World Economic Forum: Creating a Reputable and Trustworthy Digital Currency (Part 1)

Translation / Proofreading: Long Baitao

Guide

What does Libra have to do with regulation? Davos, the two central bankers and Libra's head, representing the forefront of stablecoin global regulation.

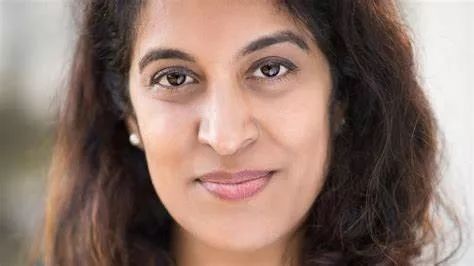

On January 24, 2020, Sheila Warren, Head of Blockchain and Distributed Ledger Technology at the World Economic Forum, Tharman Shanmugaratnam, Chairman of the Monetary Authority of Singapore, David Marcus, Head of Facebook Calibra, Valdis, Executive Vice President of "Serving the Economy for the People", European Commission Dombrovskis, Benoît Coeuré, Head of the BIS Innovation Hub, and Neha Narula, Director of the MIT Digital Currency Program, discussed the opportunities, challenges, and concerns of digital currencies at the World Economic Forum's "Building a Trustworthy and Trustworthy Digital Currency" panel meeting. This is a discussion about the highest level of stablecoin. The Chairman of the Monetary Authority of Singapore Tharman and the head of the BIS Innovation Hub Benoît are co-chairing the stablecoin working group of the Financial Stability Board. Its task is to provide stablecoin supervision policy recommendations for global regulation. The head of Calibra is essentially the head of Libra. Everyone in the group meeting is the right person to make (digital currency) happen.

- The United States has entered the era of helicopter money, and the era of Bitcoin is coming. Don't miss it.

- Dex Sparkswap, the first Lightning Network, is announced to close, and the team switches to FinTech

- Digital currency talent halves: more deadly than halving assets, halving employees

The panel discussion covered a wide range of topics, including typical use cases for digital currencies, global central bank CBDC survey results showing changes in the development schedule and demand / motivation of CBDC, differences in wholesale / retail CBDC, the relationship between digital currencies and the existing commercial banking system, Digital currency / stable currency / CBDC ecological diversity, the profound influence of digital currency on culture, the relationship between digital currency and financial exclusion, etc.

Group discussion (on)

Sheila: Welcome everyone to join us in this session of the conference, the theme is to create a trusted digital currency. Then in the next 45 minutes, we will discuss the opportunities, challenges and concerns about digital currencies together. Everyone also saw in Davos this week that the conversation mode around stablecoin and digital currency has shifted. We are not saying whether it will be released or whether we will see the opportunity for release, but when and in what form will it be released. So today I have invited a few panelists. On my right hand side are Tharman, Senior Minister from the Monetary Authority of Singapore, Valdis from the European Commission, Benoît from the Bank for International Settlements, Neha from MIT, and David from Facebook. So, can I ask Neha to introduce us the vocabulary related to digital currency. A lot of confusion here. Are we talking about Bitcoin? Or what is it?

Neha: Yes, thank you Sheila. This is certainly a bit confusing due to the craze for cryptocurrencies. I think what has happened is that cryptocurrency motivates us to rethink how we move and deliver value and what we can do with it. We have cryptocurrencies such as Bitcoin and Ethereum, which is actually not what we are going to talk about today. We are talking more about digital currencies.

The idea here is that we are talking about a form of currency, which may be a public currency issued by a central bank or a private currency issued by an institution, which corresponds to the government currency or fiat currency that we generally know. In addition, we have also seen some innovations in the field of cryptocurrency blockchain. People created stablecoins. Some examples are USDT / Tether. The idea behind stable currency is that either someone stores government currency in a bank account and issues digital tokens one-to-one to represent their value, or there are some really interesting complex ideas that are maintained based on collateral and algorithms Stable exchange rate.

Beyond that, we have a wider range of digital assets. These could be a form of digital gold or real estate, stocks, commodities. The idea here is that by packaging these assets in software, we can implement new (asset) storage and transfer methods.

Sheila: Thank you. Can you say a little bit about blockchain technology, because there are many fusions. What do you think is the difference between digital currency and blockchain technology?

Neha: I think we must have been inspired by blockchain and cryptocurrencies, rethinking how to build these things. However, it should be noted that behind the digital currency does not necessarily require a blockchain-like data structure. We can implement digital currency in many different ways. In fact, many people said to me, "Don't we already have digital currency?" You know I pay electronically and transfer electronically. What's different. I think the key here is that we are talking about a different interface. What we are talking about is something that users or companies can hold directly, not necessarily through other institutions such as banks.

