Bitcoin volatility is too high, but I still continue to hold bitcoin

But one morning a few years later, when you woke up, you found that Bitcoin did not die, and its value rose a lot again. So you start thinking, maybe your skeptical friend's point of view is not correct?

The list of Bitcoin sceptics is long and many people are famous, but these noises make Bitcoin more vulnerable to vulnerability (from the chaos), because it makes those who use Bitcoin as a means of wealth storage. Don't really understand the characteristics of Bitcoin. Although these features seem to contradict the traditionally established view of the currency, the characteristics of Bitcoin ultimately reinforce their beliefs .

The volatility of Bitcoin is one of its frequently criticized features. Skeptics, including many central banks, generally believe that Bitcoin is too volatile to be used as a value store, transaction medium or unit of account. Given the volatility of Bitcoin, why would anyone use it as a savings mechanism? Moreover, if the value of Bitcoin may fall moderately at any time, how can it effectively become a trading medium for payment?

- Bitcoin for $0.32, they dreamed back to 2009 today

- Why do Morgan, Facebook, Wal-Mart and other giants tend to use the alliance chain to release stable coins instead of public chains?

- Introduction | Market Development Model and Ethereum 2.0 Development Process

Currently, the main use of Bitcoin is not as a payment tool, but as a means of value storage . Those who use Bitcoin to store wealth are not spanned by a day, a week, a quarter, or even a year. Bitcoin is a long-term savings mechanism that will only be stable when Bitcoin is adopted on a large scale .

Prior to this, the volatility of Bitcoin was a natural evolution of its price discovery, which was the process by which Bitcoin moved along its monetized path and moved toward full adoption. In addition, most individuals and businesses do not hold bitcoin singly, but use multiple asset combinations, just like any portfolio, which can reduce the impact of the volatility of any single asset. .

Although central banks around the world have pointed out that bitcoin is a bad means of value storage and cannot function as a currency due to volatility, they measure bitcoin in days, weeks, months and quarters. Others who are optimistic about Bitcoin look at it from a longer-term perspective: years, decades, and even generations .

Despite these logical explanations, Bitcoin's volatility is still a particularly confusing place for experts: Bank of England Governor Mark Carney said in a recent comment on Bitcoin, measured by currency standards, Bitcoin Being a currency is very unsuccessful, and no one will use it as a trading medium.

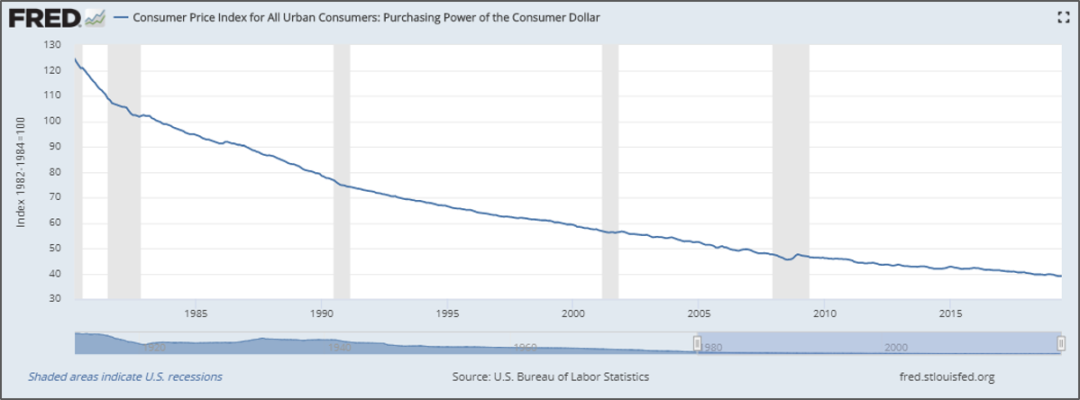

The European Central Bank also issued a similar view on Twitter: Bitcoin is “not a currency” but a “very unstable asset” and emphasizes that the central bank can “create a currency for the purchase of assets”. But in fact, the “creating money” function of the central bank is the chief culprit in causing currency depreciation and becoming a means of storing bad value .

