What is the current status of the transition from classical DeFi projects to RWA MakerDAO?

What is the current state of transitioning from classical DeFi to RWA via MakerDAO?Maker is shifting from a classical DeFi protocol to the RWA (Real World Assets) direction. After raising the DSR (DAI deposit rate) to 3.49%, ordinary users can finally earn returns from US Treasury bonds through top DeFi protocols.

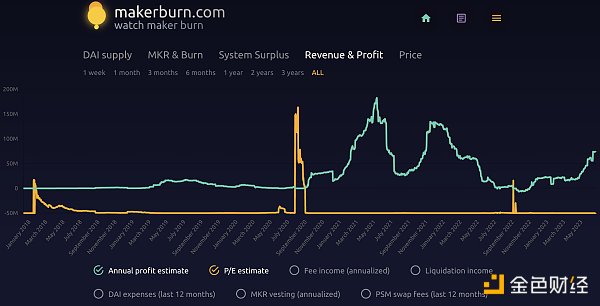

Recently, MakerDAO has shown excellent performance in various data. According to data from makerburn.com, as of June 29th, Maker’s expected annual profit is estimated to be $73.67 million, the highest in over a year. The current P/E ratio is 8.43, also a historical low, showing strong competitiveness among DeFi projects.

Various Data in Maker

As shown in the figure below, MakerDAO’s expected net profit for one year is $73.67 million. Based on current data, Maker’s stable fee (including RWA) income is expected to be $118 million per year, MKR expenditure is equivalent to $4.26 million, DSR expenditure is expected to be $6.58 million, liquidation expenditure in the past year is $0.93 million, PSM transaction fee income is $0.15 million, and DAI expenditure is $33.13 million.

- Introducing the Bitcoin Script Project: Grasping the Pulse of Bitcoin Development Amidst the Noise

- How to Choose the Financing Method and Legal Documents for Web3.0 Blockchain Project Financing?

- What is the development direction of the new NFT project with the Azuki crash and BAYC debut?

The expected income generated by RWA and crypto collateral lending in Maker is increasing. On the one hand, Maker’s investment in RWA has been increasing over the past year. With short-term US Treasury yields exceeding 5%, Maker will use more than $2 billion in stablecoin reserves to purchase US Treasuries or hold them in other ways that generate returns (Coinbase Custody and GUSD PSM).

On the other hand, the rise in US Treasury yields has also prompted Maker to raise the minimum interest rates for DSR and crypto asset collateral lending such as ETH and stETH from 1% to 3.49% on June 19, so the expected income from borrowing DAI through crypto assets with excess collateral in Maker has also increased recently.

In addition, as Maker’s endgame plan progresses, a series of measures to reduce costs and increase efficiency are being implemented. As of June 29th, only $1.9 million in DAI has been spent this month, while the average monthly expenditure from March to May this year was about $5 million. Since the DAI expenditure part refers to the actual expenditure in the past year, this data has not yet been reflected in the increase in profits.

Changes in the Status of Stablecoin Issuers, such as Maker and Circle

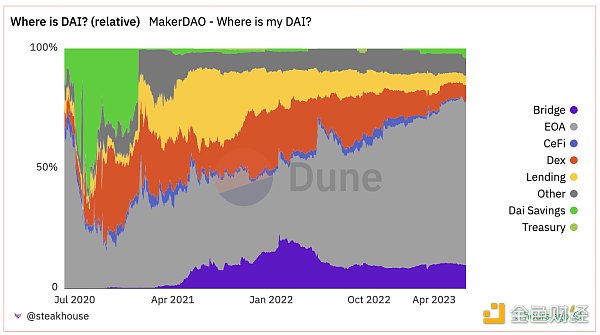

One year ago, 51.7% of the DAI issued came from USDC in the PSM, and as a result, Maker was criticized for taking on the centralization risk of USDC while failing to capture the value of this portion. The issuer of stablecoin USDC used the dollar reserves used to issue stablecoins to purchase US Treasuries to generate revenue. With Maker’s progress in RWA, this situation has changed and only 8.8% of DAI collateral is from USDC in the PSM.

