Zhu Min Dialogue Greenspan: National currency and central bank authority do not need "digital currency" to implement

Source: Financial Network

On November 12th, a brilliant dialogue was staged at the "Financial Economics Annual Conference 2020: Forecast and Strategy" with the theme of "Unchanging and Unchanging Times ".

Alan GREENSPAN, former chairman of the Federal Reserve Board, and Zhu Min, former president of the National Finance Institute of Tsinghua University and former vice president of the International Monetary Fund, have squeezed investment investment from the aging of the population and social welfare expenditures. Entering the recession, Sino-US trade frictions, and talking about hot topics such as digital currency and central bank independence.

- In 19 days, 44 policies are favorable, and the blockchain industry is accelerating into the fast lane.

- Oasis Network, the blockchain privacy computing platform, officially launched its first public beta network

- The application of transaction cost theory in the blockchain industry

I. The root cause of global investment shrinkage: population aging, welfare spending squeezes savings space

Greenspan pointed out that the biggest feature of the 21st century is the aging of the population, which is why the investment in the United States and even the world is shrinking.

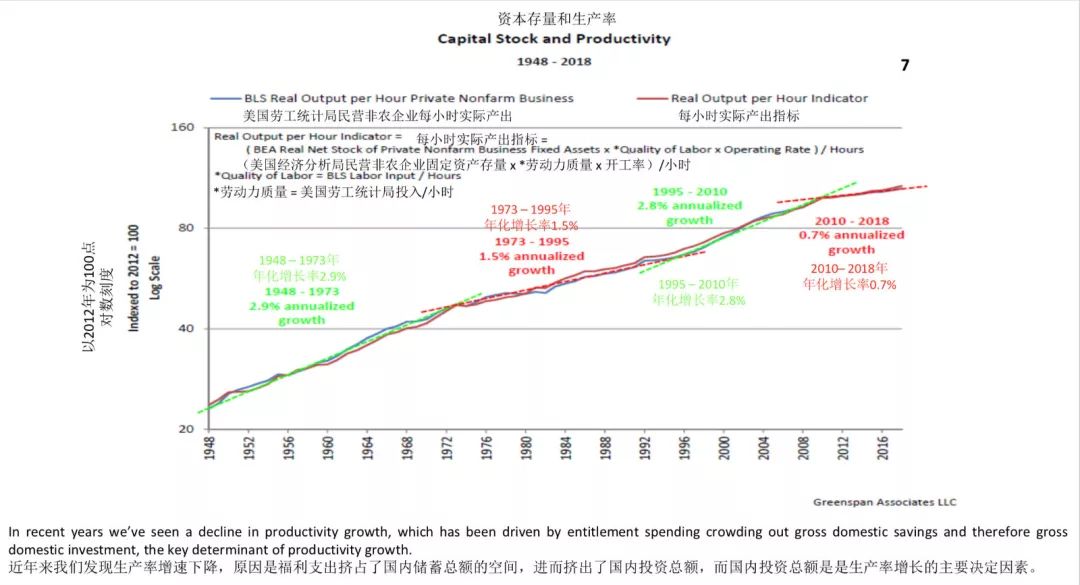

Because of the aging population, the United States, the United Kingdom and other social welfare expenditures have increased significantly. The welfare expenditures have occupied the space of total domestic savings, which in turn has squeezed out the total domestic investment, which is the main decisive factor for productivity growth.

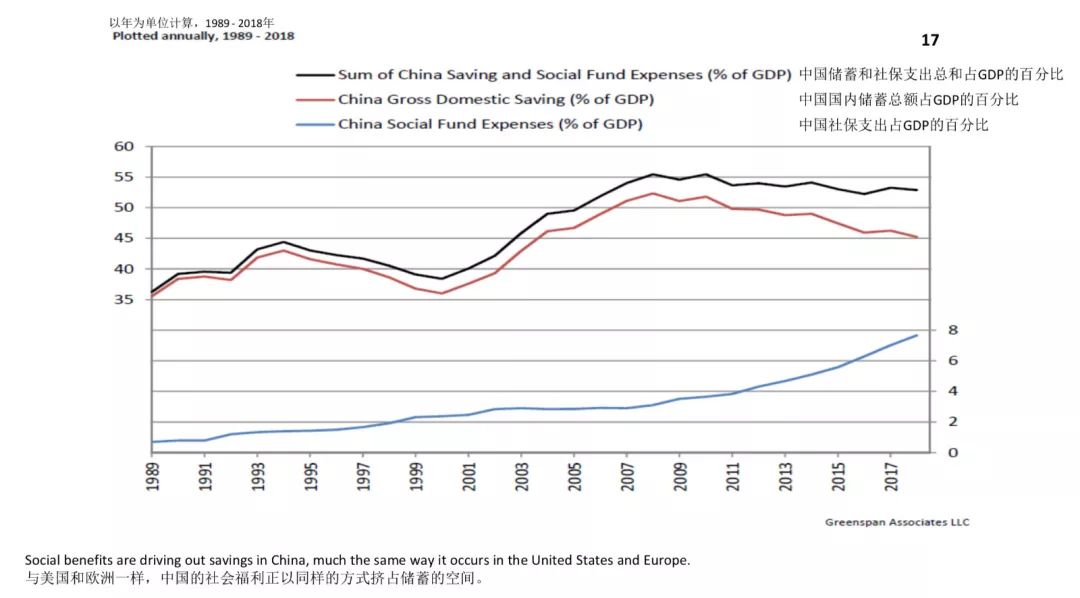

When talking about China, Greenspan said that in the past five years, China has always ranked first in terms of per capita output growth of the world's major economies. China's savings and investment account for a much higher proportion of GDP than the United States. This is also an important reason for China's actual per capita GDP and living standards to rise sharply. But China's social welfare spending is squeezing the space for total savings in the same way as the US and the UK.

In Greenspan's view, population aging is an irreversible development trend, but to prevent investment slowdown and productivity growth slow down, only try to prevent social welfare from squeezing domestic savings.

Greenspan said that Sweden has realized this problem. Because social welfare is too high, so many problems have arisen. For example, the inflation rate has increased to 500%, the system almost collapsed, and later they changed, adopting the pension DC instead of the DB system, that is, the fixed expenditure instead of the original fixed income.