Fortunately, for all of us, bitcoin is not too volatile as a currency, and experts in these traditional fields are not experts in the field of bitcoin. Regardless of the logic, empirical evidence suggests that bitcoin has proven to be an extraordinary means of value storage for any longer period of time despite the volatility of Bitcoin .

So how do assets like Bitcoin have both high volatility and an effective means of value storage?

The driving force behind the basic demand for Bitcoin lies in its scarcity , its decentralization and anti-censorship (and a fixed supply plan, which halved the block reward every four years), which enhances the credibility of Bitcoin scarcity. This is where Bitcoin has the storage value attribute.

As Nassim Taleb, Nobel laureate in economics, argues in his article The Black Swan of Cairo: “ Change is a message. When change stops, information does not exist. ” As the value of Bitcoin grows, Despite the volatility, it is still transmitting information: change is information. Higher value (depending on change) makes Bitcoin more relevant to new capital and users, triggering a new wave of adoption of Bitcoin.

As the value grows, Bitcoin attracts more potential users, and then they begin to learn the basics of Bitcoin. Similarly, the increase in value will also attract more funds to enter, using Bitcoin as a value storage tool or to build more infrastructure (such as more hosting plans, payment layers, mining hardware, etc.).

Promoting people's understanding of Bitcoin is a slow process, just like building infrastructure, but both processes have contributed to the growth of Bitcoin users, further spreading knowledge and driving infrastructure.

This feedback loop is as follows:

The spread of Bitcoin knowledge → Infrastructure development → Increased adoption → Value growth → Further diffusion of knowledge → Further development of infrastructure

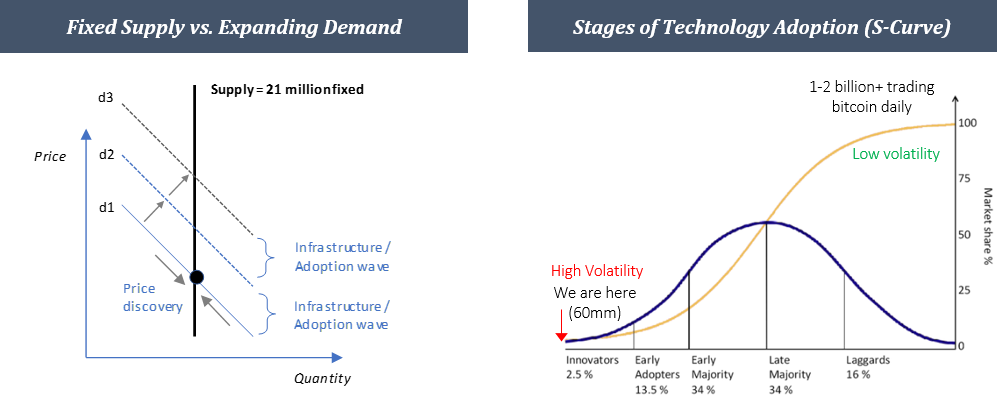

The volatility of Bitcoin will decrease as the user base and adoption increase . In other words, if the number of users of Bitcoin is to reach 1 billion, the adoption will need to be about 20 times higher than the current one, but then every additional 100 million users will only need to increase from the previous adoption. About 10% can be achieved. Although in this process, Bitcoin's supply plan is fixed (one new block is produced every 10 minutes, and the block reward is halved every four years).

Therefore, as long as the adoption of Bitcoin will increase and increase, then the volatility will be inevitable, but in the process, the volatility will naturally decrease slowly .

As Vijay Boyapati, a bitcoin economic commentator, once said: “Some authoritative economists laugh at the volatility of bitcoin, (their tone) as if they could turn something that doesn’t exist into a stable overnight. The form of money; this is really a slippery world."

The adoption curve is a natural evolution model of price discovery, and this process is by no means static. In the development of Bitcoin, people's recognition of Bitcoin will rise, will decline, will stabilize, and then rise again, which is rhythmical. Rome was not built in a day. For Bitcoin, volatility and price discovery are the necessary processes to achieve its great cause .

