Will the miners escape the tide and the bitcoin price will peak again?

Original author: medium-coinmonks

Original translation: Block rhythm BlockBeats-HQ

Source: block rhythm

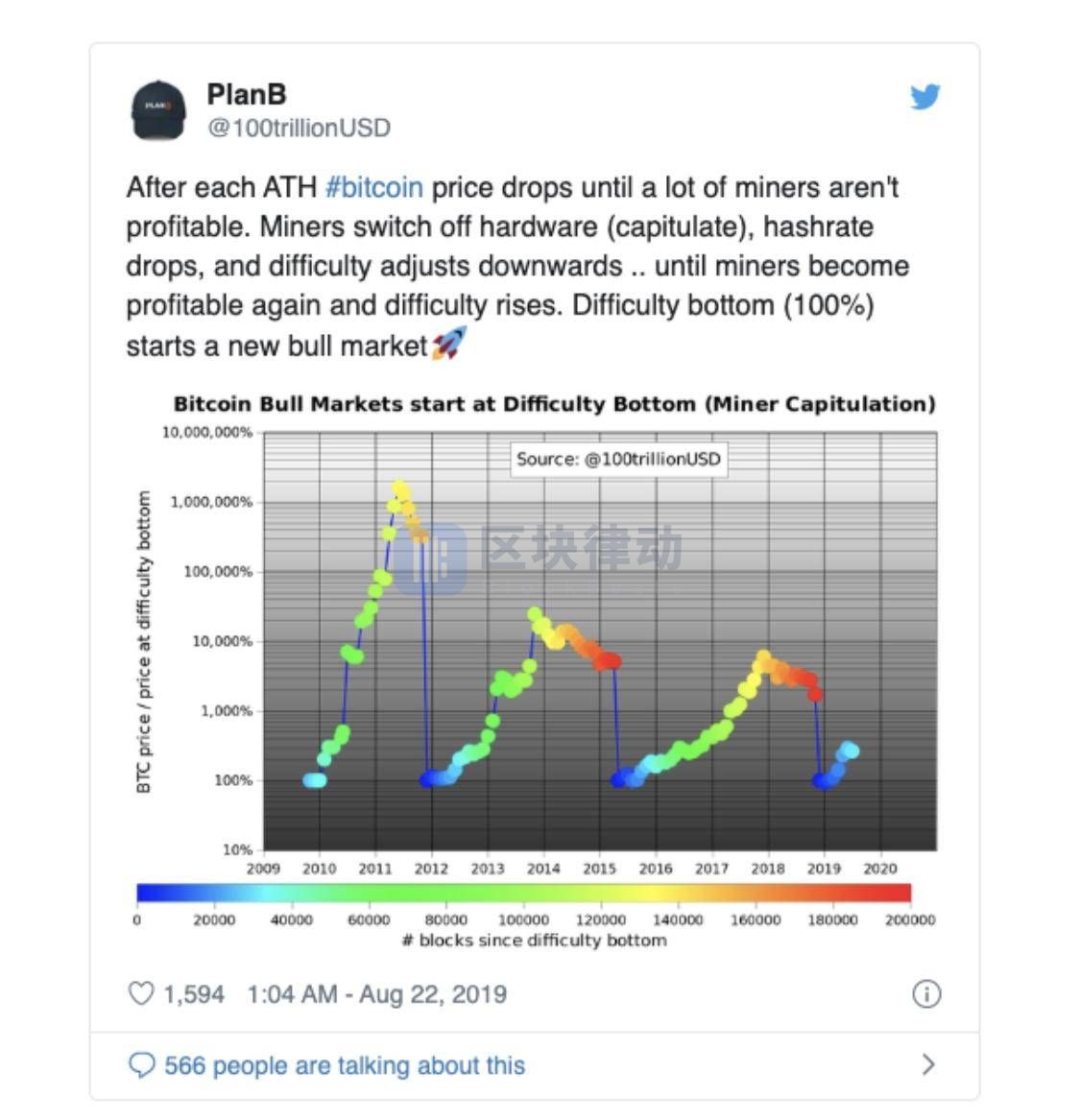

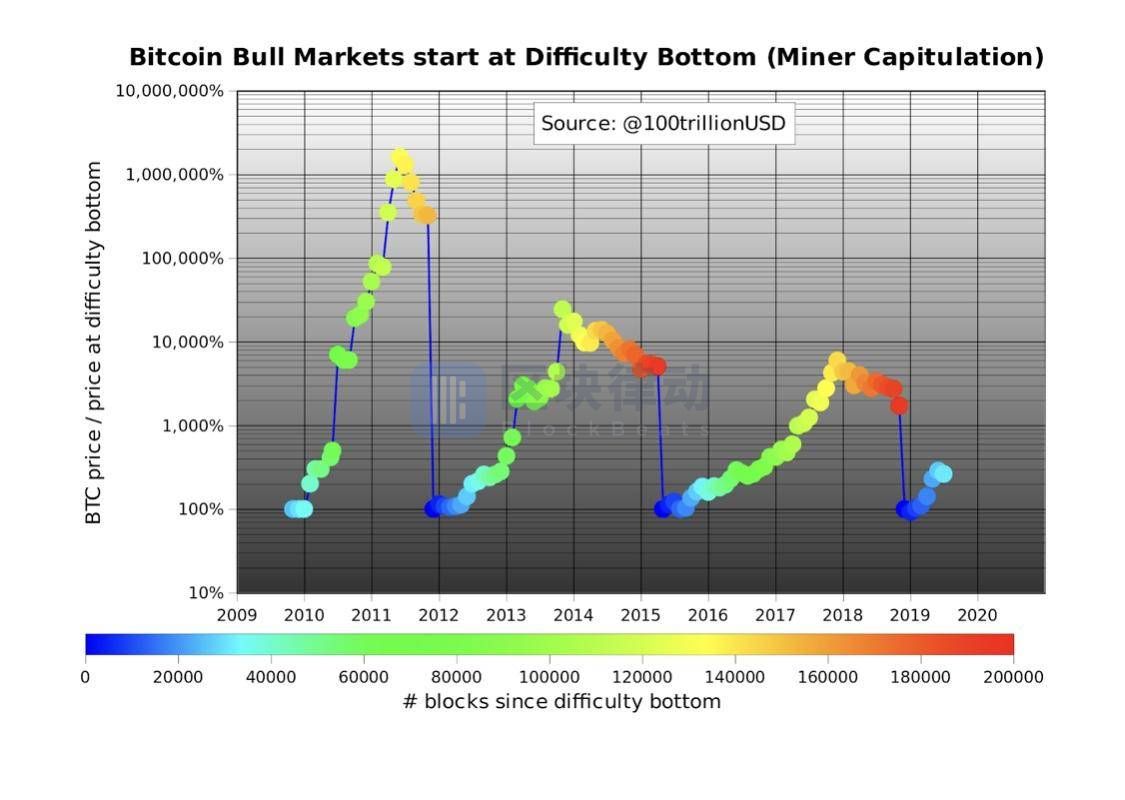

The difficulty of mining may be an indicator of the price of BTC. According to cryptocurrency researcher PlanB, the three major bull markets in the history of bitcoin have started to break out after the difficulty of mining, which means that the market may see a strong upward trend this year.

- What is Synthetix, which is second only to MakerDAO, with more than $100 million in assets locked?

- How does Bitcoin return to $20,000? These three points may become stumbling blocks

- QKL123 Quote Analysis | Bitcoin is a commodity or currency? Most countries are open-minded (1118)

Forecast bitcoin bull market using mining difficulty

Although the cryptocurrency market is known for its extremely high volatility, its market trend is cyclical. Cryptographic currency analysts use a variety of different tools and factors to predict the duration of each cycle and the different factors that influence market movements.

Moving averages are analysts' favorite analytical tools because they provide fairly accurate forecasts of major price increases. However, cryptocurrency researchers, PlanB found a different way to more accurately predict bitcoin price movements.

In a tweet stream on Twitter, the researchers explained how the past three bitcoin bull markets began to break out when the mining difficulty reached the bottom.

He explained that the price of Bitcoin will fall sharply every time the mining difficulty reaches its highest point, and it will continue to fall until a large part of the miners become unprofitable. And when bitcoin prices began to rise and market competition intensified, many miners could not continue to run their hardware, forcing them to give up.

It is speculated that the price of bitcoin is pushed up by profit miners.

When the miners leave the network, the overall network computing power is reduced. After the decline of the whole network computing power, the difficulty of mining will be adjusted soon.

In the past 10 years, whenever Bitcoin's mining difficulty fell to the bottom, it was followed by a major bull market. The charts shared on Twitter show that in the beginning of 2012, the second quarter of 2015 and the end of 2019, the computing power of the entire network has bottomed out.

The figure also shows that the difficulty of mining falls once every 3-4 years, or when about 20,000 blocks have been generated since the last time the bottom of the mining difficulty was reached.