According to makerburn’s RWA page, the DAI minted by RWA collateral has reached 1.42 billion, generating approximately $53.11 million in revenue per year. In addition, according to RWA 014, 500 million USDC stored in Coinbase Custody generates approximately $13 million in revenue per year, while the 500 million GUSD in the PSM generates approximately $10 million in revenue per year.

Currently, the stablecoins in the PSM that have not been utilized include 500 million USDP and 414 million USDC. The USDP and GUSD in the PSM have reached their maximum limit of 500 million. The holdings of Maker PSM account for 50.5% and 88.5% of the total issuance of these two stablecoins, respectively.

Due to concerns about centralization and security issues, Maker plans to reduce the upper limits of USDP and GUSD in the PSM. USDP will be used in RWA 015, and the upper limit of GUSD in the PSM may be reduced to $110 million.

In Maker’s investment in RWA, stablecoins such as USDC in the PSM will be redeemed for dollars first, and then used to purchase US Treasuries. This process also accelerated the reduction of USDC issuance over the past year. Since Maker PSM is already the primary holder of USDP and GUSD, reducing or even discontinuing these two stablecoins would have a greater impact on their issuers.

During the period when the short-term Treasury yield exceeded 5%, Maker raised the DSR to 3.49%. Holders of stablecoins such as USDC can exchange them for DAI at a 1:1 ratio through PSM, and Maker can redeem these stablecoins for dollars to purchase US Treasuries to obtain higher returns, which may result in a win-win situation.

Adjustment of repurchase and destruction rules

Recently, Maker’s governance token MKR has potential adjustments to its repurchase and destruction rules in addition to its business growth.

In the MakerDAO system, MKR serves as a tool to maintain system stability in addition to governance rights. When the system’s debt exceeds its surplus, new MKR must be sold to make up for the debt; when the surplus funds of the Maker protocol exceed a certain upper limit, the excess is used to repurchase and destroy MKR.

There is a “surplus buffer” set in Maker where the protocol’s profits (income from stability fees and liquidation penalties minus all expenditures in DAI) are stored as reserves. According to the current rules, the repurchase and destruction of MKR will only be initiated when the funds in the surplus buffer reach 250 million DAI. The current surplus in the protocol is 70.5 million USD, and approximately 180 million USD in profits are needed to start the next repurchase and destruction process.

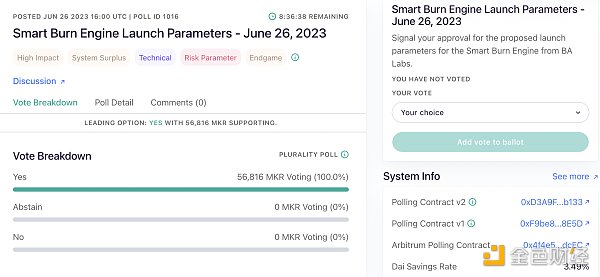

On June 26, a survey vote was conducted on the Maker forum in the name of “Smart Burn Engine (SBE) launch parameters” to change the current repurchase and destruction rules. The new governance plan will set the upper limit of the surplus buffer to 50 million DAI. When this limit is exceeded, the Smart Burn Engine will automatically use DAI to buy MKR in the DAI/MKR trading pair on Uniswap V2 and provide liquidity by creating a trading pair of MKR and DAI on Uniswap V2, with LP tokens transferred to the address owned by the protocol.

As of June 30, the survey has ended with a 100% approval rate. If this proposal is passed and implemented in subsequent execution voting, the excess will be used to purchase MKR directly as the current surplus has already exceeded the new upper limit.

Limitations and Opportunities for Maker’s Development

Maker’s investment in RWA has consumed a large amount of funds in the PSM, leaving few stablecoins in the PSM. This may also be one of the reasons why Maker has significantly increased the DSR, hoping to attract more funds with higher interest rates. However, the increase in DSR may also reduce Maker’s competitiveness in encrypted collateral lending rates and limit Maker’s future development.

1. Continuous Decrease in DAI Supply

According to data from Glassnode, the supply of DAI has been decreasing for more than a year, dropping from 10.3 billion in February 2022 to the current 4.68 billion, a decrease of 54.6%. The size of DAI determines the upper limit of the Maker protocol. DAI minted through over-collateralization provides continuous stable fee income to Maker, and most of the reserve in DAI minted through PSM has also been used to purchase national debts to generate income. The decrease in DAI supply has a negative impact on Maker.