Sweden seems to have solved this problem, but the Swedish experience is not feasible for other countries. “The rest of the country is unlikely to return to the past, because we will have more and more elderly people, they will have more and more people, and social welfare spending will increase. I also want to ask this question. For many years, I didn't get a simple answer, because no matter what the answer is, it won't be a simple answer. But no matter what you do, every country, especially all developing countries, must solve this problem and overcome it. This difficulty. If social welfare is not so high, the growth of the world will be much higher than today," Greenspan pointed out.

Second, the global economy is stagnant, but the recession has not yet begun

Since the second half of this year, economic growth has continued to slow down in many countries around the world, and negative interest rates on government bonds have been issued. A discussion about the global recession is hotly debated around the world. In Greenspan's view, there is no doubt that the economy has weakened, but it is too early to say that the recession is now.

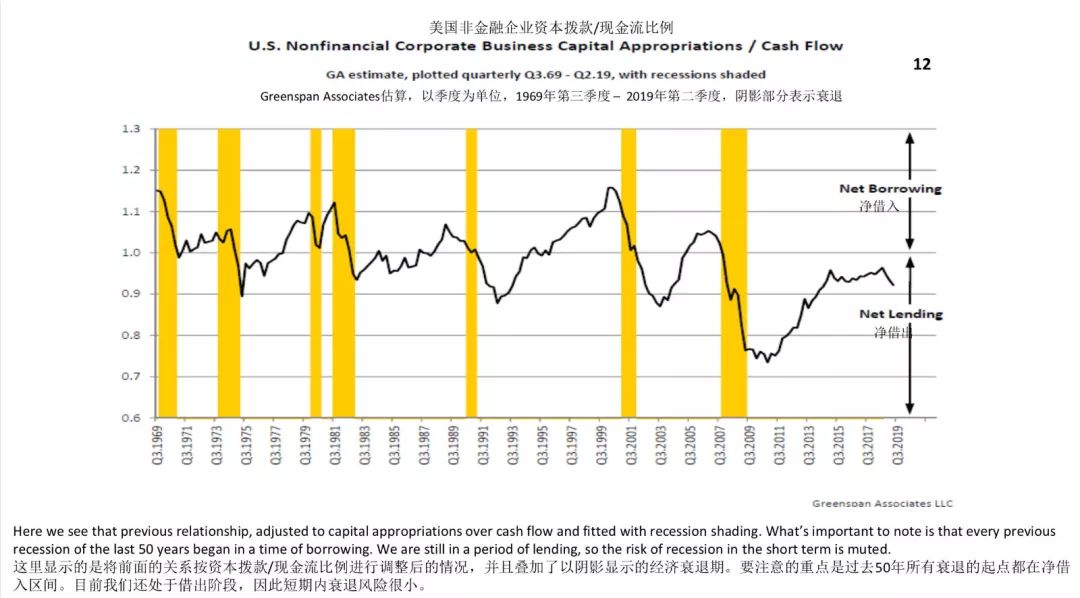

“The difference in industrial output per week is decreasing, and the number of industrial products is also shrinking, but it is not yet called the beginning of a recession.” Greenspan said that in the past 50 years, all recessions The starting point is in the net borrowing range, but at present we (the US) are still in the lending stage, so the risk of a short-term recession is very small.

On a global scale, the world is likely to enter the pressure of inflation, not the pressure of deflation. "This is very likely to happen. I can't call it a so-called "recession," but from a global perspective, it is indeed a stagnation."

Third, there is no real winner in trade friction, and measures should be taken to avoid double losses.

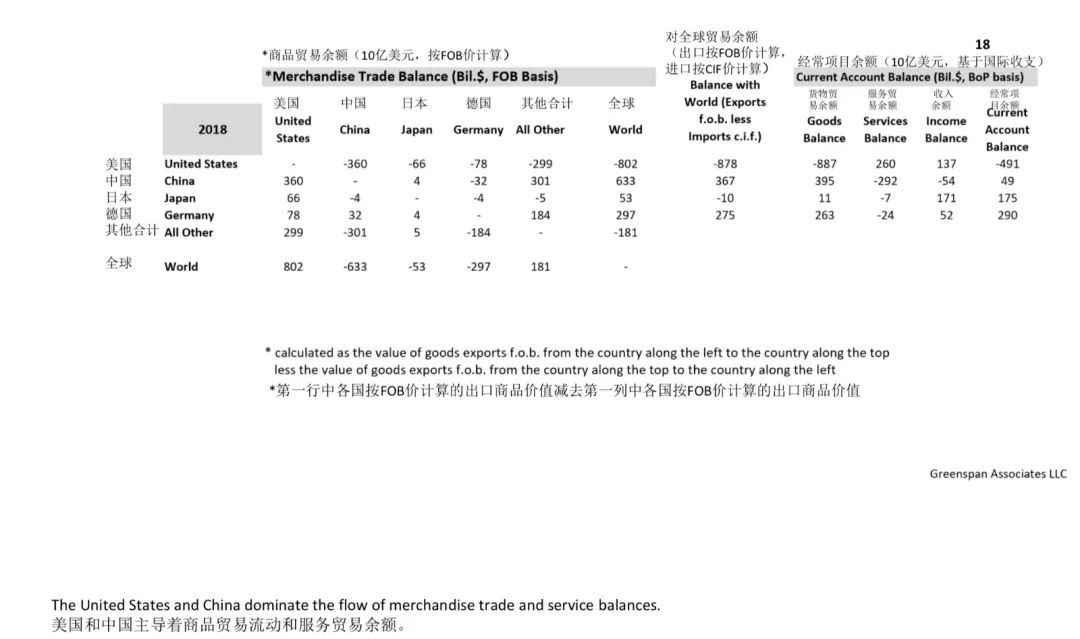

Greenspan believes that today, the United States and China dominate the global merchandise trade flow and service trade balance. In the current tariff campaign, there is no such thing as a winner or loser. "Our war of tariffs, the war of trade, the so-called winners, there will be taxes on their own producers, so it will eventually return to a basic point, that is, increase tariffs. This tariff itself will return to its own country. People."

The United States has exceeded China’s tariff revenue on the total amount of tariff revenue today. He said that tariff revenues are equal to taxing businesses and residents. It is sad that current policy makers do not understand these basic economic laws, so trade wars may continue to be maintained.

