Is Binance joining ORC-20, marking the end of BRC-20?

Will Binance switch from BRC-20 to ORC-20?Author: Asher Zhang

Binance Academy tweeted about ORC-20, and the market believes that Binance is interested in ORC-20. So, how is ORC-20 performing currently? With the narrative around the Bitcoin protocol constantly evolving, which parts are really worth paying attention to? From a technical indicator perspective, Bitcoin has already turned around in the short term. When will the meme trading frenzy subside? What different changes have happened behind the scenes of this round of meme trading frenzy?

BRC-20 Competitors Emerge, What Makes ORC-20 Different as Binance Enters the Game

There is no doubt that BRC-20 has been a hot topic recently, but the cryptocurrency market always has no shortage of stories. The competitors of BRC-20 have begun to emerge. Currently, the main competitor of BRC-20 is ORC-20. So, what makes ORC-20, which has received support from Binance, different from BRC-20? And will the market enter a new round of FOMO?

- Understanding the business model and product components of Centrifuge, one of the leading companies in RWA

- Deep Analysis: Exploring Hooked’s Ambitious Goals in Web3 Education through Collaboration with Animoca

- Is the ultimate goal of AI Web3? “Father of ChatGPT” launches encrypted wallet World App

On May 13th, Binance Academy tweeted about ORC-20, which may mean that Binance will subsequently support ORC-20 Tokens. The market is highly interested in this, and many people believe that ORC-20 will be the next hot spot.

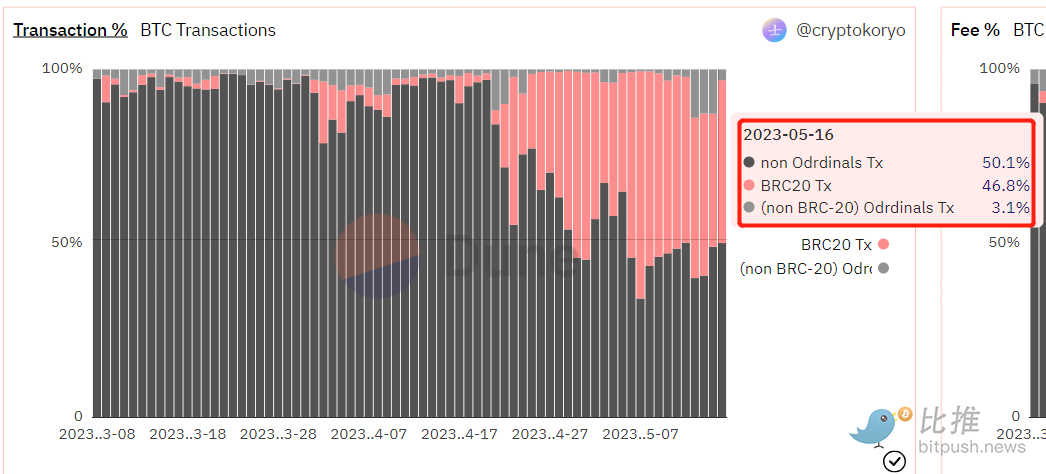

According to Dune Analytics, the BRC-20 protocol has been growing since April 21st (with a share of 4.1% on that day), and non-Ordinals protocols account for 84.2% of the total; subsequently, the BRC-20 protocol grew significantly, with a peak share of 65.3%; since May 12th, the Ordinals protocol (non-BRC-20) has been growing rapidly from a share of 2.1%, with a peak share of 13.9% on May 13th, and as of May 15th, it accounts for 12.7% of the total and is growing relatively quickly. Therefore, Binance’s boost effect is relatively obvious.

Here is a brief introduction to the differences between ORC-20 and BRC-20. BRC-20 has many restrictions, including only allowing four characters as the currency name, not being able to upgrade, double-spending risks, and not being able to cancel transactions, among others. The purpose of ORC-20 is to remove these restrictions, making it a hard fork of BRC-20. ORC-20 is an open standard designed to enhance the functionality of ordered tokens on the Bitcoin network. ORC-20 is backward-compatible with BRC-20. The specific changes made by ORC are mainly: the initial supply and maximum coinage can be changed; the namespace has no fixed restrictions and can use any size of name; the UTXO model is used to ensure that there is no duplicate spending during the transaction process; transactions can be cancelled; BRC-20 coins that have already been deployed can be transferred to ORC-20; only the deployer of BRC-20 can operate the transfer command.