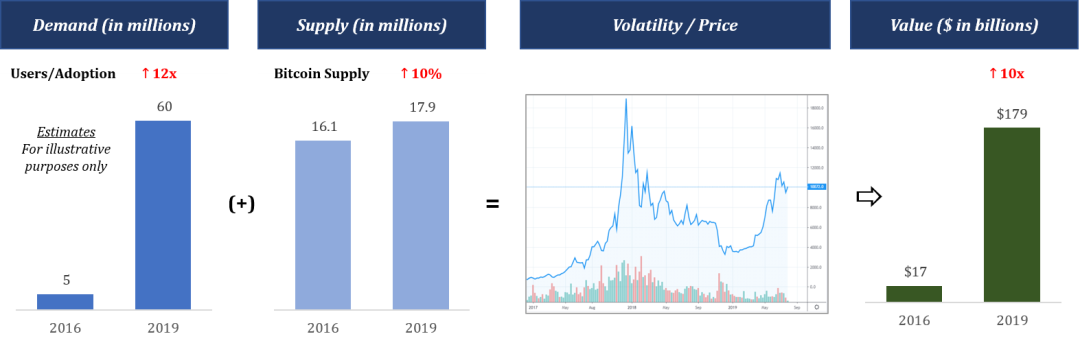

Although the adoption of Bitcoin cannot be truly quantified, a rough but fair estimate is that the number of Bitcoin users has increased from about 5 million in 2016 to about 60 million in 2019 (the demand has increased by about 12 times) However, the total supply of Bitcoin has only increased by 10%.

Of course, during this period, there is a significant difference between the information held by market participants and the capital of admission. With the emergence of a large-scale adoption of bitcoin in history, Bitcoin still maintains its fixed supply plan .

What happens when demand increases by orders of magnitude and supply increases by only 10%? And what happens if you know the number of Bitcoins and the funds you enter are different?

The very logical end result is that Bitcoin has experienced higher volatility and higher value , even if only a small number of new entrants are converted to long-term holders (which is the case). New users who initially bought Bitcoin during the bitcoin boom will slowly accumulate knowledge and turn into people who hold Bitcoin for a long time, thus stabilizing the underlying demand at values well above the previous usage cycle.

Since Bitcoin is new, relatively speaking, the total wealth stored by Bitcoin is still very small (about $200 billion), which makes the rate of change between marginal buyers and sellers (price discovery) in basic demand (volatility) ) occupies a considerable proportion. As the basic demand increases, the rate of change in the basic demand will become smaller and smaller . Over time, the volatility of Bitcoin will decrease after only a few adoption cycles .

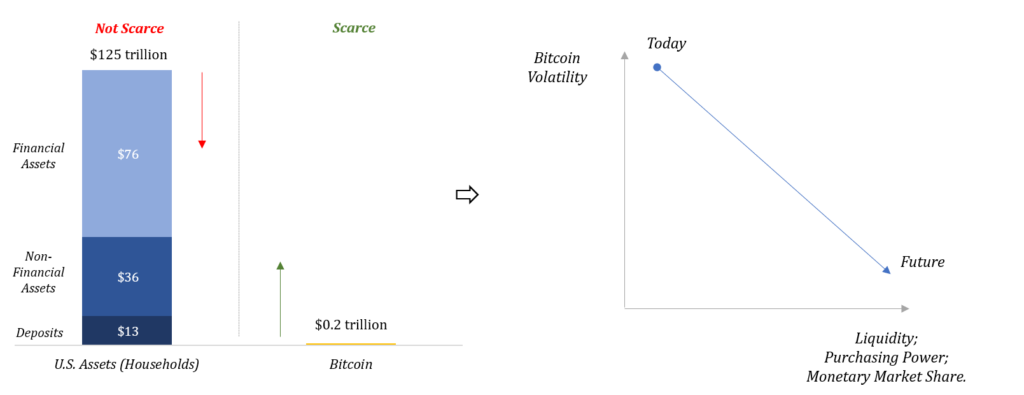

Bitcoin is a global network through which you can transfer value to anyone in the world, but Bitcoin's current total value is less than $200 billion. In contrast, the market value of only one Facebook company exceeds $500 billion, and the estimated value of US household assets is $125 trillion.