He called for "the so-called winner of the war of tariffs is actually the loser. It is just a matter of losing more and losing less. There is no real winner in the war of tariffs. We hope that there will be more reasonable actions or measures to get such a so-called as soon as possible. The war of trade or taxation ceased.

“Today, the US steel, aluminum and coal manufacturing industries are moving towards low-cost countries, and the booming software, medical services and robotics industries are replaced. In this case, the Trump-style tariff policy is once Implementation will only push up the price level and lower the standard of living of the people," Greenspan said.

Fourth, the central bank issuing sovereign digital currency is a political issue, and digital currency may pose challenges for the central bank’s forecasting function.

For the much-watched digital currency and its impact on the central bank, Greenspan believes that the central bank's main function is to predict future economic development trends based on market changes and currency liquidity. If the central bank has sufficient predictive power, then it can support monetary development.

Regarding whether central banks should consider issuing digital currencies, Greenspan said that only central banks in various countries can issue currency, and other organizations are not. However, the issuance of sovereign digital currency by the central bank is not a topic in the economic field, but more a topic in the political arena.

Zhu Min explained that the authority of the sovereign state's currency and central bank is legally formulated and does not need to be implemented through digital currency, and the digital currency will cause the central bank to plague the existing cash-money system.

5. The Fed’s independence is short-term, and the Fed’s chairman has become accustomed to “back-up”.

Recently, the call for strengthening the independence of the central bank in the United States is growing. Greenspan believes that in the short term, it is "premature" to worry that the Fed's independence will be eroded. "But politicians will definitely throw this pot to the Fed, except that they don't retort the pot, others throw the pot over. As the chairman of the Fed, we have long adapted to this kind of thing, and have long been used to it. Unless American politics The system has undergone major changes, otherwise I am not worried about the operation of the money supply, and it will continue to be stable."

The following is a dialogue record:

Zhu Min: Thanks to Dai Xiaojing for his introduction, and I am very grateful for the invitation of the meeting. I have the opportunity to return to this platform once again to communicate and communicate with you. Today is a dialogue with the former chairman of the Federal Reserve. Hello, Allen, can you hear it?

Alan Greenspan: I can definitely hear it.

Zhu Min: I am very happy to see you again. We are very honored to be able to invite Mr. Greenspan to connect with us today. He is the former chairman of the Federal Reserve. He is across six American presidents. We all know that he used to be the most Powerful people, but you may not know that he is the world's top economist and a very top statistician. He likes data, likes to observe data, analyze data, find patterns from data, and analyze it. The whole world.

When I was in Washington, I often visited him, listened to his wisdom, and went there to eat rice. Thank you, Allen. Thank you for letting me talk to me for so many years. Next time I go to Washington, I will Go visit you and go find your risotto.

Alan Greenspan: I can squat twice every time I come, and I am very happy to see you again.

I will explain to you today how the US economy is changing and how the world has undergone similar changes.

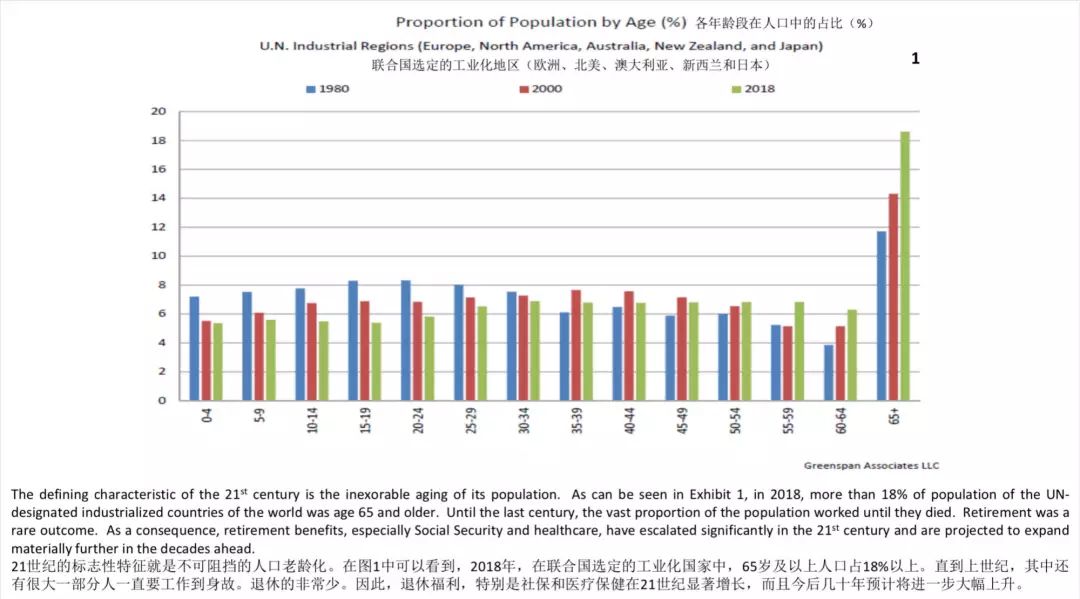

The greatest feature of the 21st century is the aging of the population. As you can see in Figure 1, in 2018, among the industrialized countries selected by the United Nations, the population aged 65 and over accounted for more than 18%. Until the last century, a large part of them had to work until death, and there were very few people who could retire. Therefore, the benefits of retirement, especially the social security of the United States and the medical insurance of the United States, have grown significantly in the 21st century and are expected to increase further in the coming decades.

