How to capture the signals of recovery and survive the cold winter in a cooling market

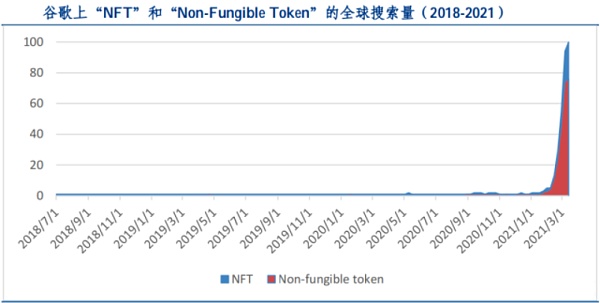

Capturing recovery signals and surviving in a cooling marketIn September 2020, an innovative term “NFT (Non-Fungible Token)” slowly entered people’s field of vision and was captured by a small number of early players and institutions. However, starting from February 2021, NFTs exploded in growth, with a weekly trading volume exceeding $2 million, and in a few months, the total market value of most NFT projects increased by as much as 2000%. Many people outside the industry rushed to learn and participate.

As more and more people join, “consensus” spreads among the crowd. But for many, the first goal is how to invest and profit from the rapidly growing NFT market. The rules of NFTs are very different from traditional ways of doing things. Although consensus is a beautiful thing, the culture behind many projects is also worth our attention and love. However, it is undeniable that during a bull market, most NFT projects resemble a game of passing the parcel, and a small image is initially difficult to have such high value.

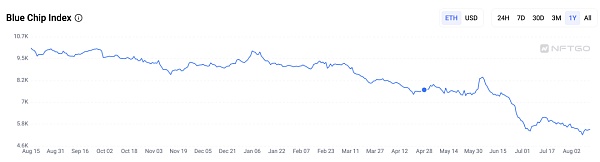

Therefore, in less than 150 days, just when most users have just understood what “non-fungible token” is and what PFP is, and are shouting “everything can be an NFT” and preparing to make grand plans, a liquidity crisis has quietly permeated every corner of the market, and the market has started to plummet. In the short term, people still held hope that it was just a correction, but the situation did not improve afterwards, with a large number of projects going to zero, and even the top blue-chip project BAYC falling nearly 90% from its peak.

- Glassnode Weekly Report Bitcoin volatility index reaches historic low, market to remain in a sideways trend.

- The Economist Old Article How did Bitcoin become a Trust Machine?

- MicroStrategy’s latest holding of $4.5 billion in Bitcoin exposed, these eight Chinese listed companies also boldly bet on encrypted assets

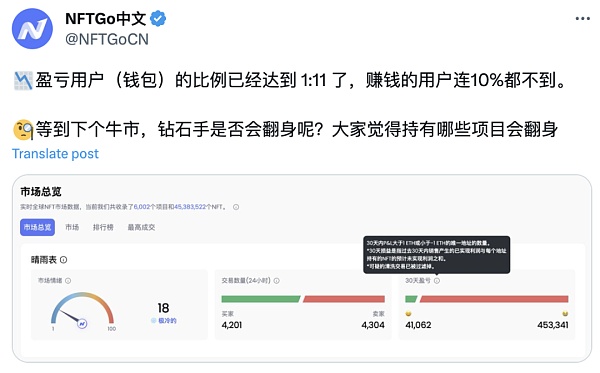

According to data from NFTGo, in the past 7 days, there were only over 40,000 profitable users, compared to over 450,000 users in loss. It can be seen that the market has been in a cold winter.

Some people jokingly say, “The essence of NFT is to see a picture you like, Ctrl C + Ctrl V, do you still need to buy it?”

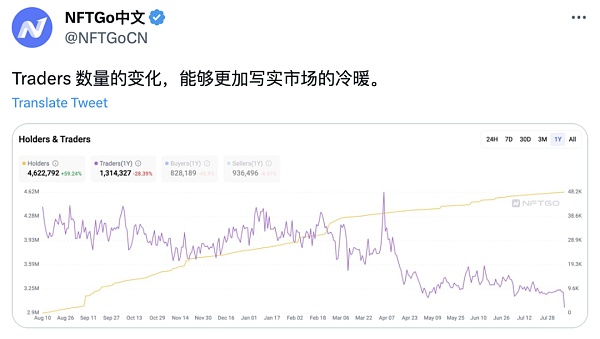

Each bull and bear market will bring in a large number of new users, and NFTs are also experiencing their first bear market. Those who are still paying attention to the NFT track are definitely racking their brains to think about when NFTs will recover and how to capture the signals of recovery in advance.