So will ORC-20 create a wealth creation myth like BRC-20 did? According to Bitpush, crypto influencer DeFi Teddy (@DeFiTeddy2020) believes that the advantages of ORC-20 are also disadvantages to some extent, such as customizability, which will make the standard more complex and user operations more prone to errors; and upgradability, which may make users feel that it violates the immutability of blockchain. Personally, I don’t think ORC-20 can be said to be an upgrade replacement for BRC-20, because they each have their own advantages and disadvantages and have their own application scenarios. If we make a comparison, BRC-20 is more like Bitcoin, and ORC-20 is more like Ethereum.

According to Bitpush, SevenUp DAO (@xiyu) believes that ORC-20 has removed some of the limitations of BRC-20 and defined more operations. In fact, the core competitiveness of issuing coins on Ordinals is centralized services, not this standard. Only when the closed-loop certification is put on the chain can the risk of centralization be prevented. The biggest problem with BRC-20 is not that there are too many restrictions, but that it depends on centralization. ORC-20 did not solve this problem, and ORC-20 regards BRC-20 as a competitor and aims to seize the market. ORC-20 has little impact on the Ordinals ecosystem, but has limited impact on BRC-20.

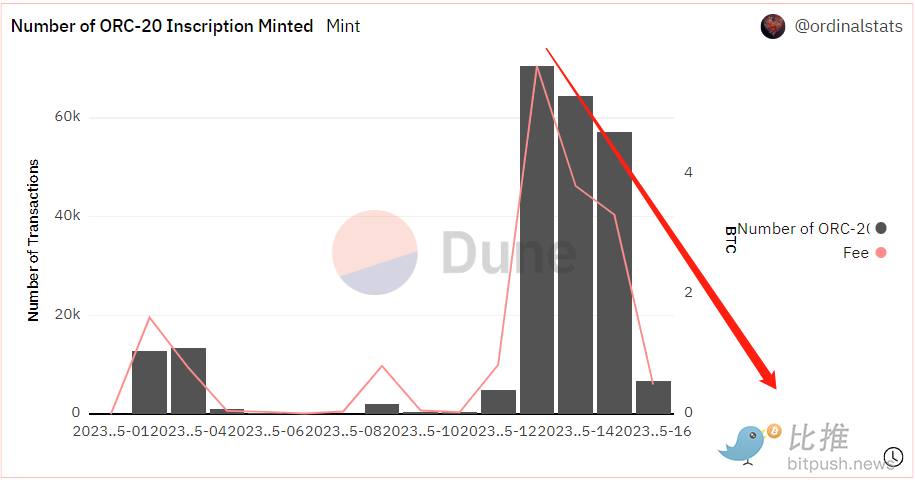

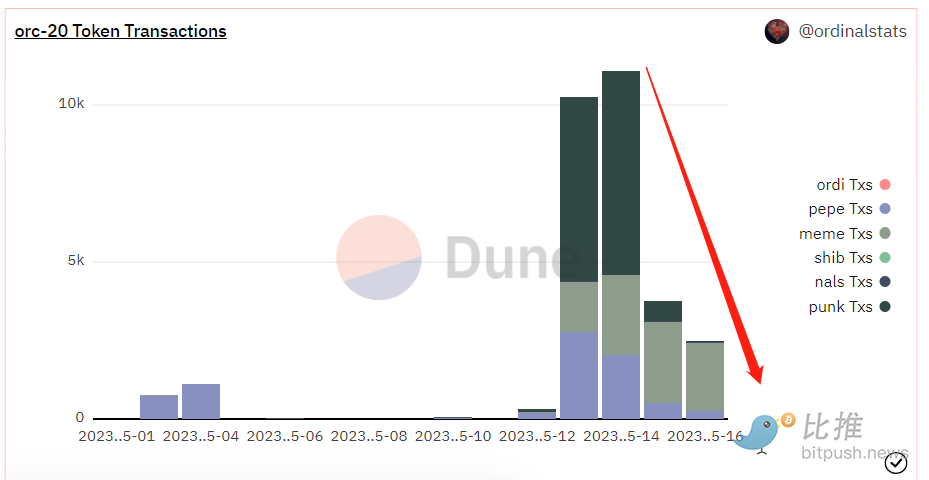

Data shows that after Binance Academy tweeted their support for ORC-20, there was indeed a lot of trading activity based on the ORC-20 protocol, but the proportion of Bitcoin chain transactions based on ORC-20 has clearly declined, and the market has not really heated up. According to Dune data, the number of inscriptions cast based on ORC-20 soared rapidly on the day Binance Academy tweeted their support, but then quickly dropped; at the same time, the number of transactions based on ORC-20 also showed a significant decline, which means that the market quickly cooled down after a brief period of activity. This means that although Binance has the intention to promote it, at least ORC-20 has not been hyped up like BRC-20, and the market’s FOMO is relatively short-lived and unsustainable.