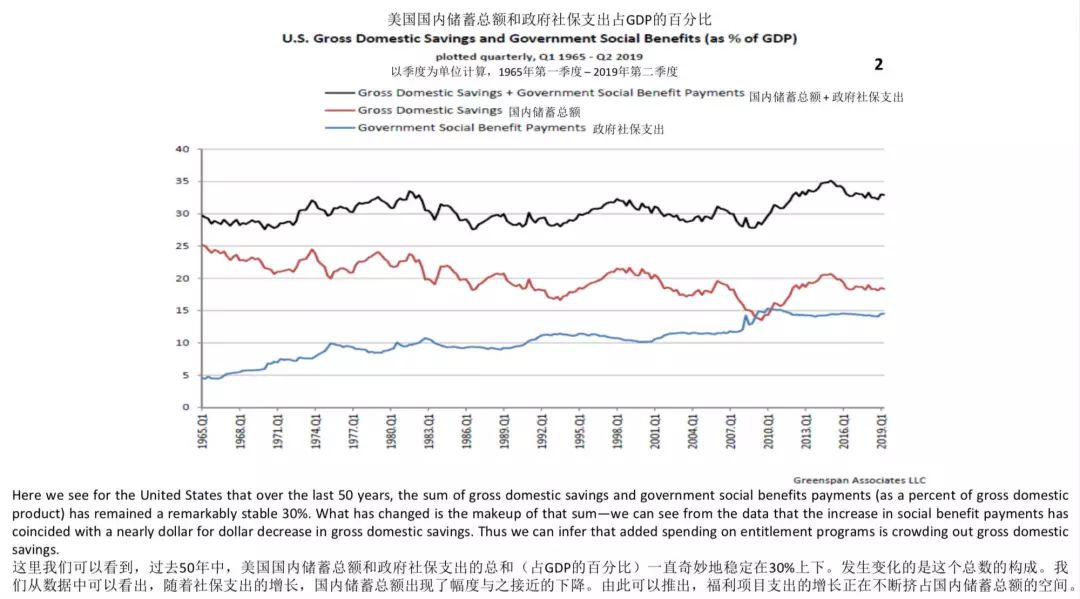

In Figure 2, we can see that in the past 50 years, the total amount of domestic savings and government social security expenditure in the United States as a percentage of GDP has been very wonderfully stable at around 30%. What happened is the composition of this total. From this data, it can be seen that with the increase in social security expenditures, the total amount of domestic savings has declined to a similar extent, so it can be introduced that the growth of welfare project expenditures is constantly squeezing the space of total domestic savings.

Figure 3, look at the situation in the UK. Although there are not enough data samples in this regard, it can be seen that its data structure changes are similar to those in the United States.

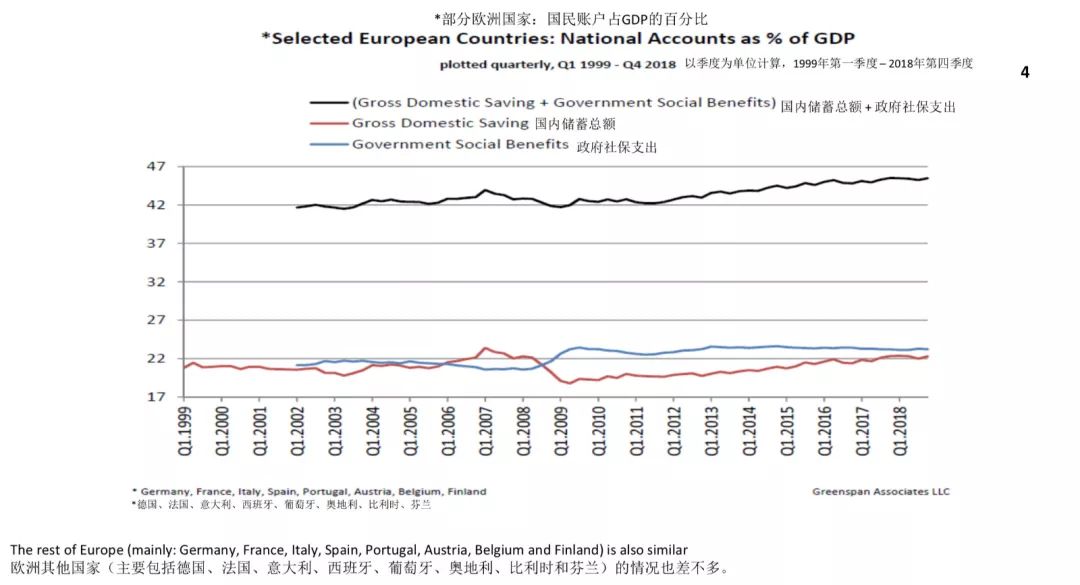

In Figure 4, I have also put data from other European countries, mainly Germany, France, Italy, Spain, Portugal, Austria, Belgium, and Finland. The overall situation of the two countries is similar to that of the United States and the United Kingdom.

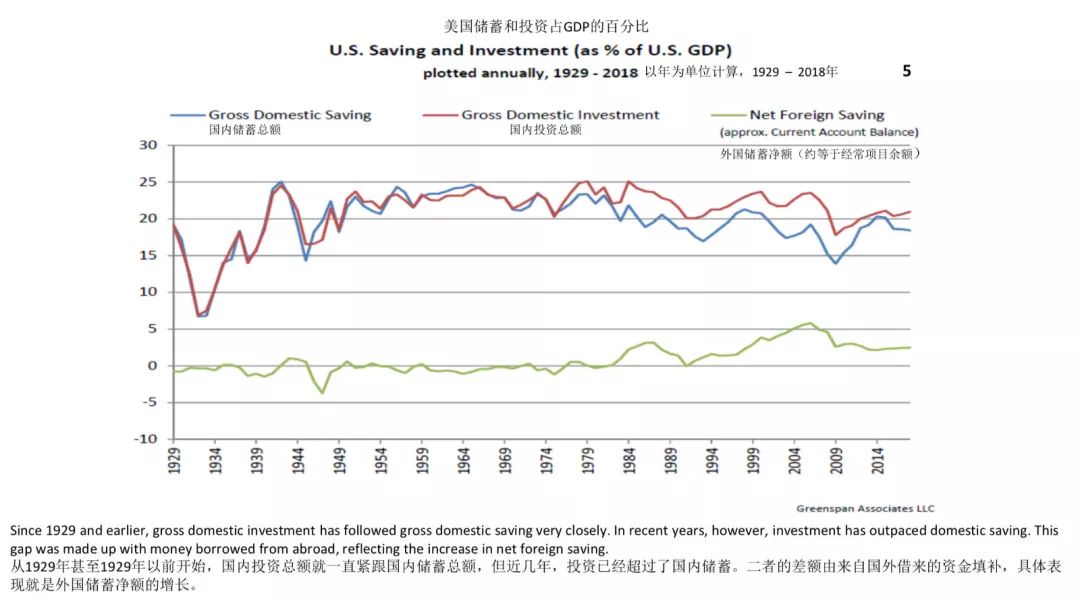

In Figure 5, starting from 1929 and even before 1929, the total amount of domestic investment in the United States has been closely followed by the total amount of domestic savings. However, in recent years, investment has exceeded domestic savings. The difference between the two is filled by funds borrowed from abroad. The specific performance is the increase in net foreign savings.

