MicroStrategy’s latest holding of $4.5 billion in Bitcoin exposed, these eight Chinese listed companies also boldly bet on encrypted assets

MicroStrategy's $4.5 billion Bitcoin holding exposed, alongside eight Chinese listed companies betting on encrypted assetsOriginal author: Nancy, LianGuaiNews

Recently, Michael Saylor, co-founder of MicroStrategy, the US-listed company with the most Bitcoin holdings, announced during its Bitcoin three-year anniversary celebration that the total market value of its Bitcoin and company stocks reached $4.53 billion, an increase of 210%. This statement immediately sparked market discussions.

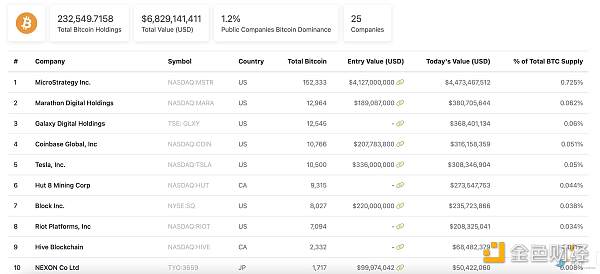

In fact, with the increasing recognition from the mainstream financial industry, more and more listed companies are incorporating cryptocurrency assets as part of their asset reserve strategies. According to CoinGecko data, as of August 14th, there are 25 publicly listed companies worldwide that hold Bitcoin, with a total of approximately 232,000 Bitcoins, accounting for 1.2% of the global Bitcoin issuance, worth over $6.79 billion.

- Can the presidential candidate’s stance on Bitcoin make Argentina the next El Salvador?

- LianGuai Morning Post | Europe’s First Spot Bitcoin ETF Listed, Embedded with Renewable Energy Certificates

- LD Capital interprets the past and present of OPNX How is the price performing? What challenges exist?

Among the listed companies worldwide that are betting on cryptocurrency assets, Chinese companies are also among them. According to incomplete statistics from LianGuaiNews, eight Chinese listed companies have formally announced the inclusion of cryptocurrency assets in their asset allocation strategies. Many of these institutions directly hold cryptocurrency assets or purchase mining machines, with many of their cryptocurrency holdings having considerable value, including Meitu, which spent as much as $100 million.

Meitu: Invested a total of $100 million in Ethereum and Bitcoin

Meitu was the first Hong Kong-listed company to purchase cryptocurrency assets. As early as March 7th, March 17th, and April 8th, 2021, Meitu purchased a total of approximately 31,000 Ethereum and 940.89 Bitcoins, spending a total of $100 million. In addition, at that time, Meitu’s chairman, Cai Wensheng, also stated in an article that the company would purchase ETH and BTC digital currencies as a long-term value reserve for blockchain development strategies.

However, Meitu has suffered significant losses due to the bear market in the cryptocurrency market. According to CoinGecko data, as of August 14th, the value of Meitu’s Bitcoin holdings is $27.49 million, a decrease of approximately 44.5% from the initial purchase value.

However, Meitu has not sold any cryptocurrency assets so far. According to its announcement in February this year, cryptocurrency is an essential part, and the adoption of cryptocurrency has ample room for growth. The recent fluctuations in the prices of Ether and Bitcoin are temporary, and Meitu remains optimistic about the long-term prospects of the purchased cryptocurrency.

It is worth mentioning that as early as 2018, Cai Wensheng publicly announced that he had achieved his personal goal of holding 10,000 Bitcoins.

Lanhai Interactive: Spent $1.24 million to purchase approximately 44.2 Bitcoins

Lanhai Interactive was established in 2007 and is a mobile game and interactive entertainment developer. It officially listed on the Hong Kong Stock Exchange GEM board on December 30th, 2014. In July 2023, Lanhai Interactive announced that it had cumulatively purchased approximately 44.2 Bitcoins in the open market for $590,000 and $650,000 in the past month. The announcement stated that the purchase of Bitcoin is part of the group’s Web3 business development and asset allocation strategy, demonstrating to investors and stakeholders the group’s ambition and determination to embrace technological innovation, thus preparing for entry into the blockchain industry.

Boyaa Interactive: Approved $5 Million Budget for Bitcoin and Ethereum Purchase

Boyaa Interactive is the largest online chess and card game company in China, with a variety of online chess and card games such as Boyaa Texas Hold’em, Boyaa Landlords, Boyaa Chinese Chess, and Boyaa Sichuan Mahjong.

