A brief history of the books: from the Babylonian Lamb to Bitcoin

Let me first ask a question for everyone to guess. The earliest word describing interest in human language is the Sumerian language of Cuban Babyn five thousand years ago. It is very coincidental that this word has another meaning. You Guess what it is.

I think it is more difficult to guess, and this means "Lamb."

- Can the digital currency of the future be popular?

- Blockchain judicial deposits are becoming more and more popular, and traditional Internet companies are entering the market.

- Read the connection between the technological revolution and financial capital: the world is changing, and the world should be changing.

Of course there is a possibility, it is just a coincidence. Another possibility is that in Babylon, if you rent someone else's field and put sheep on it, you need to hand some newborn lambs to the landlord, because you used this field for production materials, and the landlord also gave this piece. Tian invested some capital, such as irrigation systems. Similarly, in the lending activity, you ask the creditor to borrow silver or wheat and use it for other production activities. When repaying, you also have to pay some value-added assets as interest.

So why is it a lamb instead of a pig or a calf? Because Babylon was really fond of sheep at the time, it may be more suitable for sheep growth, so sheep is a very important value carrier, unlike us, this is cattle and pigs.

To give an example of this, I would like to say that the financial phenomenon like borrowing is actually closely linked to the main value production methods of the society at that time. Simply put, finance depends on industry. Next, we look at several key periods in history to see how finance and industry have evolved together.

Let us start with Babylon. Before the Babylonian game, we said that human beings have not yet entered the civilized era. A very important consideration is that there was no text or city before. These two things are very important financial technologies and systems, and we will start to elaborate on them later.

Before the civilized era, most of the human beings lived in small tribes. Many of them had blood relations. The production methods were mainly based on collection and hunting. There will also be collaboration here, but because it is a tribe, mainly public ownership, it is distributed. Time is more flexible and more humane. After all, everyone is a relative.

In Cuban Babylon, because of the development of agriculture, the land per unit area can support more people, and farming has become a new way of life. These people gather to form a city. The interpersonal relationship here has changed. Many of them have no close blood relationship. Compared with the past, even if they are a stranger society, of course, it is still incomparable with our current city. Tens of thousands of people have been very bad.

Urban life requires a new order, with rulers, rituals and wars, but also ruled, mainly peasants, and some are craftsmen, civilians, and businessmen. Everyone started to have a division of labor. Some people don't need to produce food. They need to rely on the rulers to redistribute them to support them.

This redistribution is a very crucial change, which means that there has been a major change in the distribution of mainstream values. Associated with changes in financial technology and institutions, such as borrowing.