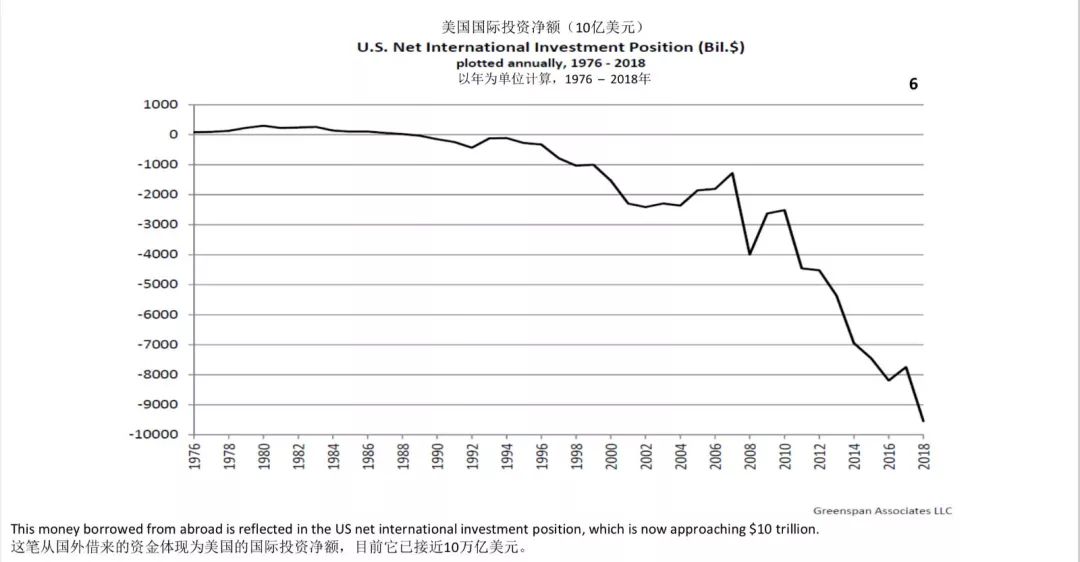

In Figure 6, we can see that the funds borrowed from abroad are reflected in the net international investment of the United States. It is now close to 10 trillion US dollars. 15 years ago, even earlier, it was very stable. The biggest change has taken place in the near future. In recent years, we have found that the growth rate of productivity has declined, because the expenditure of welfare has squeezed the space of total domestic savings, and thus squeezed out the total amount of domestic investment. Total domestic investment is the main determinant of productivity growth.

Figure VII shows the growth rate of per capita output of the major economies in the world over the past five years. The performance of the United States is better than that of many other developed economies. However, China has been at the top of the list for the past five years.

Figure 8. The actual per capita GDP of the United States and other major countries and regions is lower in China, but it should be noted that Ireland’s per capita GDP has been raised by some people because of the taxation considerations of multinational corporations and their headquarters in Europe. Based in Ireland.

At the same time, I would like to point out that it is the second part of this table. Look at the actual per capita GDP of the United States and other major countries and regions. For the United States and China, you will find that the sum of GDP between China and the United States accounts for 40% of global GDP.

Figure IX, which represents the US federal budget deficit, the federal budget deficit tends to increase the supply of unit money, as depicted in this picture, which ultimately leads to an increase in inflation. The table above is the statistical analysis regression result of the graph below. The capital grants lead the capital expenditure for 6 months, which means that the average time for the company to use the funds is 6 months. This is also the case in the regression analysis, and the adjusted value of R2 is the highest. The dependent variable in the regression analysis is the ratio of fixed assets investment and cash flow of the enterprise, that is, the management team chooses to convert a large part of the liquid cash assets into non-current fixed long-term capital. We found that the difference in US 5-year Treasury bonds and 30-year Treasury yields, as well as the US federal government's total savings as a percentage of GDP, is clearly the leading strain for two quarters.

The twelfth table, which embodies a strain and superimposes the recession period. In the past 50 years, the starting point of all recessions is in the net borrowing range. At present, we are still in the lending stage, so the risk of recession in the short term It is very small. The difference in industrial output per week is decreasing, and the number of industrial products is also shrinking, but it cannot be called the beginning of a recession. There is no doubt that the economy has weakened, including some changes in the industrial sector, and similar situations have occurred in many parts of the world. One question to answer here is that from here to there, there will be changes from now to the future, and I will talk to you at the time of questioning.

Next continue to look at our data analysis.

This is a different approach to analysis that looks at the different changes in the global economy.

The thirteenth table, this is from the perspective of Europe, in fact, the situation in Europe is now more complicated, very obvious. The situation in Europe that is most worrying to me is very specific, that is, the payment balance of the entire TARGET2 system in Europe (the clearing system between European central banks). This is the data of the clearing bank of the central bank of the euro zone. Most of the difference, including the difference in the balance of Deutsche Bank, I think other European countries can see a very significant differentiation. The Bundesbank’s balance is much higher than other countries. The European Central Bank itself is in a state of net borrowing, coupled with the role of trade, Germany provides a large amount of funds for a large part of Europe, coupled with the trade situation, it is likely that Germany is the most important fund in Europe's entire financial system. By. The same is true for Luxembourg, and it also includes other branches that have provided funding for it, especially since Germany has played such a role as a funder, especially for Southern Europe, but I don't know how long such a role lasts.

It can be seen that in this regard, and taking into account the situation of imports and exports, in Europe, especially in southern Europe, I still doubt how long such a loan relationship can last.

Let’s take a look at the fourteen charts and analyze the relationship between the commodities in the euro zone’s merchandise trade. This shows the trade gap between Northern Europe and Southern Europe. The Nordic region remains the economic driver of Europe, and the trade surplus with southern Europe is very large, especially in Germany.