2. Increase in DSR Deposits

In addition to minting stablecoins, Maker also shares part of the protocol’s income with stablecoin holders through the DSR contract, which is part of Maker’s spending. After the interest rate of DSR increased from 1% to 3.49%, the deposits in DSR increased from 106 million DAI to the current 188 million DAI, which also led to an increase in Maker’s spending in this part.

According to data from Dune@steakhouse, 67.9% of DAI is held by external addresses. Etherscan data shows that the address with the most DAI holdings is the PulseX:Sacrifice address controlled by the Pulsechain team. If these DAI holders increase their deposits in DSR, it will increase Maker’s spending.

3. Decrease and Potential Growth of Stablecoin Reserves

As mentioned earlier, the proportion of DAI minted through USDC via PSM has decreased from 51.7% to 8.8%, and the remaining part must also ensure sufficient liquidity for normal redemption of DAI. At the same time, the amount of funds available for investment in RWA has decreased significantly, and the amount of USDP and GUSD in PSM will also decrease significantly in the near future.

With the increase in DSR, Maker’s competitiveness in on-chain stablecoin deposits has increased, which may also attract new users to mint DAI through PSM with USDC to obtain higher returns. The deposit interest rate of DAI on Aave is 2.6%, that of USDC is 2.83%, and that of USDT is 2.69%, all lower than the DSR interest rate of Maker. If the funds minted through PSM using USDC to mint DAI increase, Maker’s funds for purchasing US national debts will also increase, which will increase the protocol’s income, forming a win-win situation.

4. Opportunities brought by liquidity collateral

Although the issuance of DAI is decreasing, DAI minted with some collateral is still increasing, such as wstETH. In the past 3 months, the DAI minted by the wstETH-B Vault has increased from 90.87 million to 261 million; the DAI minted by the wstETH-A Vault has increased from 181 million to 201 million. During the same period, the DAI minted by the ETH-C Vault decreased from 295 million to 290 million, but there was no significant decrease. This indicates that the newly added collateral in the wstETH Vault does not come from the funds in the original ETH Vault, and there is indeed new funding entering.

5. The impact of SubDAOs such as SBlockingrk

The first SubDAO of MakerDAO, SBlockingrk, has been launched. According to DeFiLlama data, the current TVL of SBlockingrk is 15.04 million US dollars and is growing. Due to the special composability brought by SBlockingrk, DAI deposited in DSR can also be used as collateral, further improving the utilization rate of funds.

Summary

Maker is moving from a classical DeFi project to RWA. The recent adjustments to the interest rates of DSR and encrypted collateral loans such as ETH and stETH will further enhance Maker’s competitiveness in RWA and weaken its competitiveness in encrypted collateral loans.

In the process of business transformation, stablecoin issuers such as Circle are facing significant competition and may have to consider allocating more profits to stablecoin holders. For USDP and GUSD, Maker PSM holds more than 50% of the shares of these two stablecoins. The adjustment of the PSM upper limit for these two stablecoins will cause heavy losses to their issuers.

Since there is not much funds available for RWA, this may also be an important reason for Maker’s recent increase in DSR. If more funds can be attracted through this, the investment amount in RWA may continue to grow in the future.

The MakerDAO forum is voting on proposals to change the repurchase and destruction rules. The current surplus has exceeded the upper limit of the new rules. If the new rules begin to be implemented, repurchases will begin, which will be a positive for MKR.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- dYdX Chain’s public testnet will officially launch at 01:00 (Beijing time) on July 6th.

- Further observation on the staking track: What other potential projects are there besides EigenLayer?

- Understanding the five core principles and unique features of ZKStack

- Comprehensive Interpretation of the StarkNet Ecosystem: Which Projects are Worth Paying Attention to

- Proto-Danksharding may become the biggest narrative of the year, which projects will benefit?

- 5 noteworthy zkSync ecosystem projects inventory

- Long Push: In-depth Analysis of Pendle, the LSD Genius Project that Grew 10x in Six Months