Bitcoin protocol narrative surges, what is BRC-21?

Compared with Binance Academy’s tweet supporting ORC-20, the truly innovative BRC-21 may be more anticipated. This article believes that its most innovative feature is that, first, BRC-21 will achieve greater decentralization, which is a clear flaw of BRC-20 tokens; second, unlike the MEME token issued by BRC-20, BRC-21 will introduce more valuable multi-chain assets to Bitcoin; finally, BRC-21 will promote the development of Bitcoin’s lightning network, which seems to be more in line with Bitcoin’s future main development direction. So, what is BRC-21? And how is it achieved?

According to a report by “Bitpush,” on May 7th, Alexei Zamyatin, the founder of cross-chain interoperability project Interlay, proposed the introduction of the BRC-21 standard to introduce completely decentralized cross-chain assets to the Bitcoin network and use them in the lightning network. According to the BRC-21 token standard V 0.1 documentation, BRC-21 assets are essentially still BRC-20 assets, but unlike the “spawned” BRC-20 assets, BRC-21 needs to generate by locking assets on the starting chain (such as ETH, DOT, ATOM, DAI, etc.). In other words, the BRC-21 standard provides a possibility to mint BRC-20 versions of other chain-based assets such as ETH and DAI on the Bitcoin network.

From a technical perspective, cross-chain of BRC-21 assets only needs three components to complete, and it is expected to achieve complete decentralization throughout the process: Starting chain smart contract: responsible for handling coin minting and redemption operations on the starting chain; Custom indexer: responsible for verifying BRC-21 coin minting, transfer, redemption, and other operations on the Bitcoin network, as well as the status of smart contracts on the starting chain; Bitcoin relay (BTC-Relay): acts as a lightweight client on the Bitcoin network to achieve the effect of smart contracts, verifying the inclusion of transactions on the Bitcoin network and parsing them. However, currently, Bitcoin BRC-21 is still in the technical practice stage, and its impact on the Bitcoin network is relatively small.