The fifteenth chart shows that the actual per capita income of the United States in 1960 was similar to China's current level. At that time, the United States mainly produced steel, aluminum and coal, which is very similar to the current situation in China. Creative destruction has caused these industries to shift to low-wage countries such as China. These industries are now being phased out in the United States, replaced by booming software, medical services and robotics. This is natural for rich countries. Today, Trump-style tariff policies, once implemented, will only increase prices and lower prices. National standard of living.

In the sixteenth chart, China’s savings and investment account for a much higher proportion of GDP than the United States. This is one of the many reasons why China’s real per capita GDP and living standards have risen sharply.

The seventeenth chart shows social welfare, China's savings and social security expenditures, and the ratio of GDP. China's social welfare is occupying the space of savings in the same way as the United States and the United Kingdom. I found such a process. It is staged in most countries around the world.

The eighteenth chart, which is the two most important countries, the United States and China, dominates the trade in goods and the balance of trade in services.

In the nineteenth chart, the tariff income of the United States has gradually surpassed China since March 2009. Let us look at what the so-called trade war is. This table can explain the problem, that is, the income of the United States mainly comes from tariffs. This is the income from the US tariffs starting in March 2008. The trade war has been mentioned in 2018, which is a demonstration of some data in the United States.

Another point we gradually discovered that tariffs themselves are a kind of tax. In the battle of tariffs, there is no such thing as a winner or a loser. Our war of tariffs and the war of trade, the so-called winners will also be in their own producers. There are taxes, so it will eventually return to a basic point, it will increase tariffs, and the tariff itself will return to the people and the right people in their own country.

There are similar reports in the media, and now everyone calls it the war of tariffs. I want to say that in the war of tariffs, there will be a reaction in the end. The reaction will appear in the producers of their own country. He will pay more for the cost of taxation. These data indicate the so-called win of the tariff war. Fang, in fact, is also the loser, but the problem of losing more and losing less. China and the United States, according to such predictions, will lose both sides in this war. Therefore, we believe that there is no real winner in the war of tariffs.

Considering the system of global trade, many people will pay close attention to it. In this part, I will leave more time to talk about it. We hope that there will be more reasonable actions or measures to stop such a so-called trade war or tax war as soon as possible. I am really worried because I have a lot of friends in China, and I know a lot of people in my work. They all think that this kind of action is very unnecessary. This kind of tariff war is really a losing situation.

When I came to China last time in October 2005, when the Fed chairman visited China, Premier Zhu Rongji and his wife hosted a small dinner at the Diaoyutai State Guesthouse where Chinese leaders hosted politicians. At the tea party before dinner, I and Premier Zhu. I have the opportunity to talk, and the way he talks gives me some doubts about whether he really retired at the time, even though the media have insisted that he has retired because he knows very well about the key issues between our two countries. Insight, this insight and deep insights continue throughout our 11 years of friendship.

When we discussed the perception of China's exchange rate and US trade imbalances, I was amazed at his detailed understanding of China's economic weaknesses and the remedies needed. In addition, I am also very impressed by his level of sophistication of such issues, which is one of the best among world leaders. Over the years, we have discussed many issues, such as the best form of bank supervision, the need for the development of the Chinese stock market, which was just started, and so on. During those years, I became more and more appreciative of Premier Zhu, so I was very upset. Yes, we may not see each other again in the future, and we have not seen each other until today. When he served as deputy prime minister and bank governor, we became friends. I have been paying close attention to his career. He is a great economic reformer and Deng Xiaoping’s thought heir. It is Deng Xiaoping who brought China from the bicycle era. In the era of the car, and the series of changes that followed. Premier Zhu is a technical official. According to my judgment, his influence is strongly supported by President Jiang Zemin. Chairman Jiang served as the Chinese president from 1993 to 2003 and served as the party leader from 1989 to 2002. It was Premier Zhu’s realization of many large-scale institutional reforms initiated by Deng Xiaoping. Deng Xiaoping is both a Marxist and a pragmatist. He promoted China's transformation from a closed centrally planned agricultural economy to a powerful role in the economic arena. China began its reform and opening up in 1978, when the government relaxed for a long time due to severe drought. Strict management of farmers' individual land. According to the new regulations, farmers can retain most of their agricultural products from the camp, and the result is a sharp increase in agricultural output. Encourage the government to further deregulate and develop agricultural products markets. After decades of economic stagnation, agricultural productivity has flourished.

The success of the agricultural market economy has encouraged the expansion of reform and opening up to the industrial sector. The same moderate relaxation constraints have led to greater than expected growth, supporting the view of reformers, who hope to move toward a competitive market model faster. No reformer dared to call this new model capitalism. Instead, they used some euphemisms and used Deng Xiaoping’s famous saying that socialism with Chinese characteristics. Chinese leaders have a keen insight into the inherent contradictions and limitations of socialist economics and the effectiveness of capitalism. Otherwise, why would they start such an ambitious career that is so incompatible with tradition? .

As China has moved further and further on the road to market economy and economic progress has been a great success, the ideological debate in the early years has slowly become history. I first set foot in China in 1994. It has been a long time since the reform and opening up. After that, I visited China several times. Like all foreigners visiting China, I am very impressed with China’s earth-shaking changes every time. China The economy has become the second largest economy after the United States. China has grown from a bicycle economy in the 1980s to a country that produced 23 million cars last year. For thousands of years, skyscrapers have risen on the farmland.

In recent years, China has also developed a number of market economy systems, and major changes are still emerging. The most important thing is that China is currently establishing a bankruptcy system very similar to the United States, so China’s development is amazing, the world and The United States is extremely impressed by this.

I will talk about it here. If you have any questions, please feel free to ask me.

Zhu Min: Thank you, Allen. Thank you for your very wonderful speech and speech. Thank you for your insight into the global economic situation, your comments on Sino-US trade frictions, and your optimism about China's economic development and China's reform and opening up. Future optimism.

Now let's talk about the first thing you just talked about. We all know that investment has been low since 2008, but it is also driving the growth of the world economy. But you just mentioned it very uniquely. Your data says that the investment is very The low is because savings are low, precisely because social welfare projects squeeze the space for savings, all because of the aging population. If the aging of the population is inevitable and our population structure is getting older, will your investment continue to slow down in your opinion? Will productivity growth continue to slow down? Because the ageing of the population is inevitable.