Sheila: So good, Tharman, I will turn to the framework you gave us to understand digital currencies. What chance? Why is it so exciting?

Tharman : Before we continue this horse race with all the different plans, you may ask ourselves, what are the real use cases, where will we add value, what gaps are we trying to fill, and what inefficiency we are trying to address.

I think there are three major use cases. The first is cross-border payments, especially for those who do not have large payments. The largest case of non-large payments is the remittance business involving migrant workers. That was a big business. Overall, it is now inefficient, not always reliable, and too expensive. If you pay only $ 100, the fixed fee is not a small sum.

The second is financial inclusion. Here, I think what we see in digital tokens, mobile wallets, etc. is broad digital inclusion. It started with a credit plan. Now you have the opportunity to pay by small businesses, micro businesses, and individual farmers. Everyone can truly participate in the modern economy. This is an example of how FinTech is actually expanding access, reducing costs, and bringing people into the new economy. So I think this could be a big use case, especially for emerging countries. I think this is important.

The third is from a defensive perspective. There is an opportunity to reduce the large amount of illegal financing that is impossible to eliminate. Digital tokens are either part of the solution or part of the problem. Overall, today they are part of the problem. As we all know, a large part of the use of cryptocurrencies is for illegal financing, regardless of the form. However, with good regulation and sufficient visibility and sufficient public policy as part of managing this infrastructure, it (digital currency) can be part of the solution because the cash economy is widely used for corruption and various forms of money laundering.

Therefore, our goal should be to solve the problem of the cash economy, rather than seeking the very simple solutions we see today, which are actually introducing more effective ways of illegally transferring funds. So in summary, cross-border payments make it cheaper, faster, and more reliable; second, financial inclusion, especially for small businesses, small businesses, and the general public; and third, illegal finance.

Sheila: The examples you have just mentioned can indeed play a very important role globally. Well, some people are really poor, and some are invisible poverty. If we say the American population or the European population, we know that there are many invisible poor people. In your opinion, why is Europe so keen on digital currencies now?

Benoît: First of all, I would like to thank you for hosting this discussion on digital currencies today. Digital currencies, especially those with central banks, are not fundamentally technical issues, but related to meeting demand, formulating principles, and making them internationally consistent. Because I'm not excited about whether it uses blockchain technology or which PoW algorithm it uses. They will happen in due time. Basically, this is not a technical discussion. At BIS, we conducted a second survey on the central banks of member states this year. I will talk about the differences between emerging and developed economies in a moment. Minister Tharman just started this discussion.

The survey results were just released today, and some numbers are interesting. 80% of central banks are currently involved in the work of the CBDC, compared with 70% last year and 65% in 2017. The central bank has a particular focus on retail CBDC. We asked them why (working in retail CBDC) and got different answers. Colleagues in emerging markets tell about financial inclusion and reductions in cash use; colleagues in advanced economies tell us that we need to ensure a connection between citizens and central banks when cash use is fading.

There are already different motivations here. Other interesting things are when we ask our member central banks when they will do it? 10% of central banks responded that they may issue general purpose CBDCs, namely retail CBDCs, within 3 years. Although this number is small, it is still twice that of last year (5%). 20% of members said they would promote retail CBDC in the medium term, that is, within 6 years. Last year, all central banks that said they might implement the CBDC were small central banks, and this year the big central banks joined in. About one-fifth of the world's population now belongs to the jurisdiction of the central bank that will issue the CBDC within three years. Give everyone a sense of changes in the timetable and related needs. Emerging economies do focus on financial inclusion and reduced cash use.

As Minister Tharman said, the CBDC is part of a broader discussion about payments, especially cross-border payments, and how to make cross-border payments cheaper and faster.

Sheila: You mentioned a term, and I want to pause for a while, this is retail CBDC. David, maybe you can take us through retail CBDC and wholesale CBDC to explain the difference between them.

David: So in a structure where a central bank issues or will issue digital currency, they can issue digital currency in two possible ways. One is wholesale CBDC, through the existing banking system, and the other is retail CBDB directly to consumers. Earlier in the panel discussion today, the question raised by Minister Tharman, you must focus on solving the real problem. I am a product-focused person.

So I want to see what you want to solve with a solution. If your goal is wholesale distribution to banks (CBDC), what problem are you solving? You may have some efficiency improvements, but banks currently have windows, and the Federal Reserve and the European Central Bank are doing very well. Or, if you choose retail (CBDC), a big question for central banks is whether you are capable and ready to serve consumers or small businesses. What happens to those banks that actually need leverage to make loans and boost economic growth? That said, there are some interesting hybrid models that have been evoked. CBDC enables banks and wallets to use these facilities. These are all very interesting developments and I think it's worth continuing to follow. But I have to say that the current world's attention to digital currencies, whether it is stablecoin, CBDC or other forms of currency, is encouraging.