As a Hong Kong-listed company, Boyaa Interactive recently announced that its board of directors has approved a budget of $5 million (approximately HKD 39.098 million) for the group to purchase cryptocurrencies on regulated and licensed trading platforms within the next year. The main cryptocurrencies to be purchased include Bitcoin and Ethereum, in order to promote the company’s future business layout in the Web3 field. According to Boyaa Interactive, the funds for this purchase come from the cash reserves generated by the group’s operations in Hong Kong and overseas. The purchase of cryptocurrencies will be executed at the discretion of market conditions and will strictly comply with the relevant jurisdiction’s control policies regarding cryptocurrencies.

Zhidu Co., Ltd.: Subsidiary’s Bitcoin Purchase Devalued by 63.1832 Million

Zhidu Co., Ltd., a company listed on the A-share market, was established in December 1996 and listed on the main board of the Shenzhen Stock Exchange. The company’s main business is the aggregation and operation of mobile internet traffic. Earlier this year, Zhidu Co., Ltd. announced in a public statement that the estimated loss for the company would be between CNY 305 million and CNY 395 million, with the subsidiary’s devaluation of Bitcoin purchases amounting to CNY 63.1832 million.

According to Zhidu Co., Ltd., the Bitcoin held by the company was acquired through the purchase of blockchain mining power cloud services from Bit Xiaolu in 2021. The Bitcoin generated by this portion of mining power belongs to the company as a service achievement. At the beginning of 2021, Zhidu Co., Ltd.’s Hong Kong subsidiary entered into a cooperation with Bit Xiaolu Group, purchasing a total of $12 million worth of blockchain mining power cloud services. However, Zhidu Co., Ltd. stated in May of this year that it does not have any plans to continue purchasing Bitcoin after the cooperation expires.

The9 Limited: Purchase of Bitcoin, Filecoin Miners, and Received 126 Bitcoin Rewards

The9 Limited is a game development and operation company established in 1999 and listed on NASDAQ in 2004. Since January 2021, The9 Limited has been frequently purchasing Bitcoin, Filecoin, Chia, and other miners, and has even partnered with Coinbase to open a custody account for holding cryptocurrencies. For example, in January 2021, The9 Limited completed the deployment of 36,496 Bitcoin miners through two purchases; in November 2021, The9 Limited expanded its 32 megawatt mining farm in the United States and deployed 10,000 Antminer S19j miners in cooperation with Compute North. Although The9 Limited has not publicly disclosed the amount of Bitcoin it holds at present, it previously stated in its 2020 fiscal year report released in March 2021 that it had received 126 Bitcoin rewards.

NetDragon Websoft Holdings: Cryptocurrency holdings in 2021 valued at 127 million yuan

NetDragon Websoft Holdings, a Hong Kong-listed company, is a Chinese investment holding company primarily engaged in the development and operation of online games. In September last year, NetDragon Websoft Holdings reported a confirmed impairment loss of 55.215 million yuan on its cryptocurrency investments. However, in its previously released 2021 annual report, it showed a book value of 127 million yuan for its cryptocurrency holdings.

Times China Holdings: Purchased 20,000 Filecoin for $639,000

Times China Holdings Limited, a Hong Kong-listed company, is a diversified holding company with core businesses in hotel operations, property management services, and property investments.

In November 2022, Times China Holdings announced that its wholly-owned subsidiary had purchased 20,000 Filecoin through on-exchange transactions for a total price of approximately $639,000. However, according to its announcement in November last year, the company plans to sell all of its cryptocurrency assets and expects to recognize a gain of approximately 9 million Hong Kong dollars from the sale. The company stated that it will no longer engage in cryptocurrency investments afterwards. The announcement mentioned that since 2022, the cryptocurrency market has been declining, and the company has been actively seeking opportunities to sell its cryptocurrency holdings. Considering the current cryptocurrency market, the board of directors believes that selling all of the cryptocurrency assets to avoid further fluctuations in the market price is in the best interest of the group.

Shidai Globe Holdings: Spent $1.3 million to purchase 23.4 Bitcoins

Shidai Globe Holdings is a Hong Kong-listed company primarily engaged in tourism, hotel, gaming, and casino businesses. In 2021, Shidai Globe Holdings announced on the Hong Kong Stock Exchange that the group purchased approximately 23.4 Bitcoins on a public cryptocurrency trading platform on May 10, 2021, at a total cost of approximately $1.3 million, using internal resources of the group.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What’s happening to the whales on the Bitcoin rich list now?

- Exploring the African Cryptocurrency Market Opportunities and Challenges Coexist

- Explaining RGB Protocol Exploring a New Second Layer for Bitcoin Asset Issuance

- LST will replace ETH as the new underlying asset, and LSDFi may open up a 50x growth market.

- ETH skyrockets A discussion on the future trends of the inscription pathway

- Will Wall Street scare away crypto punks after showing interest in Bitcoin?

- LianGuai Morning News | Bitcoin futures open interest reaches highest level since 2023