First of all, we must understand that it is generally difficult for the NFT market to recover on its own. The essence of sector rotation still lies in the entry of funds. Token markets can rely on the overall economic environment, but for NFTs, they have not yet become investment targets for many traditional investors and institutions, making them less susceptible to traditional financial influences.

Therefore, the signals of NFT recovery rely more on their own “strength.” There are three signals for everyone to consider:

The first point is to pay attention to the new moves of industry giants and look for positive news.

In the previous cycle, the Metaverse project gained significant attention, largely due to the renaming of Facebook’s parent company to Meta. The giants have abundant funds, vast resources, and professional team judgments; each of these factors is sufficient to propel a particular sub-track to a climax. Moreover, it is widely recognized that the giants have good foresight, and it is easier to profit by following in their footsteps.

However, sometimes one must be cautious. Many times, giants manipulate the market by spreading positive news, and there are no signals when their funds exit in advance, making it easy for people to be late in realizing. Secondly, the giants’ vision is not always 100% accurate; for example, in Meta’s first-quarter financial report this year, its Metaverse business unit, Reality Labs, reported a quarterly operating loss of $3.99 billion.

But undoubtedly, if another giant appears with a similar new move in the industry, the market will certainly not be so quiet.

Secondly, pay attention to the emergence of revolutionary applications.

Just like the emergence of StepN opened the era of Play-to-Earn (P2E), various projects related to running, skipping rope, and even “Sleep to Earn” emerged one after another, and many domestic news media began to report on StepN, raising everyone’s awareness. This shows how exaggerated its popularity was at the time (although StepN was not the first application of its kind, it was indeed the first to combine with NFT and break through the circle).

If another similar application emerges, it will definitely bring a lot of popularity. Just like the recently launched blockchain game Matr1x, it has given many users in the industry hope for breaking through the circle of blockchain games —— blockchain games finally have gameplay, not just 4399. However, even if another breakthrough application appears, we should also consider how the economic model is designed; otherwise, the final outcome will be a death spiral, and users will return to “Work to Earn”.

Thirdly, pay attention to data.

Although I said that the essence of sector rotation is the entry of funds, this happens to be the most important aspect; wherever the funds flow, there will be hotspots and a resurgence. Good projects may not necessarily fall, but bad projects will definitely not rise —— of course, this excludes some short-term gambling-like MEME projects.

We may not be able to know many news as soon as possible, but data is always the most accurate and true reflection of market sentiment. In this regard, we can visit some data platforms (such as NFTGo) and keep an eye on important data indicators such as market sentiment indicators, the number of traders, profit-loss ratios, and the trading volume of whales; once the data shows abnormal movements, we can spend more time searching for the reasons and make judgments promptly.

Every bear market is difficult to endure, but compared to the “blockchain” that many people referred to as a scam five years ago, the current bear market is much gentler —— because people have been building, at least we believe that the bull market will return, rather than questioning whether the track will disappear.

So, in the first cold winter of NFT, what can we do to prepare ourselves better when the bull market comes? Here are a few points for your reference.

First, observe more and act less.

The most painful investment experience must be when the bull market arrives and our money is gone. Most of the projects that still have heat in the bear market are MEME-type projects or projects with a strong gambling nature, with very low profit-to-loss ratios. However, because the market has been inactive for too long, impatience can easily lead to FOMO and the depletion of ammunition. We often see wealth myths online (such as PEPE’s 100,000-fold returns), but in reality, very few familiar people have achieved such results. The probability of getting rich overnight is very low, and giving up fantasies and being down-to-earth is the path to wealth accumulation for most people (except for the lucky few).

Therefore, in the bear market, we must do a good job of fund allocation and avoid investing too much capital at once. Observe more and act less.

Second, always remember that primary market > secondary market in the bear market.