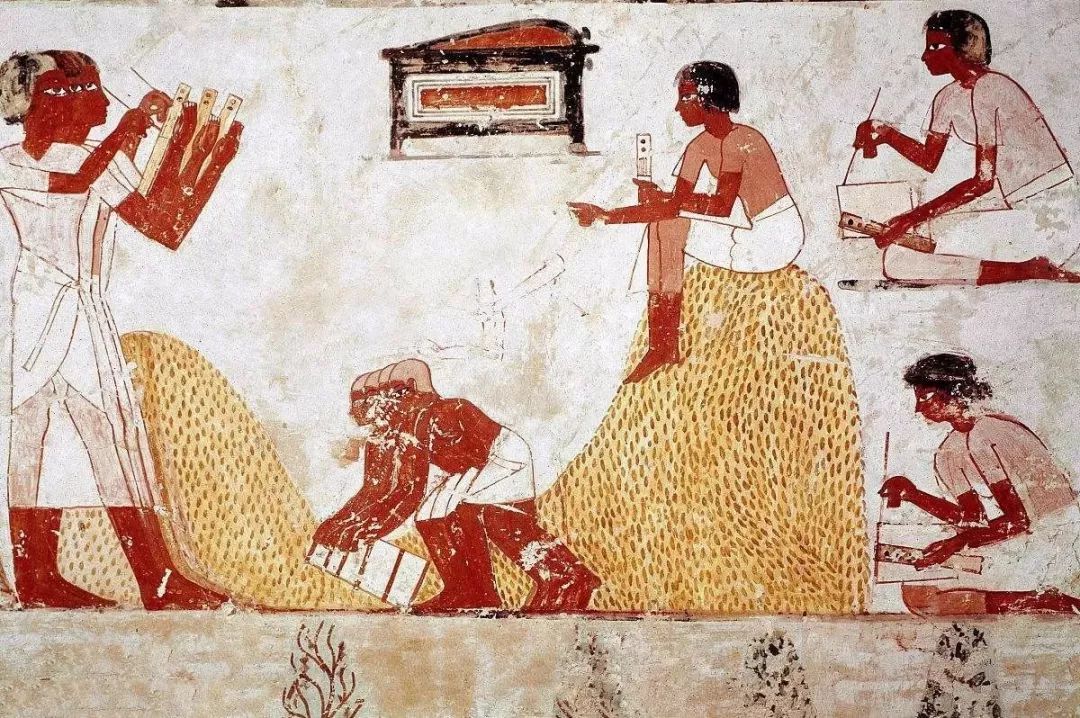

This redistribution was done at the time. The rulers asked the peasants to pay a portion of the barley to the temple and then to the people who did not engage in production, such as soldiers, officials, and craftsmen, each with their own quota.

Barley is a fixed harvest time each year. At that time, farmers must turn in. If there is a natural disaster or a man-made disaster, there is not enough barley to turn over. What should I do? Two choices, one is arrears and the other is borrowing. Both of these are borrowing. The former is the central government's loan to the peasants. If you should pay, you should owe it first, and then return it after one year. The latter is that farmers have to go to other rich people to borrow and then hand it over to the central government.

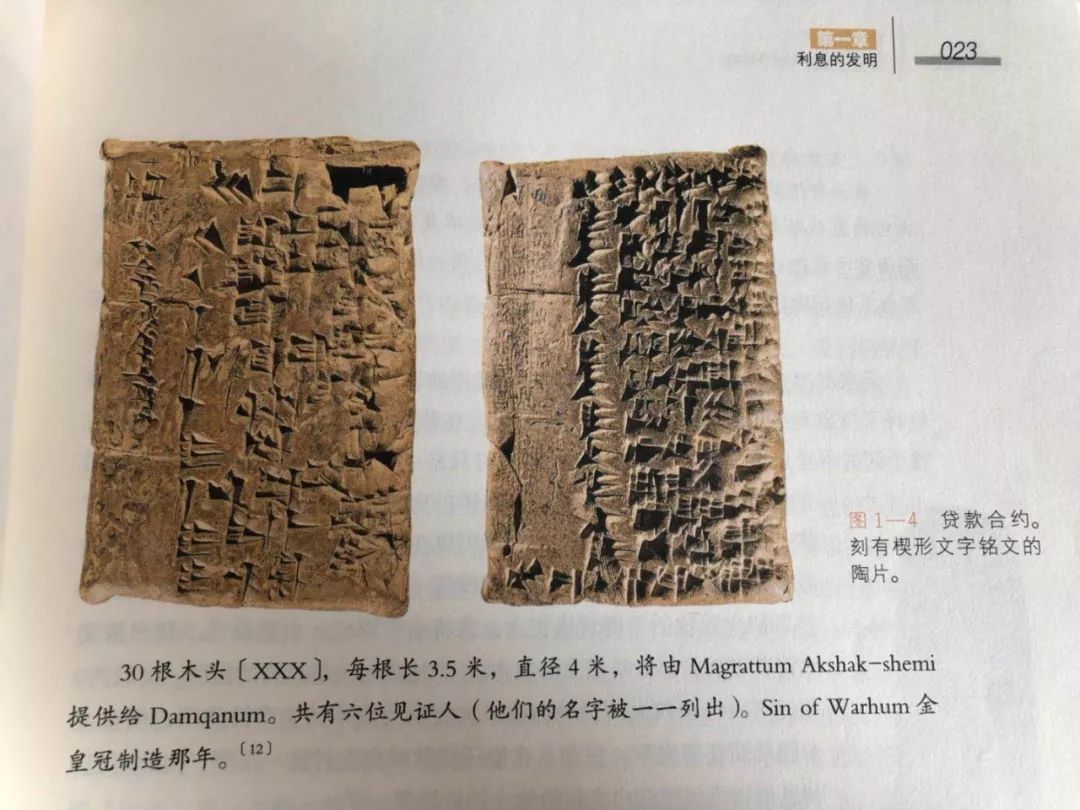

A lot of such contracts were recorded on the remaining slate and cuneiform texts. Something is particularly simple. Pzue owes Urgairn 40 grams of silver and 900 liters of barley. This is the most primitive. Both have only names, no specific identity, and no interest or repayment dates.