Because in our case, when we started this journey six months ago, the whole idea was not really about a certain way of doing things, but more about uniting us to try to solve a problem. This problem, you know, is unacceptable: 1.7 billion people currently lack banking services, and 1 billion people lack banking services. We still lack a global network to transfer digital currencies. In the field of telecommunications, we have evolved from a one-dollar international call fee to a value-free communication application using only a very cheap Android device at no cost. But the currency situation is different. It hasn't changed. Some networks are 50 years old, and the Internet is 30 years old. We still lack a simple, cheap and efficient way for people to use and transfer digital currencies. So I am personally very excited about our conversation today. Everyone at today's group meeting is the right person to make it happen (digital currency). So I hope it happens.

Sheila: Well, this is built on that, and I would love to hear your point. What do you think is a modification of the existing banking system? Is this a threat to commercial banks? What impact?

Valdis: First of all, when we look at this from an EU perspective, how do we deal with the development of crypto assets, stablecoins or other initiatives? First, we need to see what shortcomings these initiatives are addressing. From this perspective, in a sense, if you focus on crypto assets or cryptocurrencies like Bitcoin and other cryptocurrencies, there will be a very different situation. They are not widely used for value storage and transactions, they are very unstable. In fact, the European Commission has called on European regulators to warn investors about the highly speculative nature of these investments. At the same time, there are still some unresolved needs, including fast, convenient and cheap cross-border payments. In Europe we are partially addressing this issue. We have a Euro payment area. You can make Euro transfers in the Euro zone at the same cost as you do in-country Euro transfers.

Last month, we expanded the system to countries outside the European Union or the Eurozone. We can do Euro transfers at the same cost, but still not fast enough. Therefore, currently in Europe we are focusing on developing a pan-European instant payment system. That's why initiatives like libra have emerged because, in a sense, they seem to provide the same solution internationally. So we have to see what's here. Obviously, this is the European banking system. Because if we talk about instant payments, other initiatives are driven by and closely linked to the European banking system. If they don't address the need themselves, others will address it. It's Libra or some other initiative, and time will tell us. So it also shows that the European banking system needs to meet these faster and cheaper payment needs. This is not the point here.

Well, if we study the stablecoin initiative, especially like the global stablecoin initiative, of course, some problems will arise. Some people have mentioned a series of issues that need to be resolved, such as anti-money laundering, tax evasion, consumer protection, and personal data protection. So what we did recently in the EU, we did what we call regulatory mapping for different crypto assets, including stablecoins, to find their place in the current EU legal system. Do we need some new regulations? Basically, the conclusion is yes. Especially for crypto assets like stablecoins, new regulations may be needed. We will prepare them in the context of the next FinTech action plan (new regulations). But I want to say that, in a sense, we don't want to regulate financial innovation outside Europe. We hope to regulate European financial innovation while addressing potential risks.

(To be continued)

Dr. Long Baitao's new book " Digital Currency: Inheritance and Innovation from the Slate Economy to the Digital Economy " on the central bank's digital currency, the principle and classification of stable currency, the impact on financial stability and public policy, etc. Issues such as opinions and regulatory trends have been discussed in depth. In addition, the book discusses the following controversial topics:

Money originates from national needs, not barter

Commercial banks create most currencies through loans, not central bank issues

Libra does not challenge dollar hegemony, but supports dollar hegemony

Standard token economy is similar to a money disk or Ponzi scheme

Recommended by Zhu Jiaming, director of the Academic and Technical Committee of the Digital Asset Research Institute, Yi Xiqun, former chairman of Beijing Holdings Group Co., Ltd., and Wang Wei, chairman of the China Financial Museum!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Steemit civil war continues, or forks out of new chain Hive

- Data show that recent bitcoin selling has been driven by short-term holders, and BitMEX has become a major slaughterhouse

- Free and easy week review | 6 years of sword grinding, past and present of Ethereum PoS magic

- Blockchain startup Fluree announces completion of new round of financing and announces strategic cooperation with the U.S. Air Force

- Babbitt Column | 3 Thinking Differences to Help You Better Understand Blockchain Investment

- Witness history! Bitcoin plunges sentient beings: mining circle under pressure, exchange shuffled

- "Draining Promotion" Secret of the Coin Circle Revealed: Frequently changing Douban, Post Bar, etc. of the blockchain projects recommended in the group are the main positions