Even projects like Ordi that created myths of tens of thousands of times returns in the bear market, most of the users who got significant profits are those who participated in the primary market, while those who entered in the secondary market are mostly trapped because by the time you know about a project, it is likely to be at a high point (NFT Labs previously reprinted an article “xxx” during the early stage of BTC Inscriptions, and those who paid attention and took action should have made a lot of profit). Even if you have a long-term bullish view on a project, it is best to wait for the FOMO sentiment to pass before gradually buying in. Projects that take off in the short term will eventually have a landing period, as most large holders will also sell their holdings.

Previously, during the bull market, I suggested that everyone participate in the whitelist minting rather than secondary market purchases, and this is even more true in the bear market. Also, innovative projects with first-mover advantages have more collectible value and their prices are more unpredictable, such as Punks on the ETH chain and Sub10k on the BTC chain.

Third, keep an eye on innovation.

Whether NFT can truly have some application scenarios is only a matter of time, as it actually depends on the popularization and acceptance of encryption and blockchain in reality. But even in the bear market, NFT continues to innovate and progress. For example, the recently released ERC6551 protocol (one of its authors, Benny, is also the inventor of ERC721) allows an on-chain NFT to contain coins, SBT, other NFT assets, and package them together, which can bring many new narratives and application scenarios, such as the sovereignty of PFP NFTs, equity NFTs, and the splitting of virtual item attributes.

Based on these protocols, there may also be some groundbreaking applications (such as interesting applications that customize unique NFTs for each person based on their personality), which may trigger a market recovery. It is always right to stay informed. The information gap in understanding new things may be the source of your first bucket of gold.

Conclusion

Every bull-bear transition will see people entering and exiting; fundamentally, this is due to the differences in long-term investment judgment. Therefore, all you need to do is to continue paying attention to innovative products in the track you believe in, and with patience and appropriate trial and error in long-term learning, you will soon have your own investment strategy.

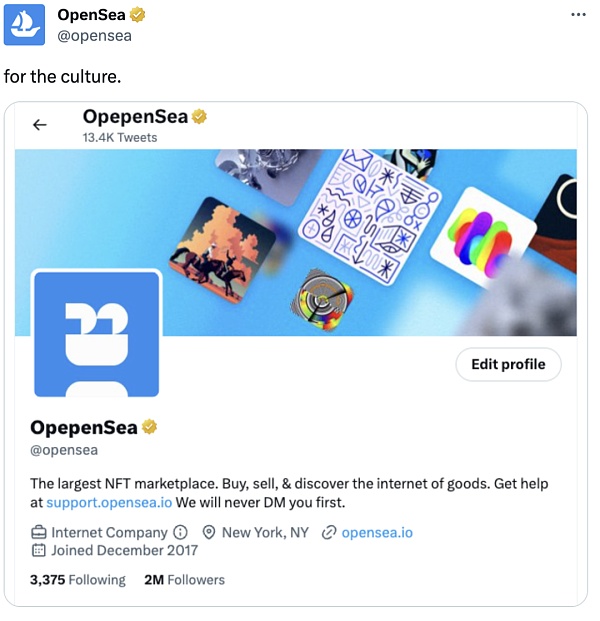

Also, it is worth noting that the popularity of NFTs overseas far exceeds that in China. Recent events such as the hot slogan “For the Culture,” controversies sparked by the latest DeGods project, and interesting projects like Milady, frEns, and Punks2023 have all happened overseas with little attention from China. Therefore, it is important to have an international perspective. Sometimes, when confidence is lost, looking at the (NFT) world from a different angle can bring enlightenment.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Can the presidential candidate’s stance on Bitcoin make Argentina the next El Salvador?

- LianGuai Morning Post | Europe’s First Spot Bitcoin ETF Listed, Embedded with Renewable Energy Certificates

- LD Capital interprets the past and present of OPNX How is the price performing? What challenges exist?

- What’s happening to the whales on the Bitcoin rich list now?

- Exploring the African Cryptocurrency Market Opportunities and Challenges Coexist

- Explaining RGB Protocol Exploring a New Second Layer for Bitcoin Asset Issuance

- LST will replace ETH as the new underlying asset, and LSDFi may open up a 50x growth market.