative points, it is unquestionably a follower and imitator in the aggregator field.

In addition to its impact on the aggregator field, the launch of UniswapX also has an impact on the cross-chain market. Uniswap has been actively promoting its multi-chain plan for a long time, deploying on 7 chains and L2. One of the purposes of UniswapX’s launch is to connect the liquidity between these chains. In the cross-chain field, it heavily relies on the endorsement of brand security, and with the backing of the Uniswap brand, it is believed that UniswapX will soon become the new leader in this field.

It is very common for a single dominant player to emerge in the market, leading to a winner-takes-all situation, but this often leads to a lack of innovation in the industry. Once a project introduces new innovative points, it may face suppression from followers relying on brand and market advantages. Currently, the launch of UniswapX has sparked a lot of controversy in the market. Some community members believe that UniswapX is an innovator that will change the game rules of decentralized exchanges, MEV, and interoperability. But some people believe that UniswapX, as a follower, is engaging in behavior that goes against the innovative spirit of blockchain by relying on brand and market advantages to squeeze out competitors.

However, these accusations selectively overlook the contributions of Uniswap in the field of industry innovation. Uniswap has always been a pioneer and has played an important role in exploring new technologies and functionalities. Whether it’s the original V1 version or the upcoming V4 version, the new features introduced by each version of Uniswap have been imitated and followed by other platforms while also leading the development direction of the entire DEX industry. Although some of the features introduced by UniswapX may not be industry-first, pushing the old technology to its extreme is also a form of innovation. In the field of innovation, smaller boats that sail alongside the big ship are bound to face more waves. But at the same time, as the leader, the big ship also guides the smaller boats in the right direction.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuai Morning News | The total supply of stablecoins has decreased by more than 10 billion US dollars net this year.

- Has Financialization Destroyed NFTs?

- zkSync Development Diagnosis Progressive Decentralization Path, Still in Early Stage with Lack of Distinctiveness in the Ecosystem

- How much can you earn working at Coinbase in a bear market? Take a look at these 6 popular positions.

- Explaining in detail the newly launched Deals feature by Opensea The ‘barter’ of the NFT world

- Arweave’s total number of transactions has exceeded 1 billion. How will it move towards large-scale applications in the future?

- Left or Right North Korean Hacker Group and US SEC Chairman