Subsequent contracts are more advanced, such as this:

Nabi's son, Ilshu, borrowed one and six cents of Shekel silver from the suns and Sintajir, and he will pay back the interest in the receiving season. Interest is calculated based on principal and standard interest rates. Witnesses are as follows: . . . Apin built the Inan Temple in July of the year signed

This is a very complete loan contract, and there are witnesses.

Looking back at this paragraph, we can see that after the hunter-gathering-tribe became a farming-city, the creation and distribution of mainstream values have undergone tremendous changes, and everyone’s daily work is completely different. With new problems to be solved, how can someone do not hand over to barley on time? Using cuneiform characters and slate as technical means to slowly optimize loan contracts, there may be some government-defined systems that combine to create new financial activities and are large-scale. From the slate in the past, we can find that a lot of records are about borrowing.

Ok, let’s move on to the next era, the era of the rise of joint-stock companies.

Generally speaking, the East India Company in the UK and the Netherlands is the earliest joint-stock company. In fact, joint-stock companies have sporadically appeared in many places and time periods in history, but the key attributes are similar. For example, both ancient Greece and Rome have joint-stock companies, and they are all related to colonial trade activities. Fortunately, the Mediterranean has provided a very good business environment for early humans.

Most of these sporadic joint-stock companies are short-lived, and they still have to stay in the early 17th century in the UK and the Dutch East India Company.

The social background at that time was such that the Eurasian commercial road was monopolized by the Arabs. Europe needed to find a new maritime trade route. The risk of ocean navigation was very high and the cycle was very long. If it can be successfully returned, the benefits are amazing. In this case, traditional lending is not applicable. To support large-scale ocean exploration, new financing and organization forms are necessary.

Most of the early ocean expeditions were supported by the royal family because the royal family was also short of money. Many financial innovations were forced by the royal family to finance the law, such as the city bonds of Venice and the joint-stock company of Genoa. and many more. At that time, the royal family lacked money, and they had to go to the international capital market to borrow. The interest rate was not low. The fierce competition between European countries has forced the government to increase investment and open source and reduce expenditure. Supporting ocean-going expedition is a way. If you can find new trade routes and markets, it is gold and silver. The government can obtain the shares of the company to make a profit by investing or transferring the franchise.

The joint-stock companies of such ocean-expeditions are not the same as those in history. The difference is that the former has more uncertainty. Zeroing is a common occurrence, more like today's venture capital and startups. Historically, joint-stock companies have become more stable. For example, a particularly famous French mill company has been able to generate profits steadily for hundreds of years.

The essential difference between the two is that the former is developing new markets and business, while the latter is very mature business. However, it is this kind of effort to open up a new commercial landscape, and the right time to send the small country of the UK and the Netherlands to the position of the world hegemon.

Focusing on some innovative designs of the Dutch East India Company, the long-term cycle of navigation requires shareholders to invest capital for a long time. The rules of the East India Company are locked in ten years. In order to make up for the long-term opportunity cost, shareholders can trade shares freely. At that time, Amsterdam, the capital of the Netherlands, had a very developed exchange. The bullish bearish various financial instruments were invented, so the deal had all very good liquidity.

This kind of liquidity is very valuable, because there are no other wealth management products with such good liquidity at the time, you can buy the stock and you can sell it, which gives investors more confidence. On the other hand, developed exchanges have also fully exploited the attributes of human speculation, just like our current market.

There are still many unfolded details, such as earlier, many financial instruments, banks, bonds, perpetual annuities that originated in the Italian city-states in the 11th and 13th centuries, all of which have contributed to the British and Dutch, and these financial instruments also It is due to the introduction of Arabic mathematics into Europe, the promotion of abacus theory by Fibonacci, and the study of probability theory in Europe. Once again, financial technology and organizations have been refactored because of changes in mainstream value production methods.

So what will the next change be like? I guess this financial technology and institutional change is a blockchain, so what is the change in mainstream value production and distribution?

To answer this question, we actually have to answer two questions:

1 What are the characteristics of the analysis blockchain technology?

2 Predict what kind of economic activity is suitable for the blockchain (existing, and future)

The essential feature of the blockchain is that it transfers value through the Internet, and both costs and speeds have evolved to an unimaginable level. Similar to the emergence of the Internet, the cost and speed of our transmission of information is also in the past two worlds.