Alan Greenspan: This question is very difficult to answer. You asked a very important question. For all economic policy makers, population aging is inevitable, and medicine is more and more developed, making us The average life expectancy is very long, so the problem of retirement, some 80-year-olds can not think of retirement, so our trend in this regard is indeed irreversible, we do not want to reverse it, how to do it? Try not to let social welfare squeeze the space for domestic savings, because the situation in each country is probably the same trend now. Only one country is now truly aware of this problem, which is Sweden. Sweden is particularly bad in this regard because its social welfare is too high, so there are many problems. Its inflation rate has increased to 500%. The system almost collapsed before making changes. What do they do? Adopting a pension system in the pension system instead of DB, which is a fixed expenditure, rather than the original fixed income, Sweden seems to solve this problem.

However, we are unlikely to return to the past, because we will have more and more elderly people, they have more and more people, and social welfare expenditures are increasing. I also think about this issue. For many years, there is no simple answer, because no matter what the answer is, it will not be a very simple answer. But no matter what you do, every country, especially all developing countries, must solve this problem to overcome difficulties. If social welfare is not so high, the growth of the world will be much higher than today.

Zhu Min: Yes, this question is indeed very difficult. Thank you very much for looking at this issue from your own unique perspective and data. I call it "Greenspan's Challenge".

We assume that Trump wants you to be his adviser. On this issue, we say that aging is inevitable, and investment will continue to fall. You just mentioned the comparison of capital allocation and cash flow, so investment will always go down. Then, we all have low growth in the end. Do you think that the United States will enter the so-called 30-year low growth and low interest rate economic stagnation like Japan? If Trump wants to ask you, what is your advice to him?

Alan Greenspan: Actually, I think in this field, others may be more professional than my answer. When we offer some suggestions, if I feel that I am not an expert in this field, my answer may not be the best answer.

Zhu Min: Just now you mentioned the situation in Europe. There is a huge imbalance in the economy in Europe. We have just seen that the trade surplus between Northern Europe and Southern Europe is getting bigger and bigger. They provide funds to enter southern Europe because there is a great deal in southern Europe. The trade deficit, to supplement this part of the funds, no doubt this is a situation that can not be maintained, do you think this will cause the EU's final collapse? Like the situation in Europe we witnessed in 2008?

Alan Greenspan: We know that there is a Brexit situation in the UK. It may have some systematic adjustments within the EU, but its uncertainty, coupled with other external factors, will continue to Suppress capital investment. The tables I have just shown are very crucial. The only thing that keeps the economy going is the supply of funds, but the supply of this funds is encouraged by some investment, or investment behavior based on political will, but this practice Not a long-term effective method.

The development of China's economy is unprecedented in history. Why is China's development so fast? It is because China has an ability, that is, the amount of savings in society is very high. This is something that other economies do not have. In other words, it is better to ask your suggestion than to ask your suggestion.

Zhu Min: Thank you very much for your compliment. I believe that your experience must be richer than me. I know that you spend a lot of time researching inflation. In many parts of the world, the inflation rate is very low. Do you think that in some cases, will the inflation rate rebound? Because everyone is watching inflation, including equity, monetary and fiscal policies, will you suddenly see that our inflation will rise again in the future, or do you think it will be a low-inflationary economy in the future?

Alan Greenspan: When it comes to inflation, what is the decision of inflation? It still depends on the labor cost of the unit, which is determined by salary and productivity. If our labor unit costs are rising, it may be difficult to maintain a relatively low inflation rate. I have shown in the previous chart that you are likely to enter an inflationary pressure instead of deflation. Under the pressure. This is very likely to happen. I can't call it a so-called economic recession, but globally, it is a stagnant state.

As I said just now, each of us has observed a pace of growth, but why can't others do as fast as China's economy? One of the basic reasons we want to see behind it is that China will use a large portion of its income as a deposit for households. Higher than Western society, he will have a high investment, which is why China’s growth rate. So fast, especially in the past few years, despite the slowdown in China's GDP.

Zhu Min: The topic of returning to the Sino-US trade war is mainly provoked by the United States. It is not provoked by China because China does not want to have such trade friction with the United States. You mentioned that there will be no so-called winners in the trade war, but you also mentioned that it is very regrettable that it is very likely that this friction will continue. Why do you make such an evaluation? The trade war can't be solved. The US deficit is still 3%, and China's trade surplus is slowly approaching zero, but it is clear that China's exports to the United States have decreased by 30%, but China's trade exports to the world are still relatively high. So you just mentioned that tariffs will form a kind of rebound in the United States for consumers in the United States. In the enterprise category, more taxes will be added. Is there a way to crack the current dilemma?

Alan Greenspan: I hope that I can answer this question, but the person making the decision does not know where the problem is. I can only answer this.

Zhu Min: So they really need your advice.

Alan Greenspan: I don't think they are willing to listen. I am sorry.

Zhu Min: There are hundreds of listeners here. I don't know if you can see our scene. I will give the microphone to the audience. If you have any questions or comments, I would like to ask Mr. Greenspan.

He Gang: I am from Caijing magazine. I know that many people are enthusiastically discussing ideas from different digital currencies, such as Facebook, and China also has digital currency. I would like to ask, what are the challenges of developing digital currency now? In the future, will the Fed still dominate the international monetary system?

Alan Greenspan: The central bank around the world understands the laws of market changes and the liquidity of money, so the central bank can predict it. If he knows the future economic development trend, or the trend of this change, This problem may be relatively simple, that is, through prediction. I always think that the most important function of the central bank is to predict, or to have a certain high predictability. He knows that a situation of current economic flow can be solved if it can be solved. If the central bank has sufficient predictive power, economic knowledge, and economic professionalism to support our currency development, I don't know if this answers you as an answer, because I can only do these evaluations on this issue.

Zhu Min: Do you think the central bank should also send its own digital currency because it takes into account a lot of cryptocurrencies and Facebook's Libra.

Alan Greenspan: This is a very important observation point. The currencies issued by various countries or central banks have no other organizations. You just talked about Facebook, but we are talking about a sovereign issuer. This may be everyone. Unthinkable, as a sovereign issuer, the central bank will not have any objections in this regard. This is not a topic in the economic field, but more a topic in the political field.

Zhu Min: So digital currency is not a question for the central bank to consider? There is a guest behind to ask questions.