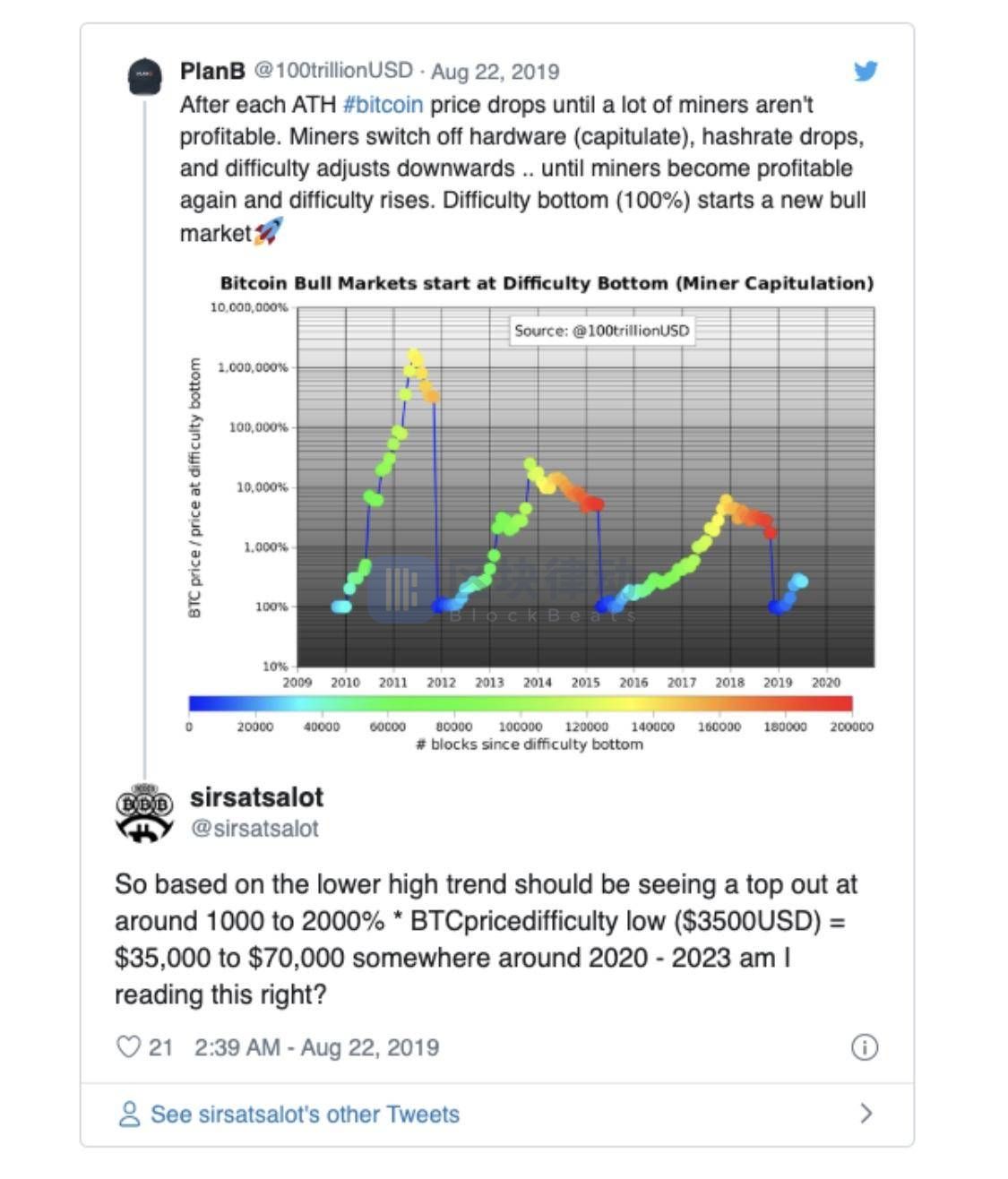

Although there is no guarantee that this market cycle will replicate the first two cycles, if this is the case, this means that bitcoin prices may reach record highs. Based on the low-high trend shown in the figure, the next "highest point" of Bitcoin may be 1000-2000% higher than the price at the lowest mining difficulty in this cycle.

Since the price of Bitcoin hovered around $3,500 at the end of last year, it would mean that its price could reach $35,000 to $75,000 in the next few years when the pit is 100% difficult.

After a Twitter user pointed this out, PlanB said it was actually a fairly conservative estimate. He explained that the last two bitcoins reached a "historical peak" after the miners fled, and the price rose by about 100 times.

In other words, the analysis of PlanB may be completely wrong. Several mining experts told CryptoSlate that mining difficulty is a lagging indicator, not a predictor of bitcoin prices. As the price of BTC rises or falls, the difficulty of mining is adjusted accordingly, rather than the opposite adjustment. Therefore, the two are closely related, and PlanB's reasoning about the causal relationship between the two is likely to be questionable.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Opinion: The blockchain is not effective in the short term, and the investment in basic R&D of large domestic banks needs to be improved.

- The daily trading volume exceeds 300,000, and the ERC-20 token surpasses Ethereum for the first time.

- Interpretation: Is it really possible to create the “root of trust” in the blockchain?

- The "mysterious" blockchain technology has been applied to people in Zhejiang for medical treatment!

- BRICS: Prelude to Overthrow the US Dollar Hegemony

- A few things you must know before Maker MCD goes live

- Kay Uncle commented: Have you lost money in the currency circle? Look for it to get back