In theory, if Bitcoin does not have any contact with the outside world, then its volatility is a problem; but in the real world, Bitcoin is not. The diversification of assets exists in the form of actual productive assets and other monetary/financial assets, which undermines the impact of bitcoin volatility. In addition, there is also asymmetry of information. For those who understand Bitcoin, more users will arrive in time.

These concepts are obvious to those who have been exposed to Bitcoin, and they also explain the short-term and long-term volatility of Bitcoin, but obviously these concepts are not so obvious for Bitcoin skeptics, they have a hard time understanding Bitcoin. The adoption is not an all-or-nothing proposition.

Since Bitcoin is fundamentally a better form of money, it will gain purchasing power relative to poorer monetary assets (and currency substitutes) and increasingly gain market share in economic coordination functions, despite Bitcoin is currently weaker as a trading medium.

Bitcoin may also trigger definancialization of the global economy , but it will neither eliminate financial assets nor eliminate physical assets . In the process of monetizing Bitcoin, these assets will continue to represent the diversification of asset forms, which will reduce the impact of daily fluctuations in Bitcoin.

For example, a 1% bitcoin + 99% dollar portfolio has a higher risk/reward than a gold, US Treasury and S&P 500 index. In addition, Xapo CEO Wences Casares has a small amount of bitcoin in its portfolio. Both examples provide a perspective on how we can manage volatility and risk if Bitcoin experiences significant depreciation or even failure (which is still a possibility).

On the road to full monetization of Bitcoin, Bitcoin will be the first to fulfill its role as a means of value storage. Despite the volatility of Bitcoin, it has proven to be an incredible way to store value. As adoption grows, volatility will naturally decline and Bitcoin will increasingly become a direct trading medium .

Let us look at individuals or businesses that exchange goods and services directly with Bitcoin. These individuals or businesses represent those who first determine that Bitcoin will maintain its value for a specific time frame. Only when the liquidity of Bitcoin gradually shifts from other monetary assets to goods and services, will it be transformed into a trading medium. This is not done overnight. The trading infrastructure is already under construction, but only when enough users first use Bitcoin as a wealth reserve, they will give priority to more substantial investments.

The instability of bitcoin prices and their fixed supply plans will continue to make them short-term volatility, but in the long run, this will push bitcoin prices to stabilize . This is in stark contrast to the ideas held by the Bank of England, ECB President Mark Carney, and the Federal Reserve. This is why Bitcoin is vulnerable to vulnerability. In the field of Bitcoin, there is no morality for the bank, and there is no moral hazard, which maximizes accountability and long-term efficiency.

The central bank controls the short-term fluctuations in currency prices by managing the currency, which will lead to long-term volatility. The volatility of Bitcoin is the natural process of its adoption, which ultimately enhances the resilience of the Bitcoin network and promotes long-term stability.

As Nassim Taleb said in his article "The Black Swan of Cairo":

“Complex systems that artificially suppress volatility tend to become extremely vulnerable while not showing significant risks.”

Author | Parker Lewis

Compile | Jhonny

Source: Unitimes

[The copyright of the article belongs to the original author, and its content and opinions do not represent the Unitimes position. Publishing articles only to disseminate more valuable information]

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Accounted for up to 64%, this report says cryptocurrency transactions are concentrated on low-quality platforms

- I sold the mining machine and I went to the shoes.

- Is there an internal contradiction in the Libra Association? Foreign media: At least 3 members are considering launching

- The central bank released the 2018 annual report: four times mentioned the digital currency, saying that "the stage has progressed" (PDF full text)

- QKL123 market analysis | Bitcoin is multi-empty, the altcoin is relatively strong (0823)

- The sky is really a pie! Many exchanges traded abnormally, and more than 40 bitcoins were sold for 0.3 dollars.

- Babbitt column | Cai Weide: How do foreign countries see China's response to Libra, how is it laid out abroad?