Market turns, cycles can still serve as a reference

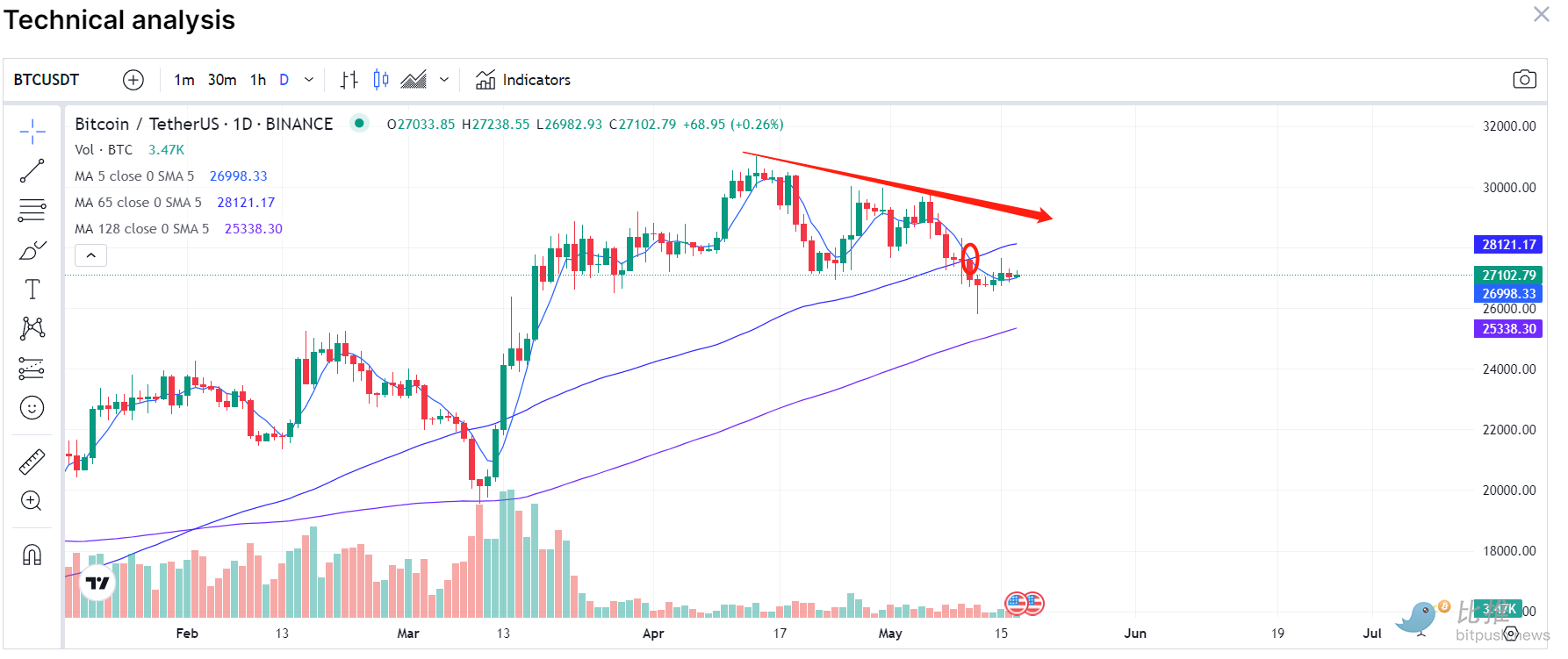

From the technical chart, it is obvious that Bitcoin is currently in a short-term downtrend. On May 11th, Bitcoin fell below the mid-term trend line MA65, further confirming the trend signal of short-term topping.

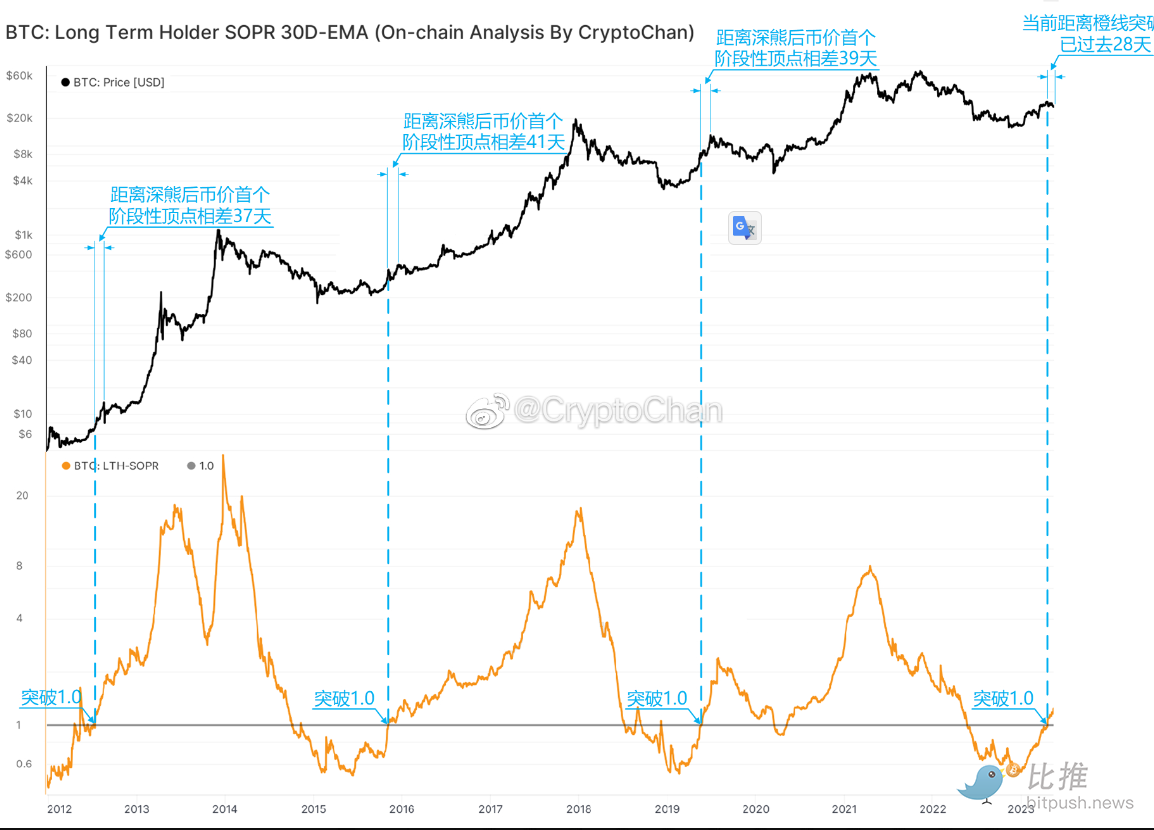

Apart from technical indicators, from the perspective of the on-chain cycle, Bitcoin is highly likely to see a short-term peak. Crypto influencer CryptoChan (@0xCryptoChan) tweeted on May 16th. The black line above in the figure represents the bitcoin price, and the orange line below represents the 30-day moving average of the bitcoin long-term holder SOPR indicator (#Bitcoin: Long Term Holder SOPR 30d-MA). In history, after the orange line successfully broke through 1.0, the first phase of the bear market top was reached 37 days later in 2012, 41 days later in 2015, and 39 days later in 2019. Currently, 28 days have passed since the orange line successfully broke through 1.0.