In many ways, the Internet is a particularly good example. At that time, we changed from centralized to decentralized networks, and information transmission changed from one-way to two-way, and one-to-many became many-to-many.

Nowadays, although traditional finance is online, the network is actually a local area network, privately owned, and not open. So in the LAN, such as WeChat payment, we have achieved the ultra-fast and ultra-low cost of value transmission, but once it involves the transmission of financial systems across different systems, it immediately returns to its original shape. Either it can't be transferred directly, such as WeChat to Alipay, or it is like transnational transfer, relying on the previous generation of SWIFT, for a few days.

This fragmentation of the financial network can only be broken by the blockchain. The reason is that the main body of each LAN is more willing to keep the wall and gain more profits. The ability to break the wall may be only like a few countries like China. On the other hand, the fence between countries is almost impossible to break.

Going one step further, the reason why the blockchain can break the wall is to redefine the way the assets are owned. In the past, all online assets were actually in the hands of LAN controllers. All we had was a bunch of data in their hands that proved that we owned an asset. Now the blockchain allows us to truly master the assets, which is the private key in your hand. With it, you can use your assets arbitrarily, transfer across different networks, and the walls disappear.

It is obvious here that if new values are produced and distributed:

1 requires high value transmission frequency and low cost.

2 need to cross multiple financial walls,

3 and the Internet is more closely integrated,

It is the nail that the blockchain is looking for.

These three points are not independent dimensions and may be causal. If a new technology is to replace the original one, it can be ten times more efficient or cost-effective than the previous one (first point), or it can realize functions (2 and 3) that could not be realized before.

If future economic activities require massive handling of cross-border transactions, the speed and cost requirements are much higher than they are now, and the existing financial system will certainly not be able to meet the blockchain.

But what is this deal? One reason is difficult to predict now. One reason is that financial technology and economic behavior are two-legged, and one change will affect the other, and vice versa. Therefore, this evolutionary path is not a linear evolution of univariate, but the emergence of multivariate.

We can look at the existing examples, Bitcoin itself is the best example, think about it:

Miners scattered around the world, without access thresholds, are constantly providing power and security to the network, and new bitcoins are allocated to a miner every ten minutes. Anyone can create an account, regardless of the country, can transfer money to any other account.

Bitcoin perfectly illustrates the advantages of blockchains across financial walls.

What other economic activities have already shown some signs, but because the conditions of the parties are not mature, why are they so close or a few feet?

We are in a global era, and many economic activities online and offline are global. The difference is that offline economic activity is already mature and adapts to existing financial technologies. While online economic activities are still in their infancy, many problems of value distribution have not been resolved, and more new economic activities are being bred, which has created new problems.

For example, the value of data in social networks belongs to the problem. Now the data of users in the social network is owned by the platform by default. This kind of distribution is definitely not long-lasting, because the importance of personal data is increasing day by day, and one day the opposition will be strong. To change this situation, everyone is asking for ownership of their own data. The operating model of the social and advertising industry will be completely refactored, and the associated impact is even more difficult to estimate.

Maybe you will think that FB and Tencent are too powerful to be refactored, and it is hard to imagine how we should live without them. To put it another way, the era of human beings entering online social life is actually less than 20 years. Since we can completely change a social way 20 years ago, why not?

The Internet has fundamentally created an online world that knows no borders. It creates and distributes value here. It should have matching financial technology. Otherwise, it will encounter various restrictions when crossing national borders, or in value transmission and line. Unnecessary friction between economic activities.

History has come to this point, and the Internet is followed by a blockchain, which may not be accidental.

Author: Orange Book

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin plunged 12%, and futures broke nearly 3 billion. What is the market?

- With the use of a single scene, the source of limited value of the Ripple Coin (XRP), why is it the third in the market value?

- Blockchain Technology Index | Defending Privacy: The Rise of Anonymous Technology

- We counted the price of Bitcoin in the past two years and found that it fluctuated the most during this time period.

- Security Events | MyDashWallet Online Wallet User Assets Theft Details Disclosure

- The US congressman candidate wants to send money, and the Federal Election Commission has promised.

- Blockchain Xiaobian Adventures, I never thought I was picked up by the police…