Explaining in detail the newly launched Deals feature by Opensea The ‘barter’ of the NFT world

Opensea's newly launched Deals feature the NFT world's barter.Today, Opensea released a new feature called Deals, which allows users to exchange a series of NFT collections with other users’ NFT collections.

According to Odaily Daily, Opensea actually introduced this peer-to-peer “NFT collection trading model” when it launched the Seaport protocol in May this year, but the front-end of Opensea has not opened this feature.

During the bear market, NFTs have been criticized for lack of liquidity, and the NFTs held by collectors (especially non-blue-chip and non-utilitarian NFTs) have little use other than self-appreciation (or secret regret). As a result, there have been a number of platforms trying to solve the liquidity problem of NFTs, either by releasing liquidity through lending and leasing models, or further “FT-izing” them with the help of financial derivatives. However, fundamentally, non-fungible NFTs still lack diversity in trading models.

Opensea, as the former dominant NFT trading platform and the second player after Blur today, ignited hope for “solving the liquidity problem of NFTs” when it launched the Seaport protocol. Now, the related feature Deals is finally online. Odaily Daily will verify its working principles and effectiveness through experience, introduction, and analysis, and share some thoughts on the competition in the NFT market.

- Arweave’s total number of transactions has exceeded 1 billion. How will it move towards large-scale applications in the future?

- Left or Right North Korean Hacker Group and US SEC Chairman

- Buidler DAO How Tokens Drive Growth from the Blur Airdrop Strategy

Introduction to the Deals feature

The Deals feature is derived from the Seaport protocol, which is a decentralized smart contract protocol used to create and fulfill orders for ERC-721 and ERC-1155 tokens. Each order contains a token combination provided by the supplier and a token combination required by the recipient.

The Deals feature allows buyers to apply to purchase a certain number of NFTs from sellers by bundling a certain quantity of NFTs and tokens on the same chain.

For example: User A wants to exchange two Azuki tokens worth 5 ETH for User B’s Bored Ape token worth 30 ETH. User A needs to search for User B’s address through the Deals interface, select the Bored Ape in User B’s wallet to generate a purchase order, and then select their own two Azuki tokens. User A needs to use WETH to make up the price difference at the current market value and initiate a transaction request to User B. After User B agrees, the transaction is completed.

As you can see from the example, this peer-to-peer bundling trading model is more suitable for the exchange of NFTs of equal value, such as Doodles and Azuki during the bull market phase. Of course, Opensea has also considered this and introduced WETH to make up the price difference, increasing the flexibility of “non-equal exchange transactions” and further improving the possibility of NFT liquidity.

(Attached: Opensea’s official introduction video about Deals.)

Facing strong competitors, Opensea seeks change

Opensea’s pace of updates has clearly accelerated compared to its slow progress from the launch of the new Seaport protocol in May to the introduction of the Deals feature today. The reason behind this is not difficult to understand:

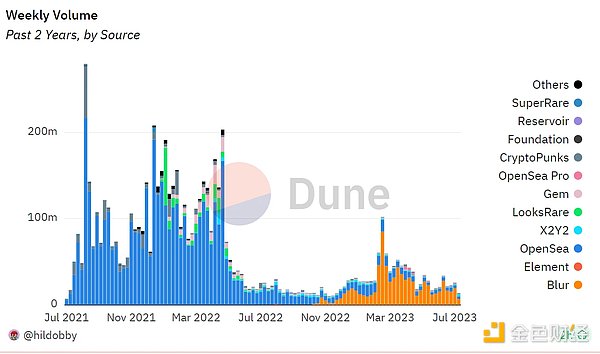

The above figure is a representation of the weekly trading volume of the major NFT trading platforms in the past two years in the Dune panel. It can be seen that from the end of last year to now, Opensea has been gradually losing market share to Blur, prompting Opensea to innovate and regain market dominance.

Aside from token economics, Blur’s rise is also attributed to its product model and supporting operations. Blur focuses on batch sales and purchases, and with the recent launch of the NFT lending platform Blend, it has formed an NFT trading matrix to improve the liquidity of NFTs.

In contrast, Opensea’s previous functionality was relatively single, only allowing for single purchases through tokens, which was not conducive to bulk purchases by large holders. This has led to a significant loss in market share. Can Opensea’s new feature, Deals, reverse this situation and regain its previous position?

The Deals feature is a trading model that differentiates itself from other platforms. It adopts an interactive combination trading model that reduces the transaction process by exchanging NFTs for NFTs through barter. What are the advantages of this model?

Take Blur as an example. Its trading model involves batch sales and purchases, which essentially follow the steps of traditional trading – payment in exchange for delivery. The only difference is that it improves convenience from the user’s perspective but does not improve the liquidity of NFTs. On the other hand, Opensea’s Deals allows buyers to exchange their own NFTs and tokens for the NFTs held by sellers, eliminating the need for buyers to sell their own NFTs separately.

The Deals model also has its drawbacks – the inefficiency caused by delayed interaction. After a buyer applies for a deal, there is no further step to facilitate the transaction; they can only wait for the seller’s acceptance or rejection. This process also increases the time cost.

Both Blur’s batch mode and Deals mode have different application scenarios. Blur is more suitable during a bull market when NFT liquidity is high. Blur’s usage is relatively user-friendly. Deals, on the other hand, are more suitable during a bear market phase to increase the possibility of transactions in a market with low liquidity.

(By the way, here’s a suggestion for Opensea: adding a chat window plugin for buyers and sellers may increase the chances of successful Deals transactions.)

NFT Projects Cool Down, NFT Platforms Heat Up

As many NFTs fall into obscurity, platforms that focus on NFT trading are also struggling. Compared to 2021, the overall trading volume has greatly declined this year. The shortcomings of NFT liquidity have become more apparent.

However, there is hope with the emergence of ERC 6551, Blur’s Blund lending, and Opensea’s Deals feature.

The three provide new vitality to NFT in different dimensions:

-

ERC 6551, as a new smart contract protocol, can enhance the new combinability of NFT, improve the operability and utility of NFT from the bottom, and is applicable to multiple fields. This makes me think of the possibility of combining NFT and FT into a whole for sale, such as airdrops for new projects.

-

There are many NFT lending protocols, and Blend integrates directly with Blur, which currently has the largest market share, which stimulates the release of NFT liquidity and enhances market vitality.

-

The Deals feature of Opensea changes the existing transaction process of NFT and eliminates transaction steps. Will it be a powerful tool to stimulate the increase of NFT liquidity? This still needs further observation.

It is gratifying that practitioners still insist on innovation and have not become complacent. These small iterations during the bear market may all become powerful weapons in the future bull market.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Opinion The true and complete Telegram Bots experience will appear on Ton.

- Variant Partner Distinguish DePIN and DeREN as two types of decentralized infrastructure networks.

- DePIN and DeREN Better Classification of Decentralized Infrastructure Networks

- After Unibot went viral, which other mainstream Telegram bots are worth paying attention to?

- RootData 10 Emerging Cryptocurrency Venture Capital Firms Not to Be Ignored in the Bear Market

- Overview of 8 Major Releases at EthCC 2023

- Blue Chip DeFi New Narrative Reviewing Aave and Compound Fundamental Data