From the perspective of market speculation logic, we have always believed that the current BRC-20 token frenzy is essentially the result of Meme token speculation in the absence of market hotspots. After Ethereum completed the Shanghai upgrade on April 13th, the previously hot staking track lost its speculative space, but immediately afterwards, the Layer2 leader Arbitrum’s coin issuance caused widespread market attention. On April 19th, Arbitrum officially announced that Arbitrum will distribute initial token allocations to DAOs that meet the criteria in the ecosystem and distribute tokens afterwards. After the expected issuance of tokens is fulfilled, the market began to look for new hotspots. It was at this point in time that, combined with the previous NFT trading on Bitcoin Ordinals already having heat and capital accumulation, Meme tokens led by BRC-20 began to enter the public eye and successfully ignited speculation in the absence of speculative targets in the market.

Crypto influencer Coin Market Operator believes that: BRC20 speculation may be quickly proven false. Data from Coinglass shows that the leading coin of the BRC2.0 concept, ORDI, has accumulated an astonishing 30000% increase in the past month, which has brought unprecedented attention to the development of the Bitcoin ecosystem. As the Bitcoin chain does not support smart contracts and transaction processing is also very slow, related tokens of BRC2.0 have almost no application scenarios, and Bitcoin Layer2 is also difficult to flex its muscles due to the low performance of the main chain. Therefore, in the absence of a grand narrative, the theme speculation of BRC2.0 is likely to be quickly proven false. Based on historical experience, when the main force faces significant pressure on the main battlefield, the local myth of wealth creation will not easily stop, and it is expected that the market for MEME tokens will continue to ferment. However, for ordinary investors, if they do not have the ability to make money from MEME tokens, then a light position and wait-and-see approach is undoubtedly the best choice.

nikkor.eth2 (@Wdahei) believes that if there are no new gameplay modes in BRC-20, it will be hot for at most another 20 days. Seize the opportunity; in the next six months, short when there is a rebound. Even if it pumps again, it will have to wait until the end of the year or even next spring. Before the halving of Bitcoin, the Matthew effect of wool shearing will be very obvious. Except for a few people who can eat the tail of the fish, wool shearing is dead. I am increasingly inclined to believe that the real users of Web3 have a scale of less than 100K.

New changes behind the hot wave of various Bitcoin protocols

The hype around BRC-20 this round is mainly speculative behavior of funds in the market after the lack of hotspots. Similar MEME hype fish tail markets have appeared in previous big market cycles, such as Doge and SHIB. However, this MEME hype has indeed brought about some new changes and has great innovativeness. Along with the entry of exchanges such as Binance, this change is very likely to become the most worthy of attention in the bull market. Let’s talk about the differences behind this Meme hype.

In the encryption market, the previous coin issuance model was largely inseparable from the team-capital-exchange-retail investors. In this process, retail investors were at the bottom of the food chain and mostly existed as bagholders. However, the emergence of BRC-20 has gradually changed this model to a certain extent. For example, decapitalization. Anyone can deploy inscriptions, but in order to obtain inscriptions, they must spend their own money to promote them, which is equivalent to “promoting their own project”, and success or failure does not depend on the founder (deployer). Going exchangeless, all transactions are conducted on the chain, and exchanges are only for riding the heat and maintaining exchange user data. Fair launch, fairness is the favorite of retail investors. However, everything has two sides. In the process of becoming more decentralized and less exchange-dependent, this has invisibly set higher technical and participation thresholds for users, which also requires users to analyze and filter.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Why has Cosmos become the first choice for many developers in application chains?

- Dark Side of NFT History: Reviewing the Darkest Moments of 5 Blue Chip Tokens

- Conversation with Coinbase Protocol Director: How is Base, as a highly anticipated new Layer2, building its ecosystem step by step?

- How does ERC-6551 change the game by turning NFTs into Ethereum accounts?

- Embark on the Opside Value Exploration Journey: Pre-Alpha Incentive Test Network Countdown officially launched

- Exploring the New Trends of the Three Pillars of DeFi: DEX, Lending, and Stablecoins

- Why is everyone choosing to create platforms instead of making games?