Question: We are doing investment management. The public sector liabilities have risen very fast in the past 10 years, especially in the financial crisis after 2008. Government debt has risen very fast. This problem is encountered by many central banks. Rate, the ratio of macro debt, there is some difference between this kind of government debt and corporate debt. Do you think that the accumulation of government debt will become a long-term challenge or problem? As the economy grows, there may be higher borrowing rates. Everyone feels that there are not too many problems. What if the economy is not good? Now that government debt has really become a hot spot for everyone, do you think he will become a risk factor for future economic development? How can the central bank reduce the proportion of government debt?

Alan Greenspan: There is no such problem without debt, but there is no debt and no investment. So I think the core of answering this question is to find a difference, the relationship between your corporate equity and corporate debt. This problem has been around for a long time. I think this problem has existed hundreds of years ago. But this issue is not a problem to be solved, but a problem of trade-off. This is mostly a question of political scope. Many sovereign countries must deal with the issue of managing debt. How do you manage the sovereign debt of your own country? It is also crucial for you to control the inflation rate. If your credit exceeds the savings rate, it will increase the savings rate. On the contrary, this kind of thing will not happen. This problem has always been like this, and there is no other possibility.

Zhu Min: Thank you. There is also a political issue. Recently, you and other former Federal Reserve Chairmans called for the possibility of an independent central bank. Do you think that the independence of the central bank is now being eroded? Are you worried? How do you think the central bank can better strengthen its independence?

Alan Greenspan: This hasn't arrived yet, but you have to remember that the Fed was established by the US Congress through legislation. The US government approved the signing of this bill. This is called the Federal Reserve Law. The Fed’s system, its roots are political, and ultimately politics has some influence. I don’t worry about it in the short term, because it’s very clear that the current Fed’s chairman’s series of operations are all we can Understand that when you become the chairman, there is a long period of time to continue to operate smoothly, unless you personally overthrow, for example, the history and political traditions of the country, there is no particularly large room for deviation. So there is no problem in the short term. However, this issue will still be raised, but as long as the US Constitution is still in force, and the Constitution is difficult to change, there will be no major problems here. But surely politicians will always throw this pot to the Fed. In addition to not owning the pot, others throw the pot over, but this kind of thing, the chairman of the Federal Reserve, we have already adapted, and have long been used to it, unless American politics occurs. Great changes in the system. I am not really worried about the operation of our money supply, and will continue to maintain stability.

Zhu Min: Yes, maintaining the independence of the central bank is the key to managing the macro economy. Thank you Mr. Greenspan for his very wonderful speech. It is now 2 points after 10:00. When our time is up, we will not say, thank you. You look very good. When I go to Washington next time, I will go to your office. What you just said can make me have two meals.

Alan Greenspan: Thank you.

Zhu Min: We have a wonderful speech by Alan Greenspan. If I can give me three minutes, I am willing to summarize what he said.

First, since 2008, we have observed that global investment is declining and investment is weak. Take the United States as an example. Today's US investment is 3 percentage points lower than GDP in 2008. The weak investment is slow economic growth. A particularly important reason for the slow labor productivity and slow wage growth, why? He gave a particularly interesting explanation, because the population is aging, the population is aging, the savings are falling, the social pension and other expenses are rising, that is, the individual's overall savings + social pension insurance expenditures have not changed, but it has not changed, but it The structure has changed, and the low investment has made investment only decline. The world is facing this result. Because aging is inevitable, investment will continue to be low and will continue to decline, so we are likely to be in low growth for a long time. pattern. This is really a far-sighted idea, very powerful.

He said that the only way to solve this problem is the Swedish model, but the Swedish model is different from the pension model in almost all countries today. We don't have the financial resources to transfer us from today's model to the Swedish model, so this reform of future pensions. It is a particularly important thing. If this does not change, investment will continue to be depressed. This is a big deal.

Inflation continues to be sluggish. He believes that the most fundamental reasons are related to investment, investment is low, and labor productivity is low, so that workers' wages are not going up and inflation is not going up. Therefore, if labor productivity continues to be sluggish, wages will not go up, inflation will not go up, so we will also be in a low inflation situation for a considerable period of time, low inflation, low growth, interest rate levels have been Very low, still going low, that is a typical Japanese recession. I asked him if the world is entering a Japanese recession. He did not answer it directly, but he believes that there is a pattern of low inflation, low growth, and low interest rates. Europe is in an unbalanced situation, as the export of the Nordic countries, especially Germany, continues to surplus, and the surplus income becomes capital input to southern Europe, which has created two sectors in Europe, surplus countries and deficit countries, between the two sectors. The growing gap in interaction is an unbalanced structure that is very similar to the imbalance in the global economy before 2008.

Sino-US trade friction is in the United States, not in China. The United States has surpassed China’s tariff revenue on the total amount of tariff revenue today. This structure is unimaginable. He said that tariff revenue is equal to taxing enterprises and residents. It is sad now. Policy makers do not understand these basic economic laws, so trade wars may continue to be maintained.

He Gang asked him how to look at the digital currency? He believes that the central bank does not have to consider the digital currency. The sovereign currency and the authority of the central bank are legally formulated and do not need to be implemented through digital currency. The digital currency will cause the central bank to plague the existing cash-money system. It is also very interesting. Because there are many disputes about digital currency, more and more central banks in the world, including our People's Bank of China, are studying digital currency. Therefore, his conclusion is also very interesting.

The independence of the central bank is of course an especially important aspect of the macro structure, so it is particularly important to maintain the independence of the central bank. He does not believe that the current central bank independence of the United States is very bad, but it is implied that the independence of the central bank has been violated.

This is a very wonderful speech. A 90-year-old man, a former retired Fed chairman, his life experience and our sharing of his observations of the world, is very exciting. Thank you again for participating in this forum. thank you all!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Report | Top Ten Trends in the Cryptographic Industry

- Monthly report|In October, the volume of digital currency transactions increased significantly, and the equity financing market was hot.

- How to prevent personal information from leaking? Here are 2 big data blockchain application cases

- Fun! Use the Google form as a side chain and send and receive ETH with an email address.

- The listing was delayed until December, and the first coal miner will be listed on November 21.

- Counterfeit legal digital currency, "Li Gui" is rampant! The central bank reminded me three times, and there is a lot of information.

- Yao Qian: The “Before and Present” of the blockchain and the central bank digital currency